Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

A couple of weeks ago SentinelOne announced it was acquiring high-speed logging platform Scalyr for $155 million. Just this morning CrowdStrike struck next, announcing it was buying unlimited logging tool Humio for $400 million.

In Humio, CrowdStrike gets a company that will provide it with the ability to collect unlimited logging information. Most companies have to pick and choose what to log and how long to keep it, but with Humio, they don’t have to make these choices, with customers processing multiple terabytes of data every single day.

Humio CEO Geeta Schmidt writing in a company blog post announcing the deal described her company in similar terms to Scalyr, a data lake for log information:

“Humio had become the data lake for these enterprises enabling searches for longer periods of time and from more data sources allowing them to understand their entire environment, prepare for the unknown, proactively prevent issues, recover quickly from incidents, and get to the root cause,” she wrote.

That means with Humio in the fold, CrowdStrike can use this massive amount of data to help deal with threats and attacks in real time as they are happening, rather than reacting to them and trying to figure out what happened later, a point by the way that SentinelOne also made when it purchased Scalyr.

“The combination of real-time analytics and smart filtering built into CrowdStrike’s proprietary Threat Graph and Humio’s blazing-fast log management and index-free data ingestion dramatically accelerates our [eXtended Detection and Response (XDR)] capabilities beyond anything the market has seen to date,” CrowdStrike CEO and co-founder George Kurtz said in a statement.

While two acquisitions don’t necessarily make a trend, it’s clear that security platform players are suddenly seeing the value of being able to process the large amounts of information found in logs, and they are willing to put up some cash to get that capability. It will be interesting to see if any other security companies react with a similar move in the coming months.

Humio was founded in 2016 and raised just over $31 million, according to Pitchbook Data. Its most recent funding round came in March 2020, a $20 million Series B led by Dell Technologies Capital. It would appear to be a decent exit for the startup.

CrowdStrike was founded in 2011 and raised over $480 million before going public in 2019. The deal is expected to close in the first quarter, and is subject to typical regulatory oversight.

Powered by WPeMatico

Artie, a startup looking to rethink the distribution of mobile games, announced today that it has raised $10 million in funding.

There are some big names backing the company — its latest investors include Zynga founder Mark Pincus, Kevin Durant and Rich Kleiman’s Thirty Five Ventures, Scooter Braun’s Raised In Space, Shutterstock founder Jon Oringer, Tyler and Cameron Winklevoss, Susquehanna International Group, Harris Blitzer Sports & Entertainment + The Sixers Lab, Googler Manuel Bronstein and YouTube co-founder Chad Hurley.

This actually represents a pivot from Artie’s original vision of creating augmented reality avatars. CEO Ryan Horrigan said that he and his co-founder/CTO Armando Kirwin ended up building distribution technology that they felt solved “a much bigger problem.”

The problem, in part, is game developers “looking for ways outside of Apple’s App Stores rules and restrictions.” (That’s certainly something Fortnite-maker Epic Games seems to be fighting for.) So Artie’s platform allows users to play mobile games without installing an app, from the browser or wherever links can be shared online.

Image Credits: Artie

Artie isn’t the only startup focused on the idea of app-less mobile gaming, but Horrigan said that while other companies are limited by JavaScript and HTML5, Artie supports Unity, meaning it can build casual (rather than hyper-casual) games, and eventually games that might even go deeper.

“Similar to cloud games, we’re running Unity games on our cloud, but rather than rendering their graphics on the cloud and pushing the video to players, we’re not running graphics on the cloud,” he said. “We’re streaming assets and animations that are highly-optimized and rendered in real-time through the embedded web browser.”

In other words, the goal is to get frictionless distribution outside of app stores, while avoiding some of the issues facing cloud gaming, namely significant infrastructure costs and lag time.

The startup is developing and releasing games of its own, with an Alice in Wonderland game, a beer pong game and more on the schedule for later this year, then a massively multiplayer online game planned for 2022. But the company also plans to release an SDK allowing other developers to distribute through its platform as well.

Horrigan said Artie’s initial games will be free-to-play, monetized through in-game purchases. They’ll use cookies to remember where players were in the game, but players will also be able to create logins.

Artie is also developing games with a major music star and a superhero IP-owner, and he argued that by combining no-code/low-code authoring tools with Artie’s distribution platform, this could become a bigger trend.

“We want to be working with the next generation of influencers to make games using these low-code or no-code solutions, then publish to their audiences directly on YouTube,” he said. “Imagine what a branded game would look like from your favorite hip hop star. We think that’s coming, and we think Artie is the platform to make that happen.”

Powered by WPeMatico

The day before Robinhood goes under the the Congressional hammer, domestic rival Public.com announced this morning that it has closed a $220 million funding round at a $1.2 billion valuation. News of the round was first broken by TechCrunch. Further reporting colored in the lines concerning the investment’s size and valuation range.

Confirming the funding news today, Public added a fresh metric to the mix, namely that it has reached one million members – over the course of just 18 months post-launch, the company was quick to point out.

That means that Public’s backers – its latest round was put together by prior investors, including Greycroft, Accel, Tiger Global, Inspired Capital and others – values the company at around $1,200 per current “member.” Whether or not that feels rich, we leave to you to decide.

But with rising interest in the savings and investing space – some data here — and Robinhood’s revenues growing to a run rate of more than $800 million in Q4 2020 and looking even better at the start of 2021, it’s not hard to see why investors are backing Public. It’s even easier if you believe that Robinhood’s brand has undergone material harm from its woes during the GameStop saga.

The pair, along with a host of other fintech services that offer savings and investing products, have been buoyed by a secular shift in banking away from the physical world (in-person shopping, bank branches, plastic cards) to the digital (neo-banks, ecommerce, virtual cards). Robinhood shook up the trading world with zero-cost investing, fitting neatly into the mobile and virtual banking future that is being built. And Public has taken that model a step further by dropping payment for order flow (PFOF), a method revenue generation in which companies like Robinhood get a small fee for sending their users’ trades to one particular market maker or another.

TechCrunch recently joked that it seems like “there is infinite money for stock-trading startups,” in light of the anticipated Public round, which has now has arrived. Let’s see who is next to take home a big check.

Powered by WPeMatico

Krisp, a startup that uses machine learning to remove background noise from audio in real time, has raised $9M as an extension of its $5M A round announced last summer. The extra money followed big traction in 2020 for the Armenian company, which grew its customers and revenue by more than an order of magnitude.

TechCrunch first covered Krisp when it was just emerging from UC Berkeley’s Skydeck accelerator, and co-founder Davit Baghdasaryan was relatively freshly out of his previous role at Twilio. The company’s pitch when I chatted with them in the shared office back then was simple and remains the core of what they offer: isolation of the human voice from any background noise (including other voices) so that audio contains only the former.

It probably comes as no surprise, then, that the company appears to have benefited immensely from the shift to virtual meetings and other trends accelerated by the pandemic. To be specific, Baghdasaryan told me that 2020 brought the company a 20x increase in active users, a 23x increase in enterprise accounts and 13x improvement of annual recurring revenue.

The rise in virtual meetings — often in noisy places like, you know, homes — has led to significant uptake across multiple industries. Krisp now has more than 1,200 enterprise customers, Baghdasaryan said: banks, HR platforms, law firms, call centers — anyone who benefits from having a clear voice on the line (“I guess any company qualifies,” he added). Enterprise-oriented controls like provisioning and central administration have been added to make it easier to integrate.

B2B revenue recently eclipsed B2C; the latter was likely popularized by Krisp’s inclusion as an option in popular gaming (and increasingly beyond) chat app Discord, though of course users of a free app being given a bonus product for free aren’t always big converters to “pro” tiers of a product.

But the company hasn’t been standing still, either. While it began with a simple feature set (turning background noise on and off, basically) Krisp has made many upgrades to both its product and infrastructure.

Noise cancellation for high-fidelity voice channels makes the software useful for podcasters and streamers, and acoustic correction (removing room echos) simplifies those setups quite a bit as well. Considering the amount of people doing this and the fact that they’re often willing to pay, this could be a significant source of income.

The company plans to add cross-service call recording and analysis; since it sits between the system’s sound drivers and the application, Krisp can easily save the audio and other useful metadata (How often did person A talk versus person B? What office locations are noisiest?). And the addition of voice cancellation — other people’s voices, that is — could be a huge benefit for people who work, or anticipate returning to work, in crowded offices and call centers.

Part of Krisp’s allure is the ability to run locally and securely on many platforms with very low overhead. But companies with machine learning-based products can stagnate quickly if they don’t improve their infrastructure or build more efficient training flows — Lengoo, for instance, is taking on giants in the translation industry with better training as more or less its main advantage.

Krisp has been optimizing and reoptimizing its algorithms to run efficiently on both Intel and ARM architectures, and decided to roll out its own servers for training its models instead of renting from the usual suspects.

“AWS, Azure and Google Cloud turned out to be too expensive,” Baghdasaryan said. “We have invested in building a data center with Nvidia’s latest A100s in them. This will make our experimentation faster, which is crucial for ML companies.”

Baghdasaryan was also emphatic in his satisfaction with the team in Armenia, where he and his co-founder Arto Minasyan are from, and where the company has focused its hiring, including the 25-strong research team. “By the end of 2021 it will be a 45-member team, all in Armenia,” he said. “We are super happy with the math, physics and engineering talent pool there.”

The funding amounts to $14 million if you combine the two disparate parts of the A round, the latter of which was agreed to just three months after the first. That’s a lot of money, of course, but may seem relatively modest for a company with a thousand enterprise customers and revenue growing by more than 2,000% year over year.

Baghdasaryan said they just weren’t ready to take on a whole B round, with all that involves. They do plan a new fundraise later this year when they’ve reached $15 million ARR, a goal that seems perfectly reasonable given their current charts.

Of course startups with this kind of growth tend to get snapped up by larger concerns, but despite a few offers Baghdasaryan says he’s in it for the long haul — and a multibillion dollar market.

The rush to embrace the new virtual work economy may have spurred Krisp’s growth spurt, but it’s clear that neither the company nor the environment that let it thrive are going anywhere.

Powered by WPeMatico

TechCrunch is excited to announce that Zoom chief revenue officer (CRO) Ryan Azus is joining us at TechCrunch Early Stage on April 1.

Azus has worked at Cisco, RingCentral and most recently Zoom. In his previous roles he held a number of sales titles, including his final role at RingCentral where he was its executive vice president of global sales and services.

Zoom needs little introduction, having crossed over from enterprise software success story to consumer phenomenon during the COVID-19 pandemic, during which time companies, groups, individuals and families leaned on the video chat provider to stay in touch.

Azus has been at the helm of Zoom’s money engine since mid-2019, which means that he has sat atop it during one of the most impressive periods of sales growth at any software company — ever.

So we’re glad that he’ll be at TC Early Stage this year, where we’ll pepper him with questions. Bring your own, of course, as we’ll be reserving around half our time for audience Q&A.

But the TechCrunch crew has a plethora of things we want to chat about too, including the importance of bottom-up sales during the pandemic, especially in contrast to the more traditional sales bullpen model that many startups have historically used; how to balance self-service sales and human-powered sales at a tech company that presents both options to customers, and their relative strength in 2021; changes to sales incentive metrics at Zoom over time from which startups might be able to learn; and how to maintain order and culture in a quickly scaling, remote sales organization.

We’re also curious how Zoom managed to adapt to the pandemic itself, like how long it took the company to reach full-strength from a sales perspective as it moved to remote work and customers that were also out of the office. The simple answer is that his company simply used more of its own product, but there’s more to the story that we want to hear.

Often at TechCrunch events we round up a cadre of executives from well-known technology companies and then hammer them for news. Early Stage is a bit different, focusing instead on extracting knowledge, tips and what-pitfalls-to-avoid from tech folks interested in helping startups do more, more quickly.

Azus won’t be coming alone. Bucky Moore from Kleiner will be in the house, along with Neal Sales-Griffin (a managing director at Techstars) and Eghosa Omoigui (a managing general partner at EchoVC Partners). The list goes on, as you can see here. (We’re also having a big pitch-off, so make sure to come to both days of the event.)

TC Early Stage continues TechCrunch’s recent spate of virtual events, so no matter where you are, you can tune in and learn. Register today to take advantage of early-bird pricing, don’t forget to bring your best questions, and we’ll see you in early April!

Powered by WPeMatico

If we are not careful, every entry of this column could consist of SPAC news.

Special purpose acquisition companies, or blank-check companies, whatever you prefer to call them, are enormous business today. But they aren’t the only thing going on, and we’ll get to other things shortly. Consider this an apology for having written about SPACs twice in two days.

Yesterday, we considered the rise of the VC-led SPAC and whether venture capital groups that offer seed-through-SPAC money will wind up with advantage in the market over firms that specialize on any particular startup stage. Sticking to the blank-check theme, this morning we’re looking into two SPAC-led deals, namely those involving Rover and MoneyLion.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We’re doubling up to prevent more SPAC-related posts. And we’ve selected Rover because Chewy, another pet-themed entity, is an already-public company. As both were venture-backed, we may be able to contrast their trading performance post-debut. Sadly, Chewy is focused on pet e-commerce while Rover is more centered around pet services, but they may prove close enough for some loose comparisons.

And why chat about MoneyLion? Because it’s a heavily venture-backed fintech startup, one that TechCrunch has covered extensively. If its SPAC-assisted vault into the public markets goes well, it could smooth the same path forward for myriad other yet-private fintechs sitting atop a mountain of raised capital.

And why chat about MoneyLion? Because it’s a heavily venture-backed fintech startup, one that TechCrunch has covered extensively. If its SPAC-assisted vault into the public markets goes well, it could smooth the same path forward for myriad other yet-private fintechs sitting atop a mountain of raised capital.

So this is a SPAC post, but as we’ll largely be looking at the financial health of two companies that we’ve heard about for ages and never got to see inside of, I hope you join me all the same.

We’re starting with the Rover investor presentation, before zipping over to MoneyLion’s own.

Rover is merging with Nebula Caravel Acquisition Corp., which is affiliated with True Wind Capital. The deal gives Rover an anticipated market cap of around $1.6 billion, with around $300 million in cash on its books.

So, how attractive is this new unicorn? You can find its investor deck here, if you want to read along as we peek.

First up, the company stresses rising use of digital services in the last year thanks to the pandemic and the fact that pet ownership is growing. Both of which are true. We’ve seen the accelerating digital transformation for both companies and consumers. And if you’ve tried to adopt a pet lately, you’ve seen how few are left waiting for forever homes.

With those things behind it, you might be wondering why Rover is pursuing a SPAC-led debut as well. If its market is hot and it has previously raised venture capital, why not just go public via an IPO? Because 2020 was tough on the company.

Image Credits: Rover

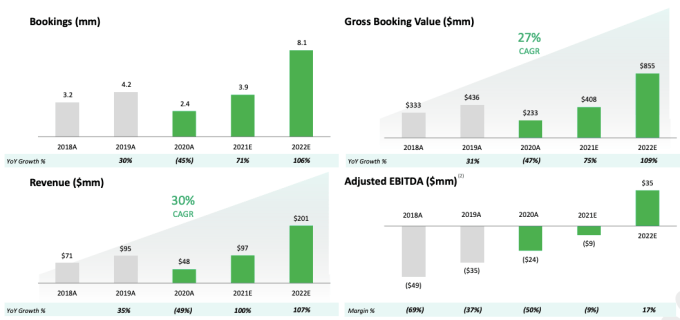

Revenue dipped from $95 million in 2019 to just $48 million last year. Bookings fell from 4.2 million to 2.4 million over the same time frame, leading to gross booking value falling from $436 million in 2019 to $233 million in 2020. Why? Because everyone was stuck at home. With their pets. A situation that limited demand for Rover-delivered pet services.

Powered by WPeMatico

Talkshoplive is a startup that’s worked with stars like Paul McCartney and Garth Brooks, as well as small businesses, to host shopping-focused live videos. Today, it’s announcing that it has raised $3 million in seed funding from Spero Ventures.

CEO Bryan Moore founded the company with his sister Tina in 2018. Moore previously led social media efforts at Twentieth Television (previously known as Twentieth Century Fox) and CBS Television, and he said he was inspired to launch Talkshoplive by the rise of livestreamed shopping experiences in China.

At the same time, Moore said it wasn’t enough to just copy what worked in China: “Small businesses are different here, talent is different, the needs are different.” One of the keys, in his view, is to focus on helping creators and businesses meet their customers where those customers already are — which he also suggested differentiates Talkshoplive from competing services as well.

For one thing, the startup does not require consumers to download any additional apps in order to watch its videos. Instead, it’s created a video player that works on the Talkshoplive website, on the websites of its partners and anywhere else that videos can be embedded. And wherever those videos are played, they also include a one-click buy button.

Moore said Talkshoplive started out with a focus in books and music, working with famous names like Matthew McConaughey, Alicia Keys and Dolly Parton, as well as the aforementioned Brooks and McCartney. For example, Brooks used Talkshoplive to exceed more than 1 million vinyl pre-sales for his “Legacy Collection” box set in 2019.

On the book side, Talkshoplive has worked with publishers including Harper Collins, Penguin Random House, Simon & Schuster and Macmillan. Moore claimed the platform is driving three to nine times the sales an author would see on other e-commerce sites.

At the same time, he emphasized that the startup is also working with more than 3,500 small businesses, and he said that when a small business owner is broadcasting on Talkshoplive, “You’re creating your own microfandom by being able to tell the story … You’re making yourself a brand story, even as a small business.”

He added, “When you’re able to help people move $25,000 in a show — for a small business, that’s a huge deal.”

In this sense, Moore said he sees Talkshoplive as a continuation of his previous work in social media, all connected by the question, “How are you creating human connection in a digital landscape?” The “ultimate goal,” he added, is to turn the platform into a “digital Main Street” for businesses everywhere.

More recently, Talkshoplive has been moving into other categories like food and beauty, and Moore said he’s excited to work with Spero founding partner Shripriya Mahesh (previously an executive at eBay and First Look Media) to “continually evolve our product and create these tools that help us scale faster — and also help benefit these businesses.”

“From the moment we met the Talkshoplive team, we were impressed with their focus on enabling SMB’s with a new, creative, innovative way to build their businesses,” Mahesh said in a statement. “Talkshoplive also innovates on the marketplace model with a way for buyers to truly engage with the sellers, get to know them, and experience shopping in a whole new way. We are incredibly excited by the community that is taking shape at Talkshoplive and are thrilled to be working with Bryan, Tina, and the TSL team as they grow their community and the marketplace.”

Powered by WPeMatico

The creator movement has exploded in the last few years as platforms ranging from Substack to Clubhouse have made it easier than ever to reach an audience of willing readers and listeners. Yet the key to building sustainable creator businesses is the economics of these enterprises themselves. Get enough subscribers, and what often starts as a side hobby can quickly become a full-time job.

Circle was founded in January 2020 to make engaging with paying customers and thus building creator businesses as effortless as possible. We profiled the NYC-based startup last year when it announced its $1.5 million seed round in August, discussing how its founder DNA originates in the online course platform Teachable. Since then, all signs point to very strong early growth.

The company surpassed $1 million ARR last month, and it already has 1,000 paying customers and is heading toward 2,000 paying communities. Usage is also growing rapidly, expanding 40-50% per month for both DAUs and MAUs, according to the company. It also brought its iOS app out of beta last month.

CEO and co-founder Sid Yadav said that “we happened to catch the tide at the right time [with] the creator movement, the community movement.” So far, paying communities have been largely centered around “a lot of YouTubers, course creators, Twitch streamers, Patreon personalities,” with Yadav estimating that 60% of the platform’s communities are “personality-led.” That said, “a lot of brands are starting to think of this creatively.”

All that positive news can’t be ignored by VCs too long. The company announced today that it has raised a $4 million seed round at a valuation “north of” $40 million, which closed late last year. The round was officially led by Notation Capital, which led the company’s pre-seed round last year, but the firm only took a quarter of a round according to Yadav.

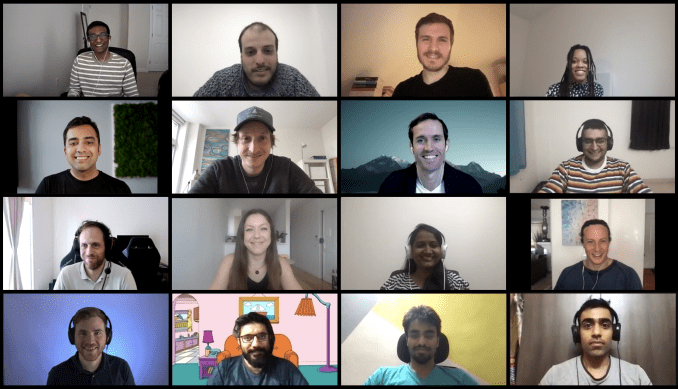

Circle’s team has grown to 20 across multiple continents. Photo via Circle.

Instead, much of the round’s allocations were handed out to the entrepreneurs building on the platform. “We had all of these offers from top-tier firms, but for the kind of product that we are — which is a creator platform — it made sense to allocate the round as much as possible to our customers,” Yadav said. According to the company, a majority of the round went to individual angels and community builders on the platform, among them Anne-Laure Le Cunff, David Perell, Tiago Forte and Nat Eliason.

Given the company’s early stage, product development remains the highest priority. “Our approach is like a Notion,” Yadav said, describing how Circle allows its communities to stitch together “building blocks” to lay out pages. Circle’s primary mode is through a Space, where community members can discuss topics with each other and the creator as well. Communities built on Circle can be white-labeled, with their own custom domains.

Circle’s community platform allows creators to publish content and engage with their community. Photo via Circle.

Circle’s ultimate goal is to integrate under one roof every tool a creator needs to engage with a customer, from publishing newsletters and podcasts to setting up streaming, event ticket sales, merchandise and event calendars — all buttressed by a payments layer. Many of those features remain to be built on top of the company’s core community platform, but Yadav and his team are certainly ambitious in their expansive scope.

Circle’s team is now 20 people, with team members in Europe, India, Australia and across the United States.

Powered by WPeMatico

This morning Citadel ID announced a combined $3.5 million raise for its income and employment verification service. The startup provides an API to customer companies, allowing them to rapidly verify details of consumer employment.

The capital came from a blend of venture firms and angels. On the firm side, Abstract and Soma VC were in there, along with ChapterOne. Brianne Kimmel put capital in as well, according to the startup. And denizens with work histories at companies like Zynga (Mark Pincus), Stripe (Lachy Groom), Carta (Henry Ward) and others also put cash into the fundraise. (The company reached out to add that Fathom Capital also put a good amount in the round.)

Citadel was founded back in June of 2020, before raising capital, snagging its first customer and shipping its product all inside of the same year.

The idea for Citadel ID came when co-founder Kirill Klokov worked at Carta, the cap-table-as-a-service startup that recently built an exchange for the trading of private stock. Klokov discovered while working on the tech side of the company how hard it was to verify certain data, like employment and income and identity.

As Carta deals with money, stock and the collection and distribution of both, you can imagine why having a quick way to verify who worked where, and since when, mattered to the company. But Klokov came to realize that there wasn’t a good solution in the market for what Carta needed, sans building integrations to a host of payroll managers by hand and dealing with lots of data with varying taxonomies. That or using an in-the-market product, like Equifax’s The Work Number, which the founder described as expensive and offering relatively low coverage.

To fill the market void Klokov helped found Citadel ID, quickly building integrations into payroll managers where there were hooks for code, and working around older login systems when needed. Citadel ID’s service allows regular folks to provide access to their employment data to others, allowing for the verification of their income (a rental group, perhaps), or employment (Carta, perhaps) quickly.

Per the startup the market demand for such verifications is in the hundreds of millions every year in the United States. So, Citadel should have plenty of market space to grow into. Citadel ID has around 20 customers today, it told TechCrunch, and charges on a per verification basis.

Finally, while Citadel also offers data via its website and not merely through its API, the startup still fits inside the growing number of startups we’ve seen in recent quarters foregoing traditional SaaS, and instead offering their products via a developer hook (sometimes referred to as a “headless” approach). API-delivered startups are not new, after all Twilio went public years ago. But their model of product delivery feels like it’s gaining momentum over managed software offerings.

Let’s see how quickly Citadel ID can scale before it raises its Series A.

Powered by WPeMatico

The hodl-crew are having quite the moment as bitcoin passed the $50,000 mark earlier today for the first time. Data pegs the peak at just over $50,500.

The price of bitcoin, the world’s best-known cryptocurrency, has historically proven a reasonable proxy for consumer interest in the cryptocurrency space, and for trading activity amongst blockchain-based assets. Bitcoin’s price has retreated since the milestone, and is now worth just over $49,000.

Bitcoin has been on a tear this year, rising from around the $30,000 mark at the start of 2021 to its recent $50,000 milestone, a gain of around 66%. Looking back a year and the gains are even more impressive, with the price of bitcoin rising from around $10,000 a year ago to its current price, a gain of 400%.

Luckily for investors and believers in other decentralized tokens, it’s not just bitcoin that is enjoying a valuation updraft. Cardano, one of the most highly valued blockchain assets, is up around 27% in the last week, according to CoinMarketCap. Its total value is nearing the $27 billion mark.

Companies built atop the burgeoning cryptocurrency space could be enjoying a boom as the price of bitcoin advances; as trading activity and consumer interest tend to rise along with the price of bitcoin, and companies like Coinbase make money from trading activity and consumer use, 2021 is starting off strongly.

Coinbase has filed to go public, and intends to pursue a direct listing in short order.

What’s driving up the price of bitcoin and its sister-tokens in the short-term? In a market melt-up its hard to point fingers with any accuracy. But broadly speaking, if it feels that nearly every asset class is setting new all-time records, so why not bitcoin as well?

Powered by WPeMatico