Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

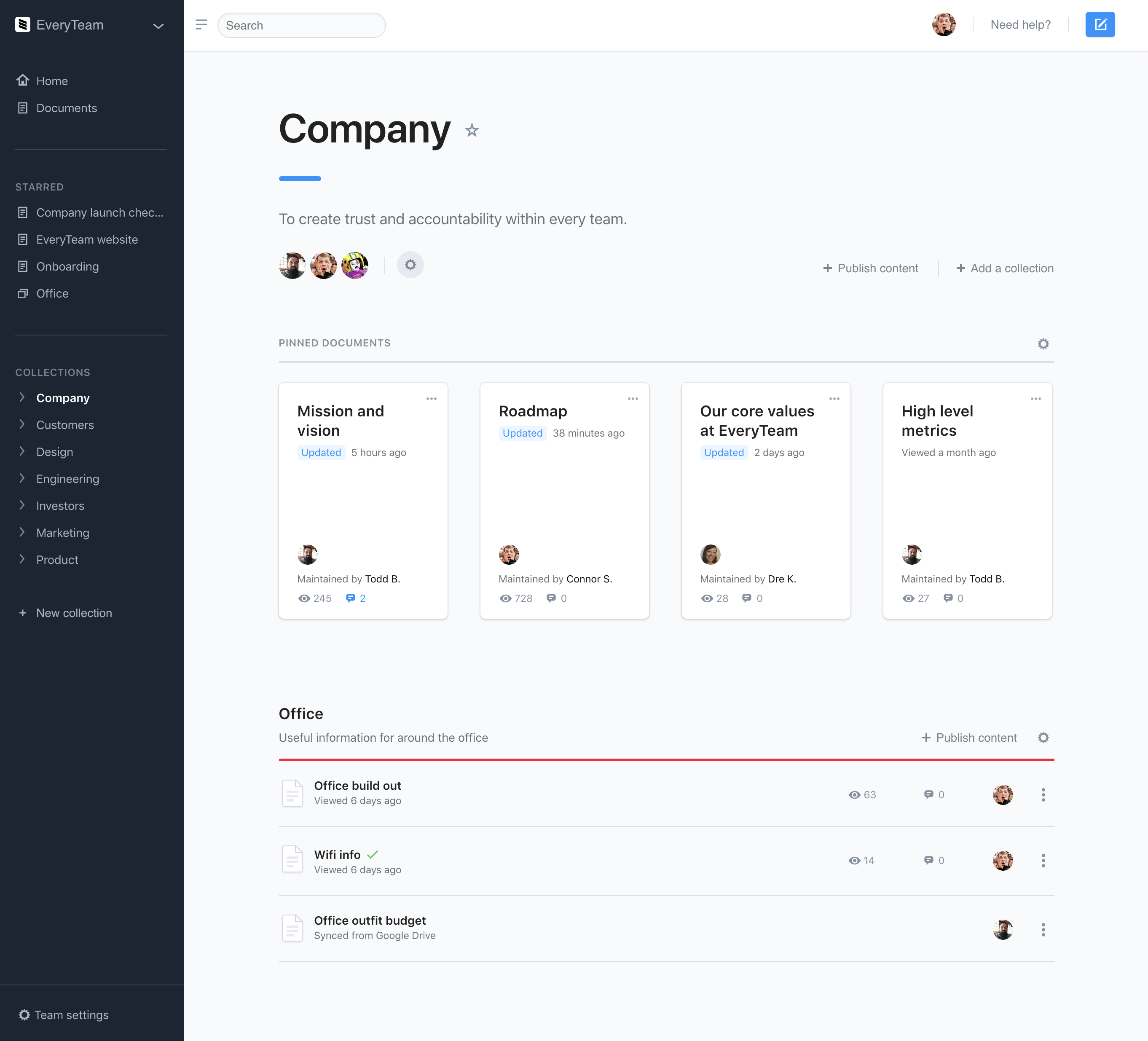

As companies get bigger and bigger, all the critical information about a company — even its mission and culture statements — can get lost in a massive pile of Google Docs or files strewn across dozens of collaboration tools, making it nearly impossible to find. That’s where the team behind EveryTeam hopes to step in and clean things up.

EveryTeam serves as a sort of hub for all of the documents and core information about a company — a kind of living library that adapts over time and can easily suck in new information as it comes about. The idea is that employees might not necessarily be going to the same internal portal for that information, or might not be updating that portal, and the information continues to sit across multiple different buckets within a company. The company came about from former GitHubbers Todd Berman, Connor Sears, and Scott Goldman, which are looking to bring that same level of collaboration and simplicity to access to internal employee information. The startup said it has raised $3 million in a seed round from Harrison Metal, Upside Partnership, Index Ventures and Greylock Partners.

“People end up creating content in them but struggling to maintain content in these [internal communications] tools,” CEO Todd Berman said. “Whether they’re using a combination of Google Docs, or Dropbox Paper, or Confluence, there’s tons of people trying to do a lot of different things here. A lot of these tools are focused on the creation, where people felt there was a lot of opportunity. But for our potential customers, the issue is that their content is all over the place. it’s not in one spot.”

EveryTeam works to surface up those kinds of critical employee documents that are probably fine to just exist in some Google Drive somewhere very early on — which might include the information for the WiFi or the schedule for office snacks. But as more and more docs flow in, EveryTeam has to parse through all of those and ensure that the right important ones are surfaced up in front of everyone, especially as they become more and more important over time. For larger and large companies, that content management can get out of control and devolve into a lot of messages across the organization just to find a single document. EveryTeam integrates with GitHub, Google Drive, Dropbox, Figma, and Airtable among others.

“It ends up looking in a lot of cases like how GitHub works — GitHub is a tool to maintain, curate and publish software. You’re publishing source code, but a lot of the workflows feel very natural and feel very similar. Ultimately, where we ended up from a product perspective is, it’s more about being a layer on top of these services [like Box] to provide a plane of organization.”

EveryTeam isn’t the only startup looking to rethink the internal employee wiki. Slite, another startup looking to create an intelligent internal notes tool that can serve as a hub of information for employees, also said it raised $4.4 million earlier this year. The idea there is to bring the Slack-like simplicity that has become popular among employees — at least, at the startup level — to a variety of different areas that haven’t changed in a while. Internal note-taking, and that Wiki functionality, is one. EveryTeam decided to work with the idea that content is just going to exist all over the place anyway, and try to fit into the employee workflow that way.

“You want to curate and expose content that exists in ten to 12 different tools you use every day,” Berman said. “Ultimately, that’s part of my day-to-day flow. I’m usually in four to five web apps. When [some tools] take the Slack model they often get very focused on recency, and that determines an arbiter of value.[You have to think], what is the desire path for a document that becomes load-bearing in the company. It starts off a little weird, people edit it, it ideates and matures, and it stands the test of time. How do you create an application that helps that happen.”

Powered by WPeMatico

Aclima, a San Francisco-based company which builds Internet-connected air quality sensors and runs a software platform to analyze the extracted intel, has closed a $24 million Series A to grow the business including by expanding its headcount and securing more fleet partnerships to build out the reach and depth of its pollution maps.

The Series A is led by Social Capital which is joining the board. Also participating in the round: The Schmidt Family Foundation, Emerson Collective, Radicle Impact, Rethink Impact, Plum Alley, Kapor Capital and First Philippine Holdings.

Three years ago Aclima came out of stealth, detailing a collaboration with Google on mapping air quality in its offices and also outdoors, by putting sensors on StreetView cars.

Though it has actually been working on the core problem of environmental sensing and intelligence for about a decade at this point, according to co-founder Davida Herzl.

“What we’ve really been doing over the course of the last few years is solving the really difficult technical challenges in generating this kind of data. Which is a revolution of air quality and climate change emissions data that hasn’t existed before,” she tells TechCrunch.

“Last year we announced the results of our state-wide demonstration project in California where we mapped the Bay Area, the Central Valley, Los Angeles. And really demonstrated the power of the data to drive new science, decision making across the private and public sector.”

Also last year it published a study in collaboration with the University of Texas showing that pollution is hyperlocal — thereby supporting its thesis that effective air quality mapping requires dense networks of sensors if you’re going to truly reflect the variable reality on the ground.

“You can have the best air quality and the worst air quality on the same street,” says Herzl. “And that really gives us a new view — a new understanding of emissions but actually demonstrated the need for hyperlocal measurement to protect human health but also to manage those emissions.

“That data set has been applied across a variety of scientific research including studies that really showed the linkages between hyperlocal data and cardiovascular risk. In LA our black carbon data was used to support increased filtration in schools to protect school children.”

“Our technology is really a proof point for emerging and new legislation in California that’s going to require community based monitoring across the entire state,” she adds. “So all of that work in California has really demonstrated the power of our platform — and that has really set us up to scale, and the funding round is going to enable us to take this to a lot more cities and regions and users.”

Asked about potential international expansion — given the presence of strategic investors from southeast Asia backing the round — Herzl says Aclima has had a “global view” for the business from the beginning, even while much of its early work has focused on California, adding: “We definitely have global ambitions and we will be making more announcements about that soon.”

Its strategy for growing the reach and depth of its air quality maps is focused on increasing its partnerships with fleets — so there’s a slight irony there given the vehicles being repurposed as air quality sensing nodes might themselves be contributing to the problem (Herzl sidestepped a question of whether Uber might be an interesting fleet partner for it, given the company’s current attempts to reinvent itself as a socially responsible corporate — including encouraging its drivers to go electric).

“Our mapping capabilities are amplified through our partnerships with fleets,” she says, pointing to Google’s StreetView cars as one current example (though this is not an exclusive partnership arrangement; a London air quality mapping project involving StreetView cars which was announced earlier this month is using hardware from a rival UK air quality sensor company, called Air Monitors, for example).

But flush with fresh Series A funding Aclima will be working on getting its kit on board more fleets — relying on third parties to build out the utility of its software platform for policymakers and communities.

“There’s a number of fleets that we are going to be speaking about our partnerships with but our platform can be integrated with any fleet type and we believe that is an incredible advantage and position for the company in really achieving our vision of creating a global platform for environmental intelligence to help cities and entire countries really manage climate risk at a scale that really hasn’t been possible before,” she adds.

“Our technology provides 100,000x greater spacial resolution than existing approaches and we do it at 100-1,000x cost reduction so our vision is to be the GPS of the environment — a new layer of environmental awareness and intelligence that really informs day-to-day decisions.

“We’re really excited because it’s taken really years of work. I incorporated Aclima 10 years ago and started really working on the technology around 2010. So this has taken… a tremendous amount of technical development and scientific rigor with partners… to really have the technology at a place where it’s really set up to scale.”

It finances (or part finances) the deployment of its sensors on the vehicles of fleet partners — with Aclima’s business model focused on monetizing the interpretation of the data provided by its SaaS platform. So a chunk of the Series A will be going to help pay for more sensor rollouts.

In terms of what fleet partners get back from agreeing for their vehicles to become mobile air quality sensing nodes, Herzl says it’s dependent on the partner. And Aclima’s isn’t naming any additional names on that front yet.

“It’s specific to each fleet. But I can say that in the case of Google we’re working with Google Earth outreach and the team at StreetView… to really reflect their commitment to sustainability but also to expand access to this kind of information,” she says of the perks for fleets, adding: “We’ll be talking more about that as we make announcement about our other partners.”

The Series A financing will also go on funding continued product development, with Aclima hoping to keep adding to the tally of pollutants it can identify and map — building on a list which includes the likes of CO2, methane and particulate matter.

“We have a very ambitious roadmap. And our roadmap is expansive — ultimately our vision is to make the invisible visible, across all of the pollutants and factors in the invisible layer of air that supports life. We want to make all of that visible — that’s our long term vision,” she says.

“Today we’re measuring all of the core gaseous pollutants that are regulated as well as the core climate change gases… We are not only deploying and expanding our platform’s availability but in our R&D efforts investing in next generation sensing technologies, whether it’s the tiniest PM2.5 sensor in the world to on our roadmap really having the ability to speciate COC [chlorinated organic compounds].

“We can’t do that today but are working on it and that is an area that is really important for specific communities but for industry and for policy makers as well.”

A key part of its ongoing engineering work is focused on shrinking certain sensing technologies — both in size and cost. As that’s the key to the sought for ubiquity, says Herzl.

“There’s a lot of hard work happening there to shrink [sensors],” she notes. “We’re talking about sensors that are the size of a thumb tack. Traditional technologies for this are very large, very difficult to deploy… so it’s not that capabilities don’t exist today but we’re working on shrinking those capabilities down into really, really tiny components so that we can achieve ubiquity… You have to shrink down the size but also reduce the cost so that you can deploy thousands, millions of these things.”

Commenting on the funding round in a supporting statement, Jay Zaveri, partner at Social Capital, added: “Aclima has successfully opened up an entirely new market domain with their innovative approach, tackling one of the biggest global challenges of our time. With a proven ability to quantify emissions and human exposure to pollution at global resolutions previously impossible, Aclima creates enormous opportunities for industry, cities and society.”

Powered by WPeMatico

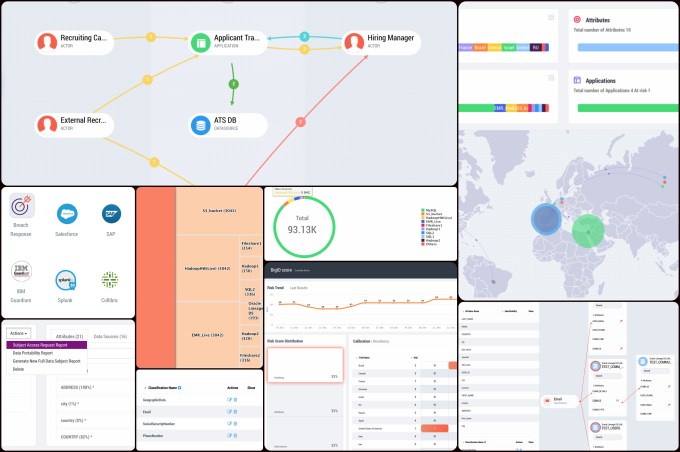

BigID announced a big $30 million Series B round today, which comes on the heels of closing their $14M A investment in January. It’s been a whirlwind year for the NYC data security startup as GDPR kicked in and companies came calling for their products.

The round was led by Scale Venture Partners with participation from previous investors ClearSky Security, Comcast Ventures, Boldstart Ventures, Information Venture Partners and SAP.io.

BigID has a product that helps companies inventory their data, even extremely large data stores, and identify the most sensitive information, a convenient feature at a time where GDPR data privacy rules, which went into effect at the end of May, require that companies doing business in the EU have a grip on their customer data.

That’s certainly something that caught the eye of Ariel Tseitlin from Scale Venture Partners. “We talked to a lot of companies, how they feel more specifically about GDPR, and more broadly about how they think about data within in their organizations, and we got a very strong signal that there is a lot of concern around the regulation and how to prepare for that, but also more fundamentally, that CIOs and chief data officers don’t have a good sense of where data resides within their organizations,” he explained.

Dimitri Sirota, CEO and co-founder, says that GDPR is a nice business driver, but he sees the potential to grow the data security market much more broadly than simply as a way to comply with one regulatory ruling or another. He says that American companies are calling, even some without operations in Europe because they see getting a grip on their customer data as a fundamental business imperative.

BigID product collage. Graphic: BigID

The company plans to expand their partner go-to market strategy in the coming the months, another approach that could translate to increased sales. That will include global systems integrators. Sirota says to expect announcements involving the usual suspects in the coming months. “You’ll see over the next little bit, several announcements with many of the names that you’re familiar with in terms of go-to market and global relationships,” he said.

Finally there are the strategic investors in this deal, including Comcast and SAP, which Sirota thinks will also ultimately help them get enterprise deals they might not have landed up until now. The $30 million runway also gives customers who might have been skittish about dealing with a young-ish startup, more confidence to make the deal.

BigID seems to have the right product at the right time. Scale’s Tseitlin, who will join the board as part of the deal, certainly sees the potential of this company to scale far beyond its current state.

“The area where we tend to spend a lot of time, and I think is what attracted Dimitri to having us as an investor, is that we really help with the scaling phase of company growth,” he said. True to their name, Scale tries to get the company to that next level beyond product/market fit to where they can deliver consistently and continually grow revenue. They have done this with Box and DocuSign and others and hope that BigID is next.

Powered by WPeMatico

Automattic, the company behind WordPress.com, WooCommerce, Longreads, Simplenote and a few other things, is acquiring Brooklyn-based startup Atavist.

Atavist has been working on a content management system for independent bloggers and writers. With an Atavist website, you can easily write and publish stories with a ton of media.

You might think that this isn’t particularly groundbreaking as anyone can create a website on WordPress.com or Squarespace and do the same thing. But the company also lets you create a paywall and build a subscription base.

Many writers don’t want to deal with the technical details of running a website. That’s why Atavist gives you the tools so that you can focus on your stories.

Atavist is also running a publication called Atavist Magazine. The publication is also joining Automattic. It’s unclear if it’s going to be part of Longreads or remain its own thing.

The CMS itself won’t stick around. Automattic said that the publishing platform will be integrated into WordPress. And this is the interesting part.

While WordPress is probably a much more solid CMS than Atavist, it could mean that Automattic wants to start offering subscriptions and paywalls. You can imagine WordPress.com websites that offer monthly subscriptions natively.

30 percent of the web runs on WordPress. Many of them are open source instances of WordPress hosted on their own servers. But many websites are hosted by WordPress.com, including TechCrunch.

Subscriptions on WordPress.com is good news for the web. Medium abruptly canceled its subscription program leaving many independent publications in the dust. So it’s hard to trust Medium when it comes to providing enough revenue to independent writers.

Automattic could create a seamless portal to manage subscriptions to multiple publications. And this could lead to less advertising and better content.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines. This week TechCrunch’s Silicon Valley Editor Connie Loizos and I jammed out on a couple of topics as Alex Wilhelm was out managing his fake stock game spreadsheets or something. (The jury is out on whether this was a good or bad thing.)

First up is Twitter buying Smyte, a startup targeting fixes for spam and abuse. This is, of course, Twitter’s perennial problem and it’s one that it’s been trying to fix for some time — but definitely not there yet. The deal terms weren’t disclosed, but Twitter to its credit has seen its stock basically double this year (and almost triple in the past few years). Twitter is going into a big year, with the U.S. midterm elections, the 2018 World Cup, and the Sacramento Kings probably finding some way to screw up in the NBA draft. This’ll be a close one to watch over the next few months as we get closer to the finals for the World Cup and the elections. Twitter is trying to bill itself as a home for news, focusing on live video, and a number of other things.

Then we have Juul Labs, an e-cigarette company that is somehow worth $10 billion. The Information reports that the PAX Labs spinout from 2015 has gone from a $250 million valuation all the way to $10 billion faster than you can name each scooter company that’s raising a new $200 million round from Sequoia that will have already been completed by the time you finish this sentence. Obviously the original cigarette industry was a complicated one circa the 20th century, so this one will be an interesting one to play out over the next few years.

Finally, we have meditation app Calm raising a $27 million round at a $250 million pre-money valuation. Calm isn’t the only mental health-focused startup that’s starting to pick up some momentum, but it’s one that’s a long time coming. I remember stumbling upon Calm.com back in 2012, where you’d just chill out on the website for a minute or so, so it’s fun to see a half-decade or so later that these apps are showing off some impressive numbers.

That’s all for this week, we’ll catch you guys next week. We apologize in advance if Alex makes it back on to the podcast.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocketcast, Downcast and all the casts.

Powered by WPeMatico

Drip Capital is raising a $20 million funding round from Accel, Wing VC and Sequoia India. The company is helping small exporters in emerging markets access working capital in order to finance big orders.

The startup also participated in Y Combinator back in 2015. Many small companies in emerging markets have to turn down orders because they can’t finance big orders. Even if you found a client in the U.S. or Europe, chances are companies will end up paying for your order a month or two after signing a contract.

If you’re an importer or an exporter, capital is arguably your most valuable resource. You know where to source your products and how to ship many goods. But you still need to buy goods yourself.

And in many emerging markets, you have to pay right away. It creates a sort of capital gap.

At the same time, local banks are often too slow and reject too many credit applications. Drip Capital thinks there’s an opportunity for a tech platform that finances exporters in no time.

The startup is first focusing on India because it meets many of the criteria I listed. This could be particularly useful for small and medium businesses. Large companies don’t necessarily face the same issues as they can access capital more easily.

So far, Drip Capital has funded more than $100 million of trade. After signing up to the platform, you can submit invoices and open a credit line to finance your next orders. Family offices and institutional investors can also invest some money in Drip Capital’s fund and get returns on investment.

This isn’t the only platform that helps you get paid faster. But larger companies tend to do it all and optimize the supply chain for the biggest companies in the world. Drip Capital is focusing on a specific vertical.

With today’s funding round, the company plans to get more customers and expand to other countries.

Powered by WPeMatico

French startup Tiller has raised a $13.9 million Series B round (€12 million) from Ring Capital. Omnes Capital and existing investors 360 Capital Partners also participated in today’s funding round. The company has been working on a cash register that works better than your clunky touchscreen from ten years ago.

Tiller is working on a software solution for restaurants. It works with a good old iPad and connects with multiple payment solutions.

You can customize the menu and restaurant layout in the app to make it as easy as possible to enter an order. And at the end of the meal, you can make your customers pay using multiple payment methods and keep track of what’s left to pay.

This sounds like basic features, but Tiller’s secret sauce is that you can configure your app and integrate with many third-party services. For instance, you can manage your inventory and your staff directly from Tiller with third-party services.

You can receive orders from UberEats or Lunchr on your Tiller tablet. You can manage bookings from TheFork and other services.

When it comes to payment, you can pair Tiller with a Sumup or Ingenico card reader and accept all sorts of cards and contactless payments. You can also add Lydia, Lyf Pay and other mobile payment apps. Finally, Tiller tries to automate your accounting reports as much as possible.

If you want to use Tiller even more than that, you can give an iPhone to your waiters so that they can use the Tiller mobile app to write down orders. You can also get reports and track your revenue depending on the time of the day or the product category.

Most of Tiller’s clients are based in France and Spain, and the startup has attracted 5,000 clients so far. With today’s funding round, the company plans to attract more customers in other European countries.

It’s also worth noting that Tiller has the option to raise an additional $9.3 million (€8 million) to finance acquisitions. It could be a good way to get started in new markets.

Powered by WPeMatico

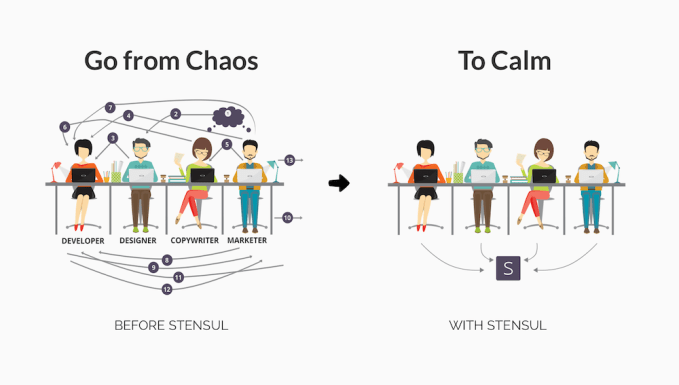

Email marketing startup Stensul is announcing that it has raised $7 million.

Stensul spun out of founder and CEO Noah Dinkin’s previous company FanBridge. Dinkin explained via email that the startup isn’t competing with the big email service providers — in fact, it integrates with ESPs including Salesforce Marketing Cloud, Oracle Marketing Cloud, Adobe Marketing Cloud and Marketo.

Dinkin said that while ESPs include email creation tools, most companies ignore them. Instead, the marketer has to work with specialists like designers, developers and agencies: “That process often takes weeks, everyone hates it, and it is SUPER expensive.”

Stensul, meanwhile, is focused exclusively on the email creation process. Marketers at large enterprises can build the email themselves, without having to rely on anyone else, in less than 20 minutes.

“They don’t need to know how to code, they don’t need to know how to use Photoshop or have memorized the 100 page pdf of brand guidelines,” Dinkin said. “The platform controls for brand governance and rules, and also guarantees that the output will be technically perfect.”

Javelin Venture Partners led the Series A, with participation from Arthur Ventures, First Round Capital, Uncork Capital, Lowercase Capital and former ExactTarget President Scott McCorkle.

“Stensul has zeroed in on a massive problem space hiding in plain sight,” said Javelin’s Alex Gurevich in the funding announcement. “Email Marketing is used by every large company in the world, and the amount of time and money spent on email creation is far more than most people realize. The quality of top-tier customers that stensul has been able to bring on made it clear to us that they have a solution that really delivers value on day 1.”

Companies that have used Stensul include YouTube, Grubhub, BMW, Lyft and Box. Dinkin said he will continue to invest in product, but the big goal with the new funding is to grow sales and marketing.

Powered by WPeMatico

Beamery, a London-based startup that offers self-styled “talent CRM”– aka ‘candidate relationship management’ — and recruitment marketing software targeted at fast-growing companies, has closed a $28M Series B funding round, led by EQT Ventures.

Also participating in the round are M12, Microsoft’s venture fund, and existing investors Index Ventures, Edenred Capital Partners and Angelpad Fund. Beamery last raised a $5M Series A, in April 2017, led by Index.

Its pitch centers on the notion of helping businesses win a ‘talent war’ by taking a more strategic and pro-active approach to future hires vs just maintaining a spreadsheet of potential candidates.

Its platform aims to help the target enterprises build and manage a talent pool of people they might want to hire in future to get out ahead of the competition in HR terms, including providing tools for customized marketing aimed at nurture relations with possible future hires.

Customer numbers for Beamery’s software have stepped up from around 50 in April 2017 to 100 using it now — including the likes of Facebook (which is using it globally), Continental, VMware, Zalando, Grab and Balfour Beatty.

It says the new funding will be going towards supporting customer growth, including by ramping up hiring in its offices in London (HQ), Austin and San Francisco.

It also wants to expand into more markets. “We’re focusing on some of the world’s biggest global businesses that need support in multiple timezones and geographies so really it’s a global approach,” said a spokesman on that.

A “significant” portion of the Series B funds will also go towards R&D and produce development focused on its HR tech niche.

“Across all sectors, there’s a shift towards proactive recruitment through technology, and Beamery is emerging as the category leader,” added Tom Mendoza, venture lead and investment advisor at EQT, in a supporting statement.

“Beamery has a fantastic product, world-class high-ambition founders, and an outstanding analytics-driven team. They’ve been relentless about building the best talent CRM and marketing platform and gaining a deep understanding of the industry-wide problems.”

Powered by WPeMatico

Nginx, the commercial company behind the open source web server, announced a $43 million Series C investment today led by Goldman Sachs Growth Equity.

NEA, which has been on board as an early investor is also participating. As part of the deal, David Campbell, managing director at Goldman Sachs’ Merchant Banking Division will join the Nginx board. Today’s investment brings the total raised to $103 million, according to the company.

The company was not willing to discuss valuation for this round.

Nginx’s open source approach is already well established running 400 million websites including some of the biggest in the world. Meanwhile, the commercial side of the business has 1,500 paying customers, giving those customers not just support, but additional functionality such as load balancing, an API gateway and analytics.

Nginx CEO Gus Robertson was pleased to get the backing of such prestigious investors. “NEA is one of the largest venture capitalists in Silicon Valley and Goldman Sachs is one of the largest investment banks in the world. And so to have both of those parceled together to lead this round is a great testament to the company and the technology and the team,” he said.

The company already has plans to expand its core commercial product, Nginx Plus in the coming weeks. “We need to continue to innovate and build products that help our customers alleviate the complexity of delivery of distributed or micro service based applications. So you’ll see us release a new product in the coming weeks called Controller. Controller is the control plane on top of Nginx Plus,” Robertson explained. (Controller was launched in Beta last fall.)

But with $43 million in the bank, they want to look to build out Nginx Plus even more in the next 12-18 months. They will also be opening new offices globally to add to its international presence, while expanding its partners ecosystem. All of this means an ambitious goal to increase the current staff of 220 to 300 by the end of the year.

The open source product was originally created by Igor Sysoev back in 2002. He introduced the commercial company on top of the open source project in 2011. Robertson came on board as CEO a year later. The company has been growing 100 percent year over year since 2013 and expects to continue that trajectory through 2019.

Powered by WPeMatico