Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Tresorit, the Swiss-Hungarian company that provides end-to-end encrypted “file sync and sharing” for businesses, has closed €11.5 million in Series B financing. The round is led by European growth capital investor 3TS Capital Partners, alongside PortfoLion, a Central European venture capital.

A number of existing investors also participated, such as Andreas Kemi, an early investor in LogMeIn and co-founder of Scala Business Solutions, and Márton Anka, founder of LogMeIn. I also understand the round included some secondary funding, meaning not all of the cash has entered Tresorit’s balance sheet.

Operating in the enterprise cloud storage and collaboration market, Tresorit provides what it describes as zero-knowledge encryption technology and unique encryption key management. The high level pitch is that the company is able to offer on-premise equivalent security for businesses while offering the type of simple user experience we have come to expect in consumer apps. It serves more than 17,000 customers and says it has grown recurring revenue by an average of 3x every year in the last three years.

Meanwhile, Tresorit will use the new Series B funding to further accelerate this growth by tapping into what it says is rising demand for secure cloud solutions, in light of a plethora of high profiles security breaches seen at major enterprises in recent years. This will include beefing up its management team with the aim of scaling up marketing and sales, and establishing new channel partners.

“We are at an inflection point with our business as awareness regarding data protection and cybersecurity threats is getting stronger and demand is set to grow exponentially for our service in and outside of Europe,” says Tresorit founder and CEO Istvan Lam.

He also says there is large market potential in channeling traditional IT expenditure into the cloud, citing a recent Deloitte survey indicating that traditional IT expenditure still accounts for two-thirds of all IT spending, while only one-third goes towards IT-as-a-service.

“Many enterprises are holding back from migrating to the cloud due to security and privacy concerns. With security guaranteed by end-to-end encryption, more businesses can and will choose Tresorit’s cloud solution,” adds Lam.

To that end, Tresorit recently launched a Beta version of “Tresorit Send,” a standalone file sharing product that offers a secure and encrypted alternative to unreliable file transfer sites and email attachments. The idea, presumably, is for the product to act as a shop window for the Tresorit user experience and the company’s broader end-to-end encryption offering.

Powered by WPeMatico

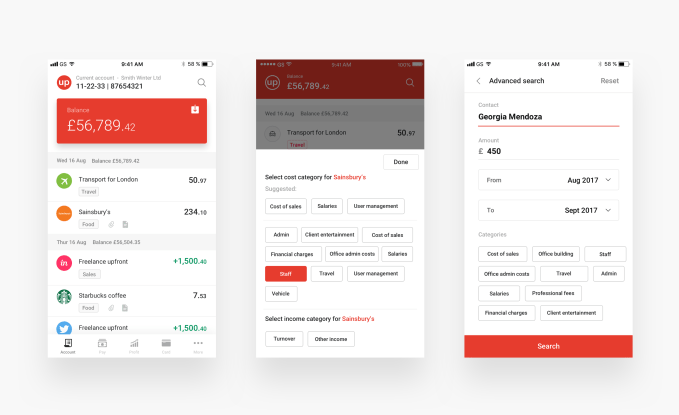

Countingup, the U.K. fintech that provides a business bank account that combines bookkeeping, has raised £2.3 million in seed funding. Leading the round is Forward Partners, with participation from previous backer Frontline Ventures, and JamJar Investments.

Founded last year by Tim Fouracre, who previously founded cloud accounting software Clear Books, Countingup wants to simplify the life of sole traders and other small businesses by reinventing the business current account. Fouracre’s vision is that for small enterprises, business banking and accounting software should be merged so that bookkeeping and filing accounts can be a lot more automated.

“If you are running a business then bookkeeping is a chore, wastes your time and is boring,” the Countingup up founder told me last year. “Your bank surprises you with hidden fees and you’ve probably lost faith in their customer service. Countingup is making starting and running a business really simple… We’re doing that by combining accounting and banking into one simple smartphone app”.

After downloading the Countingup for iOS or Andriod, you are able to open a current account on your smartphone in a claimed 5 minutes. The account comes with a U.K. sort code/account number and a contactless Mastercard. The accounting functionality currently includes a profit and loss report, bookkeeping categorisation and the ability to attach receipts to transactions.

However, the big feature that will be launched later this year is invoicing, while things like “automated receipt scanning,” and tax calculations and filing are also in the 2018 roadmap.

Fouracre says Countingup wants to be the financial platform for 1 million U.K. small businesses. It already has four thousand customers and I’m told is signing up new users at a rate of 1,500 businesses per month.

Powered by WPeMatico

Communications workflow company Mynewsdesk is acquiring French startup Mention for an undisclosed sum. Norwegian business media group NHST currently owns Mynewsdesk.

Mention lets you monitor keywords around the web. It’s a good way to hear what customers are saying about your brand on their blog, on Twitter, on Facebook or anywhere public.

You can also use Mention to generate reports, study competitors to see if people are talking about them and find influencers who use your products. It can be a useful tool for PR and marketing companies for instance.

Mynewsdesk wants to be an all-in-one tool for PR agencies. It can also help you track media coverage, but it goes a bit further than that. You can organize your media contacts in the service and segment your distribution list, write and distribute press releases and measure your campaigns.

It’s clear that Mention fits well with Mynewsdesk. Mention will stick around as a standalone product for now. But it feels like the monitoring feature of Mynewsdesk could benefit from Mention’s expertise in this area.

Mention currently has 750,000 users, including 4,000 customers. It generates $6 million in annual recurring revenue with a 35 percent growth rate year-over-year. Investors include eFounders, Alven and Point Nine Capital. Mention co-founder and CEO Matthieu Vaxelaire is becoming COO at Mynewsdesk.

Powered by WPeMatico

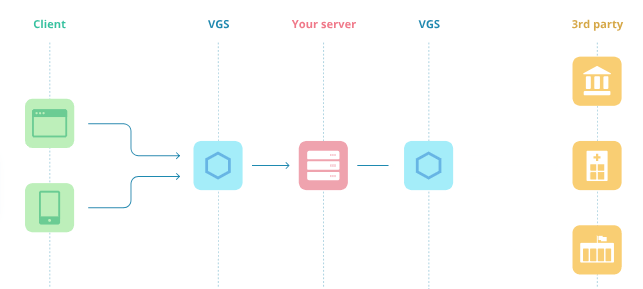

“You can’t hack what isn’t there,” Very Good Security co-founder Mahmoud Abdelkader tells me. His startup assumes the liability of storing sensitive data for other companies, substituting dummy credit card or Social Security numbers for the real ones. Then when the data needs to be moved or operated on, VGS injects the original info without clients having to change their code.

It’s essentially a data bank that allows businesses to stop storing confidential info under their unsecured mattress. Or you could think of it as Amazon Web Services for data instead of servers. Given all the high-profile breaches of late, it’s clear that many companies can’t be trusted to house sensitive data. Andreessen Horowitz is betting that they’d rather leave it to an expert.

That’s why the famous venture firm is leading an $8.5 million Series A for VGS, and its partner Alex Rampell is joining the board. The round also includes NYCA, Vertex Ventures, Slow Ventures and PayPal mafioso Max Levchin. The cash builds on VGS’ $1.4 million seed round, and will pay for its first big marketing initiative and more salespeople.

“Hey! Stop doing this yourself!,” Abdelkader asserts. “Put it on VGS and we’ll let you operate on your data as if you possess it with none of the liability.” While no data is ever 100 percent unhackable, putting it in VGS’ meticulously secured vaults means clients don’t have to become security geniuses themselves and instead can focus on what’s unique to their business.

“Privacy is a part of the UN Declaration of Human Rights. We should be able to build innovative applications without sacrificing our privacy and security,” says Abdelkader. He got his start in the industry by reverse-engineering games like StarCraft to build cheats and trainer software. But after studying discrete mathematics, cryptology and number theory, he craved a headier challenge.

Abdelkader co-founded Y Combinator-backed payment system Balanced in 2010, which also raised cash from Andreessen. But out-muscled by Stripe, Balanced shut down in 2015. While transitioning customers over to fellow YC alumni Stripe, Balanced received interest from other companies wanting it to store their data so they could be PCI-compliant.

Very Good Security co-founder and CEO Mahmoud Abdelkader

Now Abdelkader and his VP from Balanced, Marshall Jones, have returned with VGS to sell that as a service. It’s targeting startups that handle data like payment card information, Social Security numbers and medical info, though eventually it could invade the larger enterprise market. It can quickly help these clients achieve compliance certifications for PCI, SOC2, EI3PA, HIPAA and other standards.

VGS’ innovation comes in replacing this data with “format preserving aliases” that are privacy safe. “Your app code doesn’t know the difference between this and actually sensitive data,” Abdelkader explains. In 30 minutes of integration, apps can be reworked to route traffic through VGS without ever talking to a salesperson. VGS locks up the real strings and sends the aliases to you instead, then intercepts those aliases and swaps them with the originals when necessary.

“We don’t actually see your data that you vault on VGS,” Abdelkader tells me. “It’s basically modeled after prison. The valuables are stored in isolation.” That means a business’ differentiator is their business logic, not the way they store data.

For example, fintech startup LendUp works with VGS to issue virtual credit card numbers that are replaced with fake numbers in LendUp’s databases. That way if it’s hacked, users’ don’t get their cards stolen. But when those card numbers are sent to a processor to actually make a payment, the real card numbers are subbed in last-minute.

VGS charges per data record and operation, with the first 500 records and 100,000 sensitive API calls free; $20 a month gets clients double that, and then they pay 4 cent per record and 2 cents per operation. VGS provides access to insurance too, working with a variety of underwriters. It starts with $1 million policies that can be much larger for Fortune 500s and other big companies, which might want $20 million per incident.

Obviously, VGS has to be obsessive about its own security. A breach of its vaults could kill its brand. “I don’t sleep. I worry I’ll miss something. Are we a giant honey pot?,” Abdelkader wonders. “We’ve invested a significant amount of our money into 24/7 monitoring for intrusions.”

Obviously, VGS has to be obsessive about its own security. A breach of its vaults could kill its brand. “I don’t sleep. I worry I’ll miss something. Are we a giant honey pot?,” Abdelkader wonders. “We’ve invested a significant amount of our money into 24/7 monitoring for intrusions.”

Beyond the threat of hackers, VGS also has to battle with others picking away at part of its stack or trying to compete with the whole, like TokenEx, HP’s Voltage, Thales’ Vormetric, Oracle and more. But it’s do-it-yourself security that’s the status quo and what VGS is really trying to disrupt.

But VGS has a big accruing advantage. Each time it works with a clients’ partners like Experian or TransUnion for a company working with credit checks, it already has a relationship with them the next time another clients has to connect with these partners. Abdelkader hopes that, “Effectively, we become a standard of data security and privacy. All the institutions will just say ‘why don’t you use VGS?’”

That standard only works if it’s constantly evolving to win the cat-and-mouse game versus attackers. While a company is worrying about the particular value it adds to the world, these intelligent human adversaries can find a weak link in their security — costing them a fortune and ruining their relationships. “I’m selling trust,” Abdelkader concludes. That peace of mind is often worth the price.

Powered by WPeMatico

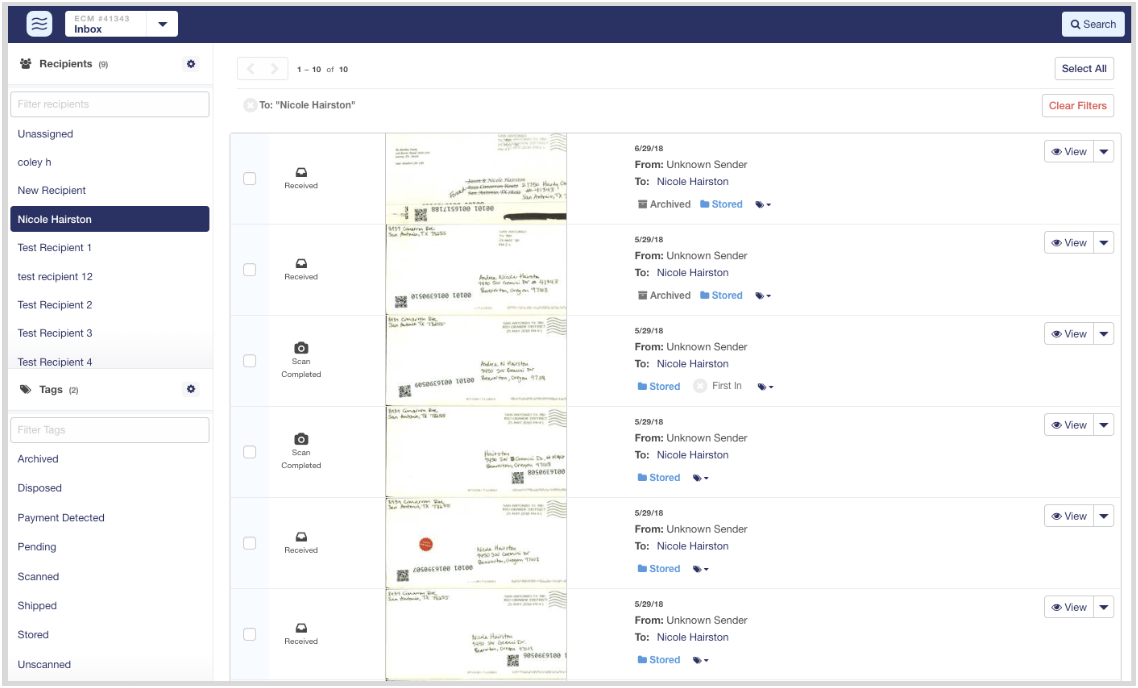

Earth Class Mail, a company that digitizes your physical mail so you don’t have to go to the mailbox every day, today announced that it has acquired receipt scanning and expense tracking service Shoeboxed.

The reason Earth Class Mail would be interested in Shoeboxed is pretty obvious, given that both companies focus on taking the pain out of dealing with paper. Both services will continue to operate as usual, though we’ll likely see some deep integrations between the two over time.

Shoeboxed, which launched 11 years ago, currently digitizes over five million documents per year for its more than 1 million customers in 90 countries. Its main market is small businesses in the U.S., which make up 500,000 of its users.

“When we started in 2008 and put the first iPhone app in the app store to scan receipts, there was one other powerhouse around helping small business go digital — Earth Class Mail,” the company’s CEO and co-founder Tobias Walter tells us. “The combined power of our two companies will be a massive shift for small businesses to finally become paperless and say goodbye to old workflows that cost them hours of their productivity. I could not be happier with the new home we found for the company, the team and our customers!”

What sets Earth Class Mail apart from the United States Postal Service’s Informed Delivery service is that it not only scans the outside of the envelopes that you are about to receive but that you can also give the company permission to scan all the documents inside, too (and the price you pay for the service depends mostly on how many of these full scans you want per month). While Oregon-based Earth Class Mail had to file for bankruptcy protection in 2015, its new leadership team turned the company around. The company says that its annual run rate is now $10 million, up 20 percent since Jess Garza become its new CEO last December.

Walter also notes that users would occasionally send unopened envelopes, too, but the company wasn’t allowed to open them. These customers can now easily become Earth Class Mail users.

Over the course of its existence, Shoeboxed only raised a moderate amount of funding, with a $580,000 Series A round led by Novak Biddle Venture Partners in 2008 (when Series A rounds were still much smaller than today) and a $1.4 million Series B round in 2011. The financial details of today’s acquisition were not disclosed.

Powered by WPeMatico

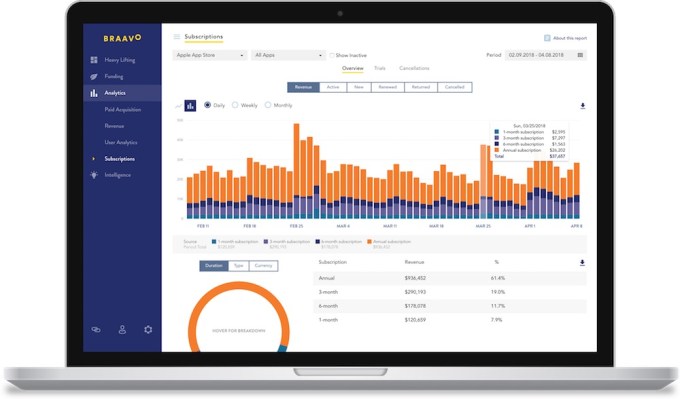

Braavo, a startup that provides financing to mobile app developers, is announcing that it has raised $6 million in Series A funding.

The might not seem like much compared to the $70 million that Braavo announced raising last year, but that was debt financing, used to loan money to developers. This new round is equity financing, used to fund Braavo’s own operations and growth.

Co-founder Mark Loranger told me Braavo was founded in 2015 in response to the “new dynamics” of mobile app businesses. And it’s worked with developers including Verv, Fanatee and Pixite.

“The data is there to create ways to provide financing to companies that otherwise would have to raise more [venture funding] and dilute themselves,” Loranger said.

For its first financing product, Braavo looks at Apple App Store and Google Play data, specifically the amount of money already earned by an app but not yet paid out. It can then provide an advance on some of that revenue.

Loranger described Braavo’s newer product as “more exciting” and “more data-driven.” It looks at user acquisition, user engagement and revenue, projecting how revenue would grow if a developer had more money for user acquisition — and then it can provide debt financing for that growth.

Braavo gets paid back as “a fixed percentage of future earnings,” Loranger said, so its incentives are aligned with the developers: “We only make our money back as they earn more revenue in the future.” And if app revenue doesn’t grow as anticipated, that just means Braavo gets paid back more slowly.

“We’ve never, ever lost a dime,” he said.

The company is also announcing the launch of a new analytics product that will allow businesses to track key metrics like the lifetime value of their customers.

Loranger said this will be available for free to anyone to anyone with a “revenue-generating mobile app business.” Rather than charging for the product directly, the goal is to “create more success for mobile app business that may end up qualifying for funding.”

The new round brings Braavo’s total equity financing to nearly $8 million. It was led by e.ventures, with participation from SWS Venture Capital (founded by Green Dot CEO Steve Streit) and Shipt CEO Bill Smith.

Powered by WPeMatico

The Movado Group, which sells multiple brands, including Lacoste, Tommy Hilfiger and Hugo Boss, has purchased MVMT, a small watch company founded by Jacob Kassan and Kramer LaPlante in 2013. The company, which advertised heavily on Facebook, logged $71 million in revenue in 2017. Movado purchased the company for $100 million.

“The acquisition of MVMT will provide us greater access to millennials and advances our Digital Center of Excellence initiative with the addition of a powerful brand managed by a successful team of highly creative, passionate and talented individuals,” Movado Chief Executive Efraim Grinberg said.

MVMT makes simple watches for the millennial market in the vein of Fossil or Daniel Wellington. However, the company carved out a niche by advertising heavily on social media and being one of the first microbrands with a solid online presence.

“It provides an opportunity to Movado Group’s portfolio as MVMT continues to cross-sell products within its existing portfolio, expand product offerings within its core categories of watches, sunglasses and accessories, and grow its presence in new markets through its direct-to-consumer and wholesale business,” said Grinberg.

MVMT is well-known as a “fashion brand,” namely a brand that sells cheaper quartz watches that are sold on style versus complexity or cost. Their pieces include standard three-handed models and newer quartz chronographs.

Powered by WPeMatico

Coinbase wants to be Facebook Connect for crypto. The blockchain giant plans to develop “Login with Coinbase” or a similar identity platform for decentralized app developers to make it much easier for users to sign up and connect their crypto wallets. To fuel that platform, today Coinbase announced it has acquired Distributed Systems, a startup founded in 2015 that was building an identity standard for dApps called the Clear Protocol.

The five-person Distributed Systems team and its technology will join Coinbase. Three of the team members will work with Coinbase’s Toshi decentralized mobile browser team, while CEO Nikhil Srinivasan and his co-founder Alex Kern are forming the new decentralized identity team that will work on the Login with Coinbase product. They’ll be building it atop the “know your customer” anti-money laundering data Coinbase has on its 20 million customers. Srinivasan tells me the goal is to figure out “How can we allow that really rich identity data to enable a new class of applications?”

Distributed Systems had raised a $1.7 million seed round last year led by Floodgate and was considering raising a $4 million to $8 million round this summer. But Srinivasan says, “No one really understood what we’re building,” and it wanted a partner with KYC data. It began talking to Coinbase Ventures about an investment, but after they saw Distributed Systems’ progress and vision, “they quickly tried to move to find a way to acquire us.”

Distributed Systems began to hold acquisition talks with multiple major players in the blockchain space, and the CEO tells me it was deciding between going to “Facebook, or Robinhood, or Binance, or Coinbase,” having been in formal talks with at least one of the first three. Of Coinbase the CEO said, they “were able to convince us they were making big bets, weaving identity across their products.” The financial terms of the deal weren’t disclosed.

Coinbase’s plan to roll out the Login with Coinbase-style platform is an SDK that others apps could integrate, though that won’t necessarily be the feature’s name. That mimics the way Facebook colonized the web with its SDK and login buttons that splashed its brand in front of tons of new and existing users. This turned Facebook into a fundamental identity utility beyond its social network.

Developers eager to improve conversions on their signup flow could turn to Coinbase instead of requiring users to set up whole new accounts and deal with crypto-specific headaches of complicated keys and procedures for connecting their wallet to make payments. One prominent dApp developer told me yesterday that forcing users to set up the MetaMask browser extension for identity was the part of their signup flow where they’re losing the most people.

This morning Coinbase CEO Brian Armstrong confirmed these plans to work on an identity SDK. When Coinbase investor Garry Tan of Initialized Capital wrote that “The main issue preventing dApp adoption is lack of native SDK so you can just download a mobile app and a clean fiat to crypto in one clean UX. Still have to download a browser plugin and transfer Eth to Metamask for now Too much friction,” Armstrong replied “On it :)”

On it 🙂

— Brian Armstrong (@brian_armstrong) August 15, 2018

In effect, Coinbase and Distributed Systems could build a safer version of identity than we get offline. As soon as you give your Social Security number to someone or it gets stolen, it can be used anywhere without your consent, and that leads to identity theft. Coinbase wants to build a vision of identity where you can connect to decentralized apps while retaining control. “Decentralized identity will let you prove that you own an identity, or that you have a relationship with the Social Security Administration, without making a copy of that identity,” writes Coinbase’s PM for identity B. Byrne, who’ll oversee Srinivasan’s new decentralized identity team. “If you stretch your imagination a little further, you can imagine this applying to your photos, social media posts, and maybe one day your passport too.”

Considering Distributed Systems and Coinbase are following the Facebook playbook, they may soon have competition from the social network. It’s spun up its own blockchain team and an identity and single sign-on platform for dApps is one of the products I think Facebook is most likely to build. But given Coinbase’s strong reputation in the blockchain industry and its massive head start in terms of registered crypto users, today’s acquisition well position it to be how we connect our offline identity with the rising decentralized economy.

Powered by WPeMatico

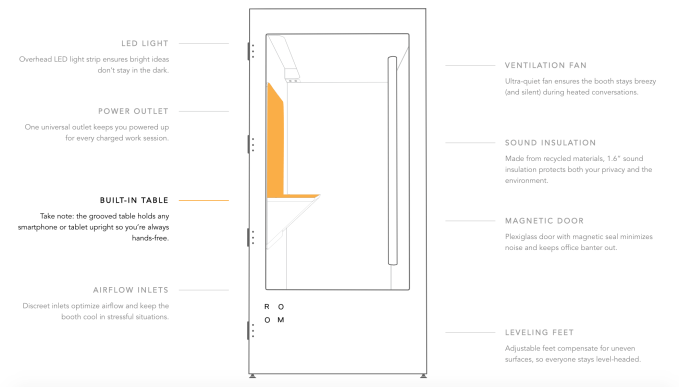

Noisy open offices don’t foster collaboration, they kill it, according to a Harvard study that found the less-private floor plan led to a 73 percent drop in face-to-face interaction between employees and a rise in emailing. The problem is plenty of young companies and big corporations have already bought into the open office fad. But a new startup called ROOM is building a prefabricated, self-assembled solution. It’s the IKEA of office phone booths.

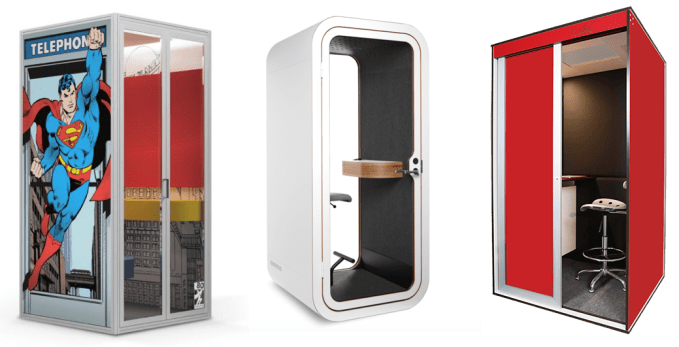

The $3,495 ROOM One is a sound-proofed, ventilated, powered booth that can be built in new or existing offices to give employees a place to take a video call or get some uninterrupted time to focus on work. For comparison, ROOM co-founder Morten Meisner-Jensen says, “Most phone booths are $8,000 to $12,000. The cheapest competitor to us is $6,000 — almost twice as much.” Though booths start at $4,500 from TalkBox and $3,995 from Zenbooth, they tack on $1,250 and $1,650 for shipping, while ROOM ships for free. They’re all dividing the market of dividing offices.

The idea might seem simple, but the booths could save businesses a ton of money on lost productivity, recruitment and retention if it keeps employees from going crazy amidst sales call cacophony. Less than a year after launch, ROOM has hit a $10 million revenue run rate thanks to 200 clients ranging from startups to Salesforce, Nike, NASA and JP Morgan. That’s attracted a $2 million seed round from Slow Ventures that adds to angel funding from Flexport CEO Ryan Petersen. “I am really excited about it since it is probably the largest revenue-generating company Slow has seen at the time of our initial Seed stage investment,” says partner Kevin Colleran.

“It’s not called ROOM because we build rooms,” Meisner-Jensen tells me. “It’s called ROOM because we want to make room for people, make room for privacy and make room for a better work environment.”

You might be asking yourself, enterprising reader, why you couldn’t just go to Home Depot, buy some supplies and build your own in-office phone booth for way less than $3,500. Well, ROOM’s co-founders tried that. The result was… moist.

Meisner-Jensen has design experience from the Danish digital agency Revolt that he started before co-founding digital book service Mofibo and selling it to Storytel. “In my old job we had to go outside and take the call, and I’m from Copenhagen, so that’s a pretty cold experience half the year.” His co-founder Brian Chen started Y Combinator-backed smart suitcase company Bluesmart, where he was VP of operations. They figured they could attack the office layout issue with hammers and saws. I mean, they do look like superhero alter-egos.

Room co-founders (from left): Brian Chen and Morten Meisner-Jensen

“To combat the issues I myself would personally encounter with open offices, as well as colleagues, we tried to build a private ‘phone booth’ ourselves,” says Meisner-Jensen. “We didn’t quite understand the specifics of air ventilation or acoustics at the time, so the booth got quite warm — warm enough that we coined it ‘the sweatbox.’ ”

With ROOM, they got serious about the product. The 10-square-foot ROOM One booth ships flat and can be assembled in less than 30 minutes by two people with a hex wrench. All it needs is an outlet to power its light and ventilation fan. Each is built from 1088 recycled plastic bottles for noise cancelling, so you’re not supposed to hear anything from outside. The box is 100 percent recyclable, plus it can be torn down and rebuilt if your startup implodes and you’re being evicted from your office.

The ROOM One features a bar-height desk with outlets and a magnetic bulletin board behind it, though you’ll have to provide your own stool. It’s actually designed not to be so comfy that you end up napping inside, which doesn’t seem like it’d be a problem with this somewhat cramped spot. “To solve the problem with noise at scale you want to provide people with space to take a call but not camp out all day,” Meisner-Jensen notes.

Booths by Zenbooth, Cubicall and TalkBox (from left)

Couldn’t office managers just buy noise-cancelling headphones for everyone? “It feels claustrophobic to me,” he laughs, but then outlines why a new workplace trend requires more than headphones. “People are doing video calls and virtual meetings much, much more. You can’t have all these people walking by you and looking at your screen. [A booth is] also giving you your own space to do your own work, which I don’t think you’d get from a pair of Bose. I think it has to be a physical space.”

But with plenty of companies able to construct physical spaces, it will be a challenge for ROOM to convey the subtleties of its build quality that warrant its price. “The biggest risk for ROOM right now are copycats,” Meisner-Jensen admits. “Someone entering our space claiming to do what we’re doing better but cheaper.” Alternatively, ROOM could lock in customers by offering a range of office furniture products. The co-founder hinted at future products, saying ROOM is already receiving demand for bigger multi-person prefab conference rooms and creative room divider solutions.

The importance of privacy goes beyond improved productivity when workers are alone. If they’re exhausted from overstimulation in a chaotic open office, they’ll have less energy for purposeful collaboration when the time comes. The bustle could also make them reluctant to socialize in off-hours, which could lead them to burn out and change jobs faster. Tech companies in particular are in a constant war for talent, and ROOM Ones could be perceived as a bigger perk than free snacks or a ping-pong table that only makes the office louder.

“I don’t think the solution is to go back to a world of cubicles and corner offices,” Meisner-Jensen concludes. It could take another decade for office architects to correct the overenthusiasm for open offices despite the research suggesting their harm. For now, ROOM’s co-founder is concentrating on “solving the issue of noise at scale” by asking, “How do we make the current workspaces work in the best way possible?”

Powered by WPeMatico

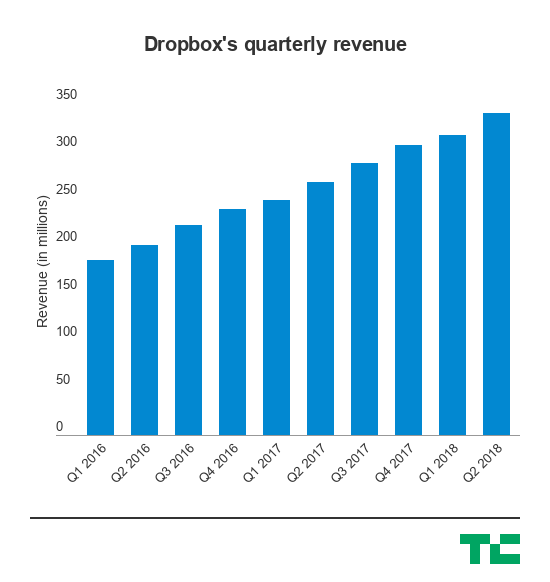

Back when Dennis Woodside joined Dropbox as its chief operating officer more than four years ago, the company was trying to justify the $10 billion valuation it had hit in its rapid rise as a Web 2.0 darling. Now, Dropbox is a public company with a nearly $14 billion valuation, and it once again showed Wall Street that it’s able to beat expectations with a now more robust enterprise business alongside its consumer roots.

Dropbox’s second quarter results came in ahead of Wall Street’s expectations on both the earnings and revenue front. The company also announced that Dennis Woodside will be leaving the company. Woodside joined at a time when Dropbox was starting to figure out its enterprise business, which it was able to grow and transform into a strong case for Wall Street that it could finally be a successful publicly traded company. The IPO was indeed successful, with the company’s shares soaring more than 40 percent in its debut, so it makes sense that Woodside has essentially accomplished his job by getting it into a business ready for Wall Street.

“I think as a team we accomplished a ton over the last four and a half years,” Woodside said in an interview. “When I joined they were a couple hundred million in revenue and a little under 500 people. [CEO] Drew [Houston] and Arash [Ferdowsi] have built a great business, since then we’ve scaled globally. Close to half our revenue is outside the U.S., we have well over 300,000 teams for our Dropbox business product, which was nascent there. These are accomplishments of the team, and I’m pretty proud.”

The stock initially exploded in extended trading by rising more than 7 percent, though even prior to the market close and the company reporting its earnings, the stock had risen as much as 10 percent. But following that spike, Dropbox shares are now down around 5 percent. Dropbox is one of a number of SaaS companies that have gone public in recent months, including DocuSign, that have seen considerable success. While Dropbox has managed to make its case with a strong enterprise business, the company was born with consumer roots and has tried to carry over that simplicity with the enterprise products it rolls out, like its collaboration tool Dropbox Paper.

Here’s a quick rundown of the numbers:

So, not only is Dropbox able to show that it can continue to grow that revenue, the actual value of its users is also going up. That’s important, because Dropbox has to show that it can continue to acquire higher-value customers — meaning it’s gradually moving up the Fortune 100 chain and getting larger and more established companies on board that can offer it bigger and bigger contracts. It also gives it the room to make larger strategic moves, like migrating onto its own architecture late last year, which, in the long run could turn out to drastically improve the margins on its business.

“We did talk earlier in the quarter about our investment over the last couple years in SMR technology, an innovative storage technology that allows us to optimize cost and performance,” Woodside said. “We continue to innovate ways that allow us to drive better performance, and that drives better economics.”

The company is still looking to make significant moves in the form of new hires, including recently announcing that it has a new VP of product and VP of product marketing, Adam Nash and Naman Khan, respectively. Dropbox’s new team under CEO Drew Houston are tasked with continuing the company’s path to cracking into larger enterprises, which can give it a much more predictable and robust business alongside the average consumers that pay to host their files online and access them from pretty much anywhere.

In addition, there are a couple executive changes as Woodside transitions out. Yamini Rangan, currently VP of Business Strategy & Operations, will become Chief Customer Officer reporting to Houston, and comms VP Lin-Hua Wu will also report to Houston.

Dropbox had its first quarterly earnings check-in and slid past the expectations that Wall Street had, though its GAAP gross margin slipped a little bit and may have offered a slight negative signal for the company. But since then, Dropbox’s stock hasn’t had any major missteps, giving it more credibility on the public markets — and more resources to attract and retain talent with compensation packages linked to that stock.

“Our retention has been quite strong,” Woodside said. “We see strong retention characteristics across the customer set we have, whether it’s large or small. Obviously larger companies have more opportunity to expand over time, so our expansion metrics are quite strong in customers of over several hundred employees. But even among small businesses, Dropbox is the kind of product that has gravity. Once you start using it and start sharing it, it becomes a place where your business is small or large is managing all its content, it tends to be a sticky experience.”

Powered by WPeMatico