Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Ketch, a startup aiming to help businesses navigate the increasingly complex world of online privacy regulation and data compliance, is announcing that it has raised $23 million in Series A funding.

The company is also officially coming out of stealth. I actually wrote about Ketch’s free PrivacyGrader tool last year, but now it’s revealing the broader vision, as well as the products that businesses will actually be paying for.

The startup was founded by CEO Tom Chavez and CTO Vivek Vaidya. The pair previously founded Krux, a data management platform acquired by Salesforce in 2016, and Vaidya told me that Ketch is the answer to a question that they’d begun to ask themselves: “What kind of infrastructure can we build that will make our former selves better?”

Chavez said that Ketch is designed to help businesses automate the process of remaining compliant with data regulations, wherever their visitors and customers are. He suggested that with geographically specific regulations like Europe’s GDPR in place, there’s a temptation to comply globally with the most stringent rules, but that’s not necessary or desirable.

“It’s possible to use data to grow and to comply with the regulations,” Chavez said. “One of our customers turned off digital marketing completely in order to comply. This has got to stop […] They are a very responsible customer, but they didn’t know there are tools to navigate this complexity.”

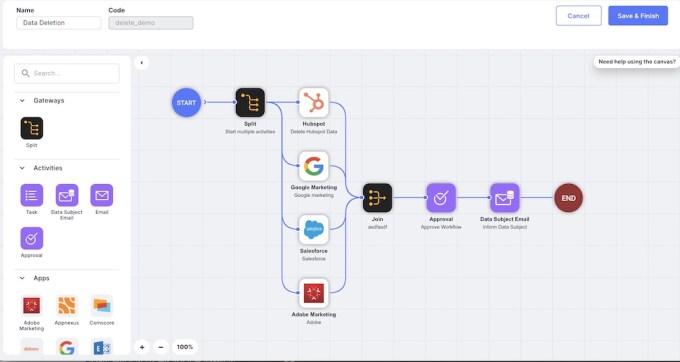

Image Credits: Ketch

The pair also suggested that things are even more complex than you might think, because true compliance means going beyond the “Hollywood façade” of a privacy banner — it requires actually implementing a customer’s requests across multiple platforms. For example, Vaidya said that when someone unsubscribes to your email list, there’s “a complex workflow that needs to be executed to ensure that the email is not going to continue … and make sure the customer’s choices are respected in a timely manner.”

After all, Chavez noted, if a customer tells you, “I want to delete my data,” and yet they keep getting marketing emails or targeted ads, they’re not going to be satisfied if you say, “Well, I’ve handled that in the four walls of my own business, that’s an issue with my marketing and email partners.”

Chavez also said that Ketch isn’t designed to replace any of a business’ existing marketing and customer data tools, but rather to “allow our customers to configure how they want to comply vis-à-vis what jurisdiction they’re operating in.” For example, the funding announcement includes a statement from Patreon’s legal counsel Priya Sanger describing Ketch as “an easily configurable consent management and orchestration system that was able to be deployed internationally” that “required minimal engineering time to integrate into our systems.”

As for the Series A, it comes from CRV, super{set} (the startup studio founded by Chavez and Vaidya), Ridge Ventures, Acrew Capital and Silicon Valley Bank. CRV’s Izhar Armony and Acrew’s Theresia Gouw are joining Ketch’s board of directors.

And if you’d like to learn more about the product, Ketch is hosting a webinar at 11am Pacific today.

Powered by WPeMatico

Airwallex, the fintech company for cross-border businesses, announced today it has added $100 million more to its Series D round, bumping its valuation up to $2.6 billion. The extension was led by Greenoaks, with participation from Grok Ventures and returning investors Skip Capital and ANZi Ventures.

Co-founder and chief executive officer Jack Zhang told TechCrunch that the new funding will be used for Airwallex’s United States launch in the second quarter of this year, expand its payment coverage to new regions like the Middle East, Africa, Eastern Europe and Latin America, and add more products, including physical cards.

This latest extension brings Airwallex’s Series D round to $300 million, and total equity raised so far to $500 million. Airwallex first announced its Series D in April 2020 after raising $160 million, then another tranche that added $40 million in September 2020.

Airwallex reached unicorn valuation after its Series C in March 2019. The company was founded in Melbourne in 2015, and now has more than 600 employees across 12 offices in Australia, China, Hong Kong, the United Kingdom, Japan and the United States. In its announcement today, Airwallex said it is also hiring for more than 500 positions.

Airwallex’s products for cross-border businesses include foreign currency accounts and multi-currency debit cards with Visa, international money transfers and a suite of APIs that allow companies to do things like accept and manage international payments, and manage their foreign exchange risk.

Powered by WPeMatico

Today Bloomberg reported, and Axios confirmed that Robinhood has filed privately to go public. The well-financed Robinhood is an American fintech company that provides zero-cost trading services to consumers.

Private IPO filings have become common in recent quarters, making Robinhood’s decision to file behind closed doors before showing its numbers to the public unsurprising. That it has filed privately, however, implies that the company is closer to a public debut than we might have anticipated.

Robinhood has long been expected to have a 2021 IPO in its plans. The company has not yet responded to an inquiry from TechCrunch regarding the news of its private IPO filing.

There are several reasons why Robinhood may be interested in a near-term public debut, despite running into controversies in recent quarters. No amount of time in front of Congress, bad PR from a user’s suicide, or settlements with the SEC can change the fact that today’s stock market favors growth, something that the company has in spades. Or that recent IPOs have been rapturously received by public investors as a cohort; it’s a warm time to pursue public-market liquidity.

The company’s revenue expanded greatly in 2020, something that TechCrunch has covered through the lens of Robinhood’s payment for order flow, or PFOF income. The company told Congress that the particular revenue source was the majority of its top line, meaning that PFOF growth is a reasonable comp for the company’s aggregate growth. And as TechCrunch has reported, those numbers rose sharply in 2020, from around ~$91 million in Q1 2020, to ~$178 million in Q2 2020, and ~$183 million and ~$221 million in the third and fourth quarter of last year.

Robinhood also makes money from consumer subscriptions, and other sources.

The fact that Robinhood has filed privately implies that it will go public sometimes soon, though perhaps not quickly enough to get around providing Q1 2021 numbers. More when we get our hands on the filing.

Powered by WPeMatico

U.K. challenger stockbroker Freetrade has raised a $69 million Series B round led by Left Lane Capital. The growth fund of L Catterton and existing investor Draper Esprit also participated. Freetrade operates a stock trading app and has managed to attract 600,000 users in the U.K. — they generated £1 billion in quarterly trade volume.

Freetrade has reached a post-money valuation of $366 million following today’s funding round. In December 2020, the company generated $1.4 million in revenue.

After signing up, Freetrade lets you buy and sell shares from the company’s mobile app. If you want to invest in companies with expensive shares, such as Alphabet (Google’s parent company), you can buy fractional shares. Instead of spending over $2,000 for a single share, you can buy one-tenth of a share for one-tenth of the price.

Freetrade lets you access U.S. and U.K. stocks as well as ETFs. Like Robinhood in the U.S., the company doesn’t charge any trading commission for basic orders — there’s a 0.45% foreign exchange fee on transactions in foreign currencies. Unlike Robinhood, the company doesn’t want to push you toward day trading.

In addition to free general investment accounts, Freetrade offers individual savings accounts (ISA). It’s a type of account specific to the U.K. that encourages long-term investments as tax on capital gains goes down over time. Freetrade charges £3 per month to open an ISA.

The company also offers pension savings accounts (SIPP). You get tax relief on contributions. If you live in the U.K., you’re probably familiar with SIPP. Those accounts cost £9.99 per month.

Finally, Freetrade has a premium plan for its most engaged users. You can pay £9.99 for Freetrade Plus. After that, you get 3% interest on cash up to £4,000, more stocks and more order types (limit and stop loss orders). You also get a free ISA and a discount on your SIPP.

As you can see, Freetrade is betting heavily on subscription revenue combined with a freemium approach. People who just want to buy a few shares probably stick with free accounts. But people who want to convert part of their savings into stocks and ETFs will likely end up subscribing to a tax-efficient account or a Freetrade Plus subscription.

With today’s funding round, the company plans to expand its product beyond its home country. You can expect some European expansion moves in the future.

For instance, Freetrade plans to launch in France with 5,000 stocks and ETFs from major European, U.K. and U.S. exchanges. Freetrade will support PEA, France’s equivalent of ISA, for €3 per month. And users will be able to subscribe to Freetrade Plus for €9.99 per month.

In other words, it’s going to be a very similar product in France and in the U.K. While there’s no dominant stock trading app in France, German startup Trade Republic recently launched its app on the French market. It’s going to be interesting to see how these two startups grow outside of their home countries.

Powered by WPeMatico

It’s demo day for the current Y Combinator class, so we’ll have a largely early-stage focus at TechCrunch today. But there’s also a host of late- and super-late-stage news this morning that matters.

Let’s get to all of it before we start to talk accelerators, overheated pre-seed valuations and the like.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

There are three things to discuss. First, the possible $10 billion exit of Discord to Microsoft. Discord is a well-financed unicorn that has raised oodles of capital and reportedly sports rapidly expanding revenues. Our goal will be to vet whether the price tag in question makes any sense, or if it is too low.

Second: Real estate tech company Compass has set an IPO price range we need to explore. Is its resulting valuation strong? Does it line up with its recent financial performance?

And, third, Intermedia Cloud Communications has priced its IPO. We’re behind on this entire debut, so we’ll take a second to riff on what the company does and what it is worth.

And, third, Intermedia Cloud Communications has priced its IPO. We’re behind on this entire debut, so we’ll take a second to riff on what the company does and what it is worth.

It’s a lot. But if we don’t get through it all now, we’ll fall behind and feel silly later. Let’s get to work!

Microsoft might be getting good at community, which is an odd thing to say about the enterprise software and cloud computing giant. The company’s Xbox gaming ecosystem has survived the test of time, Github is doing fine under Microsoft’s auspices, and Minecraft seems unharmed by Redmond’s stewardship.

That means gamers, developers and kids are all content to hang with Satya Nadella and company. Adding Discord to the mix might give Microsoft even more tooling to augment its existing communities, or perhaps tie them more closely together. But that’s all product news, which isn’t our remit. Let’s talk numbers.

The New York Times reported that Discord has “held deal talks with Microsoft for a transaction that could top $10 billion.” That figure has been widely reported, so we’ll use it for our work.

With a possible valuation in hand, we need revenue numbers to figure out if the possible sale price makes any sense. Happily, we have somewhat fresh numbers: The Wall Street Journal reported earlier this month that Discord “generated $130 million in revenue [in 2020], up from nearly $45 million in 2019.”

Powered by WPeMatico

OneTrust, a late stage privacy platform startup, announced it was adding ethics and compliance to the mix this morning by acquiring Convercent, a company that was built to help build more ethical organizations. The companies did not share the purchase price.

OneTrust just raised $300 million on a fat $5.1 billion valuation at the end of last year, and it’s putting that money to work with this acquisition. Alan Dabbiere, co-chairman at OneTrust sees this acquisition as a way to add a missing component to his company’s growing platform of services.

“Integrating Convercent instantly brings a proven ethics and compliance technology, team, and customer base into the OneTrust, further aligning the Chief Ethics & Compliance Officer strategy alongside privacy, data governance, third-party risk, GRC (governance, risk and compliance), and ESG (environmental, social and governance) to build trust as a competitive advantage,” he said.

Convercent brings 750 customers and 150 employees to the OneTrust team along with its ethics system, which includes a way for employees to report ethical violations to the company and a tool for managing disclosures.

Convercent can also use data to help surface bad behavior before it’s been reported. As CEO Patrick Quinlan explained in a 2018 TechCrunch article:

“Sometimes you have this interactive code of conduct, where there’s a new vice president in a region and suddenly page views on the sexual harassment section of the Code of Conduct have increased 200% in the 90 days after he started. That’s easy, right? There’s a reason that’s happening, and our system will actually tell you what’s happening.”

Quinlan wrote in a company blog post announcing the deal that joining forces with OneTrust will give it the resources to expand its vision.

“As a part of OneTrust, we’ll be combining forces with the leader across privacy, security, data governance, third-party risk, GRC, ESG—and now—ethics and compliance. Our customers will now be able to build centralized programs across these workstreams to make trust a competitive differentiator,” Quinlan wrote.

Convercent was founded in 2012 and has raised over $100 million, according to Pitchbook data. OneTrust was founded in 2016. It has over 8000 customers and 150 employees and has raised $710 million, according to the company.

Powered by WPeMatico

ActionIQ, which helps companies use their customer data to deliver personalized experiences, is announcing that it has extended its Series C funding, bringing the round to a total size of $100 million.

That number includes the $32 million that ActionIQ announced in January of last year. Founder and CEO Tasso Argyros said the company is framing this as an extension rather than a separate round because it comes from existing investors — including March Capital — and because ActionIQ still has most of that $32 million in the bank.

Argyros told me that there were two connected reasons to raise additional money now. For one thing, ActionIQ has seen 100% year-over-year revenue growth, allowing it to increase its valuation by more than 250%. (The company isn’t disclosing the actual valuation.) That growth has also meant that ActionIQ is getting “a lot more ambitious” in its plans for product development and customer growth.

“We raised more money because we can, and because we need to,” Argyros said.

The company continues to develop the core platform, for example by introducing more support for real-time data and analysis. But Argyros suggested that the biggest change has been in the broader market for customer data platforms, with companies like Morgan Stanley, The Hartford, Albertsons, JCPenney and GoPro signing on with ActionIQ in the past year.

Some of these enterprises, he said, “normally would not work with a cutting-edge technology company like us, but because of the pandemic, they’re willing to take some risk and really invest in their customer base and their customer experience.”

Argyros also argued that as regulators and large platforms restrict the ways that businesses can buy and sell third-party data, products like ActionIQ, focusing on the first-party data that companies collect for their own use, will become increasingly important. And he said that ActionIQ’s growth comes as the big marketing clouds have “failed” — either announcing products that have yet to launch or launching products that don’t match ActionIQ’s capabilities.

Companies that were already using ActionIQ include The New York Times. In fact, the funding announcement includes a statement from The Times’ senior vices president of data and insights Shane Murray declaring that the newspaper is using ActionIQ to deliver “hundreds of billions of personalized customer experiences” across “mail, in-app, site, and paid media.”

ActionIQ has now raised around $145 million total, according to Crunchbase.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20 percent off tickets right here.

Powered by WPeMatico

ServiceNow became the latest company to take the robotic process automation (RPA) plunge when it announced it was acquiring Intellibot, an RPA startup based in Hyderabad, India. The companies did not reveal the purchase price.

The purchase comes at a time where companies are looking to automate workflows across the organization. RPA provides a way to automate a set of legacy processes, which often involve humans dealing with mundane repetitive work.

The announcement comes on the heels of the company’s no-code workflow announcements earlier this month and is part of the company’s broader workflow strategy, according to Josh Kahn, SVP of Creator Workflow Products at ServiceNow.

“RPA enhances ServiceNow’s current automation capabilities including low code tools, workflow, playbooks, integrations with over 150 out of the box connectors, machine learning, process mining and predictive analytics,” Kahn explained. He says that the company can now bring RPA natively to the platform with this acquisition, yet still use RPA bots from other vendors if that’s what the customer requires.

“ServiceNow customers can build workflows that incorporate bots from the pure play RPA vendors such as Automation Anywhere, UiPath and Blue Prism, and we will continue to partner with those companies. There will be many instances where customers want to use our native RPA capabilities alongside those from our partners as they build intelligent, end-to-end automation workflows on the Now Platform,” Kahn explained.

The company is making this purchase as other enterprise vendors enter the RPA market. SAP announced a new RPA tool at the end of December and acquired process automation startup Signavio in January. Meanwhile Microsoft announced a free RPA tool earlier this month, as the space is clearly getting the attention of these larger vendors.

ServiceNow has been on a buying spree over the last year or so buying five companies including Element AI, Loom Systems, Passage AI and Sweagle. Kahn says the acquisitions are all in the service of helping companies create automation across the organization.

“As we bring all of these technologies into the Now Platform, we will accelerate our ability to automate more and more sophisticated use cases. Things like better handling of unstructured data from documents such as written forms, emails and PDFs, and more resilient automations such as larger data sets and non-routine tasks,” Kahn said.

Intellibot was founded in 2015 and will provide the added bonus of giving ServiceNow a stronger foothold in India. The companies expect to close the deal no later than June.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20 percent off tickets right here.

Powered by WPeMatico

In a new S-1/A filing, Coursera set an initial IPO price range between $30 and $33 a share, signaling the market views its edtech business warmly ahead of its impending public offering.

Coursera will have 130,271,466 shares outstanding after its IPO, or 132,630,966 including its underwriters’ option. At $30 per share, the low end of the company’s IPO range and a share count inclusive of 2,359,500 shares reserved for its underwriting banks, the firm would be worth $3.98 billion. That number rises to $4.38 billion at $33 per share.

Coursera is being valued as a software company, likely a breathe-easy moment for still-private edtech companies, since the debut could be an industry bellwether.

This is a solid increase from Coursera’s last private-market valuation, which was around $2.4 billion when it raised a Series F round in October 2020.

For the bulls in the room, there’s a bigger valuation if you tinker with the numbers. In a fully diluted accounting, including in our calculation, shares that are issuable upon vested options and RSUs, Coursera’s share count rises to 166,006,474, or 168,365,974 if we count its underwriters’ option. At its most generous share count and highest projected price, Coursera’s valuation could reach $5.56 billion.

However, IPO-watching group Renaissance Capital comes to a smaller $5.1 billion figure for a midpoint-range, fully diluted valuation. That result excludes shares reserved for underwriters and equity currently present in vested RSUs.

Using the more modest $5.1 billion midpoint figure, Coursera would be worth around 17.5 times its 2020 revenue of $293.5 million. Using a run-rate figure calculated from the company’s Q4 2020 results, its multiple falls to just over 15x.

Coursera is therefore being valued as a software company, likely a breathe-easy moment for still-private edtech companies, since the debut could be an industry bellwether.

The valuation is also a vote of confidence that Coursera’s rising deficits are not even a valuation risk, let alone an existential threat to its business. In the four quarters of 2020, the edtech giant lost $14.3 million, $13.9 million, $11.9 million and $26.7 million, the final Q4 net loss being the largest among the time interval for which we have data.

From all appearances, investors are valuing Coursera on its growth, not its profitability — or lack thereof.

Helping push its losses higher are rising sales and marketing costs, something TechCrunch has written about in the past. In Q4 2019, for example, the company spent $16.7 million on sales and marketing activities. That figure rose to $35 million in Q4 2020.

Powered by WPeMatico

Shares of Box, a well-known content-and-collaboration company that went public in 2015, rose today after Reuters reported that the company is exploring a sale. TechCrunch previously discussed rising investor pressure for Box to ignite its share price after years in the public-market wilderness.

At the close today Box’s equity was worth $23.65 per share, up around 5% from its opening value, but lower than its intraday peak of $26.47, reached after the news broke. The company went public a little over five years ago at $14 per share, only to see its share price rise to around the same level it returned today during its first day’s trading.

Box, famous during its startup phase thanks in part to its ubiquitous CEO and co-founder Aaron Levie, has continued to grow while public, albeit at a declining pace. Dropbox, a long-term rival, has also seen its growth rate decline since going public. Both have stressed rising profitability over revenue expansion in recent quarters.

But the problem that Box has encountered while public, namely hyper-scale platform companies with competing offerings, could also prove a lifeline; Google and Microsoft could be a future home for Levie’s company, after years of the duo challenging Box for deals.

As recently as last week, Box announced a deal for tighter integration with Microsoft Office 365. Given the timing of the release, it was easy to speculate the news could be landing ahead of a potential deal. The Reuters article adds fuel to the possibility.

While we can’t know for sure if the Reuters article is accurate, the possible sale of Box makes sense.

The article indicated that one of the possible acquisition options for Box could be taking it private again via private equity. Perhaps a firm like Vista or Thoma Bravo, two firms that tend to like mature SaaS companies with decent revenue and some issues, could swoop in to buy the struggling SaaS company. By taking companies off the market, reducing investor pressure and giving them room to maneuver, software companies can at times find new vigor.

Consider the case of Marketo, a company that Vista purchased in 2016 for $1.6 billion before turning it around and selling to Adobe in 2018 for $4.75 billion. The end result generated a strong profit for Vista, and a final landing for Marketo as part of a company with a broader platform of marketing tools.

If there are expenses at Box that could be trimmed, or a sales process that could be improved, is not clear. But Box’s market value of $3.78 billion could put it within grasp of larger private-equity funds. Or well within the reaches of a host of larger enterprise software companies that might covet its list of business customers, technology or both.

If the rumors are true, it could be a startling fall from grace for the company, moving from Silicon Valley startup darling to IPO to sold entity in just six years. While it’s important to note these are just rumors, the writing could be on the wall for the company, and it could just be a matter of when and not if.

Powered by WPeMatico