Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

One of the early backers of Musical.ly, the short video app that was acquired for $1 billion, is making a major bet that internet radio is one of the next big trends in media.

Goodwater Capital, one of a number of backers that won big when ByteDance acquired Musical.ly last year, has joined forces with Korean duo Softbank Ventures and KB Investment to invest $17 million into Korea’s Spoon Radio. The deal is a Series B for parent company Mykoon, which operates Spoon Radio and previously developed an unsuccessful smartphone battery sharing service.

That’s much like Musical.ly, which famously pivoted to a karaoke app after failing to build an education service.

“We decided to create a service, now known as Spoon Radio, that was inspired by what gave us hope when [previous venture] ‘Plugger’ failed to take off. We wanted to create a service that allowed people to truly connect and share their thoughts with others on everyday, real-life issues like the ups and downs of personal relationships, money, and work.

“Unlike Facebook and Instagram where people pretend to have perfect lives, we wanted to create an accessible space for people to find and interact with influencers that they could relate with on a real and personal level through an audio and pseudo-anonymous format,” Mykoon CEO Neil Choi told TechCrunch via email.

Choi started the company in 2013 with fellow co-founders Choi Hyuk jun and Hee-jae Lee, and today Spoon Radio operates much like an internet radio station.

Users can tune in to talk show or music DJs, and leave comments and make requests in real-time. The service also allows users to broadcast themselves and, like live-streaming, broadcasters — or DJs, as they are called — can monetize by receiving stickers and other virtual gifts from their audience.

Spoon Radio claims 2.5 million downloads and “tens of millions” of audio broadcasts uploaded each day. Most of that userbase is in Korea, but the company said it is seeing growth in markets like Japan, Indonesia and Vietnam. In response to that growth — which Choi said is over 1,000 percent year-on-year — this funding will be used to invest in expanding the service in Southeast Asia, the rest of Asia and beyond.

Audio social media isn’t a new concept.

Singapore’s Bubble Motion raised close to $40 million from investors but it was sold in an underwhelming and undisclosed deal in 2014. Reportedly that was after the firm had failed to find a buyer and been ready to liquidate its assets. Altruist, the India-based mobile services company that bought Bubble Motion has done little to the service. Most changes have been bug fixes and the iOS app, for example, has not been updated for nearly a year.

Things have changed in the last four years, with smartphone growth surging across Asia and worldwide. That could mean different fortunes but there are also differences between the two in terms of strategy.

Bubbly was run like a social network — a ‘Twitter for voice’ — whereas Spoon Radio is focused on a consumption-based model that, as the name suggests, mirrors traditional radio.

“This is mobile consumer internet at its best,” Eric Kim, one of Goodwater Capital’s two founding partners, told TechCrunch in an interview. “Spoon Radio is taking an offline experience that exists in classic radio and making it even better.”

Kim admitted that when he first used the service he didn’t see the appeal — he claimed the same was true for Musical.ly — but he said he changed his tune after talking to listeners and using Spoon Radio. He said it reminded him of being a kid growing up in the U.S. and listening to radio shows avidly.

“It’s a really interesting phenomenon taking off in Asia because of smartphone growth and people being keen for content, but not always able to get video content. It was a net new behavior that we’d never seen before… Musical.ly was in the same bracket as net new content for the new generation, we’ve been paying attention to this category broadly,” Kim — whose firm’s other Korean investments include chat app giant Kakao and fintech startup Toss — explained.

Powered by WPeMatico

Hinge Health, the San Francisco-based startup that offers a tech-enabled platform to treat musculoskeletal (MSK) disorders — things like knee pain, shoulder pain, or back pain — has raised $26 million in Series B funding.

Leading the round is Insight Venture Partners, with participation from the company’s Series A backer Atomico. In fact, I understand that the London VC firm has doubled down on its investment and has actually increased its stake in Hinge.

The new round of funding brings total raised by the company to $36 million since being founded in 2015 (and originally based in London). Hinge Health founders Daniel Perez and Gabriel Mecklenburg still maintain majority control of the board.

Billing itself as digitising healthcare, Hinge Health combines wearable sensors, an app, and health coaching to remotely deliver physical therapy and behavioural health for chronic conditions. The basic premise is that there is plenty of existing research to show how best to treat MSK disorders, but existing healthcare systems don’t do a very good job at delivering best practice, either because of cost and the way it is funded or for other systematic reasons. The result is an over tendency to fall back on the use of opioid-based painkillers or surgery, with sub-optimal results.

The startup’s initial target customers are self-insured employers and health plans, with the pitch being that its platform can significantly reduce medical costs associated with chronic MSK conditions.

To that end, Perez tells me Hinge Health now has 40 enterprise customers in the U.S. and has partnered with 10 of the largest health plans. This is off the back of improved results, with 2 in 3 patients who go through the program avoiding the need for surgery, up from 1 in 2 at the time of the startup’s Series A. “[We’re] aiming to bump that to 80 percent soon,” he says.

Just don’t call Hinge a “software as a drug” or so-called digital therapeutic. Perez isn’t a fan of either term, and certainly not when applied to the work Hinge Health is doing.

“Both seem to imply you just pop one easy pill and that’s it,” he says. “While software, connected hardware, and behavioural health support (e.g. education, coaching, targeted notifications, gamification/rewards) can help scale the labor intensive processes involved in chronic care, it’s not akin to just popping a pill and you’re done. That’s why I really dislike the term “digital therapeutic” when applied to chronic conditions, and I wish it was retired”.

Instead, Perez considers Hinge Health to be a “Digital Care Pathway” as patients are still required to carry out a lot of work in order to tackle their chronic condition. In other words, it goes well beyond just passively popping a “digital pill”.

I ask the Hinge Health founder if perhaps it is access to a one-to-one health coach via the app that makes all the difference, especially related to adherence, rather than technology. That depends, he says, revealing that some patients rely very heavily on having access to a coach, while others need very little or zero coaching support, and instead rely on Hinge’s wearable motion sensors to guide them through their exercises and to track progress.

Adds Perez: “The clinical literature is very compelling; when you have a relationship with a real person on the care team, it boosts adherence to the care plan. Critically that person doesn’t have to be a doctor or even a nurse, but it must be someone you trust”.

Powered by WPeMatico

Taxfix, the Berlin-based startup that has developed a mobile assistant to help you file your tax return, has closed $13 million in Series A funding. The round is led by Peter Thiel’s Valar Ventures, with participation from existing investors Creandum and Redalpine.

Launched in 2017, Taxfix is built on the premise that filing taxes remains a daunting task in most countries, involving a lot of archaic form filling, often carried out incorrectly and without the proper advice, and rarely optimised for tax refunds. As a result, the company says that in Germany alone, over 10 million employees decide not to file a tax return, and therefore forgo an average tax rebate of 935 Euros.

“The problem is that most people don’t have a personal tax accountant, nor the sufficient knowledge on how to file their taxes,” explains Taxfix co-founder and CEO Mathis Büchi. “Taxpayers are required to invest a substantial amount of time to become an expert themselves to receive their maximum tax refund. That’s why the rich can optimise their taxes with their own accountants and the regular citizens are overpaying billions of Euros in taxes every year in almost every country in the world”.

To help combat this, the Taxfix app works similar to a chatbot, and — coupled with the startup’s “tax-engine technology” — aims to make filing your taxes as easy as it would be if you hired your own tax accountant. You simply photograph your annual payslip and work through a questionnaire personally tailored to optimise your refund. The Taxfix app then automatically calculates the predicted tax rebate and submits your filing for you.

“[Taxfix creates] a digital tax accountant on the mobile phone, which asks the users simple questions and makes sure they optimise their refund and file their tax return correctly,” says Büchi.

To date, Taxfix’s typical customers are young people between 20-35 years old, who are not tax experts and often have never filed a tax return before. For every tax return that generates a refund of over 50 Euros, the startup charges 35 Euros for submission to the relevant financial authorities.

Of course, there are already a large number of startups and software companies that can help you file a tax return. These include legacy players such as WISO in Germany and Intuit’s TurboTax in the U.S., or upstarts such as the U.K.’s TaxScouts. A government’s own online tax filing gateway could also be considered a direct competitor.

“Taxfix differentiates itself from all other solutions by its mobile-first approach and by not using forms fields as the user interface,” adds Büchi. “Taxfix creates a completely new user experience with the conversational interface that asks simple questions and translates the information into tax language automatically. It takes on average 20 minutes to file your taxes with Taxfix, compared to 3 to 6 hours with traditional software”.

Meanwhile, Büchi says the new funding will be used for international expansion, bringing the app’s tax declaration capabilities to other jurisdictions. The German company also plans to invest heavily in machine learning to bring its tax engine technology “to the next level”.

Powered by WPeMatico

Audius wants to cut the middlemen out of music streaming so artists get paid their fair share. Coming out of stealth today led by serial entrepreneur and DJ Ranidu Lankage, Audius is building a blockchain-based alternative to Spotify or SoundCloud.

Users will pay for Audius tokens or earn them by listening to ads. Their wallet will then pay out a fraction of a cent per song to stream from decentralized storage across the network, with artists receiving roughly 85 percent — compared to roughly 70 percent on the leading streaming apps. The rest goes to compensating whomever is hosting that song, as well as developers of listening software clients, one of which will be built by Audius.

Audius plans to launch its open-sourced product in beta later this year. But it’s already found some powerful investors that see SoundCloud as vulnerable to the cryptocurrency revolution. Audius has raised a $5.5 million Series A led by General Catalyst and Lightspeed, with participation from Kleiner Perkins, Pantera Capital, 122West and Ascolta Ventures. They’re betting that Audius’ token will grow in value, making the stockpile it keeps worth a fortune. It could then sell chunks of its tokens to earn revenue instead of charging artists directly.

Audius co-founders (from left): head of product Forrest Browning, CEO Ranidu Lankage, CTO Roneil Rumburg

“The biggest problem in the music industry is that streaming is taking off and artists aren’t necessarily earning a lot of money. And it can take three months, or up to 18 months for unsigned artists, to get paid for streams,” says Lankage. “That’s what crypto really solves. You can pay artists in near real-time and make it fully transparent.”

The big question will be whether Audius can use the token economy to crack the chicken-and-egg problem of getting its first creators and listeners on a platform that might be less functionally robust than its traditional competitors. There are a lot of moving parts to decentralize, but there are also plenty of disgruntled musicians out there waiting for something better.

Most startup guys don’t have Billboard charting singles on their bio, but Lankage does. Born in Sri Lanka, his hip-hop songs in his native tongue of Sinhalese were the first of the language to be played on the BBC and MTV. He got signed to Sony and even went platinum, but left the label seeking greater control over his work. After going to Yale, he applied his music business knowledge to build a Reddit for dance music called The Drop with Twitch’s Justin Kan back in 2015.

The two teamed up again on a video version of Q&A app Quora called Whale, but that fizzled out too. Lankage’s next venture Polly, a polling tool built as a complement to Snapchat, inspired the now super-popular Instagram Stories polls and questions stickers. But after an acqui-hire by Reddit fell through, he returned to his first love: music.

“I’ve always been passionate about building tools for creators,” says Lankage. But this time, he wanted to focus on helping them turn their art into a profession. He teamed up with CTO Roneil Rumburg, an engineering partner at Kleiner Perkins who’d build a crypto wallet called Backslash, and head of product Forrest Browning, who’d sold his software metering startup StacksWare to Avi Networks.

Their goal is to build a blockchain streaming music service where listeners don’t have to understand blockchains. “A user wouldn’t even know that they have a wallet,” says Rumburg. They’ll just hear an ad every once in a while, get a subscription, or pay per stream. Since Audius is open sourced, developers will be able to build their own listening clients on top, which could specialize in discovery of certain types of music or offer their own payment schemes.

“I have known Ranidu, Forrest and Roneil for a long time, and have always been impressed with their ability to blend art, technology and business together,” says investor Niko Bonatsos of General Catalyst. “In Audius, they bring together all three skills, with a deep technical heart and a compelling solution for a very big marketplace.”

For starters, Audius is focusing on signing up independent electronic musicians. These are the types that might be popular on SoundCloud but actually have to pay for hosting there while not getting much back due to the platform’s weak monetization options. Don’t expect U2 and Ariana Grande on Audius, at least not yet. But the startup could differentiate by offering access to content you can’t find elsewhere.

To get artists on board, Lankage tells me Audius plans “to use token incentives.” Those willing to jump on first before there are many listeners could get a bonus allotment of tokens that might be worth more if they help popularize the service. And where artists go, their fans will follow. Audius is hoping artists will share its links first because that’s where they’ll earn the most money.

Audius has also lined up a legion of big-name advisors to help it develop its blockchain product and artist relationships. Those include Augur co-founder Jeremy Gardner, EDM artist 3LAU, EA co-founder Bing Gordon and more it can’t announce just yet.

Audius has also lined up a legion of big-name advisors to help it develop its blockchain product and artist relationships. Those include Augur co-founder Jeremy Gardner, EDM artist 3LAU, EA co-founder Bing Gordon and more it can’t announce just yet.

The linchpin of Audius will be the user experience. If the system feels too complicated, listeners and artists will stay elsewhere. A DJ might earn more per stream from Audius, but if Spotify or SoundCloud offer better ways for fans to subscribe to them and generate more plays long-term, they’ll still direct supporters there. But if Audius can hide the nerdy bits while solving the music industry’s problems, it has the potential to be one of the first mainstream consumer blockchain projects that treats the tech as a utility, not just a new stock market to bet on.

Powered by WPeMatico

Handiscover, a startup that lets you find and book accessible travel accommodation, has raised $700,000 in new funding. The round is backed by Howzat Partners, which has previously invested in a number of successful travel companies, such as publicly-listed Trivago and more recently Lodgify. Tranquility Capital, a Swedish family fund with a background in accessibility, also participated.

Originally launched in June 2015 to enable hosts to list accommodation and have Handiscover’s algorithm classify the accessibility of their properties or rooms, the startup has since evolved into a fully fledged two-sided marketplace, enabling consumers to search for and book travel accommodation based on various accessibility needs. The idea, founder Sebastien Archambeaud tells me, was born from his own experience as the father of 13-year-old Teo (pictured) who has a muscle condition and uses a wheelchair to get around.

“When travelling as the family we got so frustrated about the lack of purposeful information about accessibility of both vacation rentals and/or rooms for hotels,” he says. “That was what planted the first seed in my mind. Having a long background in international management and some previous tech experience and knowledge about building marketplaces, I thought I was well equipped to build a project like that. But as usual it never is as easy at it first sounds”.

Easy it might not be, but Handiscover seems to be making a decent dent so far, and appears more than capable of picking up any slack left by Airbnb’s recent acquisition of lesser-sized Accomable, which it has since shuttered. Handiscover currently lists 28,000 properties and rooms, and covers 83 countries, with more to come.

“Our mission is to enable people with disabilities and special needs (15-20 percent of the population) to travel the world, by being able to find a great choice of accommodations at different price levels, adapted to our users specific needs,” explains Archambeaud. “As there is no international standard for accessibility we created our own, using an algorithm to classify accommodations according to their level of accessibility, in a consumer friendly way”.

Archambeaud says direct competitors are mostly traditional travel agencies that specialise in disability, meaning they might have a website but are mainly focused on selling full holiday packages by phone. “We are more into helping our community travel the ‘modern’ way by bringing the freedom of booking online, when you want and with a large international choice,” he says, revealing that Handiscover will soon be working with travel tech company Amadeus to scale supply in terms of the number of hotels listed.

Meanwhile, asked what he thinks of Airbnb’s acquisition of Accomable, Archambeaud had this to say: “[It] was a great signal that our community is relevant from a business point of view and that Airbnb takes an interest in it. For us it has just been positive so far, both business-wise when talking to investors, but also from a community point of view”.

Powered by WPeMatico

Uproxx Media Group — owner of sites like HitFix, Dime and Uproxx itself — has been acquired.

The Uproxx site focuses on entertainment and pop culture news, and was founded back in 2008. It was bought by Woven Digital in 2014, which eventually rebranded as Uproxx. Like many digital media companies, it includes both a publishing arm and a studio that works with marketers to create videos and other branded content.

Today, Warner Music Group announced that it’s buying the company and its portfolio of websites (minus BroBible, which will continue to operate independently). The company says Uproxx will still to be run by CEO and chief creative officer Benjamin Blank, along with co-founder and publisher Jarret Myer, and that the individual sites will still have editorial independence.

Back in the 1990s, Myer (pictured above) was one of the founders of hip hop label Rawkus Records, where he worked with Max Lousada — who would eventually become Warner’s CEO of Global Recorded Music.

“UPROXX brings together pioneering personalities and credible brands in ways that move huge audiences to talk, listen and share,” Lousada said in the acquisition announcement. “It’ll be exciting to collaborate with Jarret again, along with Ben and their team, who will thrive in the creative and entrepreneurial environment we’re building. They’ll be great partners as we redefine what it means to be a dynamic, future-focused music company.”

Warner says Uproxx reaches an audience of 40 million people through its websites and other platforms.

The financial terms of the acquisition were not disclosed. According to Crunchbase, Uproxx raised a total of $43.3 million from investors, including IVP, Advancit Capital and WPP Ventures.

Powered by WPeMatico

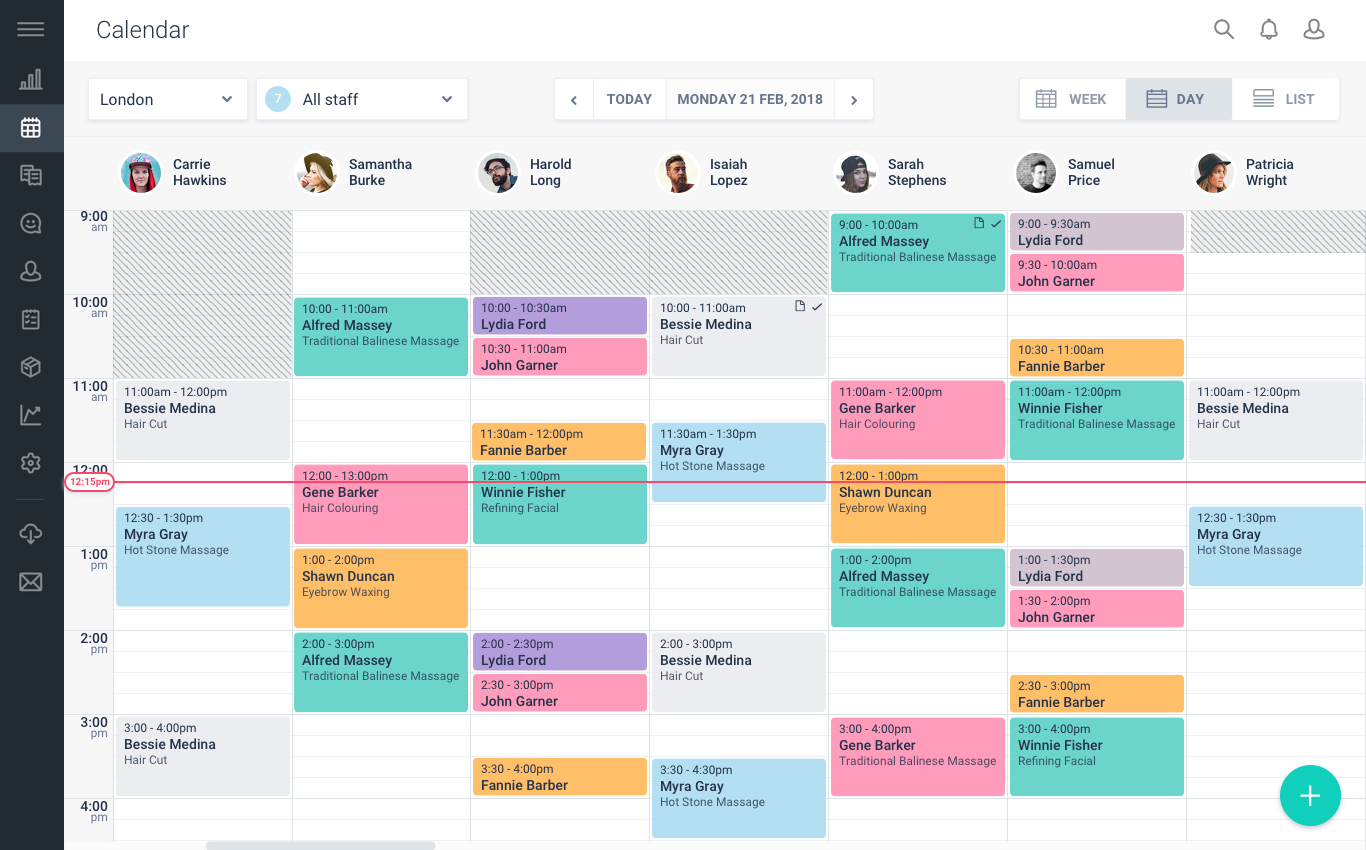

Shedul, an online booking platform for salons and spas, has raised $5 million in funding. The round is led by Berlin’s Target Global, with participation from New York based FJ Labs. A number of individuals also invested personally, including Niklas Östberg (founder and CEO of Delivery Hero), and Hakan Koç (co-founder and co-CEO of Auto1 Group).

Launched in 2015, Shedul’s first product is a free SaaS designed to help salons and spas manage their day-to-day sales and operations. The platform’s features span managing appointment bookings, point-of-sale, customer records, inventory, and financial reporting. A second, more recent offering is the Fresha.com marketplace, and it here where the London-headquartered company generates revenue by charging merchants a small percentage fee on top of bookings.

“We’ve built the world’s best platform for beauty and wellness industry and given it to all businesses globally 100 percent subscription free,” says founder and CEO William Zeqiri. “Good free software has spread virally with users in the industry enabling us to acquire new merchants very fast”.

This has seen Shedul acquire salon and spa operator customers in more than 120 countries, primarily in the U.S., U.K., Australia, and Canada. Around 6 million appointments are booked each month, growing at an average rate of 20 percent month-on-month, while the platform is on track to process $3.5 billion worth of appointment bookings by the end of 2018.

“Leveraging our existing pool of global merchants allowed us to bootstrap the consumer marketplace with a lot of liquidity,” explains Zeqiri. “This created additional value proposition for both merchants and marketplace customers. With our Free SaaS-enabled marketplace business model we are leveraging the critical mass of merchants and marketplace users to scale the platform exponentially”.

Currently in the initial rollout phase, Zeqiri says Fresha.com provides mobile apps for customers and real-time booking integrations through Instagram, Facebook and Google, along with in-app payment processing. It also incorporates intelligent features to help merchants grow revenues. This includes displaying price and availability options based on a customer’s purchase history and the merchant’s projected occupancy.

“With our two-sided Marketplace platform, we’re automating many processes of running a business in the beauty industry with powerful online booking features, marketing tools and access to our consumer marketplace to attract new clients. This frees up merchants to do what they do best and spend more face time with customers,” adds the Shedul CEO.

“We have salons where 80 percent of their bookings are now made though our online marketplace Fresha.com. Our technology helps businesses optimize their schedule with real-time online availability; in some cases it has increased merchant revenues more than 30 percent”.

Shedul counts its main competitors in the U.S. as MindBody, Vagaro, and StyleSeat. In Europe, the startup competes most directly with marketplace TreatWell.

Meanwhile, Shedul says the new capital will be used for product development and to support the continued rollout of the new marketplace offering. It brings the total amount raised by the company to over $11 million to date and should see it through to an upcoming Series B round.

Powered by WPeMatico

The dream of a startup founder can often be summarized by the following well-intentioned, and mostly delusional, quote: “We’ll raise a few rounds and in a few years we’ll IPO on Nasdaq.”

But a more likely scenario looks something like this:

You invest a few years of hard work to build something of value. One day you receive an acquisition offer out of the blue. You’re elated. And you’re not prepared. You drop everything to focus on this opportunity. Exclusive due diligence starts. Your company is a mess (IP, contracts, burn). Days become weeks; weeks become months. You’ve neglected business and fundraising. You’re running out of money. M&A is now your one and only option. The buyer says they found a bunch of cockroaches in the walls and drops the price. Now what?

Sound unlikely?

This is still a favorable situation: You had an offer! Think about how much time you invested in your various funding rounds. The hundreds of names and Google spreadsheet or Streak-powered quasi-CRM process.

Have you spent even a fraction of that on understanding exit paths? If you’d rather not live the situation described above, read along.

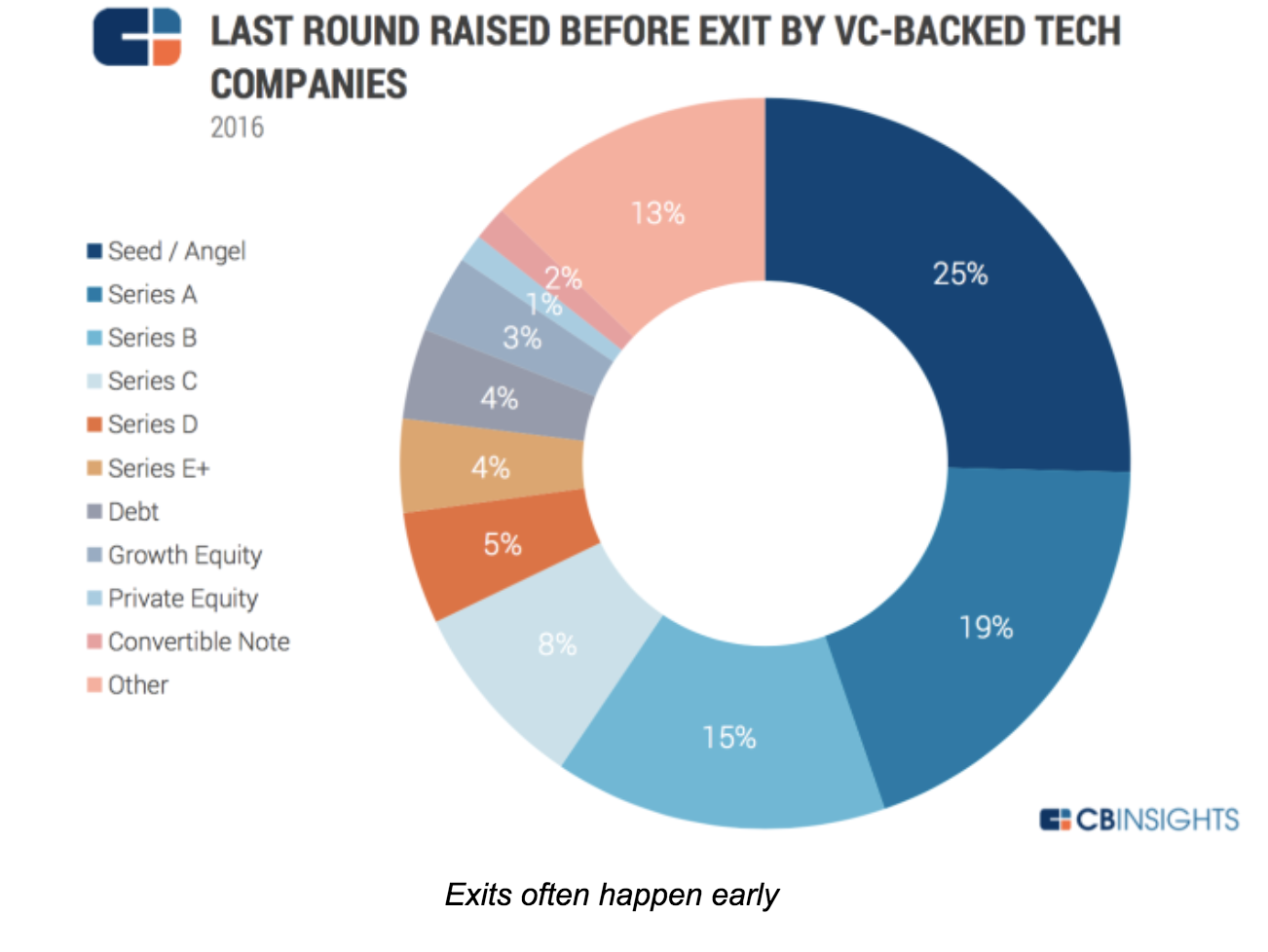

Investors live by exits, but many founders keep dreaming of unicornization and avoid the “E-word” until it’s too late. Yet, in 2016, 97 percent of exits were M&As. And most happened before Series B.

Exits matter because that’s when you, your team and your investors get paid. Oddly enough, and to use a chess metaphor, we hear a lot about the “opening game” (lean startup) and the “mid-game” (growth), but very little about this “end game.”

As a result, founders miss opportunities or leave money on the table. This is a shame. Our fund has more than 700 companies in portfolio. We want the best possible exit for each of them. And fortune favors the prepared! Now, how to get 700 exits (and counting)?

To explore the topic, we organized a series of Master Classes tapping corporate buyers, bankers, investors, lawyers and startup CEOs with M&A or IPO experience in San Francisco. It was a group that included the founders of Guitar Hero — bought by Activision; JUMP Bikes — a SOSV portfolio company bought by Uber, Ubiquisys — bought by Cisco and Withings — bought by Nokia. Each one for hundreds of millions.

Their observations can be summarized below.

“Founders must be aware of what contributes to an exit. This means understanding partnerships and how they are formed in the business space the entrepreneur is working in,” said one Master Class participant.

As founders, you build your product, your company and… optionality. You need to understand the options open to your company, and take steps to enable them.

The most likely one is an acquisition, but there are others like IPO (including small cap), RTO, SBO, LBO, Equity Crowdfunding and even ICO.

“Exit is not a goal per se, but as a CEO it is something you should think about as early in your cycle as possible, while being business-focused,” said the London-based investor Frederic Rombaut, of Seraphim Capital.

Indeed, most participants said that exits should always be on the chief executive’s agenda, no matter how early in the process. “Exits should be on the CEO agenda. Not front and center, but on the agenda. M&A is a by-product of a great business and targeted BD. IPOs are always an option once you’ve built significant cashflow forecasting.”

It’s important to ask questions like: How many “strategic engagements” with potential buyers have you had this month? Is your message and value clear in their eyes? Have you considered an acquisition track in parallel to a fundraise?

It doesn’t stop there:

One thing is sure: The time to exit is not when you’re running out of money.

Unicorn or not, the most likely exit is an acquisition.

As George Patterson, managing director at HSBC in New York said, “Good tech companies are bought, not sold. The question is thus: how to get bought?”

Patterson says it’s important to understand how mergers and acquisitions actually work; how to prepare a startup for an exit; and how to develop a “feel” for the market you’re exiting through and into.

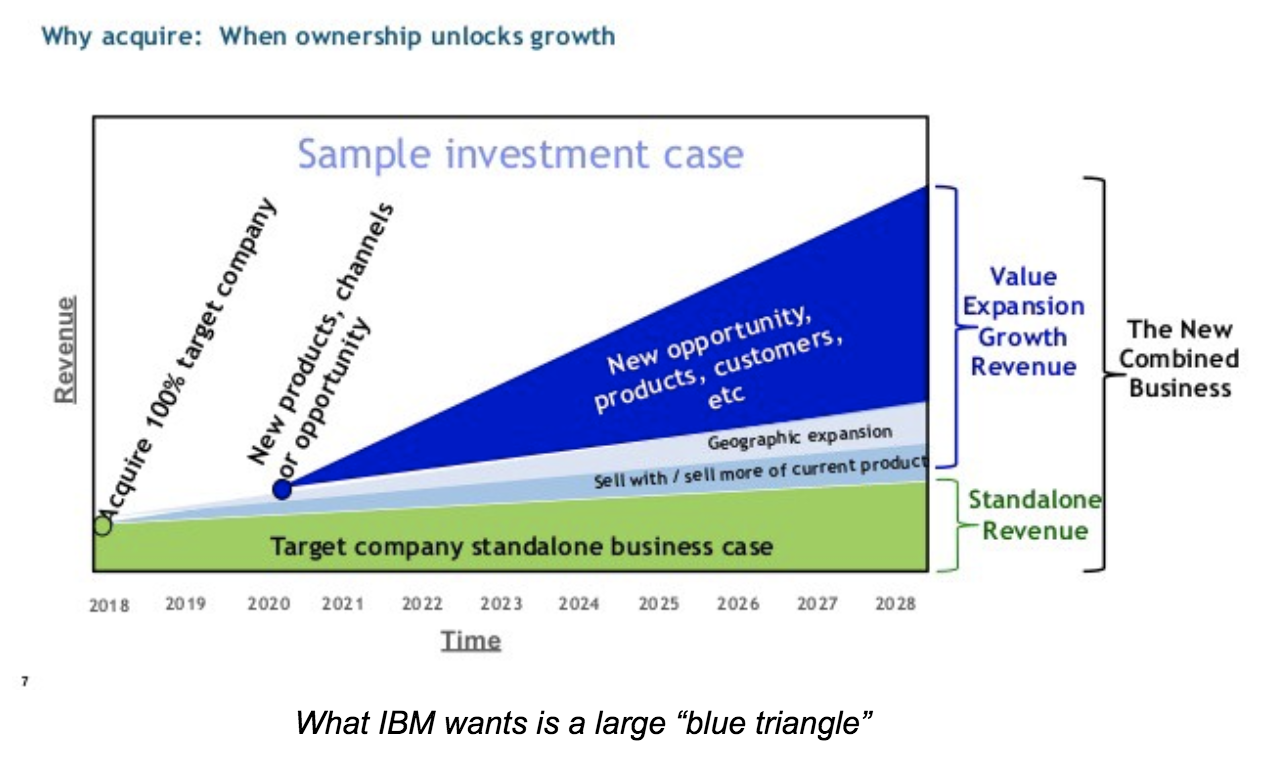

Hearing from corp dev veterans from Cisco, Logitech, Dassault and IBM, a few key ideas emerged:

Motivations vary

It could be from least to most expensive, or as a mix, as listed by Mark Suster, managing partner at Upfront Ventures:

How corporates find you

Corporates find deals via the development of partnerships, investment (CVC), their business units, corp dev research, media and investor connections.

Asked about the best approach, Todd Neville, manager of Corporate Business Development and Strategy at IBM (who gave the most detailed description of the corp dev process), said, “Do something cool to one of the IBM customers. If they rave about even a POC, we’re interested.”

In other words, business development is corporate development.

Get the house in order

Buyers typically want to know three things:

For IP, they will check your contracts (staff and contractors), and run some automated code analysis for proprietary code and open source use. They will evaluate potential IP infringement. No point buying you if you end up costing more in lawsuits!

For your team skills: Sitting down with your engineers will tell them plenty enough without understanding the details of this or that algorithm. The last thing a corporate wants is to be accused of stealing!

Lawyers engaged early can help. The later the clean-up, the more costly and painful.

Develop a feel for your “market”

Develop relationships and create champions within corporates. It will help promote your deal when the time comes, and will let you keep your finger on the pulse of corporate strategy to time your moves.

Do you read the earning calls of Cisco or IBM (or others relevant to you)? This is where strategies are presented. Are your keywords coming up there or in their press releases?

Chris Gilbert, former CEO of Ubiquisys (sold to Cisco for more than $300 million) was very deliberate in planning his exit.

“Selling starts on day one and is a leadership-only function — work out who will be your buyer. Only the CEO can do this. Constantly articulate why a company should buy you,” Gilbert said. Bring clear messages into the acquiring company so it can be presented upwards: give them the presentation you would like them to show their boss! When the time is right, force decisions through competition. If you know they have to buy you, your starting position is strong.”

The dark art of price discovery

There are dozens of formulas (from DCF to comparables) to evaluate a deal — which also means none is “correct.” What matters is: How much would you sell for, and how much is the buyer ready to pay?

Gilbert, at Ubiquisys, described how close interactions with his banker helped drive the price up among the bidders assembled.

Just like buyers, we meet bankers and lawyers too rarely at startup events, but there is much to learn with them. They make deals happen, avoid value erosion and optimize price. They often also make introductions before you engage them, to build goodwill and earn your business.

And if you worry about fees, the right banker handsomely pays for itself by finding more bidders and playing “bad cop” for you, avoiding direct confrontation with your future employer. Do you want a slice of the watermelon or the whole grape?

When asked about what happens after an M&A or IPO, buyers said they generally hoped the founders would stay with them for many years. Often using re-vesting, earn-outs or shares of the acquiring company to incentivize them. Neville, from IBM, mentioned a security company they acquired whose founder is now the head of one of the largest IBM divisions.

In the case of IPOs, supposedly the ultimate “exit,” any block of shares sold by founders would face extreme scrutiny and might cause a price drop.

So who’s exiting during those deals? Investors (and not always).

Eventually, if the average age of a startup at exit is 8-10 years, the active duty period of founders (if not replaced in the meantime) extends even more. Better love the problem you’re solving, and your customers!

Thanks to speakers, participants and supporters of this Master Class series:

London: Frederic Rombaut (Seraphim Capital), Joe Tabberer (FirstBank), Chris Gilbert (Ubiquisys), Jonathan Keeling (Crowdcube), Fred Destin, Tony Fish (AMF Ventures, James Clark (London Stock Exchange), Denise Law (SGCIB).

Paris: Frederic Rombaut (Seraphim Capital), Manuel Gruson (Dassault Systemes), Pierre-Henri Chappaz (Rothschild Global Advisory), Christine Lambert-Goue (All Invest), Olivier Younes (EXPEN), Eric Carreel (Withings), Fabien Bardinet (Balyo), Xavier Lazarus (Elaia Partners), Pierre-Eric Leibovici(Daphni). Jean de La Rochebrochard (Kima Ventures), Jeremy Sartre (SmartAngels), Gwen Regina Tan (Entrepreneur First).

San Francisco: Natasha Ligai (Logitech), Matt Cutler (Cisco),Will Hawthorne, (CODE Advisors), Ryan Rzepecki (JUMP Bikes), Charles Huang (Guitar Hero), Jeff Thomas (Nasdaq), Shahin Farshchi (Lux Capital), Ammar Hanafi (Moment Ventures), Adam J. Epstein (Third Creek Advisors), Nathan Harding (EKSO Bionics), Kate Whitcomb, Anthony Marino and Ethan Haigh (SOSV).

New York: Todd Neville (IBM), George Patterson (HSBC), Ryan Rzepecki (JUMP Bikes), Aaron Kellner (SeedInvest), Jeremy Levine (Bessemer Venture Partners), Taylor Greene (Collaborative Fund), Adam Rothenberg (BoxGroup), Eli Curi (Fenwick & West), Ian Engstrand and Salil Gandhi (Goodwin), Warren Spar(Sparring Partners Capital), Duncan Turner, Vivian Law and Sheng Ge (SOSV).

Powered by WPeMatico

Skyline AI founders Iri Amirav, Or Hiltch, Guy Zipori and Amir Leitersdorf

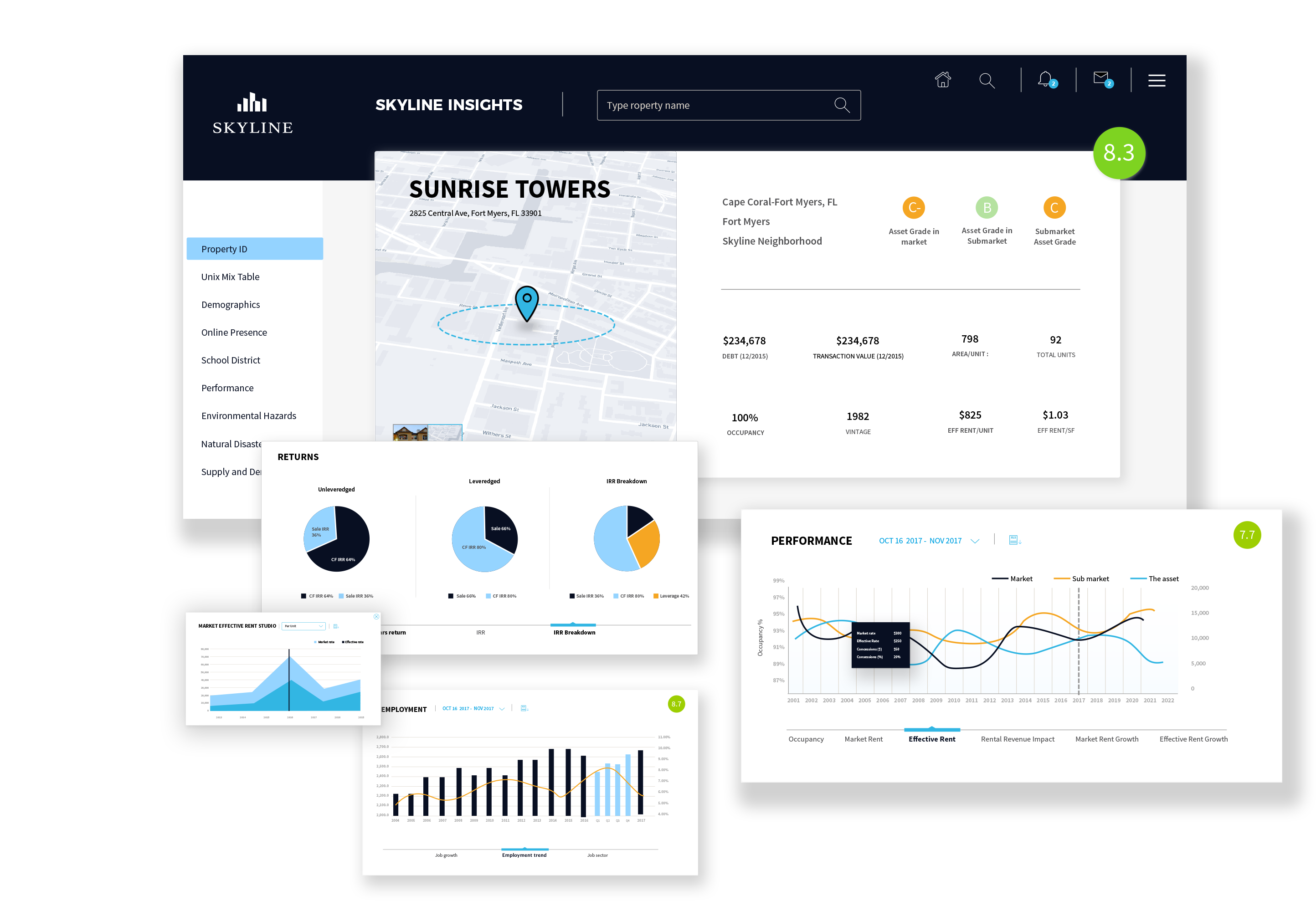

A mere four months after coming out of stealth mode with $3 million in seed funding, real estate investment startup Skyline AI announced that it has raised an $18 million Series A. The round was led by Sequoia Capital, a returning investor, and TLV Partners, with participation from JLL Spark, a division of real estate investment management firm JLL. The strategic funding will allow Skyline AI to add more asset classes to its platform, which uses data science and machine learning algorithms to help institutional investors make better decisions about properties.

Skyline AI says its technology is trained on what it claims is the most comprehensive data set in the industry, drawing from more than 100 sources, with market information covering the last 50 years. Its technology is meant to provide faster and more accurate analysis than traditional methods, so investors can react more quickly to changes in the real estate market.

Co-founder and CEO Guy Zipori told TechCrunch in an email that the startup decided to raise its Series A so soon after coming out of sleath because of positive response from investors, adding that the round was oversubscribed. “The timing of the round also worked out perfectly with our current deal flow and expansion plans. The round was significant, putting us in a great position to move forward,” he said.

Skyline AI has had a busy few months since emerging from stealth. In June, it teamed up with an unnamed partner in the U.S. to acquire two residential complexes in Philadelphia for $26 million. Zipori said they decided to make an unsolicited offer after Skyline AI’s platforms determined the properties were being mismanaged. Then in July, Skyline AI announced a partnership with Greystone, a real estate lending, investment and advisory firm, to collaborate on improving the dealmaking and loan underwriting processes.

JLL and other strategic investors in Skyline AI’s Series A will allow the startup to add analysis and underwriting for new asset classes, including industrial, retail and office properties, to its platform. “This in turn will enable us to deepen and strengthen cooperation with the leading commercial real estate investment firms across the U.S.,” said Zipori. Some of the capital will also be spent on growing its research and development, data science and AI teams in Tel Aviv, and its recently opened sales and real estate office in New York.

In a press statement, Sequoia Capital partner Haim Sadger said “Over the last few years, we’ve seen AI disrupt a number of traditional industries and the real estate market should be no different. The power of Skyline AI technology to understand vast amounts of data that affect real estate transactions, will unlock billions of dollars in untapped value.”

Powered by WPeMatico

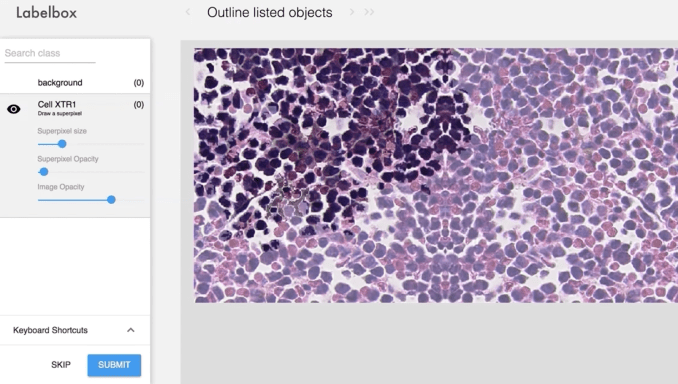

Every artificial intelligence startup or corporate R&D lab has to reinvent the wheel when it comes to how humans annotate training data to teach algorithms what to look for. Whether it’s doctors assessing the size of cancer from a scan or drivers circling street signs in self-driving car footage, all this labeling has to happen somewhere. Often that means wasting six months and as much as a million dollars just developing a training data system. With nearly every type of business racing to adopt AI, that spend in cash and time adds up.

Labelbox builds artificial intelligence training data labeling software so nobody else has to. What Salesforce is to a sales team, Labelbox is to an AI engineering team. The software-as-a-service acts as the interface for human experts or crowdsourced labor to instruct computers how to spot relevant signals in data by themselves and continuously improve their algorithms’ accuracy.

Today, Labelbox is emerging from six months in stealth with a $3.9 million seed round led by Kleiner Perkins and joined by First Round and Google’s Gradient Ventures.

“There haven’t been seamless tools to allow AI teams to transfer institutional knowledge from their brains to software,” says co-founder Manu Sharma. “Now we have over 5,000 customers, and many big companies have replaced their own internal tools with Labelbox.”

Kleiner’s Ilya Fushman explains that “If you have these tools, you can ramp up to the AI curve much faster, allowing companies to realize the dream of AI.”

Sharma knew how annoying it was to try to forge training data systems from scratch because he’d seen it done before at Planet Labs, a satellite imaging startup. “One of the things that I observed was that Planet Labs has a superb AI team, but that team had been for over six months building labeling and training tools. Is this really how teams around the world are approaching building AI?,” he wondered.

Before that, he’d worked at DroneDeploy alongside Labelbox co-founder and CTO Daniel Rasmuson, who was leading the aerial data startup’s developer platform. “Many drone analytics companies that were also building AI were going through the same pain point,” Sharma tells me. In September, the two began to explore the idea and found that 20 other companies big and small were also burning talent and capital on the problem. “We thought we could make that much smarter so AI teams can focus on algorithms,” Sharma decided.

Labelbox’s team, with co-founders Ysiad Ferreiras (third from left), Manu Sharma (fourth from left), Brian Rieger (sixth from left) Daniel Rasmuson (seventh from left)

Labelbox launched its early alpha in January and saw swift pickup from the AI community that immediately asked for additional features. With time, the tool expanded with more and more ways to manually annotate data, from gradation levels like how sick a cow is for judging its milk production to matching systems like whether a dress fits a fashion brand’s aesthetic. Rigorous data science is applied to weed out discrepancies between reviewers’ decisions and identify edge cases that don’t fit the models.

“There are all these research studies about how to make training data” that Labelbox analyzes and applies, says co-founder and COO Ysiad Ferreiras, who’d led all of sales and revenue at fast-rising grassroots campaign texting startup Hustle. “We can let people tweak different settings so they can run their own machine learning program the way they want to, instead of being limited by what they can build really quickly.” When Norway mandated all citizens get colon cancer screenings, it had to build AI for recognizing polyps. Instead of spending half a year creating the training tool, they just signed up all the doctors on Labelbox.

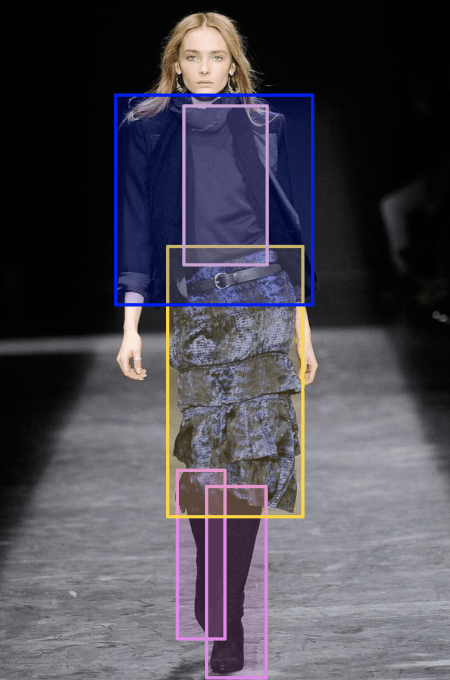

Any organization can try Labelbox for free, and Ferreiras claims hundreds have. Once they hit a usage threshold, the startup works with them on appropriate SaaS pricing related to the revenue the client’s AI will generate. One called Lytx makes DriveCam, a system installed on half a million trucks with cameras that use AI to detect unsafe driver behavior so they can be coached to improve. Conde Nast is using Labelbox to match runway fashion to related items in their archive of content.

The big challenge is convincing companies that they’re better off leaving the training software to the experts instead of building it in-house where they’re intimately, though perhaps inefficiently, involved in every step of development. Some turn to crowdsourcing agencies like CrowdFlower, which has their own training data interface, but they only work with generalist labor, not the experts required for many fields. Labelbox wants to cooperate rather than compete here, serving as the management software that treats outsourcers as just another data input.

Long-term, the risk for Labelbox is that it’s arrived too early for the AI revolution. Most potential corporate customers are still in the R&D phase around AI, not at scaled deployment into real-world products. The big business isn’t selling the labeling software. That’s just the start. Labelbox wants to continuously manage the fine-tuning data to help optimize an algorithm through its entire life cycle. That requires AI being part of the actual engineering process. Right now it’s often stuck as an experiment in the lab. “We’re not concerned about our ability to build the tool to do that. Our concern is ‘will the industry get there fast enough?’” Ferreiras declares.

Long-term, the risk for Labelbox is that it’s arrived too early for the AI revolution. Most potential corporate customers are still in the R&D phase around AI, not at scaled deployment into real-world products. The big business isn’t selling the labeling software. That’s just the start. Labelbox wants to continuously manage the fine-tuning data to help optimize an algorithm through its entire life cycle. That requires AI being part of the actual engineering process. Right now it’s often stuck as an experiment in the lab. “We’re not concerned about our ability to build the tool to do that. Our concern is ‘will the industry get there fast enough?’” Ferreiras declares.

Their investor agrees. Last year’s big joke in venture capital was that suddenly you couldn’t hear a startup pitch without “AI” being referenced. “There was a big wave where everything was AI. I think at this point it’s almost a bit implied,” says Fushman. But it’s corporations that already have plenty of data, and plenty of human jobs to obfuscate, that are Labelbox’s opportunity. “The bigger question is ‘when does that [AI] reality reach consumers, not just from the Googles and Amazons of the world, but the mainstream corporations?’”

Labelbox is willing to wait it out, or better yet, accelerate that arrival — even if it means eliminating jobs. That’s because the team believes the benefits to humanity will outweigh the transition troubles.

“For a colonoscopy or mammogram, you only have a certain number of people in the world who can do that. That limits how many of those can be performed. In the future, that could only be limited by the computational power provided so it could be exponentially cheaper” says co-founder Brian Rieger. With Labelbox, tens of thousands of radiology exams can be quickly ingested to produce cancer-spotting algorithms that he says studies show can become more accurate than humans. Employment might get tougher to find, but hopefully life will get easier and cheaper too. Meanwhile, improving underwater pipeline inspections could protect the environment from its biggest threat: us.

“AI can solve such important problems in our society,” Sharma concludes. “We want to accelerate that by helping companies tell AI what to learn.”

Powered by WPeMatico