Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

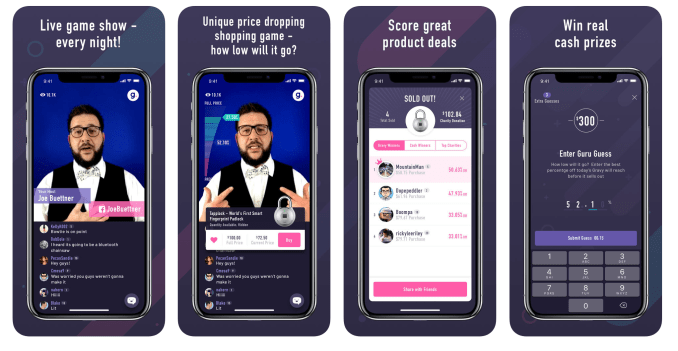

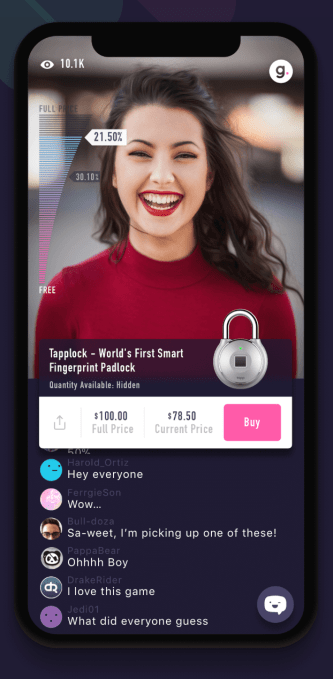

Following the success of the live mobile game show HQ Trivia, a team of serial entrepreneurs have begun testing the market to see if another game show concept can work, too. Their new game show-inspired app, Gravy, is meant to be a riff on the “Price is Right” combined with a QVC-style shopping experience. That is, the “contestants” compete for discounts of 30 to 70 percent off the products advertised, with a portion of the proceeds going to charity. In addition, through a side game, users can guess when the product – whose quantities are unknown – will sell out and at what price. Those who guess closest win a cash prize.

The startup was created by Mark McGuire, Brian Wiegand, and Craig Andler – the founding team behind Jellyfish.com, an older social shopping network that was acquired by Microsoft back in 2007, to help create Bing Shopping. They’ve also paired up on other projects, including NameProtect (before Jellyfish), printable coupons resource Hopster, social network Nextt, and e-commerce subscription retail site, Alice.com. These have either exited or shut down or both.

The team’s efforts imply a clear passion for working with brands, but getting consumers to connect with brands in new ways is far more difficult, as their track record shows.

That’s why they’re now trying Gravy.

The hope is that the excitement around seeing the product unveiled nightly – and knowing you’ll get a big discount if you buy – will become an entirely new ad unit of sorts, while keeping players engaged in a game-show like experience.

“One of the challenges with millennials is their short attention spans, and they don’t respond well to interruptive advertising,” explains Wiegand, of why the team wanted to build this startup. “I don’t think anyone’s really mastered how to monetize live video. So we came up with this opportunity to create this new ad unit where brands could tell their story, and – for seven or eight or nine minutes – create a live shopping event where millennials can tune in and hear that story but in a fun, gamified kind of manner,” he says.

Here’s how Gravy works. Every night, at 8:30 PM ET in the Gravy iOS app, a live host will unveil the product users can buy. Currently, there’s a rotating selection of hosts who work on a per-show contract basis, usually local comedians – not brand reps.

Players are not told how many items are available, but it’s typically anywhere from two to twenty.

Then the price starts to drop. If you buy early, you’ll have a chance to snag it at a slight discount. But the longer you wait, the higher the percentage off will become. However, you don’t know who else could snatch it up first and when. If you wait too long, the product will sell out.

Meanwhile, if you’re not interested in the product itself, you can guess when you expect it to sell out (meaning, at which price.) Those ten or so closest will receive a small cash prize – a split of maybe $200 or $300, with first place receiving the largest chunk.

At least 20 percent of sales are given away to charity – a nod, I suppose, to millennials’ interest in do-gooder style companies. But ultimately, that decision that has more to do with the fact that Gravy doesn’t aim to be a retailer – it’s not another deal-of-the-day destination like Woot!, despite the similarities around generating product excitement.

Instead, it expects brands to donate products and pay a fee for the “advertising opportunity” Gravy offers.

Brands will like Gravy because they get millennials’ attention for seven minutes or more, Wiegand says. “They love the engagement. It’s a highly engaged audience…I have a chance to buy the products, so I’m heavily engaged in thinking about that product. The recall, memorability, and all of the subsequent buzz – tweeting and all the social media that gets created because of that – is great,” he adds.

However, none of this is proven out yet – Gravy is just a couple of weeks old.

So far, around 50 percent of the products it has featured have actually been donated by brands, including 23andMe, 3D Doodler, Tapplock, and others. The rest have been subsidized by Gravy, including the bigger draws – like a DJI drone, for example.

It’s not yet charging for the ad opportunity, either, as it’s hoping to grow the audience first.

The company says that’s already underway. After alerting friends and family to the app’s launch, the games are seeing 600+ players nightly, Wiegand claims, and is growing its audience 15 percent week-over-week. Around half of those who signed up to play are returning to watch around three shows per week, he says.

While the early numbers are promising if true, and it’s clear the team likes to work in the general space of connecting brands with consumers, Gravy still feels – like much of what the founders have created before – designed primarily with the needs of brands in mind, before that of consumers.

While the early numbers are promising if true, and it’s clear the team likes to work in the general space of connecting brands with consumers, Gravy still feels – like much of what the founders have created before – designed primarily with the needs of brands in mind, before that of consumers.

A “Price is Right”-style app would be a lot of fun, but this isn’t it – it’s, at the end of the day, an invitation to watch an ad and shop at a discount. That’s not something consumers may want to do every day, long-term – even if you try to woo them with a small cash prize won through a guessing game.

And like Trivia HQ , which has dropped from a top 20 app to the 140’s (by App Store overall rank, the shine may eventually wear off for Gravy, too. Especially because it’s not primarily a game – and millennials, as fickle and short attention-spanned as they may be (really? the generation that binges entire TV seasons in a few days?), will know it.

Wiegand isn’t concerned, though.

He says he gets bored with trivia apps in a few weeks, but Gravy is different.

“I always shop and I always like a deal. The deal industry and the shopping industry are so much larger than the trivia space,” Wiegand insists. “And the thrill of seeing a product that you like going down into the sixties and seventies percent off is unbelievably thrilling,” he enthuses. “We are able to feature things that have the best price on the planet of first-run products…it creates this heart-pounding, exhilarating and experience like, ‘Should I buy? Oh my God, look at this price. I can’t turn it down,’” he says.

The company raised $2.1 million in seed funding from a range of investors, including the founders at the turn of the year. Around eighty percent was outside capital, led by New Capital. The under-20 person team is based in both Madison and Minneapolis.

Gravy is on the App Store here.

Powered by WPeMatico

Dot, a new U.K. startup de-cloaking today, aims to make it easy to invest in property without the hassle of taking out a traditional ‘buy to let’ mortgage. The company is founded by Gray Stern, who previously co-founded London-based Buy to Let mortgage lender Landbay, and so knows at least a thing or two about investing in property. Namely, that it doesn’t need to be as arduous as it currently is.

In fact, Dot’s headline draw is that it makes property ownership a one-click affair via the “Dot Button” it wants to embed on property listings sites, including estate agents and property developers. Under the hood of the offering is what the startup describes as a “point-of-sale finance and management solution” that can be wrapped around any property that meets Dot’s lending criteria.

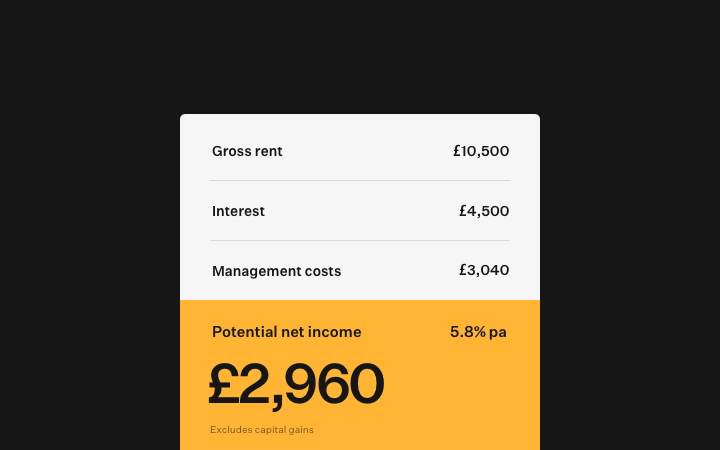

If you want to purchase the property as an investment, you simply click the button, pay the required deposit, and Dot will acquire and manage the property on your behalf, advancing 70 percent of the purchase price in the form of its pre-approved or “instant mortgage”. In addition, the property is furnished and Dot takes out buildings, contents and rent guarantee insurance. After those expenses, you receive monthly rent from the property, minus management fees and interest paid on your Dot mortgage.

Technically, once the property is purchased it is moved into a passive investment structure: an SPV known as a “Dot Container”. This structure holds the asset on your behalf (you effectively become the SPV’s beneficial owner/shareholder).

When you’re ready to sell, in theory a Dot Container can move from owner to owner without conveyancing, and can be refinanced without requiring new mortgage documents (via Dot Platform, Dot’s mortgage marketplace). Alternatively, the property can be put on the open market. Either way, as the SPV’s sole shareholder, you benefit from any increase in the valuation of the property, less the remaining balance of the mortgage.

“Dot enables anyone with a 30 percent deposit to become a professional property investor instantly, with none of the hassle of being a landlord,” explains Stern. “We do this by providing U.K. and U.S. estate agents and property developers with a pre-approved finance and management solution — a Dot Container — that can hold any suitable property. The agent can then offer Dot as a payment option (via the embedded Dot Button), turning their previously static listings into turnkey investments that anyone, anywhere can buy online on a fully financed and managed basis.

“Every Dot Container comes complete with a pre-approved mortgage, insurance, legal/conveyancing, tax compliance and reporting, lettings and management, furnishings and everything else required to turn that property into a compliant, well-managed and good-looking rental home. Dot takes care of the entire end-to-end process… and because we are lending a large portion of the total cost we have a vested interest in managing your property well”.

Stern says that Dot differs from property crowd-investing type platforms, such as Property Partner or Bricklane, which typically let you buy shares in a portion of a property or a property portfolio and aren’t coupled with a financing option.

“Dot’s solution is for sole investors or couples looking to build property portfolios that they control, we do not offer fractional ownership,” he adds. “Our clients own the asset and while they give Dot management rights, they can also remove Dot at any time, sell at any time, refinance their loans at any time. Dot’s challenge is to make our offer sufficiently compelling that they won’t want to”.

Meanwhile, Dot has raised $1.5 million in a pre-seed round from Stage Dot O, an L.A.-based venture-build firm run by Roofstock co-founder Devin Wade and ex hedge fund manager Mike Self.

Powered by WPeMatico

Rover, a dog-walking and dog-boarding service that merged with DogVacay around this time last year, is now the second of such startups this year to raise a massive new round of funding with its announcement of a $155 million financing round.

While competitor Wag has become a juggernaut, there seems room for both room for a second player and the potential to outmaneuver Wag even with its massive influx of capital. Both DogVacay and Rover had a very similar model and eventually merged in an all-stock deal, creating a more substantial competitor for Wag. The round consisted of $125 million in equity financing led by funds and accounts advised by T. Rowe Price Associates, with a $30 million credit facility with Silicon Valley Bank. The Wall Street Journal is reporting that the round values Rover at $970 million.

Wag earlier this year picked up $300 million in a massive funding round led by SoftBank. That was, of course, SoftBank — which is investing massive piles of capital into startups and pretty much altering the calculus of venture capital in the process. But it also signaled a huge interest in various dog-care services, including apparently Rover, as a potential business opportunity for the millions of dog owners in the world. If you’ll walk anywhere in San Francisco, you’re destined to run into a very large number of very good dogs, and it makes enough sense that there should be an opportunity to capitalize on dog-ownership as a whole.

Rover connects dog owners with various users that will walk, board, or generally take care of dogs — a critical service for anyone who might be traveling, or just work in a non-dog friendly office. Users just book a dog walker or sitter through the app, which connects them with area sitters. It’s an area where Wag has faced a lot of criticism following a major Bloomberg report regarding poor service (and losing dogs). There are, of course, many challenges for any service that offloads some kind of daily need to a third party starting in a similar fashion to Uber.

Rover, interestingly, notes on its website that it “accepts less than 20% of potential sitters,” perhaps a dig at the criticism for Wag or the space in general and as an attempt to soothe concerns from potential users. Rover says it has more than 200,000 sitters throughout North America. The company previously raised $156 million, and previous investors include A-Grade Investments, Foundry Group, Madrona Venture Group, Menlo Ventures, OMERS Ventures, Petco, and StepStone Group.

Powered by WPeMatico

Chatbot startup Hugging Face has raised a $4 million seed round led by Ronny Conway from a_capital. Existing investors Betaworks, SV Angel and Kevin Durant are also participating.

I already reviewed Hugging Face so I won’t write the same thing again. But the startup has been building a chatbot app with a strong personality for bored teenagers. Instead of focusing on customer support or convenience, Hugging Face is focusing on emotions and entertainment.

It’s been available in the App Store as a standalone app and on Kik. Today, the company is also launching Hugging Face on Messenger. It should help bring new users.

Even without Messenger, Hugging Face now handles 1 million messages per day. In total, Hugging Face has received over 100 million messages.

It’s also worth noting that Hugging Face accepts text messages, photos, emojis, everything. So you can take a selfie, send a sad emoji, and the chatbot will know how you feel.

And it’s clear that Hugging Face is betting on surprise and enjoyment. The app doesn’t have to be perfect to be entertaining.

Beyond the consumer app, the team behind Hugging Face has written a couple of research papers about artificial intelligence. It’s clear that the startup plans on building a great team of engineers when it comes to natural language conversations. The team will double over the coming months.

Powered by WPeMatico

Excited to announce that this year’s The Europas Unconference & Awards is shaping up! Our half day Unconference kicks off on 3 July, 2018 at The Brewery in the heart of London’s “Tech City” area, followed by our startup awards dinner and fantastic party and celebration of European startups!

The event is run in partnership with TechCrunch, the official media partner. Attendees, nominees and winners will get deep discounts to TechCrunch Disrupt in Berlin, later this year.

The Europas Awards are based on voting by expert judges and the industry itself. But key to the daytime is all the speakers and invited guests. There’s no “off-limits speaker room” at The Europas, so attendees can mingle easily with VIPs and speakers.

What exactly is an Unconference? We’re dispensing with the lectures and going straight to the deep-dives, where you’ll get a front row seat with Europe’s leading investors, founders and thought leaders to discuss and debate the most urgent issues, challenges and opportunities. Up close and personal! And, crucially, a few feet away from handing over a business card. The Unconference is focused into zones including AI, Fintech, Mobility, Startups, Society, and Enterprise and Crypto / Blockchain.

We’ve confirmed 10 new speakers including:

Eileen Burbidge, Passion Capital

Carlos Eduardo Espinal, Seedcamp

Richard Muirhead, Fabric Ventures

Sitar Teli, Connect Ventures

Nancy Fechnay, Blockchain Technologist + Angel

George McDonaugh, KR1

Candice Lo, Blossom Capital

Scott Sage, Crane Venture Partners

Andrei Brasoveanu, Accel

Tina Baker, Jag Shaw Baker

We’d love for you to ask your friends to join us at The Europas – and we’ve got a special way to thank you for sharing.

Your friend will enjoy a 15% discount off the price of their ticket with your code, and you’ll get 15% off the price of YOUR ticket.

That’s right, we will refund you 15% off the cost of your ticket automatically when your friend purchases a Europas ticket.

So you can grab tickets here.

Public Voting is still humming along. Please remember to vote for your favourite startups!

Awards by category:

Hottest Media/Entertainment Startup

Hottest E-commerce/Retail Startup

Hottest Marketing/AdTech Startup

Hottest Enterprise, SaaS or B2B Startup

Hottest Platform Economy / Marketplace

Hottest Cyber Security Startup

Hottest Internet of Things Startup

Fastest Rising Startup Of The Year

Hottest GreenTech Startup of The Year

Best Angel/Seed Investor of the Year

Hottest VC Investor of the Year

Hottest Blockchain/Crypto Startup Founder(s)

Hottest Blockchain Protocol Project

Hottest Corporate Blockchain Project

Hottest Blockchain ICO (Europe)

Hottest Financial Crypto Project

Hottest Blockchain for Good Project

Hottest Blockchain Identity Project

Hall Of Fame Award – Awarded to a long-term player in Europe

The Europas Grand Prix Award (to be decided from winners)

The Awards celebrates the most forward thinking and innovative tech & blockchain startups across over some 30+ categories.

Startups can apply for an award or be nominated by anyone, including our judges. It is free to enter or be nominated.

Instead of thousands and thousands of people, think of a great summer event with 1,000 of the most interesting and useful people in the industry, including key investors and leading entrepreneurs.

• No secret VIP rooms, which means you get to interact with the Speakers

• Key Founders and investors speaking; featured attendees invited to just network

• Expert speeches, discussions, and Q&A directly from the main stage

• Intimate “breakout” sessions with key players on vertical topics

• The opportunity to meet almost everyone in those small groups, super-charging your networking

• Journalists from major tech titles, newspapers and business broadcasters

• A parallel Founders-only track geared towards fund-raising and hyper-networking

• A stunning awards dinner and party which honors both the hottest startups and the leading lights in the European startup scene

• All on one day to maximise your time in London. And it’s PROBABLY sunny!

That’s just the beginning. There’s more to come…

Interested in sponsoring the Europas or hosting a table at the awards? Or purchasing a table for 10 or 12 guest or a half table for 5 guests? Get in touch with:

Petra Johansson

Petra@theeuropas.com

Phone: +44 (0) 20 3239 9325

Powered by WPeMatico

Microsoft announced today that it has acquired Semantic Machines, a Berkeley-based startup that wants to solve one of the biggest challenges in conversational AI: making chatbots sound more human and less like, well, bots.

In a blog post, Microsoft AI & Research chief technology officer David Ku wrote that “with the acquisition of Semantic Machines, we will establish a conversational AI center of excellence in Berkeley to push forward the boundaries of what is possible in language interfaces.”

According to Crunchbase, Semantic Machines was founded in 2014 and raised about $20.9 million in funding from investors, including General Catalyst and Bain Capital Ventures.

In a 2016 profile, co-founder and chief scientist Dan Klein told TechCrunch that “today’s dialog technology is mostly orthogonal. You want a conversational system to be contextual so when you interpret a sentence things don’t stand in isolation.” By focusing on memory, Semantic Machines claims its AI can produce conversations that not only answer or predict questions more accurately, but also flow naturally, something that Siri, Google Assistant, Alexa, Microsoft’s own Cortana and other virtual assistants still struggle to accomplish.

Instead of building its own consumer products, Semantic Machines focused on enterprise customers. This means it will fit in well with Microsoft’s conversational AI-based products. These include Microsoft Cognitive Services and Azure Bot Service, which the company says are used by one million and 300,000 developers, respectively, and its virtual assistants Cortana and Xiaolce.

Powered by WPeMatico

Pluralsight priced the shares in its IPO at $15 this afternoon, above its previously set target range of between $12 and $14, and will raise as much as $357 million ahead of its public debut tomorrow morning.

Pluralsight offers software development courses, specifically ones targeting employees that are looking to advance in their careers by acquiring new skills in order to transition to higher-level roles. As knowledge workers become increasingly valuable, especially in larger enterprises with sprawling workforces, companies like Pluralsight have found a sweet spot in building tools that enable companies to help identify talent in their own workforce and train them, rather than have to aggressively search outside the company to satisfy their needs. The company has raised $310.5 million in its IPO, with underwriters having the option to purchase an additional 3.1 million shares and bring that up to $357 million.

The company is one of a continuing wave of enterprise IPOs this year, including multiple successful ones like zScalar and Dropbox — the latter of which was more of a flagship as both a hotly-anticipated one and as a company that possesses a unique business model. But nonetheless, it’s shown that there’s an appetite for enterprise startups looking to go public, which offers those companies a way to raise capital in addition to offering their employees liquidity.

Pluralsight will be another of an increasing pack of unicorns in the Utah tech scene that are on their way to going public. Founded in 2004, Pluralsight was largely bootstrapped until its first financing round in 2013 where it raised $27.5 million from Insight Venture Partners. That firm is the company’s largest shareholder, and since then Pluralsight has raised nearly $200 million in financing.

Its The company’s IPO tomorrow will once again test the appetite for fresh IPOs among public investors. Enterprise companies generally offer a more stable batch for venture portfolios, with predictable and reliable growth that eventually carries it to an IPO with varying levels of success. They’re smaller than blockbuster consumer-ish IPOs, but they are the ones that can provide a stable return for funds like IVP.

Powered by WPeMatico

Cryptocurrency startup Circle has raised a $110 million funding round, which values the company near $3 billion. Cryptocurrency mining company Bitmain is leading the round.

Existing investors IDG Capital, Breyer Capital, General Catalyst, Accel, Digital Currency Group and Pantera are investing more money. Blockchain Capital and Tusk Ventures are investing in Circle for the first time. Goldman Sachs also invested in the company in a previous round.

It’s hard to describe Circle in a few words because the company has been active on all fronts. For a really long time, the company pitched itself as a social payment company, a Venmo and Square Cash competitor. But Circle is more focused than ever on cryptocurrencies.

The company has been operating one of the largest over-the-counter trading desks for big cryptocurrency investors and exchanges. Circle Trade manages more than $2 billion a month in transactions and is able to fulfill large orders and provide liquidity.

More recently, the company launched Circle Invest, a really simple mobile app for the U.S. market. It lets you buy and sell Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Zcash and Monero in just a few taps. It’s a good way to get started with cryptocurrencies without learning about exchanges and order types. It could become a good Coinbase competitor for small cryptocurrency investors.

And Circle also acquired Poloniex, one of the largest cryptocurrency exchanges in the U.S.

But the most interesting projects right now are probably CENTRE and a new tokenized USD coin. There are so many different cryptocurrencies, fiat currencies, exchanges and wallets that it has become hard to make everything work together. Cryptocurrencies still suffer from price volatility, so bitcoin can’t be the common denominator.

That’s why Circle is creating a token that is pegged to the U.S. dollar. The USD Coin is based on an open source framework developed by CENTRE and everything should be audited regularly.

CENTRE is a Circle initiative to create a common framework to connect all electronic wallets. This protocol could let you send money to an Alipay user with your Square Cash balance.

It’s clear that Circle wants to build the infrastructure of the cryptocurrency industry. The company will need to convince multiple industry players to work with Circle, but it could help the cryptocurrency ecosystem as a whole.

Powered by WPeMatico

Teatime Games, a new Icelandic “social games” startup from the same team behind the hugely popular QuizUp (acquired in by Glu Mobile), is disclosing $9 million in funding, made up of seed and Series A rounds.

Index Ventures led both, but have been joined by Atomico, the European VC fund founded by Skype’s Niklas Zennström, for the $7.5 million Series A round. I understand this is the first time the two VC firms have done a Series A deal together in over a decade.

Both VCs have a decent track record in gaming. Index counts King, Roblox and Supercell as previous gaming investments, whilst Atomico also backed Supercell, along with Rovio, and most recently Bossa Studios.

As part of the round, Guzman Diaz of Index Ventures, Mattias Ljungman of Atomico, and David Helgason, founder of Unity, have joined the Teatime Games board of directors.

Meanwhile, Teatime Games is keeping shtum publicly on exactly what the stealthy startup is working on, except that it plays broadly in the social and mobile gaming space. In a call with co-founder and CEO Thor Fridriksson yesterday, he said a little more off the record and on condition that I don’t write about it yet.

What he was willing to describe publicly, however, is the general problem the company has set out to solve, which is how to make mobile games more social and personalised. Specifically, in a way that any social features — including communicating with friends and other players in real-time — enhances the gameplay rather than gets in its way or is simply bolted on as an adjunct to the game itself.

The company’s macro thesis is that games have always been inherently social throughout different eras (e.g. card games, board games, arcades, and consoles), and that most games truly come to life “through the interaction between people, opponents, and the audience”. However, in many respects this has been lost in the age of mobile gaming, which can feel like quite a solitary experience. That’s either because they are single player games or turn-based and played against invisible opponents.

Teatime plans to use the newly disclosed investment to double the size of its team in Iceland, with a particular focus on software engineers, and to further develop its social gaming offering for third party developers. Yes, that’s right, this is clearly a developer platform play, as much as anything else.

On that note, Atomico Partner Mattias Ljungman says the next “breakout opportunity” in games will see a move beyond individual studios and titles to what he describes as fundamental enabling technologies. Linked to this he argues that the next generation of games companies being developed will “become ever more mass market and socially connected”. You can read much more on Ljungman and Atomico’s gaming thesis in a blog post recently published by the VC firm.

Powered by WPeMatico

MemSQL, a company best known for the real-time capabilities of its eponymous in-memory database, today announced that it has raised a $30 million Series D round, bringing the company’s overall funding to $110 million. The round was led by GV (the firm you probably still refer to as Google Ventures) and Glynn Capital. Existing investors Accell, Caffeinated Capital, Data Collective and IA Ventures also participated.

The MemSQL database offers a distributed, relational database that uses standard SQL drivers and queries for transactions and analytics. Its defining feature is the combination of its data ingestions technology that allows users to push millions of events per day into the service while its users can query the records in real time. The company recently showed that its tools can deliver a scan rate of over a trillion rows per second on a cluster with 12 servers.

The database is available for deployments on the major public clouds and on-premises.

MemSQL recently announced that it saw its fourth-quarter commercial booking hit 200 percent year-over-year growth — and that’s typically the kind of growth that investors like to see, even as MemSQL plays in a very competitive market with plenty of incumbents, startups and even open-source projects. Current MemSQL users include the likes of Uber, Akamai, Pinterest, Dell EMC and Comcast.

“MemSQL has achieved strong enterprise traction by delivering a database that enables operational analysis at unique speed and scale, allowing customers to create dynamic, intelligent applications,” said Adam Ghobarah, general partner at GV, in today’s announcement. “The company has demonstrated measurable success with its growing enterprise customer base and we’re excited to invest in the team as they continue to scale.”

Powered by WPeMatico