Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

While massive restaurant chains might have resources to build out their own management systems or integrate with larger point-of-sale providers, Toast — a provider of tools for restaurants to manage their business — is raising a big round of funding to go after everyone else.

Now Toast is a business valued at $1.4 billion, thanks to a fresh infusion of $115 million in its latest round of funding. At its core, Toast is a point-of-sale for restaurants, though over time it’s added more and more services on top of that. Now the goal is to be not just a point of sale, but offer a whole system to help restaurants operate efficiently. That can range from the actual point of sale all the way to loyalty programs and reporting on that information. The round was led by T. Rowe Price Associates, with participation from new investor Tiger Global Management and other existing investors.

“We’re just trying to keep our finger on the pulse to what matters to restauranteurs,” CFO Tim Barash said. “We hear a lot about the labor side of the equation. We’re working through what to do there. If you ask restaurants about the number one thing they’re thinking about, most respondents say it’s around labor — that’s a really big one.”

Starting off in 2011 as a point-of-sale business, the company now offers a complete suite of tools that help restaurants streamline both the front and back house of the restaurant. And as Toast collects more and more data on how restaurants are using its tools — like any startup with a lot of inbound data, really — it can start helping those restaurants figure out how to improve their businesses further. That might be modifying menus slightly based on what people are enjoying, or pointing them in the right direction as to when to make slight adjustments to their basic operations.

There’s also an online ordering part of the business. Toast helps restaurants boot up an online ordering part of their business quickly, in addition to offering tools to help streamline that process. A restaurant might deal with a flood of orders or throttle them if necessary. Businesses then get reports on their whole online ordering business, helping them further calibrate what to offer — and what might work better for the in-person experience as well.

The next focus for Toast, Barash said, is figuring out the labor side of the equation. That comes down to helping restaurants not only find new employees, but also figure out how to retain them in an industry with a significant amount of turnover. Attacking the hiring part of the problem is one approach, though there are other approaches like Pared, which looks to turn the labor market for restaurants into an on-demand one. But there’s obvious low-hanging fruit, like making it easier to switch shifts, among other things, Barash said.

“One in 11 working human beings work in restaurants,” Barash said. “I would say we’re still trying to figure out what we can do as a central platform of record, continuing to carry a high quality network of partners or us building some things ourselves. We’re early days in figuring them out. If you go to any restaurant in Boston, and look at all the help wanted signs, you can see the barrier to being successful is a lot of times more on the employee side than on the guest side. Then once you have them hired, you have to think about how you can retain those employees and make sure they’re engaged and successful.”

Toast isn’t the only startup looking to own a point-of-sale and then expand into other elements of running a business, though. Lightspeed POS, which also offers a pretty large set of tools for brick-and-mortar stores — including restaurants — raised $166 million late last year. There are also the obvious point-of-sale competitors like Square that, while designed to be a broad solution and not just target restaurants, are pretty widely adopted and can also try to own that whole restaurant management stack, from clocking in and out to getting reports on what’s selling well.

Powered by WPeMatico

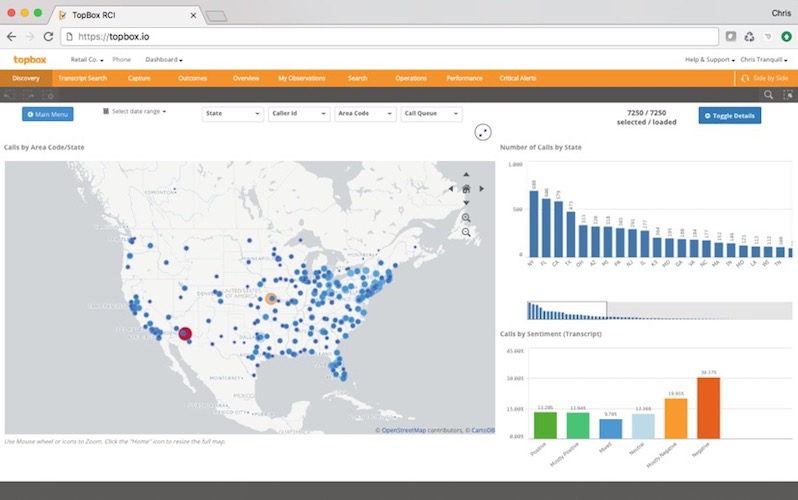

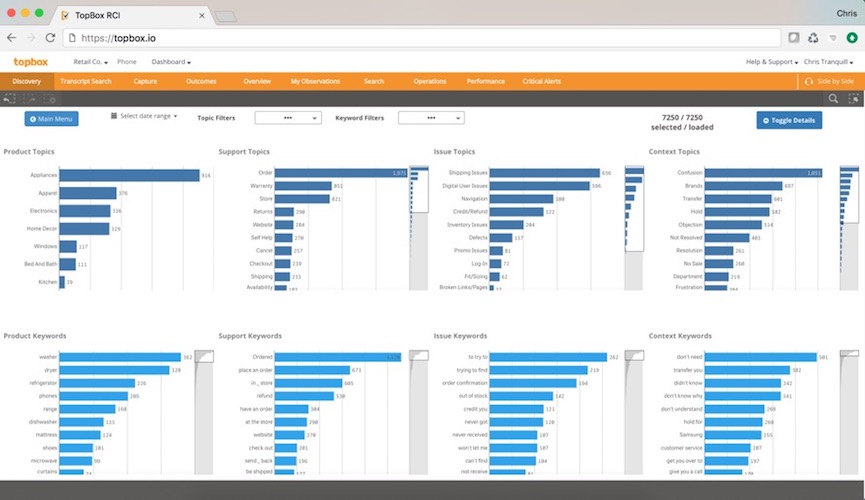

Topbox helps businesses understand how their customers experience their products and where they run into issues by analyzing voice and text chats to surveys, social media posts and online reviews. Today, the company announced it has raised a $5 million funding round led by Telescope Partners, with participation from Cascade Angels, Flyover Capital and the Maryland Venture Fund.

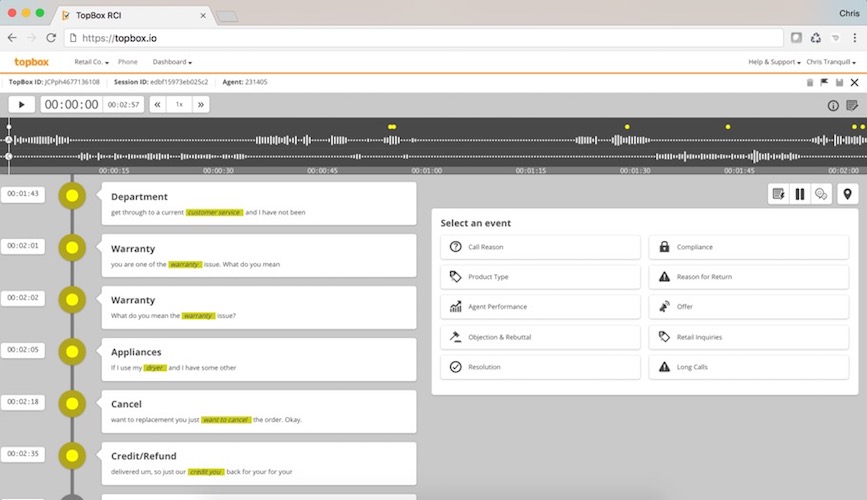

Topbox CEO Chris Tranquill told me he first experienced the problem he’s trying to solve when he was running call centers with thousands of agents. All of the companies that contracted his services faced the same problem: understanding the friction points their customers were experiencing.

“We always had this vision that being able to really understand those friction points with deep context — that’s what the key is — but really getting to that granular level of detail so that you can have that context to support a decision,” Tranquill said. Say you want to understand what issues customers are having with a new shoe. Ideally, Topbox will aggregate all of the data across all channels about that shoe and help the company understand who the wearers are and what issues they are experiencing.

Theoretically, companies could do this on their own, but all of this data exists in various silos and combining those disparate data sets is a major challenge. Topbox uses its technology to ingest this data (and it’s pretty agnostic about where it comes from) and then runs it through its classification models. Indeed, as Tranquill told me, it’s this model that’s the secret sauce behind the company’s ability to classify data.

It’s not just about getting a high-level overview of your customer’s reactions, though. Tranquill stressed that users can go deeper. “The big thing for us is granularity,” he told me. “I can find high-level data all day long, but can I find the root cause?” With a few clicks, any Topbox user should be able to understand what issues their customers are facing, no matter whether that’s a product issue, a shipping problem or something else.

Current Topbox customers include the likes of Orvis, Bed Bath & Beyond and Western Union. With this new round, Topbox expects to build out its go-to-market strategy and continue to develop its product. Currently, the company focuses on a number of verticals where its model works best (retailers, mobile telcos, cable and broadband providers and healthcare companies), and Tranquill tells me this is where it will focus its energy for now. The company will also soon launch a new user interface and bring on more machine learning experts as it looks to provide its users deeper insights into their data.

Powered by WPeMatico

TaxScouts, a U.K. startup founded by TransferWise and Marketinvoice alumni, is the latest online service designed to make filing your tax return a lot less tedious. However, rather than focusing on the bookkeeping part of the problem primarily tackled by cloud accounting software — which is often overkill if you are self-employed or simply earn a little additional income outside of your day job — the company combines “automation” with human accountants to help you prepare your tax submission.

“Doing taxes is either tedious when you have to do them yourself, or expensive when you hire an accountant,” says TaxScouts co-founder and CEO Mart Abramov, who was employee number 8 at TransferWise and also previously worked at Intuit, MarketInvoice and Skype. “We’re automating as much of the admin part of tax preparation as possible in our online app. We then connect you with a certified accountant who will take care of the entire tax filing process for you”.

The headline draw is that TaxScouts charges a flat fee of £99 if you pay in advance, and promises a turn-around of just 24 hours. To help with this, the web app walks you through your tax status, income and expenses without assuming too much prior knowledge. This includes asking you to upload or take a photo of any required documents, such as invoices or dividend certificates. The idea is that all of the admin is captured digitally and packaged up ready for your assigned accountant to take a look.

“As more of the menial tasks are handled by our app this allows accountants to focus on what they do best and not get stuck in admin,” explains Abramov. “They can focus on providing advice and expertise to make sure everything is done right. Our customers get both the benefits of getting a personal accountant and having a simple tool to manage it all, without the huge costs”.

Abramov tells me that TaxScouts’ typical customers are anyone who wants to have their self assessment done for them or who just wants help with tax preparation. This spans self-employed people — from construction workers to professional freelancers — entrepreneurs and company directors, and people who are entitled to some kind of tax relief or refund, such as investors on crowdfunding platforms. He also said that gig economy workers are a good fit.

Moving forward, TaxScouts plans to further develop the automation functionality, including plugging into more data sources beyond its existing integration with HMRC. Abramov says this could include a driver’s Uber data for tracking mileage claims, for example, while I can immediately see how the app could integrate with various fintech offerings that capture transactions and receipts.

To that end, the startup has raised £300,000 in “pre-seed” funding to continue building out the product. Backers include Picus Capital, Charlie Delingpole (co-founder of ComplyAdvantage and MarketInvoice), and Charlie Songhurst (former GM corporate strategy at Microsoft).

Powered by WPeMatico

Have you felt a disconnect with your Alexa and wished she could share more of your sense of humor or tell you an actually scary ghost story? Startup Storyline makes designing your own Alexa skills as easy and dragging and dropping speech blocks, and has just raised $770,000 in a funding round led by Boost VC to help grow its skill builder API.

The company launched in 2017 to help bridge the gap between creators and the tricky voice recognition software powering smart speakers like Alexa. With its new funding, CEO and co-founder Vasili Shynkarenka says that Storyline is hoping to expand its team and its interface to other smart speakers, like Google Home, as well work on integrating monetization and third-party services into the interface.

Storyline’s user friendly interface lets users drag-and-drop speech commands and responses to customize user’s interactions with their smart speaker devices. Users can choose between templates for a skill or a flash briefing, and test the voice recognition and logic of the design live in their browser window.

Since its launch, over 12,000 Storyline users have published 2,500 skills in the Alexa Skills Store — more than 6% of all skills in the store. The interface has also been used by the grand-prize winners of Amazon’s developer Alexa Skills Challenge: Kids and the publication Slate.

For Shynkarenka, the creation of these skills is vastly different from the creation of a typical smartphone app.

“Most people think of Alexa as another software platform, like a smartphone or the web, and that’s not [actually] true,” he said. “The most popular apps on Alexa are not the apps that let you chat with friends or browse your social networks. The most popular apps are content apps — the apps that you can use to play trivia games with your family over dinner.”

Just as YouTube has video creators, Shynkarenka says he wants Storyline to become the home for smart speaker content across devices. The startup has already cultivated an active online community of 2,500 creators excited about creating and sharing this content.

Storyline is not alone in this space however, Amazon itself released Amazon Blueprints in April that allows users to create customized Amazon skills using several different available templates.

As the smart speaker space, and subsequent skill creation one, continue to heat up, the creation of your perfectly customized new smart speaker family member may be closer than you think.

Powered by WPeMatico

The Securities and Exchange Commission, the federal agency responsible for protecting investors and maintaining fair and orderly functioning of our securities markets, has 11 regional offices, including in Miami, New York, Boston and Chicago.

None has quite the workload as the SEC’s San Francisco regional office, where a major area of focus in recent years has been investor fraud in pre-IPO companies, particularly the many startups that in an earlier era would have either have gone public or else out of business, but which today linger as privately held outfits because there’s so much money sloshing around.

Among the companies to find themselves in the SEC’s sights in recent years is HR software outfit Zenefits and its founder, Parker Conrad; they were fined $1 million last October as part of a settlement over charges that they’d misled investors. In March, the online personal finance company Credit Karma also settled SEC charges; it had been accused of unlawfully offering securities to its employees — then failing to provide them with timely financial statements and risk disclosures.

Of course, the best-known SEC case to date has centered on the blood-testing company Theranos, which was charged with massive fraud in March, along with the company’s founder, Elizabeth Holmes, and its former president, Sunny Balwani.

Leading the charge in each of these cases and many more: Jina Choi, a graduate of Oberlin and Yale Law School who worked as a lawyer for the Justice Department in Washington before heading to San Francisco and the SEC’s enforcement division in 2000.

Five years ago, Choi was promoted to director of that office, where she has since overseen enforcement and examinations in Northern California and the Pacific Northwest, despite critics who believe the SEC should keep its eye on public companies alone. (“If no one is policing private markets, that’s a problem,” Choi said at a public forum in May.)

In an age of initial coin offerings, cryptocurrencies and mushrooming numbers of blockchain-related projects, Choi and her colleagues have their hands particularly full, so you can imagine how excited we are that Choi is coming to Disrupt to discuss some of those challenges, as well as the agency’s victories. We’re also looking forward to learning more about how decisions are made in Choi’s office and back in Washington.

If you’re interested in learning more about the SEC’s ever-evolving approach to Silicon Valley startups — and why you shouldn’t expect its interest to dissipate any time soon — you really won’t want to miss this conversation.

You can buy tickets to the show, taking place in San Francisco September 5th through September 7th, right here.

Powered by WPeMatico

French venture capital firm ISAI just raised a new $175 million fund (€150 million) called ISAI Expansion II. This fund is designed for later stage investments.

The firm says that it managed to raise this fund in less than three months. This is a growth fund and the team plans to invest between $6 million and $35 million per deal (between €5 million and €30 million).

ISAI first started with a seed fund back in 2010. The company raised a $41 million fund (€35 million) and invested in BlaBlaCar shortly after that. The firm has raised a growth fund and another seed fund since then.

If you include today’s new fund, ISAI has raised over $350 million in total (€300 million). So ISAI Expansion II is by far the biggest fund to date.

Limited partners include dozens of successful tech entrepreneurs as well as institutional partners. Many existing investors invested once again in ISAI’s new fund. Some entrepreneurs joined the list for the first time.

With the previous ISAI Expansion fund, the firm invested in nine companies over five years. And ISAI already sold its shares in two companies, Hospimedia and Labelium.

ISAI also says that it can help entrepreneurs using owner buy-out transactions. By creating a holding company, this type of operations lets entrepreneurs cash out, buy shares from existing minor investors and work with a new investor.

More interestingly, ISAI doesn’t necessarily want to focus on Paris-based tech startups. The firm is also looking for investments in more traditional companies that aren’t yet taking advantage of digital opportunities.

Powered by WPeMatico

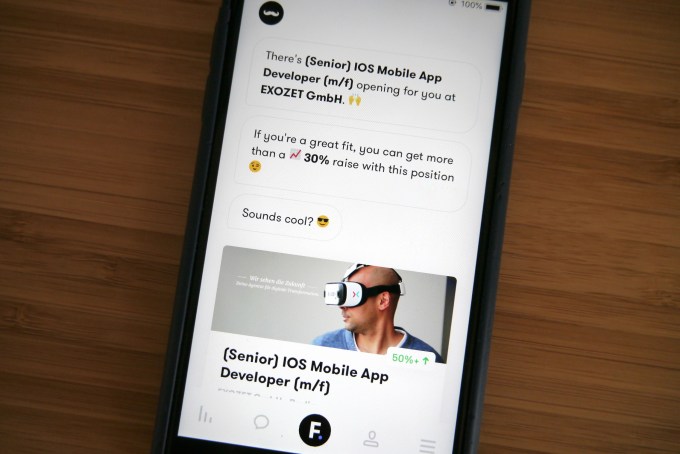

MeetFrank, aka a ‘secret’ recruitment app that uses machine learning plus a chatbot wrapper to take the strain out of passive job hunting and talent-to-vacancy matching, has closed a €1 million (~$1.1M) seed funding round to fuel market expansion in Europe.

Hummingbird VC, Karma VC, and Change Ventures are the investors.

The Estonian startup was only founded last September but says it has ~125,000 active users in its first markets: Estonia, Finland, Sweden, Latvia, Lithuania, plus its most recent market addition, Germany, an expansion this seed has financed.

Around 2,000 companies are using the app to try to attract talent. In Germany employers on board with MeetFrank include Daimler, Eon, Delivery Hero, SumUp, Blinkist, High Mobility and MyTaxi.

“The average company profile we have at the moment is a start-up/scale-up company that develops their product in-house,” says co-founder Kaarel Holm.

“At the moment we are mainly focused on technology-related companies — so positions you can find from average start-up or a scale-up,” he tells TechCrunch. “Around 50% of the position are engineering and other 50% is marketing, sales, customer support, legal, data science, product/project management etc.”

He names TransferWise, Taxify, Testlio, Smartly and High-Mobility as other early customers.

Here’s how MeetFrank works on the talent side: The person downloads the app and goes through a relatively quick onboarding chat with ‘Frank’ (the emoji-loving chatbot) where they are asked to specify their skills and experience — choosing from pre-set lists, rather than needing to type — plus to state their current job title and salary.

So while MeetFrank’s target is passive job seekers, these people do still need to actively download the app and input some data.

Hence the chatbot having a strong emoji + GIF game to convince talent that a little upfront effort will go a long way…

The bot also asks what would convince them to switch jobs — offering options to choose from such as a higher salary, more flexible or remote working, relocation, a startup culture and so on.

The anonymous aspect comes in because there’s no requirement for users to provide their real name or any other identifying personal information in order to get matches with potential positions.

Talent is therefore assessed on its merits, at least at this stage of the job hunt.

And while people are asked up front to specify their current salary, which you might think puts them at a potential disadvantage during any pay negotiations, Holm says the aim of MeetFrank’s platform is also to encourage greater openness from employers and steer away from traditional pay negotiation situations.

“We use salary as one datapoint for matching and we try to make sure that offers we make to the user are match their preferences. In lot of cases the salary is the main deal breaker and we would like to present the information as early as possible,” he explains. “Companies on the other side of the marketplace disclose their salary for the users as well — in that case we can avoid the negotiating disadvantage.”

“The policy of MeetFrank platform is that companies have to be extremely open about the position they are trying to fill — this also includes the salary information,” he adds.

Employers are not at all anonymous on the platform. On the contrary, they have to write detailed job advertisements — including levels of pay for advertised roles.

And a pay range will be disclosed to applicants that the app deems potentially suitable — i.e. after its matching process — by displaying a percentage of how much more they could earn above their current salary.

So employers need to be comfortable showing their hand to people who may just be curious what’s out there.

For employers, MeetFrank takes over the ad placement process — using its machine learning to algorithmically match potential candidates to positions. So its proposition is automatic pre-selection across “thousands” of potential job applicants.

And also the possibility of reaching talent which might otherwise not realize that company is hiring. Or think about working for a certain brand.

The app is mainly focused on a “passive talent pool” — aka “currently or recently employed talent that is open for offers”, as Holm puts it. So it’s certainly cherrypicking easier types of jobs to match and fill.

“Entry level jobs is bit out of reach for us at the moment but we will launch a beta project with couple of universities in the autumn this year,” he adds when we ask if the app is open to matching people who don’t currently have a job or are looking for a first job.

Holm says MeetFrank is currently showing 50% MRR growth. It’s already out of the pre-revenue phase — so is charging employers to advertise (the service remains free for the talent side).

The main monetization model is a daily subscription, with employers being charged on a pay-as-you-go basis. Holm says the price per day for employers is €9, and MeetFrank lets them cancel at any time — with no minimum time commitment required to sign up.

“We believe that the new-aged classifieds will only monetize on that kind of on-demand model and should only pay when they find us useful. This also lowers the barrier of entry to most of the start-ups and allows them to vet the market and get visibility with low budgets,” he adds.

Powered by WPeMatico

Dell, which went private in one of the the largest leveraged buyouts in tech circa 2013, announced today that it will once again be going public through a relatively complex mechanism that will once again bring the company back onto the public markets with founder Michael Dell and Silver Lake Partners largely in control.

Dell’s leveraged buyout largely marked the final page in the company’s storied history as a PC provider, going back to the old “dude, you’re getting a Dell” commercials. The company rode that wave to dominance, but as computing shifted to laptops, mobile phones, and complex operations were offloaded into cloud services like Amazon Web Services, Azure and Google Cloud, Dell found itself navigating a complex environment while having to make a significant business transition beyond the PC era. That meant Dell would be beholden to the whims of public markets, perhaps laden with short-term pessimism over the company’s urgent need to find a transition.

The transaction is actually an offer to buy shares that track the company’s involvement in VMWare, converting that tracking stock into Dell Technologies stock that would mark its return as a publicly-traded company. Those shares will end up traded on the NYSE, around five years later after its founder took the company private with Silver Lake Partners in a deal worth roughly $25 billion. Silver Lake Partners owns around 24% of the company, while Dell owns 72% and will continue to serve as the chairman and CEO of the company. This move helps the company bypass the IPO process, which would remove the whole time period of potential investors scrutinizing the company (which has taken on a substantial debt load).

Dell said in its most recent quarter it recorded revenue of $21.4 billion, up 19% year-over-year, and over the past 12 months the company generated $82.4 billion of revenue with a net loss of $2.3 billion. The company said it has also paid down $13 billion of gross debt since its combination with EMC back in 2016. All this has been part of the company’s transition to find new businesses beyond just selling computers, though there’s clearly still demand for those computers in offices around the world. As it has expanded into a broader provider of IT services, it’s potentially positioned itself as a modern enterprise tools provider, which would allow it to more securely navigate public markets while offering investors a way to correctly calibrate its value.

Powered by WPeMatico

Norway-based company Opera Ltd. has filed for an initial public offering in the U.S. According to its F-1 document, the company plans to raise up to $115 million.

In 2017, Opera generated $128.9 million in operating revenue, which led to a net income of $6.1 million.

While many people are already familiar with the web browser Opera, the company itself has had a tumultuous history. Opera shareholders separated the company into two different entities — the browser maker and the adtech operations.

The advertising company is now called Otello. And a consortium of Chinese companies acquired the web browser, the consumer products and the Opera brand. That second part is the one that is going public in the U.S.

Opera currently manages a web browser for desktop computers and a handful of web browsers for mobile phones. On Android, you can download Opera, Opera Mini and Opera Touch. On iOS, you’ll only find Opera Mini. More recently, the company launched a standalone Opera News app.

Overall, Opera currently has around 182 million monthly active users across its mobile products, 57.4 million monthly active users for its desktop browser and 90.2 million users for Opera News in its browsers and standalone app. There’s some overlap across those user bases.

More interestingly, Opera only makes money through three revenue sources. The main one is a deal with two search engines. Yandex is the default search engine in Russia, and Google is the default search engine in the rest of the world. As the company’s user base grows, partners pay more money to remain the default search engine.

“A small number of business partners contribute a significant portion of our revenues,” the company writes in its F-1 document. “In 2017, our top two largest business partners in aggregate contributed approximately 56.1% of our operating revenue, with Google and Yandex accounting for 43.2% and 12.9% of our operating revenue, respectively.”

The rest is ads and licensing deals. You may have noticed that Opera’s speed dial is pre-populated with websites by default, such as Booking.com or eBay. Those are advertising partners. Some phone manufacturers and telecom companies also pre-install Opera browsers on their devices. The company is getting some revenue from that too.

The browser market is highly competitive and Opera is facing tech giants such as Google, Apple and Microsoft. At the same time, people spend so much time in their browser that there is probably enough room for a small browser company like Opera. The company will be listed on NASDAQ under the symbol OPRA.

Powered by WPeMatico

Google is turning startup investor to further its goal of putting Google services like search, maps, and its voice assistant front and center for the next billion internet users in emerging markets. It has invested $22 million into KaiOS, the company that has built an eponymous operating system for feature phones that packs a range of native apps and other smartphone-like services. As part of the investment, KaiOS will be working on integrating Google services like search, maps, YouTube and its voice assistant into more KaiOS devices, after initially announcing Google apps for KaiOS-powered Nokia phones earlier this year.

“This funding will help us fast-track development and global deployment of KaiOS-enabled smart feature phones, allowing us to connect the vast population that still cannot access the internet, especially in emerging markets,” said KaiOS CEO Sebastien Codeville in a statement.

Our mobile world is dominated today by smartphones: there were about 1.6 billion of them sold last year. But feature phones have continued to move, too: it’s estimated that there were about 450 million-500 million of them shipped in 2017. And their sales are actually growing faster right now than their souped-up cousins.

KaiOS-powered phones play squarely in the latter category, and they are gaining traction in markets where feature phones still hold sway. In India, they have overtaken Apple’s iOS to become the second-most popular devices after Android handsets. KaiOS tells us that there have been more than 40 million KaiOS phones shipped to-date.

Google’s KaiOS investment could be seen as a way of introducing its services to feature phone users who might eventually graduate to smartphones. However, there is also scope for holding on to these users even as they stay in the feature phone category, which continues to evolve and become more functional.

“We’re excited to work with Google to deliver its services on more mobile devices,” said Codeville, the KaiOS CEO. “Having an intelligent voice assistant on an affordable mobile phone is truly revolutionary as it helps overcome some of the limitations a keypad brings.”

A Nokia device running KaiOS

KaiOS is a U.S.-based project that started in 2017, built on the ashes of Mozilla’s failed Firefox OS experiment, as a fork of the Linux codebase. Firefox OS was intended to be the basis of a new wave of HTML-5, low-cost smartphones. And while those devices and the wider ecosystem never really took off, KaiOS has fared significantly better.

KaiOS powers phones made by OEMs including Nokia (HMD), Micromax and Alcatel, and it works with carriers including Sprint and AT&T — it counts offices in North America, Europe and Asia. But its most significant deployment to date has been with India’s Reliance Jio, the challenger telco that disrupted the Indian market with affordable 4G data packages.

Reliance Jio offers its own range of KaiOS handsets, and coupling that with its low-cost data packages, KaiOS’ share of India’s phone market has reportedly jumped to 15 percent — overtaking Apple’s iOS in the process and putting it second behind only Android. (Jio’s own devices have actually increased the number of feature phones in India, such has been its impact in the country.)

That market share alone in a high-growth market like India is likely enough to pique Google’s interest.

“We want to ensure that Google apps and services are available to everyone, whether they are using desktops, smartphones, or feature phones.” said Anjali Joshi, VP of Product Management for Google’s Next Billion Users division, in a statement. “Following the success of the JioPhones, we are excited to work with KaiOS to further improve access to information for feature phone users around the world.”

Beyond this, the Next Billion business unit works on customizing the Google experience and services to fit the needs of new internet users in emerging markets, including the launch of new services like this neighborhoods app and a successful public WiFi program.

While Google continues to develop its Android smartphone platform, it has long been an advocate of expanding its services to other platforms, too, and that’s been the case with KaiOS.

In February, KaiOS announced that it would be adding Google Search, Google Maps and the Google Voice Assistant to the new Nokia 8110 feature phone, and it seems that this is the Google agreement that will be expanded to all models as part of Google’s investment.

To be clear, Google services are not the only ones on KaiOS. It added apps for Twitter and Facebook earlier this year, and it mixes dedicated KaiOS apps — WhatsApp is said to be coming — with others that are more basic HTML-5 web apps.

Google’s investment in KaiOS is the latest in a line of direct startup deals from the U.S. tech giant that sit alongside investments made by GV and CapitalG, its two investment arms. Google has also backed concierge service Dunzo and is partnering with the carrier Orange to make investments and potentially acquire startups in Europe, the Middle East and Africa.

Powered by WPeMatico