Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

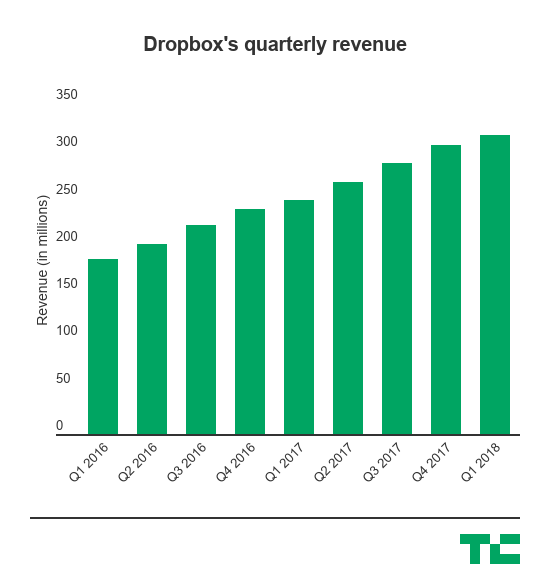

Dropbox made its debut as a public company earlier this year and today passed through its first milestone of reporting its results to public investors, and it more or less beat expectations set for Wall Street on the top and bottom line.

The company reported more revenue and beat expectations for earnings that Wall Street set, bringing in $316.3 million in revenue and appearing to pick up momentum among its paying user base. It also said it had 11.5 million paying users, a jump from last year. However, the stock was largely flat in extended trading. One small negative signal — and it definitely appears to be a small one — was that its GAAP gross margin slipped slightly to 61.9% from 62.3% a year earlier. Dropbox is a software company that’s supposed to have great margins as it begins to ramp up its own hardware, but that slipping margin may end up being something that investors will zero in on going forward. Still, as the company continues to ramp up the enterprise component of its business, the calculus of its business may change over time.

This is a pretty important moment for the company, as it was a darling in Silicon Valley and rocketed to a $10 billion valuation in the early phases of the Web 2.0 era but began to face a ton of criticism as to whether it could be a robust business as larger companies started to offer cloud storage as a perk and not a business. Dropbox then found itself going up against companies like Box and Microsoft as it worked to create an enterprise business, but all this was behind closed doors — and it wasn’t clear if it was able to successfully maneuver its way into a second big business. Now the company is beholden to public shareholders and has to show all this in the open, and it serves as a good barometer of not just storage and collaboration businesses, but also some companies that are looking to drastically simplify workflow processes and convert that into a real business (like Slack, for example).

Here’s the final scorecard for the company:

(The GAAP and non-GAAP comparison is typically related to share-based compensation, which is a key component of employee compensation and retention.)

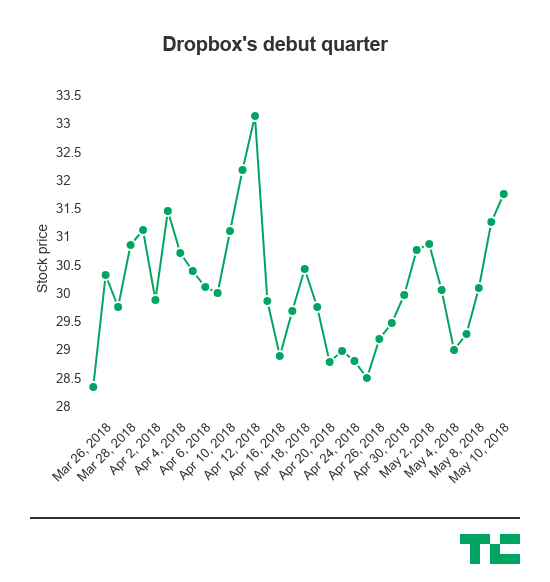

Dropbox was largely considered to be a successful IPO, rising more than 40% in its trading debut. That does mean that it may have left some money on the table, but its operating losses have been largely stable, even as it looks to woo larger enterprise customers as it — which is a bit of a taller order than its typical growth amid consumers that’s heavily driven by organic growth. Those larger enterprise customers offer more stable, and larger, revenue streams than a consumer base that faces a variety of options as many companies start to offer free storage. The company is now worth well over that original $10 billion valuation as a public company. Dropbox says it has more than 500 million users.

Since going public, the stock has had its ups and downs, but for the most part hasn’t dipped below that significant jump it saw from day one. Keeping that number propped up — and growing — is an important part of growing a business as a public company as it waves off more intense scrutiny and pressure for change from public shareholders, as well as offering competitive compensation packages for incoming employees in order to attract the best talent. It’s also good for morale as it offers a kind of grade for how the company is doing in the eyes of the public, though CEOs of companies often say they are committed toward long-term goals. The company’s shares are up around 11% since going public.

While there have been a wave of enterprise IPOs this year, including zScalar and Pluralsight’s upcoming IPO, Dropbox was largely considered to be a potential gauge of whether the IPO window was still open this year because of its hybrid nature. Dropbox started off as a consumer company based around a dead-simple approach of hosting and sharing files online, and used that to build a massive user base even as the cost of cloud storage was rapidly commoditized. But it also is building a robust enterprise-focus business, and continues to roll out a variety of tools to woo those businesses with consistent updates to products like its document tool Paper. Last month, the company started rolling out templates, as it looked to make traditional workflow processes easier and easier for companies in order to capture their interest much in the same way it captured the interest of consumers at large.

Powered by WPeMatico

Robinhood started off as a dead-simple stock trading application that had no transaction fees — but since it’s continued to grow, and especially as it starts to dive into cryptocurrency, investors are getting pretty excited about its prospects and are pouring a ton of new funding into it.

And it’s that tantalizing prospect of creating a next generation way of trading assets and cryptocurrency that is now sending Robinhood to a $5.6 billion valuation in a new financing round that the company is announcing today. Robinhood says it’s closed a $363 million Series D financing round; DST Global led this new round and Iconiq, Kleiner Perkins, Sequoia and Capital G participated. Robinhood had a $1.3 billion valuation last year when it had around 2 million users, and the company says it now has 4 million users and has passed $150 billion in transaction volume.

“It’s the only place right now where you can trade crypto, stocks, and options all in one place,” CEO Vlad Tenev said. “For us to construct an experience that feels seamless and natural for customers, that for example want to sell an equity and use the proceeds to buy crypto, seamlessly, that’s been challenging not just from a product and design standpoint, but also infrastructure standpoint. There’s complexity under the hood, and our goal is to make it as seamless as possible in the process and make that complexity go away.”

Those 4 million users — and that valuation — indicates that Robinhood has clearly exposed a lot of demand for an easier way for users to dip their toes into financial services without having to work with firms that have trading fees like Scottrade or E*Trade. And while there are a lot of services that offer robo-advisory services like Betterment and Wealthront, which make it easier to start investing small amounts of money, Robinhood offers users the opportunity to do these things at a more granular level.

And, of course, there’s the cryptocurrency aspect that is clearly spurring a lot of interest in the company. At the time, 1 million users waitlisted for access in just the five days after Robinhood Crypto was announced. Robinhood has premium services like Robinhood Gold, where the company can find additional ways to generate revenue that offset the requirements of running a system that allows users to trade stocks for free. Robinhood has raised $539 million to date, as diving into financial services can be an expensive prospect, as well as getting enough users on board to the point that it can scale to a level that the business starts to increasingly make sense.

Robinhood’s crypto trading service came out in February and by today, the company says it’s available in 10 states. The company also rolled out a web version and stock option trading, trying to become a more robust financial services company that’s still tuned to a younger generation that wants an easier way to get into investing without needing a big balance to invest. Most of Robinhood’s users, too, aren’t so-called “day traders” and are instead holding stocks for a while after they buy them.

“If you look at the data and the statistics, people that are active day traders are actually a very small percentage of our space,” Tenev said. “People that are actually transacting on that cadence are the minority of our customers. Most of our customers engage in more of these buy and hold accumulation strategies. We really see a lot of unique things because we don’t charge trading commissions. There are customers that deposit money regularly twice or once a month and then buy stocks as soon as those deposits come in. We don’t see a lot of customers that are doing rapid buying and selling.”

Still, as it tries to further expand — especially into products like crypto and new regions — it’s going to increasingly find itself trying to jump hurdles that financial services companies find when going abroad. And there’s always a chance that the trading platforms will try to become a little more competitive (and companies like Square are even getting into Bitcoin trading). That’s going to require a robust amount of funding to try to outmaneuver well-capitalized companies that might already have those relationships in place to more easily expand.

“The political climate is uncertain, it sort of affects everyone, it doesn’t affect us uniquely,” Tenev said. “We’re a crypto business now. Not a lot of people have a ton of clarity on what that’s gonna look like in the future, it’s a new space that’s evolving really rapidly. I think that we’re confident we can adapt and evolve, and we’re operating the business in a responsible way. There’s only so much you can do, but I feel like we’ve done a lot to address any concerns.”

Powered by WPeMatico

Google announced today it was going to acquire Israeli cloud migration startup, Velostrata. The companies did not share the purchase price.

Velostrata helps companies migrate from on-premises datacenters to the cloud, a common requirement today as companies try to shift more workloads to the cloud. It’s not always a simple matter though to transfer those legacy applications, and that’s where Velostrata could help Google Cloud customers.

As I wrote in 2014 about their debut, the startup figured out a way to decouple storage and compute and that had wide usage and appeal. “The company has a sophisticated hybrid cloud solution that decouples storage from compute resources, leaving the storage in place on-premises while running a virtual machine in the cloud,” I wrote at the time.

But more than that, in a hybrid world where customer applications and data can live in the public cloud or on prem (or a combination), Velostrata gives them control to move and adapt the workloads as needed and prepare it for delivery on cloud virtual machines.

“This means [customers] can easily and quickly migrate virtual machine-based workloads like large databases, enterprise applications, DevOps, and large batch processing to and from the cloud,” Eyal Manor VP of engineering at Google Cloud wrote in the blog post announcing the acquisition.

This of course takes Velostrata from being a general purpose cloud migration tool to one tuned specifically for Google Cloud in the future, but one that gives Google a valuable tool in its battle to gain cloud marketshare.

In the past, Google Cloud head Diane Greene has talked about the business opportunities they have seen in simply “lifting and shifting” data loads to the cloud. This acquisition gives them a key service to help customers who want to do that with the Google Cloud.

Velostrata was founded in 2014. It has raised over $31 million from investors including Intel Capital and Norwest Venture partners.

Powered by WPeMatico

Treating issues with mental health can be a daunting and very sensitive task for anyone that is suffering from any kind of mental illness — but the problem for many is that a lot of patients just don’t know where to start, according to David Ebersman.

That’s where Lyra Health hopes to help. The service works with employers to offer a tool to their employees that helps them securely and confidentially begin to understand what kind of treatment they need to seek if they feel like they are suffering from any mental health problems. Employers naturally have a stake in this as they want their employees to stay health, but the goal is to offer a sort of safe space where users can benefit from years of growth in pattern matching and data to help them figure out where to start. The company said it has raised $45 million in a new financing round including Tenaya Capital, Glynn Capital Partners, Crown Ventures, and Casdin Capital. Existing investors that include Greylock Partners, Venrock, and Providence Ventures also participated in the funding round.

“We felt it was important to build an offering that would be helpful to all of the people who work at these companies and are suffering from a mental health condition like depression, or anxiety, or substance abuse,” Ebersman said. “A lot of the people we want to help don’t know where they’re starting. Trying to build and market something narrowly to a subset of the audience requires the audience to know they’re in that subset. Trying to build something more welcoming and engaging for a broader set of conditions felt to us to be a realistic response to the fact that not everyone can self identify. Fortunately technology really helps us with this — we can build a secure and confidential place where an employee can go and answer some questions that relate to their symptoms, severity, treatment preferences and use technology to match them for the right care.”

Lyra Health first starts off working with employers to figure out a plan to communicate to employees that the tool actually exists. But that’s one of the biggest challenges, as mental health issues — like anxiety or depression — can be very sensitive subjects for employees. Lyra Health has to work with employers to convince to give them confidence to explore it as a safe and confidential place, where they can put in information about some of their symptoms while feeling like that information is going to be locked down.

From there, Lyra takes a close look at that data and then build a set of recommendations for the patients based on what they think some of their symptoms correlate to. Lyra Health has a network of around 2,500 therapists, most of which don’t participate in traditional health plans, Ebersman said. Lyra Health then connects patients with those therapists, and they can schedule the appointment online and get started right away. Lyra Health then periodically checks in with the patients to see how they are doing and ensuring they feel like they are getting better — another data point that helps the company figure out if its recommendations are working.

“We really believed that the experience that we give to patients today could be dramatically improved,” Ebersman said. “This is part of the healthcare system that’s really hard to understand, it’s hard to navigate, and there are a bunch of different types of solutions for a variety of different conditions. We felt that trying to build a comprehensive solution that would make it easy for clients to find the care that was matched correctly to their needs and preferences was a tech problem we could start grappling right away.”

Ebersman previously oversaw the initial public offering of Facebook as its CFO, but the challenge Lyra Health entails is one that may be just as complex. Not only does the company have to establish and maintain that network of high-quality doctors and therapists, it also has to ensure that it builds and maintains a robust data set that ensures that its recommendations are actually on point — and get better over time. If it ends up as a bad product, employees won’t use it, and the recommendations can’t improve at any point. And amid all of this, the experience has to feel like a good and approachable one, even though it’s partially tackled through machine learning.

“I think we are able to successfully communicate to employees what Lyra does in a way that doesn’t seem intimidating or stigmatized,” Ebersman said. “I think the experience of exploring what your care options are using technology is a little easier for people. I think there are places where technology plays a critical role in this journey. One is creating a safe environment where you can dip your toe in the water. I also think a technology based experience can give you confidence that the best care for what you need is out there. I do believe that for most people in the care journey, interacting with a human who is warm and who you can relate to, and who has skills to help you, improve is an important piece. But if you think comprehensively from the beginning to the end of someone’s care journey, there’s a critical set of roles technology can play to ensure that more people engage and have a better experience.”

Ebersman hopes Lyra Health is riding a wave of increased awareness and attention for mental health. That could encompass anything from apps like Lyra Health to companies that are focusing on wellness like meditation apps like Calm (which is reportedly valued over $250 million). All of these companies have been able to raise pretty significant rounds of financing, but it also means that there will be a lot of activity — and a bit of a race to get adoption and build up the kind of robust data sets you need to have a formal defensibility in the marketplace. There are other approaches to mental health like Huddle, but the trick will be figuring out how to get people on board and spin up that flywheel that will make the experience better and better.

” Many people with mental health conditions don’t ever engage with the system, or if they do, are quickly intimidated with how confusing and frustrating it can be,” he said. “We believe if we build a simple and warm tech-based experience that’s confidential and secure, we can get more people engaged with the mental health system. Our engagements are about seven times higher than the companies were seeing with the solutions they had before they launched Lyra.”

Powered by WPeMatico

As SoundHound looks to leverage its ten-plus years of experience and data to create a voice recognition tool that companies can bake into any platform, it’s raising another big $100 million round of funding to try to make its Houndify platform a third neutral option compared to Alexa and Google Assistant.

While Amazon works to get developers to adopt Alexa, SoundHound has been collecting data since it started as an early mobile app for the iPhone and Android devices. That’s given it more than a decade of data to work with as it tries to build a robust audio recognition engine and tie it into a system with dozens of different queries and options that it can tie to those sounds. The result was always a better SoundHound app, but it’s increasingly started to try to open up that technology to developers and show it’s more powerful (and accurate) than the rest of the voice assistants on the market — and get them to use it in their services.

“We launched [Houndify] before Google and Amazon,” CEO Keyvan Mohajer said. “Obviously, good ideas get copied, and Google and Amazon have copied us. Amazon has the Alexa fund to invest in smaller companies and bribe them to adopt the Alexa Platform. Our reaction to that was, we can’t give $100 million away, so we came up with a strategy which was the reverse. Instead of us investing in smaller companies, let’s go after big successful companies that will invest in us to accelerate Houndify. We think it’s a good strategy. Amazon would be betting on companies that are not yet successful, we would bet on companies that are already successful.”

This round is all coming in from strategic investors. Part of the reason is that taking on these strategic investments allows SoundHound to capture important partnerships that it can leverage to get wider adoption for its technology. The companies investing, too, have a stake in SoundHound’s success and will want to get it wherever possible. The strategic investors include Tencent Holdings Limited, Daimler AG, Hyundai Motor Company, Midea Group, and Orange S.A. SoundHound already has a number of strategic investors that include Samsung, NVIDIA, KT Corporation, HTC, Naver, LINE, Nomura, Sompo, and Recruit. It’s a ridiculously long list, but again, the company is trying to get that technology baked in wherever it can.

So it’s pretty easy to see what SoundHound is going to get out of this: access to China through partners, deeper integration into cars, as well as increased expansion to other avenues through all of its investors. Mohajer said the company could try to get into China on its own (or ignore it altogether), but there has been a very limited number of companies that have had any success there whatsoever. Google and Facebook, two of the largest technology companies in the world, are not on that list of successes.

“China is a very important market, it’s very big and has a lot of potential, and it’s growing,” Mohajer said. “You can go to Canada without having to rethink a big strategy, but China is so different. We saw even companies like Google and Facebook tried to do that and didn’t succeed. When those bigger companies didn’t succeed, it was a signal to us that strategy wouldn’t work. [Tencent] was looking at the space and they saw we have the best technology in the world. They appreciated it and were respectful, they helped us get there. We looked at so many partners and [Tencent and Midea Group] were the ones that worked out.”

The idea here is that developers in all sorts of different markets — whether that’s cars or apps — will want to have some element of voice interaction. SoundHound is betting that companies like Daimler will want to control the experience in their cars, and not be saying “Alexa” whenever they want to make a request while driving. Instead, it may come down to something as simple as a wake word that could change the entire user experience, and that’s why SoundHound is pitching Houndify as a flexible and customizable option that isn’t demanding a brand on top of it.

SoundHound still does have its stable of apps. The original SoundHound app is around, though those features are also baked into Hound, its main consumer app. That is more of a personal assistant-style voice recognition service where you can string together a sentence of as many as a dozen parameters and get a decent search result back. It’s more of a party trick than anything else, but it is a good demonstration of the technical capabilities SoundHound has as it looks to embed that software into lots of different pieces of hardware and software.

SoundHound may have raised a big round with a fresh set of strategic partners, but that certainly doesn’t mean it’s a surefire bet. Amazon is, after all, one of the most valuable companies in the world and Alexa has proven to be a very popular platform, even if it’s mostly for nominal requests and listening to music (and party tricks) at this point. SoundHound is going to have to convince companies — small and large — to bake in its tools, rather than go with massive competitors like Amazon with pockets deep enough to buy a whole grocery chain.

“We think every company is going to need to have a strategy in voice AI, jus like ten years ago everyone needed a mobile strategy,” Mohajer said. “Everyone should think about it. There aren’t many providers, mainly because it takes a long time to build the core technology. It took us 12 years. To Houndify everything we need to be global, we need to support all the main languages and regions in the world. We built the technology to be language independent, but there’s a lot of resources and execution involved.”

Powered by WPeMatico

Startup life is nothing if not full of ups and downs. On the up this week is Cera, the London-based homecare startup advised by former Deputy Prime Minister Sir Nick Clegg, which today is announcing $17 million in Series A funding. Investing in the round is Guinness Asset Management (via its EIS fund), Yabeo (which is also the lead investor in Germany’s biggest care supply company Pflegebox), and Kairos. In addition, a number of Cera’s seed backers have followed on.

Contrast that with last week when a Bloomberg report alleged that fake reviews of Cera had been posted to third-party websites, such as TrustPilot — allegedly written by “Cera Care employees or people close to them” — and that at the time of its report some non-existent or expired NHS partnerships were incorrectly listed on Cera’s website.

The same report also revealed that Cera — which makes a virtue of its ability to collect and take actions on client data — wasn’t registered with the U.K. data regulator, the Information Commissioner’s Office (ICO), before February this year, although the company tells TechCrunch it began the process a year earlier. Either way, the startup launched as early as November 2016 and therefore was likely operating for a period without the proper data regulation.

Addressing the alleged fake reviews, and alleged misrepresentation of some NHS partnerships, Cera issued TechCrunch with the following statement:

“We have looked into this, and TrustPilot have removed unverified reviews. We pride ourselves on delivering outstanding, high-quality care, which is demonstrated through our platform’s automated customer feedback, which remains at a 95% satisfaction rate.

“Contrary to certain statements in recent press articles, we have partnered with several NHS organisations over the past year, successfully delivering NHS-funded and referred care services. In 2018 we have delivered NHS CCG funded care with the following CCGs: Lambeth, Tower Hamlets, Haringey, Enfield, and previously had partnered with CCGs including Brent, Harrow and Hillingdon, and East London Foundation Trust, in addition to marketing in NHS hospitals including: Central Middlesex, West Middlesex, Northwick Park, Royal Marsden, Whittington and Barnet & Chase Farm. We note that at the time the articles were written, our website was not fully up to date with these materials and have since rectified it – this was in part due to variable contractual expiry dates”.

Meanwhile, Cera says it will use its Series A funding — which is made up of both equity and debt — to expand its services further across the U.K., launching in an additional three cities beyond London, namely Manchester, Leeds and Birmingham, via what it is calling a “buy and build” strategy. This will see Cera buy struggling homecare agencies across the U.K. — many of which it says lack the technology to scale and grow independently — as a more rapid means of expanding.

“In a fragmented market of over 8,000 homecare providers, Cera has built the technology to quickly aggregate U.K. homecare businesses in a scalable manner, in what will be a U.K.-first from a startup in this space. This model will also be used to drive Cera’s expansion to Germany,” says the company.

The injection of capital will also support Cera’s continued investment in “AI”. It has been prototyping a chatbot-styled assistant it calls “Martha,” which it claims can successfully foresee deterioration in patient health, based on carer feedback, such as whether a patient hasn’t been eating, has a fever, or isn’t walking normally. The aim is to pre-empt more serious illnesses and avoid unnecessary admissions to hospital.

Related to this, I understand from Cera’s latest investor email report that Cera has grown its data set to “over 1 million data points” — a 90 percent quarter-on-quarter increase — which it intends to feed into its machine learning-powered predictive analytics tool to help improve health outcomes and reduce preventable hospital admissions. “We are taking active steps to ensure GDPR compliance,” says the company, which is just as well.

The same email details a number of business development updates by Cera, including that it is working on a collaboration with NHS 111 that — if it goes ahead — would permit integration of data records between Cera and the NHS 111 service. The startup is also working on Amazon Alexa integration, and has formed an exclusive partnership with the Daily Mail Group, to offer home care to Daily Mail readers and users.

To that end, the U.K. homecare startup space is pretty crowded already and therefore media partnerships and other more direct ways to market could be quite important beyond simply becoming a partner provider to local health and social care authorities. Cera’s direct U.K. competitors include HomeTouch (backed by Rocket Internet’s GFC, Passion Capital, Bupa, and 500 Startups), and SuperCarers.

Powered by WPeMatico

Poq, the London-based startup that offers a SaaS to make it easier for retailers to launch and maintain a consumer-facing shopping app, has raised £9.5 million in Series B funding. Leading the round is Smedvig Capital, with participation from previous backers Beringea, and Revolt Ventures. It brings the total amount raised by Poq to £16.5 million since the company was founded in 2011.

A fairly early entrant into the so-called ‘apps-as-a-service’ space, Poq’s pitch is that it enables retailers — with a particular focus on ‘pureplay’ or multichannel brands — to create their own e-commerce app at a fraction of the price of using a traditional app development agency or doing it all in-house. The company counts the likes of House of Fraser, Missguided, Prettylittlething, Holland & Barrett, Hotel Chocolat, Fragrance Direct, and Made.com as clients.

“Our platform is the result of years of focus on retail apps and is proven to increase conversion rates and revenue,” Øyvind Henriksen, CEO and co-founder at Poq, tells TechCrunch. “New code is rolled out every week and major releases delivered every quarter”.

This, he says, is often in contrast to the way retailers engage with a traditional app agency, which typically sees a lot of work and investment go into a version one, only for the app to be left unloved as each update can be costly and has unnecessary friction.

The other option is to not bother with an app and just have a mobile website, but Poq claims these don’t perform well in retail and that apps are proven to provide a better shopping experience, which leads to much better engagement, retention and conversion.

“While everyone would love to have an app, the reality is that apps are typically hard to build and maintain. By using Poq’s SaaS approach, retailers get the product faster to market, keep it up to date easier, [and] have the ability to plug into an ecosystem of pre-built integrations to technology providers,” says Henriksen.

The Poq CEO describes Poq’s typical customer as a large pureplay or multichannel retailer. “Our first major customer was House of Fraser,” he says, “and that’s when we proved ourselves as an enterprise-ready software provider. From then we’ve seen multichannel customers such as Holland and Barrett and House of Fraser use apps as a new digital channel, the apps also power their loyalty programs in the stores”.

Meanwhile, Poq says the new funding will help the company drive growth in the U.K. and Europe, as well as in the U.S., where it plans to open offices. I’m told the U.S. currently makes up 20 percent of Poq’s revenue.

Powered by WPeMatico

Zinc, the London-based company builder tackling various societal problems, has picked up £3 million in seed investment as it readies its second cohort and mission. Backing the round is LocalGlobe, Niklas Zennström’s Atomico, U.K. university LSE, and a number of angel investors.

Launched late last year, Zinc helps build startups almost from scratch. Somewhat similar to Entrepreneur First, it focuses on recruiting potential founders — in this instance, experts in social science, technology, design and business — who through the 9-month programme form new companies.

Each Zinc cohort is tasked with tackling a specific mission around a broader theme. The debut programme, which was used to prove the model and is currently drawing to a close, set out to create startups that can tackle the problem of women’s mental and emotional health. This saw 55 prospective founders and entrepreneurs participate, resulting in 17 new companies being formed.

They span tech-enabled businesses working on problems as diverse as perinatal mental health, loneliness amongst the elderly, young women discovering sexual pleasure, stress-related physical conditions like IBS, women walking safely in cities, new talking therapies, and more. One criteria of Zinc-founded companies is that the resulting solution needs to be applicable globally, and that the problem being tackled affects a large enough number of people in the developed world ie ~100 million or more.

“We try to solve huge societal issues by mobilising talent, ideas and capital, and by taking a mission-led approach,” Ella Goldner, co-founder and GM of Zinc, tells TechCrunch. “Our programme does so by finding the best talent, surrounding them with smarts experts to help them build new tech-enabled scalable businesses, and help them develop products and services that tackle the issues in the context of the mission”.

Zinc’s second mission, which the company builder is currently recruiting for, will see it focus on the 150 million people living in places that have been hit hard by automation and globalisation over the last 20 or 30 years, as traditional industries in those areas have declined (e.g. coal, manufacturing, textiles, shipbuilding, ports and tourism).

“The founders on the programme are a diverse group of entrepreneurial creative individuals who are driven by the mission, and are keen to set up a new business. They have background in tech, the mission’s focus area, or in ops and marketing. The average age is 34 and they are truly diverse in terms of nationalities… We believe in people’s ability to take control over those issues and solve them, rather than relying on public sector to do that,” explains Goldner.

Suzanne Ashman Blair, partner at LocalGlobe, echoes that sentiment and says that Zinc has got off to a great start with its first mission. “To have an impact on society’s deepest challenges, we need to bring together entrepreneurial talent and capital. Zinc has demonstrated that its approach to addressing social problems through technology is a powerful combination”.

LSE’s investment in Zinc also sees it effectively become a founder of the burgeoning company builder. The London university is leading a new consortium of U.K. universities (Oxford, Manchester, Sussex and Sheffield) who will work with the Zinc programme to “turn research insight into new businesses that have commercial and social impact”.

To that end, in addition to Goldner, Zinc lists it founders as Paul Kirby (a former Head of the No 10 Policy Unit and previously a senior partner at KPMG), Saul Klein (co-founder of LocalGlobe and a serial tech entrepreneur), and Professor Julia Black (Pro-Director for Research at the London School of Economics and Political Science and a Board Member of U.K. Research & Innovation).

Meanwhile, Zinc says the new £3 million funding will enable it to plan future missions and replicate the success of its launch programme.

Powered by WPeMatico

ZeroCater may have made its name in bringing restaurant food to offices for lunch (or other meals), but it has now raised a new fresh round of funding for the next perk it hopes to bring to companies: snacks.

While ZeroCater continues to expand from city to city with new restaurants as it tries to grow beyond just bringing lunch to startups in the Bay Area, it’s now looking to compete with the likes of Aramark to make sure it gains control of the fridges and pantries in offices as its next big line of business. And while it may seem like a perk, as competition for talent continues to heat up regardless of city, those perks are increasingly becoming table stakes to keeping the best people around. To do that, the company today said it has raised a new $12 million financing round led by Cleveland Avenue, with participation by Justin Kan, Romulus Capital and Struck Capital.

“You have more companies trying to compete for the same talent,” co-founder Arram Sabeti said. “When you’re looking at the cost of labor and recruiting great talent, all this stuff is a rounding error. When you’re looking at lunch, for example, the economic argument is pretty obvious.”

As such, getting into that market will be a tricky one — hence the new financing. ZeroCater increasingly has to ingest a lot of new data and form those partnerships, which requires talent. The company already has more than 1,000 SKUs (or options, really) for products it can stock as snacks. ZeroCater is looking to create a suite of tools for managers to help give employees a level of granularity they might be used to when it comes to procuring office equipment, giving them the ability to give specific feedback as to what kind of drinks they might want in their fridge. Those options may even vary from floor to floor, and the goal is to keep track of all of this in a consistent way.

The theory of owning snacks is pretty similar to its goal with restaurants: figure out what employees actually want, and help those businesses get the right products in the building based on employee feedback. Rather than burying a line item in a spreadsheet somewhere, ZeroCater wants to help employers understand what they are buying, and why they are buying it. The goal in the end is to keep their employees happy.

ZeroCater got its start working with restaurants that were trying to either expand their business, or even get off the ground. The company offers an opportunity for restaurants to run a kind of test for their meals and businesses with companies, which get access to good food while enabling those restaurants to run a trial before either introducing new dishes, or even opening up an actual restaurant. The whole point is to create a feedback loop where employees can help inform businesses on what’s good, and what isn’t.

“[Managers] really don’t feel like employees get to participate [in the picking process],” Sabeti said. “They want a mechanism for employees to give feedback and tell the provider what they want to receive. The most feedback [vendors] get is from sending someone to sit with a facilities manager once a quarter. With our product, we have a dashboard where employees can see what’s coming, vote on different items, and then we can collect that feedback.”

Snacks may, indeed, serve as an interesting differentiator in a market that is increasingly complex. Square earlier this month acquired office-ordering startup Zesty as it looks to continue to expand its Caviar service. While that’s one example, it may indeed be a sort of harbinger of increased competition when it comes to office catering — and an example of having to move beyond just restaurants in order to remain competitive.

Powered by WPeMatico

When trying to figure out what to do after an extensive career at Google, Motorola, and Flipkart, Punit Soni decided to spend a lot of time sitting in doctors’ offices to figure out what to do next.

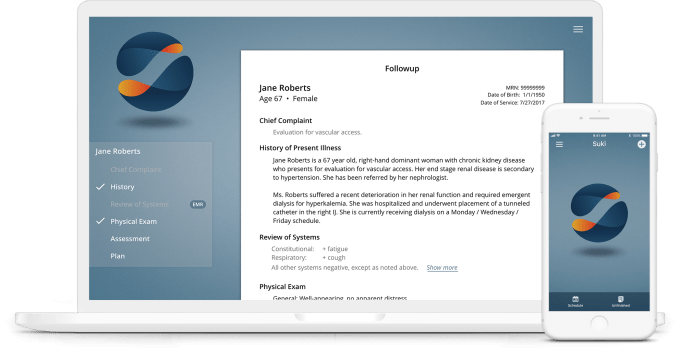

It was there that Soni said he figured out one of the most annoying pain points for doctors in any office: writing down notes and documentation. That’s why he decided to start Suki — previously Robin AI — to create a way for doctors to simply start talking aloud to take notes when working with patients, rather than having to put everything into a medical record system, or even writing those notes down by hand. That seemed like the lowest hanging fruit, offering an opportunity to make it easier for doctors that see dozens of patients to make their lives significantly easier, he said.

“We decided we had found a powerful constituency who were burning out because of just documentation,” Soni said. “They have underlying EMR systems that are much older in design. The solution aligns with the commoditization of voice and machine learning. If you put it all together, if we can build a system for doctors and allow doctors to use it in a relatively easy way, they’ll use it to document all the interactions they do with patients. If you have access to all data right from a horse’s mouth, you can use that to solve all the other problems on the health stack.”

The company said it has raised a $15 million funding round led by Venrock, with First Round, Social+Capital, Nat Turner of Flatiron Health, Marc Benioff, and other individual Googlers and angels. Venrock also previously led a $5 million seed financing round, bringing the company’s total funding to around $20 million. It’s also changing its name from Robin AI to Suki, though the reason is actually a pretty simple one: “Suki” is a better wake word for a voice assistant than “Robin” because odds are there’s someone named Robin in the office.

The challenge for a company like Suki is not actually the voice recognition part. Indeed, that’s why Soni said they are actually starting a company like this today: voice recognition is commoditized. Trying to start a company like Suki four years ago would have meant having to build that kind of technology from scratch, but thanks to incredible advances in machine learning over just the past few years, startups can quickly move on to the core business problems they hope to solve rather than focusing on early technical challenges.

Instead, Suki’s problem is one of understanding language. It has to ingest everything that a doctor is saying, parse it, and figure out what goes where in a patient’s documentation. That problem is even more complex because each doctor has a different way of documenting their work with a patient, meaning it has to take extra care in building a system that can scale to any number of doctors. As with any company, the more data it collects over time, the better those results get — and the more defensible the business becomes, because it can be the best product.

“Whether you bring up the iOS app or want to bring it in a website, doctors have it in the exam room,” Soni said. “You can say, ‘Suki, make sure you document this, prescribe this drug, and make sure this person comes back to me for a follow-up visit.’ It takes all that, it captures it into a clinically comprehensive note and then pushes it to the underlying electronic medical record. [Those EMRs] are the system of record, it is not our job to day-one replace these guys. Our job is to make sure doctors and the burnout they are having is relieved.”

Given that voice recognition is commoditized, there will likely be others looking to build a scribe for doctors as well. There are startups like Saykara looking to do something similar, and in these situations it often seems like the companies that are able to capture the most data first are able to become the market leaders. And there’s also a chance that a larger company — like Amazon, which has made its interest in healthcare already known — may step in with its comprehensive understanding of language and find its way into the doctors’ office. Over time, Soni hopes that as it gets more and more data, Suki can become more intelligent and more than just a simple transcription service.

“You can see this arc where you’re going from an Alexa, to a smarter form of a digital assistant, to a device that’s a little bit like a chief resident of a doctor,” Soni said. “You’ll be able to say things like, ‘Suki, pay attention,’ and all it needs to do is listen to your conversation with the patient. I’m, not building a medical transcription company. I’m basically trying to build a digital assistant for doctors.”

Powered by WPeMatico