Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

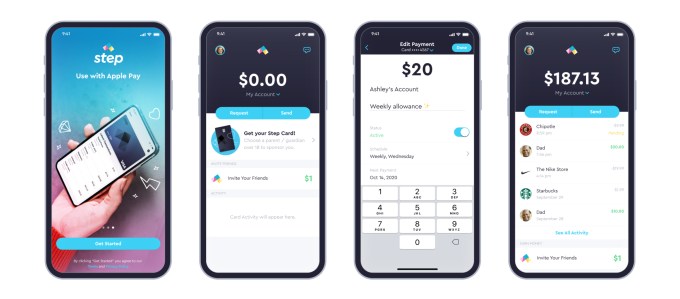

Step, the digital banking service aimed at teens and endorsed by TikTok star Charli D’Amelio, announced this morning the close of a $100 million round of Series C funding after growing to more than 1.5 million users just six months after launch. The new round, led by General Catalyst, comes shortly after Step’s $50 million Series B, announced at the end of last year after the startup hit half a million users in only two months post-launch.

The new round also includes participation from Step’s existing investors, Coatue, Stripe, Charli D’Amelio, The Chainsmokers, Will Smith and Jeffrey Katzenberg, and brings on newcomer Franklin Templeton, signaling a plan to move into investments is on the horizon. It also includes actor and musician Jared Leto. Step is also formally announcing NBA All-Star Stephen Curry as an investor, which had not previously been disclosed, as well as former Square executives Sarah Friar, Jacqueline Reses and Gokul Rajaram.

As a result of the fundraise, Kyle Doherty of General Catalyst is joining Step’s board. To date, Step has raised more than $175 million.

Image Credits: Step

According to CEO CJ MacDonald, Step hasn’t yet spent the money from its Series B, but believes the additional funds can help the startup grow more quickly.

“We’ve signed up more than a million and a half accounts in the first six months. We’re signing up 10,000 accounts-plus a day, and there’s just a lot of things that we want to do to bring this to millions and millions of households to help educate the next generation be smarter with money,” he says. At the time of the Series B, for comparison, Step said it was adding around 7,000 to 10,000 accounts per day.

“Honestly we don’t need the capital,” MacDonald added. “It’s just we think speed to market is really key and we think we can accelerate our growth and invest in infrastructure.”

The company is also planning to hire across operations, engineering, product and design, to double its now 65-person team over the next year.

Step today competes in a crowded market of mobile banking services aimed at a younger demographic, but it’s one of very few that targets teenagers ages 13 to 18. Through Step’s app, teens gain access to an FDIC-insured bank account without fees and a secured Visa card that helps them establish credit before they turn 18. The app also offers Venmo-like functionality for sending money to friends.

Image Credits: Step

Step’s growth so far has benefitted from a combination of factors, including word-of-mouth, use of social media and its popular referral program, which has paid out a few dollars per new sign-up. Step has also leveraged its partnerships with social media influencers like D’Amelio and Josh Richards, as well as celebs like Step investor Justin Timberlake.

The company believes the Curry announcement may also help to raise awareness about the banking app. As a father of three, if Curry talks about introducing Step to his own children, people will take notice.

While the additional funds are focused on driving growth, Step is also thinking about its future as its existing users begin to age up. The company plans to enter into the credit and lending market, as well as introduce investments at some point in the future. The Franklin Templeton investment could be useful here, MacDonald notes.

“Franklin [Templeton is] obviously, one of the largest financial institutions in the world. And, as we start thinking about investments and the journey of the customer, to have a great brand like Franklin Templeton that’s invested in this round — I think it’s just a testament to where they see the world going,” he says.

Step’s fundraise falls on the same day that competitor Current and Greenlight, both which focus on families, also raised new rounds.

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading.

A week ago TechCrunch covered Pico’s $6.5 million funding round and described it as “a New York startup that helps online creators and media companies make money and manage their customer data.” The Exchange has also covered Pico before, most recently during a mid-2020 dive into the world of indie pubs and subscription media.

While our own Anthony Ha did an inimitable job covering the Pico round, I got on a Zoom call with the company, as well, as their new capital came with a relaunch of sorts that I wanted to better understand.

The Pico team walked me through what’s changed at their business by describing the historical progress of creative digital tooling. They said earlier eras in the space focused on content hosting and distribution. In the startup’s view, a new generation of creative-focused tooling will bring the market to an era in which content management systems, or CMSs — say, Substack or WordPress — will not own the center of tooling. Instead, monetization will.

That’s Pico’s bet, and so it’s building what it considers to be an operating system for the creator market. My gut read is that a creative digital world that centers around monetization sounds like one that is more lucrative than what preceding eras brought us.

Pico’s view is that regardless of where someone first builds their audience, they eventually go multi-SKU — or multi-platform, perhaps — so keeping a single, centralized register of customer data may prove critical.

The startup’s revamped service is a bit of a monetization tool, as before, along with a creator-focused CRM that sits atop your CMS or other digital output on any particular platform. So far customer growth at the company looks good, growing by about 5x in the last year. Let’s see how far Pico can ride its vision, and if it can help build out a middle class in the creator economy.

Somewhat lost in our circles amid the hype regarding Instacart’s epic COVID period is the fact that most folks still go to stores to buy their fruit and veg, as our friends in the UK might say.

Grocers did not forget the fact. But their historically thin margins and rising competition for customer ownership in the Instacart era hasn’t left them too secure. How can they pursue a more digitally enabled strategy without outsourcing their customer relationship to a third party?

Swiftly might be part of the answer. The startup is building technology that may help grocery chains of all sizes go digital, take advantage of modern mobile technology, and generate more incomes via ads, while offering consumers more shopping options. Neat, yeah?

The startup has raised a little over $15 million to date, per Crunchbase data, but came back into our minds thanks to the launch of a deal with the Dollar Tree company, a consumer retailer that has around one zillion stores in America.

I’ve been aware of Swiftly for ages, having met its co-founder Henry Kim back when he was building Sneakpeeq, which later became Symphony Commerce. The latter company was eventually bought by Quantum Retail. But during my chats with Kim over the years in and around San Francisco, he consistently brought up the grocery market, a space he’d had experience in before building Symphony Commerce.

After hearing Kim hype up the possibilities for grocery and digital for a half decade or so, to see the company that came out of his hopes and planning land a major partner is fun.

Swiftly provides two main products, a retail system and a media service. The retail side of its business provides checkout services, loyalty programs, personalized offers and the like for mobile shoppers. And the media side allows IRL grocers to snag a bit of the consumer packaged goods (CPG) ad spend that they often miss out on, while looping in analytics to provide better attribution to the impact of ads sold.

I expect that Swiftly will raise more capital in the next few quarters now that it has a big, public deal out. More when we have it.

Over the past two weeks The Exchange has written quite a lot about the UiPath IPO. Probably too much. But to catch you up just in case, the company’s first IPO pricing range looked like a warning for late-stage investors as the resulting valuations were a bit lower than anticipated. Next the company raised that range, ameliorating if not eliminating our earlier concern. Then the company priced above its raised range, though still at a discount to its final private round. Then it gained ground after starting to trade, and its CFO was like, we did good.

To dig even more into the company’s private-public valuation saga, The Exchange asked B2B investor Dharmesh Thakker, a general partner at Battery Ventures, about his take on the company’s final private round in the context of it landing a bit higher than where the company eventually priced its IPO. Here’s what he had to say:

[T]here was smart money involved in that round. These are people who understand that material value creation happens 3-5 years post IPO, as we have seen with Twilio, Atlassian, MongoDB, Okta, and Crowdstrike who have increased value 5-10x post IPO.

Right now, UIPath has only 1% penetration at $608M revenue in a $60B automation market, and the urgency around intelligent process automation for repetitive tasks is only increasing post-COVID. Companies need help managing their costs with automation. So, as the company penetrates its target market and grows over time, UIPath will drive ongoing value, which pre-IPO and IPO stage investors realize. They will be patient.”

He’s bullish, in other words. A more acerbic take on the UiPath IPO came in from PitchBook analyst Brendan Burke. Here’s what he had to say about the company and its market:

RPA has scaled rapidly due to the demand for automation yet remains a limited solution that may lack durable value. Due to its reliance on custom scripts, we view RPA as a bridge technology to cloud-native AI automation that faces competitive risk from AI-native challengers. The future of enterprise automation is for front-line users to deploy cloud-native machine learning models that can adapt to dynamic data streams and make accurate decisions. UiPath’s implementations are not cloud-native and require third party integrations with around 75 AI model vendors for intelligent decision-making. Additionally, the company lists the ability to recruit AI engineers as a risk factor for the business. UiPath’s ability to expand across the AI value chain will be critical for its long-term prospects.

I include that remark as it can be, at times, hard to get actual negative commentary out of the broader analyst world, as people are so terrified of being rude.

Scooting along, there’s a new SPAC deal out this week that I wanted to flag for you: SmartRent is merging with Fifth Wall Acquisition Corp. I. SmartRent raised more than $100 million while private, according to Crunchbase data, from RET Ventures, Spark Capital and Bain Capital Ventures, among others.

So this particular SPAC deal, which puts a $2.2 billion equity valuation on SmartRent, is a material venture-backed exit. You can check its investor deck here. We care about the company as it appears to work in a similar space to Latch, which is also going out via a SPAC. Dueling OS companies for rental units? This should be fun. (More on Latch’s SPAC deal here.)

Finally for our main work today, HYPR raised $35 million this week. Among all the venture capital rounds that I wish I could have written about this week but didn’t get to, HYPR is up there because it promises a password-free future. And having just raised a Series C, it may have a shot at pulling it off. Please god, let it happen.

I got to cover a few rounds raised by recent Y Combinator graduates this week, including Queenly and Albedo’s recent funding events. Check ‘em out.

Oh, and Afterpay’s recent earnings show that the buy-now-pay-later market is still growing like all hell,

Powered by WPeMatico

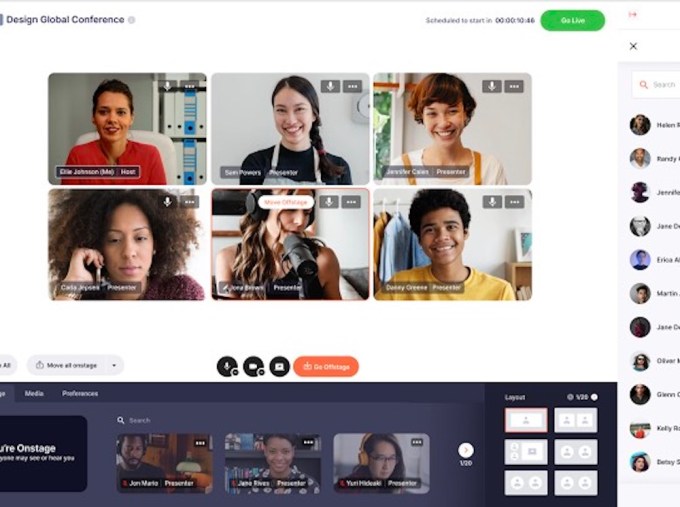

While there’s been plenty of attention and money lavished on virtual event platforms over the past year, Introvoke co-founder and CEO Oana Manolache predicted that we’re only at the beginning of a “third wave of digital transformation.”

In her framing, the first wave came at the beginning of the pandemic, when everyone was using video conferencing tools like Zoom for their virtual events. Next came conference platforms like Hopin (which has been raising money at a mind-boggling clip). But Manolache argued that even Hopin represents a “Band-Aid” that customers are hoping will tide them over until in-person events can resume — particularly when organizers have to point attendees to a third-party platform.

“One size does not fit all,” she said. “The Band-Aid solution that was only supposed to last for a couple months has had big benefits as companies grew their customer base and revenue targets. Now we’ve reached the third wave, as organizations want to bring solutions to their own universe and own their relationship with the audience.”

San Francisco-based Introvoke is a Techstars Accelerator graduate aiming to provide this third-wave solution. It’s announcing today that it has raised $2.7 million in funding led by Struck Capital, while Comcast, Social Leverage, Great Oaks, V1vc, Time CTO Bharat Krish and Resy co-founder Mike Montero also participated.

The startup offers components like virtual stages, chat rooms and networking hubs, all customizable and embeddable on a customer’s website. Manolache said Introvoke (the name comes from the idea of “thought-provoking introductions”) is designed for a hybrid future, which will take multiple forms: “Hybrid is going to mean virtual-only events, in-person only events and events that have in-person and virtual elements.”

Image Credits: Introvoke

Introvoke charges customers based on live event minutes, a model that it says is accessible to companies large and small. Its components can be embedded on websites built with WordPress, Squarespace, Wix, Splash and other platforms, but also on a customer’s internal intranet.

“We’ve been so impressed by the way customers are using the technology — conferences, career fairs, employee engagements,” Manolache said.

She added that as customers like Comcast, Wharton and Ritual Motion have used the platform in private preview mode, they’re beginning to break free of the in-person model. For example, Introvoke events can allow for attendees to chat with each other over weeks or months, not just a few days.

In a statement, Struck Capital founder and Managing Partner Adam B. Struck suggested that virtual events “will continue far beyond the COVID-19 pandemic.”

“Right now, virtual experiences, from conferences and concerts to company all-hands, are generally hosted on third party platforms, which creates a disjointed experience for the brand or organization hosting the event,” he continued. “Virtual enablement should be native to the website and platform of the enterprise itself, and it’s the role of technologists like the Introvoke team to make these experiences as seamless as any in-person event.”

Powered by WPeMatico

To close out the week, a short meditation on value, or, more precisely, how assets are valued in today’s markets.

Do you recall the pre-direct-listing hype Coinbase enjoyed? After reporting its estimated first-quarter financial performance, interest in the domestic cryptocurrency trading giant ran red-hot.

When Coinbase set a $250 per-share direct listing reference price, it was broadly viewed as modest, if not downright low. Of course, a reference price is just that — a reference — so it wasn’t too big a deal. But it also wasn’t surprising that Coinbase shares traded as high as $429.54 on their first day, according to Yahoo Finance data.

Coinbase equity hasn’t topped $400 in any following day and is now under the $300 mark, with more declines set to arrive as trading commences. Its reference price looms, and suddenly a price that felt intensely conservative before Coinbase began to trade is starting to look nearly reasonable.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

There have been other notable declines in value among some recently public, more technologically differentiated companies. The Exchange has watched with something akin to polite confusion as the value of Root, a neoinsurance company, fell to a third of its public-market highs after going public, even though it beat growth expectations in its most recent quarterly report.

There have been other notable declines in value among some recently public, more technologically differentiated companies. The Exchange has watched with something akin to polite confusion as the value of Root, a neoinsurance company, fell to a third of its public-market highs after going public, even though it beat growth expectations in its most recent quarterly report.

We could toss UiPath into our trend of wildly meandering value. The company’s initial IPO price range targeted a price as low as $43 per share. Today it’s worth $76.75 per share in pre-market trading.

No one knows what anything is worth, again. This is the feeling I get while watching the markets work to determine how to value assets as diverse as startups crossing the private-public divide to the value of Bitcoin, which was supposed to keep going up. Until it suddenly reversed gear.

Frankly, we’re still dealing with new-enough models — or big-enough guesses about the future baked into business models — that it’s hard to really value the most uncertain (and therefore most exciting) companies, let alone cryptocurrencies. Let’s discuss.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

First and foremost, Equity was nominated for a Webby for “Best Technology Podcast”!!! Drop everything and go Vote for Equity! We’d appreciate it. A lot. And even if we lose, well, we’ll keep doing our thing and making each other laugh.

Natasha and Danny and Alex and Chris got together to chat through the week’s biggest news. And like every other week in recent memory, it was a busy one. But we did our best to hit some M&A news, some unicorn news and some funding news from smaller startups.

Now, onto the show rundown; here’s what we discussed:

We’ll see you on Monday.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

The clock begins ticking on a startup the day the doors open. Regardless of a young company’s struggles or success, sooner or later the question of when, how or whether to sell the enterprise presents itself. It’s possibly the biggest question an entrepreneur will face.

For founders who self-funded (bootstrapped) their startup, a boardroom full of additional factors come into play. Some are the same as for investor-funded firms, but many are unique.

Put happiness at the center of the decision, and let your intuition — the instincts that made you the person you are today — be your guide.

After 18 years of bootstrapping a BI software firm into a business that now serves 28,000 companies and three million users in 75 countries, here’s what I’ve learned about myself, my company, about entrepreneurship and about when to grab for that brass ring.

Starting a software company 7,900 miles southwest of Silicon Valley requires some forethought and not a small amount of crazy. When we opened, it didn’t occur to us that one could have an idea and then go knock on someone’s door and ask for money.

Bootstrapping forced us to be a bit more creative about how we would go about building our company. In the early days, it was a distraction to growth, because we were doing other revenue-generating activities like consulting, development work, whatever we could find to keep ourselves afloat while we built Yellowfin. It meant we couldn’t be 100% focused on our idea.

However, it also meant we had to generate income from our new company from Day One — something funded companies don’t have to do. We never got into the mindset that it was okay to burn lots of cash and then cross our fingers and hope that it worked.

Powered by WPeMatico

With the increase of digital transacting over the past year, cybercriminals have been having a field day.

In 2020, complaints of suspected internet crime surged by 61%, to 791,790, according to the FBI’s 2020 Internet Crime Report. Those crimes — ranging from personal and corporate data breaches to credit card fraud, phishing and identity theft — cost victims more than $4.2 billion.

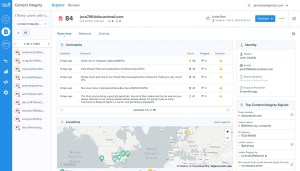

For companies like Sift — which aims to predict and prevent fraud online even more quickly than cybercriminals adopt new tactics — that increase in crime also led to an increase in business.

Last year, the San Francisco-based company assessed risk on more than $250 billion in transactions, double from what it did in 2019. The company has over several hundred customers, including Twitter, Airbnb, Twilio, DoorDash, Wayfair and McDonald’s, as well a global data network of 70 billion events per month.

To meet the surge in demand, Sift said today it has raised $50 million in a funding round that values the company at over $1 billion. Insight Partners led the financing, which included participation from Union Square Ventures and Stripes.

While the company would not reveal hard revenue figures, President and CEO Marc Olesen said that business has tripled since he joined the company in June 2018. Sift was founded out of Y Combinator in 2011, and has raised a total of $157 million over its lifetime.

The company’s “Digital Trust & Safety” platform aims to help merchants not only fight all types of internet fraud and abuse, but to also “reduce friction” for legitimate customers. There’s a fine line apparently between looking out for a merchant and upsetting a customer who is legitimately trying to conduct a transaction.

Sift uses machine learning and artificial intelligence to automatically surmise whether an attempted transaction or interaction with a business online is authentic or potentially problematic.

Image Credits: Sift

One of the things the company has discovered is that fraudsters are often not working alone.

“Fraud vectors are no longer siloed. They are highly innovative and often working in concert,” Olesen said. “We’ve uncovered a number of fraud rings.”

Olesen shared a couple of examples of how the company thwarted fraud incidents last year. One recently involved money laundering through donation sites where fraudsters tested stolen debit and credit cards through fake donation sites at guest checkout.

“By making small donations to themselves, they laundered that money and at the same tested the validity of the stolen cards so they could use it on another site with significantly higher purchases,” he said.

In another case, the company uncovered fraudsters using Telegram, a social media site, to make services available, such as food delivery, with stolen credentials.

The data that Sift has accumulated since its inception helps the company “act as the central nervous system for fraud teams.” Sift says that its models become more intelligent with every customer that it integrates.

Insight Partners Managing Director Jeff Lieberman, who is a Sift board member, said his firm initially invested in Sift in 2016 because even at that time, it was clear that online fraud was “rapidly growing.” It was growing not just in dollar amounts, he said, but in the number of methods cybercriminals used to steal from consumers and businesses.

“Sift has a novel approach to fighting fraud that combines massive data sets with machine learning, and it has a track record of proving its value for hundreds of online businesses,” he wrote via email.

When Olesen and the Sift team started the recent process of fundraising, Insight actually approached them before they started talking to outside investors “because both the product and business fundamentals are so strong, and the growth opportunity is massive,” Lieberman added.

“With more businesses heavily investing in online channels, nearly every one of them needs a solution that can intelligently weed out fraud while ensuring a seamless experience for the 99% of transactions or actions that are legitimate,” he wrote.

The company plans to use its new capital primarily to expand its product portfolio and to scale its product, engineering and sales teams.

Sift also recently tapped Eu-Gene Sung — who has worked in financial leadership roles at Integral Ad Science, BSE Global and McCann — to serve as its CFO.

As to whether or not that meant an IPO is in Sift’s future, Olesen said that Sung’s experience of taking companies through a growth phase such as what Sift is experiencing would be valuable. The company is also for the first time looking to potentially do some M&A.

“When we think about expanding our portfolio, it’s really a buy/build partner approach,” Olesen said.

Powered by WPeMatico

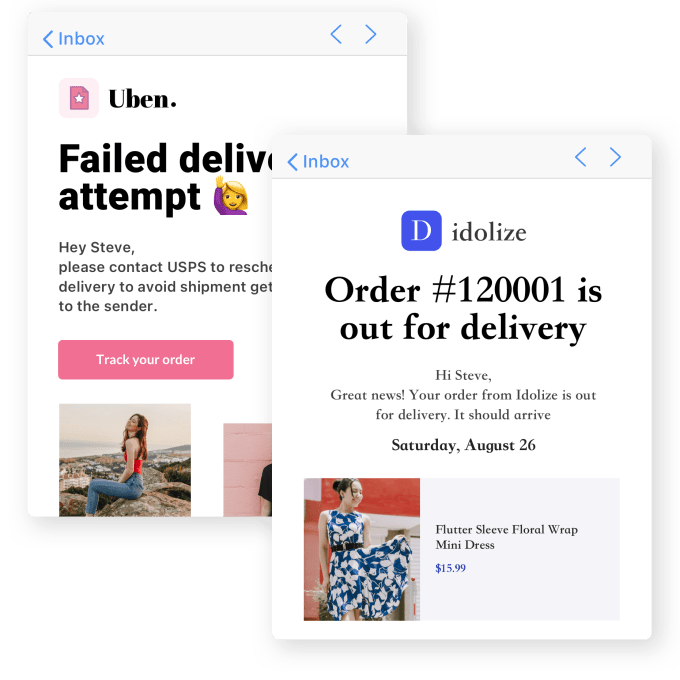

AfterShip launched in 2012 to help online sellers track packages across different carriers, but since then it has built a suite of data analytics tools covering almost every step of the shopping experience, from email marketing to customer retention. The Hong Kong-headquartered startup announced today it has raised a $66 million Series B led by Tiger Global, with participation from Hillhouse Capital’s GL Ventures.

AfterShip’s last round of funding was a $1 million Series A in 2014. Co-founder Andrew Chan told TechCrunch that the company has been profitable since its launch and grew mainly through word-of-mouth referrals and partnerships, like a Shopify integration, that boosted its profile. But the company recently added a sales team and will use its latest capital on international hiring for sales and customer support. It also plans to launch new products and expand further in the United States, where about 70% of AfterShip’s customers are located.

The company’s software enables sellers to track shipments made through more than 740 carriers and handles more than 6 billion shipments each year. AfterShip’s partners with about 10,000 companies, including some of the biggest names in e-commerce: Shopify (where it is used by 50,000 merchants), Magento, Squarespace, Amazon, eBay, Etsy, Groupon, Rakuten, Wish and retail brands like Dyson and Inditex.

A branded shipment tracking page and email created with AfterShip’s software. Image Credits: AfterShip

AfterShip’s core product is its shipment tracking platform, but it also makes apps for shoppers, including self-service returns and package tracking, and sales and marketing tools for merchants that let them get more use out of data from shipments. Chan explained that package tracking is also a user engagement tool for sellers that lets them show more product recommendations and promotions to shoppers. AfterShip’s tools enables merchants to create their own branded tracking pages and notifications. Other features allow them to track the performance of different carriers, create email marketing campaigns and increase customer retention.

Its CRM capabilities help AfterShip differentiate from other shipment tracking aggregator providers.

“When we think of our vision, we look at what Salesforce is doing, but is there an e-commerce Salesforce that can cover more topics for sales people to use,” Chan said.

In press statement, Pengfei Wang, global partner at Tiger Global, said, “AfterShip leads the charge in making the shipping process more transparent and reliable for consumers and companies alike. As growth in e-commerce spirals ever upward, we are excited to partner with AfterShip and its leadership team as they continue to advance technology in this critical and expanding industry.”

Powered by WPeMatico

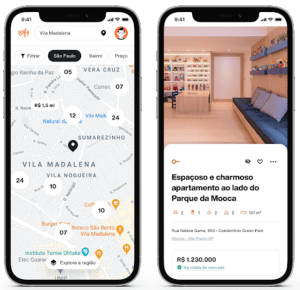

Nearly exactly one month ago, digital real estate platform Loft announced it had closed on $425 million in Series D funding led by New York-based D1 Capital Partners. The round included participation from a mix of new and existing investors such as DST, Tiger Global, Andreessen Horowitz, Fifth Wall and QED, among many others.

At the time, Loft was valued at $2.2 billion, a huge jump from its being just near unicorn territory in January 2020. The round marked one of the largest ever for a Brazilian startup.

Now, today, São Paulo-based Loft has announced an extension to that round with the closing of $100 million in additional funding that values the company at $2.9 billion. This means that the 3-year-old startup has increased its valuation by $700 million in a matter of weeks.

Baillie Gifford led the Series D-2 round, which also included participation from Tarsadia, Flight Deck, Caffeinated and others. Individuals also put money in the extension, including the founders of Better (Zach Frenkel), GoPuff, Instacart, Kavak and Sweetgreen.

Loft has seen great success in its efforts to serve as a “one-stop shop” for Brazilians to help them manage the home buying and selling process.

Image Credits: Loft

In 2020, Loft saw the number of listings on its site increase “10 to 15 times,” according to co-founder and co-CEO Mate Pencz. Today, the company actively maintains more than 13,000 property listings in approximately 130 regions across São Paulo and Rio de Janeiro, partnering with more than 30,000 brokers. Not only are more people open to transacting digitally, more people are looking to buy versus rent in the country.

“We did more than 6x YoY growth with many thousands of transactions over the course of 2020,” Pencz told TechCrunch at the time of the company’s last raise. “We’re now growing into the many tens of thousands, and soon hundreds of thousands, of active listings.”

The decision to raise more capital so soon was due to a variety of factors. For one, Loft has received “overwhelming investor interest” even after “a very, very oversubscribed main round,” Pencz said.

“We have seen a continued acceleration in our market share growth, especially in São Paulo and Rio de Janeiro, the two markets we currently operate in,” he added. “We saw an opportunity to grow even faster with additional capital.”

Pencz also pointed out that Baillie Gifford has relatively large minimum check size requirements, which led to the extension being conducted at a higher price and increased the total round size “by quite a bit to be able to accommodate them.”

While the company was less forthcoming about its financials as of late, it told me last year that it had notched “over $150 million in annualized revenues in its first full year of operation” via more than 1,000 transactions.

The company’s revenues and GMV (gross merchandise value) “increased significantly” in 2020, according to Pencz, who declined to provide more specifics. He did say those figures are “multiples higher from where they were,” and that Loft has “a very clear horizon to profitability.”

Pencz and Florian Hagenbuch founded Loft in early 2018 and today serve as its co-CEOs. The aim of the platform, in the company’s words, is “bringing Latin American real estate into the e-commerce age by developing online alternatives to analogue legacy processes and leveraging data to create transparency in highly opaque markets.” The U.S. real estate tech company with the closest model to Loft’s is probably Zillow, according to Pencz.

In the United States, prospective buyers and sellers have the benefit of MLSs, which in the words of the National Association of Realtors, are private databases that are created, maintained and paid for by real estate professionals to help their clients buy and sell property. Loft itself spent years and many dollars in creating its own such databases for the Brazilian market. Besides helping people buy and sell homes, it offers services around insurance, renovations and rentals.

In 2020, Loft also entered the mortgage business by acquiring one of the largest mortgage brokerage businesses in Brazil. The startup now ranks among the top-three mortgage originators in the country, according to Pencz. When it comes to helping people apply for mortgages, he likened Loft to U.S.-based Better.com.

This latest financing brings Loft’s total funding raised to an impressive $800 million. Other backers include Brazil’s Canary and a group of high-profile angel investors such as Max Levchin of Affirm and PayPal, Palantir co-founder Joe Lonsdale, Instagram co-founder Mike Krieger and David Vélez, CEO and founder of Brazilian fintech Nubank. In addition, Loft has also raised more than $100 million in debt financing through a series of publicly listed real estate funds.

Loft plans to use its new capital in part to expand across Brazil and eventually in Latin America and beyond. The company is also planning to explore more M&A opportunities.

This article was updated post-publication to reflect accurate investor information.

Powered by WPeMatico

The global venture capital market had a cracking start to the year. Coming off a 2020 high, VC totals in the United States, in Europe, and among competitive verticals like insurtech and AI are on pace to set new records in 2021.

The rapid-fire deal-making and trend of larger venture checks at higher valuations that The Exchange has tracked for some time require private-market investors to make decisions faster than ever. For venture capitalists, the timeline for reaching conviction around a startup’s thesis and executing due diligence has become compressed.

Some venture capitalists are turning to data to move more quickly. Some are spending more time preparing to be vetted themselves. And some investors are simply doing the work beforehand.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

We were tipped off to the concept of pre-diligence during the reporting process for a look into recent fundraising trends in the AI/ML space. Sapphire investor Jai Das, when asked about how he was handling a competitive and swiftly moving market for AI startup investments, said that “most firms are completing their due diligence way before the financing actually happens.”

How does that work in practice? Per Das, startups that raise quick Series A and B rounds are “tracked by [early-stage] investors as soon as they raise their seed financings. So there is no need to do any due diligence during the financing and hence most of these financings are pre-emptive.”

How does that work in practice? Per Das, startups that raise quick Series A and B rounds are “tracked by [early-stage] investors as soon as they raise their seed financings. So there is no need to do any due diligence during the financing and hence most of these financings are pre-emptive.”

Venture capital: Now more about sales than ever before!

This morning, The Exchange is digging into the question of how VCs are handling diligence in a world where the most attractive deals can open and close faster than ever, and old models of deep diligence and paced deal-making are outmoded.

One way that investors are betting on themselves in a bid to speed their diligence and decision-making is by investing in their own tech. That may sound obvious, given that venture capital dollars often land in the accounts of tech-focused companies, but in a business that was previously known for its relationship focus — more on that shortly — the trend is worth considering.

Powered by WPeMatico