Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Zuora, which helps businesses handle subscription billing and forecasting, filed for an initial public offering this afternoon following on the heels of Dropbox’s filing earlier this month.

Zuora’s IPO may signal that Dropbox going public, and seeing a price range that while under its previous valuation seems relatively reasonable, may open the door for coming enterprise initial public offerings. Cloud security company Zscaler also made its debut earlier this week, with the stock doubling once it began trading on the Nasdaq. Zuora will list on the New York Stock Exchange under the ticker “ZUO.” Zuora CEO Tien Tzuo told The Information in October last year that it expected to go public this year.

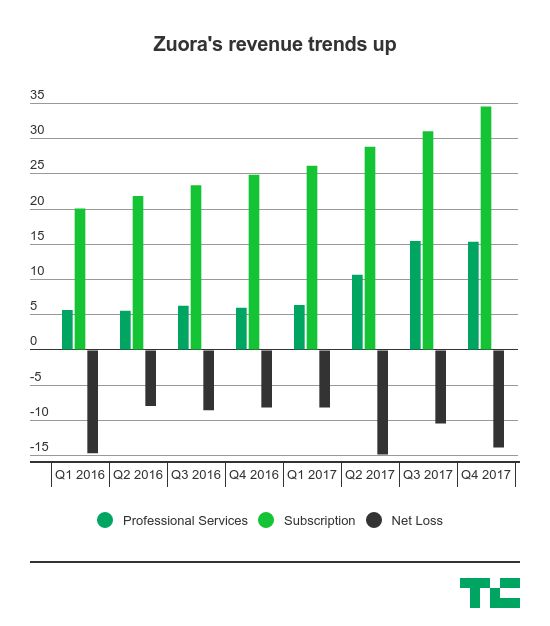

Zuora’s numbers show some revenue growth, with its subscriptions services continue to grow. But its losses are a bit all over the place. While the costs for its subscription revenues is trending up, the costs for its professional services are also increasing dramatically, going from $6.2 million in Q4 2016 to $15.6 million in Q4 2017. The company had nearly $50 million in overall revenue in the fourth quarter last year, up from $30 million in Q4 2016.

But, as we can see, Zuora’s “professional services” revenue is an increasing share of the pie. In Q1 2016, professional services only amounted to 22% of Zuora’s revenue, and it’s up to 31% in the fourth quarter last year. It also accounts for a bigger share of Zuora’s costs of revenue, but it’s an area that it appears to be investing more.

Zuora’s core business revolves around helping companies with subscription businesses — like, say, Dropbox — better track their metrics like recurring revenue and retention rates. Zuora is riding a wave of enterprise companies finding traction within smaller teams as a free product and then graduating them into a subscription product as more and more people get on board. Eventually those companies hope to have a formal relationship with the company at a CIO level, and Zuora would hopefully grow up along with them.

Snap effectively opened the so-called “IPO window” in March last year, but both high-profile consumer IPOs — Blue Apron and Snap — have had significant issues since going public. While both consumer companies, it did spark a wave of enterprise IPOs looking to get out the door like Okta, Cardlytics, SailPoint and Aquantia. There have been other consumer IPOs like Stitch Fix, but for many firms, enterprise IPOs serve as the kinds of consistent returns with predictable revenue growth as they eventually march toward an IPO.

The filing says it will raise up to $100 million, but you can usually ignore that as it’s a placeholder. Zuora last raised $115 million in 2015, and was PitchBook data pegged the valuation at around $740 million, according to the Silicon Valley Business Journal. Benchmark Capital and Shasta Ventures are two big investors in the company, with Benchmark still owning around 11.1% of the company and Shasta Ventures owning 6.5%. CEO Tien Tzuo owns 10.2% of the company.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This week Katie Roof and I were joined by Mayfield Fund’s Navin Chaddha, an investor with early connections with Lyft to talk about, well, Lyft — as well as two bombshell news events in the form of an SEC fine for Theranos and Broadcom’s hostile takeover efforts for Qualcomm hitting the brakes. Alex Wilhelm was not present this week but will join us again soon (we assume he was tending to his Slayer shirt collection).

Starting off with Lyft, there was quite a bit of activity for Uber’s biggest competitor in North America. The ride-sharing startup (can we still call it a startup?) said it would be partnering with Magna to “co-develop” an autonomous driving system. Chaddha talks a bit about how Lyft’s ambitions aren’t to be a vertical business like Uber, but serve as a platform for anyone to plug into. We’ve definitely seen this play out before — just look at what happened with Apple (the closed platform) and Android (the open platform). We dive in to see if Lyft’s ambitions are actually going to pan out as planned. Also, it got $200 million out of the deal.

Next up is Theranos, where the SEC investigation finally came to a head with founder Elizabeth Holmes and former president Ramesh “Sunny” Balwani were formally charged by the SEC for fraud. The SEC says the two raised more than $700 million from investors through an “elaborate, years-long fraud in which they exaggerated or made false statements about the company’s technology, business, and financial performance.” You can find the full story by TechCrunch’s Connie Loizos here, and we got a chance to dig into the implications of what it might mean for how investors scope out potential founders going forward. (Hint: Chaddha says they need to be more careful.)

Finally, BroadQualm is over. After months of hand-wringing over whether or not Broadcom would buy — and then commit a hostile takeover — of the U.S. semiconductor giant, the Trump administration blocked the deal. A cascading series of events associated with the CFIUS, a government body, got it to the point where Broadcom’s aggressive dealmaker Hock Tan dropped plans to go after Qualcomm altogether. The largest deal of all time in tech will, indeed, not be happening (for now), and it has potentially pretty big implications for M&A going forward.

That’s all for this week, we’ll catch you guys next week. Happy March Madness, and may fortune favor* your brackets.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocketcast, Downcast and all the casts.

* assuming you have Duke losing before the elite 8.

Powered by WPeMatico

By adding a cryptocurrency exchange, a web version and stock option trading, Robinhood has managed to quadruple its valuation in a year, according to a source familiar with a new round the startup is raising. Robinhood is closing in on around $350 million in Series D funding led by Russian firm DST Global, the source says. That’s just 11 months after Robinhood confirmed TechCrunch’s scoop that the zero-fee stock trading app had raised a $110 million Series C at a $1.3 billion valuation. The new raise would bring Robinhood to $526 million in funding.

Details of the Series D were first reported by The Wall Street Journal.

The astronomical value growth shows that investors see Robinhood as a core part of the mobile finance tools upon which the next generation will rely. The startup also just proved its ability to nimbly adapt to trends by building its cryptocurrency trading feature in less than two months to make sure it wouldn’t miss the next big economic shift. One million users waitlisted for access in just the five days after Robinhood Crypto was announced.

The launch completed a trio of product debuts. The mobile app finally launched a website version for tracking and trading stocks without a commission in November. In December it opened options trading, making it a more robust alternative to brokers like E*Trade and Scottrade. They often charge $7 or more per stock trade compared to zero with Robinhood, but also give away features that are reserved for Robinhood’s premium Gold subscription tier.

Robinhood won’t say how many people have signed up for its $6 to $200 per month Gold service that lets people trade on margin, with higher prices netting them more borrowing power. That and earning interest on money stored in Robinhood accounts are the startup’s primary revenue sources.

Rapid product iteration and skyrocketing value surely helped recruit Josh Elman, who Robinhood announced yesterday has joined as VP of product as he transitions to a part-time roll at Greylock Partners. He could help the company build a platform business as a backbone for other fintech apps, they way he helped Facebook build its identity platform.

In effect, Robinhood has figured out how to make stock trading freemium. Rather than charge per trade with bonus features included, Robinhood gives away the bare-bones trades and charges for everything else. That could give it a steady, scalable business model akin to Dropbox, which grew by offering small amounts of free storage and then charging for extras and enterprise accounts. From a start with free trades, Robinhood could blossom into a hub for your mobile finance life.

Powered by WPeMatico

Spotify explained why it’s ditching the traditional IPO for a direct listing on the NYSE on April 3rd today during its Investor Day presentation. With no lockup period and no intermediary bankers, Spotify thinks it can go public without all the typical shenanigans.

Spotify described the rationale for using a direct listing with five points:

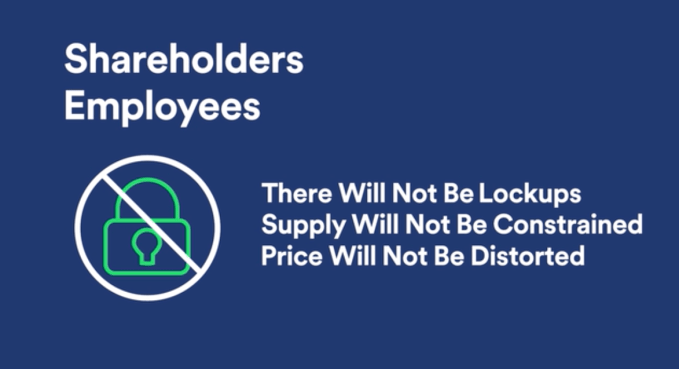

Spotify won’t wait for the direct listing, and on March 26th will announce first quarter and 2018 guidance before markets open. It also announced today that there will be no lock-up period, so employees can start selling their shares immediately. This prevents a looming lock-up period expiration that can lead to a dump of shares on the market that sinks the price from spooking investors.

It’s unclear exactly what Spotify will be valued at on April 3rd, but during 2018 its shares have traded on the private markets for between $90 and $132.50, valuing the company at $23.4 billion at the top of the range. The music streaming service now has 159 million monthly active users (up 29 percent in 2017) and 71 million paying subscribers (up 46 percent in 2017.

During CEO Daniel Ek’s presentation, he explained that Spotify emerged as an alternative to piracy by convenience to make paying or ad-supported access easier than stealing. Now he sees the company as the sole leading music streaming service that’s a dedicated music company, subtly throwing shade at Apple, Google, and Amazon. “We’re not focused on selling hardware. We’re not focused on selling books. We’re focused on selling music and connecting artists with fans” said Ek.

Head of R&D Gustav Soderstrom outlined Spotify’s ubiquity strategy, opposed to trying to lock users into a “single platform ecosystem”. He says Spotify does “what’s best for the user and not for the company, and trying to solve the users’ problems by being everywhere.” That’s more shade for Apple, who’s HomePod only works with Apple Music despite customers obviously wishing they could play other streaming services through it.

By now being baked into a wide range of third-party hardware through the Spotify Connect program, Soderstrom says Spotify gets a more holistic understanding of its listeners. He declared that Spotify has 5X as much personalization data as its next closest competitor, and that allows it to know what to play you next. He cheekily calls this “self-driving music”.

Spotify CEO Daniel Ek giving the Investor Day presentation

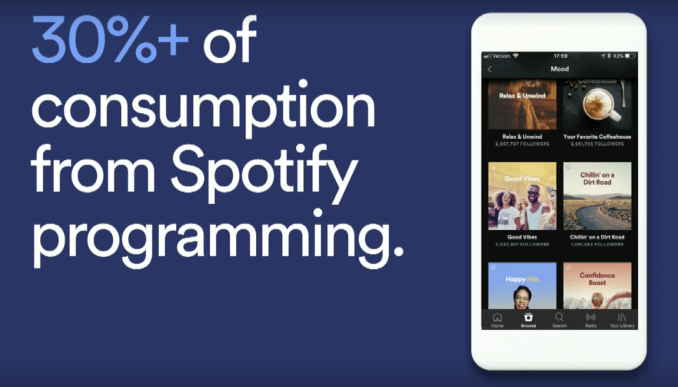

Directing what people listen to turns Spotify into the new top 40 radio — the hit-maker. That gives it leverage over the record labels so Spotify can get better licensing deals and favorable treatment. Now over 30 percent of Spotify listening is based on its own programming through featured playlists, artists, and more.

There’s plenty of room for Spotify to grow. Only 12 percent of the 1.3 billion payment-enabled smartphones in the world have a streaming music subscription and Spotify makes up half of those. And with the free tier, Spotify has the best way to capture people tip-toeing into streaming.

Wall Street loves a two-sided marketplace, so Spotify is positioning itself in the middle of artists and fans, with each side attracting the other. It’s both selling music streaming services to listeners, and selling the tools to reach and monetize those listeners to musicians. That’s both on its platform, and using its targeting and analytics info to deliver efficient ticket and merchandise promotions elsewhere. Ek discussed the flywheel that drives Spotify’s business, explaining that the more people discover music, the more they listen, and the more artists that become successful on the platform, and the more artists will embrace the platform and bring their fans.

Yet with music catalogues and prices mostly similar across the industry, Spotify will have to depend on its personalized recommendations and platform-agnositic strategy to beat its deep pocketed competitors. Music isn’t going away, so whoever can lock in listeners now at the dawn of streaming could keep coining off them for decades. That’s why Spotify not raising cash for marketing through a traditional IPO is a strange choice. But with its focus on playlists and suggestion data, Spotify could build melodic handcuffs for its listeners who wouldn’t dream of starting from scratch on a competitor.

You can follow along with the presentation here.

For more on Spotify’s not-an-IPO, check out our feature piece:

Powered by WPeMatico

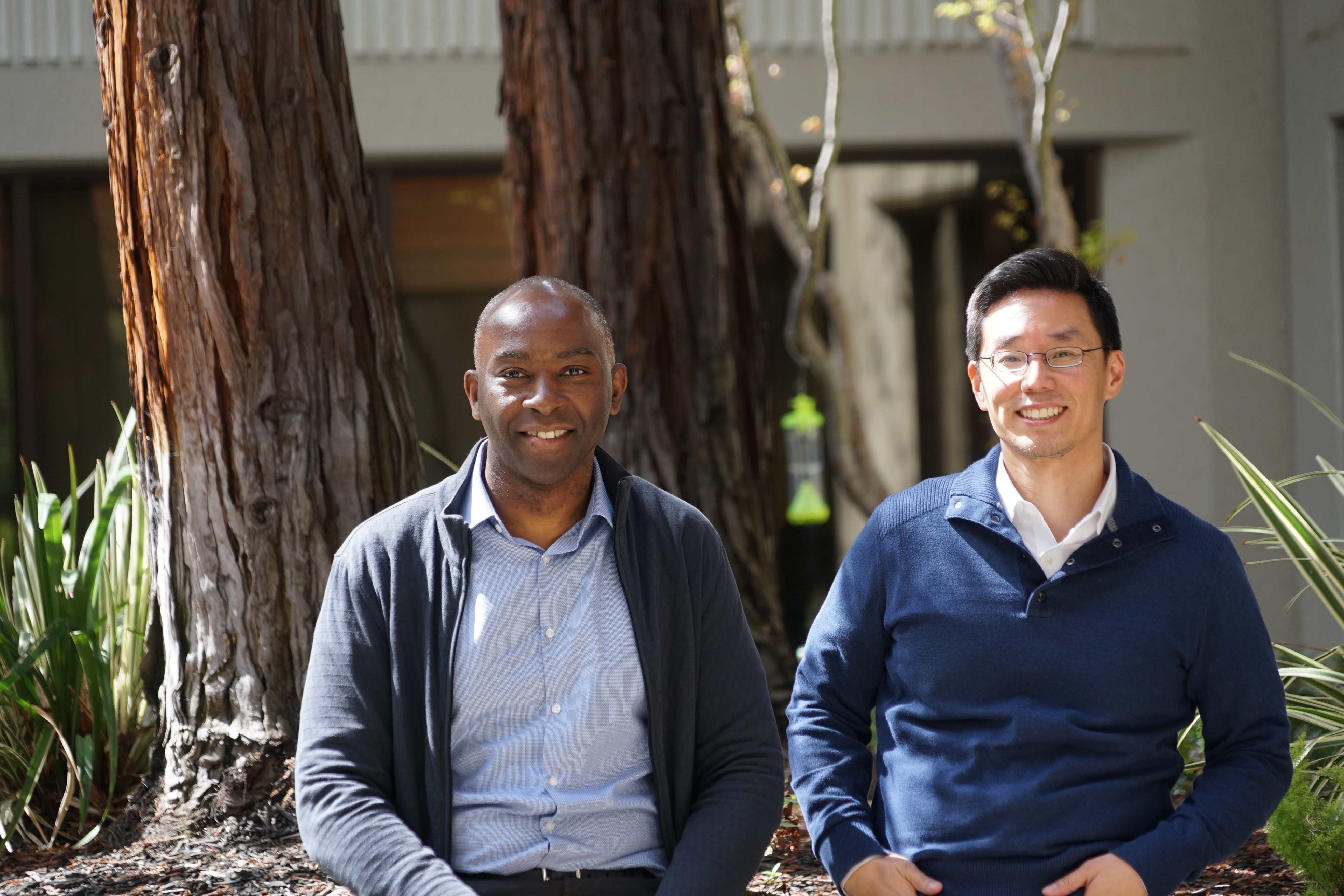

Another massive financing round for an AI chip company is coming in today, this time for SambaNova Systems — a startup founded by a pair of Stanford professors and a longtime chip company executive — to build out the next generation of hardware to supercharge AI-centric operations.

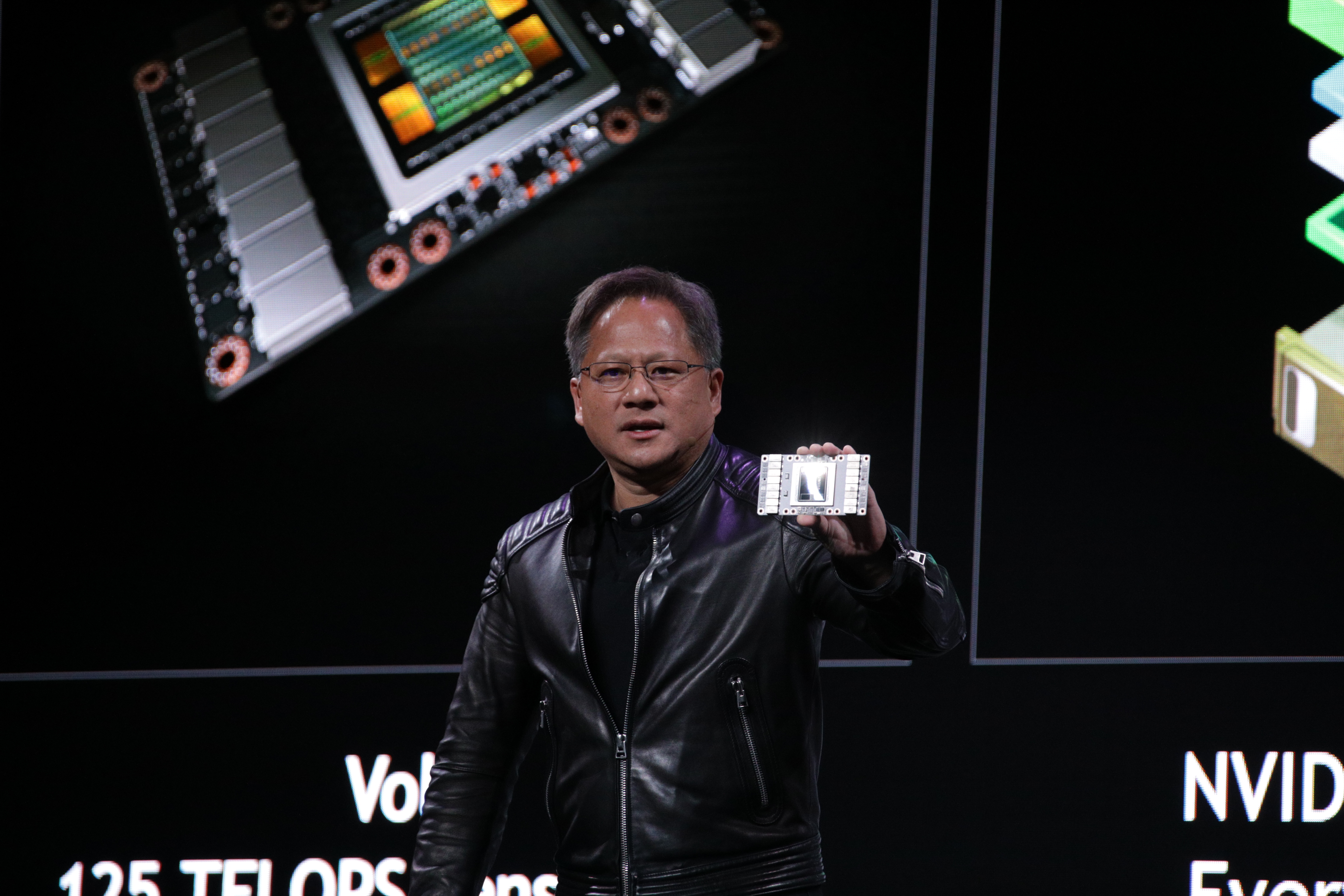

SambaNova joins an already quite large class of startups looking to attack the problem of making AI operations much more efficient and faster by rethinking the actual substrate where the computations happen. The GPU has become increasingly popular among developers for its ability to handle the kinds of lightweight mathematics in very speedy fashion necessary for AI operations. Startups like SambaNova look to create a new platform from scratch, all the way down to the hardware, that is optimized exactly for those operations. The hope is that by doing that, it will be able to outclass a GPU in terms of speed, power usage, and even potentially the actual size of the chip. SambaNova today said it has raised a huge $56 million series A financing round was co-led by GV and Walden International, with participation from Redline Capital and Atlantic Bridge Ventures.

SambaNova is the product of technology from Kunle Olukotun and Chris Ré, two professors at Stanford, and led by former Oracle SVP of development Rodrigo Liang, who was also a VP at Sun for almost 8 years. When looking at the landscape, the team at SambaNova looked to work their way backwards, first identifying what operations need to happen more efficiently and then figuring out what kind of hardware needs to be in place in order to make that happen. That boils down to a lot of calculations stemming from a field of mathematics called linear algebra done very, very quickly, but it’s something that existing CPUs aren’t exactly tuned to do. And a common criticism from most of the founders in this space is that Nvidia GPUs, while much more powerful than CPUs when it comes to these operations, are still ripe for disruption.

“You’ve got these huge [computational] demands, but you have the slowing down of Moore’s law,” Olukotun said. “The question is, how do you meet these demands while Moore’s law slows. Fundamentally you have to develop computing that’s more efficient. If you look at the current approaches to improve these applications based on multiple big cores or many small, or even FPGA or GPU, we fundamentally don’t think you can get to the efficiencies you need. You need an approach that’s different in the algorithms you use and the underlying hardware that’s also required. You need a combination of the two in order to achieve the performance and flexibility levels you need in order to move forward.”

While a $56 million funding round for a series A might sound colossal, it’s becoming a pretty standard number for startups looking to attack this space, which has an opportunity to beat the big chipmakers and create a new generation of hardware that will be omnipresent among any device that is built around artificial intelligence — whether that’s a chip sitting on an autonomous vehicle doing rapid image processing to potentially even a server within a healthcare organization training models for complex medical problems. Graphcore, another chip startup, got $50 million in funding from Sequoia Capital, while Cerebras Systems also received significant funding from Benchmark Capital.

Olukotun and Liang wouldn’t go into the specifics of the architecture, but they are looking to redo the operational hardware to optimize for the AI-centric frameworks that have become increasingly popular in fields like image and speech recognition. At its core, that involves a lot of rethinking of how interaction with memory occurs and what happens with heat dissipation for the hardware, among other complex problems. Apple, Google with its TPU, and reportedly Amazon have taken an intense interest in this space to design their own hardware that’s optimized for products like Siri or Alexa, which makes sense because dropping that latency to as close to zero as possible with as much accuracy as possible in the end improves the user experience. A great user experience leads to more lock-in for those platforms, and while the larger players may end up making their own hardware, GV’s Dave Munichiello — who is joining the company’s board — says this is basically a validation that everyone else is going to need the technology soon enough.

“Large companies see a need for specialized hardware and infrastructure,” he said. “AI and large-scale data analytics are so essential to providing services the largest companies provide that they’re willing to invest in their own infrastructure, and that tells us more investment is coming. What Amazon and Google and Microsoft and Apple are doing today will be what the rest of the Fortune 100 are investing in in 5 years. I think it just creates a really interesting market and an opportunity to sell a unique product. It just means the market is really large, if you believe in your company’s technical differentiation, you welcome competition.”

There is certainly going to be a lot of competition in this area, and not just from those startups. While SambaNova wants to create a true platform, there are a lot of different interpretations of where it should go — such as whether it should be two separate pieces of hardware that handle either inference or machine training. Intel, too, is betting on an array of products, as well as a technology called Field Programmable Gate Arrays (or FPGA), which would allow for a more modular approach in building hardware specified for AI and are designed to be flexible and change over time. Both Munichiello’s and Olukotun’s arguments are that these require developers who have a special expertise of FPGA, which is a sort of niche-within-a-niche that most organizations will probably not have readily available.

Nvidia has been a major benefactor in the explosion of AI systems, but it clearly exposed a ton of interest in investing in a new breed of silicon. There’s certainly an argument for developer lock-in on Nvidia’s platforms like Cuda. But there are a lot of new frameworks, like TensorFlow, that are creating a layer of abstraction that are increasingly popular with developers. That, too represents an opportunity for both SambaNova and other startups, who can just work to plug into those popular frameworks, Olukotun said. Cerebras Systems CEO Andrew Feldman actually also addressed some of this on stage at the Goldman Sachs Technology and Internet Conference last month.

“Nvidia has spent a long time building an ecosystem around their GPUs, and for the most part, with the combination of TensorFlow, Google has killed most of its value,” Feldman said at the conference. “What TensorFlow does is, it says to researchers and AI professionals, you don’t have to get into the guts of the hardware. You can write at the upper layers and you can write in Python, you can use scripts, you don’t have to worry about what’s happening underneath. Then you can compile it very simply and directly to a CPU, TPU, GPU, to many different hardwares, including ours. If in order to do that work, you have to be the type of engineer that can do hand-tuned assembly or can live deep in the guts of hardware, there will be no adoption… We’ll just take in their TensorFlow, we don’t have to worry about anything else.”

(As an aside, I was once told that Cuda and those other lower-level platforms are really used by AI wonks like Yann LeCun building weird AI stuff in the corners of the Internet.)

There are, also, two big question marks for SambaNova: first, it’s very new, having started in just November while many of these efforts for both startups and larger companies have been years in the making. Munichiello’s answer to this is that the development for those technologies did, indeed, begin a while ago — and that’s not a terrible thing as SambaNova just gets started in the current generation of AI needs. And the second, among some in the valley, is that most of the industry just might not need hardware that’s does these operations in a blazing fast manner. The latter, you might argue, could just be alleviated by the fact that so many of these companies are getting so much funding, with some already reaching close to billion-dollar valuations.

But, in the end, you can now add SambaNova to the list of AI startups that have raised enormous rounds of funding — one that stretches out to include a myriad of companies around the world like Graphcore and Cerebras Systems, as well as a lot of reported activity out of China with companies like Cambricon Technology and Horizon Robotics. This effort does, indeed, require significant investment not only because it’s hardware at its base, but it has to actually convince customers to deploy that hardware and start tapping the platforms it creates, which supporting existing frameworks hopefully alleviates.

“The challenge you see is that the industry, over the last ten years, has underinvested in semiconductor design,” Liang said. “If you look at the innovations at the startup level all the way through big companies, we really haven’t pushed the envelope on semiconductor design. It was very expensive and the returns were not quite as good. Here we are, suddenly you have a need for semiconductor design, and to do low-power design requires a different skillset. If you look at this transition to intelligent software, it’s one of the biggest transitions we’ve seen in this industry in a long time. You’re not accelerating old software, you want to create that platform that’s flexible enough [to optimize these operations] — and you want to think about all the pieces. It’s not just about machine learning.”

Powered by WPeMatico

A massive company probably has plenty of engineers on staff and the resources to build a complex backbone of interconnected information that can contain tons of data and make acting on it easy — but for smaller companies, and for those that aren’t technical, those tools aren’t very accessible.

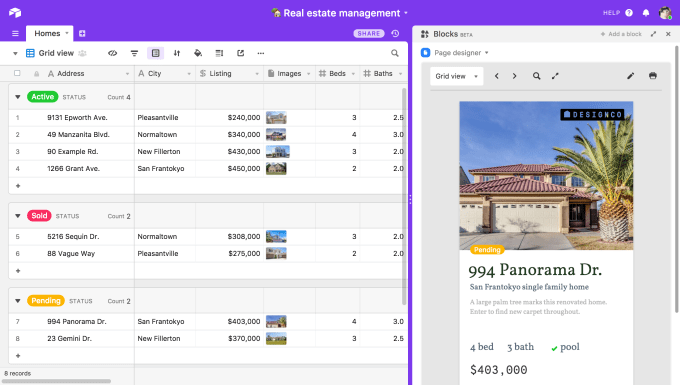

That’s what convinced Howie Liu to create Airtable, a startup that looks to turn what seems like just a normal spreadsheet into a robust database tool, hiding the complexity of what’s happening in the background while those without any programming experience create intricate systems to get their work done. Today, they’re trying to take that one step further with a new tool called Blocks, a set of mix-and-match operations like SMS and integrating maps that users can just drop into their systems. Think of it as a way to give a small business owner with a non-technical background to meticulously track all the performance activity across, say, a network of food trucks by just entering a bunch of dollar values and dropping in one of these tools.

“We really want to take this power you have in software creation and ‘consumerize’ that into a form anyone can use,” Liu said. “At the same time, from a business standpoint, we saw this bigger opportunity underneath the low-code app platforms in general. Those platforms solve the needs of heavyweight expensive use cases where you have a budget and have a lot of time. I would position Airtable making a leap toward a graphical user interface, versus a lot of products that are admin driven.”

Liu said the company has raised an additional $52 million in financing in a round led by CRV and Caffeinated Capital, with participation from Freestyle Ventures and Slow Ventures. All this is going toward a way to build a system that is trying to abstract out even the process of programming itself, though there’s always going to be some limited scope as to how custom of a system you can actually make with what amounts to a set of logic operation legos. That being said, the goal here is to boil down all of the most common sets of operations with the long tail left to the average programmers (and larger enterprises often have these kinds of highly-customized needs).

All this is coming at a time when businesses are increasingly chasing the long tail of small- to medium-sized businesses, the ones that aren’t really on the grid but represent a massive market opportunity. Those businesses also probably don’t have the kinds of resources to hire engineers while companies like Google or Facebook are camping out on college campuses looking to snap up students graduating with technical majors. That’s part of the reason why Excel had become so popular trying to abstract out a lot of complex operations necessary to run a business, but at the same time, Liu said that kind of philosophy should be able to be taken a step further.

“If you look at cloud, you have Amazon’s [cloud infrastructure] EC2, which abstracted the hardware level and you can build on existing machine intelligence,” Liu said. “Then, you get the OS level and up. Containers, Heroku, and other tools have extracted away the operation level complexity. But you have to write the app and modal logic. Our goal is to go a big leap forward on top of that and abstract out the app code layer. You should be able to directly use our interface, and blocks, all these plug and play lego pieces that give you more dynamic functionality — whether a map view or an integration with Twilio.”

And, really, all these platforms like Twilio have tried to make themselves pretty friendly to coding beginners as-is. Twilio has a lot of really good documentation for first-time developers to learn to use their platforms. But Airtable hopes to serve as a way to interconnect all these things in a complex web, creating a relational database behind the scenes that users can operate on in a more simplistic matter that’s still accurate, fast, and reliable.

“Obviously MySQL is great if you want to use code or custom SQL queries to interface with the data,” Liu said. “But, ultimately, you’d never as a business end user consider using literally a terminal-based SQL prompt as the primary interface to and from your data. Certainly you wouldn’t put that on your designs. Clearly you would want some interface on top of the SQL level database. We basically expose the full value of a relational database like Postgres to the end user, but we also give them something equally but more important: the interface on the top that makes the data immediately visible.”

There’s been a lot of activity trying to rethink these sort of fundamental formats that the average user is used to, but are ripe for more flexibility. Coda, a startup trying to rethink the notion behind a word document, raised $60 million, and all this points towards moves to try to create a more robust toolkit for non-technical users. That also means that it’s going to be an increasingly hot space, and especially look like an opportunity for companies that are already looking to host these kinds of services online like Amazon or Microsoft and have the buy-in from those businesses.

Liu, too, said that the goal of the company was to go after all potential business cases right away by creating a what-you-see-is-what-you-get one size fits all platform — which is usually called a horizontal approach. That’s often a very risky move, and it’s probably the biggest question mark for the company as there’s an opportunity for some other startups or companies to come in and grab niches of that whole pie in specific areas (like, say, a custom GUI programming interface for healthcare). But Liu said the opportunity for Airtable was to go horizontal from day one.

“There’s this assumption that software has to involve literally writing code,” Liu said. “It’s sort of a difficult thing to extricate ourselves from because we have built so much with writing code. But when you think about what goes into a useful application, especially in the business-to-business internal tools in a company use case which forms the bulk of software that’s consumed in terms of lines of code written, most of them are primarily a relational database model, and the relational database aspect of it is not an arbitrary format.

Powered by WPeMatico

The first time Waseem Daher, Jessica McKellar, and Jeff Arnold worked together on a startup, they built one that allowed administrators to patch security updates to a system without having to restart it.

So it might come as a bit of a surprise that the next big technical challenge the three MIT graduates want to tackle is bookkeeping . But after selling Ksplice to Oracle back in 2011, it was actually the financial software they had built internally that made the jaws of the finance teams at Oracle drop, Daher said. They had created a continuously-updating internal version of QuickBooks, keeping a close eye on their spending and accounting and not having do hire a bookkeeper to do so, out of pure frustration with the process. And today that’s basically launching as Pilot, a startup that has now raised $15 million in a financing round led by Index Ventures.

“If you look at the history of bookkeeping, it goes back to the 1400s,” Daher said. “Probably the oldest written records were of transactions. Around 1400s, we invented double-entry bookkeeping, a system for how money moves into and out of various accounts of companies. That system, as articulated in 1400 in Venice, is basically still what people do in every American business today. You hire a bookkeeper or bookkeeping firm, you send them all your stuff and they track and produce the set of books. The way it’s done today is the same way it’s done in the 90s, the 40s.”

When a company starts working with Pilot, the actual core experience on the customer side doesn’t really change all that much: they still work with a human on the other end. But the bookkeeper from Pilot is working with the internal tools they have built to bring in the data from the company, organize it and structure it, and produce a set of books that are more accurate than someone might have produced than just doing it by hand. Customers will get the kinds of questions you might expect from a normal bookkeeper as they look to clarify what’s happening, but in the end the process happens much more seamlessly. They can integrate directly with their existing services like Expensify or Gusto (or ask Pilot to help out with that) and then go from there.

That kind of human-software mix is something that’s increasingly common in services businesses — like Pilot — as the tech industry figures out what should be automated and what should still be handled by a person. There are still a lot of things that a person can catch, but there’s also the actual human relationship, which isn’t a kind of repetitive task you’d want to automate with an algorithm. To begin, Pilot isn’t trying to force companies to completely rip out their bookkeeping software and start from scratch, and instead start to collect the electronic information they already have.

“Uber’s like that, the drivers are humans but the software makes them much more effective,” Index Ventures’ Mike Volpi said. “You can see it in a lot of applications where in IT support there’s a few businesses like this, you troubleshoot using software, and when you can’t you fix it pass it to humans. In customer service chats, a lot of times it’s an AI, and when the questions get tricky enough it rolls over to humans. It’s interesting because there are tasks which humans are fundamentally needed and there are tasks that are mundane that software can do and the human can avoid doing. It’s an interesting thesis around this hybrid.”

Prior to Pilot, the team sold another company to Dropbox called Zulip, and spent some time at the company as it continued to scale up (Dropbox is now in the process of going public). Some of the challenge alone was somehow assembling a team that found some fascination with the intersection of accounting, machine learning and working directly with customers, but so far McKellar said that they’ve been able to put one together thus far. And, more importantly, now that they are starting to roll out their service they can start getting some perspective on the industry as a whole.

“I think people can get motivated by almost any problem if you know you’re tackling a big problem for many people,” McKellar said. “But there’s quite a lot of subtlety to what we’re building. The rules and principles of bookkeeping are well define but the real world is really messy, and designing the right systems to automate bookkeeping at scale is actually a tricky thing. We have an incredible engineering team that is able to tackle this with the right mindset it. The analogy you can draw is self-driving cars — that’s a system normally done by a human, everyone understands what it takes to drive a car, what actions you should take. It’s difficult for people to put into words, what are the rules given a set of inputs, but it needs to work and be reliable.”

As more and more of this information comes in, and more and more companies start to work with Pilot, they can start spotting trends in the industry. For example, if a 17th SaaS business with a similar business model to other Pilot companies signs up, they could down the line take a look at their info and spot potential discrepancies based on anonymized trend data picked up from other comparables in the industry — or do a better job of spotting inefficiencies or others. And there are some obvious funnels for this already, like getting the right information for tax purposes to accountants.

There’s going to be a lot of increasing activity in this space, though. Already you’re seeing some funded projects like botkeeper, which are looking to find some ways to automate a bookkeeping service. There’s nothing quite so formalized and an obvious tool that looks to take out QuickBooks (and, again, a lot of these seem to be playing nice for now), and there’s always the chance that Intuit could try to take on the space itself. But at the end of the day, Volpi says it’s based on the team that they’ve assembled — and that combination of humans and algorithms — that gives them a shot at succeeding.

“If you look at a fundamental level, the bookkeeping for the doctor’s office or florist, it is really all following the same underlying principles,” McKellar said. “One of the engineering challenges is to build the tooling and systems and software in a way that’s intelligent. It has to be a set of processes that can flexibly accommodate every vertical over time. In some sense this company, why we raised this, was to validate a huge hypothesis — it’s possible to automate bookkeeping at scale across a range of industries.”

Here’s the rest of the investors in this round, since it’s a long list: Patrick and John Collison, Drew Houston, Diane Greene, Frederic Kerrest, Hans Robertson, Adam D’Angelo, Paul English, Howard Lerman, Joshua Reeves, Tien Tzuo, as well as many others.

Powered by WPeMatico

Tandem, the U.K. challenger bank co-founded by fintech veteran Ricky Knox, continues to be a shopping spree. Following the purchase of Harrods Bank, the banking arm of the famous luxury British department store, the company is acquiring Pariti, a money management app that has garnered 95,000 users. Read More

Tandem, the U.K. challenger bank co-founded by fintech veteran Ricky Knox, continues to be a shopping spree. Following the purchase of Harrods Bank, the banking arm of the famous luxury British department store, the company is acquiring Pariti, a money management app that has garnered 95,000 users. Read More

Powered by WPeMatico

Danish startup Artland has closed $1M in seed funding for a social art marketplace app that aims to connect galleries and professional buyers. It’s also hoping to attract newcomers with an appetite to buy art but who don’t necessarily know how to go about learning about the market. Read More

Danish startup Artland has closed $1M in seed funding for a social art marketplace app that aims to connect galleries and professional buyers. It’s also hoping to attract newcomers with an appetite to buy art but who don’t necessarily know how to go about learning about the market. Read More

Powered by WPeMatico

Beijing-based bike-sharing startup Ofo has raised $866 million in new financing led by Alibaba Group to fuel its expensive competition with Mobike, which is backed by Tencent, one of Alibaba’s biggest rivals. Ofo and Mobike are the two largest bike-sharing companies in China. Read More

Beijing-based bike-sharing startup Ofo has raised $866 million in new financing led by Alibaba Group to fuel its expensive competition with Mobike, which is backed by Tencent, one of Alibaba’s biggest rivals. Ofo and Mobike are the two largest bike-sharing companies in China. Read More

Powered by WPeMatico