Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

The first quarter of 2021 was a busy season for technology exits. Coming off a hot period in the final quarter of 2020, it was no surprise that tech upstarts pursued liquidity through a variety of mechanisms as the new year began.

There were IPOs, there were direct listings, there were PE deals. Hell, we even saw enough SPACs that we lost track of a few; amid all the noise, you’ll miss the occasional note no matter how well-tuned your ear.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Each path is still open for later-stage startups to pursue exits: The IPO market was welcoming until a few minutes ago and private equity firms are stacked with cash and willing to pay higher multiples than they might in more normal times. And there are sufficient SPACs to take the entire recent Y Combinator class public.

Choosing which option is best from a buffet’s worth of possibilities is an interesting task for startup CEOs and their boards.

DigitalOcean went public via a traditional IPO, raising a slug of capital in the process. The SMB-focused public cloud company likely felt like a somewhat obvious IPO candidate when you read its results. The Exchange spoke with the company’s CEO, Yancey Spruill, about the choice.

DigitalOcean went public via a traditional IPO, raising a slug of capital in the process. The SMB-focused public cloud company likely felt like a somewhat obvious IPO candidate when you read its results. The Exchange spoke with the company’s CEO, Yancey Spruill, about the choice.

Latch, in contrast, decided that a SPAC was its best route out the gate. The Exchange caught up with the company’s CFO, Garth Mitchell, about the transaction and why it made sense for his company.

And, finally, The Exchange spoke with AlertMedia’s founder and CEO, Brian Cruver, about his decision to sell his Texas-based company to a private equity firm.

To prevent this post from reaching an astronomic word count, we’ll give a brief overview of each deal and then summarize the company’s views about why their liquidity choice was the right one.

Kicking off with DigitalOcean, a few notes: First, the company has been pretty darn public about its growth in the last few years. We knew that it had an annualized run rate of around $200 million in 2018, $250 million in 2019 and around $300 million in the first half of 2020. It later announced that it hit that mark in May of last year.

So when DigitalOcean decided to go public, we weren’t bowled over. The company wound up pricing at $47 per share, the high end of its range. Since then, its stock has struggled somewhat, falling below $37 per share before recovering to $43.80 at the end of trading yesterday.

Enough of all that. Why did the company choose to go public via a traditional IPO? Spruill said his company looked at SPAC deals and direct listings. It selected the IPO route because it fit the company’s goals of generating a broad base of shareholders while creating a branding opportunity.

The cost of an IPO is comparable, he added, to other exit options. Spruill also praised the IPO process itself, noting that its rigorous requirements made DigitalOcean a better company.

Earlier in our chat, I asked Spruill a question that I put to every CEO on IPO day: How are you feeling? It’s a bit of a sop, but it sometimes elicits insights from executives and founders who, after weeks of discussing their companies’ inner workings, are asked a rare personal question.

Spruill said he felt incredible and that nothing could replicate an IPO as the culmination of so much work put into building a company and its team. If you add up the wins and losses over time, with more of the former than the latter, and can cross the finish line with the right metrics and market, you can earn a spot to be “grilled” by the “best investors,” he said.

Those investors put $750 million or so into his company, Spruill added. Funds that it can use to retire debt and free up more cash flow. Not a bad day, I’d say.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Natasha and Danny and Alex and Grace were all here to chat through the week’s biggest tech happenings. It was a busy week on the IPO front, Danny was buried in getting the Tonal EC-1 out, and Natasha took some time off. But the host trio managed to prep and record a show that was honestly a kick to record, and we think, a pleasure to listen to!

So, for your morning walk, here’s what we have for you:

It was a mix of laughs, ‘aha’ moments and honest conversations about how complex ambition in startups should be. One listener the other day mentioned to us that the pandemic made it harder to carve out time for podcasts, since listening was often reserved for commutes. We get it, and in true scrappy fashion, we’re curious how you’ve adapted to remote work and podcasts. Let us know how you tune into Equity via Twitter and remember that we’re thankful for your ears!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Today Coinbase, an American cryptocurrency trading platform and software company, said that it will begin to trade via a direct listing on April 14th. In a separate release the company also said that it will provide a financial update on April 6th, after the close of trading.

Coinbase’s impending public debut comes at an interesting market moment. As some tech companies delay their offerings over demand concerns, Coinbase is pushing ahead with its flotation perhaps in part because it will not price its debut in the traditional sense; direct listings forgo raising capital at a specific price point, and instead merely begin to trade, albeit with a reference price attached.

That Coinbase will release new numbers before beginning to trade is at once interesting and pedestrian. It’s interesting as TechCrunch cannot recall a private company looking to go public holding a similar event. And, Coinbase deciding to share “first quarter 2021 estimated results” and “provide a financial outlook for 2021” is also in part a common move, as many companies provide updated financials in their S-1 documents if time passes from when they first file to when they actually trade.

We’ll be tuned into that call, as the numbers shared will impact not only how Coinbase trades when it does float, but will also provide insight into how active consumer trading is writ large, and particularly in the cryptocurrency space; more than one startup in the market today depends on trading incomes to generate top-line, so seeing new numbers from Coinbase will be welcome.

The company will trade under the ticker symbol “COIN.”

Powered by WPeMatico

While several tech companies are opting to delay their IPOs in the face of less-than-enthusiastic market demand for their shares, real estate tech company Compass forged ahead and went public today. After pricing its shares at $18 apiece last night, the low end of a lowered IPO price range, Compass shares closed the day up just under 12% at $20.15 apiece.

TechCrunch caught up with Compass CEO and founder Robert Reffkin to chat about his company’s debut in the market’s suddenly choppy waters for tech and tech-enabled debuts.

Regarding whether Compass is a tech company or a real estate brokerage, Reffkin — who raised the comparison himself — used the opportunity to note that companies like Amazon or Tesla aren’t only one thing. Amazon is a logistics company, an e-commerce company, a cloud-computing business and a media concern all at the same time. Price that.

The argument was good enough for Compass to sell 25 million shares — a lowered amount — at its IPO price for a gross worth $450 million. That, the CEO said, was his company’s goal for its public offering.

Sparing TechCrunch the usual CEO line about an IPO not being a destination but merely one stop on a longer journey at that juncture, Reffkin instead argued that putting nine figures of capital into his company was his objective, not a particular price or resulting valuation.

That might sound simple, but as Kaltura and Intermedia Cloud Communications have pushed their IPOs back, it’s a bit gutsy. Still, if financing was the key objective, Compass did succeed in its debut. It was even rewarded with a neat little bump in value during its first day’s trading.

Reffkin did confirm to TechCrunch what we’ve been reporting lately, namely that the IPO market has changed for the worse in recent weeks. He described it as “challenging.”

So why go public now when there is so much capital available for private companies?

Reffkin cited a few numbers, but centered his view around having what he construes as the “right team” and the “right results.” We’ll get a bit more on the latter when Compass reports its first set of public earnings.

For now, it’s a company that braved stormier seas than we might have expected to see so soon after a blistering first few months of the year for IPOs.

And because I would also bring her along if I ever took a company public, here’s the company’s founder and CEO with his mother:

Image Credits: Compass

Powered by WPeMatico

The Exchange just yesterday discussed a downward revision in the impending Compass IPO and the disappointing Deliveroo flotation as signals that market demand for high-growth, unprofitable tech shares could be slipping. Recent news underscores the possibly chilling conditions. This morning, Kaltura, a technology company that provides video streaming software and services, delayed its IPO. JioForMe reports that the postponement comes after Kaltura’s “valuation demand was lower than expected.”

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

TechCrunch noted yesterday that Kaltura had not released a second, higher IPO price range. The fact stood out given how hot the public markets had proven in recent months for new tech offerings. Kaltura’s S-1 filing detailed accelerating revenue growth, which at the time we thought would be more than enough to fetch the company an attractive initial public valuation.

It appears that Kaltura was also surprised that it was not trending toward a higher IPO price.

In another sign of how quickly the temperature for new tech flotations may have chilled, digital comms firm Intermedia Cloud Communications also delayed its IPO today. In a release, CEO Michael Gold said the decision is due “to challenging current conditions in the market for initial public offerings, especially for technology companies.”

In another sign of how quickly the temperature for new tech flotations may have chilled, digital comms firm Intermedia Cloud Communications also delayed its IPO today. In a release, CEO Michael Gold said the decision is due “to challenging current conditions in the market for initial public offerings, especially for technology companies.”

Challenging current conditions? For IPOs? For tech IPOs? That’s new.

Axios reporter Dan Primack noted this morning that SPAC formation appears to be slowing. Mix that into the delays and yesterday’s anemic-to-awful IPO news, and the market could be seeing a somewhat rapid retrenchment toward more historical valuations and demand levels for unprofitable equities.

Thinking out loud: We should expect SPAC formation and deal volume to fall the fastest of all the signals we’re tracking, including IPO pricing, the pace of S-1 filings and first-day trading performance. Why? Because it’s the most exotic of the various data points we’ve observed on the way up during the tech boom. Therefore, it should also be the thing most vulnerable to rising financial gravity.

Powered by WPeMatico

Holler, described by founder and CEO Travis Montaque as “a conversational media company,” just announced that it’s raised $36 million in Series B funding.

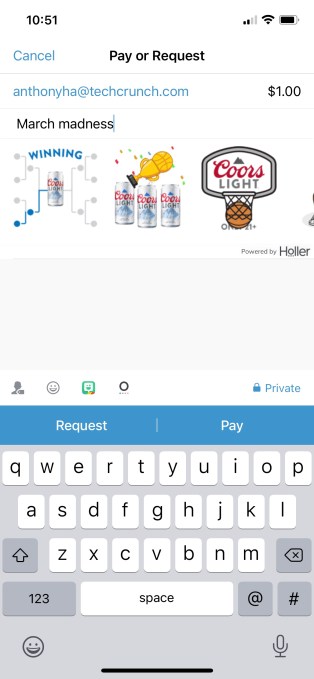

You may not know what conversational media is, but there’s a decent chance you’ve used Holler’s technology. For example, if you’ve added a sticker or a GIF to your Venmo payments, Holler actually manages the app’s search and suggestion experience around that media. (You may notice a little “powered by Holler” identifier at the bottom of the window.)

Montaque told me the company started out initially as a news and video content app before focusing on messaging in 2016. Messaging, he argued, is “the most important experience for people online,” since “it’s where we communicate with the people who are closest to us.”

He continued, “It seemed bizarre that we haven’t seen much innovation in the text messaging experience since the first text message was sent in 1992.”

So Holler works with partners like PayPal-owned Venmo and The Meet Group to bring more compelling content into the messaging side of their apps — or as Montaque put it, the startup aims to “enrich conversations everywhere.”

Image Credits: Holler

There’s both an art and a science to this, he said. The art involves creating and curating the best stickers and GIFs, while the science takes the form of Holler’s Suggestion AI technology, which will recommend the right content based on the user’s conversations and contexts — the stickers and GIFs you want to send in a dating app are probably different from what you’d in a work-related chat. Montaque said that this context-focused approach allows the company to provide smart recommendations in a way that also respects user privacy.

“I believe that the future is context, not identity,” he said. “Because I don’t really need to know about Anthony, I just need to know someone is in need of lunch. If I know you’re in the mood for Mexican food, I don’t need to know every aspect of the last 10 times you went to a Mexican restaurant.”

Holler monetizes this content by partnering with brands like HBO Max, Ikea and Starbucks to create branded stickers and GIFs that become part of the company’s content library. Montaque said the startup has also worked with brands to measure the impact of these campaigns across a variety of metrics.

Holler’s content now reaches 75 million users each month, compared to 19 million users a year ago, while revenue has grown 226%, he said. (Apparently, last year was the first time the company saw significant revenue growth.)

The startup has now raised more than $51 million in total funding. The Series B was co-led by CityRock Venture Partners and New General Market Partners, with participation from Gaingels, Interplay Ventures, Relevance Ventures, Towerview Ventures and WorldQuant Ventures.

“Holler is more than simply a groundbreaking technology company,” said CityRock Managing Partner Oliver Libby in a statement. “Under Travis Montaque’s visionary leadership, Holler boldly stands for a new era of ethics in social media, and also deeply reflects the values of diversity, inclusion and belonging.”

Montaque (who, as a Black tech CEO, wrote a post for TechCrunch last year about bringing more diversity to the industry) said that Holler will use the funds to continue developing its product and advertising model. For one thing, he noted that although stickers and GIFs were an obvious starting point, the company is now looking to explore and create new media formats.

“We want to invent a new kind of content consumption paradigm,” he said.

Powered by WPeMatico

Meet Stockly, a French startup that keeps the inventory of various e-commerce websites in sync. When you see an out-of-stock item on an e-commerce website, chances are you leave that website and try to find the same item on another site.

If you operate an e-commerce website, Stockly lets you sell items even when they’re currently out of stock. The startup automatically finds a third-party Stockly supplier with that specific item.

The order will go through and be sent by that supplier directly. Stockly tells its partners to use neutral packaging so that the end consumer isn’t confused.

This could be particularly useful for small-scale e-commerce companies that don’t have a healthy marketplace of third-party retailers. For instance, Amazon can already sell you an out-of-stock item if a supplier has listed that specific item on Amazon’s own marketplace. But that’s not the case for most e-commerce websites.

The main challenge for Stockly is that it has to sort through various catalog formats and match the different inventories of different retailers. It is focusing on clothing items at first. When an order is routed through Stockly, it selects a specific supplier based on different criteria, such as logistics, delivery time and historical data.

So far, Stockly has been working with Galeries Lafayette, Go Sport, Foot Shop and others. The startup has recently raised a $6 million (€5.1 million) funding round from Idinvest Partners, Daphni, Techstars, Checkout.com CEO Guillaume Pousaz and various business angels.

With this funding round, the company plans to expand its team to 20 people, add new clients and iterate on its product.

Powered by WPeMatico

Capitolis, which makes technology for capital markets players such as investment and merchant banks, has closed on a $90 million Series C funding round led by Andreessen Horowitz (a16z).

The financing included participation from existing backers Index Ventures, Sequoia Capital, S Capital, Spark Capital, SVB Capital, Citi, J.P. Morgan and State Street, and brings Capitolis’ total funding to date to $170 million. SVB Capital and Spark Capital co-led a $40 million Series B for the company in November 2019.

Capitolis CEO and founder Gil Mandelzis said the startup’s mission since its 2017 inception has been to “fundamentally re-imagine how the capital markets operate” after the last financial crisis and the “bold steps taken by regulators” in its aftermath.

The company says that its advanced workflow technology and proprietary algorithms allows banks, hedge funds and asset managers to eliminate, move or create trading positions by collaborating with other financial institutions. That results in freed up capital, open credit lines and access to capital from a bigger pool of sources, the company claims.

Ultimately, Capitolis’ network software is designed to help financial institutions optimize their balance sheets and reduce risk.

Seventy-five financial institutions currently use the Capitolis platform. The company says it grew its revenue run rate by “sixfold” in 2020. Since 2019, Capitolis has experienced a 230% increase in the number of users of its platform. To date, the startup says it has optimized $9 trillion in terms of gross notional balances.

Alex Rampell, partner at a16z, said that his firm believes that what sets Capitolis apart from other financial services players “is the sheer scale of management’s ambition and the substantial talent, technology and capital milestones they have achieved.”

The New York-based company says it plans to use its new capital toward product development and to boost its customer support and sales staff. It plans to increase its headcount from 90 today to over 150 by year’s end.

Capitolis currently covers foreign exchange products and equity swaps. It says it could expand into others if there is client demand.

This article was updated post-publication with additional information from the company

Powered by WPeMatico

Cybersecurity training is one of those things that everyone has to do but not something everyone necessarily looks forward to.

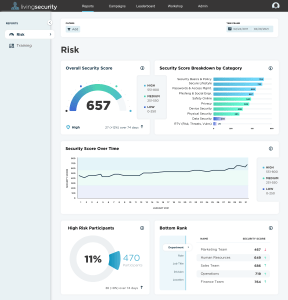

Living Security is an Austin-based startup out to change cybersecurity training something you look forward to, not dread. And the company has just closed on a $14 million Series B to continue its expansion beyond cybersecurity awareness training into human risk management.

Washington, D.C. based-Updata Partners led the financing, which also included participation from existing investors Silverton Partners, Active Capital, Rain Capital and SaaS Venture Partners. The investment comes after its $5 million Series A, led by Austin-based Silverton, raised last April.

Husband and wife Drew and Ashley Rose founded Living Security out of their house in June 2017 with the mission of making cybersecurity training less boring and more effective via gamified learning, with live action immersive storylines, role-based micro modules and reporting.

Living Security launched with its flagship product — Cyber Escape Room. When the pandemic hit, the startup brought its in-person training sessions online through the launch of CyberEscape Online.

With more people working remotely, the need for the type of offering Living Security provides has become even more paramount, considering how many people use personal devices for professional reasons, among other things. Employees are more vulnerable than ever to inadvertently providing entry points into the networks of the enterprises where they work — whether through social engineering, phishing or other methods.

Today, Living Security works with more than 100 large enterprises to train their global workforces to better protect sensitive data and secure their organizations. The startup’s customer list is impressive, and includes large enterprises such as CVS Health, Mastercard, Verizon, MassMutual, Biogen, AmerisourceBergen, Hewlett Packard, JPMorgan and Target.

So it’s not a big surprise that in 2020, Living Security tripled its revenue and employee headcount and more than doubled its customer count. The company declined to provide hard revenue figures, saying only that ARR grew nearly 200% last year.

“We have seen a significant increase in account growth and expansion in existing accounts…largely in part due to the scalability of our digital solution,” CEO Ashley Rose said.

With the success of its escape rooms and gamified training, Living Security’s team then asked themselves how they could make their efforts “more predictable.”

“We added risk management and scoring so program and security owners could become more targeted and focused on the delivery of their training,” Rose said.

So now Living Security aims to use behavioral data and analytics to measure and manage human risk. It plans to take that data and provide “predictive interventions” to employees.

“We’re focused on ‘How do we turn people from our greatest risk, to our greatest assets in cybersecurity?’ ” Rose said. “That’s our big vision for the company.”

Image Credits: Living Security

With its “Unify” human risk management platform, Living Security wants to provide an even more scalable solution. The company also plans to use its new capital toward expanding its geographic reach and scaling both direct and channel sales efforts.

Currently, Living Security has 55 employees, with the goal of having 90 by year’s end.

Deb Walter, director of information security training and awareness at AmerisourceBergen, said she first engaged with Living Security in 2017 when she requested its CyberSecurity Card game.

“I wanted to gamify how I presented training,” she recalls.

Introducing episodic gamification and its “bingeable” content into her training program was a big hit with employees, according to Walter.

“Their new platform is enabling us to deploy an ‘Information security academy’ to encourage associates and contractors to use several modes of training to earn points and track themselves on a leaderboard,” she said.

Updata General Partner Jon Seeber, who is taking a seat on Living Security’s board with the funding, said his firm saw “breakout potential” in the startup’s platform.

“It comes as close as you can to closing the loop between people and the systems on which they’re operating,” he said.

Plus, he said, it does it in a way that avoids the compliance-focused, “check-the-box” mindset that so often dominates employee-focused cybersecurity solutions.

Powered by WPeMatico

MessageBird, the omnichannel cloud communications platform recently valued at $3 billion, is continuing to ramp up its M&A activity. Following last year’s acquisition of Pusher, a company that provides real-time web technologies, it is announcing that it has acquired “video-first” customer engagement platform 24sessions, and customer data platform Hull.

Terms of the two new deals aren’t being disclosed, although MessageBird founder and CEO Robert Vis tells me the three acquisitions add up to about $100 million in total, and we alreadly know that Pusher’s acquisition price was $35 million. I also understand that the 24sessions and Hull acquisitions saw both companies’ investors exit entirely.

Originally seen as a European or “rest of the world” competitor to U.S.-based Twilio — offering a cloud communications platform that supports voice, video and text capabilities all wrapped up in an API — MessageBird has since repositioned itself as an “Omnichannel Platform-as-a-Service” (OPaaS). The idea is to easily enable enterprises and medium and smaller-sized companies to communicate with customers on any channel of their choosing.

Out of the box, this includes support for WhatsApp, Messenger, WeChat, Twitter, Line, Telegram, SMS, email and voice. Customers can start online and then move their support request or query over to a more convenient channel, such as their favourite mobile messaging app, which, of course, can go with them. It’s all part of MessageBird Vis’ big bet that the future of customer interactions is omni-channel.

To that end, the acquisition of 24sessions adds another channel: video. This, Vis tells me, is a particularly important channel where in-person interactions are being replicated digitally. However, he says it’s not just enough to have a video option — you need one that is compliant and secure. This is especially true for regulated industries such as financial services and healthcare. In addition, 24sessions is web-based, meaning that end-users aren’t required to install an app.

“Bringing a safe, secure and customizable video platform into the MessageBird family is the next step in our strategic journey,” said Vis in a statement. “Our portfolio of owned services already includes SMS, voice, email, OTT, social, live chat and push. The addition of 24sessions’ video platform gives us one of the world’s most comprehensive and powerful omnichannel offerings, and is consistent with our having end-to-end control of the stack in order to create magical experiences for our customers”.

“By joining forces with MessageBird, we’re making a leap forward in our mission to improve personal customer contact and turn it into a smooth digital experience, without losing the human touch,” adds Rutger Teunissen, CEO of 24sessions. “Video has become a more embedded, instant, intelligent, and integrated part of the omnichannel customer experience”.

However, communicating with customers more efficiently doesn’t just mean interacting with them on the channels of their choosing and building backend workflows to support this, it also requires a better understanding of the customer and the context of their query. That’s where the acquisition of Hull, based in France and the U.S., comes into play.

Described as a customer data platform (CDP), Hull’s team and technology will be deployed to create an “in-depth analytics layer” between MessageBird’s omnichannel offering and the workflow solutions it provides to customers.

“We want to empower clients to have easy, frictionless conversations with customers, so it’s crucial that we understand where those customers are and how they like to communicate,” said Vis. “To do that, it’s crucial that our platform is able to collect, unify and enrich product, marketing, and sales data and synchronize it across the workflow.”

In total, 45 staff will join from 24sessions, and 14 will join from Hull. The combined M&A brings MessageBird’s total headcount to almost 500 people across its nine hubs globally.

Powered by WPeMatico