Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

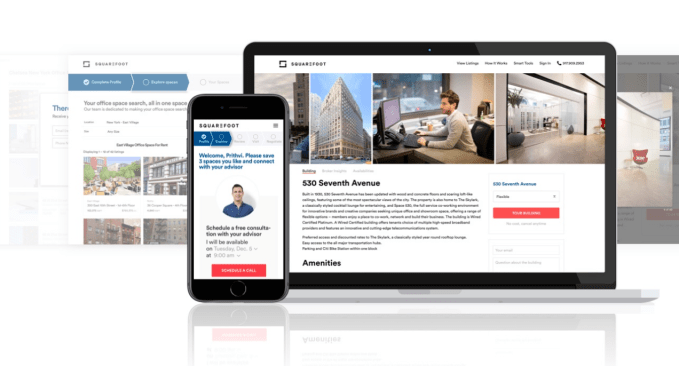

While smaller companies are seeing a lot of new options for distributed office space, or can pick up a couple offices in a WeWork, eventually they get big enough and have to find a bigger office — but that can end up as one of the weirdest and most annoying challenges for an early-stage CEO.

Finding that space is a whole other story, outside of just searching on Google and crossing your fingers. It’s why Jonathan Wasserstrum started Squarefoot, which looks to not only create a hub for these vacant offices, but also have the systems in place — including brokers — to help companies eventually land that office space. Eventually companies as they grow have to graduate into increasingly larger and larger spots, but there’s a missing sweet spot for mid-stage companies that are looking for space but don’t necessarily have the relationships with those big office brokers just yet, and instead are just looking through a friend of a friend. The company said today that it has raised $7 million in a new financing round led by Rosecliff Ventures, with RRE Ventures, Triangle Peak Partners, Armory Square Ventures, and others participating.

“If you talk to any CEO and you ask what they think about commercial real estate brokers, they’ll say, ‘oh, the guys that send an email every week,’” co-founder Jonathan Wasserstrum said. “The industry has been slow to adopt because the average person who owns the building is fine. They don’t wake up every morning and say this process sucks. But the people who wake up and say the process sucks are looking for space. That was kind of one fo the early things that we kind of figured out and focused a lot of attention on aggregating that tenant demand.

Squarefoot starts off on the buyer side as an aggregation platform that localizes open office space into one spot. While companies used to have to Google search something along the lines of “Chelsea office space” in New York — especially for early-stage companies that are just starting to outgrow their early offices — the goal is to always have Squarefoot come up as a result for that. It already happens thanks to a lot of efforts on the marketing front, but eventually with enough inventory and demand the hope is that building owners will be coming to Squarefoot in the first place. (That you see an ad for Squarefoot as a result for a lot of these searches already is, for example, no accident.)

Squarefoot is also another company that is adopting a sort of hybrid model that includes both a set of tools and algorithms to aggregate together all that space into one spot, but keep consultants and brokers in the mix in order to actually close those deals. It’s a stance that the venture community seems to be increasingly softening on as more and more companies launch with the idea that the biggest deals need to have an actual human on the other end in order to manage that relationship.

“We’re not trying to remove brokers, we have them on staff, we think there’s a much better way to go through the process,” Wasserstrum said. “When I am buying a ticket to Chicago, I’m fine going to Kayak and I don’t need a travel agent. But when I’m the CEO of a company and about to sign a three-year lease that’s a $1.5 million liability, and I’ve never done this before, shouldn’t I want someone to help me out? I do not see in the near future this e-commerce experience for commercial real estate. You don’t put it in your shopping cart.”

And, to be sure, there are a lot of platforms that already focus on the consumer side, like Redfin for home search. But this is a big market, and there already is some activity — it just hasn’t picked up a ton of traction just yet because it is a slog to get everything all in one place. One of the original examples is 42Floors, but even then that company early on faced a lot of troubles trying to get the model working and in 2015 cut its brokerage team. That’s not a group of people Wasserstrum is looking to leave behind, simply because the end goal is to actually get these companies signing leases and not just serving as a search engine.

Powered by WPeMatico

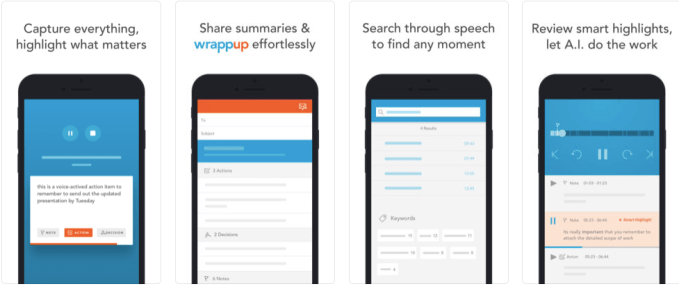

Voicera wants to be the company that eliminates the need for human note taking once and for all. Their vision is an AI-driven voice recognition system that not only takes notes, but identifies speakers and summarizes key points and action items. Today, the company announced it had acquired a similar startup, Wrappup, an AI-fueled note taking app that fits in nicely with that vision.

The Wrappup team is joining Voicera immediately. Terms were not disclosed.

Voicera CEO Omar Tawakol certainly saw the fit. “Both companies approached the problem with meetings in synergistic ways. Wrappup’s mobile-first, in-person meeting product complements and extends Voicera’s initial focus on conference calls,” he said in a statement.

Wrappup’s special strength it turns out it is identifying the salient points in a meeting in a mobile context. To that end, the company also announced the launch of a new mobile app. Chances are this combining of these two companies has been in the works for some time, and is just being made official today.

Photo: Voicera

Wrappup CEO Rami Salman says joining forces with Voicera creates a more compelling and powerful solution for customers. “Our combined tech stack and AI algorithms more accurately identify and summarize important moments from all your meetings, regardless of where they are held,” he said in a statement.

Voicera’s voice recognition tool is a cloud service called Eva. It is designed to remove the task of note taking from the meeting experience. The company got a $13.5 million Series A last month from some big-time investors, including e.ventures, Battery Ventures, GGV Capital and Greycroft. They also got some attention from enterprise corporate venture investors, including GV (the investment firm affiliated with Google), Microsoft Ventures, Salesforce Ventures and Workday Ventures. The level of these investors shows the company is attacking a real pain point for meeting attendees.

Wrappup is based in Dubai and was founded in 2015. It has raised $800,000 to date. It works with existing meeting tools, including GoToMeeting from Citrix, WebEx from Cisco, UberConference and Zoom.

Powered by WPeMatico

AJ Brustein was out spending time with a member of his merchandising team when a nearby store ran out of stock of some goods — but there was no one on staff responsible for that location. Fortunately, the employee he was with had already showed him how to restock the shelves, and he offered to peel off and do it himself.

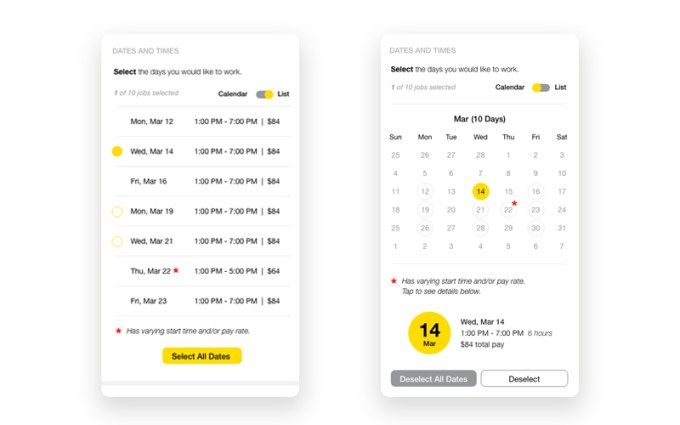

But that gap in the workforce may have just continued, leading directly to potential lost revenue for companies that sell products in those stores. That’s why Brustein and Yong Kim started Wonolo, a tool to connect companies with temporary workers in order to fill the unexpected demand those companies might face in those same out-of-stock situations. Wonolo employees sign up for the platform, and the companies that partner with the startup have an opportunity to grab the necessary workers they need on a more flexible basis. Wonolo today said it has raised $13 million in a new financing round led by Sequoia Capital, including existing investors PivotNorth and Crunchfund, and new investor Base10. Sequoia Capital’s Jess Lee is joining the company’s board of directors as part of the financing.

“There’s a big opportunity helping people fill in their schedule with shifts,” Brustein said. “We really found there’s this huge untapped market of people who are looking for work who are underemployed. Let’s say Mary is a great worker and has a great job at the Home Depot, but no matter how good she, is she can only get 29 hours of work. It’s hard to manage schedules between different employers that want you to work the same hours. That’s the market we’ve really focused on, the underemployed market, which is a growing unfortunate trend in the U.S. That’s changed a little bit about the types of jobs we have on the platform.”

Wonolo is essentially looking to replace the typical temp agency experience, which helps workers find positions with companies that need a more limited amount of time. Meanwhile, those workers get an opportunity to fill in extra shifts that they might need for additional income on a more flexible schedule. Once a company posts a job to Wonolo, employees will get notified that it’s available and then get a chance to pick up those shifts, and when the job is approved those workers get paid right away.

While the jobs that Wonolo is suited for are more along the lines of merchandising, events staff, or more general labor, the hope is that the service will also expose those employees to a variety of companies who may actually end up wanting to hire them at some point. It allows them to get a good snapshot of all the work that’s available, and theoretically would help offer them an additional step on a career path that could get them to a direct full-time job with any of the companies from which they might end up accepting jobs.

“We thought we could address [the idea of being able to deal with unpredictability] better than temp staffing, and we realized the antidote was flexibility on the worker side,” Brustein said. “We could match them with these jobs that would unpredictably pop up. When we dug into it, we realized flexibility was something that was just completely lacking for workers. We took a very different approach to the way that people will often recruit talent for staffing agencies or their own employees. We are looking at character traits.”

Wonolo was born out of Brustein and Kim’s experience at Coca-Cola, where they had an opportunity to work with a major brand for a number of years. After a while, they got an opportunity to start working on a more entrepreneurial project, and that’s when that whole merchandising scenario played out and prompted them to start working on Wonolo. That part about character traits is an important part for Wonolo, Brustein said — because as long as someone can complete a job, they don’t have to be an absolute expert, as long as they are there ready and good to go.

There are, of course, companies trying to create platforms for temporary workers, like TrueBlue, and Brustein said Wonolo will inevitably have to compete with more local players as it looks to expand. But the hope is that aiming to tap the same kind of flexibility that made Uber so popular for temporary staffers — and potentially that pathway to a big career opportunity — will be one that attracts them to their service.

Powered by WPeMatico

According to Parsley Health, the average adult spends 19 minutes with their physician every year. Seventy percent of the time, these short visits result in the prescription of a medication.

“According to the CDC, 70% of diseases in our country are chronic and lifestyle-driven,” said Parsley Health founder and CEO Dr. Robin Berzin. “And yet instead of addressing the root causes of health problems, medicine’s toolkit is limited to prescriptions and procedures, driving up costs while the average person gets sicker. The answer isn’t just another pill.”

Parsley Health, an annual membership service ($150/month), reimagines what medicine can be. The company focuses on the cause of an illness rather than simply throwing Band-Aids at the problem. But in order to do this, your doctor needs far more than 19 minutes of your time each year.

Today, Parsley announced the close of a $10 million Series A funding led by FirstMark Capital, with participation from Amplo, Trail Mix Ventures, Combine and The Chernin Group. Individual investors such as Dr. Mark Hyman, M.D., director of the Cleveland Clinic Center for Functional Medicine; Nat Turner, CEO of Flatiron Health; Neil Parikh, co-founder of Casper; and Dave Gilboa, co-founder of Warby Parker, also invested in the round.

As part of the financing, FirstMark Capital partner Catherine Ulrich will join the board.

Here’s how Parsley works:

When a user first signs up online, they enter in a wide range of data about themselves, from family health history to past procedures to symptoms and lifestyle. The user then schedules their first visit with their new doctor, which will last for 75 minutes, during which time the doctor will exhaustively go through that information to download a full picture of that patient’s health.

After that visit, the user has full transparency into their medical data and the doctor’s notes. The patient also leaves with a health plan, including lifestyle nutritional advice, and access to their own health coach. Parsley also writes prescriptions, when necessary, and refers patients to top-of-the-line specialists, if needed.

Membership includes five annual visits with their doctors (which rounds out to about four hours), as well as five sessions with their certified health coach. These coaches help patients stay on their health plan, whether it’s advice on physical exercise or getting better sleep or finding take-out places and menu items near their office to eat healthier meals.

Throughout a patient’s membership, they have full access to their medical data and doctor’s notes online, as well as unlimited direct messaging with their doctor. At Parsley, there is always a doctor on call to answer questions about semi-urgent issues like a UTI or a sinus infection.

All of Parsley’s doctors and health coaches are full-time employees at Parsley, and Dr. Berzin told TechCrunch that the company sees a lot of inbound from doctors who want to spend more time with patients and help solve the root of their problems.

Parsley also trains their doctors in functional medicine, which uses a systems-biology approach to better resolve and manage modern chronic disease, as part of Parsley’s clinical fellowship, where they are trained in evaluating thousands of biomarkers to diagnose and treat diseases at their origin.

Parsley is not the first in the space. Forward and One Medical also look to change the way that healthcare is provided in this country, while NextHealth Technologies is focused on supplemental treatments like IV treatments and cryo.

“When I tell people about Parsley, they say ‘wow! That’s what medicine should be’,” said Dr. Berzin. “People are really searching for something better than feeling like they’re paying more and more for healthcare while getting less and less. People are excited to invest in their health and wellness and to have a team that’s working to care for them.”

Parsley has clinics in San Francisco, New York and Los Angeles.

Editor’s Note: An earlier version of this article incorrectly stated that Parsley Health costs $150/year.

Powered by WPeMatico

When you’re raising venture capital, it helps if you’ve had “exits.” In other words, if your company has been acquired or you’ve taken one public, investors are more inclined to take a bet on anything you do.

Boston -based serial entrepreneur David Cancel has sold not just one, but four companies. And after a few years running product for HubSpot, he’s in the midst of building number five.

That startup, Drift, managed to raise $47 million in its first three years. Now it’s announcing another $60 million led by Sequoia Capital, with participation from existing investors CRV and General Catalyst. The valuation is undisclosed.

So what is Drift? It’s “changing the way businesses buy from businesses,” said Cancel. He wants to eventually build an alternative to Amazon to make it easier for companies to make large orders.

Currently, Drift subscribers can use chatbots to help turn web visits into sales. It has 100,000 clients including Zenefits, MongoDB, Zuora and AdRoll.

Drift “turns those conversations into customers,” Cancel explained. He said that technology is comparable to what is commonly used for customer service. It’s the “same messaging that was used for support, but used in the sales context.”

In the long-run, Cancel says he hopes Drift will expand its offerings to compete with Salesforce.

The company wouldn’t disclose revenue, but says it is ten times better compared to whatever it was in the past year. And it’s on track to grow another five times this year. This, of course, means little without hard numbers.

Yet we’re told that the new round means that Drift will have $90 million in the bank. It plans to use some of the funding to make acquisitions in voice and video technology. Drift also plans to expand its teams in both Boston and San Francisco, with new offices for both. The company presently has 130 employees.

Powered by WPeMatico

Pluralsight, the Utah-based education technology company, has revealed its IPO filing.

Given the timing of the unveiling, the company is likely targeting a May public debut.

Its core business is online software development courses, helping people improve their skills in categories like IT, data and security. Businesses small and large pay Pluralsight to help train their employees. It also has offerings for individual subscribers.

In the filing, the company acknowledges that it is a competitive landscape, and names Cornerstone OnDemand, Udacity, Udemy, LinkedIn Learning as others in a comparable market. It also mentions General Assembly, which was recently acquired by Adecco for $413 million.

This is the first glimpse we get at Pluralsight’s financials. For 2017, the company brought in $166.8 million in revenue, up from $131.8 million in 2016 and $108.4 million in 2015.

Losses are growing, however. This is partly due to a sizeable increase in sales and marketing expenditures. For 2017, the company lost $96.5 million. This is up from losses of $20.6 million in 2016 and $26.4 million in 2015.

Pluralsight has been around since 2004. Like many startups outside of the San Francisco Bay Area, the company bootstrapped its business and didn’t raise significant outside funding until 2013. Pluralsight previously raised nearly $200 million in financing.

The largest shareholder is Insight Venture Partners, which owned 46.1 percent of the shares prior to the IPO, an unusually high percentage. Co-founder and CEO Aaron Skonnard owned 13.4 percent and investment group ICONIQ owned 8.1 percent.

Morgan Stanley and J.P. Morgan served as lead underwriters. Wilson Sonsini and Goodwin Procter served as counsel.

Pluralsight plans to list on the Nasdaq under the ticker “PS.”

A provision in the JOBS Act from 2012 helped make it so that companies could file confidentially and then reveal financials and other business information just weeks before making public debuts. This helps companies avoid too much scrutiny in the months leading up to an IPO. There is also a quiet period in this time, meaning that companies are limited in what they can say publicly about their businesses.

Like most tech companies, Pluralsight chose to take advantage of this confidential filing provision. But it also announced that it filed, something that companies don’t usually do. Most choose to stay quiet about IPO plans until they make the filings public, unless reporters break the news first.

It was no surprise to those who have been following Utah’s tech scene that Pluralsight is planning to list on the stock market this year. The venture-backed “unicorn” has been a late-stage company for several years now, with a reported valuation of $1 billion as of 2014.

After a slow first couple of months, there has been a flurry of tech IPO activity in recent weeks. Dropbox, Spotify and Zuora recently debuted. Pivotal, Smartsheet and Carbon Black are amongst the companies expected to list in the coming weeks.

Powered by WPeMatico

More devices are coming onto the Internet every single day, and that’s especially true within organizations that have a fleet of devices with access to sensitive data — which means there are even more holes for potential security breaches.

That’s the goal of Kolide. The aim is to ensure that companies have access to tools that give them the ability to get a thorough analysis of every bit of data they have — and where they have it. The Kolide Cloud, its initial major rollout for Mac and Linux devices, turns an entire fleet of apps and devices into what’s basically a table that anyone can query to get an up-to-date look at what’s happening within their business. Kolide looks to provide a robust set of tools that help analyze that data. By doing that, companies may have a better shot at detecting security breaches that might come from even mundane miscalculations or employees being careless about the security of that data. The company said today it has raised $8 million in new venture financing in a round led by Matrix Partners.

“It’s not just an independent event,” Kolide CEO Jason Meller said. “The way I think about it, if you look at any organization, there’s a pathway to a massive security incident, and the pathway is rather innocuous. Let’s say I’m a developer that works at one of these organizations and I need to fix a bug, and pull the production database. Now I have a laptop with this data on this, and I did this and didn’t realize my disk wasn’t encrypted. I went from these innocuous activities to something existentially concerning which could have been prevented if you knew which devices weren’t encrypted and had customer data. A lot of organizations are focused on these very rare events, but the reality is the risk that they face is mishandling of customer data or sensitive information and not thinking about the basics.”

Kolide is built on top of Osquery, a toolkit that allows organizations to essentially view all their devices or operations as if it were a single database. That means that companies can query all of these incidents or any changes in the way employees use data or the way that data is structured. You could run a simple select query for, say, apps and see what is installed where. It allows for a level of granularity that could help drill down into those little innocuous incidents Meller talks about, but all that still needs some simpler approach or interface for larger companies that are frantically trying to handle edge cases but may be overlooking the basics.

Like other companies looking to build a business on top of open source technology, the company looks to offer ways to calibrate those tools for a company’s niche needs that they necessarily don’t actively cover. The argument here is that by basing the company and tools on open source software, they’ll be able to lean on that community to rapidly adapt to a changing environment when it comes to security, and that will allow them to be more agile and have a better sales pitch to larger companies.

There’s going to be a lot of competition in terms of application monitoring and management, especially as companies adopt more and more devices in order to handle their operations. That opens up more and more holes for potential breaches, and in the end, Kolide hopes to create a more granular bird’s-eye view of what’s happening rather than just creating a flagging system without actually explaining what’s happening. There are some startups attacking device management tools, like Fleetsmith does for Apple devices (which raised $7.7 million), and to be sure provisioning and management is one part of the equation. But Kolide hopes to provide a strong toolkit that eventually creates a powerful monitoring system for organizations as they get bigger and bigger.

“We believe data collection is an absolute commodity,” Meller said. “That’s a fundamentally different approach, they believe the actual collection tools are proprietary. We feel this is a solved problem. Our goal isn’t to take info and regurgitate it in a fancy user interface. We believe we should be paid based on the insights and help manage their fleet better. We can tell the whole industry is swinging this way due to the traction OSQuery had. It’s not a new trend, it’s really the end point as a result of companies that have suffered from this black box situation.”

Powered by WPeMatico

Zuroa’s founder and CEO Tien Tzuo had a vision of a subscription economy long before most people ever considered the notion. He knew that for companies to succeed with subscriptions, they needed a bookkeeping system that understood how they collected and reported money. The company went public yesterday, another clear sign post on the road to SaaS maturation.

Tzuo was an early employee at Salesforce and their first CMO. He worked there in the early days in the late 90s when Salesforce’s Marc Benioff famously rented an apartment to launch the company. Tzuo was at Salesforce 9 years, and it helped him understand the nature of subscription-based businesses like Salesforce.

“We created a great environment for building, marketing and delivering software. We rewrote the rules, the way it was built, marketed and sold,” Tzuo told me in an interview in 2016.

He saw a fundamental problem with traditional accounting methods, which were designed for selling a widget and declaring the revenue. A subscription was an entirely different model and it required a new way to track revenue and communicate with customers. Tzuo took the long view when he started his company in early 2007, leaving a secure job at a growing company like Salesforce.

He did it because he had the vision, long before anyone else, that SaaS companies would require a subscription bookkeeping system, but before long, so would other unrelated businesses.

As he put it in that 2016 interview, if you commit to pay me $1 for 10 years, you know that $1 was coming in come hell or high water, that’s $10 I know I’m getting, but I can’t declare the money until I get it. That recurring revenue still has value though because my investors know that I’m secure for 10 years, even though it’s not on the books yet. That’s where Zuora came in. It could account for that recurring revenue when nobody else could. What’s more, it could track the billing over time, and send out reminders, help the companies stay engaged with their customers.

Photo: Lukas Kurka/Getty Images

As Ray Wang, founder and principal analyst at Constellation Research put it, they pioneered the whole idea of a subscription economy, and not just for SaaS companies. Over the last several years, we’ve heard companies talking about selling services and SLAs (service/uptime agreements) instead of a one-time sale of an item, but not that long ago it wasn’t something a lot of companies were thinking about.

“They pioneered how companies can think about monetization,” Wang said. “So large companies like a GE could go from selling a wind turbine one time to selling a subscription to deliver a certain number of Kw/hr of green energy at peak hours from 1 to 5 pm with 98 percent uptime.” There wasn’t any way to do this before Zuora came along.

Jason Lemkin, founder at SaaStr, a firm that invests in SaaS startups, says Tzuo was a genuine visionary and helped create the underlying system for SaaS subscriptions to work. “The most interesting part of Zuora is that it is a “second” order SaaS play. It could only thrive once SaaS became mainstream, and could only scale on top of other recurring revenue businesses. Zuora started off as a niche player helping SaaS companies do billing, and it dramatically expanded and thrived as SaaS became … Software.”

When he launched the company in 2007, perhaps he saw that extension of his idea out on the distant horizon. He certainly saw companies like Salesforce needing a service like the one he had decided to create. The early investors must have recognized that his vision was early and it would take a slow, steady climb on the way to exiting. It took 11 years and $242 million in venture capital before they saw the payoff. The revenue after 11 years was a reported $167 million. There is plenty of room to grow.

But yesterday the company had its initial public offering, and it was by any measure a huge success. According TechCrunch’s Katie Roof, “After pricing its IPO at $14 and raising $154 million, the company closed at $20, valuing the company around $2 billion.” Today it was up a bit more as of this writing.

When you consider the Tzuo’s former company has become a $10 billion company, that companies like Box, Zendesk, Workday and Dropbox have all gone public, and others like DocuSign and Smartsheet are not far behind, it’s pretty clear that we are in a golden age of SaaS — and chances are it’s only going to get better.

Powered by WPeMatico

While companies’ operations become increasingly fragmented into a wide variety of different spots — especially if they exist somewhere in a group of different cloud tools — making sure those operations are still healthy has become more and more critical.

And for companies whose lifeblood is directly keeping that software online longer, it’s even more important. Uptime maps directly to revenue, and that’s why Caleb Hailey — who previously worked on this as a consultancy — decided to start Sensu to try to piece together the monitoring operations into a single spot where a company can keep an eye on the health of their operations. The company said it has raised $10 million in a new financing round led by Battery Ventures, with existing investor Foundry Group participating. Battery’s General Partner Dharmesh Thakker is joining the company’s board of directors.

“Big enterprises are hesitant to work on startups, they’re risk averse, and it reduces the risk exposure to double down on an open source stack,” Hailey said. ” But this open source technology, it’s used in the largest institutions in the world, and we have found that by delivering cost savings in a competitive market we have already established a rapidly growing developer stream.”

While all those different tools may have their own way of monitoring the health of a system, Sensu tries to get all this into one place to make things a little easier than checking things one-by-one. The aim is to be more proactive and try to flag problems before they are even noticed by the people using Sensu, plugging directly into services like Slack or sending emails to flag potential issues before they end up becoming larger problems. Like others like Cloudera, Sensu builds its business around helping companies deploy this otherwise open source technology efficiently.

Sensu’s backstory starts as a consultancy for Hailey, which was focused on infrastructure and automation — especially as more and more companies moved to a hybrid cloud model that existed partially in some box somewhere on Azure or AWS. Starting off as an open source project is one way that he hopes to convince larger enterprises that might already be using similar tools to adopt a known entity rather than just giving some random startup the keys to maintaining their operations.

The monitoring space is still a competitive — and crowded — one. There are tools like AppDynamics or New Relic, but Hailey argues that Sensu can be competitive with those as they are very bundled while his startup helps companies piece together a more complete solution. For example, a company might need higher granularity in their reports, and Sensu aims to try to provide a robust toolkit for companies that have many disparate operations they need to keep online and running smoothly.

Powered by WPeMatico

Subscription biller Zuora was well-received by stock market investors on Thursday, following its public debut. After pricing its IPO at $14 and raising $154 million, the company closed at $20, valuing the company around $2 billion.

It was also much higher than expected. The company said in its filings that it planned to price its shares between $9 and $11, before it raised that range to $11 to $13.

Founder and CEO Tien Tzuo told TechCrunch that he believes “a bet on us is really a bet on an entire shift to a new business model, to a subscription economy.” He is optimistic that subscriptions are the “business model of the future.”

Zuora sees itself as an early pioneer in a growing category. The company believes that more businesses will shift their business models to subscriptions, across sectors like media and entertainment, transportation, publishing, industrial goods and retail.

It helps its 950 customers manage subscriptions, including billing and revenue recognition. Zuora touts that it has 15 of the Fortune 100 businesses as clients.

Zuora’s revenue for its fiscal 2018 year was $167.9 million. This was up from $113 million in 2017 and $92.2 million the year before. Losses remained constant in this time frame, from $48.2 million in 2016 to $47.2 million in 2018.

“We have a history of net losses, anticipate increasing our operating expenses in the future, and may not achieve or sustain profitability,” warned the requisite risk factors section of the filing.

It also acknowledged a competitive landscape. Oracle and SAP are amongst the companies offering software in the ERP (enterprise resource planning) category. It also competes with other startups like Chargebee and Chargify.

The largest shareholders are Benchmark, which owned 11.1 percent prior to the IPO. Founder and CEO Tien Tzuo owned 10.2 percent. Others with a significant stake included Wellington Management, Shasta Ventures, Tenaya Capital and Redpoint.

The San Mateo, Calif.-based company previously raised more than $240 million, dating back to 2007.

Zuora listed on the New York Stock Exchange, under the ticker “ZUO.” Goldman Sachs and Morgan Stanley worked as lead underwriters on the deal. Fenwick & West and Wilson Sonsini served as counsel.

After a slow start to the year for tech IPOs, there has been a flurry of activity in recent weeks. Dropbox and Spotify were amongst the recent public debuts. We also have DocuSign, Pivotal and Smartsheet on the horizon.

Powered by WPeMatico