Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

While most startups today are creating software, not every upstart enterprise is taking a code-only approach to building a business. Some of today’s most ambitious startups are aiming quite a bit higher.

Albedo is one such company. The recent Y Combinator graduate wants to build a constellation of low-orbit satellites that can provide higher-resolution Earth imaging than what is generally available today. And it just closed a $10 million seed round.

Initialized Capital led the investment, which also saw participation from Jetstream, Liquid2 Ventures and Soma Capital.

TechCrunch has had its eye on Albedo since its Y Combinator run, discussing the firm’s approach to providing what it describes as “aerial-quality” images — though they are taken from space instead of a drone or aircraft. In more technical parlance, Albedo wants to provide 10-centimeter visual imagery and 2-meter thermal imagery.

According to Topher Haddad, Albedo’s co-founder and CEO, the company aims to launch its first satellite in 2024 and bring its full constellation to orbit by 2027. With eight satellites, the company can provide daily image revisits; with 24, it can do that three times each day, though the eight-satellite fleet will be an early milestone for the startup, according to its CEO.

Why hasn’t someone already tried to build what Albedo is working on? The company, Haddad explained, has been made possible in part due to advances in the larger space economy, and the fact that major cloud providers AWS and Azure have both built out services to handle satellite data — “AWS Ground Station” in the case of the former and “Azure Orbital” in the latter. Mix in cheaper launches and more modular satellite construction, and what Albedo wants to do is becoming possible.

Albedo CEO and co-founder Topher Haddad. Image Credits: Albedo

There’s some tech risk to what Albedo aims to do, however. Haddad explained to TechCrunch how his company hopes to employ in-orbit refueling for its satellites’ electric propulsion so that they can stay afloat longer; if that effort fails, or drag winds up being worse than anticipated, Albedo’s satellites might have to opt for slightly higher orbits and lower-res photos in the 12- to 15-centimeter range.

For fun, what does that resolution mean in more practical terms? A 10-centimeter-resolution image from a satellite is one in which each pixel is 10 centimeters on each side. So, a 15-centimeter-resolution image would have pixels that were more than twice the surface area of a 10-centimeter shot.

Resolution matters, as does the regularity of new pictures being taken. On the latter front, the company’s eventual fleet of satellites should keep its photos fresh.

Albedo intends to target companies of all sizes as customers. The imaging world is a big market, with Haddad expecting to find customers among property insurance companies, mapping concerns, utility firms and other large companies. And now it has more capital than ever to pursue its goals.

It takes more money to get a space startup off the ground than it takes to iterate on an early software product. So, what does the $10 million it just raised get Albedo? The first thing is staff. When TechCrunch last spoke with Haddad, the company was still a team of three. That’s about to change, however; a number of new hires recently accepted offers, and the company expects to add another four or five people to its staff in addition to those already planning to join.

Albedo said it anticipates a staff of 10 to 12 by the end of the year.

The $10 million will also allow the company to fund a down payment on rocket space and payments to suppliers that should allow Albedo to wrap up its satellite design. Per its CEO, the startup expects to raise a larger Series A in around a year to help finance getting its first satellite into orbit. That moment will allow the startup to better prove its technology, and, if all goes well, help it to raise even more capital to keep its launch schedule packed.

Let’s see how far the company can get with its new capital, and if it finds sufficient, ahem, lift to reach the next funding milestone. If it does, we could wind up covering the launch of its first satellite. That would be fun.

Powered by WPeMatico

Applied XL, a startup creating machine learning tools with what it describes as a journalistic lens, is announcing that it has raised $1.5 million in seed funding.

Emerging from the Newlab Venture Studio last year, the company is led by CEO Francesco Marconi (previously R&D chief at The Wall Street Journal) and CTO Erin Riglin (former WSJ automation editor). Marconi told me that Applied XL started out by working on a number of different data and machine learning projects as it looked for product-market fit — but it’s now ready to focus on its first major industry, life sciences, with a product launching broadly this summer.

He said that Applied XL’s technology consists of “essentially a swarm of editorial algorithms developed by computational journalists.” These algorithms benefit from “the point of view and expertise of journalists, as well as taking into account things like transparency and bias and other issues that derive from straightforward machine learning development.”

Marconi compared the startup to Bloomberg and Dow Jones, suggesting that just as those companies were able to collect and standardize financial data, Applied XL will do the same in a variety of other industries.

He suggested that it makes sense to start with life sciences because there’s both a clear need and high demand. Customers might include competitive intelligence teams at pharmaceutical companies and life sciences funds, which might normally try to track this data by searching large databases and receiving “data vomit” in response.

Update: Marconi provided additional context about the startup’s initial focus via email, writing,”The life science industry has specific information needs currently not being fully met by existing private and public data sources; for example, many existing data providers cannot provide the kind of real-time context life science organizations require to make decisions on clinical development, competitive positioning and commercialization.”

“Our solution for scaling [the ability to spot] newsworthy events is to design the algorithms with the same principles that a journalist would approach a story or an investigation,” Marconi said. “It might be related to the size of the study and the number of patients, it might be related to a drug that is receiving a lot of attention in terms of R&D investment. All of these criteria that a science journalist would bring to clinical trials, we’re encoding that into algorithms.”

Eventually, Marconi said the startup could expand into other categories, building industry “micro models.” Broadly speaking, he suggested that the company’s mission is “measuring the health of people, places and the planet.”

The seed funding was led by Tuesday Capital, with participation from Frog Ventures, Correlation Ventures, Team Europe (the investment arm of Delivery Hero co-founder Lukasz Gadowski) and Ringier executive Robin Lingg.

“With industry leading real-time data pipelining, Applied XL is building the tools and platform for the next generation of data-based decision making that business leaders will rely on for decades,” said Tuesday Capital partner Prashant Fonseka in a statement. “Data is the new oil and the team at Applied XL have figured out how to identify, extract and leverage one of the most valuable commodities in the world.”

Powered by WPeMatico

After an upward revision, UiPath priced its IPO last night at $56 per share, a few dollars above its raised target range. The above-range price meant that the unicorn put more capital into its books through its public offering.

For a company in a market as competitive as robotic process automation (RPA), the funds are welcome. In fact, RPA has been top of mind for startups and established companies alike over the last year or so. In that time frame, enterprise stalwarts like SAP, Microsoft, IBM and ServiceNow have been buying smaller RPA startups and building their own, all in an effort to muscle into an increasingly lucrative market.

In June 2019, Gartner reported that RPA was the fastest-growing area in enterprise software, and while the growth has slowed down since, the sector is still attracting attention. UIPath, which Gartner found was the market leader, has been riding that wave, and today’s capital influx should help the company maintain its market position.

It’s worth noting that when the company had its last private funding round in February, it brought home $750 million at an impressive valuation of $35 billion. But as TechCrunch noted over the course of its pivot to the public markets, that round valued the company above its final IPO price. As a result, this week’s $56-per-share public offer wound up being something of a modest down-round IPO to UiPath’s final private valuation.

Then, a broader set of public traders got hold of its stock and bid its shares higher. The former unicorn’s shares closed their first day’s trading at precisely $69, above the per-share price at which the company closed its final private round.

So despite a somewhat circuitous route, UiPath closed its first day as a public company worth more than it was in its Series F round — when it sold 12,043,202 shares sold at $62.27576 apiece, per SEC filings. More simply, UiPath closed today worth more per-share than it was in February.

How you might value the company, whether you prefer a simple or fully-diluted share count, is somewhat immaterial at this juncture. UiPath had a good day.

While it’s hard to know what the company might do with the proceeds, chances are it will continue to try to expand its platform beyond pure RPA, which could become market-limited over time as companies look at other, more modern approaches to automation. By adding additional automation capabilities — organically or via acquisitions — the company can begin covering broader parts of its market.

TechCrunch spoke with UiPath CFO Ashim Gupta today, curious about the company’s choice of a traditional IPO, its general avoidance of adjusted metrics in its SEC filings, and the IPO market’s current temperature. The final question was on our minds, as some companies have pulled their public listings in the wake of a market described as “challenging”.

Powered by WPeMatico

French startup BlaBlaCar has raised a new $115 million funding round (€97 million). While the company is better known for its long distance carpooling marketplace, BlaBlaCar has also added a bus marketplace with the acquisition of Ouibus and an online bus ticketing platform with the acquisition of Busfor.

Existing investor VNV Global is leading the round. Two new investors are also participating — Otiva J/F AB and FMZ Ventures. Otiva J/F AB is a fund created by Avito founders Jonas Nordlander and Filip Engelbert. If you’re not familiar with Avito, they specialize in classified ads for the Russian market. Classified giant and global tech investor Naspers acquired Avito. As for FMZ Ventures, it’s a growth fund created by Michael Zeisser, who previously led investments for Alibaba and was a board member at Lyft and Tripadvisor.

It’s a convertible note, which means that the valuation will depend on the next financial event, such as another fundraising round or an initial public offering. But BlaBlaCar co-founder and CEO Nicolas Brusson consider it as a “pre-IPO convertible” round as BlaBlaCar still has a ton of cash on its bank account.

“We already had a lot of cash before this round and we still have more than €200 million in cash following this funding round,” Brusson told me.

Even if BlaBlaCar doesn’t go public right away (or doesn’t raise), there’s a clause with a time frame. After a while, those $115 million will convert into BlaBlaCar shares at a $2 billion valuation in case there’s no financial event.

BlaBlaCar’s strategy and goal with today’s funding round could be summed up with three pillars — carpooling, buses and aggregation.

Let’s start with carpooling, BlaBlaCar’s core business. The company started 15 years ago with a simple goal — matching empty car seats with passengers going in the same direction. While last year’s lockdown has impacted carpooling, it shouldn’t be compared with trains or flights.

“With our carpooling network, there’s no fixed costs,” Brusson said. So BlaBlaCar isn’t paying to put empty cars on the road as everything is community-powered. But, of course, as BlaBlaCar takes a cut from each transaction, revenue took a hit during last year’s lockdown.

Activity bounced back last summer and it’s been up and down ever since depending on current restrictions. “Car is and will be the universal connector that doesn’t rely on train stations or bus stops,” Brusson said.

The carpooling marketplace will always remain a strong revenue generator. In 2020 alone, BlaBlaCar had 50 million passengers across 22 markets overall. In other words, never bet against carpooling.

For the past few years, BlaBlaCar’s second pillar has been buses. In particular, buses represent a huge opportunity in emerging markets and Eastern Europe.

There are already a ton of buses on the road, you simply can’t buy tickets online. BlaBlaCar’s total addressable market in this category is huge and the company is mostly focused on moving offline supply to its online marketplace.

That’s why the company is also acquiring Octobus, a Ukrainian company working on an inventory management system for bus supply. “It consolidates our tech stack in the region,” Brusson said.

Finally, BlaBlaCar’s third pillar is all about creating loyal users that keep coming back to the platform. The company wants to build a multimodal app where you can find all shared travel — carpooling, buses and soon trains.

The startup will add train operators on its marketplace by the end of 2021 or early 2022. I asked Brusson whether he wanted to build an Omio competitor. Formerly known as GoEuro, Omio lets you book train tickets, bus tickets and flights on a single platform.

BlaBlaCar wants to follow a different strategy. It wants to focus first on a handful of countries so that it can sell everything a local would expect.

Eventually, you could imagine opening the BlaBlaCar app to find the best way to go from A to B. It could involve a train ticket followed by a carpooling ride to reach a tiny town. Or it could mix carpooling with bus rides. Thanks to BlaBlaCar’s reach, the French startup is uniquely positioned to connect two small cities through shared transportation.

Powered by WPeMatico

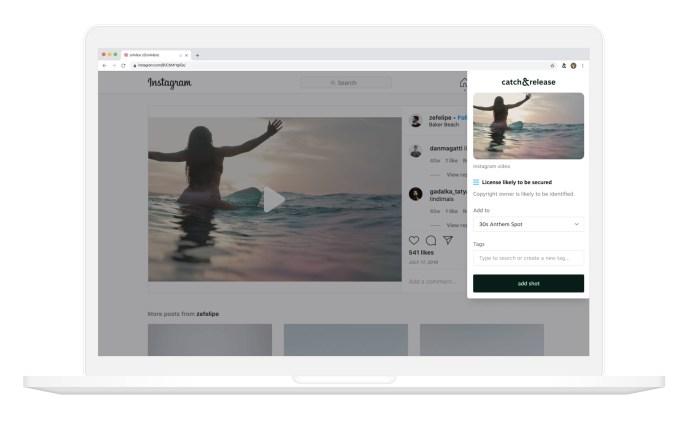

Catch&Release founder and CEO Analisa Goodin told me that she wants to help brands break free from the limitations of stock photography — and that her startup has raised $14 million in Series A funding to achieve that goal.

Goodin explained that the company started out as an image research firm before becoming a product-focused, venture-backed startup in 2015. The Series A was led by Accel (with participation from Cervin Ventures and other existing investors), and it brings Catch&Release’s total funding to $26 million.

Stock media and video services are moving in this direction themselves, for example by introducing their own libraries of user-generated content. Goodin applauded this, and she said Catch&Release isn’t opposed to the use of stock photos — it integrates with these stock marketplaces. At the same time, she suggested that she has a much bigger vision.

“This isn’t just about UGC, this is about tapping into the creative potential of the internet,” she said.

After all, you can now find pretty much any kind of content you can imagine somewhere online, but “a lot of advertising agencies and brands have been trained that if a piece of content comes from the internet, avoid it,” because it’s just “too hard” to figure out how to license it. (And indeed, that’s why I went with a stock photo for the lead image of this post.)

Image Credits: Catch&Release

Catch&Release aims to make that process as simple as possible, first with a browser extension that allows marketers to save any media that they find on the web, anytime they think they might want to use it in their own campaigns (this is the “catch” part of the process). It even presents a “licensability score,” which is a rating based on factors like the person who posted the content, the description and the comments, indicating how likely it is that a marketer will actually be able to license this content.

Then, when someone from a brand or advertising agency decides that they want to use a piece of content, they can send a licensing request with a push of a button (this is the “release”). Catch&Releases also analyzes the content for anything else that needs to be cleared or obscured, such as a company logo.

While we’ve written about other tools for licensing online content, Goodin emphasized that Catch&Release isn’t just about finding photos for a social media campaign. Part of the goal, she said, is to erase the “stigma” around UGC, which now “represents the entire spectrum of culturally relevant content.”

For example, she showed me a Red Lobster commercial that looks like a normal TV ad, but was in fact assembled entirely from footage found online — something that’s been even more useful in the past year, with pandemic-related safety concerns around large shoots. (Catch&Release has also been used to license content for ads promoting TechCrunch’s parent company Verizon.)

Goodin added that the new funding will allow Catch&Release to continue investing in product, engineering and marketing.

“No one has defined the commercial licensing layer for the web,” she said. “What’s got me really excited to build this product is being that layer for the internet, not just for photos and videos, but for writing, art, graphics and building the commercial licensing engine of the web.”

Powered by WPeMatico

The investment landscape for insurtech startups is off to a hot start in Q2 2021. Since the end of the first quarter, we’ve seen several players in the broad startup category announce new capital, including Clearcover, Alan, Next Insurance and The Zebra.

But, as anyone who’s familiar with startups that offer insurance-related products and services knows, the sector is enough of a mixed bag that one needs to segment down to get clarity on how constituent companies are performing. So while Clearcover’s $200 million round from last week, Next Insurance’s $250 million round from the first of the month and Alan’s $220 million round from yesterday are interesting, this morning we’re going to focus a bit more on The Zebra’s side of the insurtech house.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The Exchange divides insurtech startups into three categories: neoinsurance providers, insurtech marketplaces and insurtech enablers. (You can see why we need to segment the insurtech genre!)

Briefly, neoinsurance providers are companies like Root, Metromile and Next Insurance, which use technology to underwrite and sell insurance in an updated manner; these companies also often have optimized mobile experiences.

Marketplaces like The Zebra, Gabi, Insurify and others provide a way for consumers to better identify their insurance options. And, finally, there are companies like AgentSync, which fit neatly into our third category of firms that help other companies in the insurance business digitize their operations or otherwise modernize.

Insurtech marketplaces came back into our view when The Zebra put together a $150 million Series D earlier this month and released a host of metrics regarding its growth, and Insurify dropped the news that it is partnering with Toyota.

Insurtech marketplaces came back into our view when The Zebra put together a $150 million Series D earlier this month and released a host of metrics regarding its growth, and Insurify dropped the news that it is partnering with Toyota.

This morning, let’s discuss insurtech’s 2020 as a whole, peek at some preliminary 2021 venture data and then dive deep into what we’ve collected regarding growth among insurtech marketplace players. The Exchange has data and other details from The Zebra, Insurify, Wefox and more.

Covering longitudinal progress of specific startup categories is one of our favorite things to do. So, please, walk with us!

PitchBook data regarding the insurtech category in 2020 underscores how large the startup niche has grown. Per the data company, $18.3 billion was spent last year on insurtech startups across venture capital, private equity and M&A activity. That was a billion dollars under its 2019 result, but given the pandemic’s onset, 2020’s final result is somewhat impressive — who expected insurance investing to hold up during an unprecedented global catastrophe?

This year is proving lucrative for the insurtech market, at least from a venture capital perspective. Normally I’d make a joke about how unprofitable some neoinsurance providers are at this juncture, but because our focus is elsewhere, bringing up the fact that, say, Lemonade’s adjusted losses in the final quarter of 2020 were around 150% of its revenue is kind of irrelevant. So we won’t!

Powered by WPeMatico

Farshad Yousefi and Masoud Jalali used to drive through Palo Alto neighborhoods and marvel at the outrageous home prices. But the drives sparked an idea. They were not in a financial position to purchase a home in those neighborhoods (to be clear, not many people are) either for investment or to live. But what if they could invest in homes in up and coming cities throughout the U.S.?

Then they realized that even that might be a challenge, considering that with all their student debt, affording a down payment would be impossible.

“There was nothing available out there besides a crowdfunding platform, which when we first signed up, took away $1,000 from our account that we didn’t have, and then our capital would be locked up for three to 10 years,” recalls Yousefi.

So the pair started doing research and spoke to 1,000 individuals under the age of 35. Eight out of 10 said they would like to invest in real estate but were deterred by all the barriers to entry.

“There is clearly a large demand for access to real estate,” Yousefi said. “And we wanted to give people a way to invest in it like they can in stocks, via a mobile app.”

And so the idea for Fintor was born.

Yousefi and Jalali founded the company in 2020 with the goal of purchasing homes via an LLC, and turning each into shares through an SEC-approved broker dealer. Individuals can then buy shares of the homes via Fintor’s platform. Its next step is to sign agreements with individual real estate investors or bigger real estate development firms to list their properties on the platform and give people the opportunity to buy shares.

And now Fintor has raised $2.5 million in seed money to continue building out its fractional real estate investing platform. The startup aims to “fractionalize” houses and other residential property, giving people in the U.S. access to investment opportunities “starting with as little as $5.” The company attracted the interest of investors such as 500 Startups, Hustle Fund, Graphene Ventures, Houston-based real estate investor Manny Khoshbin, Mana Ventures and other angel investors such as Cindy Bi, Skyler Fernandes, VU Venture Partners, Minal Hasan, Andrew Zalasin, Alluxo CEO and founder Safa Mahzari, SquareFoot CEO and founder Jonathan Wasserstrum and Teachable CEO and founder Ankur Nagpal.

Image Credits: Fintor

Fintor is eying markets such as Kansas City, South Carolina and Houston, where it already has some properties. It’s looking for homes in the $80,000 to $350,000 price range, and millennials and Gen Zers are its target demographic.

“Fintor can give the same return as the stock market, but at half the risk,” Yousefi said. “As two [Iranian] immigrants, we’ve seen how much this country has to offer and how real estate sits at the top of everything, yet is so inaccessible.”

The pair had originally set out to raise just $1 million but the round was quickly “way oversubscribed,” according to Yousefi, and they ended up raising $2.5 million at triple the original valuation.

Jalali said the company will use machine learning technology to filter and rate properties as it scales its business model.

“We’ll use ML to categorize neighborhoods and to come up with the price of properties to offer to potential sellers,” he added. “Our ultimate goal is to create indexes so that people can invest in multiple properties in a given city. That creates diversification right away.”

Elizabeth Yin, co-founder and general partner of Hustle Fund, believes that Fintor is solving a generational problem with real estate.

“Retail investors have almost no access to great real estate investments today and the best opportunities are reserved for the select few,” she told TechCrunch. “Not to mention that in addition to access, retail investors often need a lot of capital in order to have a diversified portfolio or be accredited to join funds.”

Fintor’s approach to securitize real estate assets will give millions of investors who are not accredited investors access they would otherwise not have had, Yin added.

“Simultaneously, it provides increased liquidity to property owners, while improving the user experience for both parties,” she said. “Effectively this becomes a new asset class, because it’s entirely turnkey and is fractionalized, which opens up many new pockets of investors.”

Powered by WPeMatico

Pragma is building what it calls a “backend as a service,” providing ready-made infrastructure to developers of online, live service games. And it’s announcing today that it has raised $12 million in Series A funding.

The round was led by David Thacker at Greylock, with participation from Zynga founder Mark Pincus, Oculus founder Nate Mitchell and Cloudera founder Amr Awadallah, along with previous investors Upfront Ventures and Advancit Capital. Amy Chang, who sold her business intelligence startup Accompany to Cisco, is joining Pragma’s board of directors.

Co-founder and CEO Eden Chen told me that where Unity and Unreal have built popular frontend game engines, he and his co-founder Chris Cobb (former engineering lead at Riot Games) are hoping Pragma will fill the void for a “de facto backend game engine.”

And while “many companies tried to do this” over the past decade, Chen suggested that this is the right time to launch the platform, thanks to the continued rise of live service games (like League of Legends) that have to be treated as “living, breathing products,” as well as improved tooling around infrastructure platforms like Amazon Web Services.

Image Credits: Pragma

Pragma is launching a starter kit today designed to allow developers to quickly set up and test game loops. Meanwhile, the broader platform is currently in private beta testing with studios including One More Game (started by started by Pat Wyatt, one of Blizzard’s first employees) and Mitchell’s Mountain Top Studios.

Chen said the platform’s features fall into three broad categories — player accounts/social, game loops (including lobbies and matchmaking) and player/game data. Pragma isn’t building all of this from scratch; in some cases, it’s “acting as the integrator” for other platforms like Discord. Chen also noted that while the team plans to build a fully managed solution in the future, the current version is on-premise: “We’re building an instance of Pragma on the studio’s own infrastructure, [so they can] so they can take our code base and customize it to their own preferences.”

Pragma is initially targeting game studios with about 10 to 50 team members. Eventually, Chen hopes the platform could serve larger studios while also supporting “the democratization of these tools, so that a one- to five-person team can really leverage [them] to launch a networked, online game.”

He added, “The vision for us long term is that we really want to be innovating on the social side, creating social features that improve the game and build stronger connections.”

Powered by WPeMatico

Fintech startup Payhawk has raised a $20 million funding round. QED Investors is leading the round with existing investor Earlybird Digital East also participating. Payhawk is building a unified system to manage all the money that is going in and out.

Essentially, companies switching to Payhawk can replace several services they already use and that didn’t interact well with each other. Payhawk lets you issue corporate cards for your employees, manage invoices and track payments from a single interface.

After signing up, customers get their own banking details with a dedicated IBAN. You can connect with your existing bank account, load funds to your Payhawk account and start using it in multiple ways.

Compared to other companies working on similar products, Payhawk gives each customer their own IBAN, which means they can receive third-party payments.

One of the key features of Payhawk is that customers can issue virtual and physical cards for employees with different rules. You can set up a team budget, configure an approval workflow for large transactions and let Payhawk handle receipt collection from those card transactions.

You can upload invoices to manage them through Payhawk. The startup tries to automatically extract data from those invoices for easier reconciliation. Payhawk also lets you reimburse employees. The service acts as a single source of truth for your company’s spending. Finally, you can connect Payhawk with your existing ERP system.

As a software-as-a-service solution, you pay a monthly subscription fee that will vary depending on optional features and the number of active cards. Clients include LuxAir, Lotto24, Viking Life, ATU, Gtmhub, MacPaw and By Miles. Overall, the startup has 200 clients.

The company has been growing nicely as revenue doubled in Q1 2021. It currently accepts clients in the European Union and the U.K. but it already plans to expand beyond those markets. Up next, Payhawk plans to launch credit cards, more currencies and tighter integration with corporate bank accounts.

Powered by WPeMatico

Druva, a software company that sells cloud data backup services, announced today that it has closed a $147 million round of capital. Caisse de dépôt et placement du Québec (CDPQ), a group that manages Quebec’s pension fund, led the round, which also saw participation from Neuberger Berman. Prior investors including Atreides Management and Viking Global Investors put capital into the deal, as well.

Druva last raised a $130 million round led by Viking in mid-2019 at around a $1 billion valuation. At the time TechCrunch commented that the company’s software-as-a-service (SaaS) backup service was tackling a large market. (TechCrunch also covered the company’s $51 million round back in 2016 and its $80 million raise from 2017.)

Since then SaaS has continued to grow at a rapid clip, including a strong 2020 spurred on by COVID-19 boosting digital transformation efforts at companies of all sizes. In that context, it’s not surprising to see Druva put together a new capital round.

A recent tie-up between Dell and Druva, first reported in January of this year, was formally announced earlier this month. The selection of Druva by Dell could help provide the unicorn with a customer base to sell into for some time. TechCrunch wrote about Druva earlier this year, during the reporting process the company said that it had “almost tripled its annual revenue in three years.”

Its new round did include some secondary shares, which Neuberger Berman managing director Raman Gambhir described as difficult to snag during a call with TechCrunch. He explained that some of the secondary sales were due to some prior funds reaching their end-of-life cycle. Druva CEO Jaspreet Singh stressed that his backers are working to do what’s best for the company instead of merely maximizing their returns during a joint interview.

Singh told TechCrunch that business at Druva is accelerating. Normally we’d note that that sounds like IPO fodder, especially as Druva passed the $100 million ARR threshold back in 2019. However, as the company has been making IPO noise for some time, it’s hard to predict when it might pull the trigger. Our coverage of the company’s 2016 round noted that the company could go public within a year. And our coverage of its 2019 investment included Singh telling TechCrunch that an IPO was 12 to 18 months away.

It probably is, now, but that’s beside the point. With refreshed accounts, a market moving in its direction, and some early investor relieved in its latest investment the company has quarters worth of time to play with. Still, Singh did stress that its new financing round did select investors that he said is building a long-term position; that’s the sort of verbiage that CEOs break out when they are building a pre-IPO cap table.

Gambhir told TechCrunch that his firm has already requested shares in Druva’s eventual IPO. Perhaps we’ll see Fidelity show up with a $50 million check in a few months.

Every startup that raises capital tells the media that they are going to use the funds to expand their staff, double down on their tech and, often, invest in their go-to-market (GTM) motion. Druva is no exception, but its CEO did tell TechCrunch that his company currently has over 200 open GTM positions. That’s quite a few. Presumably that spend will help the company keep its growth rate strong in percentage terms as it does, finally, look to list.

This is yet another growth round for a late-stage, enterprise-facing software company. But it’s also a round into a company that had to move its operations to the United States when it was founded, at the behest of its investors per Singh. And Druva has done some pretty neat cloud work, it told TechCrunch earlier this year, to ensure that it can defend software-like margins despite material storage loads.

It’s an S-1 that we’re looking forward to. Start the countdown.

Powered by WPeMatico