Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Another proptech is considering raising capital through the public arena.

Knock confirmed Monday that it is considering going public, although CEO Sean Black did not specify whether the company would do so via a traditional IPO, SPAC merger or direct listing.

“We are considering all of our options,” Black told TechCrunch. “We pioneered the real estate transaction revolution over five years ago and our priority is to build a war chest to dramatically widen the already cavernous gap between us and any unoriginal knock-offs.”

Bloomberg reported earlier today that the company had hired Goldman Sachs to advise on such a bid, which Knock also confirmed.

According to Bloomberg, Knock is potentially seeking to raise $400 million to $500 million through an IPO, according to “people familiar with the matter,” at a valuation of about $2 billion. The company declined to comment on valuation.

Black and Knock COO Jamie Glenn are no strangers to the proptech game, having both been on the founding team of Trulia, which went public in 2012 and was acquired by Zillow for $3.5 billion in 2014. The pair started Knock in 2015, and have since raised over $430 million in venture funding and another $170 million or so in debt.

Knock started out as a real estate brokerage business until last July, when the company announced a major shift in strategy and said it was becoming a lender. At the time, Knock unveiled its Home Swap program, under which Knock serves as the lender to help a homeowner buy a new home before selling their old house. It previously worked with lending partners but has now become a licensed lender itself.

In other words, the company now offers integrated financing — the mortgage and an interest-free bridge loan — with the goal of helping consumers make strong non-contingent offers on a new home before repairing and listing their old home for sale on the open market.

With that move, Knock eliminated its Home Trade-In program, where it helped consumers buy before selling by using its own money to purchase the new home on behalf of the consumer before prepping and listing the consumer’s old house on the open market. Under that trade-in model, the homeowner used the proceeds from selling their old home to buy the new home from Knock and pay the company back for any repairs it did to prep the house for sale.

At that time, Black told me that Knock had decided to move away from its trade-in program in part because it was capital-intensive and required the closing of a house to take place twice.

“It added friction to the experience,” he said. “And now, especially during COVID, it can be inconvenient to try and sell a house at the same time as buying one. This is about making something possible that isn’t possible with any other traditional lender. We’re able to lend some money before an owner’s [old] house is even listed on the market.”

To sum up what Knock does today, Black said the company aims to offer a full service technology platform that includes everything “from pre-funding the homebuyers to make non-contingent offers and win bidding wars, to getting their old home ready for market with our contractor network to selling their old home quickly at the highest price and empowers them to have their own agent working with them in the app through the entire process.”

Demand for the Home Swap, he added, has “exceeded all expectations.”

Knock is headquartered in New York and San Francisco. The company launched the Home Swap in three markets in July 2020, and today it is in 27 markets in nine states, including Texas, California and North Carolina.

“Our original plan was to be in 21 markets by the end of 2021,” Black said. “At our current growth rate, we expect to end the year at 45 markets and be in 100 by 2023.”

Knock began 2021 with 100 employees and now has 150. Its plan is to have at least 400 employees by year’s end.

Other proptech startups that have recently announced plans to go public include Compass and Doma (formerly States Title).

Powered by WPeMatico

One of the biggest pain points for startups and small businesses is keeping up with back office tasks such as bookkeeping and managing taxes.

QuickBooks, it seems, just doesn’t always cut it.

Three-time co-founders Waseem Daher, Jeff Arnold, and Jessica McKellar formed Pilot with the mission of affordably providing back office services to startups and SMBs. With over 1,000 customers, it has gained serious traction over the years. And Pilot has now also received validation from some big-name investors. On Friday, the company announced a $100 million Series C that doubles the company’s valuation to $1.2 billion.

Bezos Expeditions — Amazon founder Jeff Bezos’ personal investment fund — and Whale Rock Capital (a $10 billion hedge fund) co-led the round, which also included participation from Sequoia Capital, Index Ventures, Authentic Ventures and others.

Stripe and Index Ventures co-led Pilot’s $40 million Series B in April 2019. The latest financing brings the company’s total funding raised to over $158 million since its 2017 inception.

The founding team certainly has an impressive track record, having founded and sold two previous companies: Ksplice (to Oracle) and Zupli (to Dropbox).

Pilot’s pitch is about more than just software. The company combines its software with accountants to do things such as provide “CFO Services” to SMBs without a full-stack finance team. It also provides monthly variance analysis for all its bookkeeping customers, essentially serving as a controller for those companies, so they can make better budgeting and spending decisions.

It also helps companies access small business tax credits they may not have otherwise known about.

Last year, Pilot completed more than $3 billion in bookkeeping transactions for its customers, which range from pre-revenue startups to larger companies with more than $30M of revenue a year. Customers include Bolt, r2c and Pathrise, among others.

Pilot has also inked a number of co-marketing partnerships with companies such as American Express, Bill.com, Brex, Carta, Gusto, Rippling, Stripe, SVB, and Techstars.

Ironically, Pilot says it aspires to the “AWS of SMB backoffice.” (In fact, co-founder Waseem Daher started his career as an intern at Amazon). Put simply, Pilot wants to take care of all those back office tasks so companies can focus more on growth and winning business.

Pilot strives to offer an “exceptional customer experience,” which is reflected in the fact that over 80% of the company’s business is driven by customer referrals and organic interest, according to Daher.

Whale Rock Partner Kristov Paulus said that white-glove customer service experience and Pilot’s “carefully-engineered” software make a powerful combination.

“We look forward to supporting Pilot in their vision to make back office services as easy-to-use, scalable, and ubiquitous as AWS has with the cloud,” he said.

Pilot’s model reminds me a lot of that of ScaleFactor’s, an Austin-based startup that raised $100 million in a year before it crashed and burned. But the difference in this case is that Pilot seems to have satisfied customers.

Powered by WPeMatico

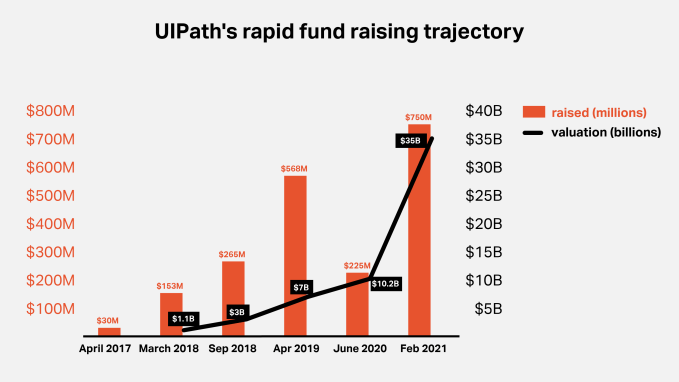

When TechCrunch covered UIPath’s Series A in 2017, it was a small startup out of Romania working in a little known area of enterprise software called robotic process automation (RPA).

Then the company took off with increasingly large multibillion dollar valuations. It progressed through its investment rounds, culminating with a $750 million round on an eye-popping $35 billion valuation last month.

This morning, the company took the next step on its rapid-fire evolutionary path when it filed its S-1 to go public. To illustrate just how fast the company’s rise has been, take a look at its funding history:

Image Credits: Bryce Durbin/TechCrunch

RPA is much better understood these days with larger enterprise software companies like SAP, Microsoft, IBM and ServiceNow getting involved. With RPA, companies can automate a mundane process like processing an insurance claim, moving work automatically, while bringing in humans only when absolutely necessary. For example, instead of having a person enter a number in a spreadsheet from an email, that can happen automatically.

In June 2019, Gartner reported that RPA was the fastest-growing area in enterprise software, growing at over 60% per year, and attracting investors and larger enterprise software vendors to the space. While RPA’s growth has slowed as it matures, a September 2020 Gartner report found it expanding at a more modest 19.5% with total revenue expected to reach $2 billion in 2021. Gartner found that stand-alone RPA vendors UIPath, Blue Prism and Automation Anywhere are the market leaders.

Although the market feels rather small given the size of the company’s valuation, it’s still a nascent space. In its S-1 filing this morning, the company painted a rosy picture, projecting a $60 billion addressable market. While TAM estimates tend to trend large, UIPath points out that the number encompasses far more than pure RPA into what they call “Intelligent Process Automation.” That could include not only RPA, but also process discovery, workflow, no-code development and other forms of automation.

Indeed, as we wrote earlier today on the soaring process automation market, the company is probably going to need to expand into these other areas to really grow, especially now that it’s competing with much bigger companies for enterprise automation dollars.

While UIPath is in the midst of its quiet period, it came up for air this week to announce that it had bought Cloud Elements, a company that gives it access to API integration, an important component of automation in the enterprise. Daniel Dines, the company co-founder and CEO said the acquisition was about building a larger platform of automation tools.

“The acquisition of Cloud Elements is just one example of how we are building a flexible and scalable enterprise-ready platform that helps customers become fully automated enterprises,” he said in a statement.

While there is a lot of CEO speak in that statement, there is also an element of truth in that the company is looking at the larger automation story. It can use some of the cash from its prodigious fundraising to begin expanding on its original vision with smaller acquisitions that can fill in missing pieces in the product road map.

The company will need to do that and more to compete in a rapidly moving market, where many vendors are fighting for different parts of the business. As it continues its journey to becoming a public company, it will need to continue finding new ways to increase revenue by tapping into different parts of the wider automation stack.

Powered by WPeMatico

Ryu Games, a startup that helps developers add cash tournaments to their mobile games, announced this morning it has raised $2.3 million in a seed round. The funds came from a number of investors, including Side Door Ventures, MGV Capital, Velo Partners and Citta Ventures.

In addition, 500 Startups participated in the round. To see the accelerator take part in the funding round is not a surprise, as TechCrunch first caught wind of Ryu during its participation in the most recent 500 Startups demo day. At the time, we were enthused by the idea of gamers wagering money to go head-to-head with other players on mobile devices. Investors appear to back our first impression of the company.

The gist behind our bullishness on the company’s idea is that esports is cool. And though your humble servant is sufficiently ancient as to favor PC-based esports, younger folks are into mobile gaming esports. Fair enough. Now mix in the sports-betting frenzy that we’ve seen in the United States, and you have a potentially potent cocktail.

TechCrunch caught up with Ryu Games co-founder and CEO Ross Krasner to dig in a bit more. It turns out that the original esports-y model that we envisioned for Ryu was a bit off. Instead, players will often go toe-to-toe in an asynchronous fashion, betting high scores in a game against one another. So, competitive “StarCraft II” this is not. But “StarCraft” is famously difficult to be even mediocre at, while mobile games are simpler by nature, and thus more popular.

Perhaps your parents will square off against office friends in cash-fueled solitaire tournaments.

The money setup is simple, with Krasner likening it to a poker tournament. You wager a set amount, and then play. Ryu collects a fee for hosting, and then players get to it.

Ryu hopes to be present on a few dozen games this year. One matter that could slow adoption, however, is that games it partners with tend to relaunch a version of their title with Ryu’s SDK built in. The startup bites back against the work that partner-developers have to undertake by cross-promoting titles that use its system. So, if you sign up, you can do more than generate revenue. Your game might also find a new audience.

Like with most seed-stage startups, Ryu Games is more of a bet on the future than proof of a new trend. Let’s see how far it can get with this set of capital, especially as vaccines take larger and larger bites out of the pandemic that has kept us locked up for so very long.

Powered by WPeMatico

What happens to hot fintech startups that have benefited from a rise in consumer trading activity if regular folks lose interest in financial wagers?

That’s the question facing Robinhood, Coinbase and other trading platforms that have ridden an upward cycle. Each has performed well in recent quarters: Robinhood by securing huge payment-for-order-flow revenues, while Coinbase’s trading fees have proven incredibly lucrative, something we learned when it filed to go public.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

According to recent reporting, the consumer trading frenzy could be slowing: Bloomberg recently noted that options trading volume is slipping, Robinhood’s app store ranking is falling, and some alternative assets are also losing steam. Other reporting from the publication notes that many SPAC shares are underwater while Google trends data indicates falling consumer trading interest, perhaps limiting the inflow of new users for equities-focused apps.

There are other indications that the red-hot speculative consumer market is cooling. Bitcoin is off around 10% in the last week after a blistering rise in recent quarters. Hot stocks like Peloton, once a darling of traders, fell more than 10% yesterday alone.

But looking past price declines and other signals of market chop, volume itself at some well-known exchanges could be falling.

But looking past price declines and other signals of market chop, volume itself at some well-known exchanges could be falling.

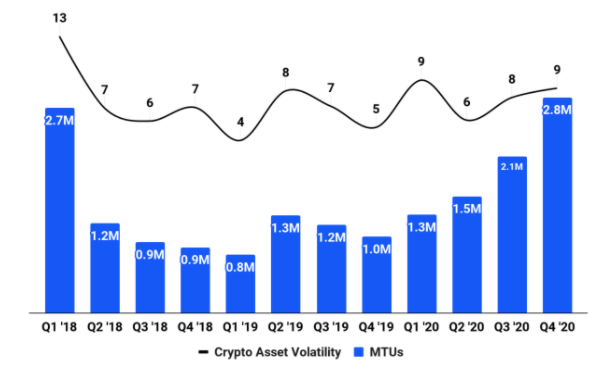

There’s a historical precedent for such declines. Coinbase’s historical revenues, to pick an example, have proved variable based on consumer interest in cryptocurrencies, with the company benefiting from rising demand and trading activity and seeing its top line decline in periods of restrained enthusiasm.

Robinhood and its fellow free trading apps have yet to undergo a similar rise-and-fall in trading volume, I’d reckon. At least of the sort of extreme up-and-down that Coinbase endured after the 2017-2018 bitcoin boom. Our question is, what would happen to Robinhood and its cohorts if the apparent cooling in consumer trading demand continues? Let’s talk about it.

Coinbase was a famously lucrative organization during the 2017-2018 bitcoin boom.

Indeed, we can see from the following chart from its S-1 filing that the company’s monthly transacting users (MTUs) dropped sharply into 2018. The percentage decline from 2.7 million to 800,000 is just over 70%.

Image Credits: Coinbase

And in case you think we’re being rude, we have a related chart from the same SEC filing that shows trading volume falling over the same period, not merely MTUs. We’re not picking a loose proxy to merely infer that trading revenue dipped at Coinbase. We can show it:

Powered by WPeMatico

Gorillas, the Berlin-HQ’d startup that promises to let you order groceries and other “every day” items for delivery in as little as 10 minutes, has raised $290 million in Series B funding, at a valuation that surpasses $1 billion.

The round — which was first reported by BI — is led by Coatue Management, DST Global and Tencent, with participation from Green Oaks, Fifth Wall and Dragoneer. Previous backer Atlantic Food Labs also followed on.

Noteworthy, Gorillas CEO and co-founder Kağan Sümer tells TechCrunch the round is “100% equity” (i.e. without a debt component). Asked if it includes any secondary funding — seeing existing shareholders liquidate a portion of their shares — Gorillas declined to comment.

Having become one of the fastest European startups to have achieved so-called “unicorn” status — a valuation of $1 billion or more — Gorillas says it will reward its rider crew and warehouse staff with $1 million in bonuses. However, the company isn’t disclosing how this one-off bonus breaks down per worker, and it isn’t clear if the bonus is cash or stock or a mixture of both. The move comes at a time when Gorillas riders in Germany are reportedly organising to unionise.

“In contrast to established gig economy models, we employ more than a thousand riders directly,” says Sümer. “Therefore, we invest in a strong career development program, rider security and a healthy working environment. Beyond that, all riders will receive a once-off payment”.

Founded last May by Kağan Sümer and Jörg Kattner in Berlin, Gorillas has already expanded to more than 12 cities, including Amsterdam, London and Munich. The company lets you order groceries and other household items on-demand with an average delivery time of 10 minutes.

To do this, it operates a vertical or “dark store” model, seeing it set up its own micro fulfillment centers, which currently total 40, spread across Germany, the U.K. and the Netherlands. Customers are charged just over $2 per delivery and can order from “more than 2,000 essential items at retail prices”.

“We believe that the weekly grocery run is outdated because people’s lives are increasingly spontaneous and shopping habits change accordingly,” says Sümer, noting that while access to supermarkets has increased, the space we have to store goods has decreased as people in cities are living in smaller spaces.

“Additionally, this pandemic has accelerated the need for grocery deliveries. If we can order clothes and trinkets and have them delivered to our door, the same should be said for our essential needs. Gorillas helps customers get what they need when they need it, whether this is their weekly grocery list or the tomatoes they forgot for tonight’s pasta recipe”.

Sümer says the service initially attracted typical early adopters because it was a radically new experience and the app was only available in English. He claims that Gorillas has since gained a “very broad” base of users that are “extremely loyal”. “With geographical expansion and the rapid increase of word-of-mouth, we now cater to pretty much anyone you’d meet in a supermarket,” he says.

Asked to share what a typical basket looks like, and therefore what kind of existing grocery habits Gorillas is displacing, Sümer says that users increase their basket size over time as they gain trust in the service and its products. “Simultaneously, customers are integrating an increasing share of their typical supermarket purchases within their Gorillas orders. This includes fresh goods like fruit and vegetables, as well as products of local suppliers”.

Meanwhile, dark store competition in cities like London — where Gorillas recently expanded and counts as a key market — continues to ramp up. This is seeing operators issue vouchers and offer sizeable discounts in a bid to acquire customers fast, while VCs are pumping huge amounts of early-stage cash into a space where unit economics aren’t yet definitively proven.

Earlier this month, Berlin-based Flink announced that it had raised $52 million in seed financing in a mixture of equity and debt. The company didn’t break out the equity-debt split, though one source told me the equity component was roughly half and half.

Others in the space include London’s Jiffy, Dija and Weezy, and France’s Cajoo. There’s also London-based Zapp, which remains in stealth, and heavily backed Getir, which started in Turkey but recently also came to London.

Meanwhile, U.S.-founded goPuff — which this week raised another $1.15 billion in funding at a whopping $8.9 billion valuation (compared to $3.9 billion in October) — is also looking to expand into Europe and has held talks to acquire or invest in the U.K.’s Fancy.

Powered by WPeMatico

This morning CoScreen, a startup that helps teams share screens and collaborate in real time, formally launched its product to market. It also disclosed that it has raised $4.6 million to date.

Unusual Ventures led its seed round. Till Pieper, CoScreen’s co-founder and CEO, told TechCrunch in an interview that it raised the bulk of its capital pre-pandemic, with the rest coming during 2020 in smaller chunks. A number of angels took part in funding the company, including GitHub CTO Jason Warner.

Why is screen-sharing worth millions in funding, and the time and attention of a whole team? It’s a good question. Happily the CoScreen team have built something that could prove more than a bit better than what you currently use in Zoom to share puppy pics with your team during meetings.

CoScreen provides screen-sharing capabilities, but in a neat manner. Let’s say you are on a Mac at your house, and I’m on a PC at mine. And we need to collab and share some work. I have a document you need to help me edit, and you have an image you want me to view. Using CoScreen, with one click according to Pieper, we can share the two apps across the internet. Yours will appear on my screen as it was native, and vice versa, and we can both interact with them in real time.

Or as close to real time as possible; Pieper told TechCrunch that latency is something that CoScreen will work on forever. Which makes sense, but what the company has built it thinks is good enough to take to market. So, today it’s launching the service after a period of time in beta for both Windows and Mac.

CoScreen also has audio and video-chatting capabilities. With limits. You can’t make video windows too big, for example, helping to keep the mental-load of chatting low. As someone with regular Zoom poisoning, that makes sense.

The startup’s project hits me as one of those things that sounds easy but isn’t. Remember Google Wave? It allowed for instantaneous co-writing. It was amazing. It died. And its successor-of-sorts Google Docs is a laggy mess to this day that feels more quarter-baked than half-done. Real-time tech is not simple.

Is the market too full of apps that allow a version of what CoScreen does for the startup to succeed? Maybe, maybe not. Zoom stormed the already mature video chat market with a product that actually worked. And so software that I have used has been very good at screen-sharing, let alone sharing and collaborating. So if CoScreen’s tech is good, the company should have a shot at broad adoption.

Which it is banking on. The startup is currently offering its product for free for a few weeks. It will focus on monetization later, Pieper explained. Making money is just not a burning desire for the firm at the moment, which implies both confidence in its product and bank account.

Closing, the startup is targeting engineers and other agile teams, though I suspect that its product will have wider market remit in time.

At this juncture, we’ll have to wait for numbers to see what’s ahead for CoScreen. The company didn’t share much in the way of usage metrics, which was reasonable, given its recent beta status. We’ll expect more hard figures the next time we chat.

Powered by WPeMatico

When the world shifted toward virtual one year ago, one service in particular saw heated demand: remote online notarization.

The ability to get a document notarized without leaving one’s home suddenly became more of a necessity than a luxury. Pat Kinsel, founder and CEO of Boston-based Notarize, worked to get appropriate legislation passed across the country to make it possible for more people in more states to get documents notarized digitally.

That hard work has paid off. Today, Notarize has announced $130 million in Series D funding led by fintech-focused VC firm Canapi Ventures after experiencing 600% year over year revenue growth. The round values Notarize at $760 million, which is triple its valuation at the time of its $35 million Series C in March of 2020. This latest round is larger than the sum of all of the company’s previous rounds to date, and brings Notarize’s total raised to $213 million since its 2015 inception.

A slew of other investors participated in the round, including Alphabet’s independent growth fund CapitalG, Citi Ventures, Wells Fargo, True Bridge Capital Partners and existing backers Camber Creek, Ludlow Ventures, NAR’s Second Century Ventures and Fifth Wall Ventures.

Notarize insists that it “isn’t just a notary company.” Rather, Canapi Ventures partner Neil Underwood described it as the “last mile” of businesses (such as iBuyers, for example).

The company has also evolved to “also bring trust and identity verification” into those businesses’ processes.

Over the past year, Notarize has seen a massive increase in transactions and inked new partnerships with companies such as Adobe, Dropbox, Stripe and Zillow Group, among others. It’s seen big spikes in demand from the real estate, financial services, retail and automotive sectors.

“In 2020, the world rushed to digitize. Online commerce ballooned, and businesses in almost every industry needed to transition to digital basically overnight so they could continue uninterrupted,” Kinsel said. “Notarize was there to help them safely close these deals with trust and convenience.”

The company plans to use its new capital to expand its platform and product and scale “to serve enterprises of all sizes.” It also plans to double down on hiring in the next year.

“Notarize is disrupting outdated business models and technologies, and there’s massive potential, particularly in the financial services space, as more companies will need to offer secure digital alternatives to in-person transactions,” Canapi’s Underwood said.

Notarize’s success comes after a difficult 2019, when the company saw “critical financing” fall through and had to lay off staff, according to Kinsel. Talk about a turnaround story.

Powered by WPeMatico

Pie Insurance, a startup offering workers’ compensation insurance to small businesses, announced this morning that it has closed on $118 million in a Series C round of funding.

Allianz X — investment arm of German financial services giant Allianz — and Acrew Capital co-led the round, which brings the Washington, D.C.-based startup’s total equity funding raised to over $300 million since its 2017 inception. Pie declined to disclose the valuation at which its latest round was raised, other than to say it was “a significant increase.”

Return backers Greycroft, SVB Capital, SiriusPoint, Elefund and Moxley Holdings also participated in the Series C financing.

The startup, which uses data and analytics in its effort to offer SMBs a way to get insurance digitally and more affordably, has seen its revenues climb by 150% since it raised $127 million in a Series B extension last May. Its headcount too has risen — to 260 from 140 last year.

Pie began selling its insurance policies in March 2018. The company declined to give recent hard revenue numbers, saying it only has grown its gross written premium to over $100 million and partnered with over 1,000 agencies nationwide. Last year, execs told me that in the first quarter of 2020, the company had written nearly $19 million in premiums, up 150% from just under $7.5 million during the same period in 2019.

Like many other companies over the past year, Pie Insurance — with its internet-driven, cloud-based platform — has benefited from the increasing further adoption of digital technologies.

“We are riding that wave,” said Pie Insurance co-founder and CEO John Swigart. “We believe small businesses deserve better than they have historically gotten. And we think that technology can be the means by which that better experience, that more efficient process, and fundamentally, that lower price can be delivered to them.”

Pie’s customer base includes a range of small businesses including trades, contractors, landscapers, janitors, auto shops and restaurants. Pie sells its insurance directly through its website and also mostly through thousands of independent insurance agents.

Workers’ compensation insurance is the only commercial insurance mandated for nearly every company in the United States, points out Lauren Kolodny, founding partner at Acrew Capital.

“Historically, it’s been extremely cumbersome to qualify, onboard and manage workers’ comp insurance — particularly for America’s small businesses which haven’t been prioritized by larger carriers,” she wrote via email.

Pie, Koldony said, is able to offer underwriting decisions “almost instantly,” digitally and more affordably than legacy insurance carriers.

“I have seen very few insurtech teams that come close,” she added.

Dr. Nazim Cetin, CEO of Allianz X, told TechCrunch via email that his firm believes Pie is operating in an “attractive and growing market that is ripe for digital disruption.”

The company, he said, leverages “excellent,” proprietary data and advanced analytics to be able to provide tailored underwriting and automation.

“We see some great collaboration opportunities with Allianz companies too,” he added.

Looking ahead, the company plans to use its new capital to invest further in technology and automation, as well as to grow its core workers’ comp insurance business and “lay the groundwork for new business offerings in 2021 and beyond.”

Powered by WPeMatico

Digital House, a Buenos Aires-based edtech focused on developing tech talent through immersive remote courses, announced today it has raised more than $50 million in new funding.

Notably, two of the main investors are not venture capital firms but instead are two large tech companies: Latin American e-commerce giant Mercado Libre and San Francisco-based software developer Globant. Riverwood Capital, a Menlo Park-based private equity firm, and existing backer early-stage Latin American venture firm Kaszek also participated in the financing.

The raise brings Digital House’s total funding raised to more than $80 million since its 2016 inception. The Rise Fund led a $20 million Series B for Digital House in December 2017, marking the San Francisco-based firm’s investment in Latin America.

Nelson Duboscq, CEO and co-founder of Digital House, said that accelerating demand for tech talent in Latin America has fueled demand for the startup’s online courses. Since it first launched its classes in March 2016, the company has seen a 118% CAGR in revenues and a 145% CAGR in students. The 350-person company expects “and is on track” to be profitable this year, according to Duboscq.

Digital House CEO and co-founder Nelson Duboscq. Image Credits: Digital House

In 2020, 28,000 students across Latin America used its platform. The company projects that more than 43,000 will take courses via its platform in 2021. Fifty percent of its business comes out of Brazil, 30% from Argentina and the remaining 20% in the rest of Latin America.

Specifically, Digital House offers courses aimed at teaching “the most in-demand digital skills” to people who either want to work in the digital industry or for companies that need to train their employees on digital skills. Emphasizing practice, Digital House offers courses — that range from six months to two years — teaching skills such as web and mobile development, data analytics, user experience design, digital marketing and product development.

The courses are fully accessible online and combine live online classes led by in-house professors, with content delivered through Digital House’s platform via videos, quizzes and exercises “that can be consumed at any time.”

Digital House also links its graduates to company jobs, claiming an employability rate of over 95%.

Looking ahead, Digital House says it will use its new capital toward continuing to evolve its digital training platforms, as well as launching a two-year tech training program — dubbed the the “Certified Tech Developer” initiative — jointly designed with Mercado Libre and Globant. The program aims to train thousands of students through full-time two-year courses and connect them with tech companies globally.

Specifically, the company says it will also continue to expand its portfolio of careers beyond software development and include specialization in e-commerce, digital marketing, data science and cybersecurity. Digital House also plans to expand its partnerships with technology employers and companies in Brazil and the rest of Latin America. It also is planning some “strategic M&A,” according to Duboscq.

Francisco Alvarez-Demalde, co-founder & co-managing partner of Riverwood Capital, noted that his firm has observed an accelerating digitization of the economy across all sectors in Latin America, which naturally creates demand for tech-savvy talent. (Riverwood has an office in São Paulo).

For example, in addition to web developers, there’s been increased demand for data scientists, digital marketing and cybersecurity specialists.

“In Brazil alone, over 70,000 new IT professionals are needed each year and only about 45,000 are trained annually,” Alvarez-Demalde said. “As a result of such a talent crunch, salaries for IT professionals in the region increased 20% to 30% last year. In this context, Digital House has a large opportunity ahead of them and is positioned strategically as the gatekeeper of new digital talent in Latin America, preparing workers for the jobs of the future.”

André Chaves, senior VP of Strategy at Mercado Libre, said the company saw in Digital House a track record of “understanding closely” what Mercado Libre and other tech companies need.

“They move as fast as we do and adapt quickly to what the job market needs,” he said. “A very important asset for us is their presence and understanding of Latin America, its risks and entrepreneurial environment. Global players have succeeded for many years in our region. But things are shifting gradually, and local knowledge of risks and opportunities can make a great difference.”

Powered by WPeMatico