Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Opera is now a public company. The Norway-based company priced its initial public offering at $12 a share — the company initially expected to price its share in the $10 to $12 price range. Trading opened at $14.34 per share, up 19.5 percent. The company raised over $115 million with this IPO.

Opera Ltd. filed for an initial public offering in the U.S. earlier this month. The company is now trading on NASDAQ under the ticker symbol OPRA.

Chances are you are reading this article in Google Chrome on your computer or Android phone, or in Safari if you’re reading from an iPhone. Opera has a tiny market share compared to its competitors. But it’s such a huge market that it’s enough to generate revenue.

In its F-1 document, the company revealed that it generated $128.9 million in operating revenue in 2017, which resulted in $6.1 million in net profit.

The history of the company behind Opera is a bit complicated. A few years ago, Opera shareholders decided to sell the browser operations to a consortium of Chinese companies. The adtech operations now form a separate company called Otello.

Opera Ltd., the company that just went public, has a handful of products — a desktop browser, different mobile browsers and a standalone Opera News app. Overall, around 182 million people use at least one Opera product every month.

The main challenge for Opera is that most of its revenue comes from two deals with search engines — Google and Yandex. Those two companies pay a fee to be the default search engine in Opera products. Yandex is the default option in Russia, while Google is enabled by default for the rest of the world.

The company also makes money from ads and licensing deals. When you first install Opera, the browser is pre-populated with websites by default, such as eBay and Booking.com. Those companies pay Opera to be there.

Now, Opera will need to attract as many users as possible and remain relevant against tech giants. Opera’s business model is directly correlated to its user base. If there are more people using Opera, the company will get more money from Google, Yandex and its advertising partners.

Cheers to @opera on its IPO day! #OperaIPO $OPRA pic.twitter.com/dYeHux7pvq

— Nasdaq (@Nasdaq) July 27, 2018

Powered by WPeMatico

Facebook had a rough day yesterday when its stock plunged after a poor earnings report. What better way to pick yourself up and dust yourself off than to buy a little something for yourself. Today the company announced it has acquired Redkix, a startup that provides tools to communicate more effectively by combining email with a more formal collaboration tool. The companies did not reveal the acquisition price.

Redkix burst out of the gate two years ago with a $17 million seed round, a hefty seed amount by any measure. What prompted this kind of investment was a tool that combined a collaboration tool like Slack or Workplace by Facebook with email. People could collaborate in Redkix itself, or if you weren’t a registered user, you could still participate by email, providing a more seamless way to work together.

Alan Lepofsky, who covers enterprise collaboration at Constellation Research, sees this tool as providing a key missing link. “Redkix is a great solution for bridging the worlds between traditional email messaging and more modern conversational messaging. Not all enterprises are ready to simply switch from one to the other, and Redkix allows for users to work in whichever method they want, seamlessly communicating with the other,” Lepofsky told TechCrunch.

As is often the case with these kinds of acquisitions, the company bought the technology itself along with the team that created it. This means that the Redkix team including the CEO and CTO will join Facebook and they will very likely be shutting down the application after the acquisition is finalized.

Lepofsky thinks that enterprises that are adopting Facebook’s enterprise tool will be able to more seamlessly transition between the two modes of communication, the Workplace by Facebook tool and email, as they prefer.

Although a deal like this has probably been in the works for some time, after yesterday’s earning’s debacle, Facebook could be looking for ways to enhance its revenue in areas beyond the core Facebook platform. The enterprise collaboration tool does offer a possible way to do that in the future, and if they can find a way to incorporate email into it, it could make it a more attractive and broader offering.

Facebook is competing with Slack, the darling of this space and others like Microsoft, Cisco and Google around communications and collaboration. When it launched in 2015, it was trying to take that core Facebook product and put it in a business context, something Slack had been doing since the beginning.

To succeed in business, Facebook had to think differently than as a consumer tool, driven by advertising revenue and had to convince large organizations that they understood their requirements. Today, Facebook claims 30,000 organizations are using the tool and over time they have built in integrations to other key enterprise products, and keep enhancing it.

Perhaps with today’s acquisition, they can offer a more flexible way to interact with the platform and could increase those numbers over time.

Powered by WPeMatico

Y Combinator backed Zbiotics has spend two years developing what they’re billing as the world’s first genetically engineered probiotic. The startup’s initial product isn’t exactly world-changing but it might just save your day — given they’ve invented an elixir of ‘next day’ life: Aka a hangover cure.

Although you actually have to take it before — or, well, during — drinking rather than waiting until the moment of regretful misery when you wake up.

How have they done this? For their first product they’ve bioengineered probiotic bacteria to produce more of the enzyme that the body naturally uses to break down a toxic chemical byproduct of alcohol which is in turn responsible for people feeling awful after too many alcoholic drinks. So you could say they’re hoping to put probiotics on steroids. (NB: No actual steroids are involved, obviously.)

While probiotics themselves aren’t at all new, having been in the human diet for thousands of years — with wide acceptance that certain strains of these live ‘friendly’ bacteria/microorganisms can be beneficial for things like human gut health — the team’s approach of using gene editing techniques (specifically fiddling with the bacteria’s DNA) to enhance what a probiotic can deliver to the person who’s ingested it is the novel thing here.

So new they haven’t yet conducted the placebo controlled, peer-reviewed clinical trials that will ultimately be necessary to back up the efficacy claims they’re making for their biotech enhanced hangover cure.

Nor are they therefore in a position to defend their forthcoming hangover elixir from accusations of supplementary ‘snake oil’ — and, well, the supplement industry as a whole often has that charge leveled at it. And yet people keep buying and popping its pills. (Therein lies the temple rub, vitamin potion and wellness capsule. And, well, also the investor appetite for carving a fresh chunk out of a very large pie.)

Zbiotics co-founders Zack Abbott and Stephen Lamb freely admit it’s going to be a challenge to stand out — and be considered credible amid all this, er, goop noise.

“This consumer space is rife with pseudo science,” agrees Abbott, who has a PhD in microbiology and immunology from the University of Michigan. “Everybody is banging the drum of real science. And so we have a huge challenge to differentiate ourselves. And really convince the consumer that we’ve built something specific.

“And it really is a first effort to invent a product to specifically address their problem, as opposed to grabbing vitamins off a shelf, putting them in a bottle and labelling it.”

“There are some companies… [that] address dehydration [for hangovers]; that’s not enough. There are other companies they just put [vitamins] into a bottle, that’s not enough. There’s so much noise out there. How do we break through that? It could take some time,” admits Lamb. “And it could take a lot of work.”

At this pre-launch stage, the founders say they’ve tested their beefed up probiotic on themselves — and will go so far as to say they’ve seen “promising results”.

“I had the fortune of having the final prototype built just a week or two before my birthday and so I ended up trying it out for my birthday and it was great,” adds Abbott.

They are also keen to say they don’t want to encourage irresponsible drinking. So don’t expect their future marketing to talk about ‘a biotech license for your next bender’. Product pricing is tbc but they say they’re aiming for widely affordable, rather than lux or overly premium.

With hangover results that could speak for themselves, their hope is that people will feel confident enough to have a pop and see whether the idea of a biotech enhanced probiotic that’s pumping out extra alcohol-metabolizing enzymes stands up to several pints of lager and a few chasers (or not).

Though — when asked — they do say they also want to carry out clinical trials to glean data on the efficacy of their hangover cure.

“We are a very science-first company and so we don’t want to be making any claims about anything that we don’t have data to back up,” says Abbott.

“At this point… we’ve done significant testing in a test tube, in vitro, and shown that the bacteria we’ve built do perform the function that they’re supposed to perform. Which is to break down acetaldehyde. But we can’t make further health claims until we do clinical trials. And we in the process of drafting up a protocol for a human clinical study with one of our scientific advisors — Dr Joris Verster — a world expert in academic hangover research. But in the meantime we can’t make those claims until we have that.”

They are also planning to launch a crowdfunding campaign later this year — in order to start making some of their own noise and trying to drum up interest and, well, willing guinea pigs.

Though they are also adamant the product is entirely safe. It’s just the efficacy vs hangover misery that’s yet to be stood up in human clinical trials.

While a hangover cure might seem a trivial problem to focus high tech bioengineering effort on, they say the unmissable fact of a hangover — or indeed the lack of one — was one of the reasons why they selected such an “everyday problem” for the first application of their technique vs going for a more fuzzy (and, well forgiving on the efficacy front) generic goal like ‘wellness’. Or indeed targeting an issue where a ‘cure’ is pretty subjective and hard to quantify (like anti-aging).

Absolutely no one is going to mistake a hangover for feeling great. Though of course the power of the placebo effect working its psychological magic cannot be ruled out — not until they’ve clinically tested their stuff against it in robust trials.

On the other hand, even if it ends up that a placebo effect is what’s making people feel better, given that the target problem is (just) a hangover there aren’t likely to be too many consumer complaints and cries for money back.

“One of the reasons why we chose this use-case was that it would allow people to try it and feel the advocacy for themselves. That was very important,” says Abbott. “It’s something you can feel the results of. So that was really important. Having a visceral read-out of efficacy. People can experience the product working for themselves.”

The other reason for choosing a hangover cure was more practical: They needed a problem that could be solved with an enzyme and therefore which could be helped by genetically engineering bacteria to produce more of the sought for substance.

“The whole point here is that we’ve engineered a bacteria to express an enzyme specifically that can solve a problem,” he explains. “Enzymes are these really powerful complex molecules that are not easy to deliver to people. So it has to be a problem that you can solve with an enzyme.

“There has to be a nice fit with the technology. So we look for things where parts of the body where bacteria has access to you; you have a lot of bacteria in your gut, in your skin, in your mouth, in your nose… places were we can deliver bacteria and they can express these enzymes to solve problems of everyday health.”

“We start with probiotics that have an extremely good safety profile, have been used in regular food by humans for centuries. And we identify those because we know that they’re going to be safe, and we know that they’re going to be able to interact with your body in the way that we want them to. And then we engineer those bacteria as oppose to choosing something that your body may never have seen before,” adds Lamb, who brings prior experience helping food companies enter new markets to the startup.

He says they’ve been safety testing their prototype probiotic for the past year and change at this point — “making sure that this is ready for market before we actually launch anything”.

“We are not going to launch any kind of product until it’s completely safety tested according to every regulatory framework here in the U.S. — and we’re totally comfortable with that,” he adds emphatically.

They do also intend to move beyond hangover cures, with the plan being to develop additional probiotics that target other use-cases. And say they’ve been building a gene editing platform that’s flexible for that purpose. Though they’re not disclosing exactly what else they’re working on or eyeing up — wanting to keep that powder dry for now.

“I spent over a year building the first product, and the lion’s share of that time was spent making sort of a genetic platform… that was adaptable to multiple use-cases,” says Abbott. “At first I just engineered the bacteria to be able to make a lot of enzyme generally. Whatever enzyme I put into the platform. And so the first enzyme I put in was to break down acetaldehydes. That being said it could be easily switched out for an enzyme to break down… a different toxin that your body has to deal with. So the platform is very adaptable and it was designed to be that way.”

“That being said there are certain use-cases we’re really excited about that may require additional optimization techniques in order to make them work specifically for that use-case. So, generally speaking, some may require more work than others but the platform we started with gives us a good launch pad,” he adds.

As well as YC’s standard startup deal, the team has raised an additional $2.8M in seed funding this year for R&D and the initial product roadmap. They’re hoping the forthcoming crowdfunding campaign will give them the additional lift to ship the consumer product into the US market.

Investors in the seed round aren’t being disclosed at this stage. Abbott also notes that he previously got a small amount of pre-seed funding, early on, to fund building the prototype.

It’s fair to say that biotech as an investment space isn’t a bet for every investor — given product development risks, timeframes and perhaps also some of the deflated hype of past years. Which perhaps explains why Zbiotics investors aren’t ready to shout all about it just yet. Even if they’re feeling great about not having a hangover.

“We’ve found different levels of success with different investors,” agrees Lamb. “Where we’ve found the most success is in investors who see the vision for the technology and understand it as something that is and can be truly innovative relative to what’s on the market today. So probiotics themselves — traditional probiotics — are a $40BN industry, and the fact is that most of those probiotics don’t do anything or are inconsistent at best. So we found investors who have a mindset where they can see how a novel probiotic, something that actually is engineered to work and is based in a high level of biotech is something that can really disrupt that area. And that may or may not be traditional biotech investors. Oftentimes it’s investors who are really looking to push the envelope.

“We definitely had to find the right investor and the traditional biotech investor often is looking for different things than we had to offer,” adds Abbott. “And different pathways — more traditional pathways. We’re going not conventionally I think with bringing this hard biotech to market quickly. So it definitely is threading the needle and finding the right investors.”

Powered by WPeMatico

Line, the company best-known for its popular Asian messaging app, is doubling down on games after it acquired a controlling stake in Korean studio NextFloor for an undisclosed amount.

NextFloor, which has produced titles like Dragon Flight and Destiny Child, will be merged with Line’s games division to form the Line Games subsidiary. Dragon Flight has racked up 14 million users since its 2012 launch — it clocked $1 million in daily revenue at peak. Destiny Child, a newer release in 2016, topped the charts in Korea and has been popular in Japan, North America and beyond.

Line’s own games are focused on its messaging app, which gives them access to social features such as friend graphs, and they have helped the company become a revenue generation machine. Alongside income from its booming sticker business, in-app purchases within games made Line Japan’s highest-earning non-game app publisher last year, according to App Annie, and the fourth highest worldwide. For some insight into how prolific it has been over the years, Line is ranked as the sixth highest earning iPhone app of all time.

But, despite revenue success, Line has struggled to become a global messaging giant. The big guns WhatsApp and Facebook Messenger have in excess of one billion monthly users each, while Line has been stuck around the 200 million mark for some time. Most of its numbers are from just four countries: Japan, Taiwan, Thailand and Indonesia. While it has been able to tap those markets with additional services like ride-hailing and payments, it is certainly under pressure from those more internationally successful competitors.

With that in mind, doubling down on games makes sense and Line said it plans to focus on non-mobile platforms, which will include the Nintendo Switch among others consoles, from the second half of this year.

Line went public in 2016 via a dual U.S.-Japan IPO that raised over $1 billion.

Powered by WPeMatico

Sonos today took the next step in its initial public offering price, setting a range for the shares it intends to sell that will help calibrate the final amount of money — and valuation — that it will have when it begins its trading debut.

This isn’t the final, final step in the IPO process, as this is usually done to test the waters and figure out the exact appetite for the company’s shares when it goes public. Sonos is offering 5,555,555 (a wonderful palindrome of a number) shares, where it will raise as much as $105 million if it prices on the upper end of its range and sells them at $19 per share. The official range is between $17 and $19, but this can go up and down throughout the process — with a drop-off signaling a lack of interest or skepticism, and an increased range a sign of heavy demand. Companies will sometimes lowball their range, though we won’t find out for a little bit where everything lands.

Insiders are also selling 8,333,333 million shares in this initial public offering. Including that, the IPO could end up raising around $250 at the middle of that $17 to $19 range that it’s estimating, including the shares sold by existing stockholders. The proceeds from those shares sold by stockholders aren’t going to end up in Sonos’ hands, so the company itself is only going to net around that $105 million at the top end of its range. There’s also an over-allotment, typically called a greenshoe, that consists of shares sold by Sonos and existing stockholders. That could add a total of $15 million and $22.5 million, respectively, at a price of $18 in the middle of that range.

The company is offering some preliminary estimates for its second quarter, saying it generated between $206.4 million and $208.4 million in revenue with a net loss of between $29 million and $27.1 million (this is probably because the final accounting isn’t finished up as we’re just about entering the front end for earnings season for major companies). The company said it sold between 880,000 and 890,000 products as an estimated range in the second quarter this year, up from 796,000 products in the second quarter last year.

Sonos is nicely positioned as a third-party option in an ecosystem that’s getting increasingly crowded by proprietary speakers from the larger companies that own voice assistants like the Echo, HomePod and Google Home. But Sonos has been around for a considerable amount of time and has clearly built up a significant following to ensure that it could find itself operating as an independent public company. In its fiscal 2017 year, Sonos said it brought in nearly $1 billion in revenue, an increase of 10 percent year-over-year. The initial filing indicated that the company had sold a total of 19 million products in 6.9 million households, with customers listening to 70 hours of content each month.

This is basically the next step in the process as the company continues its march toward making its debut, and we’ll get more details soon enough as to whether or not investors are interested in a publicly traded company that’s known for its speakers.

Powered by WPeMatico

Cogito announced a $37 million Series C investment today led by Goldman Sachs Growth Equity. Previous investors Salesforce Ventures and OpenView also chipped in. Mark Midle of Goldman Sachs’ Merchant Banking Division, has joined Cogito’s Board of Directors

The company has raised over $64 million since it emerged from the MIT Human Dynamics Lab back in 2007 trying to use the artificial intelligence technology available at the time to understand sentiment and apply it in a business context.

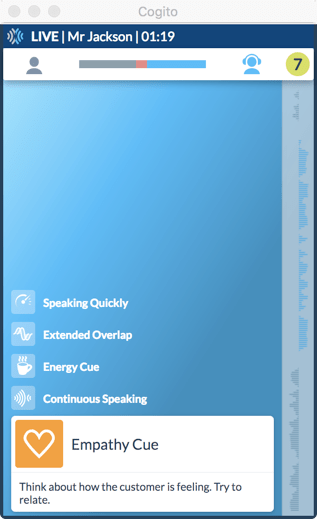

While it took some time for the technology to catch up with the vision, and find the right use case, company CEO and founder Joshua Feast says today they are helping customer service representatives understand the sentiment and emotional context of the person on the line and give them behavioral cues on how to proceed.

“We sell software to very large software, premium brands with many thousands of people in contact centers. The purpose of our solution is to help provide a really wonderful service experience in moments of truth,” he explained. Anyone who deals with a large company’s customer service has likely felt there is sometimes a disconnect between the person on the phone and their ability to understand your predicament and solve your problem.

Cogito in action giving customer service reps real-time feedback.

He says using his company’s solution, which analyzes the contents of the call in real time, and provides relevant feedback, the goal is to not just complete the service call, but to leave the customer feeling good about the brand and the experience. Certainly a bad experience can have the opposite effect.

He wants to use technology to make the experience a more human interaction and he recognizes that as an organization grows, layers of business process make it harder for the customer service representative to convey that humanity. Feast believes that technology has helped create this problem and it can help solve it too.

While the company is not talking about valuation or specific revenue at this point, Feast reports that revenue has grown 3X over the last year. Among their customers are Humana and Metlife, two large insurance companies, each with thousands of customer service agents.

Cogito is based in downtown Boston with 117 employees at last count, and of course they hope to use the money to add on to that number and help scale this vision further.

“This is about scaling our organization to meet client’s needs. It’s also about deepening what we do. In a lot of ways, we are only scratching the surface [of the underlying technology] in terms of how we can use AI to support emotional connections and help organizations be more human,” Feast said.

Powered by WPeMatico

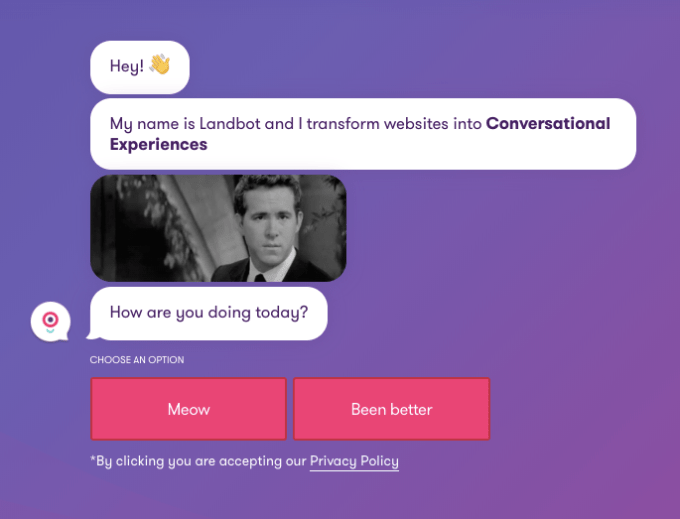

Who needs AI to have a good conversation? Spanish startup Landbot has bagged a $2.2 million seed round for a ‘dumb’ chatbot that doesn’t use AI at all but offers something closer to an old school ‘choose your adventure’ interaction by using a conversational choice interface to engage potential customers when they land on a website.

The rampant popularity of consumer messaging apps has long been influencing product development decisions, and plenty of fusty business tools have been consumerized in recent years, including by having messaging-style interfaces applied to simplify all kinds of digital interactions.

In the case of Landbot, the team is deploying a familiar rich texting interface as a website navigation tool — meaning site visitors aren’t left to figure out where to click to find stuff on their own. Instead they’re pro-actively met with an interactive, adaptive messaging thread that uses conversational choice prompts to get them the information they need.

Call it a chatty twist on the ‘lazyweb’…

It’s also of course mobile first design, where constrained screen real estate is never very friendly to full fat homepages. Using a messaging thread interface plus marketing bots thus offers an alternative way to cut to the navigational chase, while simultaneously creaming off intent intelligence on potential customers. (Albeit it does risk getting old fast if your site visitors have a habit of clearing their cookies.)

Landbot, which was launched just over a year ago in June 2017, started as an internal experiment after its makers got frustrated by the vagaries of their own AI chatbots. So they had the idea to create a drag-and-drop style bot-builder that doesn’t require coding to support custom conversation flows.

“Since we already had a product, a business model, and some customers, we developed Landbot as an internal experiment. “What would happen with a full-screen conversation instead of the regular live-chat?,” we thought. What we got? A five times higher conversion rate on our homepage! Ever since, our whole strategy changed and Landbot, born from an experiment, became our core product,” explains CEO and co-founder Jiaqi Pan.

At the same time, the current crop of ‘cutting-edge’ AI chatbots are more often defined by their limitations than by having impressively expansive conversational capacities. Witness, for example, Google’s Duplex voice AI, heavily trained to perform very specific and pretty formulaic tasks — such as booking a hair appointment or a restaurant. Very few companies are in a position to burn so much engineering resource to try to make AI useful.

So there’s something rather elegant about eschewing the complexity and chaos of an AI engine (over)powering customer engagement tools — and just giving businesses user-friendly building blocks to create their own custom chat flows and channel site visitors through a few key flows.

After all, a small business knows its customers best. So a tool that helps SMEs create an engaging interface themselves, without having to plough resources they likely don’t have into training high maintenance chat AIs which are probably overkill for their needs anyway, seems a good and sensible thing.

Hence Pan talks about “democratizing the power of chatbots”. “Most landbot customers are marketing managers from small and medium companies that want to discover new ways of optimizing their conversion rates,” he tells us, saying that most are using the tool to convert more leads in their home/landing page; add dynamic surveys/forms to their websites; or explain their services — “in a more engaging way while scoring leads and being able to take over conversations when necessary”. (Buddy Nutrition is a Landbot customer, for example).

“We started our chatbot journey using Artificial Intelligence technology but found out that there was a huge gap between user expectations and reality. No matter how well trained our chatbots were, users were constantly dropped off the desired flow, which ended up in 20 different ways of saying “TALK WITH A HUMAN”,” he adds. “But we were in love with the conversational approach and, inspired by some great automation flow builders out there, we decided to give Conversational User Interfaces a try. Some would call them ‘dumb chatbots’.

“The results were amazing: The implementation process was way shorter, the technical background was removed from the equation and, finally, costs dropped too! Now, even companies with 100% focus on AI-based chatbots use Landbot as a truly cost-effective prototyping tool. We ended up creating the easiest and fastest chatbot builder out there. No technical knowledge, just a drag and drop interface and unlimited possibilities.”

Despite the startup-y hyperbole, the team does seem to have hit a sweet spot for their product. In less than a year since launching — via Product Hunt — Landbot has signed up more than 900 customers from 50+ countries, and is seeing a 30-40% MRR Growth MoM, according to Pan. Although they are offering a (branded) freemium version to help stoke the product’s growth, as well as paid tiers.

The $2.2M seed round is led by Nauta Capital, with Bankinter and Encomenda Smart Capital also participating. The plan for the funding is to grow headcount and pay for relocating Landbot’s head office from Valencia to Barcelona — to help with their international talent hunt as they look to triple the size of the team.

They’ll also be using the funding on their own brand marketing, rather than relying on viral growth — acknowledging that marketing spend is going to be important to stand out in such a crowded space, with thousands of competing solutions also vying for SMEs’ cash.

And, indeed, other conversational UIs out in the wild delivering a similarly chatty experience on the customer end, though Landbot’s claim is it’s differentiating in the market behind the scenes, with easy to use, ‘no coding necessary’ customization tools.

On the competition from, Pan names the likes of Chatfuel and Manychat as “powerful but channel-dependent” rival chatbot builders, while at the more powerful end he points to DialogFlow or IBM Watson but notes they do require technical knowledge, so the market positioning is different.

“Landbot tries to bring chatbots to the average Joe,” he adds. “While still keeping features for developers that demand complex functionalities in their chatbots (they can achieve by configuring webhooks, callbacks, CSS and JS customization).”

He also identifies players in the automated lead generation space — such as Intercom (Operator) and Drift (Drift bot) — saying they are aiming to transform sales and marketing processes “into something more conversational”. “The flow customization possibilities are fewer but the whole product is robust as they cover each stage of the conversion funnel, all the way to customer service,” he adds.

In terms of capabilities, Landbot also rubs up against survey/form offerings like SurveyMonkey and Google Form — or indeed Barcelona-based Typeform, which has raised around $50M since 2012 and bills itself as a platform for “conversational data collection”.

Pan rather delightfully characterizes Typeform as “bringing that conversational essence to the almighty sequences of fields”. Though he argues it’s also more limited “in terms of integrations and real-time human take-over capabilities”, i.e. as a consequence of wrangling those “almighty sequences”. So basically his argument is that Landbot isn’t saddled with Typeform’s form(ulaic) straightjacket. (Though Typeform would probably retort that its conversational platform is flexible.)

Still, where customer engagement is concerned, there’s never going to be one way. Sometimes the straight form will do it, but for another brand or use case something more colloquial might be called for.

Commenting on the seed round in a statement, Jordi Vinas, general partner at Nauta Capital, adds: “Landbot has experienced strong commercial traction and virality over the past months and the team has been able to attract customers from a variety of countries and verticals. We strongly believe in Jiaqi’s ability to continue scaling the business in a capital efficient way.”

Powered by WPeMatico

Engaging Care, a Swedish heathtech startup co-founded by Charlotta Tönsgård, who was previously CEO of online doctor app Min Doktor before being asked to step down, has raised $800,000 in “pre-seed” funding to continue building out its digital healthcare SaaS. Backing the burgeoning company are a host of well-established angel investors in the region.

They include Hampus Jakobsson (venture partner at BlueYard Capital and co-founder of TAT, which sold to Blackberry for $150 million), Sophia Bendz (EIR at Atomico and the former Global Marketing Director at Spotify), Erik Byrenius (founder of OnlinePizza, an online food ordering company sold to Delivery Hero) and Neil Murray’s The Nordic Web Ventures.

With the aim of dragging healthcare into the digital age, but in a more patient-friendly and patient-centred way than tradition electronic medical record systems, Engaging Care is developing a SaaS and accompanying apps to bring together patients, healthcare providers and partners to be “smarter and better connected”. Unlike software and digital services that work outside existing healthcare systems, the startup’s wares are billed as being designed to work within them. It is initially targeting people with long-term health conditions.

“There has been tremendous progress made in the healthcare sector over the last decade. New advanced drugs, new methods for surgery and other treatments, but how healthcare workers share important information with the patient and the interaction between caregiver and patient still basically happens the same way it did 50 years ago,” Tönsgård tells me.

“The systems of today are still designed around the doctor – even though we might spend as little as 15 minutes with him or her every year, but hours, days and years alone with our condition. On top of this, most western healthcare systems are struggling financially, with an ageing population, more prevalence of chronic diseases and a shift in expectations from the public, adding to the challenges”.

In order to maintain current levels of service and make room for medical breakthroughs and new treatments that are happening at an increasing pace, Tönsgård argues that individual patients and healthcare providers need to work together in a different way. And that begins with empowering patients to better understand and take greater control of their health conditions and treatment — which is where a platform like Engaging Care can help.

“Our ambition is to become the first truly global healthcare system; supporting us as individuals to be more in control, and to make better decisions about our healthcare and to provide digital tools for healthcare providers to share knowledge and use their resources more efficiently,” she says.

“Our goal is to become the end-users first point of contact, but the clinics/healthcare providers are our customers. Right now we’re targeting specific clinics, but in the end, our platform will support any type of healthcare”.

The first “vertical” Engaging Care is exploring is patients who have gone through an organ transplant. “It might sound like a strange place to start, but it’s actually perfect in many ways,” says Tönsgård. “Both in terms of the possibility to make a difference for the patients and the care teams, but also in terms of a landing pod when going international”.

This has seen the company work with a small number of clinics in Sweden that are performing organ transplants to put patients through a pilot of the software. The first stages of commercial discussions are underway and Tönsgård is hopeful of securing the first customer this Fall, which will coincide with a full launch of the Engaging Care platform. “In parallel, we’re exploring multiple options for which verticals to kick off next,” she adds.

Meanwhile, Murray of The Nordic Web Ventures concedes that Engaging Care’s goal to be the first platform that enables a truly global healthcare system is “incredibly lofty,” but says that if anyone has the “drive, passion, ambition and guts to pull this off then it’s Charlotta and team”.

Powered by WPeMatico

TrueLayer, the London startup that’s built a developer platform to make it easy for fintech and other adjacent companies, such as retailers, to access bank APIs — and ride the Open Banking and PSD2 gravy train — has picked up further $7.5 million in funding.

Leading the round is venture capital fund Northzone. It follows a $3 million Series A in June last year, and will be used for European expansion, starting with Germany and France.

The new capital will also be invested in growing the TrueLayer team and to develop new products to help companies and consumers make the most of Open Banking and PSD2, where co-founder Francesco Simoneschi tells me the opportunities are huge, even if they remain largely untapped, thus far.

“I think the first quarters of 2018 have been about working and educating companies on Open Banking and how to build propositions on top of it,” he says. “This has seen a silent yet massive stream of inbound demand for us. To put things in context, we grew 500 percent in terms of the developer community averaging hundreds of companies a month asking how to start using TrueLayer and the services that we enable — from two people in a garage to the largest enterprise”.

Since Open Banking was tentatively launched in the U.K. January, TrueLayer has secured partnerships and integrations with a number of fintech companies including challenger banks Monzo and Starling Bank, along with the likes of Zopa, ClearScore, Canopy, Plum, BitBond, Emma, Anorak, and CreditLadder.

This has happened in despite of a press narrative around a “failed Big Bang kind of uptake” and incumbent banks not cooperating or meeting their minimum statutory requirements in time (which is undeniably true, in some instances). The reality on the ground, however, is quite different, argues Simoneschi.

“Remember that exponential growth often looks sub-linear at the very beginnings,” he says. “Based on the view of the market that we have, contracts signed, POCs and advanced conversations, I can assure you that you will see a wealth of high street banks and retailers, financial institutions, global platforms, marketplaces, loyalty and rewards propositions, crypto exchanges, wallets and fintech applications experimenting and launching Open Banking-based propositions in the next 12 months”.

To that end, TrueLayer offers a single platform/API to connect to 16 major and not so major banks and credit cards in the U.K., using a mixture of official Open Banking APIs, access to private APIs, and, at a push, screen scraping — depending on a developer’s data needs and stomach for the different kinds of official and unofficial access available. As well as account verification, the platform supports KYC processes, and transactional data for things like account aggregation, credit scoring, and risk assessment.

In addition to its developer-friendly ‘universal’ API, TrueLayer is also developing a number of other value-add services that do even more heavy-lifting and negate the need for other fintechs to keep re-inventing the wheel. These include features such as data cleansing, enhanced security and transaction categorisation.

However, Simoneschi says there is a lot more Open Banking goodness to come yet, especially in the payments space.

“We got FCA authorization for both access to data (AISP) and access to payments (PISP). The demand for the latter has been going through the roof in the last few months and we are taking steps to release a Payment API to the general public later this fall,” he tells me.

This means that companies, such as online retailers, will be able to use TrueLayer to connect directly to customers’ bank accounts as a means of taking payment, therefore bypassing traditional debit and credit card charges, which legislators hope will help to break the duopoly of Visa and MasterCard.

On that note, Jeppe Zink, Partner at Northzone, says that the “walled gardens” of financial institutions, such as banks, are being knocked down, and that banking transactions will increasingly take place away from a bank’s main interface. “To enable this to function, you need thousands of banks to deliver transaction data in a single, secure and compliant way,” he says. “This is a massive undertaking which TrueLayer intends to be the centrepiece of”.

Powered by WPeMatico

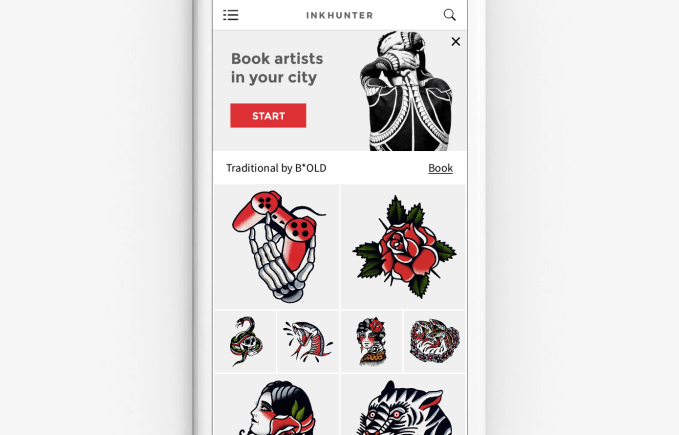

InkHunter, an augmented reality tattoo try-on app that was born out of a 48-hour hackathon back in the altogether gentler days of 2014, has bagged a place in Y Combinator’s summer 2018 batch, scoring itself the seed accelerator’s standard $120,000 deal in exchange for 7 percent equity.

We first covered InkHunter in April 2016 when it had just launched an MVP on iOS and was toying with building a marketplace for tattoo artists. Several months and 2.5 million downloads later, InkHunter launched its Android app, having spent summer 2016 going through the ERA accelerator program in New York.

At that time the team was considering a B2B business model pivot, based on licensing their core AR tech to e-commerce apps and other developers. Though they wanted to keep the tattoo try-on app ticking over as a showcase.

Fast-forward two years and it’s the SDK idea on ice after InkHunter’s app gained enough traction in the tattoo community for the team to revive their marketplace idea — having passed eight million users — so they’ve relocated to Mountain View and swung back around to the original concept of a try-before-you buy tattoo app, using AR to drive bookings for local tattoo artists.

“We are focusing on iterating from ‘try’ to ‘try and buy’ experience, based on feedback we got from our users. And this is our goal for the YC program, which places a lot of focus on growth and user interactions,” CTO Pavlo Razumovskyi tells us.

“Last time we have talked, we did not expect such adoption on the tattoo market. But when we saw really strong usage and feedback from the tattoo community, we decided to double down on that audience.”

The newly added booking option is very much an MVP at this stage — with InkHunter using a Typeform interface to ask users who tap through with a booking request to input their details to be contacted later, via text message, with information about relevant local tattoo artists (starting with the U.S. market).

But the team’s hope for the YC program is help to hone their approach.

“While this approach doesn’t scale, it helps us to figure out problems and quickly iterate solutions,” he adds. “We are almost done with this stage, and close to launch an in-app search for tattoo artist into selected locations, listing only licensed artists with the large portfolio.”

InkHunter says close to half (45 percent) its users have expressed a desire to get a tattoo within the next few months, while it got more than 500 booking requests in the first week of the concierge feature.

Though you do have to wonder whether users’ desire to experiment with ink on their skin will also extend to a desire to experiment with different tattoo artists too — or whether many regular inkers might not prefer to stick with a tattooist they already know and trust, and whose style they like. (A scenario which may not require an app to sit in the middle to take repeat bookings.)

“We want to help them do this with as little regret as possible,” says CEO Oleksandra Rohachova of InkHunter’s tattoo-hungry users — so presumably the team will also be carefully vetting the tattoo artists they list on their marketplace.

The main function of the app lets users browse thousands of tattoo designs and virtually try them on using its core AR feature — which requires people spill a little real-world ink to anchor the virtual design by making a few pen marks on their skin where they want the tattoo to live. As use-cases for AR go it’s a pretty pleasing one.

InkHunter also supports taking and sharing photos — to loop friends’ opinions into your skin-augmenting decision, and help the app’s fame spread.

The team’s hope for the next stage of building an app business is once an InkHunter user has settled on the design and placement of their next tat, they’ll get comfortable about relying on the app to find and book an artist. And the next time, for their next tattoo too.

Powered by WPeMatico