Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Decentralized finance startup MOUND, known for its yield farming aggregator Pancake Bunny, has raised $1.6 million in seed funding led by Binance Labs. Other participants included IDEO CoLab, SparkLabs Korea and Handshake co-founder Andrew Lee.

Built on Binance Smart Chain, a blockchain for developing high-performance DeFi apps, MOUND says Pancake Bunny now has more than 30,000 daily average users, and has accumulated more than $2.1 billion in total value locked (TVL) since its launch in December 2020.

The new funding will be used to expand Pancake Bunny and develop new products. MOUND recently launched Smart Vaults and plans to unveil Cross-Chain Collateralization in about a month, bringing the startup closer to its goal of covering a wide range of DeFi use cases, including farming, lending and swapping.

Smart Vaults are for farming single asset yields on leveraged lending products. It also automatically checks if the cost of leveraging may be more than anticipated returns and can actively lend assets for MOUND’s cross-chain farming.

Cross-Chain Collateralization is cross-chain yield farming that lets users keep original assets on their native blockchain instead of relying on a bridge token. The user’s original assets serve as collateral when the Bunny protocol borrows assets on the Binance Smart Chain for yield farming. This allows users to keep assets on native blockchains while giving them liquidity to generate returns on the Binance Smart Chain.

In a statement, Wei Zhou, Binance chief financial officer, and head of Binance Labs and M&A’s, said “Pancake Bunny’s growth and MOUND’s commitment to execution are impressive. Team MOUND’s expertise in live product design and service was a key factor in our decision to invest. We look forward to expanding the horizons of Defi together with MOUND.”

Powered by WPeMatico

Practically every film production these days needs some kind of visual effects work, but independent creators often lack the cash or expertise to get that top-shelf CG. Wonder Dynamics, founded by VFX engineer Nikola Todorovic and actor Tye Sheridan, aims to use AI to make some of these processes more accessible for filmmakers with budgets on the tight side, and they’ve just raised $2.5 million to make it happen.

The company has its origins in 2017, after Sheridan and Todorovic met on the set of Rodrigo Garcia’s film Last Days in the Desert. They seem to have both felt that the opportunity was there to democratize the tools that they had access to in big studio films.

Wonder Dynamics is very secretive about what exactly its tools do. Deadline’s Mike Fleming Jr saw a limited demo and said he “could see where it will be of value in the area of world creation at modest budgets. The process can be done quickly and at a fraction of a traditional cost structure,” though that leaves us little closer than we started.

Sheridan and Todorovic (who jointly answered questions I sent over) described the system, called Wallace Pro, as taking over some of the grunt work of certain classes of VFX rather than a finishing touch or specific effect.

“We are building an AI platform that will significantly speed up both the production and post-production process for content involving CG characters and digital worlds. The goal of the platform is to reduce the costs associated with these productions by automating the ‘objective’ part of the process, leaving the artists with the creative, ‘subjective’ work,” they said. “By doing this, we hope to create more opportunities and empower filmmakers with visions exceeding their budget. Without saying too much, it can be applied to all three stages of filmmaking (pre-production, production and post-production), depending on the specific need of the artist.”

From this we can take that it’s an improvement to the workflow, reducing the time it takes to achieve some widely used effects, and therefore the money that needs to be set aside for them. To be clear this is distinct from another, more specific product being developed by Wonder Dynamics to create virtual interactive characters as part of the film production process — an early application of the company’s tools, no doubt.

The tech has been in some small scale tests, but the plan is to put it to work in a feature entering production later this year. “Before we release the tech to the public, we want to be very selective with the first filmmakers who use the technology to make sure the films are being produced at a high level,” they said. First impressions do matter.

The $2.5M seed round was led by Founders Fund, Cyan Banister, the Realize Tech Fund, Capital Factory, MaC Venture Capital, and Robert Schwab. “Because we are at the intersection of technology and film, we really wanted to surround ourselves with investment partners who understand how much the two industries will depend on each other in the future,” Sheridan and Todorovic said. “We were extremely fortunate to get MaC Venture Capital and Realize Tech Fund alongside FF. Both funds have a unique combination of Silicon Valley and Hollywood veterans.”

Wonder Dynamics will use the money to, as you might expect, scale its engineering and VFX teams to further develop and expand the product… whatever it is.

With their advisory board, it would be hard to make a mistake without someone calling them on it. “We’re extremely lucky to have some of the most brilliant minds from both the AI and film space,” they said, and that’s no exaggeration. Right now the lineup includes Steven Spielberg and Joe Russo (“obviously geniuses when it comes to film production and innovation”), UC Berkeley and Google’s Angjoo Kanazawa and MIT’s Antonio Torralba (longtime AI researchers in robotics and autonomy), and numerous others in film and finance who “offer us a wealth of knowledge when we’re trying to figure out how to move the company forward.”

AI is deeply integrated into many tech companies and enterprise stacks, making it a solid moneymaker in that industry, but it is still something of a fringe concept in the more creator-driven film and TV world. Yet hybrid production techniques like ILM’s StageCraft, used to film The Mandalorian, are showing how techniques traditionally used for 3D modeling and game creation can be applied safely to film production — sometimes even live on camera. AI is increasingly that part of the world, as pioneers like Nvidia and Adobe have shown, and it seems inevitable that it should come to film — though in exactly what form it’s hard to say.

Powered by WPeMatico

Realworld has a big vision — founder and CEO Genevieve Ryan Bellaire told me her goal is “simplifying adulthood.” And the New York startup has raised $3.4 million in seed funding to make it happen.

Apparently that’s something Bellaire struggled with herself in her early twenties. Despite being a lawyer with an MBA, she said she found herself “just totally unprepared for all these real-world things,” whether that was figuring out housing or heath insurance — something I (a non-lawyer, non-MBA) can definitely relate to.

“There’s tons of content out there out there that can tell you to fill out this form to sign up for a credit card, but you don’t know what you don’t know,” she said. “There’s not one place that defines adulthood.”

At the same time, there are online services that can make aspects of adulthood easier — whether that’s Lemonade for insurance, Betterment for investing or Zocdoc for doctor’s appointments. But again, finding these services and just knowing that you should use them can be a challenge, so Bellaire said Realworld is meant to serve as the “single point of entry.”

To do that, the startup has created more than 90 step-by-step playbooks, covering everything from budgeting to moving to salary negotiation. Bellaire said these are designed for members of Gen Z who are just leaving college and entering the workforce.

Realworld CEO Genevieve Ryan Bellaire. Image Credits: Realworld

Of course, even if you focus on a specific age group, different twentysomethings will have different backgrounds, income levels and challenges. Bellaire said the playbooks will customize their instructions based on a user’s specific goals and circumstances, but she also argued that Realworld’s “starter pack” of 15 playbooks covers things that every adult will need to deal with in some form, such as creating budgets, finding an apartment and understanding income taxes.

The startup plans to release its first mobile app next month, and its goal is to become what Bellaire described as a “platform, marketplace and community.” The playbooks are a big piece of the platform, and eventually, Realworld could also include a marketplace for services that will help you accomplish those adulthood goals, as well as a community where users share their knowledge and advice.

Realworld initially charged for access to its playbooks, but they’re now available for free. Instead, Bellaire said the company could charge a subscription fee for additional features and for “concierge-oriented support.”

“This is one of those problems where if you get it right, you can make a huge impact, but you can also have huge financial success,” she added.

It sounds like investors agree. Realworld had previously raised $1.1 million, and this new seed round was led by Fitz Gate Ventures, with participation from Bezos Expeditions (Jeff Bezos’ personal investment firm), Knightsgate Ventures, The Helm, Great Oaks VC, Copper Wire Ventures, AmplifyHer Ventures, Underdog Labs, Human Ventures and Techstars.

Amplifyher partner Meghan Cross Breeden noted that Realworld could “corner the market on life milestones,” not just for Gen Z right now, but for “every future milestone … in the long-haul of adulthood, from buying a home to caring for a parent.”

Powered by WPeMatico

At first glance, Quiq and Snaps might sound like similar startups — they both help businesses talk to their customers via text messaging and other messaging apps. But Snaps CEO Christian Brucculeri said “there’s almost no overlap in what we do” and that the companies are “almost complete complements.”

That’s why Quiq (based in Bozeman, Montana) is acquiring Snaps (based in New York). The entire Snaps team is joining Quiq, with Brucculeri becoming senior vice president of sales and customer success for the combined organization.

Quiq CEO Mike Myer echoed Bruccleri’s point, comparing the situation to dumping two pieces of a jigsaw puzzle on the floor and discovering “the two pieces fit perfectly.”

More specifically, he told me that Quiq has generally focused on customer service messaging, with a “do it yourself, toolset approach.” After all, the company was founded by two technical co-founders, and Myer joked, “We can’t understand why [a customer] can’t just call an API.” Snaps, meanwhile, has focused more on marketing conversations, and on a managed service approach where it handles all of the technical work for its customers.

In addition, Myer said that while Quiq has “really focused on the platform aspect from the beginning” — building integrations with more than a dozen messaging channels including Apple Business Chat, Google’s Business Messages, Instagram, Facebook Messenger and WhatsApp — it doesn’t have “a deep natural language or conversational AI capability” the way Snaps does.

Myer said that demand for Quiq’s offering has been growing dramatically, with revenue up 300% year-over-year in the last six months of 2020. At the same time, he suggested that the divisions between marketing and customer service are beginning to dissolve, with service teams increasingly given sales goals, and “at younger, more commerce-focused organizations, they don’t have this differentiation between marketing and customer service” at all.

Apparently the two companies were already working together to create a combined offering for direct messaging on Instagram, which prompted broader discussions about how to bring the two products together. Moving forward, they will offer a combined platform for a variety of customers under the Quiq brand. (Quiq’s customers include Overstock.com, West Elm, Men’s Wearhouse and Brinks Home Security, while Snaps’ include Bryant, Live Nation, General Assembly, Clairol and Nioxin.) Brucculeri said this will give businesses one product to manage their conversations across “the full customer journey.”

“The key term you’re hearing is conversation,” Myer added. “It’s not about a ticket or a case or a question […] it’s an ongoing conversation.”

Snaps had raised $13 million in total funding from investors including Signal Peak Ventures. The financial terms of the acquisition were not disclosed.

Powered by WPeMatico

It appears that the slowdown in tech debuts is not a complete freeze; despite concerning news regarding the IPO pipeline, some deals are chugging ahead. This morning, we’re adding Alkami Technology to a list that includes Coinbase’s impending direct listing and Robinhood’s expected IPO.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We are playing catch-up, so let’s learn about Alkami and its software, dig into its backers and final private valuation, and pick apart its numbers before checking out its impending IPO valuation. After all, if Kaltura and others are going to hit the brakes, we must turn our attention to companies that are still putting the hammer down.

We are playing catch-up, so let’s learn about Alkami and its software, dig into its backers and final private valuation, and pick apart its numbers before checking out its impending IPO valuation. After all, if Kaltura and others are going to hit the brakes, we must turn our attention to companies that are still putting the hammer down.

Frankly, we should have known about Alkami’s IPO sooner. One of a rising number of large tech companies based in nontraditional areas, the bank-focused software company is based in Texas, despite having roots in Oklahoma. The company raised $385.2 million during its life, per Crunchbase data. That sum includes a September 2020 round worth $140 million that valued the company at $1.44 billion on a post-money basis, PitchBook reports.

So, into the latest SEC filing from the software unicorn we go!

Alkami Technology is a software company that delivers its product to banks via the cloud, so it’s not a legacy player scraping together an IPO during boom times. Instead, it is the sort of company that we understand; it’s built on top of AWS and charges for its services on a recurring basis.

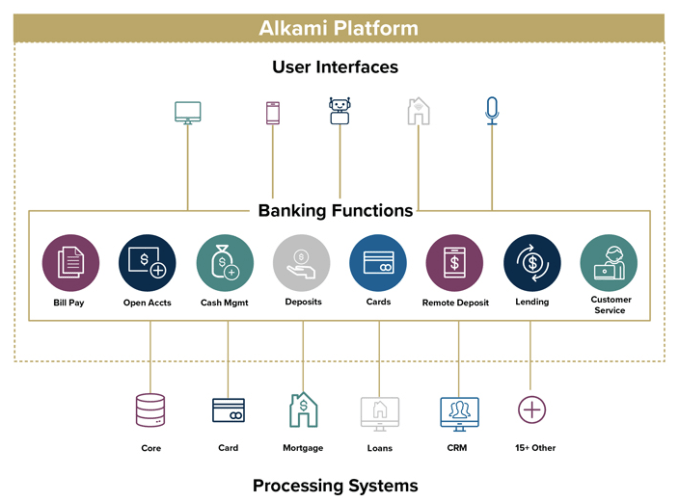

The company’s core market is all banks smaller than the largest, it appears, or what Alkami calls “community, regional and super-regional financial institutions.” Its service is a software layer that plugs into existing financial systems while also providing a number of user interface options.

In short, it takes a bank from its internal systems all the way to the end-user experience. Here’s how Alkami explained it in its S-1/A filing:

Image Credits: Alkami S-1

Simple enough!

Powered by WPeMatico

Cora, a São Paulo-based technology-enabled lender to small and-medium-sized businesses, has raised $26.7 million in a Series A round led by Silicon Valley VC firm Ribbit Capital.

Kaszek Ventures, QED Investors and Greenoaks Capital also participated in the financing, which brings the startup’s total raised to $36.7 million since its 2019 inception. Kaszek led Cora’s $10 million seed round (believed at that time to be one of the largest seed investments in LatAm) in December 2019, with Ribbit then following.

Last year, Cora got its license approved from the Central Bank of Brazil, making it a 403 bank. The fintech then launched its product in October 2020 and has since grown to have about 60,000 customers and 110 employees.

Cora offers a variety of solutions, ranging from a digital checking account, Visa debit card and management tools such as an invoice manager and cashflow dashboard. With the checking account, customers have the ability to send and receive money, as well as pay bills, digitally.

This isn’t the first venture for Cora co-founders Igor Senra and Leo Mendes. The pair had worked together before — founding their first online payments company, MOIP, in 2005. That company sold to Germany’s WireCard in 2016 (with a 3 million-strong customer base), and after three years the founders were able to strike out again.

Cora co-founders Leo Mendes and Igor Senra; Image courtesy of Cora

With Cora, the pair’s long-term goal is to “provide everything that a SMB will need in a bank.”

Looking ahead, the pair has the ambitious goal of being “the fastest growing neobank focused on SMBs in the world.” It plans to use the new capital to add new features and improve existing ones; on operations; and launching a portfolio of credit products.

In particular, Cora wants to go even deeper in certain segments, such as B2B professional services such as law and accounting firms, real estate brokerages and education.

Ribbit Capital partner Nikolay Kostov believes that Cora has embarked on “an ambitious mission” to change how small businesses in Brazil are able to access and experience banking.

“While the consumer banking experience has undergone a massive transformation thanks to new digital experiences over the last decade, this is, sadly, still not the case on the small business side,” he said.

For example, Kostov points out, opening a traditional small business bank account in Brazil takes weeks, “reels of paper, and often comes with low limits, poor service and antiquated digital interfaces.”

Meanwhile, the number of new small businesses in the country continues to grow.

“The combination of these factors makes Brazil an especially attractive market for Cora to launch in and disrupt,” Kostov told TechCrunch. “The Cora founding team is uniquely qualified and deeply attuned to the challenges of small businesses in the country, having spent their entire careers building digital products to serve their needs.”

Since Ribbit’s start in 2012, he added, LatAm has been a core focus geography for the firm “given the magnitude of challenges, and opportunities in the region to reinvent financial services and serve customers better.”

Ribbit has invested in 15 companies in the region and continues to look for more to back.

“We fully expect that several fintech companies born in the region will become global champions that serve to inspire other entrepreneurs across the globe,” Kostov said.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

This morning we took a global look at the news, trying to take in the latest from around our little planet:

It’s going to be a blast of a week. Talk to you Wednesday!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Over the course of their careers, Alex Bovee and Paul Querna realized that while the use of SaaS apps and cloud infrastructure was exploding, the process to give employees permission to use them was not keeping up.

The pair led Zero Trust strategies and products at Okta, and could see the problem firsthand. For the unacquainted, Zero Trust is a security concept based on the premise that organizations should not automatically trust anything inside or outside its perimeters and, instead must verify anything and everything trying to connect to its systems before granting access.

Bovee and Querna realized that while more organizations were adopting Zero Trust strategies, they were not enacting privilege controls. This was resulting in delayed employee access to apps, or to the over-permissioning employees from day one.

Last summer, Bovee left Okta to be the first virtual entrepreneur-in-residence at VC firm Accel. There, he and Accel partner Ping Li got to talking and realized they both had an interest in addressing the challenge of granting permissions to users of cloud apps quicker and more securely.

Recalls Li: “It was actually kind of fortuitous. We were looking at this problem and I was like ‘Who can we talk to about the space?’ And we realized we had an expert in Alex.”

At that point, Bovee told Li he was actually thinking of starting a company to solve the problem. And so he did. Months later, Querna left Okta to join him in getting the startup off the ground. And today, ConductorOne announced that it raised $5 million in seed funding in a round led by Accel, with participation from Fuel Capital, Fathom Capital and Active Capital.

ConductorOne plans to use its new capital to build what the company describes as “the first-ever identity orchestration and automation platform.” Its goal is to give IT and identity admins the ability to automate and delegate employee access to cloud apps and infrastructure, while preserving least-privilege permissions.

“The crux of the problem is that you’ve got these identities — you’ve got employees and contractors on one side and then on the other side you’ve got all this SaaS infrastructure and they all have sort of infinite permutations of roles and permissions and what people can do within the context of those infrastructure environments,” Bovee said.

Companies of all sizes often have hundreds of apps and infrastructure providers they’re managing. It’s not unusual for an IT helpdesk queue to be more than 20% access requests, with people needing urgent access to resources like Salesforce, AWS or GitHub, according to Bovee. Yet each request is manually reviewed to make sure people get the right level of permissions.

“But that access is never revoked, even if it’s unused,” Bovee said. “Without a central layer to orchestrate and automate authorization, it’s impossible to handle all the permissions, entitlements and on- and off-boarding, not to mention auditing and analytics.”

ConductorOne aims to build “the world’s best access request experience,” with automation at its core.

“Automation that solves privilege management and governance is the next major pillar of cloud identity,” Accel’s Li said.

Bovee and Querna have deep expertise in the space. Prior to Okta, Bovee led enterprise mobile security product development at Lookout. Querna was the co-founder and CTO of ScaleFT, which was acquired by Okta in 2018. He also led technology and strategy teams at Rackspace and Cloudkick, and is a vocal and active open-source software advocate.

While the company’s headquarters are in Portland, Oregon, ConductorOne is a remote-first company with 10 employees.

“We’re deep in building the product right now, and just doing a lot of customer development to understand the problems deeply,” Bovee said. “Then we’ll focus on getting early customers.”

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday? Sign up here.

Happy Saturday, everyone. I do hope that you are in good spirits and in good health. I am learning to nap, something that has become a requirement in my life after I realized that the news cycle is never going to slow down. And because my partner and I adopted a third dog who likes to get up early, please join me in making napping cool for adults, so that we can all rest up for Vaccine Summer. It’s nearly here.

On work topics, I have a few things for you today, all concerning data points that matter: Q1 2021 M&A data, March VC results from Africa, and some surprising (to me, at least) podcast numbers.

On the first, Dan Primack shared a few early first-quarter data points via Refinitiv that I wanted to pass along. Per the financial data firm, global M&A activity hit $1.3 trillion in Q1 2021, up 93% from Q1 2020. U.S. M&A activity reached an all-time high in the first quarter, as well. Why do we care? Because the data helps underscore just how hot the last three months have been.

I’m expecting venture capital data itself for the quarter to be similarly impressive. But as everyone is noting this week, there are some cracks appearing in the IPO market, as the second quarter begins that could make Q2 2021 a very different beast. Not that the venture capital world will slow, especially given that Tiger just reloaded to the tune of $6.7 billion.

On the venture capital topic, African-focused data firm Briter Bridges reports that “March alone saw over $280 million being deployed into tech companies operating across Africa,” driven in part by “Flutterwave’s whopping $170 million round at a $1 billion valuation.”

The data point matters as it marks the most active March that the African continent has seen in venture capital terms since at least 2017 — and I would guess ever. African startups tend to raise more capital in the second half of the year, so the March result is not an all-time record for a single month. But it’s bullish all the same, and helps feed our general sentiment that the first quarter’s venture capital results could be big.

And finally, Index Ventures’ Rex Woodbury tweeted some Edison data, namely that “80 million Americans (28% of the U.S. 12+ population) are weekly podcast listeners, +17% year-over-year.” The venture capitalist went on to add that “62% of the U.S. 12+ population (around 176 million people) are weekly online audio listeners.”

As we discussed on Equity this week, the non-music, streaming audio market is being bet on by a host of players in light of Clubhouse’s success as a breakout consumer social company in recent months. Undergirding the bets by Discord and Spotify and others are those data points. People love to listen to other humans talk. Far more than I would have imagined, as a music-first person.

How nice it is to be back in a time when consumer investing is neat. B2B is great but not everything can be enterprise SaaS. (Notably, however, it does appear that Clubhouse is struggling to hold onto its own hype.)

TechCrunch Early Stage was this week, which went rather well. But having an event to help put on did mean that I covered fewer rounds this week than I would have liked. So, here are two that I would have typed up if I had had the spare hours:

And two more rounds that you also might have missed that you should not. Holler raised $36 million in a Series B. Per our own Anthony Ha, “[y]ou may not know what conversational media is, but there’s a decent chance you’ve used Holler’s technology. For example, if you’ve added a sticker or a GIF to your Venmo payments, Holler actually manages the app’s search and suggestion experience around that media.”

I feel old.

And in case you are not paying enough attention to Latin American tech, this $150 million Uruguayan round should help set you straight.

Finally this week, some good news. If you’ve read The Exchange for any length of time, you’ve been forced to read me prattling on about the Bessemer cloud index, a basket of public software companies that I treat with oracular respect. Now there’s a new index on the market.

Meet the Lux Health + Tech Index. Per Lux Capital, it’s an “index of 57 publicly traded companies that together best represent the rapidly emerging Health + Tech investment theme.” Sure, this is branded to the extent that, akin to the Bessemer collection, it is tied to a particular focus of the backing venture capital firm. But what the new Lux index will do, as with the Bessemer collection, is track how a particular venture firm is itself tracking the public comps for their portfolio.

That’s a useful thing to have. More of this, please.

Powered by WPeMatico

Cross-border payments startup dLocal has raised $150 million at a $5 billion valuation, less than seven months after securing $200 million at a $1.2 billion valuation.

This means that the five-year-old Uruguayan company has effectively quadrupled its valuation in a matter of months.

Alkeon Capital led the latest round, which also included participation from BOND, D1 Capital Partners and Tiger Global. General Atlantic led its previous round, which closed last September and made dLocal Uruguay’s first unicorn and one of Latin American’s highest-valued startups.

DLocal connects global enterprise merchants with “billions” of emerging market consumers in 29 countries across Asia-Pacific, the Middle East, Latin America and Africa. More than 325 global merchants, including e-commerce retailers, SaaS companies, online travel providers and marketplaces use dLocal to accept over 600 local payment methods. They also use its platform to issue payments to their contractors, agents and sellers. Some of dLocal’s customers include Amazon, Booking.com, Dropbox, GoDaddy, MailChimp, Microsoft, Spotify, TripAdvisor, Uber and Zara.

In conjunction with this latest round, dLocal has named Sumita Pandit to the role of COO. Pandit is former global head of fintech and managing director for JP Morgan, and also worked at Goldman Sachs.

“Sumita is a highly respected and accomplished fintech investment banker, and she’s played a pivotal role advising some of the world’s most successful fintech companies as they’ve scaled to become global leaders,” said dLocal CEO Sebastián Kanovich in a written statement.

Meanwhile, former COO Jacobo Singer has been promoted to president of dLocal.

The company plans to use its new capital to enhance its technology and continue to expand geographically.

Alkeon General Partner Deepak Ravichandran believes that emerging markets represent some of the fastest growth opportunities in digital payments.

“However, as global merchants look to access these markets, they are often faced with a complex web of local payment methods, cross-border regulations, and other operational roadblocks,” he said in a written statement. “dLocal’s unique platform empowers merchants with a single integrated payment solution, to reach billions of customers, accept payments, send payouts, and settle funds globally.”

Powered by WPeMatico