Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Freightos, a marketplace for logistics providers, announced today that it has raised a $44.4 million Series C led by Singapore Exchange. Returning investors including General Electric Ventures (the lead investor of Freightos’ Series B extension last year), ICV and Aleph also participated in the round, which brings Freightos’ total funding so far to $94.4 million.

Launched in 2016 as a price comparison service for freight forwarders—the agents that organize shipments from a supplier or manufacturer to their final destination—Freightos now also lets users book, manage and track shipments with more than 1,200 logistics providers.

In an email, founder and CEO Zvi Schreiber said its online freight marketplace will continue to be Freightos’ flagship product, but the company also wants to find ways to make the industry more efficient by building a global digital infrastructure.

The company claims to process more than one million instant freight quote requests each month using its patent-pending routing and pricing engines. Its database of global shipping rates also underpins the Freightos Baltic Index (FBX), an industry-specific index created to provide more pricing transparency.

Developed in partnership with the Baltic Exchange, a market information provider for the maritime transportation industry, the FBX tracks freight pricing from 12 major routes around the world and also combines them into one index to serve as the freight industry’s equivalent of the S&P 500.

“Nearly every major global industry, from jet fuel to livestock, leverages dynamic pricing based on real-time metrics to make smarter, automated decisions. We’re excited to explore how our global freight index, the Freightos Baltic Index, can reduce pricing risks and improve stability, and are already exploring implementation with major multinational corporations,” Schreiber said.

He added that Freightos is also looking at more ways to connect airlines with logistics providers to sell cargo space on passenger flights.

Freightos will partner with the Singapore Exchange, which owns the Baltic Exchange, to develop new financial instruments. It will start by launching daily reporting on the FBX, which is currently updated weekly.

In a press statement, SGX head of derivatives Michael Syn said, “Freightos is at the forefront of a new wave of solutions for price discovery and digital marketplaces in global freight – an industry at the heart of the global economy. SGX is excited by the potential to develop risk management tools and services and build on Singapore’s unique position in the trade ecosystem, to bridge the physical and financial markets.”

Powered by WPeMatico

Drone operating system startup Airware today suddenly informed employees it will cease operations immediately despite having raised $118 million from top investors like Andreessen Horowitz, Google’s GV, and Kleiner Perkins. The startup ran out of money after trying to manufacture its own hardware that couldn’t compete with drone giants like China’s DJI. The company at one point had as many as 140 employees, all of which are now out of a job.

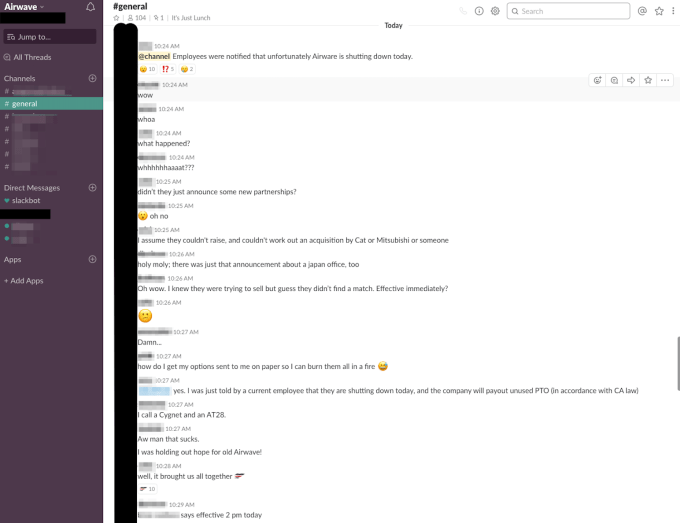

A source sent TechCrunch screenshots from the Airware alumni Slack channel detailing how the staff was told this morning that Airware would shut down.

Airware makes a cloud sofware system that helps enterprise customers like construction companies, mining operations, and insurance companies reviewing equipment for damages to use drones to collect and analyze aerial data. That allowed companies to avoid using expensive helicopters or dangerous rigs with humans on harnesses to make inspections and gauge work progress.

One ex-employee asked “How do I get my options sent to me on paper so I can burn them all in a fire? ”

”

Founded in 2011 by Jonathan Downey, the son of two pilots, Airware first built an autopilot system for programming drones to follow certain routes to collect data. It could help businesses check rooftops for damage, see how much of a raw material was coming out of a mine, or build constantly-updated maps of construction sites. Later it tried to build its own drones before pivoting to consult clients on how to most efficiently apply unmanned aerial vehicles.

While flying high, Airware launched its own Commercial Drone Fund for investing in the market in 2015, and acquired 38-person drone analytics startup Redbird in 2016. In this pre-crypto, pre-AI boom, Airware scored a ton of hype from us and others as tried to prove drones could be more than war machines. But over time, the software that shipped with commercial drone hardware from other manufacturers was good enough to make Airware irrelevant, and a downward spiral of layoffs began over the past two years, culminating in today’s shutdown. Demonstating how sudden the shut down is, Airware opened a Tokyo headquarters alongside an investment and partnership from Mitsubishi just four days ago.

While flying high, Airware launched its own Commercial Drone Fund for investing in the market in 2015, and acquired 38-person drone analytics startup Redbird in 2016. In this pre-crypto, pre-AI boom, Airware scored a ton of hype from us and others as tried to prove drones could be more than war machines. But over time, the software that shipped with commercial drone hardware from other manufacturers was good enough to make Airware irrelevant, and a downward spiral of layoffs began over the past two years, culminating in today’s shutdown. Demonstating how sudden the shut down is, Airware opened a Tokyo headquarters alongside an investment and partnership from Mitsubishi just four days ago.

“Airware was ahead of the game trying to build their software. So far ahead that the drone hardware on the market wasn’t sophisticated enough to actually produce the granularity of data they needed to test out their software/train their algorithms” an ex-employee told TechCrunch (emphasis ours). “So they spent shitloads of money designing bespoke hardware, including two drones in-house, one multi-rotor called an AT-28, and one fixed-wing called Cygnet. Both projects were scuttled as hardware from DJI and Ebee caught up to needs, after sinking tons of engineering time and manufacturing into them.”

Following TechCrunch’s inquiry about the unnannounced news, Airware confirmed the shut down to us with this statement:

“History has taught us how hard it can be to call the timing of a market transition. We have seen this play out first hand in the commercial drone marketplace. We were the pioneers in this market and one of the first to see the power drones could have in the commercial sector. Unfortunately, the market took longer to mature than we expected. As we worked through the various required pivots to position ourselves for long term success, we ran out of financial runway. As a result, it is with a heavy heart that we notified our team, customers, and partners that we will wind down the business.

This is not the business outcome we had worked so hard for over the years and yet we are deeply proud of our company’s accomplishments and our leadership in driving the adoption of drone powered analytics to improve productivity, mitigate risks, and take workers out of harm’s way.

As we close the book of Airware; we want to thank the partners and customers who believed in us and helped us along the way. And, while it is difficult to say goodbye to our team, we want to thank them for all they have contributed to Airware and the industry. We look forward to seeing how they will take their learnings from Airware to fuel continued innovations in the world around us.”

[Update: Since we broke the news, Airware has put up a “thank you” note about the shutdown informing clients that “A representative from the Airware team will be in touch.”]

An Airware-hardware equipped drone

Employees will get one week’s severance, COBRA insurance until November, and payouts for unused paid time off. It appears the startup wasn’t able to raise necessary funding to save the company or secure an acquisition from one of its strategic partners like Catepillar.

Airware will serve as cautionary tale of startup overspending in hopes of finding product-market fit. Had it been more frugal, saved cash to extend its runway, and given corporate clients more time to figure out how to use drones, Airware might have stayed afloat. Sometimes, even having the most prestigious investors can’t save a startup from mismanagement.

Our ex-employee source concludes that “I think having $118M in the bank led Airware to charge ahead and sink tons of money into force-it-to-work methods rather than exercise a bit of patience and wait for the inevitable advance of hardware to catch up. They had a knack for hiring extremely talented and expensive people from places like Google, Autodesk, there was even SpaceX and NASA alumni there.

They spared no expense ever.”

Powered by WPeMatico

Tyler Cowen, who I interviewed here, is a fascinating economist. Part pragmatist and part dreamer, he has been researching and writing about the future for a long time in books and his blog, Marginal Revolution. Now he and his university, George Mason, are putting some money where his mouth is.

Cowen and the team at GMU are working on Emergent Ventures, a fellowship and grant program for moon shots. The goal is to give people with big ideas a little capital to help them build out their dreams.

“It has long been my view that risk-takers are not sufficiently rewarded in the world of ideas and that academic incentives are too conservative,” he said. “The intellectual scene should learn something from Silicon Valley and venture capital.”

Cowen is raising $4 million for the first fund. He announced the fund in a podcast on the Mercatus website.

“People such as Satoshi and Jordan Peterson have had huge impacts (regardless of one’s degree of enthusiasm for their ideas), and yet in terms of philanthropic funding the world just isn’t geared to seed their ambitions,” said Cowen.

The project is part of the GMU Mercatus Center, a “source for market-oriented ideas—bridging the gap between academic ideas and real-world problems.” The fund has just opened applications and the amounts granted depend on the project and creator.

Cowen, for his part, is optimistic about the prospects of the future-focused fund.

“I expect to produce a better and freer world, some degree of human self-realization, a better climate for public intellectuals and other creators of ideas, more innovation, and to bring the intellectual side of America more in touch with the entrepreneurial side,” said Cowen.

Powered by WPeMatico

Twilio, a company best known for supplying a communications APIs for developers has a product called Twilio Flex for building sophisticated customer service applications on top of Twilio’s APIs. Today, it announced it was acquiring Ytica (pronounced Why-tica) to provide an operational and analytical layer on top of the customer service solution.

The companies would not discuss the purchase price, but Twilio indicated it does not expect the acquisition to have a material impact on its “results, operations or financial condition.” In other words, it probably didn’t cost much.

Ytica, which is based in Prague, has actually been a partner with Twilio for some time, so coming together in this fashion really made a lot of sense, especially as Twilio has been developing Flex.

Twilio Flex is an app platform for contact centers, which offers a full stack of applications and allows users to deliver customer support over multiple channels, Al Cook, general manager of Twilio Flex explained. “Flex deploys like SaaS, but because it’s built on top of APIs, you can reach in and change how Flex works,” he said. That is very appealing, especially for larger operations looking for a flexible, cloud-based solution without the baggage of on-prem legacy products.

What the product was lacking, however, was a native way to manage customer service representatives from within the application, and understand through analytics and dashboards, how well or poorly the team was doing. Having that ability to measure the effectiveness of the team becomes even more critical the larger the group becomes, and Cook indicated some Flex users are managing enormous groups with 10,000-20,000 employees.

Ytica provides a way to measure the performance of customer service staff, allowing management to monitor and intervene and coach when necessary. “It made so much sense to join together as one team. They have huge experience in the contact center, and a similar philosophy to build something customizable and programmable in the cloud,” Cook said.

While Ytica works with other vendors beyond Twilio, CEO Simon Vostrý says that they will continue to support those customers, even as they join the Twilio family. “We can run Flex and can continue to run this separately. We have customers running on other SaaS platforms, and we will continue to support them,” he said.

The company will remain in Prague and become a Twilio satellite office. All 14 employees are expected to join the Twilio team and Cook says plans are already in the works to expand the Prague team.

Powered by WPeMatico

PingCAP co-founder and CEO Max Liu

PingCAP, the company behind MySQL-compatible distributed database TiDB, said today that it plans its global operations after raising a $50 million Series C. The round was led by Chinese venture capital firms Fosun and Morningside Venture Capital, with participation from returning investors including China Growth Capital, Yunqi Partners and Matrix Partners.

Based in Beijing, the company says it will also use the new capital to build more cross-cloud products. PingCAP is focusing on the North American market since it is the most mature cloud market, said Kevin Xu, the company’s general manager of U.S. strategy and operations, in an email.

Founded in 2015 by Dylan Cui, Edward Huang and Max Liu, PingCAP has raised about $72 million so far, including its $15 million Series B announced in June 2017. TiDB is an open-source hybrid transactional and analytical database targeted at companies that need to handle large volumes of data and plan to scale up quickly, but still want to be able to use the same database. Many of its users come from the financial, e-commerce, gaming and travel industries and currently include Mobike, Bank of Beijing, Hulu, Lenovo and Ele.me.

In terms of other distributed databases, TiDB is often compared to CockroachDB and FoundationDB. Xu says one of the main things that differentiatese TiDB from CockroachDB is its ability to handle hybrid transactional and analytical processing workloads at scale, in addition online transaction processing. It is also MySQL compatible, while CockroachDB is PostgreSQL compatible. He adds that FoundationDB is more comparable to TiKV, the key-value storage layer developed by PingCAP that recently became a Cloud Native Computing Foundation project, because FoundationDB is not a relational database like TiDB with a SQL interface.

In a press statement, Morningside Venture Capital managing director Richard Liu said “The database industry has always been a competitive arena, and PingCAP has secured a prominent spot in this crowded field by becoming the go-to solution for many large-scale Internet companies and financial services enterprises in China. Thus, we are glad to grow with PingCAP and continue building the TiDB ecosystem together.”

Powered by WPeMatico

In a world where large hyperscale companies like Amazon, Microsoft and Google dominate the public cloud, it would seem foolhardy for a startup to try to carve out a space, but Packet has an alternative customized cloud vision, and investors have taken notice. Today, the company announced a $25 million Series B led by Third Point Ventures.

An interesting mix of strategic and traditional investors joined the round including Battery Ventures, JA Mitsui Leasing and Samsung Next. Existing investors SoftBank Corp. and Dell Technologies Capital also participated. The company has now raised over $36 million.

The company also showed some signs of maturing by bringing in Ihab Tarazi as CTO and George Karidis as COO. Tarazi, who came over from Equinix, likes what he sees in Packet .

He says they offer several advantages over the public providers. First of all, customers can buy whatever hardware they want. “We offer the most diverse hardware options,” he said. That means they could get servers equipped with Intel, ARM, AMD or with specific nVidia GPUs in whatever configurations they want. By contrast public cloud providers tend to offer a more off-the-shelf approach. It’s cheap and abundant, but you have to take what they offer, and that doesn’t always work for every customer.

Another advantage Packet bring to the table, according to Tarazi, is that they support a range of open source software options, letting customers build whatever applications they want on top of that custom hardware.

They currently have 18 locations around the world, but Tarazi said they will soon be adding 50 more, also adding geographic diversity to the mix.

Finally, each customer gets their own bare metal offering, providing them with a single tenant private option inside Packet’s data center. This gives them the advantages of a privately run data center but where Packet handles all of the management, configuration and upkeep.

Tarazi doesn’t see Packet competing directly with the hyperscale players. Instead, he believes there will be room for both approaches. “I think you have a combination of both happening where people are trying to take advantage of all these hardware options to optimize performance across specific applications,” he explained.

The company, which launched in 2014, currently has about 50 employees with headquarters in New York City and offices in Palo Alto. They are also planning on opening an operations center in Dallas soon. The number should swell to 100 employees over the next year as they expand operations.

Powered by WPeMatico

Zendesk has mostly confined itself to customer service scenarios, but it seems that’s not enough anymore. If you want to truly know the customer behind the interaction, you need a customer system of record to go with the customer service component. To fill that need, Zendesk announced it was acquiring Base, a startup that has raised over $50 million.

The companies did not share the purchase price, but Zendesk did report that the acquisition should not have a significant impact on revenue.

While Base might not be as well known as Salesforce, Microsoft or Oracle in the CRM game, it has created a sophisticated sales force automation platform, complete with its own artificial intelligence underpinnings. CEO Uzi Shmilovici claimed his company’s AI could compete with its more well-heeled competitors when it was released in 2016 to provide salespeople with meaningful prescriptive advice on how to be more successful.

Zendesk CEO Mikkel Svane certainly sees the value of adding a company like Base to his platform. “We want to do for sales what Zendesk has already done for customer service: give salespeople tools built around them and the customers they serve,” he said in a statement.

If the core of customer data includes customer service, CRM and marketing, Base gives Zendesk one more of those missing components, says Brent Leary, owner at CRM Essentials, a firm that keeps close watch on this market.

“Zendesk has a great position in customer service, but now to strengthen their position with midmarket/enterprise customers looking for integrated platforms, Base adds a strong mobile sales force automation piece to their puzzle,” Leary told TechCrunch.

As he points out, we have seen HubSpot make a similar move with HubSpot Apps, while SugarCRM, which was recently sold to Accel-KKR, could be shopping too, with its new owner’s deeper pockets. “This is almost like a CRM enterprise software Hunger Games going on,” he joked. But he indicates that we should be expecting more consolidation here as these companies try to acquire missing pieces of their platforms to offer more complete solutions.

Matt Price, who previously had the title of senior vice president for product portfolio at Zendesk will lead the Base team moving forward.

Base was founded in 2009 and boasts more than 5,000 customers. It’s worth pointing out that Base was already available for sale in the company app marketplace, so there was some overlap here, but the company intends to try to move existing customers to Base, of course.

Zendesk has indicated it will continue to support all Base customers. In addition, Base’s 125 employees have been invited to join Zendesk, so there will be no blood-letting here.

Powered by WPeMatico

Evaneos, the online marketplace for tailor-made travel experiences, has picked up $80 million in Series D funding. Leading the round is Partech, and Level Equity, with participation from Quadrille Capital, and existing backers XAnge, Serena Capital, and Bpifrance.

The injection of cash is to be used to international development, including increasing headcount from the current 180 employees. It brings total funding to around $108 million since being founded in 2009.

Competing primarily with traditional tour operators, Evaneos offers a marketplace for tailored travel experiences that claims to cut out the middle-person -– that is, the tour operators and major travel agencies -– by connecting travellers directly with a community of local travel agents. Through the site you can browse a range of holiday ideas, then contact a local agent living in the destination country to design a tailor-made itinerary.

The draw for consumers is more personalized travel experiences, while local agencies benefit from an additional source of direct revenue, retaining more income for the local economy. Evaneos counts 1,300 local partners based in 160 destinations, and says it aims to add another 500 in 2009.

The product is available in 9 European countries, and Evaneos name checks Germany, France, Italy, Spain & the U.K. as particularly competitive but where it is seeing most business. To date, more than 300,000 travellers have used Evaneos to create and book a trip.

Meanwhile, personalised travel remains a hot sector for investors. In June, TourRadar, the Vienna, Austria-headquartered online travel agency (OTA) that also targets the multi-day touring market, raised $50 million in Series C funding led by the Silicon Valley growth VC firm TCV.

Powered by WPeMatico

Intel today is announcing another acquisition as it continues to pick up talent and IP to bolster its next generation of computing chips beyond legacy PCs. The company has acquired NetSpeed Systems, a startup that makes system-on-chip (SoC) design tools and interconnect fabric intellectual property (IP). The company will be joining Intel’s Silicon Engineering Group, and its co-founder and CEO, Sundari Mitra, herself an Intel vet, will be coming on as a VP at Intel where she will continue to lead her team.

Terms of the deal are not being disclosed, but for some context, during NetSpeed’s last fundraise in 2016 (a $10 million Series C) it had a post-money valuation of $60 million, according to data from PitchBook.

SoC is a central part of how newer connected devices are being made. Moving away from traditional motherboards to create all-in-one chips that include processing, memory, input/output and storage is an essential cornerstone when building ever-smaller and more efficient devices. This is an area where Intel is already active but against others like Nvidia and Qualcomm many believe it has some catching up to do, and so this acquisition in important in that context.

“Intel is designing more products with more specialized features than ever before, which is incredibly exciting for Intel architects and for our customers,” said Jim Keller, senior vice president and general manager of the Silicon Engineering Group at Intel, in a statement. “The challenge is synthesizing a broader set of IP blocks for optimal performance while reining in design time and cost. NetSpeed’s proven network-on-chip technology addresses this challenge, and we’re excited to now have their IP and expertise in-house.”

Intel has made a series of acquisitions to speed up development of newer chips to work in connected objects and smaller devices beyond the PCs that helped the company make its name. Another recent acquisition in the same vein include eASIC for IoT chipsets, which Intel acquired in July. Intel has also been acquiring startups in other areas where it hopes to make a bigger mark, such as deep learning (case in point: its acquisition of Movidius in August).

NetSpeed has been around since 2011 and Intel was one of its investors and customers.

“Intel has been a great customer of NetSpeed’s, and I’m thrilled to once again be joining the company,” said Mitra, in a statement. “Intel is world class at designing and optimizing the performance of custom silicon at scale. As part of Intel’s silicon engineering group, we’re excited to help invent new products that will be a foundation for computing’s future.”

Intel said it will to honor NetSpeed’s existing customer contracts, but it also sounds like it the company will not be seeking future business as Intel integrates the company into its bigger business.

Powered by WPeMatico

Let the computers do the legal busy work so attorneys can focus on complex problem solving for their clients. That’s the lucrative idea behind Atrium LTS, Twitch co-founder Justin Kan’s machine learning startup that digitizes legal documents and builds applications on top to speed up fundraising, commercial contracts, equity distribution and employment issues. For example, one of its apps automatically turns startup funding documents into Excel cap tables.

Automating expensive legal labor has led to a rapid rise to 110 employees and 250 clients for Atrium, including startups like Bird and MessageBird. Atrium only came of stealth a year ago with a $10.5 million party round before going into Y Combinator last winter. Today it announces it’s raised a $65 million round led by Andreessen Horowitz.

In characteristic dude fashion, Kan tells me “I’m pretty stoked about that because of having more resources for Atrium.” The venture firm’s partner Andrew Chen is taking a board seat and famed co-founder Marc Andreessen is joining as a board observer. “I wanted a visionary who’s always going to be pushing us to build something really big,” Kan says. General Catalyst, YC’s Continuity Fund and Ashton Kutcher’s Sound Ventures are also joining the round.

With the massive influx of cash, Atrium will be able to develop more internal tools it can use to crank out client work faster than its traditional competitors. “We can ultimately be this platform on top of which you’re building these legal businesses and eventually other professional services and software services,” Kan explains.”They’re all sitting on top of the platform that understands legal documents.”

In more Atrium news, Y Combinator’s leading partner Michael Seibel will join the startup’s board, too. And it’s acquired Tetra, a YC artificial intelligence startup that had raised $1.5 million to analyze voice, “to help us build our platform that understands and structures data,” Kan tells me.

What Kan didn’t initially mention is that two of Atrium’s co-founders, CTO Chris Smoak and legal partner BeBe Chueh, have left. He later admitted they had transitioned out of the company several months before the new funding. “BeBe wanted to spend time working on family (she just got engaged); Chris and I disagreed on his job role” regarding the definition of the CTO position, Kan tells me. He’ll now be running Atrium with remaining co-founder Augie Rakow, formerly of mega-law firm Orrick, and Kan’s long-term business partner and former McKinsey analyst Nick Cortes.

Justin Kan (Atrium) at TechCrunch Disrupt SF 2017

The law firm business model has left the door open for disruption by technology companies like Atrium. “Law firms generate revenue from hourly billing, and lack an incentive to vastly improve efficiency,” Chen writes. “Many law firms dividend out all their profits at the end of each year, making it hard to invest in the expensive investment of building software. Software is hard to build inside a software company, much less a law firm.”

But Atrium is an engineering company with a legal clientele. It takes the most common and time-consuming activities — often related to ingesting mountains of documents — and builds machine learning workarounds. Atrium’s lawyers can focus on advising their clients on what to do, rather than burning the midnight oil doing it as they look for tiny quirks in the paperwork. The legal services get faster, cheaper and more predictable, so Atrium can offer upfront pricing. It’s been using fundraising workshops and other educational materials to drum up leads.

For now, Atrium’s tech is limited to a narrow band of use cases. But “over $300 billion is spent per year in the enterprise legal market,” Chen writes, so there’s plenty of room to grow now that Atrium is well capitalized. It will have to convince big corporations to ditch the old way and let computers lend a hand. Luckily, Atrium isn’t a SAAS company forcing clients to use the tech themselves. Done right, they shouldn’t even know that it’s machine vision software, not junior associates, pouring over their docs. It will have to out-match fellow legal tech startups like Ravel, CaseText, Judicata, Premonition and more, though they’re often just tools rather than software-equipped law firms.

Kan also cops to his lack of experience in legal. “I think for any full stack vertical startup started by a non-subject matter expert (i.e. me who is not a lawyer), there is a risk that you come in and are very prescriptive on how things work. Then you build software that says ‘the providers must do it this way!’,” Kan tells me. “But the practical reality is that it doesn’t work with the nuanced, non-linear workflows that providers already have. So the technology doesn’t get adopted and fails to provide value. That to me is the biggest upcoming risk.”

Justin Kan, from lifevlogger to legal giant

Yet if Atrium can ease clients into this new world service by service, it could generate network effects that fuel the whole business. It’s just a matter of prioritization. “One of the things I always need to be focused on is…focusing. That’s sometimes a blind spot.” From Justin.tv to Twitch to its acquisition by Amazon to his role as YC partner, Kan delivers, but can be frenetic. “As an entrepreneur, I have a tendency to take on too much.”

But after leaving YC because “I had felt like I’d stopped learning,” Kan has found the legal space so full of knowledge and opportunity that it can hold his attention. “Part of why I like this business is because it was so different. I didn’t think it was something that would be as easily competed with,” Kan recalls. “I had this calendar company and Google came out with something similar. I told [Twitch co-founder] Emmett ‘We have to do something no one can compete with. At least Google will never do this.’ Then they did.”

But unlike with that game streaming startup, Atrium doesn’t have to worry about beating or getting bought by some legal tech giant. Instead, it wants to become one.

Powered by WPeMatico