Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday morning? Sign up here.

Earnings season is coming to a close, with public tech companies wrapping up their Q4 and 2020 disclosures. We don’t care too much about the bigger players’ results here at TechCrunch, but smaller tech companies we knew when they were wee startups can provide startup-related data points worth digesting. So, each quarter The Exchange spends time chatting with a host of CEOs and CFOs, trying to figure what’s going on so that we can relay the information to private companies.

Sometimes it’s useful, as our chat with recent fintech IPO Upstart proved after we got to noodle with the company about rising acceptance of AI in the conservative banking industry.

This week we caught up with Yext CEO Howard Lerman and Smartsheet CEO Mark Mader. Yext builds data products for small businesses, and is betting its future on search products. Smartsheet is a software company that works in the collaboration, no-code and future-of-work spaces.

They are pretty different companies, really. But what they did share this time ’round the earnings cycle were macro notes, or details regarding their forward financial guidance and what economic conditions they anticipate. As a macro-nerd, it piqued my interest.

Yext cited a number of macroeconomic headwinds when it reported its Q4 results. And tying its future results somewhat to an uncertain macro picture, the company said that it is “basing [its] guidance on the business conditions [it sees for itself] and [its] customers currently, with the macro economy, which remains sluggish, and customers who remain cautious,” per a transcript.

Lerman told The Exchange that it was not clear when the world would open — something that matters for Yext’s location-focused products — so the company was guiding for the year as if nothing would change. Wall Street didn’t love it, but if the economy improves Yext won’t have high hurdles to jump over. This is one tack that a company can take when it talks guidance.

Smartsheet took a slightly different approach, saying in its earnings call that its “fiscal year ’22 guidance contemplates a gradual improvement in the macro environment in the second half of the year.” Mader said in an interview that his company wasn’t hiring economists, but was instead simply listening to what others were saying.

He also said that the macro climate matters more in saturated markets, which he doesn’t think that Smartsheet is in; so, its results should be more impacted by things more like “the secular shift to the cloud and digital transformation,” to quote its earnings call.

What the economy will do this year matters quite a lot for startups. An improving economy could boost interest rates, making money a bit more expensive and bonds more attractive. Valuations could see modest downward pressure in that case. And venture capital could slow fractionally. But with Yext forecasting as if it was facing a flat road and Smartsheet only expecting things to pick up pace from Q3 on, it’s likely that what we have now is mostly what we’ll get.

And things are pretty damn good for startups and late-stage liquidity at the moment. So, smooth sailing ahead for startup-land? At least as far as our current perspective can discern.

We still have a grip of notes from Splunk CEO Douglas Merritt on how to take an old-school software company and turn it into a cloud-first company, and Jamf CEO Dean Hager about packaging discrete software products. More to come from them in fits.

There were rounds big and small this week. Companies like Squarespace raised $300 million, while Airtable raised $277 million. On the smaller-end of the spectrum, my favorite round of the week was a modest $2.9 million raise from Copy.ai.

But there were other rounds that TechCrunch didn’t get to that are still worth our time. So, here are a few more for you to dig into this weekend:

Next week is Y Combinator Demo Day week, so expect a lot of early-stage coverage on the blog. Here’s a preview. From The Exchange we’re looking back into insurtech (with data from WeFox and Insurify), and talking about Austin-based software startup AlertMedia’s decision to sell itself to private-equity instead of raising more traditional capital.

And to leave you with some reading material, make sure you’ve picked through our look at the valuations of free-trading apps, the issues with dual-class shares, the recent IPO win for the New York scene and how unequal the global venture capital market really is.

Closing, this BigTechnology piece was good, as was this Not Boring essay. Hugs, and have a lovely respite,

Powered by WPeMatico

Fetcher, a startup that promises to make the recruiting process easier while also diversifying the candidate pool, is announcing that it has raised $6.5 million in Series A funding.

Originally known as Scout, the New York startup was founded by CEO Andres Blank, CPO Chris Calmeyn and engineering directors Javier Castiarena and Santi Aimetta.

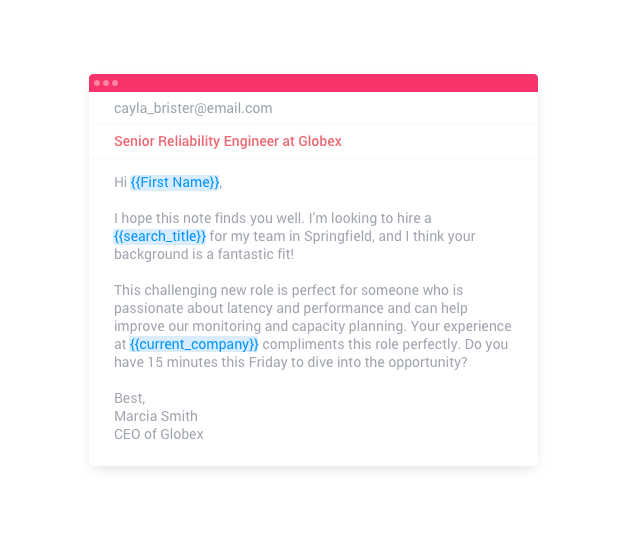

Blank told me that Fetcher automates parts of recruiters’ jobs, namely finding job candidates and sending the initial outreach emails. When I wondered whether that just leads to more spammy recruiting messages, he said that Fetcher emails actually result in “a very good response rate” because they’re targeted at the right candidates.

“The reality is that if you’re looking for a job, you don’t need an email to be so amazing, and if you’re a recruiter, you don’t want to spend 10 minutes thinking about what to write to each candidate,” he said.

He also described Fetcher’s approach as a “human in the loop” approach. Yes, the initial outreach is automated, but then the recruiter handles the conversations with candidates who respond.

Image Credits: Fetcher

“By automating both the sourcing [and] outreach sides of recruiting, Fetcher reduces the amount of time a recruiter spends in front of a computer searching for candidates, making a recruiter’s job more balanced, strategic and impactful, all while continuing to build a robust, diverse pipeline for the company,” Blank wrote in a follow-up email.

He also suggested that automated sourcing allows recruiters to reach a much more diverse candidate pool than they would through traditional methods. For example, he sent me a case study in which Fetcher helped video collaboration startup Frame.io hire 11 new employees in less than 12 months, nine of whom were women and/or underrepresented minorities.

“Fetcher has freed up time and given us the capacity to diversify our pipeline more organically,” said Anna Chalon, Frame.io’s senior director of talent and diversity, equity and inclusion, in a statement. “This has allowed us to make some incredible hires, mostly from underrepresented groups, over the last year.”

Blank added that after Fetcher has seen its revenue increase every month since July of last year, owing to shrinking recruiting teams needing to be able to do more with fewer resources, as well as a greater corporate focus on the aforementioned diversity, equity and inclusion.

Fetcher has now raised a total of $12 million. The Series A was led by G20 Ventures, with participation from KFund, Slow Ventures and Accomplice. Blank said he’s planning to double the employee count (currently 80) by the end of the year and to build out additional analytics (including diversity analytics) and CRM tools.

Powered by WPeMatico

Snowflake announced earlier this month that it would give up its dual-class shareholder structure, a corporate governance setup that often gives founders and executives superior voting rights, typically involving 10 times as many votes for their own shares as others receive. The mechanism can enable founders to maintain control despite later dilution and may sometimes even grant ironclad control to an individual in perpetuity.

For many companies, these supervoting shares represent a highly powerful tool, allowing founders to have their cake and eat it, too — to go public and receive the advantages of being a public company while limiting the power of external shareholders to influence how they run the company once it floats.

Some founders and their investors argue that these preferred shares protect them from the short-term whims of the market, but the perspective isn’t universally accepted.

Some founders and their investors argue that these preferred shares protect them from the short-term whims of the market, but the perspective isn’t universally accepted. Dual-class shares are a controversial governance structure, and some wonder if they are setting up an unfair playing field by allowing a cabal to wield outsized power.

Why would Snowflake give up such a powerful tool a mere six months after it went public? We decided to look at the notion of dual-class shares and why Snowflake may have been willing to let them go.

If one of the primary purposes of dual-class shares is to consolidate CEO power, then perhaps Snowflake felt they weren’t necessary, given the history of CEO-shuffling at the company. While Snowflake’s founders are still part of the organization, they hired Sutter Hill investor Mike Speiser to be their first CEO, followed by former Microsoft exec Bob Muglia before finally bringing in veteran CEO Frank Slootman to take their company public.

Without an all-powerful CEO founder in place, perhaps the company felt that supervoting shares weren’t necessary. Regardless, Snowflake CFO Mike Scarpelli framed the move as a decision that works for all parties when he announced that his company would abandon the special shares during its earnings call earlier this month.

“Today, we announced that on March 1st, 2021, our Class B shareholders in accordance with our governing documents converted all of our Class B common stock to Class A common stock, eliminating the dual-class structure of our common stock and ensuring that each share has an equal vote. We view this as operationally beneficial to the company and our shareholders,” Scarpelli said during the call.

Powered by WPeMatico

Saleor, a Poland and U.S.-based startup that offers a “headless” e-commerce platform to make it easier for developers to build better online shopping experiences, has raised $2.5 million in seed funding.

The round is led by Berlin’s Cherry Ventures, with participation from various angels. They include Guillermo Rauch (Vercel CEO and inventor of Next.js), Chris Schagen (former CMO of Contentful) and Kevin Mahaffey (co-founder of Lookout).

Saleor says the injection of capital will be invested in further developing Saleor‘s headless e-commerce platform, including a soon-to-launch cloud product and GraphQL API for front-end engineers.

Founded in 2020 but with a history going back to 2013, years before founders Mirek Mencel and Patryk Zawadzki spun out the product separate from their agency, Saleor is described as an “API-first” e-commerce platform that takes a “headless” approach. The idea is that the platform does the back-end heavy lifting so that developers can focus on the front end where most of the value is created for users.

“Saleor was born of necessity when our agency work at Mirumee Software required more modular, flexible and scalable e-commerce software,” Saleor co-founder Mirek Mencel recalls. “Most solutions for bigger brands came with proprietary baggage like vendor lock-in, slow adoption of new technologies and commercial certification programs. On the open-source side, we didn’t enjoy Magento’s developer experience and felt alternatives weren’t viable at scale”.

And so Saleor was conceived as an open-source platform focused on “technical excellence and quality” that could deliver greater scalability and extensibility than existing proprietary software. By 2016, the product had grown from something Mencel and Zawadzki’s agency used internally into a platform used by developers around the world.

“We could have stopped there, but saw brands pressing for more revolutionary front-end experiences,” Mencel says. “Decoupling Saleor’s core from its presentation layer was the obvious path to revolutionary front-ends. As difficult as it was, we tore down what was a rather good open-source e-commerce platform and rebuilt it API-first”.

Beyond their early headless conviction, the pair also came to the realisation that GraphQL delivered “more power, precision and developer happiness” than REST. Reasoning that most developers prefer “a few things done superbly to many things done well,” they committed exclusively to Saleor’s GraphQL API. “We have never looked back,” says Mencel.

In 2018, the original six-person team shipped Saleor 2.0. Now with a headcount of 20, Mencel says Saleor has a simple vision of developer-first commerce: open-source, GraphQL and “fair-priced” cloud — a vision that Cherry Ventures has clearly bought into.

“We are currently witnessing a paradigm shift with developers switching to headless commerce solutions, allowing more flexible, differentiated shopping experiences,” says Filip Dames, founding partner of Cherry. “Mirek, Patryk, and their team are at the forefront of this development and will enable innovative merchants to build state-of-the-art shopping experiences that scale across all consumer touch points and devices”.

“We decided to pursue venture backing as a way to increase the Saleor core team size and accelerate buildout of Saleor Cloud, which we’ll launch this year,” adds Mencel.

Powered by WPeMatico

Cymbio, a Tel Aviv-based startup focused on what it calls “brand-to-retailer connectivity,” announced today that it has raised $7 million in Series A funding.

CEO Roy Avidor, who founded the company with Mor Lavi and Gilad Zirkel, told me that the platform is designed to help brands sell their products on any e-commerce marketplace that they want. Whereas adding a new market might normally require a cost-benefit analysis (“How much money will it cost me to set up this retailer? How much sales will this retailer drive? Will the margins justify this?”), Avidor said Cymbio turns the process into a “no brainer” with immediate integration.

That’s because the platform automatically handles all the differences between marketplaces, whether that involves the taxonomy of the product pages or the background color of the product images, as well as inventory syncing, tracking and returns. It allows the brand to fulfill orders using drop shipping — so the brand stores and ships the products, rather than the marketplace, getting access to customer names and addresses in the process.

Avidor said that increasingly, brands realize “they need to be where the customers are.” That doesn’t mean they’ll sell on every single marketplace, but with Cymbio, “brand perception and visibility” are the main limitations, rather than time and money.

Cymbio founders. Image Credits: Cymbio

In 2020, the company says that its customer count increased 12x and now includes Steve Madden, Marchesa, Camper and Micro Kickboard. The company also says that it reduces the time to launch on a new marketplace by 91%, while increasing digital revenue for the average customer by 65%.

The company says the Series A will allow it to expand its sales and marketing team while continuing to develop the product — on the product front, Avidor said the team is working on “a no-code integration where anyone can connect to anything quickly, no developers needed.”

The new funding was led by Vertex Ventures, with participation from Udian Investments, Payoneer founder Yuval Tal and Sapiens co-founder Ron Zuckerman.

“We believe deeply that Cymbio’s technology will fundamentally change the game for brands that sell online, making long, cumbersome integrations a thing of the past,” said Emanuel Timor, general partner at Vertex Ventures Israel, in a statement.

Powered by WPeMatico

This morning TechCrunch covered an interesting round for Copy.ai, a startup that employs GPT-3 to help other companies with their writing projects. GPT-3, or Generative Pre-trained Transformer 3, is a piece of AI from the OpenAI group that takes text from the user, and writes a lot more for them.

As part of the process of covering the Copy.ai round, I got caught up in the idea of AI-powered writing. I’ve long been more curious than afraid of automated writing. So when the Copy team described their very positive impressions of the GPT-3 AI writing tool to TechCrunch during an interview, I was intrigued.

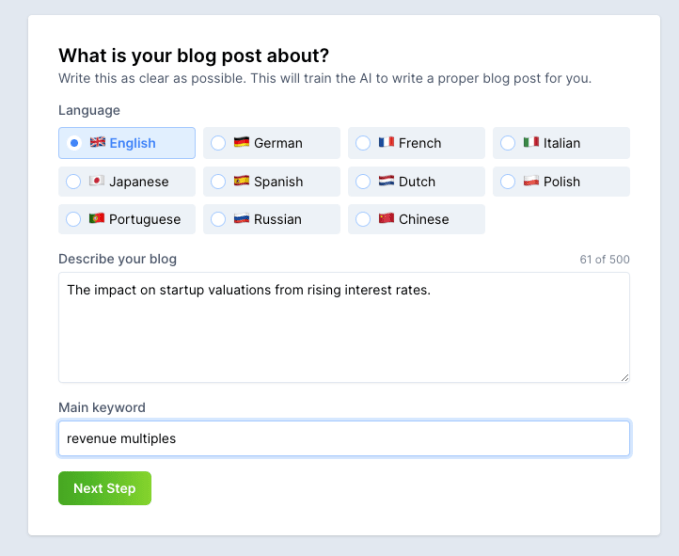

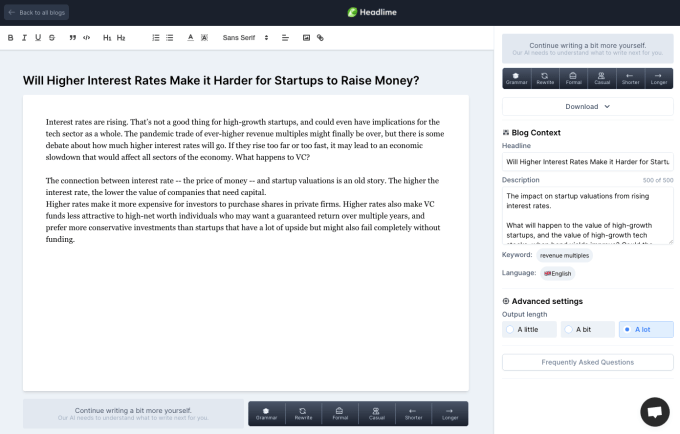

To scratch this newly-formed itch, I doodled around this morning with a competitor of sorts to the Copy team , Headlime. And, freaking heck am I am impressed at what folks have managed to build around the GPT-3 technology.

Sure, GPT-3 can add words to a prompt. But the technology can do a lot more than that. The GPT-3-powered Headlime managed to not only write some medium-good stuff for me, but also managed bring in concepts concerning my reporting beat that were in my head but not in the prompts I provided.

I can’t do better than just show you what I mean. So, here’s what happened when I used Headlime for the first time, sans help.

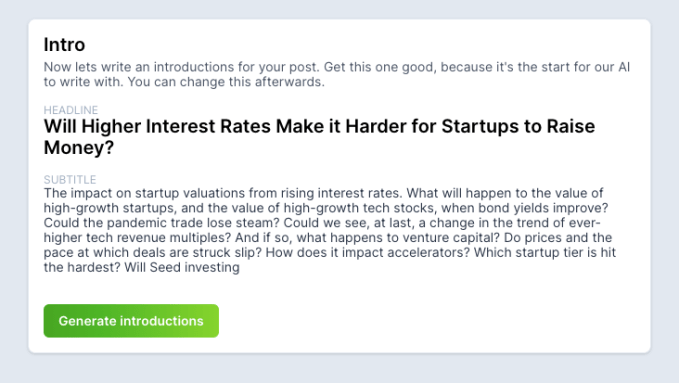

Here’s the first thing that Headlime showed me, a language selector and a request for a description of the post that I wanted to write. I decided to push the system a bit by just telling it about a piece I need to write in light of today’s market action:

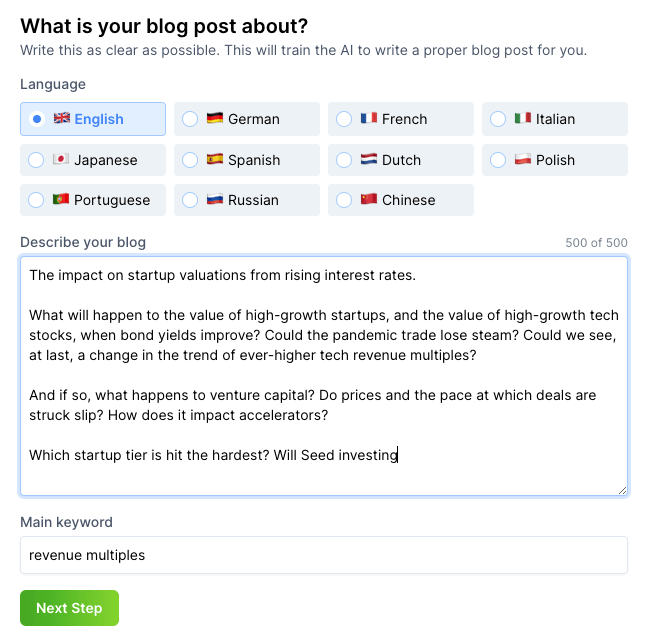

Ha ha, I thought, that will kick it in the teeth and I, a biped of intelligent meat wrapped around some calcium sticks, will feel grossly superior to the computer player. I hit go and then realized that I actually had to provide 500 characters of stuff, so I rambled for a bit to fill in required length:

Time for the next step! Hitting the button brought up a list of possible headlines for the post I was helping create, which were honestly not terrible:

Fair enough, yeah? At this point I was starting to become impressed.

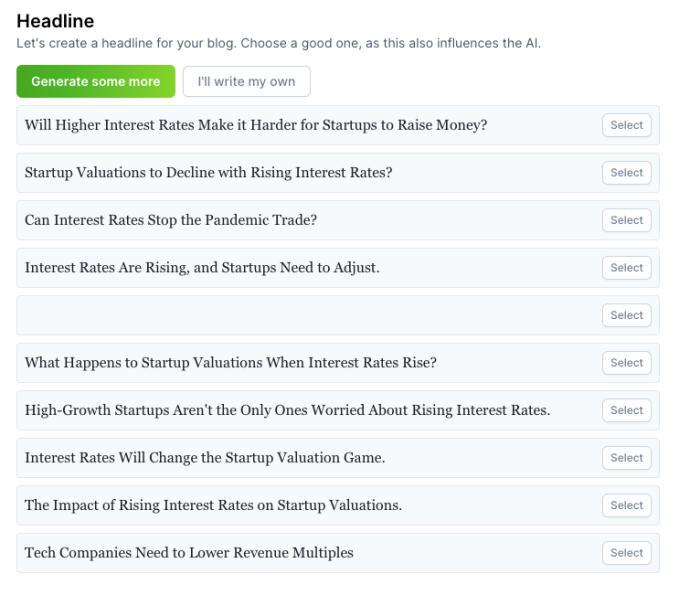

I selected the first headline as it was my favorite and moved along. Next came the work to get an intro put together for the post, a process that involved the strenuous work of clicking a button:

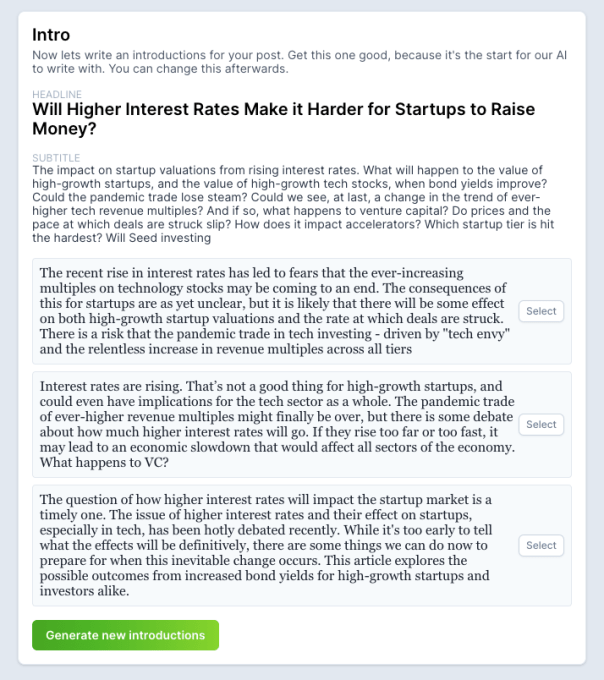

Here are the options proffered:

Here are the options proffered:

Again, not bad.

What struck me about these are not merely minor variations on each other. They are structured differently, taking various angles on what I was halfway talking about in the 500 characters of bilge I had fed into the system. I was starting to wish that I had given GPT-3 a bit more to work with up top, as it was trying its best after I had clearly not.

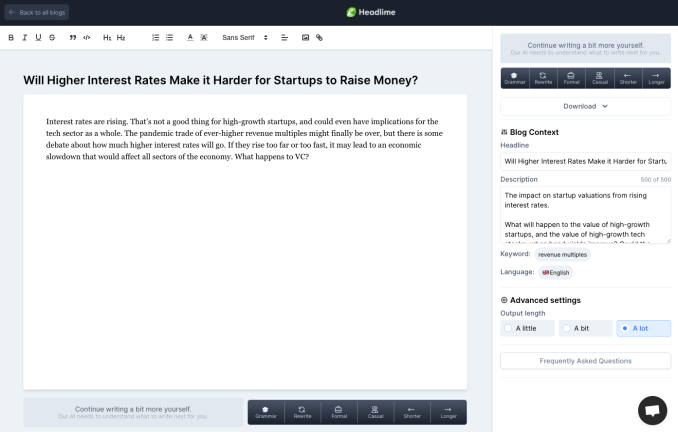

Intro selected, I was brought into a CMS of sorts, where our selected bits were included, and your humble servant was asked to do a bit more writing.

I was happy to oblige, only for the system to stop me and offer to take over:

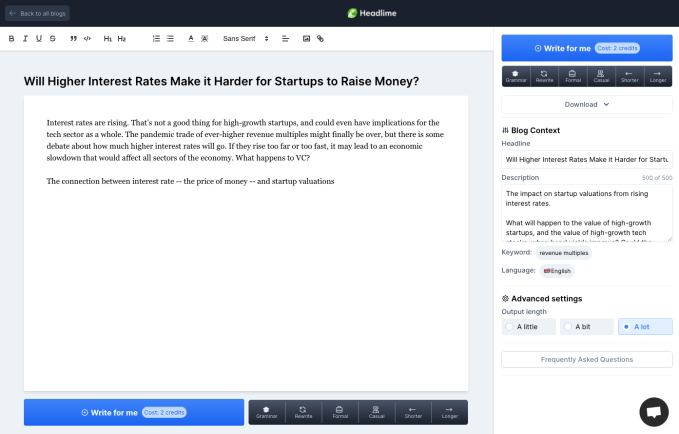

Having precisely no idea what a credit is, or what two of them cost as I was on a free trial of sorts, I hit the “Write for me” button. This is what came out:

Look at how it finished that sentence I started, even after I used em-dashes! The software gets the next sentence backwards, but is right back on the horse afterwards talking about how higher interest rates make exotic investment classes like venture capital less attractive! I was gobsmacked.

I will keep playing with the tech and the various software wrappers that are being built to productize GPT-3. More notes to come. But I wanted to pause and share my initial delight. This is cool. I can’t recall the last time that technology actually shocked me. But, well played GPT-3, you’re amazing.

Powered by WPeMatico

A big story in the finance world this morning is that the Nasdaq composite index lost ground in pre-market trading while bond yields rose. The concern is that inflation could rise, which led to bonds selling off and falling valuations for expensive stocks. So, tech stocks were broadly lower this morning.

Unlike last night, when New York-based restaurant software company Olo priced its IPO at $25 per share, sharply above its raised IPO target price range.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Today, we’re checking in on the price investors paid for a block of Olo shares before it began trading. The resulting valuation and its new revenue multiples will help us answer several questions.

First, how hot is the market for high-growth tech shares that also feature profitability? And, second, is Olo pricing ahead of, or behind, known comps? If the latter is true, it could point to a cooling enthusiasm among public investors for tech IPOs, even if the headline numbers coming from the Olo IPO are impressive.

First, how hot is the market for high-growth tech shares that also feature profitability? And, second, is Olo pricing ahead of, or behind, known comps? If the latter is true, it could point to a cooling enthusiasm among public investors for tech IPOs, even if the headline numbers coming from the Olo IPO are impressive.

Then we’re going to chat about Coinbase’s latest S-1/A filing, which helps provide a bit of guidance regarding how its direct listing is scooting along.

Ready to get caught up on the public-private divide that the most successful startups cross? Let’s get into it!

As a quick reminder, Olo initially targeted a $16 to $18 per-share IPO price interval. That was raised, as expected, to $20 to $22 per share. Pricing at $25, then, is a strong 56.25% greater per-share value than the low end of the company’s first estimate.

As Olo featured rapid growth (an acceleration in year-over-year revenue from 59.4% in 2019 to 94.2% in 2020), and GAAP profits (a 2019-era net loss of $8.3 million became 2020 net income of $3.1 million) in its IPO filings, the first price range it rolled out felt a bit light. The second, however, felt more appropriate.

At $25 per share, we have to do new math. Using a simple share count inclusive of the company’s underwriters’ option, Olo is worth $3.62 billion. That figure swells to $4.6 billion when a fully diluted valuation is calculated, per IPO watch group Renaissance Capital.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This is our Wednesday show, where we niche down and focus on a single topic, or theme. This is our sweet spot: going beyond definitions and into the dirty and deep impact of how a phenomenon could impact startups and tech. We are hoping to explore more than answer, and debate more than agree.

This week we’re riffing on the impending Y Combinator Demo Day class, all hailing from the Winter 2021 cohort. As we stated on the show, we’re not saying that these are the only startups worth looking at. They’re simply the startups from the batch that TechCrunch has already covered, as well as some crowdsourced favorites.

Here’s a brief rundown of the show, bucketed by market choice, loosely:

The actual Demo Day is happening next Tuesday, so TechCrunch and Extra Crunch will be all over day-of coverage as per usual. Talk then!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday morning at 7:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Copy.ai, a startup building AI-powered copywriting tools for business customers, announced a $2.9 million round this morning. The investment was led by Craft Ventures. Other investors took part in the deal, including smaller checks from Li Jin’s newly formed Atelier Ventures and Sequoia.

The startup is notable for a few reasons. First for its model of building in public. I initially heard of the company through its monthly updates that it posts on Twitter. Thanks to that, I can tell you that Copy.ai generated monthly recurring revenue (MRR) of $53,600. That figure, up 46% from January, works out to annual recurring revenue (ARR) of $643,200.

Copy.ai also shares usage numbers, and, humorously, the number of Twitter followers that its founder Paul Yacoubian picked up in the last month.

The startup is also worth watching because it is part of a growing cohort of companies building atop GPT-3, what its progenitor the OpenAI project describes as an “autoregressive language model with 175 billion parameters.” More generally, it’s a piece of AI that can generate words.

Some investors are rather bullish on startups using the technology. Recently on TechCrunch, for example, Madrona’s Matt McIlwain wrote that “the introduction of GPT-3 in 2020 was a tipping point for artificial intelligence” that will lead to “the launch of a thousand new startups and applications.”

So far that’s holding up. Not only has Copy.ai managed to find early in-market traction, TechCrunch has covered a number of other startups busy leveraging GPT-3, including OthersideAi, which raised $2.6 million back in November of 2020, and an “AI Dungeon-maker” called Latitude that also employs GPT-3 and raised $3.3 million this February.

But enough about its cohort. Let’s get into how Copy.ai got built.

Before founding Copy.ai, Yacoubian was an investor and, it seems, a tinkerer. He played with GPT-3 predecessor GPT-2 when it came out, telling TechCrunch in an interview that he discovered that the tool generated lots of “nonsense,” with the occasional “flash of brilliance.” GPT-3 proved even better in his view, providing something akin to a “50x” improvement on the generation that came before it.

Leaning on Twitter as a distribution method — Copy.ai uses Twitter as a distribution channel, hence its reporting on social media metrics — Yacoubian and his co-founder Chris Lu launched a few different draft-projects using GPT-3. Simplify.so did text condensing, a slackbot was built but never made it to the outside world and taglines.ai was put together to help companies come up with slogans.

That last one found early traction, generating around 700 sign-ups in two days. That was enough of a user base, the co-founders decided, to begin monetizing their tool. Then they decided that the initial concept could be extended to other writing use cases, helping people with myriad distinct writing projects. Copy.ai was formed out of that concept.

The product can now generate text for blogs and products and headlines and the like, based on user-provided word inputs.

What’s odd and nearly antithetical to your humble servant as a writer is that Copy.ai doesn’t want to save you word count, per se. Instead, it generates a number of possible text results from which the customer then chooses. Recall the flashes of brilliance that Yacoubian said GPT-2 could generate? GPT-3 is even better, giving users of Copy.ai even better possible text formulations for their needs. And then the human-in-the-loop plays the editor role, choosing which they want the most and, I presume, tweaking from there.

When it was released back in October of 2020, Copy.ai snagged 2,000 sign-ups in its first two days. Then investors started reaching out.

Quitting their day jobs, Copy.ai became a full-time affair. The unorthodox startup also put together an unorthodox round, raising from what Yacoubian described as “as many people as [they] could.” That wound up being 80 people, give or take.

The round was raised as a capped SAFE, the Y Combinator-favored investing instrument that allows startups to accrete capital from external sources without a formal pricing; instead, SAFEs are often “capped” at a maximum valuation. Copy.ai raised its cap as its fundraising process trundled along.

David Sacks, founder of Craft Ventures, told TechCrunch that he thinks that “natural language generation powered by AI is going to change the way that marketing teams write copy,” adding that amongst startups it is “rare to see such strong bottom-up adoption in so short a time.”

I am honestly a bit excited to see what Copy.ai can do, not because I will use its product — it’s not precisely in my wheelhouse — but because I am rather excited about GPT-3 as a technology. And the startup is an in-market experiment regarding AI and writing. Two things I care quite a lot about.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico

Squarespace has raised $300 million in a round of funding that values the company at a staggering $10 billion valuation.

New backers include Dragoneer, Tiger Global, D1 Capital Partners, Fidelity Management & Research Company, funds and accounts advised by T. Rowe Price Associates, Inc. and Spruce House. Existing backers Accel and General Atlantic also participated.

Squarespace founder & CEO Anthony Casalena said the fresh capital will advance the company’s growth initiatives and help it scale its product suite.

The move comes less than two months after the company filed confidentiality to go public via a direct listing or initial public offering.

Squarespace, which has helped millions create their own websites, was founded in 2003 and bootstrapped until a $38.5 million Series A in 2010 that was co-led by Accel and Index Ventures.

The online website creation and hosting service — which has now expanded into e-commerce by hosting online stores — then raised another $40 million round in 2014. But it is perhaps best known for its epic 2017-era $200 million secondary round that General Atlantic financed. That round was raised at a $1.5 billion pre-money valuation. That means it has effectively upped its valuation by more than five times in just over three years.

At that time, TechCrunch reported that Squarespace was a profitable company, with revenues increasing 50% in the prior year, to about $300 million. Execs are declining to comment on the company’s latest funding round beyond a post on its website.

New York City-based Squarespace has over 1,200 employees spread across its headquarters and offices in Dublin, Ireland; Portland, Oregon; and Los Angeles, California.

Powered by WPeMatico