Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Una Brands’ co-founders (from left to right): Tobias Heusch, Kiren Tanna and Kushal Patel. Image Credits: Una Brands

One of the biggest funding trends of the past year is companies that consolidate small e-commerce brands. Many of the most notable startups in the space, like Thrasio, Berlin Brands Group and Branded Group, focus on consolidating Amazon Marketplace sellers. But the e-commerce landscape is more fragmented in the Asia-Pacific region, where sellers use platforms like Tokopedia, Lazada, Shopee, Rakuten or eBay, depending on where they are. That is where Una Brands comes in. Co-founder Kiren Tanna, former chief executive officer of Rocket Internet Asia, said the startup is “platform agnostic,” searching across marketplaces (and platforms like Shopify, Magento or WooCommerce) for potential acquisitions.

Una announced today that it has raised a $40 million equity and debt round. Investors include 500 Startups, Kingsway Capital, 468 Capital, Presight Capital, Global Founders Capital and Maximilian Bitner, the former CEO of Lazada who currently holds the same role at secondhand fashion platform Vestiaire Collective.

Una did not disclose the ratio of equity and debt in the round. Like many other e-commerce aggregators, including Thrasio, Una raised debt financing to buy brands because it is non-dilutive. The round will also be used to hire aggressively in order to evaluate brands in its pipeline. Una currently has teams in Singapore, Malaysia and Australia and plans to expand in Southeast Asia before entering Taiwan, Japan and South Korea.

Tanna, who also founded Foodpanda and ZEN Rooms, launched Una along with Adrian Johnston, Kushal Patel, Tobias Heusch and Srinivasan Shridharan. He estimates that there are more than 10 million third-party sellers spread across different platforms in the Asia-Pacific.

“Every single seller in Asia is looking at multiple platforms and not just Amazon,” Tanna told TechCrunch. “We saw a big gap in the market where e-commerce is growing very quickly, but players in the West are not able to look at every platform, so that is why we decided to focus on APAC, launch the business there and acquire sellers who are selling on multiple platforms.”

Una looks for brands with annual revenue between $300,000 to $20 million and is open to many categories, as long as they have strong SKUs and low seasonality (for example, it avoids fast fashion). Its offering prices range from about $600,000 to $3 million.

Tanna said Una will maintain acquisitions as individual brands “because what’s working, we don’t change it.” How it adds value is by doing things that are difficult for small brands to execute, especially those run by just one or two people, like expanding into more distribution channels and countries.

“For example, in Indonesia there are at least five or six important platforms that you should be on, and many times the sellers aren’t doing that, so that’s something we do,” Tanna explained. “The second is cross-border in Southeast Asia, which sellers often can’t do themselves because of regulations around customs, import restrictions and duties. That’s something our team has experience in and want to bring to all brands.”

Amazon FBA roll-up players have the advantage of Amazon Marketplace analytics that allow them to quickly measure the performance of brands in their pipeline of potential acquisitions. Since it deals with different marketplaces and platforms, Una works with much more fragmented sources of data for revenue, costs, rankings and customer reviews. To scale up, the company is currently building technology to automate its valuation process and will also have local teams in each of its markets. Despite working with multiple e-commerce platforms, Tanna said Una is able to complete a deal within five weeks, with an offer usually happening within two or three days.

In countries where Amazon is the dominant e-commerce player, like the United States, many entrepreneurs launch FBA brands with the goal of flipping them for a profit within a few years, a trend that Thrasio and other Amazon roll-up startups are tapping into. But that concept is less common in Una’s markets, so it offers different team deals to appeal to potential sellers. Though Una acquires 100% of brands, it also does profit-sharing models with sellers, so they get a lump sum payment for the majority of their business first, then collect more money as Una scales up the brand. Tanna said Una usually continues working with sellers on a consulting basis for about three to six months after a sale.

“Something that Amazon players know very well is that they can find a product, sell it for four to five years, and then ideally make a multi-million deal exit and build another product or go on holiday,” said Tanna. “That’s something Asian sellers are not as familiar with, so we see this as an education phase to explain how the process works, and why it makes sense to sell to us.”

Powered by WPeMatico

The number of SPACs in the deep tech sector was skyrocketing, but a combination of increased SEC scrutiny and market forces over the past few weeks has slowed the pace of new SPAC transactions. The correction is an inevitable step on the path to mainstreaming SPACs as an alternative to IPOs, but it won’t cause them to go away. Instead, blank-check vehicles will evolve and will occupy a small and specialized — but important — part of the startup financing landscape.

I believe that SPAC financings can solve a major problem for all capital-intensive technology startups: the need for faster — and potentially cheaper — access to large amounts of capital to fund product development over multiple years.

The tsunami of SPAC financings sparked commentary from all corners of the capital markets community, from equity analysts and securities lawyers to VCs and fund managers — and even central bankers. That’s understandable, as more than $60 billion of SPAC deals have been announced since the beginning of 2020, plus $55 billion in PIPE capital, according to investment bank PJT Partners.

The views debated by finance experts often relate to the reasonableness of SPAC pricing and transaction structures, the alignment of incentives for stakeholders, and post-merger financial and stock price performance. But I’m not going to add another voice to the debate on the risk-reward calculus.

As the co-founder of a quantum computing software startup who worked in financial markets for two decades, I’d like to offer my perspective on two issues that I think my peers care more about: Can SPACs still solve the funding problem for capital-intensive, deep tech startups? And will they become a permanent financing option?

I believe that SPAC financings can solve a major problem for all capital-intensive technology startups: the need for faster — and potentially cheaper — access to large amounts of capital to fund product development over multiple years.

SPACs have created a limitless well of capital that deep tech startups are diving into. That’s because they are proving to be more attractive than other sources of financing, such as taking investments from later-stage VC funds or growth equity funds with finite fund sizes and specific investment themes.

The supply of growth capital from these vehicles has been astounding. In 2020, SPACs alone raised more than $83 billion via 248 IPOs, which is equal to a third of the total $300 billion raised by the entire global VC community. If the present rate of financings had continued, the annual amount of SPAC financings would have been on par with the total R&D expenditure of the U.S. government — roughly $130 billion to $150 billion.

This new supply of capital can let startups keep the lights on, helping them address a practical need while they develop products that may take a decade to field. Before SPACs, any startup that wanted to remain independent had to lurch from one round of VC financing to the next. That, as well as the intense IPO process, is a major time sink for management teams and distracts them from focusing on product development.

Powered by WPeMatico

People have been discussing the importance of expanding opportunities for women in venture capital and startup entrepreneurship for decades. And for some time it appeared that progress was being made in building a more diverse and equitable environment.

The prospect of more women writing checks was viewed as a positive for female founders, a cohort that has struggled to attract more than a fraction of the funds that their male peers manage. All-female teams have an especially tough time raising capital compared to all-male teams, underscoring the disparity.

Then COVID-19 arrived and scrambled the venture and startup scene, creating a risk-off environment during the end of Q1 and the start of Q2 2020. Following that, the venture world went into overdrive as software sales became a safe harbor in the business world during uncertain economic times. And when it became clear that the vaunted digital transformation of businesses large and small was accelerating, more capital appeared.

But data indicate that the torrent of new capital has not been distributed equally — indeed, some of the progress that female founders made in recent years may have eroded.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

During a time of plenty, many female founders are still going without. The Exchange reached out to a number of American and European investors and founders to get their perspective on how today’s venture market treats female founders.

Recurring among the responses was a general view that more women venture capitalists would help lessen the gender gap in investments, and that VCs became more conservative due to COVID-19 and its constituent economic disruption, reverting to offering capital to repeat founders and their existing networks, both groups that are less diverse than the pool of new founders.

Our collection of founders and investors also said that women have been especially double-tasked during the pandemic to take on more domestic responsibilities in part due to sexist societal expectations, adding that that sexism more generally remains a problem that either isn’t improving or is improving too slowly.

Our collection of founders and investors also said that women have been especially double-tasked during the pandemic to take on more domestic responsibilities in part due to sexist societal expectations, adding that that sexism more generally remains a problem that either isn’t improving or is improving too slowly.

But before we get into the core issues that prevent improvements in gender equity in venture funding, let’s check in on the data from last year and contrast it to its antecedents.

While there have already been reports on gender disparities in funding, Nokia-backed VC firm NGP Capital made a great contribution to research on the topic with its 2021 dossier.

Powered by WPeMatico

Text Blaze, which was a part of the recent Winter 2021 Y Combinator accelerator batch, announced that it has closed a $3.3 million seed round. The company’s investment was led by Two Sigma Ventures’s Villi Iltchev and Susa Ventures’s Leo Polovets.

The company’s product hybridizes two trends that TechCrunch has been tracking in recent years, namely automation and the written word. On the automation front, we’ve seen Zapier grow into a behemoth, while no-code products and RPA have made the concept of letting software boost worker output increasingly mainstream. And on the writing-assistance side of things, from Grammarly to Copy.ai, it’s clear that people are willing to pay for tools to help them writer better and more quickly.

So what does Text Blaze do? Two main things. First, its Chrome extension allows users to save “snippets” of text that they can add to emails, and other notes in rapid-fire fashion. I might save “Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines” to “/intro in Text Blaze, saving myself lots of time whenever I kick off a new podcast script.

But saving snippets and quickly inserting them into various text boxes in a user’s browser are just part of what makes Text Blaze neat. The product can also save template snippets with various boxes left open for users to fill in. So, a user could have a user-feedback snippet saved, that reserved spots for them to add in names, and other unique information quickly, while reusing the bulk of the text itself.

Text Blaze also has integrations with external services to ensure that its service can save users time. For example, the service can pull in CRM data from Hubspot into a text snippet used in Gmail. The idea is to link different services and data sources automatically, helping users shave minutes from their days, and hours from their weeks.

So far Text Blaze has run lean, according to its co-founder Dan Barak, who told TechCrunch that its staff of four will grow to around 10 this year, thanks to its new capital. Like nearly every startup that we’ve spoken to in recent months, Barak said that Text Blaze is a remote-first startup with a wide hiring lens.

Text Blaze’s model is freemium, with a consumer paid offering that costs $2.99 monthly. The key limitation in its free product, Barak, is a hard cap of 20 snippets. Past that you’ll need to pay. TechCrunch was modestly confused at the low price point, and relatively robust free feature set that the startup is offering. The co-founder explained that the company’s long-term plan is to sell into enterprises, making the pro version of Text Blaze more of a tool to generate awareness in what its service can do more than its final monetization scheme.

Some 70% of the company’s users so far have signed up using their corporate email, which could provide a wide avenue into later enterprise sales. According to the Text Blaze website, business users will pay a little more than double what its prosumer users will.

The company’s strategy appears to be working. Not only is it attracting users — its Chrome extension notes more than 70,000 users — and early revenue, but it also managed to convert Iltchev and Polovets into believers in its product. “When I first saw Text Blaze, it reminded me of the early days of Zapier which helped professionals to automate repetitive tasks, except Text Blaze provides a more approachable and easier to adopt entry point though written communications,” the Two Sigma investor told TechCrunch.

Susa’s Polovets said that he “fell in love with the [startup’s] product,” adding that he “wanted to invest as soon as I tried the product.”

Text Blaze’s round closed a few weeks ago. Let’s see how quickly it can scale with the new funds under its belt.

Powered by WPeMatico

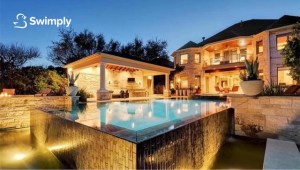

As the oldest of 12 children, Bunim Laskin spent much of his teen years looking for ways to help keep his siblings entertained. Noticing that a neighbor’s pool was often empty, Laskin reached out to ask if his family could use her pool. To make it worth her while, he suggested that they could help cover her expenses for maintaining the pool.

Soon after, five other families had made the same arrangement with her and the pool owner had six families covering 25% of her expenses. This meant that the neighbor was actually making money off her pool. The arrangement sparked a business idea in Laskin’s mind. At the age of 20, he founded Swimply, a marketplace for homeowners to rent out their underutilized pools to local swimmers, with Asher Weinberger.

The Cedarhurst, New York-based company launched a beta in 2018, starting with four pools in the New Jersey area.

“We used Google Earth to find houses, and then knocked on 80 doors with a pool,” CEO Laskin recalls. “We got to 100 pools organically. Word of mouth really helped us grow.” The site was pretty bare bones, he admits, with potential customers only able to view photos of the pools and connect with the pool owner by phone.

That year, Swimply did around 400 reservations and raised $1.2 million from friends and family.

In 2019, Swimply launched what he describes as a “proper” website and app with an automated platform. It grew “four to five times” that year, again mostly organically. In an episode that aired in March 2020, the company appeared on Shark Tank but went home without a deal.

Then the COVID-19 pandemic hit. Swimply, Laskin said, pivoted right into the pandemic.

“We were the perfect solution for people when the world was falling on its head,” he said. The company restructured its offering to ensure that pool owners did not have to interact with guests. “It was the perfect, contact-free, self-serve experience to hang out and be with people you quarantined with.”

The CDC then came out to say that it was safe to swim because chlorine could help kill the virus, and that proved to be a big boon to its business.

“On one end, it was a way for people to have a normal day and on the other, it helped give owners a way to earn an income, at a time when many people were being affected financially,” Laskin told TechCrunch.

Business took off in 2020 with revenue growing 4,000% and now Swimply is announcing a $10 million Series A round. Norwest Venture Partners led the financing, which also included participation from Trust Ventures and a number of angel investors such as Poshmark founder and CEO Manish Chandra; Rob Chesnut, former general counsel and chief ethics officer at Airbnb; Ancestry.com CEO Deborah Liu and Michael Curtis.

Swimply is now operating in a total of 125 U.S. markets, two markets in Canada and five markets in Australia. It plans to use its new capital in part to expand into new markets and toward product development.

Image Credits: Swimply

The way it works is pretty straightforward. Swimply simply connects homeowners that have underutilized backyard spaces and pools with those seeking a way to gather, cool off or exercise, for example. People or families can rent pools by the hour, ranging in price from $15 to $60 per hour (at an average of $45/hour) depending on the amenities. New markets that Swimply has recently expanded to include Portland, Oregon; Raleigh, North Carolina and the California cities of Oakland, San Luis Obispo and Los Gatos.

“The shifting mindset from younger generations about ownership is a huge contributor to increased growth of the Swimply marketplace,” said co-founder Weinberger, who serves as Swimply’s COO. “Swimming is the third most popular activity for adults and number one for children, and yet no other company has tackled the aquatic space to make swimming more affordable and accessible…until now.”

While the company declined to provide hard revenue figures, Laskin said Swimply was seeing “seven digits a month in revenue” and 15,000 to 20,000 reservations a month. Families represent the most popular reservation.

“People can book and pay through our platform, and only 20% of hosts ever meet their guests,” Laskin said. “We’re enabling a new kind of consumer behavior with what we’re doing.”

The company is planning to use its new capital to also rebuild much of its tech infrastructure and boost its customer support team to be more “readily available.”

It is also now offering a complimentary up to $1 million worth of insurance per booking for liability as well as $10,000 for property damage.

Swimply has a little over 20 employees, up 10 times from two people in December of 2020. It plans to double that number over the next few months.

The company’s model has proven quite lucrative for some owners, according to Laskin.

“Last year, there were some owners who earned $10,000 a month. One owner in Denver earned $50,000 last year and he had signed up toward the end of the summer. He should make over $100,000 this year,” Lasken projects.

Its only criteria is that owners offer a clean pool. Eighty-five percent of hosts offer restrooms as well. If they don’t, they are limited to one-hour reservations with a max of five guests. Swimply has also partnered with local pool companies, and if they pay one of its owners a visit and certify that pool, that owner gets a badge on the site “so guests get an additional level of security,” Laskin said.

Ed Yip of Norwest Venture Partners admits that when he first heard of the concept of Swimply, he “didn’t know what to make of it.”

But the more he heard about it, the more excited he got.

“This is the Holy Grail for a consumer investor. We’re not changing consumer behavior, but rather [we] productize the experience and make it safer and easier on both sides,” Yip told TechCrunch.

What also gets the investor excited is the potential for Swimply beyond just swimming pools in the future.

“We’re seeing a ton of demand from hosts wanting to list hot tubs and tennis courts, for example,” Yip said. “So this can turn into a marketplace for shared outdoor resources and that’s a huge market opportunity that adds value on both sides.”

Indeed, the concept of monetizing underutilized space is a growing concept. Earlier this year, we reported on Neighbor, which operates a self-storage marketplace, raising $53 million in a Series B round of funding. Neighbor’s unique model aims to repurpose under-utilized or vacant space — whether it be a person’s basement or the empty floor of an office building — and turn it into storage.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

For this week’s deep dive Natasha and Alex and Chris dug into the world of the IPO. Not just the numbers and the metrics and the calculations of valuations at diluted, and non-diluted, share counts. No. We wanted to talk about the morality and efficacy of going public.

So to round out our conversation we enlisted Steve Cakebread, the CFO of Yext, and Garth Mitchell, the CFO of Latch. Cakebread is known for being aboard the Salesforce, Pandora and Yext IPOs. Mitchell has sat on both sides of the table during the IPO process, and is currently helming the money equations as Latch approaches the public markets via a SPAC.

For more context, Yext, a company that first launched at a TechCrunch event back in 2009, provides data tooling and search software to businesses, while Latch builds software and hardware for rental-focused buildings. Yext is public. Latch will be in a few months.

Back to our topic, we asked Cakebread to talk about his thesis on why going public earlier than later can help a company’s maturity process and can help provide greater returns to the general public. The CFO has written a rather good book about the IPO process more generally and what it means for a company’s internal processes, but his morality notes especially stood out because it’s an argument far less noisy than the POP critics. Baked beans come up, somehow!

We also asked Mitchell to talk about Latch’s choice to go public, and what opportunities and challenges the SPAC route brings for the company. Of course, there’s a SPAC joke in there (or two), but we get into broader “what’s next” debates about if more companies will start to leave the private world, venture capital’s role in this whole mess and the financial lift of going to the public market.

Hope you enjoy the show, and get excited: Equity is going to have more guests on from time to time, and we welcome any suggestions you want to throw at us.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Earlier today recent dog-parent Alex Konrad and fellow Forbes staffer Eliza Haverstock broke the news that Divvy, a Utah-based corporate spend unicorn, is considering selling itself to Bill.com for a price that could top $2 billion. For the fintech sector, it’s big news.

Corporate spend startups including Ramp and Brex are raising rapid-fired rounds at ever-higher valuations and growing at venture-ready cadences. Their growth and its resulting private investment were earned by a popular approach to offering corporate cards, and, increasingly, the group’s ability to build software around those cards that took into account a greater portion of the functionality that companies needed to track expenses, manage spend access, and, perhaps, save money.

The latter category was what Ramp focused on when it launched. It worked. More recently Ramp added expense tracking efforts to its own software suite. And Brex, an early leader in its efforts to get corporate cards into the hands of smaller, and more nascent businesses, has also built out its software efforts. So much so that the company, in conjunction with its huge recent fundraise, announced that it will begin offering a software package for a monthly fee.

Competitors like Airbase charge for their code, while some, like Divvy, traditionally have not.

Enter Bill.com. As the software work from the corporate spend startups has improved, it may have begun cutting into the corporate payments and expense software categories. For Bill.com in the payments world, and Expensify in the expense universe, that possible incursion could prove to be a growth-retarding concern. Thus, it makes sense to see Bill.com decide to take on the yet-private corporate spend startups that are playing the field; why not absorb a growing customer base and fend off competition in a single move?

To get a better handle on how the startups that compete with Divvy feel about the deal, TechCrunch reached out to both Ramp CEO Eric Glyman, and Brex CEO Henrique Dubugras. We’ll start with Glyman, who broadly agrees with our read of the situation:

Powered by WPeMatico

The public markets give, and the public markets take away. Earlier this morning, enterprise cloud storage and productivity company Box got into a more public spat with some of its shareholders upset with its performance and management decisions. But while Box endures the more difficult chapters of being a public company, other companies are racing to join the ranks of the listed concerns of the world.

If it feels like IPO news slowed for a few weeks at the start of the second quarter, your gut is correct. Investors previously told The Exchange that the first, third and fourth quarters of 2021 would be hot periods for public debuts, but that Q2 would be slower. Their argument revolved around reporting cadences and how long it takes for certain periods of accounting work to be completed.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

So we weren’t surprised when the second quarter’s IPO cycle began to feel a bit soft compared to the rapid-fire first quarter. And, as we’ve all heard in recent days, the great SPAC rush is slowing.

But that hasn’t stopped a number of firms from defying expectations and going public all the same. Online hosting and website builder Squarespace has not only filed but filled in its public filing with notes on its anticipated direct listing. We have to talk about its choice to list directly in light of new financial information we have concerning its recent performance.

But there’s more: Expensify filed to go public yesterday, albeit privately. And the SmartRent SPAC combination, though now slightly dated, is also worth a moment of our time.

But there’s more: Expensify filed to go public yesterday, albeit privately. And the SmartRent SPAC combination, though now slightly dated, is also worth a moment of our time.

The final element in the current IPO landscape is the recent Darktrace IPO in the United Kingdom, which, after that market had a rough start to its tech IPO calendar, is now seeing better results. So, let’s discuss IPOs to fully understand where we stand today in the realm of unicorn liquidity.

When The Exchange first dug into Squarespace’s IPO filing, we did our best to parse its full-year results because we lacked its quarterly details. This leaves us with two things to chew on: Why is Squarespace pursuing a direct listing over another listing technique, and what can its current and more granular operating results tell us about the choice?

On the first count, if Squarespace is direct listing, we can presume that it doesn’t need more cash to operate. So, how much cash does the company have on hand? A good chunk of change: $183.3 million.

Powered by WPeMatico

Personalized nutrition startup Zoe — named not for a person but after the Greek word for ‘life’ — has topped up its Series B round with $20M, bringing the total raised to $53M.

The latest close of the B round was led by Ahren Innovation Capital, which the startup notes counts two Nobel laureates as science partners. Also participating are two former American football players, Eli Manning and Ositadimma “Osi” Umenyiora; Boston, US-based seed fund Accomplice; healthcare-focused VC firm THVC and early stage European VC, Daphni.

The U.K.- and U.S.-based startup was founded back in 2017 but operated in stealth mode for three years, while it was conducting research into the microbiome — working with scientists from Massachusetts General Hospital, Stanford Medicine, Harvard T.H. Chan School of Public Health, and King’s College London.

One of the founders, professor Tim Spector of King’s College — who is also the author of a number of popular science books focused on food — became interested in the role of food (generally) and the microbiome (in particular) on overall health after spending decades researching twins to try to understand the role of genetics (nature) vs nurture (environmental and lifestyle factors) on human health.

Zoe used data from two large-scale microbiome studies to build its first algorithm which it began commercializing last September — launching its first product into the U.S. market: A home testing kit that enables program participants to learn how their body responds to different foods and get personalized nutrition advice.

The program costs around $360 (which Zoe takes in six instalments) and requires participants to (self) administer a number of tests so that it can analyze their biology, gleaning information about their metabolic and gut health by looking at changes in blood lipids, blood sugar levels and the types of bacteria in their gut.

Zoe uses big data and machine learning to come up with predictive insights on how people will respond to different foods so that it can offer individuals guided advice on what and how to eat, with the goal of improving gut health and reducing inflammatory responses caused by diet.

The combination of biological responses it analyzes sets it apart from other personalized nutrition startups with products focused on measuring one element (such as blood sugar) — is the claim.

But, to be clear, Zoe’s first product is not a regulated medical device — and its FAQ clearly states that it does not offer medical diagnosis or treatment for specific conditions. Instead it says only that it’s “a tool that is meant for general wellness purposes only”. So — for now — users have to take it on trust that the nutrition advice it dishes up is actually helpful for them.

The field of scientific research into the microbiome is undoubtedly early — Zoe’s co-founder states that very clearly when we talk — so there’s a strong component here, as is often the case when startups seek to use data and AI to generate valuable personalized predictions, whereby early adopters are helping to further Zoe’s research by contributing their data. Potentially ahead of the sought for individual efficacy, given so much is still unknown around how what we eat affects our health.

For those willing to take a punt (and pay up), they get an individual report detailing their biological responses to specific foods that compares them to thousands of others. The startup also provides them with individualized ‘Zoe’ scores for specific foods in order to support meal planning that’s touted as healthier for them.

“Reduce your dietary inflammation and improve gut health with a 4 week plan tailored to your unique biology and life,” runs the blurb on Zoe’s website. “Built around your food scores, our app will teach you how to make smart swaps, week by week.”

The marketing also claims no food is “off limits” — implying there’s a difference between Zoe’s custom food scores and (weight-loss focused) diets that perhaps require people to cut out a food group (or groups) entirely.

“Our aim is to empower you with the information and tools you need to make the best decisions for your body,” is Zoe’s smooth claim.

The underlying premise is that each person’s biology responds differently to different foods. Or, to put it another way, while we all most likely know at least one person who stays rake-thin and (seemingly) healthy regardless of what (or even how much) they eat, if we ate the same diet we’d probably expect much less pleasing results.

“What we’re able to start scientifically putting some evidence behind is something that people have talked about for a long time,” says co-founder George Hadjigeorgiou. “It’s early [for scientific research into the microbiome] but we have shown now to the world that even twins have different gut microbiomes, we can change our gut microbiomes through diet, lifestyle and how we live — and also that there are associations around particular [gut] bacteria and foods and a way to improve them which people can actually do through our product.”

Users of Zoe’s first product need to be willing (and able) to get pretty involved with their own biology — collecting stool samples, performing finger prick tests and wearing a blood glucose monitor to feed in data so it can analyze how their body responds to different foods and offer up personalized nutrition advice.

Another component of its study of biological responses to food has involved thousands of people eating “special scientific muffins”, which it makes to standardized recipes, so it can benchmark and compare nutritional responses to a particular blend of calories, carbohydrate, fat, and protein.

While eating muffins for science sounds pretty fine, the level of intervention required to make use of Zoe’s first at-home test kit product is unlikely to appeal to those with only a casual interest in improving their nutrition.

Hadjigeorgiou readily agrees the program, as it is now, is for those with a particular problem to solve that can be linked to diet/nutrition (whether obesity, high cholesterol or a disease like type 2 diabetes, and so on). But he says Zoe’s goal is to be able to open up access to personalized nutrition advice much more widely as it keeps gathering more data and insights.

“The idea is, as always, we start with a focused set of people with problems to solve who we believe will have a life-changing experience,” he tells TechCrunch. “At this point we are not trying to create a product for everyone — and we understand that that has limitations in terms of how much we scale in the beginning. Although even still within this focused group of people I can assure you there’s tonnes of people!

“But absolutely the whole idea is that after we get a first [set of users]… then with more data and with more experience we can simplify and start making this simpler and more accessible — both in terms of its simplicity and also it’s price. So more and more people. Because at the end of the day everyone has this right to be able to optimize and understand and be in control — and we want to make that available to everyone.

“Regardless of background and regardless of socio-economic status. And, in fact, many of the people who have the biggest problems around health etc are the ones who have maybe less means and ability to do that.”

Zoe isn’t disclosing how many early users it’s onboarded so far but Hadjigeorgiou says demand is high (it’s currently operating a wait-list for new sign ups).

He also touts promising early results from interim trial with its first users — saying participants experienced more energy (90%), felt less hunger (80%) and lost an average of 11 pounds after three months of following their AI-aided, personalized nutrition plan. Albeit, without data on how many people are involved in the trials it’s not possible to quantify the value of those metrics.

The extra Series B funding will be used to accelerate the rollout of availability of the program, with a U.K. launch planned for this year — and other geographies on the cards for 2022. Spending will also go on continued recruitment in engineering and science, it says.

Zoe already grabbed some eyeballs last year, as the coronavirus pandemic hit the West, when it launched a COVID-19 symptom self-reporting app. It has used that data to help scientists and policy makers understand how the virus affects people.

The Zoe COVID-19 app has had some 5M users over the last year, per Hadjigeorgiou — who points to that (not-for-profit) effort as an example of the kind of transformative intervention the company hopes to drive in the nutrition space down the line.

“Overnight we got millions and millions of people contributing to help uncover new insights around science around COVID-19,” he says, highlighting that it’s been able to publish a number of research papers based on data contributed by app users. “For example the lack of smell and taste… was something that we first [were able to prove] scientifically, and then it became — because of that — an official symptom in the list of the government in the U.K.

“So that was a great example how through the participation of people — in a very, very fast way, which we couldn’t predict when we launched it — we managed to have a big impact.”

Returning to diet, aren’t there some pretty simple ‘rules of thumb’ that anyone can apply to eat more healthily — i.e. without the need to shell out for a bespoke nutrition plan? Basic stuff like eat your greens, avoid processed foods and cut down (or out) sugar?

“There are definitely rules of thumb,” Hadjigeorgiou agrees. “We’ll be crazy to say they’re not. I think it all comes back to the point that although there are rules of thumb and over time — and also through our research, for example — they can become better, the fact of the matter is that most people are becoming less and less healthy. And the fact of the matter is that life is messy and people do not eat even according to these rules of thumb so I think part of the challenge is… [to] educate and empower people for their messy lives and their lifestyle to actually make better choices and apply them in a way that’s sustainable and motivating so they can be healthier.

“And that’s what we’re finding with our customers. We are helping them to make these choices in an empowering way — they don’t need to count calories, they don’t need to restrict themselves through a Keto [diet] regime or something like that. We basically empower them to understand this is the impact food has on your body — real time, how your blood sugar levels change, how your bacteria change, how your blood fat levels changes. And through that empowerment through insight then we say hey, now we’ll give you this course, it’s very simple, it’s like a game — and we’ll given you all these tools to combine different foods, make foods work for you. No food is off limits — but try to eat most days a 75 score [based on the food points Zoe’s app assigns].

“In that very empowering way we see people get very excited, they see a fun game that is also impacting their gut and metabolism and they start feeling these amazing effects — in terms of less hunger, more energy, losing weight and over time as well evolving their health. That’s why they say it’s life changing as well.”

Gamifying research for the goal of a greater good? To the average person that surely sounds more appetitizing than ‘eat your greens’.

Though, as Hadjigeorgiou concedes, research in the field of microbiome — where Zoe’s commercial interests and research USP lie — is “early”. Which means that gathering more data to do more research will remain a key component of the business for the foreseeable future. And with so much still to be understood about the complex interactions between food, exercise and other lifestyle factors and human health, the mission is indeed massive.

In the meanwhile, Zoe will be taking it one suggestive nudge at a time.

“Sugar is bad, kale’s great but the whole kind of magic happens in the middle,” Hadjigeorgiou goes on. “Is oatmeal good for you? Is rice good for you? Is wholewheat pasta good for you? How do you combine wholewheat pasta and butter? How much do you have? This is where basically most of our life happens.

“Because people don’t eat ice-cream the whole day and people don’t eat kale the whole day. They eat all these other foods in the middle and that’s where the magic is — knowing how much to have, how to combine them to make it better, how to combine it with exercise to make it better? How to eat a food that doesn’t dip your sugar levels three hours after you eat it which causes hunger for you. Theses are all the things we’re able to predict and present in a simple and compelling way through a score system to people — and in turn help them [understand their] metabolic response to food.”

Powered by WPeMatico

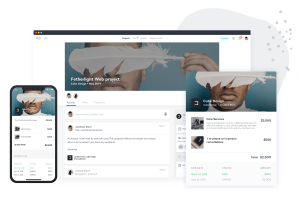

HoneyBook, which has built out a client experience and financial management platform for service-based small businesses and freelancers, announced today that it has raised $155 million in a Series D round led by Durable Capital Partners LP.

Tiger Global Management, Battery Ventures, Zeev Ventures, 01 Advisors as well as existing backers Norwest Venture Partners and Citi Ventures also participated in the financing, which brings the San Francisco-based company’s valuation to over $1 billion. With the latest round, HoneyBook has now raised $248 million since its 2013 inception. The Series D is a big jump from the $28 million that HoneyBook raised in March 2019.

When the COVID-19 pandemic hit last year, HoneyBook’s leadership team was concerned about the potential impact on their business and braced themselves for a drop in revenue.

Rather than lay off people, they instead asked everyone to take a pay cut, and that included the executive team, who cut theirs “by double” the rest of the staff.

“I remember it was terrifying. We knew that our customers’ businesses were going to be impacted dramatically, and would impact ours at the same time dramatically,” recalls CEO Oz Alon. “We had to make some hard decisions.”

But the resilience of HoneyBook’s customer base surprised even the company, who ended up reinstating those salaries just a few months later. And, as corporate layoffs driven by the COVID-19 pandemic led to more people deciding to start their own businesses, HoneyBook saw a big surge in demand.

“Our members who saw a hit in demand went out and found demand in another thing,” Oz said. As a result, HoneyBook ended up doubling its number of members on its SaaS platform and tripling its annual recurring revenue (ARR) over the past 12 months. Members booked more than $1 billion in business on the platform in the past nine months alone.

HoneyBook combines on its platform tools like billing, contracts and client communication, with the goal of helping business owners stay organized. Since its inception, service providers across the U.S. and Canada such as graphic designers, event planners, digital marketers and photographers have booked more than $3 billion in business on its platform. And as the pandemic had more people shift to doing more things online, HoneyBook prepared to help its members adapt by being armed with digital tools.

Image Credits: HoneyBook

“Clients now expect streamlined communication, seamless payments, and the same level of exceptional service online that they were used to receiving from business owners in person,” Alon said.

Oz co-founded HoneyBook with wife Naama and longtime friend Dror Shimoni. Oz and Naama were both small business owners themselves at one time, so they had firsthand insight on the pain points of running a service-based business.

HoneyBook’s software not only helps SMBs do more business, but helps them “convert potentials to actual clients,” Oz said.

“We help them communicate with potential clients so they can win their business, and then help them manage the relationship so they can keep them,” Naama said.

The company plans to use its new capital toward continued product development and to “dramatically” boost its 103-person headcount across its New York and Tel Aviv offices.

“We’re seeing so much demand for additional services and products, so we definitely want to invest and create better ways for our members to present themselves online,” Alon told TechCrunch. “We’re also seeing demand for financial products and the ability to access capital faster. So that’s just a few of the things we plan to invest in.”

The company also wants to make its platform “more customizable” for different categories and verticals.

Chelsea Stoner, general partner at Battery Ventures, said her firm recognized that the expansive market of productivity tools to serve small businesses and entrepreneurs was “a market of discrete and separate productivity tools.”

HoneyBook, she said, is a true platform for SMBs, “providing a huge array of functionality in one cohesive UX.”

“It unites and connects every task for the solopreneurs, from creating and distributing marketing collateral, to organizing and executing proposals, to sending invoices and collecting payments,” Stoner said. “The company is constantly innovating and iterating in response to its members; we also see a lot of opportunity with payments going forward…And, due to COVID-19 and other factors, the company is sitting on pent-up demand that will accelerate growth even more.”

Powered by WPeMatico