Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

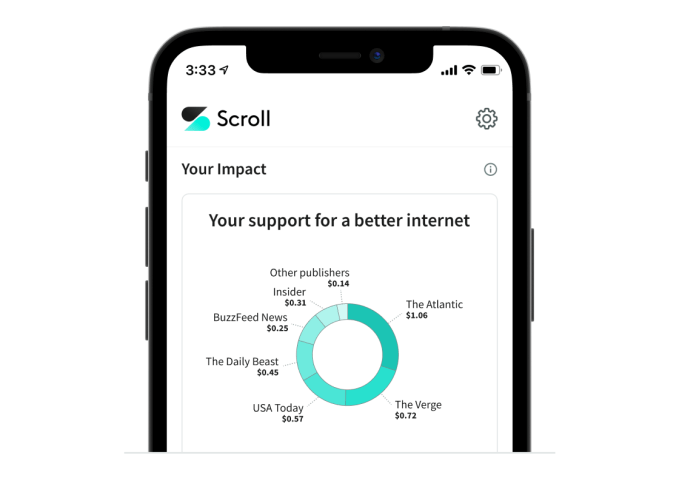

Twitter this morning announced it’s acquiring Scroll, a subscription service that offers readers a better way to read through long-form content on the web, by removing ads and other website clutter that can slow down the experience. The service will become a part of Twitter’s larger plans to invest in subscriptions, the company says, and will later be offered as one of the premium features Twitter will provide to subscribers.

Premium subscribers will be able to use Scroll to easily read their articles from news outlets and from Twitter’s own newsletters product, Revue, another recent acquisition that’s already been integrated into Twitter’s service. When subscribers use Scroll through Twitter, a portion of their subscription revenue will go to support the publishers and the writers creating the content, explains Twitter in an announcement.

Scroll’s service today works across hundreds of sites, including The Atlantic, The Verge, USA Today, The Sacramento Bee, The Philadelphia Inquirer and The Daily Beast, among others. For readers, the experience of using Scroll is similar to that of a “reader view” — ads, trackers and other website junk is stripped so readers can focus on the content.

Image Credits: Twitter

Scroll’s pitch to publishers has been that it can end up delivering cleaner content that can make them more money than advertising alone.

Deal terms were not disclosed, but Twitter will be bringing on the entire Scroll team, totaling 13 people.

For the time being, Scroll will pause new customer sign-ups so it can focus on integrating its product into Twitter’s subscriptions work and prepare for the expected growth. It will, however, continue to onboard new publishers who want to participate in Scroll’s network, following the deal’s closure.

And Scroll itself will be headed back into private beta as the team works to integrate the product into Twitter.

Image Credits: Twitter

Twitter says it will also be winding down Scroll’s news aggregator product, Nuzzel, but will work to bring some of Nuzzel’s core elements to Twitter over time. Nuzzel’s blog post has more details, explaining that the product will need to be rebuilt in order to scale with Twitter.

“Twitter exists to serve the public conversation. Journalism is the mitochondria of that conversation. It initiates, energizes and informs. It converts and confounds perspectives. At its best it helps us stand in one another’s shoes and understand each other’s common humanity,” said Tony Haile, Scroll CEO, in the company’s post about Scroll’s acquisition.

“The mission we’ve been given by Jack and the Twitter team is simple: take the model and platform that Scroll has built and scale it so that everyone who uses Twitter has the opportunity to experience an internet without friction and frustration, a great gathering of people who love the news and pay to sustainably support it,” he added.

Twitter earlier this year detailed its plans to head into subscriptions as a way to diversify beyond ad revenue for its own business. The company unveiled what it’s calling “Super Follow,” a creator-focused subscription that would give paid subscribers access to an expanded array of perks, like exclusive content, subscriber-only newsletters, deals, badges, paywalled media and more. The company is aiming to use this new product to help it achieve its goal of doubling company revenue from $3.7 billion in 2020 to $7.5 billion or more in 2023, it said.

Powered by WPeMatico

The identity verification space has been heating up for a while and the COVID-19 pandemic has only accelerated demand with more people transacting online.

Persona, a startup focused on creating a personalized identity verification experience “for any use case,” aims to differentiate itself in an increasingly crowded space. And investors are banking on the San Francisco-based company’s ability to help businesses customize the identity verification process — and beyond — via its no-code platform in the form of a $50 million Series B funding round.

Index Ventures led the financing, which also included participation from existing backer Coatue Management. In late January 2020, Persona raised $17.5 million in a Series A round. The company declined to reveal at which valuation this latest round was raised.

Businesses and organizations can access Persona’s platform by way of an API, which lets them use a variety of documents, from government-issued IDs through to biometrics, to verify that customers are who they say they are. The company wants to make it easier for organizations to implement more watertight methods based on third-party documentation, real-time evaluation such as live selfie checks and AI to verify users.

Persona’s platform also collects passive signals such as a user’s device, location, and behavioral signals to provide a more holistic view of a user’s risk profile. It offers a low code and no code option depending on the needs of the customer.

The company’s momentum is reflected in its growth numbers. The startup’s revenue has surged by “more than 10 times” while its customer base has climbed by five times over the past year, according to co-founder and CEO Rick Song, who did not provide hard revenue numbers. Meanwhile, Persona’s headcount has more than tripled to just over 50 people.

“When we look back at the space five to 10 years ago, AI was the next differentiation and every identity verification company is doing AI and machine learning,” Song told TechCrunch. “We believe the next big differentiator is more about tailoring and personalizing the experience for individuals.”

As such, Song believes that growth can be directly tied to Persona’s ability to help companies with “unique” use cases with a SaaS platform that requires little to no code and not as much heavy lifting from their engineering teams. Its end goal, ultimately, is to help businesses deter fraud, stay compliant and build trust and safety while making it easier for them to customize the verification process to their needs. Customers span a variety of industries, and include Square, Robinhood, Sonder, Brex, Udemy, Gusto, BlockFi and AngelList, among others.

“The strategy your business needs for identity verification and management is going to be completely different if you’re a travel company verifying guests versus a delivery service onboarding new couriers versus a crypto company granting access to user funds,” Song added. “Even businesses within the same industry should tailor the identity verification experience to each customer if they want to stand out.”

Image Credits: Persona

For Song, another thing that helps Persona stand out is its ability to help customers beyond the sign-on and verification process.

“We’ve built an identity infrastructure because we don’t just help businesses at a single point in time, but rather throughout the entire lifecycle of a relationship,” he told TechCrunch.

In fact, much of the company’s growth last year came in the form of existing customers finding new use cases within the platform in addition to new customers signing on, Song said.

“We’ve been watching existing customers discover more ways to use Persona. For example, we were working with some of our customer base on a single use case and now we might be working with them on 10 different problems — anywhere from account opening to a bad actor investigation to account recovery and anything in between,” he added. “So that has probably been the biggest driver of our growth.”

Index Ventures Partner Mark Goldberg, who is taking a seat on Persona’s board as part of the financing, said he was impressed by the number of companies in Index’s own portfolio that raved about Persona.

“We’ve had our antennas up for a long time in this space,” he told TechCrunch. “We started to see really rapid adoption of Persona within the Index portfolio and there was the sense of a very powerful and very user friendly tool, which hadn’t really existed in the category before.”

Its personalization capabilities and building block-based approach too, Goldberg said, makes it appealing to a broader pool of users.

“The reality is there’s so many ways to verify a user is who they say they are or not on the internet, and if you give people the flexibility to design the right path to get to a yes or no, you can just get to a much better outcome,” he said. “That was one of the things we heard — that the use cases were not like off the rack, and I think that has really resonated in a time where people want and expect the ability to customize.”

Persona plans to use its new capital to grow its team another twofold by year’s end to support its growth and continue scaling the business.

In recent months, other companies in the space that have raised big rounds include Socure and Sift.

Powered by WPeMatico

It looks like everyone and their mother is trying to reinvent the Brazilian banking system. Earlier this year we wrote about Nubank’s $400 million Series G, last month there was the PicPay IPO filing and today, alt.bank, a Brazilian neobank, announced a $5.5 million Series A led by Union Square Ventures (USV).

It’s no secret that the Brazilian banking system has been poised for disruption, considering the sector’s little attention to customer service and exorbitant fee structure that’s left most Brazilians unbanked, and alt.bank is just the latest company trying to take home a piece of the pie.

Following Nubank’s strategy of launching a bank with colors that are very un-bank-like, signaling that they do things differently, alt.bank similarly launched its first financial product in 2019 — a fluorescent-yellow debit card which the locals have endearingly dubbed, “o amarelinho,” meaning, “the little yellow card.”

The company, founded by serial entrepreneur Brad Liebmann, follows the founder’s $480 million exit of Simply Business, which was acquired by U.S. insurance giant Travelers in 2017.

Unlike many fintechs, alt.bank has a strong social mission and pays commissions for referrals that last for the customer’s lifetime.

“Most fintechs just help wealthy people get wealthier, so I thought let’s do something with a social mission,” Liebmann told TechCrunch in an interview.

To drive home the mission, and really target the unbanked, Liebman and his team of 80 employees have designed an app that can be used by the illiterate. Instead of words, users can follow color-coded prompts to complete a transaction. The company also plans to launch credit products soon.

According to the company, close to a million people have downloaded the android app since launch, but Liebman declined to disclose how many active users the company actually has.

Today, the company’s core offerings include the debit card, a prepaid credit card, Pix (similar to Zelle), a savings account and even telemedicine visits via a partnership with Dr. Consulta, a network of healthcare clinics throughout the country. The prepaid credit card is key because online stores in Brazil don’t accept debit card purchases.

In addition to the perk of ongoing commissions, alt.bank has also partnered with three major drugstores, allowing their users to get 5-30% off any item at the stores, including medication.

While the company is based in São Paulo and São Carlos, Liebmann and his family are currently based in London due to regulations around the pandemic.

The investment in alt.bank marks USV’s first investment in South America, solidifying a trend by other major U.S. investors such as Sequoia who only in the last several years have started looking to LatAm for deals.

“The bar was high for our first investment in South America,” said Union Square Ventures partner John Buttrick. “The combination of the alt.bank business model and world-class management team enticed us to expand our geographic focus to help build the leading digital bank targeting the 100 million Brazilians who are currently being neglected by traditional lenders,” he added in a statement.

Powered by WPeMatico

Sony and Discord have announced a partnership that will integrate the latter’s popular gaming-focused chat app with PlayStation’s own built-in social tools. It’s a big move and a fairly surprising one given how recently acquisition talks were in the air — Sony appears to have offered a better deal than Microsoft, taking an undisclosed minority stake in the company ahead of a rumored IPO.

The exact nature of the partnership is not expressed in the brief announcement post. The closest we come to hearing what will actually happen is that the two companies plan to “bring the Discord and PlayStation experiences closer together on console and mobile starting early next year,” which at least is easy enough to imagine.

Discord has partnered with console platforms before, though its deal with Microsoft was not a particularly deep integration. This is almost certainly more than a “friends can see what you’re playing on PS5” and more of a “this is an alternative chat infrastructure for anyone on a Sony system.” Chances are it’ll be a deep, system-wide but clearly Discord-branded option — such as “Start a voice chat with Discord” option when you invite a friend to your game or join theirs.

The timeline of early 2022 also suggests that this is a major product change, probably coinciding with a big platform update on Sony’s long-term PS5 roadmap.

While the new PlayStation is better than the old one when it comes to voice chat, the old one wasn’t great to begin with, and Discord is not just easier to use but something millions of gamers already do use daily. And these days, if a game isn’t an exclusive, being robustly cross-platform is the next best option — so PS5 players being able to seamlessly join and chat with PC players will reduce a pain point there.

Of course Microsoft has its own advantages, running both the Xbox and Windows ecosystems, but it has repeatedly fumbled this opportunity and the acquisition of Discord might have been the missing piece that tied it all together. That bird has flown, of course, and while Microsoft’s acquisition talks reportedly valued Discord at some $10 billion, it seems the growing chat app decided it would rather fly free with an IPO and attempt to become the dominant voice platform everywhere rather than become a prized pet.

Sony has done its part, financially speaking, by taking part in Discord’s recent $100 million H round. The amount they contributed is unknown, but perforce it can’t be more than a small minority stake, given how much the company has taken on and its total valuation.

Powered by WPeMatico

It’s a big morning for fintech startups today: Flywire, a Boston-based magnet for venture capital, has filed to go public.

Flywire is a global payments company that attracted more than $300 million as a startup, according to Crunchbase, most recently raising a $60 million Series F last month. We don’t have its most recent valuation, but PitchBook data indicates that the company’s February 2020, $120 million round valued Flywire at $1 billion on a post-money basis.

So what we’re looking at here is a fintech unicorn IPO. A great way to kick off the week, to be honest, though I’d thought that Robinhood would be the next such debut.

Fintech venture capital activity has been hot lately, which makes the Flywire IPO interesting. Its success or failure could dictate the pace of fintech exits and fintech startup valuations in general, so we have to care about it.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Regardless, we’re doing our regular work this morning. First, what does Flywire do and with whom does it compete? Then, a closer look at its financial results as we hope to get our hands around its revenue quality, aggregate economics and growth prospects.

After that, we’ll discuss valuations and which venture capital groups are set to do well in its flotation. The company had a number of backers, but Spark Capital, Temasek, F-Prime Capital and Bain Capital Ventures made the major shareholder list, along with Goldman Sachs. So, a number of firms and funds are hoping for a big Flywire exit. Let’s dig in.

Flywire is a global payments company. Or, as it states in its S-1 filing, it’s “a leading global payments enablement and software company.” And it thinks that its market, and by extension itself, has lots of room to grow. While “substantial strides [have been] made in payments technology in the retail and e-commerce industries,” the company wrote, “massive sectors of our global economy—including education, healthcare, travel, and business-to-business, or B2B, payments—are still in the early stages of digital transformation.”

That’s the same logic behind Stripe’s epic valuation and the rising value of payments-focused companies like Finix.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

This morning was a notable one in the life of TechCrunch the publication, as our parent company’s parent company decided to sell our parent company to a different parent company. And now we’re going to have to get new corporate IDs, again, as it appears that our new parent company’s parent company wants to rebrand our parent company. As Yahoo.

Cool.

Anyway, a bunch of other stuff happened as well:

We’re back Wednesday with something special. Chat then!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Remote work is no longer a new topic, as much of the world has now been doing it for a year or more because of the COVID-19 pandemic.

Companies — big and small — have had to react in myriad ways. Many of the initial challenges have focused on workflow, productivity and the like. But one aspect of the whole remote work shift that is not getting as much attention is the culture angle.

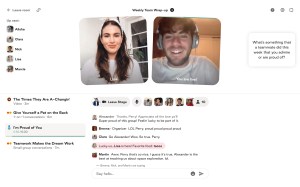

A 100% remote startup that was tackling the issue way before COVID-19 was even around is now seeing a big surge in demand for its offering that aims to help companies address the “people” challenge of remote work. It started its life with the name Icebreaker to reflect the aim of “breaking the ice” with people with whom you work.

“We designed the initial version of our product as a way to connect people who’d never met, kind of virtual speed dating,” says co-founder and CEO Perry Rosenstein. “But we realized that people were using it for far more than that.”

So over time, its offering has evolved to include a bigger goal of helping people get together beyond an initial encounter –– hence its new name: Gatheround.

“For remote companies, a big challenge or problem that is now bordering on a crisis is how to build connection, trust and empathy between people that aren’t sharing a physical space,” says co-founder and COO Lisa Conn. “There’s no five-minute conversations after meetings, no shared meals, no cafeterias — this is where connection organically builds.”

Organizations should be concerned, Gatheround maintains, that as we move more remote, that work will become more transactional and people will become more isolated. They can’t ignore that humans are largely social creatures, Conn said.

The startup aims to bring people together online through real-time events such as a range of chats, videos and one-on-one and group conversations. The startup also provides templates to facilitate cultural rituals and learning & development (L&D) activities, such as all-hands meetings and workshops on diversity, equity and inclusion.

Gatheround’s video conversations aim to be a refreshing complement to Slack conversations, which despite serving the function of communication, still don’t bring users face-to-face.

Image Credits: Gatheround

Since its inception, Gatheround has quietly built up an impressive customer base, including 28 Fortune 500s, 11 of the 15 biggest U.S. tech companies, 26 of the top 30 universities and more than 700 educational institutions. Specifically, those users include Asana, Coinbase, Fiverr, Westfield and DigitalOcean. Universities, academic centers and nonprofits, including Georgetown’s Institute of Politics and Public Service and Chan Zuckerberg Initiative, are also customers. To date, Gatheround has had about 260,000 users hold 570,000 conversations on its SaaS-based, video platform.

All its growth so far has been organic, mostly referrals and word of mouth. Now, armed with $3.5 million in seed funding that builds upon a previous $500,000 raised, Gatheround is ready to aggressively go to market and build upon the momentum it’s seeing.

Venture firms Homebrew and Bloomberg Beta co-led the company’s latest raise, which included participation from angel investors such as Stripe COO Claire Hughes Johnson, Meetup co-founder Scott Heiferman, Li Jin and Lenny Rachitsky.

Co-founders Rosenstein, Conn and Alexander McCormmach describe themselves as “experienced community builders,” having previously worked on President Obama’s campaigns as well as at companies like Facebook, Change.org and Hustle.

The trio emphasize that Gatheround is also very different from Zoom and video conferencing apps in that its platform gives people prompts and organized ways to get to know and learn about each other as well as the flexibility to customize events.

“We’re fundamentally a connection platform, here to help organizations connect their people via real-time events that are not just really fun, but meaningful,” Conn said.

Homebrew Partner Hunter Walk says his firm was attracted to the company’s founder-market fit.

“They’re a really interesting combination of founders with all this experience community building on the political activism side, combined with really great product, design and operational skills,” he told TechCrunch. “It was kind of unique that they didn’t come out of an enterprise product background or pure social background.”

He was also drawn to the personalized nature of Gatheround’s platform, considering that it has become clear over the past year that the software powering the future of work “needs emotional intelligence.”

“Many companies in 2020 have focused on making remote work more productive. But what people desire more than ever is a way to deeply and meaningfully connect with their colleagues,” Walk said. “Gatheround does that better than any platform out there. I’ve never seen people come together virtually like they do on Gatheround, asking questions, sharing stories and learning as a group.”

James Cham, partner at Bloomberg Beta, agrees with Walk that the founding team’s knowledge of behavioral psychology, group dynamics and community building gives them an edge.

“More than anything, though, they care about helping the world unite and feel connected, and have spent their entire careers building organizations to make that happen,” he said in a written statement. “So it was a no-brainer to back Gatheround, and I can’t wait to see the impact they have on society.”

The 14-person team will likely expand with the new capital, which will also go toward helping adding more functionality and details to the Gatheround product.

“Even before the pandemic, remote work was accelerating faster than other forms of work,” Conn said. “Now that’s intensified even more.”

Gatheround is not the only company attempting to tackle this space. Ireland-based Workvivo last year raised $16 million and earlier this year, Microsoft launched Viva, its new “employee experience platform.”

Powered by WPeMatico

Hangry, an Indonesian cloud kitchen startup that wants to become a global food and beverage company, has raised a $13 million Series A. The round was led by returning investor Alpha JWC Ventures and included participation from Atlas Pacific Capital, Salt Ventures and Heyokha Brothers. It will be used to increase the number of Hangry’s outlets in Indonesia, including launching its first dine-in restaurants, over the next two years before it enters other countries.

Along with a previous round of $3 million from Alpha JWC and Sequoia Capital’s Surge program, Hangry’s Series A brings its total funding to $16 million. It currently operates about 40 cloud kitchens in Greater Jakarta and Bandung, 34 of which launched in 2020. Hangry plans to expand its total outlets to more than 120 this year, including dine-in restaurants.

Founded in 2019 by Abraham Viktor, Robin Tan and Andreas Resha, Hangry is part of Indonesia’s burgeoning cloud kitchen industry. Tech giants Grab and Gojek both operate networks of cloud kitchens that are integrated with their food delivery services, while other startups in the space include Everplate and Yummy.

One of the main ways Hangry sets itself apart is by focusing on its own brands, instead of providing kitchen facilities and services to restaurants and other third-party clients. Hangry currently has four brands, including Indonesian chicken dishes (Ayam Koplo) and Japanese food (San Gyu), that cost about 15,000 to 70,000 IDR per portion (or about $1 to $6 USD). Its food can be ordered through Hangry’s own app, plus GrabFood, GoFood and ShopeeFood.

“Given that Hangry has developed an extensive cloud kitchen network across Indonesia, we naturally would have interest from other brands to leverage our networks,” chief executive officer Viktor told TechCrunch. “However, our focus is to grow our brands since our brands are rapidly growing in popularity in Indonesia and require all kitchen resources that they need to realize their full potential.”

Providing food deliveries helped Hangry grow during COVID-19 lockdowns and social distancing, but in order to become a global brand within a decade, it needs to operate in multiple channels, he added.

“We knew that we will one day have to serve customers in all channels, including dine in,” said Viktor. “We started the hard way, doing delivery-first business, where we faced the challenges surrounding making sure our food still tastes good when it reaches customers’ homes. Now we feel ready to serve our customers in our restaurant premises. Our dine-in concept is an expansion of everything we’ve done in delivery channels.”

In a press statement, Alpha JWC Ventures partner Eko Kurniadi said, “In the span of 1.5 years, [Hangry] launched multiple brands across myriad tastes and categories, and almost all of them are amongst the best sellers list with superior ratings in multiple platforms, tangible examples of product-market fit. This is only the beginning and we can already foresee their growth to be a top local F&B brand in the country.”

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. If you want it in your inbox every Saturday morning, sign up here. Ready? Let’s talk money, startups and spicy IPO rumors.

TechCrunch isn’t a public-market-focused publication. We care about startups. But public tech companies can, at times, provide interesting insights into how the broader technology market is performing. So we pay what we might call minimum-viable attention to former startups that made it all the way to an IPO.

Then there are the Big Tech companies. In the United States the list is well-known: Facebook, Alphabet, Microsoft, Apple and Amazon. And, in a series of results that could indicate a hot market for startup growth, they had a smashingly good first quarter of 2021. You can read our notes on their results here and here, but that’s just part of the story.

Yes, the Big Tech financial results were good — as they have been for some time — but lost amid the usual earnings deluge of numbers is how shockingly accretive Big Tech’s recent performances have proven for their valuations.

Microsoft fell as low as the $135 per-share range last March. Today it’s worth $252 and change. Alphabet traded down to around $1,070 per share. Today the search giant is worth $2,410 per share.

The result of the huge share-price appreciation is that Apple is now worth $2.21 trillion, Microsoft $1.88 trillion, Amazon $1.76 trillion, Alphabet $1.60 trillion and Facebook $0.93 trillion. That’s around $8.4 trillion for the five companies.

Back in July of 2017, I wrote a piece noting that their aggregate value had reached the $3 trillion mark. That became $4 trillion in mid-2018. And then in the next three years or so it more than doubled again.

Why?

Myles Udland, a reporter at our sister publication Yahoo Finance, has at least part of the puzzle in a piece he wrote this week. Here’s Udland:

And while it seems that almost every earnings story has sort of followed this same arc, data also confirms that this is not just our imagination: corporate earnings have never been this far out of line with expectations.

Data out of the team at Refinitiv published Thursday showed the rate at which companies were beating estimates and the magnitude by which they were beating expectations through Thursday morning’s results were the best on record.

So earnings are beating the street’s guesses more frequently, and at a higher differential, than ever? That makes recent stock-market appreciation less worrisome, I suppose. And it helps explain why startups have been able to raise so much capital lately in the United States, as they have in Europe, and why private-market investors are pouring so much capital into fintech startups. And it’s probably why Zomato is going public and why we’re still waiting for the Robinhood debut.

This is what a market feels like when the underlying businesses are firing on all cylinders, it appears. Just don’t forget that no business cycle is unending, and no boom is forever.

Extending The Exchange’s recent reporting regarding fintech funding, and our roundup from last week of insurtech startup rounds, a few more notes on the latter startup niche, which can be broadly viewed as part of the larger financial technology world.

This time we’ll hear from Accel’s John Locke regarding his investments in The Zebra — which recently raised even more capital — and the insurtech space more broadly.

Asked why insurtech marketplaces like The Zebra have been able to raise so very much money in the last year, Locke said that it’s a mix of “insurance carriers […] finally embracing marketplaces and willing to design integrated consumer experiences with marketplaces,” along with more consumer “comparison shopping” and, finally, growth and revenue quality.

The Zebra, Locke said, is “still growing north of 100% at ~$120M+ revenue run-rate.” That means it can go public whenever it wants.

But on that matter, there has been some weakness in the stock market for some public insurtech companies. Is Locke worried about that? He’s neutral-to-positive, saying that his firm does not “think all the companies in the market will work but still thinks ‘insurtechs’ will take market share from incumbents over the next decade.” Fair enough.

And Accel is still considering more deals in the space, as are others. Locke said that the venture market for insurtech investments is “definitely more aggressive” this year than last.

Closing today, a few notes on things that we didn’t get to that matter:

A long, weird week. Make sure to follow the second denizen of The Exchange’s writing team: Anna Heim. Okay! Chat next week!

Powered by WPeMatico

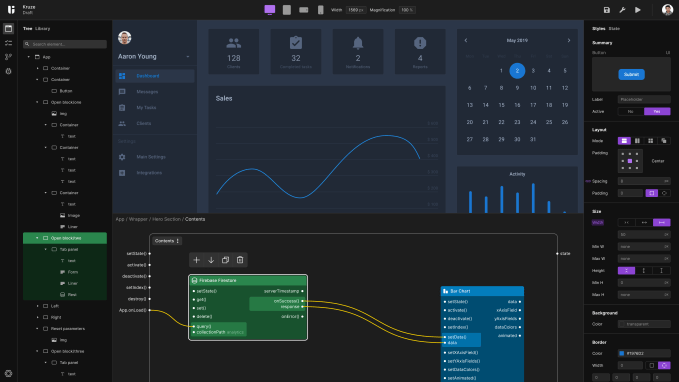

TechCrunch recently caught up with recent Y Combinator graduate Uiflow, a startup that is building a no-code enterprise app creation service.

If you are thinking wait, don’t a number of companies already do that?, the answer is yes. But what Quickbase, Smartsheet and others are working on isn’t quite the same thing, at least from the startup’s perspective.

Uiflow, a Bay Area-based concern that has been alive for far less than a year, has built an app creation tool that works with whatever backend a large company currently employs, and helps its development team build apps collaboratively. As the startup explained in a public posting, customer developers can import Figma files while their engineers can use existing UI libraries, and product managers can quickly vet an app’s logic.

The service is akin to a “cross between Unity and Figma,” Uiflow says.

Here’s what its own user interface looks like, per a screenshot the company provided to TechCrunch after an interview:

Per Y Combinator, the company has closed a pre-seed round of more than $500,000. The company told TechCrunch that it has been talking to investors lately — as essentially every Y Combinator-backed startup does after their public unveiling — but appears to be holding off raising more capital until it fully launches self-service of its product; the company may also accelerate its hiring efforts once its self-serve GTM motion is more broadly available.

The startup told TechCrunch that after its Product Hunt launch it picked up around 1,200 signups. It’s vetting the group and letting in some as pilot customers. Those customers currently pay the company, so it has revenue, although the startup is more product-focused at the moment than centered around boosting its short-term revenues.

Uiflow thinks that its target customers are companies with 250 or more workers, the scale at which a company begins to start thinking about its own UI elements. However, Uiflow is talking to companies with 100 to 1,000 customers, it said.

The five-person team is building a service in a market that is more than active at the moment. As TechCrunch has explored, private-market investors are bullish on the no-code space, especially after the COVID-19 pandemic bolstered the pace at which companies large and small moved toward digital solutions. No-code and low-code services came into greater demand as accelerating digital transformation efforts met the market’s general dearth of available developer talent.

TechCrunch has covered the no-code space extensively in recent quarters, given both rising market demand for its products and what seemed to be growing investor demand for shares in startups pursuing the model. All that’s to say that there’s a reasonable chance that we’ll hear from Uiflow soon regarding a fresh capital raise. Let’s see how long that takes.

In the meantime, here’s a photo of the Uiflow team. In 2021-style, it’s a Zoom shot:

From upper left, clockwise: Michael Tildahl, Eric Rowell (CTO and co-founder), Brian Lichliter, Rocco Cataldo and D. Sol Eun (CEO and co-founder). Via the company.

Powered by WPeMatico