Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Robotic process automation unicorn UiPath is set to go public this week, concentrating our focus on its value.

The well-known company was last valued on the private markets at $35 billion in February when it closed a $750 million round. Living up to that price as a public company, however, at least when it comes to its formal IPO price, is proving to be challenging.

In a sense, that’s not too surprising given that the red-hot IPO market cooled as Q1 2021 came to a close. UiPath raised its last private round when the markets were most interested in public offerings and is now going public in a slightly altered climate.

In numerical terms, UiPath raised its IPO range from $43 to $50 per share, to $52 to $54 per share. That’s a 21% jump in the value of the lower end of its range, and an 8% gain to the value of the upper end of its per-share IPO price interval.

UiPath is also selling more shares than before, which should make its total valuation slightly larger at the top end than a mere 8% gain. So let’s go through the math one more time. Afterward, we’ll stack its new simple, fully diluted IPO valuations against its final private price, ask ourselves if our musings on the company’s recent profitability bore out, and close by asking where the company might finally price, and if we expect it to do so above its new price range.

Powered by WPeMatico

A stunning first quarter in venture capital funding was not restricted to the United States; Europe also had one hell of a start to the year.

According to data from Dealroom and Crunchbase News, an investor, and an analyst from PitchBook, European startups put together an impressive fundraising haul. The venture capital world kicked off its 2021 European investing cycle with enough activity to set the continent on the path that would crush yearly records.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Inside the data, there’s lots to unpack, including which sectors of European startups stood out in terms of capital raised, rising seed and late-stage deals, and dollar volume. We’ll also need to discuss exits — the Deliveroo IPO and its various woes was not the only transaction from the period worth understanding.

As with our prior looks at AI startup fundraising and the United States’ own blistering start to the year, we’ll lean on multiple sources to ensure that we have a wide lens. And we’ll keep in mind that all venture capital data lags reality somewhat, as many deals from a particular period are not disclosed or discovered until long after they actually occurred.

As with our prior looks at AI startup fundraising and the United States’ own blistering start to the year, we’ll lean on multiple sources to ensure that we have a wide lens. And we’ll keep in mind that all venture capital data lags reality somewhat, as many deals from a particular period are not disclosed or discovered until long after they actually occurred.

In this case, it makes the numbers all the more impressive. Let’s get into the data.

Dealroom was first out of the gate, reporting that European startups had a record quarter in Q1 2021 back when April just got started. Its preliminary results for the first quarter indicated that startups on the continent raised €16.6 billion, or $19.9 billion at today’s exchange rates.

That total was not only a record, but what Dealroom described as double the results of Q1 2020. While we’ve become slightly inured in recent months to the venture capital market’s rapid pace and capital-rich environment, it’s worth considering for a moment, as the first quarter of last year ended, how few of us would have guessed that just a year later — as COVID-19 still harms public health and disrupts life and business — we’d see numbers like this.

The Dealroom data, however, was not all records. Round volume by the group’s estimates was down from the year-ago period, if slightly better than the last few quarters. The general move toward the later-stage and larger-round venture capital market is alive and well in Europe.

Powered by WPeMatico

French startup Alan has raised a $220 million funding round at a $1.67 billion valuation (€185 million and €1.4 billion respectively). Coatue is leading the round with Dragoneer, Exor, and existing investors Index Ventures, Ribbit Capital and Temasek also participating.

Alan has been building health insurance products from scratch. When I first covered the company back in 2016, the startup had just managed to get approval from regulators to become an official health insurance company.

Since then, it’s been a not-so-slow-and-steady growth story as the company now covers 160,000 people. Overall, Alan generates over €100 million in annualized revenue. While most of that revenue is spent back on claims, it’s an impressive revenue trajectory.

Like other insurance companies, Alan has some capital requirements to comply with health insurance regulation. Alan has to raise more if it wants to insure more people. But that’s just part of the story as the startup still had enough cash on its bank account for the next 12 to 18 months.

“The context is that we managed to end the year 2020 very strong, finally — and I say finally because it’s been stressful until the last minute,” co-founder and CEO Jean-Charles Samuelian-Werve told me.

Alan managed to meet its goals and international expansion finally started to take off. Many startups try to raise when they’re in a strong position. You shouldn’t wait until you have your back against the wall and that’s exactly what’s happening here.

“We thought it was the right time and we had multiple term sheets. Even though valuation is really good we first looked at a partner that has a really long-term vision,” Samuelian-Werve said.

With today’s funding round, the company can iterate on its core product — health insurance — and everything that makes Alan a superapp — a single app that lets you access several services. In France, employees are covered by both the national healthcare system and private insurance companies. Alan sells its products to other companies so that their employees are automatically covered by Alan contracts. It’s a sort of B2B2C play.

9,400 companies have opted for Alan in France, Belgium and Spain — the company’s home market remains its main market. Clients include WeWork, Deliveroo, JustEat, Vitaliance and Big Mamma. By 2023, Alan wants to reach 1 million members.

In order to gain more customers, Alan is betting on three pillars — product innovation, customer satisfaction through additional services, and expansions to new verticals and markets.

When it comes to product innovation, Alan has designed a modular insurance builder. Small companies can subscribe to Alan in a few clicks. Big companies can tweak every single parameter to build the right insurance package for them.

After that, the company tries to make it easy to manage your health insurance. You’ll soon be able to automatically manage sick leaves, change the employee affiliation status, etc. As for employees, the company has always promoted a transparent offering. For instance, you should know how much you’re going to pay out of pocket when you see a doctor. You can see a map of doctors around you and how much they charge on average. This way, there’s no surprise.

Alan also tries to reimburse you as quickly as possible. If it’s a straightforward claim, the startup tries to analyze and categorize your claim as quickly as possible and then issue an instant SEPA transfer. Seventy-five percent of claims are reimbursed and available on your bank account in less than an hour.

These core product features definitely contributes to customer satisfaction. But Alan is expanding beyond insurance products with several additional services that should increase retention. For instance, you can chat with a doctor, get medical advice for your baby’s health, get a free meditation app subscription, start a telehealth appointment via a partner, talk with someone about your mental health, etc.

Those services contribute to turning Alan into a superapp for your health. Essentially, as soon as you’re insured by Alan, you become a member and can access all those services without additional charges.

Eventually, Alan plans to launch a personal care guidance service to help you contact the right healthcare professional based on your health issue. In Spain, Alan can already book appointments for you.

Finally, Alan plans to reach new customers through aggressive expansion goals. The company plans to hire 400 people within the next three years and expand to other industries with tailor-made insurance products, such as retail, wholesale and manufacturing.

While the company is still going to focus on France, Belgium and Spain in the near future, it is looking at opportunities across Europe. So let’s see where Alan is going to expand next.

Powered by WPeMatico

We’ve all heard the phrase “passive income” to describe how people can make money by owning rental properties. Many Americans would love to passively earn money, but the process of becoming a landlord can be intimidating and complicated.

I mean, how many people have looked back and wished they hadn’t sold a property after seeing its value rise years after selling it?

And those who are already landlords can get overwhelmed by the complexities of managing properties.

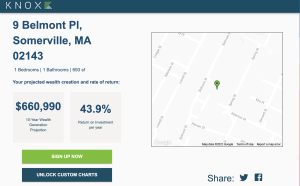

One startup out of Boston, Knox Financial, aims to help people identify and manage residential rentals with its algorithm-based platform, and it’s raised a $10 million Series A to help it further that goal. Boston-based G20 Ventures led the round, which included participation from Greycroft, Pillar VC, 2LVC, and Gaingels.

The investment brings Knox’s total raised since its inception in 2018 to $14.7 million. The company closed on a $3 million seed round in January 2020, led by Greycroft.

Knox co-founder and CEO David Friedman is no stranger to startups. He founded Boston Logic — an integrated marketing platform and online marketing services for real estate offices and agents — in 2004. He sold that company (now under the name Propertybase) to Providence Equity for an undisclosed amount in 2016.

Knox launched its platform in March of 2019, with the goal of offering homeowners who are ready to move “a completely hands-off way” of converting a home they’re moving out of into an investment property. It also claims to help landlords more easily and efficiently manage their rentals.

At the time of its seed round early last year, the company was only operating in the Boston market and had 50 units on its platform. It’s now operating in seven states, has “hundreds” of investment properties on its platform and is overseeing a portfolio of more than $100 million.

So how does it work? Once a property is enrolled on Knox’s “Frictionless Ownership Platform,” the company automates and oversees the property’s finances and taxes, insurance, leasing and legal, tenant and property care, banking and bill pay.

Knox also has developed a rental pricing and projection model for calculating the investment rate of return a property will produce over time.

Image Credits: Knox Financial

“We save investors a lot and almost always make their portfolios more profitable,” Friedman said. “If someone is moving or upsizing, we can turn properties into incredible ROI generators or cash flow.”

The company’s revenue model is simple.

“When a dollar of rent moves through our system, we keep a dime,” Friedman told TechCrunch. “We align our interests with our customers. If there’s no rent coming in, we’re not making money. Or if a tenant doesn’t pay rent, we don’t make money.”

Knox plans to use its new capital to continue expanding geographically and getting the word out to more people.

“We want to become the de facto platform for real estate investment acquisition and ownership,” Friedman said. “And we have to be coast to coast to really do that for everybody. So, we’re still very early in our growth trajectory.”

Bob Hower, co-founder and partner of G20 Ventures, shared that weeks after his college graduation, he had bought a fixer upper with his mother’s help. A week after finishing renovations, he put the house on the market. Over the subsequent five months, he gradually reduced the price as the market softened, and eventually the property sold at a small profit.

“That house now is worth a multiple of what I paid for it,” Hower recalls. “In hindsight, the mistake I made was deciding to sell the house at all.”

That experience helped Hower appreciate what he describes as a “clarity of thinking” in Knox’s business model.

“Had Knox existed decades ago, I’d likely still have that fixer-upper I bought after college,” he said. “Investing platforms such as Betterment have collapsed multiple advising and optimization activities into a simple single-sign-on service, and Knox is the first company to apply this type model to residential real estate investing.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

First, our news roundup from last week was probably the most fun I’ve had in a few months, so make sure to catch up on that if you haven’t. That said, here’s a rundown of what we got into on the show this morning:

The week is here, everyone! It’s Monday! We can do this!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Coinbase’s direct listing was a massive finance, startup and cryptocurrency event that impacted a host of public and private investors, early employees, and crypto-enthusiasts. Regardless of where one sits in the broader tech and venture world, Coinbase storming north of a $100 billion valuation during its first day of trading was the biggest startup happening of the year.

The transaction’s effects will be felt for some time in the public market, but also among the startups and capital that comprise the private market.

In the buildup to Coinbase’s flotation — and we’d argue especially after it released its blockbuster Q1 2021 results — there was a general expectation that the unicorn’s direct listing would provide a halo effect for other startups in the space. Anthemis’ Ruth Foxe Blader told The Exchange, for example, that “the Coinbase listing shows this great inflection point for crypto,” with another “wave” of startup work in the space coming up.

The widely held perspective raised two questions: Will the success of Coinbase’s direct listing bolster private investment in crypto-focused startups, and will that success help other areas of financially focused startup work garner more investor attention?

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Presuming that Coinbase’s listing will positively impact its niche and others around it is not a stretch. But to make sure we weren’t misreading sentiment, and to get deeper into the why of the concept, The Exchange reached out to venture capitalists who invest in the broader fintech world to get their take. We even roped in an analyst or two to round out our panel.

The answer is not a simple yes. There are several ways to approach investing in the cryptocurrency space — from buying coins themselves, to investing in mainstream-ish institutions like legal exchanges, to the more exotic, like supporting efforts on the forefront of the decentralized blockchain world. And while it is somewhat clear that most folks expect more capital to be available for crypto projects, it’s not clear where it may end up inside the market.

We’ll wrap by considering what impact Coinbase’s direct listing will have, if any, on non-crypto fintech venture capital investing.

We’ll wrap by considering what impact Coinbase’s direct listing will have, if any, on non-crypto fintech venture capital investing.

After yesterday’s examination of how blazingly hot the venture capital market looked in the first quarter, we’re again trying to gauge the private market’s temperature. Let’s talk to some folks on the ground and hear what they are seeing.

Coinbase’s direct listing floated a company that is worth more than all but two major blockchains, namely Ethereum and Bitcoin. Several other chains have aggregate coin values in the 11-figure range, but a 12-digit worth is still rare among crypto assets.

The scale of Coinbase’s valuation post-listing matters, according to Chainalysis Chief Economist Phillip Gradwell. Gradwell told The Exchange that “Coinbase’s $100 billion valuation today demonstrates that venture investors can make great returns from putting money into crypto companies, not just cryptocurrencies. That proof point is good for the entire ecosystem.”

More simply, it is now eminently reasonable to invest in the companies working in the crypto space instead of merely putting capital to work hard-buying coins themselves. The other way to consider the comment is to realize that Coinbase’s share price appreciation is steep enough since its 2012 founding to rival the returns of some coins over the same time frame.

Cleo Capital‘s Sarah Kunst expanded on the point, telling The Exchange in an email that “it’s now credible to say you’re a crypto startup and plan to IPO [versus] having acquisition or ICO be the only proven exit paths in the U.S.”

Powered by WPeMatico

Casa Blanca, which aims to develop a “Bumble-like app” for finding a home, has raised $2.6 million in seed funding.

Co-founder and CEO Hannah Bomze got her real estate license at the age of 18 and worked at Compass and Douglas Elliman Real Estate before launching Casa Blanca last year.

She launched the app last October with the goal of matching home buyers and renters with homes using an in-app matchmaking algorithm combined with “expert agents.” Buyers get up to 1% of home purchases back at closing. Similar to dating apps, Casa Blanca’s app is powered by a simple swipe left or right.

Samuel Ben-Avraham, a partner and early investor of Kith and an early investor in WeWork, led the round for Casa Blanca, bringing its total raise to date to $4.1 million.

The New York-based startup recently launched in the Colorado market and has seen some impressive traction in a short amount of time.

Since launching the app in October, Casa Blanca has “made more than $100M in sales” and is projected to reach $280 million this year between New York and its Denver launch.

Bomze said the app experience will be customized for each city with the goal of creating a personalized experience for each user. Casa Blanca claims to streamline and sort listings based on user preferences and lifestyle priorities.

Image Credits: Casa Blanca

“People love that there is one place to book, manage feedback, schedule and communicate with a branded agent for one cohesive experience,” Bomze said. “We have a breadth of users from first time buyers to people using our platform for $15 million listings.”

Unlike competitors, Casa Blanca applies a direct-to-consumer model, she pointed out.

“While our agents are an integral part of the company, they are not responsible for bringing in business and have more organizational support, which allows them to focus on the individual more and creates a better end-to-end experience for the consumer,” Bomze said.

Casa Blanca currently has over 38 agents in NYC and Colorado, compared to about 15 at this time last year.

“We are in a growth phase and finding a unique opportunity in this climate, in particular, because there are many women exploring new, more flexible job opportunities,” Bomze noted.

The company plans to use its new capital to continue expanding into new markets, nationally and globally; as well as enhancing its technology and scaling.

“As we continue to grow in new markets, the app experience will be curated to each city — for example, in Colorado you can edit your preferences based on access to ski areas — to make sure we’re offering a personalized experience for each user,” Bomze said.

Powered by WPeMatico

Automation has become a big theme in enterprise IT, with organizations using RPA, no-code and low-code tools, and other technology to speed up work and bring more insights and analytics into how they do things every day, and today IBM is announcing an acquisition as it hopes to take on a bigger role in providing those automation services. The IT giant has acquired myInvenio, an Italian startup that builds and operates process mining software.

Process mining is the part of the automation stack that tracks data produced by a company’s software, as well as how the software works, in order to provide guidance on what a company could and should do to improve it. In the case of myInvenio, the company’s approach involves making a “digital twin” of an organization to help track and optimize processes. IBM is interested in how myInvenio’s tools are able to monitor data in areas like sales, procurement, production and accounting to help organizations identify what might be better served with more automation, which it can in turn run using RPA or other tools as needed.

Terms of the deal are not being disclosed. It is not clear if myInvenio had any outside investors (we’ve asked and are awaiting a response). This is the second acquisition IBM has made out of Italy. (The first was in 2014, a company called CrossIdeas that now forms part of the company’s security business.)

IBM and myInvenio are not exactly strangers: The two inked a deal as recently as November 2020 to integrate the Italian startup’s technology into IBM’s bigger automation services business globally.

Dinesh Nirmal, GM of IBM Automation, said in an interview that the reason IBM acquired the company was two-fold. First, it lets IBM integrate the technology more closely into the company’s Cloud Pak for Business Automation, which sits on and is powered by Red Hat OpenShift and has other automation capabilities already embedded within it, specifically robotic process automation (RPA), document processing, workflows and decisions.

Second and perhaps more importantly, it will mean that IBM will not have to tussle for priority for its customers in competition with other solution partners that myInvenio already had. IBM will be the sole provider.

“Partnerships are great but in a partnership you also have the option to partner with others, and when it comes to priority, who decides?” he said. “From the customer perspective, will they work just on our deal, or others first? Now, our customers will get the end result of this… We can bring a single solution to an end user or an enterprise, saying, ‘look you have document processing, RPA, workflow, mining.’ That is the beauty of this and what customers will see.”

He said that IBM currently serves with its automation products customers across a range of verticals, including financial, insurance, healthcare and manufacturing.

Notably, this is not the first acquisition that IBM has made to build out this stack. Last year, it acquired WDG to expand into robotic process automation.

And interestingly, it’s not even the only partnership that IBM has had in process mining. Just earlier this month, it announced a deal with one of the bigger names in the field, Celonis, a German startup valued at $2.5 billion in 2019.

Ironically, at the time, my colleague Ron wondered aloud why IBM wasn’t just buying Celonis outright in that deal. It’s hard to speculate if price was one reason. Remember: We don’t know the terms of this acquisition, but given myInvenio was off the fundraising radar, chances are it’s possibly a little less than Celonis’s price tag.

We’ve asked and IBM has confirmed that it will continue to work with Celonis alongside now offering its own native process mining tools.

“In keeping with IBM’s open approach and $1 billion investment in ecosystem, [Global Business Services, IBM’s enterprise services division] works with a broad range of technologies based on client and market demand, including IBM AI and Automation software,” a spokesperson said in a statement. “Celonis focuses on execution management which supports GBS’ transformation of clients’ business processes through intelligent workflows across industries and domains. Specifically, Celonis has deep connectivity into enterprise systems such as Salesforce, SAP, Workday or ServiceNow, so the Celonis EMS platform helps GBS accelerate clients’ transformations and BPO engagements with these ERP platforms.”

Indeed, at the end of the day, companies that offer services, especially suites of services, are working in environments where they have to be open to customers using their own technology, or bringing in something else.

There may have been another force pushing IBM to bring more of this technology in-house, and that’s wider competitive climate. Earlier this year, SAP acquired another European startup in the process mining space, Signavio, in a deal reportedly worth about $1.2 billion. As more of these companies get snapped up by would-be IBM rivals, and those left standing are working with a plethora of other parties, maybe it was high time for IBM to make sure it had its own horse in the race.

“Through IBM’s planned acquisition of myInvenio, we are revolutionizing the way companies manage their process operations,” said Massimiliano Delsante, CEO, myInvenio, who will be staying on with the deal. “myInvenio’s unique capability to automatically analyze processes and create simulations — what we call a ‘Digital Twin of an Organization’ — is joining with IBM’s AI-powered automation capabilities to better manage process execution. Together we will offer a comprehensive solution for digital process transformation and automation to help enterprises continuously transform insights into action.”

Powered by WPeMatico

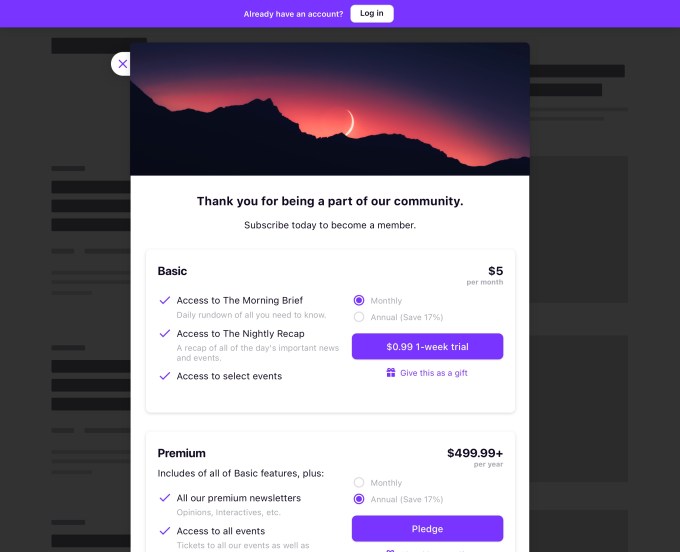

Pico, a New York startup that helps online creators and media companies make money and manage their customer data, announced today that it has launched an upgraded platform and raised $6.5 million in new funding.

In a statement, the startup’s co-founder and CEO Nick Chen said Pico helps creators with their two biggest problems — “how to make money more easily and how to get to know your audience better” — while also giving them control over their two most important assets, namely “your brand and the relationship to your audience.”

The company provides a long list of different tools, including landing pages, pop-ups to collect email addresses, paid newsletters, subscription paywalls, tiered membership programs, recurring and one-time donations and video revenue tools. With version 2.0, the company says it’s bringing all these features together with a unified data structure, so that customers can see “who is paying for what content and where they came from” in one dashboard.

Via email, co-founder and President Jason Bade (pictured above with Chen) pointed to “the power of our CRM to help creators understand their audience” as the most significant upgrade, suggesting that this “makes Pico the operating system for the creator economy.”

Image Credits: Pico

“A creator can’t scale a business without the proper tools,” Bade continued. “Take email capture, that is the first step in audience development. But what next? You need data and a CRM to handle it. 2.0 upgrades every part of Pico to rearchitect it for the scalability and extensibility that the creator economy demands.”

Pico also said it will be launching an API soon to support integrations with different parts of the platform.

Apparently, the company has seen its customer count increase nearly 5x in the past year, with customers including The Colorado Sun, Defector Media and The Generalist. And it recently recruited Rodolphe Ködderitzsch (who held a number of roles at YouTube, including global head of partner sales) as its chief revenue officer.

The new funding was led by Ann Lai at Bullpen Capital and brings Pico’s total funding to $10 million. Other investors include Precursor Ventures, Stripe, BloombergBeta and Village Global.

Powered by WPeMatico

Today shares of Coinbase began to trade after the company executed a direct listing. From a reference price of $250, Coinbase shares opened at $381 today, a change of around 52%. At its open Coinbase was valued at $99.6 billion on a fully diluted basis. As of the time of writing Coinbase has appreciated further to just over $400 per share, valuing the company at a touch more than $104 billion.

Coinbase was worth $65.3 billion at its reference price, on a fully diluted basis.

Coinbase’s debut has been hotly anticipated, thanks to its position inside the greater crypto economy and, from a purely startup perspective, its huge value unlock. Private investors poured capital into the company during its life as a private company, valuing it as high as $8 billion.

The company’s new valuation dwarfs that prior figure, implying strong returns for its long-term backers. Today even regular folks could get a scratch at the company’s equity, and they were willing to pay up for the privilege. TechCrunch asked its audience about the debut, pre-trading results that served as an anti-indicator of where the crypto-unicorn’s shares would trade:

For Coinbase the road ahead is interesting. The company is richly capitalized and posted monster profits in its most recent quarter. However, Coinbase has yet to chart a future sufficiently delinked from the impacts of cryptocurrency price levels and resulting trading volume to be immune to a potential setback in growth and income if the value of bitcoin, et al. dropped.

But for crypto believers, watching Coinbase list is a win; it is ironic that a traditional company listing on an old-fashioned exchange is a key moment for the crypto economy, but most things come in steps. Perhaps the next major crypto company trading debut will be on a decentralized exchange.

Powered by WPeMatico