Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

As Roblox began to trade today, the company’s shares shot above its reference price of $45 per share. Currently, Roblox is trading at $71.10 per share, up just over 60% from the reference price that it announced last night. That effort finally set a directional value of sorts on Roblox’s shares before it floated on the public markets.

Roblox, a gaming company aimed at children and powered by an internal economy and third-party development activity, has had a tumultuous if exciting path to the public markets. The company initially intended to list in a traditional IPO, but after enthusiastic market conditions sent the value of some public-offering shares higher after they began to trade, Roblox hit pause.

The former startup then raised a Series H round of capital, a $520 million investment that boosted the value of Roblox from around $4 billion to $29.5 billion. TechCrunch jokes that, far from IPOs mispricing IPOs, that $4 billion price set in early 2020 was the real theft, given where the company was valued just a year later. Sure, the pandemic was good for Roblox, but seeing a 5x repricing in four quarters was hilarious.

Regardless. At $45 per share, Roblox’s direct listing reference price, the company was worth $29.1 billion, per Renaissance Capital, an IPO-focused group. Barron’s placed the number at $29.3 billion. No matter which is closer to the truth, they were both right next to the company’s final private price.

So, the Series H investors nailed the value of Roblox, or the company merely tied its reference price to that price. Either way, we had a pretty clear Series H → direct listing reference price handoff.

The company’s performance today makes that effort appear somewhat meaningless as both prices were wildly under what traders were willing to cough up during its first day of trading; naturally, we’ll keep tabs on its price as time continues, and one day is not a trend, but seeing Roblox trade so very far above its direct listing reference price and final private valuation appears to undercut the argument that this sort of debut can sort out pricing issues inherent in more traditional IPOs.

To understand the company’s early trading activity, however, we need to understand just how well Roblox performed in Q4 2020. When we last noodled on the company’s valuation, we only had data through the third quarter of last year. Now we have data through December 31, 2020. Let’s check how much Roblox grew in that final period, and if it helps explain how the company managed that epic Series H markup.

Powered by WPeMatico

This morning Arist, a startup that sells software allowing other organizations to offer SMS-based training to staff, announced that it has extended its seed round to $3.9 million after adding $2 million to its prior raise.

TechCrunch has covered the company modestly before this seed-extension, noting that it was part of the CRV-backed Liftoff List, and reporting on some of its business details when it took part in a recent Y Combinator demo day.

Something that stood out in our notes on the company when it presented at the accelerator’s graduation event was its economics, with our piece noting that the startup “already [has] several big ticket clients and [says it] will soon be profitable.” Profitable is just not a word TechCrunch hears often when it comes to early-stage, high-growth companies.

So, when the company picked up more capital, we picked up the phone. TechCrunch spoke with the company’s founding team, including Maxine Anderson, the company’s current COO; Ryan Laverty, its president; and Michael Ioffe, its CEO, about its latest round.

According to the trio, Arist raised its initial $1.9 million around the time it left Y Combinator, a round that was led by Craft Ventures at a $15 million valuation. Following that early investment, the company’s business with large clients performed well, leading to it closing $2 million more last December. The founders said that the new funds were raised at a higher price-point than its previous seed tranche.

The second deal was led by Global Founders Capital.

The company’s enterprise adoption makes sense, as all large companies have regular training requirements for their workers; and as anyone who has worked for a megacorp knows, current training, while improved in recent years, is far from perfect. Arist is a bet that lots of corporate training — and the training that emanates from governments, nonprofits and the like — can be sliced into small pieces and ingested via text-message.

For that the company charges around $1,000 per month, minimum.

Arist did catch something of a COVID wave, with its founding team telling TechCrunch that pitching its service to large companies got easier after the pandemic hit. Many concerns better realized how busy their staff was when they moved to working from home, the trio explained, and with some folks suffering from limited internet connectivity, text-based training helped pick up slack.

We were also curious about how the startup onboards customers to the somewhat new text-based learning world; is there a steep learning curve to be managed? As it turns out, the startup helps new customers build their first course. And, in response to our question about the expense of that effort, the Arist crew said that they use freelancers for the task, keeping costs low.

Recently Arist has expanded its engineering staff, and plans to scale from around 11 people today to around 30 by the end of the year. And while Anderson, Laverty and Ioffe are based in Boston, they are hiring remotely. The startup serves global customers via a WhatsApp integration. So Arist should be able to scale its staff and customer base around the world effectively from birth. (This is the new normal, we reckon.)

What’s ahead? Arist wants to grow its revenues by 5x to 10x by the end of the year, hire, and might share if it wants to raise more capital around the end of the year.

Oh, and it partners with Twilio to some degree, though the group was coy on just what sort of discounts it may receive; the founding team merely noted that they liked the SMS giant and deferred further commentary.

All told, Arist is what we look for in an early-stage startup in terms of growth, vision and potential market scale — the startup thinks that 80% of training should be via SMS or Slack and Teams, the latter two of which are a hint about its product direction. But Arist feels a bit more mature financially than some of its peers, perhaps due to its price point. Regardless, we’ll check back in at the mid-point of the year and see how growth is ticking along at the company.

Powered by WPeMatico

We’re putting aside the IPO news cycle this morning to check in on the venture capital world and the fintech market in particular.

As we all know, fintech is booming: Between Robinhood and Public and M1 Finance raising competing rounds, payment-tech startup Finix moving to diversify its cap table, and ideas that work in one market finding purchase and capital in others, it’s a damn good time to build financial technology.

But perhaps even with all that recent knowledge, we’re still missing the point.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

A provisional report from data and research group CB Insights indicates that we’re not merely in a warm period for fintech funding — we are in a period of all-time record investment for so-called mega-rounds, or investments of $100 million or more inside the fintech realm.

The first quarter of 2020 had stiff competition to overcome to set a mega-round record. The preceding period, Q4 2020, for example, saw 30 fintech rounds across the globe that were worth nine figures. But, to date, Q1 2021 is ahead and is thus guaranteed to set a new record, having already bested the preceding all-time high.

The first quarter of 2020 had stiff competition to overcome to set a mega-round record. The preceding period, Q4 2020, for example, saw 30 fintech rounds across the globe that were worth nine figures. But, to date, Q1 2021 is ahead and is thus guaranteed to set a new record, having already bested the preceding all-time high.

This morning we’re talking big money and fintech, with a splash of early-stage digging. I asked a CB Insights analyst about what appears to be falling fintech seed deal volume. Is this the result of data reporting delays inherent to seed data, the impact of SAFEs and other sorts of notes limiting visibility into the earliest stages of venture, or just a plain-old slowdown? Let’s find out.

Per the interim CB Insights dataset, there have been some 33 fintech mega-rounds so far in 2021. For context, it’s more than 50% more such rounds in Q1 2020 and Q1 2019. Via the preliminary report, here’s the data:

Powered by WPeMatico

The team behind Songclip thinks that social media could use more music.

Yes, music is a big part of the experience on a handful of apps like TikTok and Triller, but Songclip co-founder and COO John vanSuchtelen told me, “That is not the end of how music is going to be a feature, that is a beginning.”

He added, “In the next nine to 12 months … just like you never have a phone without a camera, you’re not going to have an app without music clips as a feature when you make videos.”

That’s what vanSuchtelen and his co-founder and CEO Andy Blacker are hoping to enable with Songclip, which announced today that it has raised $11 million in new funding.

The startup has created an API that, when integrated with other apps (current integrations include photo- and video-editing app PicsArt), allows users to search for and share music. VanSuchtelen said that like Giphy, Songclip plans to popularize a new media format — the short audio clip — and make it accessible across a wide range of services.

“If I were to say, I’m going to send you a four-minute song,’ it’s just not going to work that way, that’s not how we communicate anymore,” vanSuchtelen said. “How do you take the music and turn it into the bite that you want to use in a social context?”

To do this, Blacker said Songclip doesn’t just license music, it also does its own tagging and clipping, while offering tools for music labels to protect their intellectual property and providing data on how people are interacting with the music. And unlike Giphy, Songclip isn’t looking to build a consumer brand.

All of this involves a combination of human editors and technology. Blacker said the human element is key to understand the nuances of songs and their association, like the fact that Simon & Garfunkel’s “Bridge Over Troubled Water” isn’t really about bridges or water, or that Katrina and the Waves’ “Walking on Sunshine” is a happy song even though it doesn’t have the word “happy” in it.

Songclip has now raised a total of $23 million. The new round was led by Gregg Smith of Evolution VC Partners. The Kraft Group, Michael Rubin, Raised in Space, Gaingels and Forefront Venture Partners also participated, as did industry executives Jason Flom and Steve Greenberg and the band AJR.

Powered by WPeMatico

Wrapbook, a startup that simplifies the payroll process for TV, film and commercial productions, has raised $27 million in Series A funding from noteworthy names in both the tech and entertainment worlds.

The round was led by Andreessen Horowitz, with participation from Equal Ventures and Uncork Capital, as well as from WndrCo (the investment and holding company led by DreamWorks and Quibi founder/co-founder Jeffrey Katzenberg) and from CAA co-founder Michael Ovitz.

“It’s time we bring production financial services into the 21st century,” Katzenberg said in a statement. “We need a technology solution that will address the increasing complexities of production onboarding, pay and insuring cast and crew, only exacerbated by COVID-19, and I believe that Wrapbook delivers.”

Wrapbook co-founder and CEO Ali Javid explained that entertainment payroll has remained a largely old-fashioned, paper-based process, which can be particularly difficult to track as cast and crew move from project to project, up to 30 times in single year. Wrapbook digitizes and simplifies the process — electronically collecting all the forms and signatures needed at the beginning of production, handling payroll itself, creating a dashboard to track payments and also making it easy to obtain the necessary insurance.

Wrapbook founders Cameron Woodward, Ali Javid, Hesham El-Nahhas and Naysawn Naji

Although the startup was founded in 2018, Javid told me that demand has increased dramatically as production resumed during the pandemic, with COVID-19 “totally” changing the industry’s culture and prompting production companies to say, “Hey, if there’s an easier, faster way to do this from my house, then yeah let’s look at it.”

Javid also described the Wrapbook platform as a “a vertical fintech solution that’s growing really fast in an industry that we understand really well and not many others have thought about.” In fact, he said the company’s revenue grew 7x in 2020.

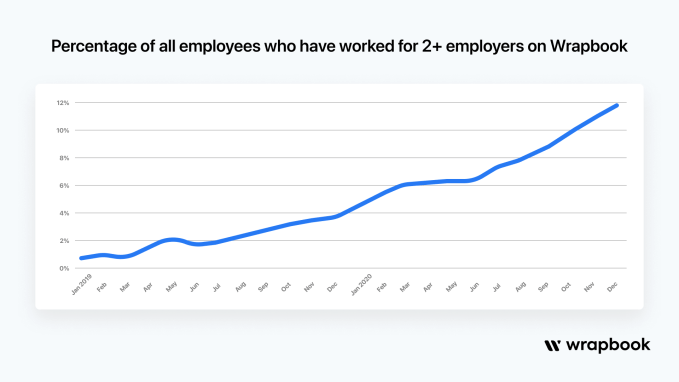

And while Wrapbook’s direct customers are the production companies, co-founder and CMO Cameron Woodward (who previously worked in filmmaking insurance and commercial production) said that the team has also focused on creating a good experience for the cast and crew who get paid through the platform — a growing number of them (12% thus far) have used their Wrapbook profiles to get paid on multiple productions.

Image Credits: Wrapbook

The startup previously raised $3.6 million in seed funding. Looking ahead, Javid and Woodward said that Wrapbook’s solution could eventually be adopted in other project-based industries. But for now, they see plenty of opportunity to continue growing within entertainment alone — they estimated that the industry currently sees $200 billion in annual payments.

“We’re going to double down on what’s working and build things out based on what customers have asked for within entertainment,” Javid said. “To that end, we’re working towards hiring 100 people in the next 12 months.”

Powered by WPeMatico

Dropbox announced today that it plans to acquire DocSend for $165 million. The company helps customers share and track documents by sending a secure link instead of an attachment.

“We’re announcing that we’re acquiring DocSend to help us deliver an even broader set of tools for remote work, and DocSend helps customers securely manage and share their business-critical documents, backed by powerful engagement analytics,” Dropbox CEO Drew Houston told me.

When combined with the electronic signature capability of HelloSign, which Dropbox acquired in 2019, the acquisition gives the company an end-to-end document-sharing workflow it had been missing. “Dropbox, DocSend and HelloSign will be able to offer a full suite of self-serve products to help our millions of customers manage the entire critical document workflows and give more control over all aspects of that,” Houston explained.

Houston and DocSend co-founder and CEO Russ Heddleston have known each for other years, and have an established relationship. In fact, Heddleston worked for Dropbox as a summer in intern in 2010. He even ran the idea for the company by Houston prior to launching in 2013, who gave it his seal of approval, and the two companies have been partners for some time.

“We’ve just been following the thread of external sending, which has just kind of evolved and opened up into all these different workflows. And it’s just really interesting that by just being laser-focused on that we’ve been able to create a really differentiated product that users love a ton,” Heddleston said.

Those workflows include creative, sales, client services or startups using DocSend to deliver proposals or pitch decks and track engagement. In fact, among the earliest use cases for the company was helping startups track engagement with their pitch decks at VC firms.

The company raised a modest amount of the money along the way, just $15.3 million, according to Crunchbase, but Heddleston says that he wanted to build a company that was self-sufficient and raising more VC dollars was never a priority or necessity. “We had [VCs] chase us to give us more money all the time, and what we would tell our employees is that we don’t keep count based on money raised or headcount. It’s just about building a great company,” he said.

That builder’s attitude was one of the things that attracted Houston to the company. “We’re big believers in the model of product growth and capital efficiency, and building really intuitive products that are viral, and that’s a lot of what what attracted us to DocSend,” Houston said. While DocSend has 17,000 customers, Houston says the acquisition gives the company the opportunity to get in front of a much larger customer base as part of Dropbox.

It’s worth noting that Box offers a similar secure document-sharing capability enabling users to share a link instead of using an attachment. It recently bought e-signature startup SignRequest for $55 million with an eye toward building more complex document workflows similar to what Dropbox now has with HelloSign and DocSend. PandaDoc is another competitor in this space.

Both Dropbox and DocSend participated in the TechCrunch Disrupt Battlefield, with Houston debuting Dropbox in 2008 at the TechCrunch 50, the original name of the event. Meanwhile, DocSend participated in 2014 at TechCrunch Disrupt in New York City.

DocSend’s approximately 50 employees will be joining Dropbox when the deal closes, which should happen soon, subject to standard regulatory oversight.

Powered by WPeMatico

Zapier, a well-known no-code automation tool, has purchased Makerpad, a no-code education service and community. Terms of the deal were not disclosed.

TechCrunch has covered Zapier often during its life, including its first, and only, fundraising event, a $1.2 million round back in 2012 that tapped Bessemer, DFJ and others. Since then the company has added more expensive tiers to its service, built out team-focused features, and recently talked to Extra Crunch about how it scaled its remote-only team.

In an interview Monday, Zapier CEO Wade Foster told TechCrunch that his company now has 400 workers and crossed the $100 million ARR mark last summer.

The Makerpad deal is its first acquisition. TechCrunch asked Makerpad founder Ben Tossell about the structure of the deal, who said via email that his company will operate as a “stand-alone” entity from its new parent company.

The deal doesn’t seem prepped to upend what the smaller startup was working on before it was signed. “Ultimately,” Tossell wrote, “Makerpad’s vision is to educate as many people as possible on the possibilities of building without writing code.”

Foster seems content with that focus, describing to TechCrunch how he intends to let Makerpad operate largely independently, albeit inside a set of editorial guidelines.

TechCrunch asked the Makerpad founder why this was the right time to sell his business. He said that the pairing would help his team take the no-code world farther than it could alone, also noting that the deal was a “no-brainer” over “alternative routes such as VC funding.”

The acquisition was partially driven by a single tweet. This one, in fact. According to Tossell, the CEO of Zapier reached out after reading it, leading to conversations and a deal. Foster expanded on the story during a call, saying that he had long followed Tossell’s work and that the two had met previously at dinners. The tweet wound up in his Slack, he said, so he reached out to the Makerpad founder, and from there it was a pretty quick ramp to a deal.

The two companies have seen rapid growth in recent quarters. Foster detailed to TechCrunch how small businesses have become increasingly reliant on his company’s service in the post-COVID world, with Zapier seeing strong SMB adoption after the pandemic hit. Given the digital transformation’s acceleration, that’s a trend that likely won’t slow soon. And Tossell told TechCrunch that no-code has already “grown bigger than [he] had imagined it could,” with his company seeing users expanding 4x in just under the last year.

Zapier, perhaps one of the largest success stories in the broad swath of technology products that we might call the no-code world, now has an attached community that could help directly add users to its service, and perhaps indirectly by making the aggregate pool of no-coders larger over time.

The no-code space has been active in recent months, as has its sibling niche, the low-code market. The latter has seen recent rounds in the nine figures, as some corporations turn to low-code tools to help them more quickly build internal software. The no-code world has its own successes, like Zapier’s nine-figure revenues.

Foster was neutral on more acquisitions, neither closing the door on them when TechCrunch asked, but not opening it any wider at the same time. On the SPAC question, however, the CEO was a bit clearer. That’s a no.

After having spoken to a grip of no-code and low-code founders and investors in recent months, it seems clear that the broader business market is coming around to low-code services and that smaller companies have been quick adopters of no-code tooling. As low-code tools become increasingly abstracted from coding, and no-code tools add functionality, perhaps we’ll see the two related categories merge.

Powered by WPeMatico

Cosi Group, a Berlin-based startup offering an alternative to boutique hotels and managed short-stay apartments, is disclosing €20 million in new investment.

Backing the round is Vienna-based Soravia, a leading real estate group in German-speaking countries. Existing investors Cherry Ventures, e.ventures, Kreos Capital and Bremke followed on, along with a number of individual investors. They are described as including the founders of Flixbus, Travelperk, Comtravo and Cosi’s own founders.

Cosi says it will use the fresh capital to accelerate international expansion in Europe, implement a new brand and launch a “new strategic business unit” soon.

Originally described as a tech-enabled or “full-stack” hospitality service that competes with well-run boutique hotels or traditional local managed apartments, the company signs long-term leases with property owners, and then furnishes those apartments itself to “control” the interior design experience. It claims to have digitised, and where possible, automated its processes in order to scale and maintain quality of service throughout the guest journey, from initial contact to loyalty.

Christian Gaiser, CEO of Cosi, tells me the startup has not only been able to mitigate the pandemic — which has seen major restrictions in travel, including countries going into full lockdown — but actually thrive. That’s because Cosi was able to tap “new demand channels” that aren’t reliant on holiday travel or short business trips.

Described as “midstay” (guests that stay for one month or longer), examples include people who arrive in a city and need a home for one or two months until they find a longer-term apartment, citizens who need to get away from shared apartments (perhaps to be less at risk or to work from home), or families who are building or renovating a house that faces construction delays due to the pandemic.

“Thus, we were able to reach over 90% occupancy and managed to operate our locations on a cash-flow-positive scale,” adds the Cosi CEO. “Lesson learned for us: Even when almost all your demand channels dry out, you still can do a lot if you focus on what you can control. We simply activated new demand channels.”

In addition, he says the pandemic has accelerated a shift in demand preferences, seeing “big hotel bunkers” become less popular versus individual apartment style accommodations.

Meanwhile, Cosi has also seen a “massive boost in supply,” with lots of takeover opportunities in the hotel space, especially for underperforming hotel properties. And since office space demand has contracted dramatically, the company is receiving offers to convert office space for use as midstay accommodation.

“On the back of our strong COVID performance, we’ve built a lot of trust among the real estate community and receive more and more offers,” says Gaiser. “Prices for supply have fallen sometimes dramatically, depending on the city, due to these factors”.

To that end, Cosi currently has 750 units under contract, with 1,500 more under negotiation.

Adds the Cosi CEO: “Now is exactly the right timing to double down on Cosi’s growth from a long-term perspective. When everyone is scared/shocked, you can win big if you have a clear plan. Our investors bought into this plan, as we have demonstrated that our business model is resilient and we also have the capacity to navigate the ship both in good but also in rough waters.”

Powered by WPeMatico

This morning Vendr announced a $60 million Series A round, a huge funding event led by Tiger Global, with participation from Y Combinator, Sound Ventures, Craft Ventures, F-Prime Capital and Garage Capital.

The outsized Series A comes after Vendr last raised $4 million in a mid-2020 seed round, with TechCrunch reporting that the company was profitable at the time. Vendr had raised just over $6 million total before this latest round.

TechCrunch had a few questions. First, how the company had managed to attract so much capital so quickly. According to an interview with Vendr CEO Ryan Neu, his startup grew just under 5x in 2020, and was cash flow-positive last year as well. The startup’s model of standing between SaaS buyers and sellers, speeding up transactions while lowering their cost, appears to have fit well into 2020’s twin trends of rising software reliance and a focus on cost control.

Second, how did the company manage to grow so much? Vendr charges its customers between 1% and 5% of their software spend that it manages, which can add up. Neu told TechCrunch that a somewhat standard 500-person company might spend $2 million to $3.5 million on software each year, which by our math would make that company worth no less than $20,000 to $35,000 in revenue for Vendr at 1% of spend. At Vendr’s midpoint 2.5%, those figures rise $50,000 to $87,500.

At those prices, Vendr can stack up annual revenue pretty quickly. But why would Vendr customers pay it to handle their software spend? Savings, effectively. So long as they save more than Vendr charges, they are coming out ahead. And as the startup claims that it can cut the time to buying, its own customers can reduce time spent on securing tooling.

Everyone wins, it seems, except for software sellers. After all, they are the ones losing a chance to get less-sophisticated buyers to pay more for their code, right? Neu said that his company’s model isn’t too bad for selling companies as they close deals much more quickly, at a higher rate of closure. That could save their sales team time, which might help balance the price differential.

Pressed on what Vendr might be able to do for the selling side of the software market given its present-day buyer focus, Neu declined to share any possible plans.

Returning to the round, why did Vendr raise the money at all if it was doing just fine sans new external funding? The company told TechCrunch that it has scaled its staff to 60 from 10 a year ago, and that it wanted a stronger balance sheet. That’s fine. We’d be hard-pressed to find the startup that wouldn’t take such a large check from Tiger, given the valuation gain the raise implies for Vendr, so there isn’t too much mystery to unpack.

A theme that TechCrunch has explored in recent weeks has been the huge depth of the software market. Given the TAM for bits and bytes, Vendr may be able to keep up the hypergrowth that its new round implies its investors will expect. Let’s see how 2021 winds up for the company.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Olo, the New York-based fintech startup that provides order processing software to restaurants, shared its initial IPO price range this morning. The company’s debut comes ahead of the expected IPO of Toast, a Boston-based unicorn with a similar market remit.

Targeting $16 to $18 per share, Olo could raise as much as $372.6 million in its public offering.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Unlike most companies going public in recent quarters that we’ve tracked, Olo has a history of growth and profitability, making its impending pricing all the more interesting. It’s unknown if Toast is profitable, but because most venture-backed IPOs aren’t, we’re presuming it isn’t.

This morning, we’re doing our usual work: parsing the company’s pricing interval to get a valuation range for Olo. We’ll calculate both simple and fully diluted pricing and then do some quick work on its revenue scale to come to grips with its total scale.

Are investors willing to pay more for profits? And, if so, how much? This is a niche question because most IPOs look a bit more like Coursera than Olo, but it’s still worth answering.

If you’d like to follow along, you can read the new S-1 filing here. Our first look at Olo is here, and its fundraising history is here, per Crunchbase.

The company is targeting $16 to $18 per share with an expected sale of 18 million shares. The company is also reserving 2.7 million shares for its underwriters. At the upper end of its range, not counting shares reserved for its bankers, Olo could raise $324 million in its debut.

Per the company, its total number of Class A and B shares outstanding after its IPO would come to 142,012,926, or what we calculate to be 144,712,926 shares, including its underwriters’ option. Using the latter — because we tend to look for valuation extremes — Olo would be worth $2.32 billion to $2.6 billion.

But what about its fully diluted valuation? Adding in shares that are currently tied to unexercised but vested stock options bring Olo to around 188,085,714 shares. Add in the underwriters’ option and the total rises to 190,785,714 shares.

Using the latter figure, at $16 and $18 per share Olo could be worth $3.05 billion to $3.43 billion on a fully diluted basis.

Let’s find out! Digging back into Olo’s growth, we can see a business with rapidly expanding software incomes. And the same software revenues are improving in quality over time. From 2019 to 2020, for example, Olo’s “platform” revenues — a mix of subscription and transaction top line from software — grew from $45.1 million to $92.8 million. Over the same time, the company’s platform revenue saw its gross margin improve from 73.6% to 84.5%.

Powered by WPeMatico