Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

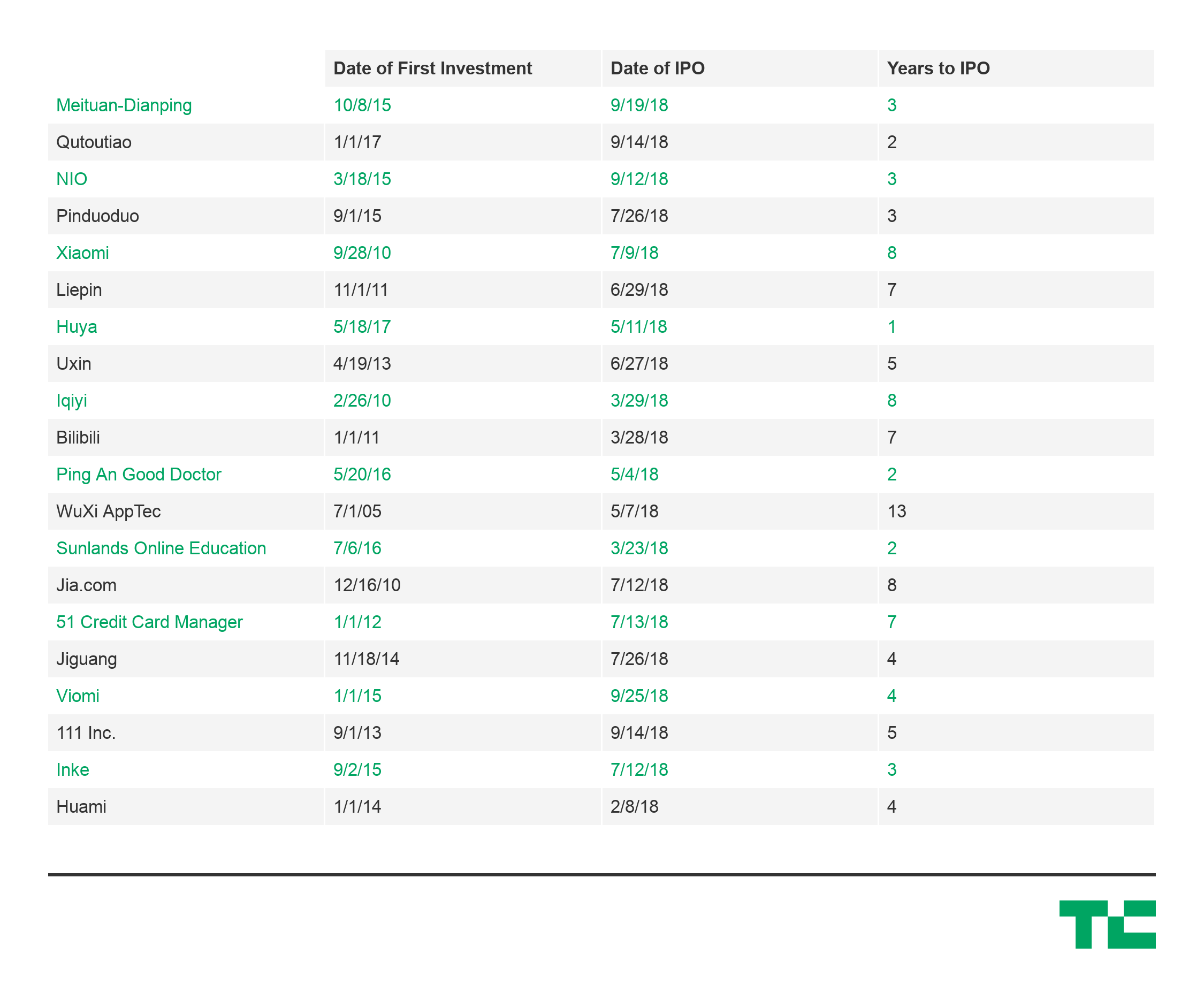

This year’s rush of IPOs from Chinese tech companies has dominated headlines, but what’s more interesting is how quickly they got there.

Traditionally, “going public” represented the gratifying culmination of sleepless nights and missed birthdays that went into building a company. The peak of a lengthy climb, where founders and VCs would finally see the fruits of their labor.

However, Chinese companies appear to be reaching that peak much quicker than their American peers, heading to the public markets only a few years after initial venture investments, and often with little operating history.

Analyzing twenty of the most high profile Chinese tech IPOs this year, the average time from first venture investment to IPO was only around three to five years. Take e-commerce platform Pinduoduo, which pulled in $1.6 billion less than three years after its Series A. Or the recent IPO of EV-manufacturer NIO, which raised a billion dollars just three-and-a-half years after its Series A and having just delivered its first car in June.

China IPO data for 2018 compiled from NASDAQ, Pitchbook, and Crunchbase

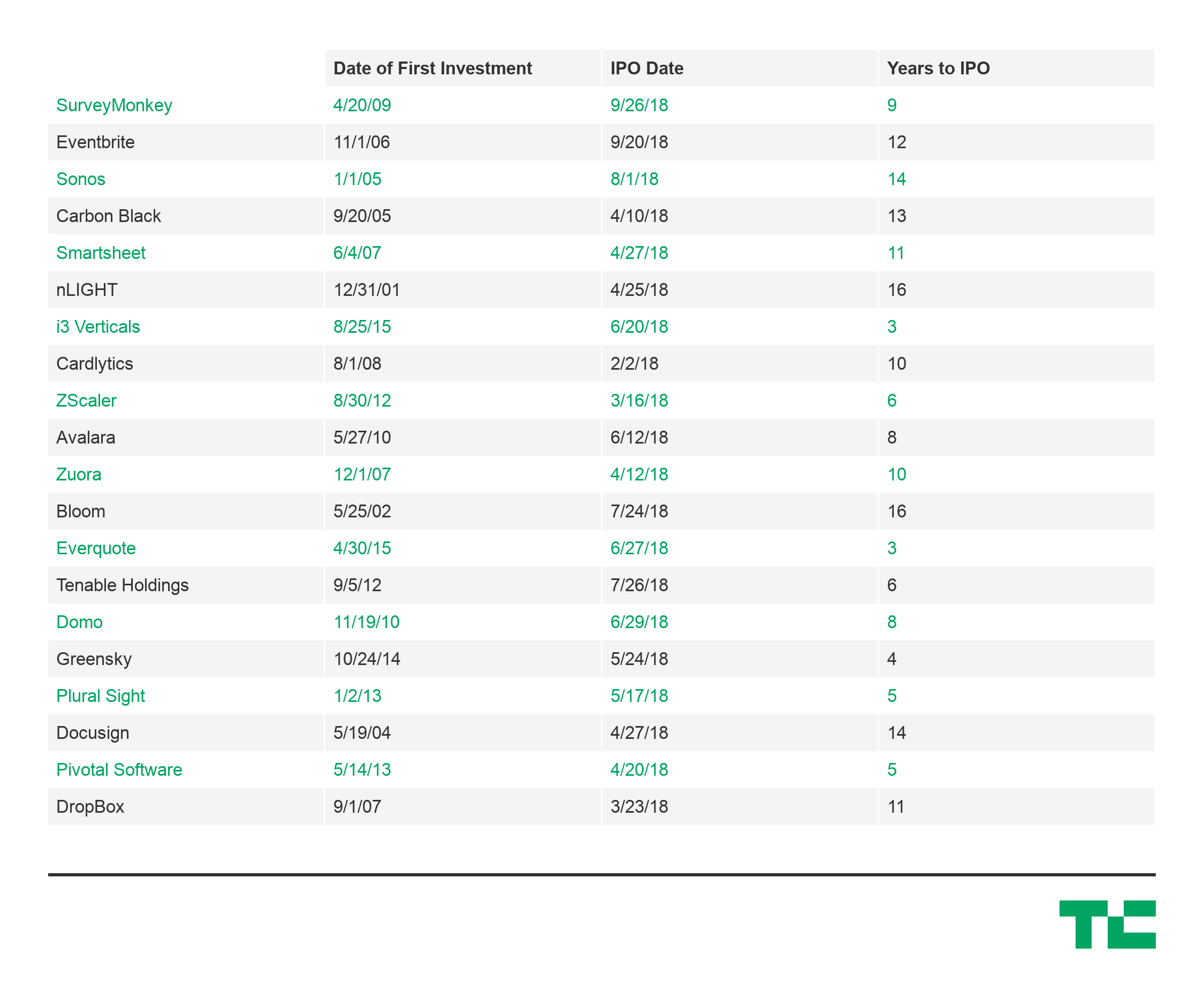

That’s less than half the average 10-year timeline for venture-backed US tech companies that went public in 2018, including Dropbox, Eventbrite, and DocuSign, which all IPO’d more than a decade after their initial investments.

Differences in market maturity, government involvement, and support from large tech incumbents all undoubtedly play a factor, but the speed to liquidity for the Chinese companies is still astounding.

Speed to liquidity is a critical metric for the health of a startup ecosystem. It creates a positive cycle where faster liquidity can drive faster fundraising, faster reinvestment, faster startup building, and faster public liquidity again. An accelerated cycle could be especially appealing for funds with LPs that require faster returns due to cash commitments or otherwise.

It’s important to note that venture returns are a function of capital and time, so quicker exits will also drive higher returns for the same amount invested. For example, a $1 million investment with a $5 million exit after ten years would generate an Internal Rate of Return (a commonly used metric to evaluate VC performance) of 20%. If the same exit occurred after five years, the IRR would be 50%.

Liquidity is a key consideration as China’s influence on the flow of global venture capital intensifies. As China’s tech ecosystem sees more of its darlings mature and more consistently deliver smashing exits, investments in China will have to be a more serious consideration for VCs, even if only to minimize the sheer amount of time, resources, and painstaking energy needed to build a company in the U.S.

Powered by WPeMatico

Instana, an application performance monitoring (APM) service with a focus on modern containerized services, today announced that it has raised a $30 million Series C funding round. The round was led by Meritech Capital, with participation from existing investor Accel. This brings Instana’s total funding to $57 million.

The company, which counts the likes of Audi, Edmunds.com, Yahoo Japan and Franklin American Mortgage as its customers, considers itself an APM 3.0 player. It argues that its solution is far lighter than those of older players like New Relic and AppDynamics (which sold to Cisco hours before it was supposed to go public). Those solutions, the company says, weren’t built for modern software organizations (though I’m sure they would dispute that).

What really makes Instana stand out is its ability to automatically discover and monitor the ever-changing infrastructure that makes up a modern application, especially when it comes to running containerized microservices. The service automatically catalogs all of the endpoints that make up a service’s infrastructure, and then monitors them. It’s also worth noting that the company says that it can offer far more granular metrics that its competitors.

Instana says that its annual sales grew 600 percent over the course of the last year, something that surely attracted this new investment.

“Monitoring containerized microservice applications has become a critical requirement for today’s digital enterprises,” said Meritech Capital’s Alex Kurland. “Instana is packed with industry veterans who understand the APM industry, as well as the paradigm shifts now occurring in agile software development. Meritech is excited to partner with Instana as they continue to disrupt one of the largest and most important markets with their automated APM experience.”

The company plans to use the new funding to fulfill the demand for its service and expand its product line.

Powered by WPeMatico

Chinese electric scooter startup Niu Technologies has filed for an initial public offering on Nasdaq to raise up to $150 million. In its form, Niu said it is “the largest lithium-ion battery-powered e-scooters company in China,” according to data from China Insights Consultancy, and also a market leader in Europe based on sales volume.

Founded in 2014 and based in Beijing, Niu says it currently holds a market share of 26% in China based on sales volume. Niu’s debut will the latest in a string of recent Chinese tech IPOs, the most prominent of which include the recent Hong Kong listings of Xiaomi and Meituan.

Niu’s scooters connect with an app that give drivers maintenance and performance data and also delivers firmware updates. As of the end of June, Niu claims it had sold more than 431,500 smart electric scooters in China, Europe and other markets.

According to the CIC’s data, China is the largest market for electric two-wheeled vehicles, with retail sales expected to increase to $13 million by 2022, up from $8 billion in 2017. Niu says its growth markets also include Southeast Asia and India, where scooters are a popular form of transportation.

In its filing, Niu said its net revenue in 2017 was RMB 769.4 million ($116.2 million), an increase of 116.8% from RMB 354.8 million in 2016. Its net losses during that time decreased to RMB 184.7 million ($27.9 million) in 2017 from RMB 232.7 million in 2016. More recently, net revenue for the first six months of 2018 was RMB 557.1 million ($84.2 million), an increase of 95.4% from RMB 285.1 million the same period a year earlier. Net loss was RMB 314.9 million ($47.6 million) during that period, compared to RMB 96.6 million the year before.

Powered by WPeMatico

French startup Qonto has raised a $23 million funding round for its fintech product. The company is trying to make business banking cheaper, faster and more efficient.

Existing investors Valar Ventures and Alven are once again leading the round. The European Investment Bank Group is also participating.

If you are running a small company or work as a freelancer, Qonto wants to replace your professional bank account. When you sign up, you get a French IBAN, one or multiple debit cards and the ability to send and receive money.

And then, it works pretty much like any challenger bank. You can create virtual cards, order more cards for your team, get real time notifications and freeze cards. This is a breath of fresh air compared to traditional business banks and their time-consuming processes.

You can then sync your transactions with accounting and invoicing services, and grant access to your accountant. Premium plans let you select multiple administrators and create a validation workflow to approve expensive transfers for instance.

With today’s funding round, the company plans to double the size of the team and create its own payment infrastructure. Qonto currently relies heavily on Treezor for the back end. The startup also plans to expand to Germany, Italy and Spain in 2019.

Qonto now has 90 employees and 25,000 clients. The company has managed $2 billion in total transaction volume so far. The fact that the same VC funds keep investing more money into Qonto is a great vote of confidence.

Powered by WPeMatico

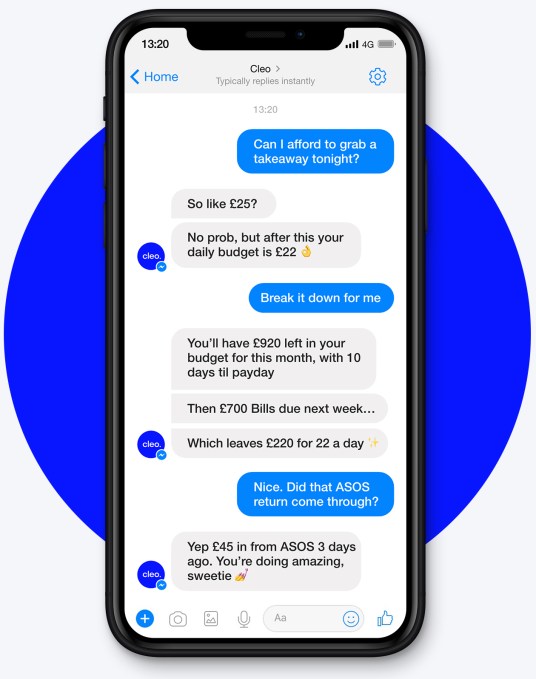

When Cleo, the London-based “digital assistant” that wants to replace your banking apps, quietly entered the U.S., the company couldn’t have expected to be an instant hit. Many better-funded British startups have failed to “break America.” However, just four months later, the fintech upstart counts 350,000 users across the pond — claiming more than 600,000 active users in the U.K., U.S. and Canada in total — and says it is adding 30,000 new signups each week. All of which hasn’t gone unnoticed by investors.

Already backed by some of the biggest VC names in the London tech scene — including Entrepreneur First, Moonfruit founder Wendy Tan White, Skype founder Niklas Zennström, Wonga founder Errol Damelin, TransferWise founder Taavet Hinrikus and LocalGlobe — Cleo is adding Balderton Capital to the list.

The European venture capital firm, which has previously invested in fintech unicorn Revolut and the well-established GoCardless, has led Cleo’s $10 million Series A round, in which I understand most early backers, including Zennström, also followed on. One source told me the Series A gives the hot London startup a post-money valuation of around £30 million (~$39.7m), although Cleo declined to comment.

The European venture capital firm, which has previously invested in fintech unicorn Revolut and the well-established GoCardless, has led Cleo’s $10 million Series A round, in which I understand most early backers, including Zennström, also followed on. One source told me the Series A gives the hot London startup a post-money valuation of around £30 million (~$39.7m), although Cleo declined to comment.

In a call with co-founder and CEO Barney Hussey-Yeo, he explained that the new capital will be used to continue scaling the company, with further international expansion the name of the game. Hussey-Yeo says Cleo will be targeting Western Europe, the Americas and Australasia, aiming to launch in a whopping 22 countries in the next 12 months, as Cleo bids to become the “default interface” for millennials interacting and managing their money.

Primarily accessed via Facebook Messenger, the AI-powered chatbot gives insights into your spending across multiple accounts and credit cards, broken down by transaction, category or merchant. In addition, Cleo lets you take a number of actions based on the financial data it has gleaned. You can choose to put money aside for a rainy day or specific goal, send money to your Facebook Messenger contacts, donate to charity, set spending alerts and more.

However, in the context of traction and Cleo’s broader global ambitions, it is the decision not to become a bank in its own right that Hussey-Yeo feels is really beginning to bear fruit. His argument has always been that you don’t need to be a bank to become the primary way users interface with their finances, and that without the regulatory and capital burden that becoming a fully licensed bank brings, you can scale much more quickly. I have a feeling that strategy — and its pros and cons — has a long way to play out just yet.

Powered by WPeMatico

A week ago rumors were flying that Adobe would be buying Marketo, and lo and behold it announced today that it was acquiring the marketing automation company for $4.75 billion.

It was a pretty nice return for Vista Equity partners, which purchased Marketo in May 2016 for $1.8 billion in cash. They held onto it for two years and hauled in a hefty $2.95 billion in profit.

We published a story last week, speculating that such a deal would make sense for Adobe, which just bought Magento in May for $1.6 billion. The deal gives Adobe a strong position in enterprise marketing as it competes with Salesforce, Microsoft, Oracle and SAP. Put together with Magento, it gives them marketing and ecommerce, and all it cost was over $6 billion to get there.

“The acquisition of Marketo widens Adobe’s lead in customer experience across B2C and B2B and puts Adobe Experience Cloud at the heart of all marketing,” Brad Rencher, executive vice president and general manager, Digital Experience at Adobe said in a statement.

Ray Wang, principal analyst and founder at Constellation Research sees it as a way for Adobe to compete harder with Salesforce in this space. “If Adobe takes a stand on Marketo, it means they are serious about B2B and furthering the Microsoft-Adobe vs Salesforce-Google battle ahead,” he told TechCrunch. He’s referring to the deepening relationships between these companies.

Brent Leary, senior analyst and founder at CRM Essentials agrees, seeing Microsoft as also getting positive results from this deal. “This is not only a big deal for Adobe, but another potential winner with this one is Microsoft due to the two companies growing partnership,” he said.

Adobe reported its earnings last Thursday announcing $2.29 billion for the third quarter, which represented a 24 percent year over year increase and a new record for the company. While Adobe is well on its way to being a $10 billion company, the majority of its income continues to come from Creative Cloud, which includes Photoshop, InDesign and Illustrator, among other Adobe software stalwarts.

But for a long time, the company has wanted to be much more than a creative software company. It’s wanted a piece of the enterprise marketing pie. Up until now, that part of the company, which includes marketing and analytics software, has lagged well behind the Creative Cloud business. In its last report, Digital Experience revenue, which is where Adobe counts this revenue represented $614 million of total revenue. While it continues to grow, up 21 percent year over year, there is much greater potential here for more.

Adobe had less than $5 billion in cash after the Magento acquisition, but it has seen its stock price rise dramatically in the last year rising from $149.96 last year at this time to $266.05 as of publication.

The acquisition comes as there is a lot of maneuvering going on this space and the various giant companies vie for market share. Today’s acquisition gives Adobe a huge boost and provides them with not only a missing piece, but Marketo’s base of 5000 customers and the opportunity to increase revenue in this part of their catalogue, while allowing them to compete harder inside the enterprise.

The deal is expected to close in Adobe’s 4th quarter. Marketo CEO Steve Lucas will join Adobe’s senior leadership team and report to Rencher.

It’s also worth noting that the announcement comes just days before Dreamforce, Salesforce’s massive customer conference will be taking place in San Francisco, and Microsoft will be holding its Ignite conference in Orlando. While the timing may be coincidental, it does end up stealing some of their competitors’ thunder.

Powered by WPeMatico

Alchemist is the Valley’s premiere enterprise accelerator and every season they feature a group of promising startups. They are also trying something new this year: they’re putting a reserve button next to each company, allowing angels to express their interest in investing immediately. It’s a clever addition to the demo day model.

You can watch the live stream at 3pm PST here.

Videoflow – Videoflow allows broadcasters to personalize live TV. The founding team is a duo of brothers — one from the creative side of TV as a designer, the other a computer scientist. Their SaaS product delivers personalized and targeted content on top of live video streams to viewers. Completely bootstrapped to date, they’ve landed NBC, ABC, and CBS Sports as paying customers and appear to be growing fast, having booked over $300k in revenue this year.

Redbird Health Tech – Redbird is a lab-in-a-box for convenient health monitoring in emerging market pharmacies, starting with Africa. Africa has the fastest growing middle class in the world — but also the fastest growing rate of diabetes (double North America’s). Redbird supplies local pharmacies with software and rapid tests to transform them into health monitoring points – for anything from blood sugar to malaria to cholesterol. The founding team includes a Princeton Chemical Engineer, 2 Peace Corps alums, and a Pharmacist from Ghana’s top engineering school. They have 20 customers, and are growing 36% week over week.

Shuttle – Shuttle is getting a head start on the future of space travel by building a commercial spaceflight booking platform. Space tourism may be coming sooner than you think. Shuttle wants to democratize access to the heavens above. Founded by a Stanford Computer Science alum active in Stanford’s Student Space Society, Shuttle has partnerships with the leading spaceflight operators, including Virgin Galactic, Space Adventures, and Zero-G. Tickets to space today will set you back a cool $250K, but Shuttle believes that prices will drop exponentially as reusable rockets and landing pads become pervasive. They have $1.6m in reservations and growing.

Birdnest – Threading the needle between communal and private, Birdnest is the Goldilocks of office space for startups. Communal coworking spaces are accessible but have too many distractions. Traditional office spaces are private but inflexible on their terms. Birdnest brings the best of each without the drawbacks: finding, leasing, and operating a network of underutilized spaces inside of private offices. The cofounders, a duo of Duke and Kellogg MBA grads, are at $300K ARR with a fast-growing 50+ client waitlist.

Tag.bio – Tag.bio wants to make data science actionable in healthtech. The founding team is comprised of a former Ayasdi bioinformatician and a former Honda Racing engineer with a Stanford MBA. They’ve developed a next-generation data science platform that makes it easy and fast to build data apps for end users, or as they say, “WordPress for data science.” The result they claim is lightning-fast analysis apps that can be run by end users, dramatically accelerating insight discovery. They count the UCSF Medical Center and a “large Swiss pharma company” as early customers.

nCorium – They’ve built a new server architecture to handle the onslaught of AI to come with what they claim is the world’s first AI accelerator on memory to deliver 30x greater performance than the status quo. The quad founding team is intimidatingly technical — including a UCSD Professor, and former engineers from Qualcomm and Intel with 40 patents among them. They have $300K in pilots.

Spiio – Software eats landscaping with Spiio, which combines cloud-driven AI with physical sensors to monitor watering and landscaping for big companies. Their smart system knows when to water and when not to. This reduces water consumption by 50%, which means their system pays for itself in less than 30 days for big companies. They want to connect every plant to the internet, and look like they are off to a good start — $100K in orders from brand name Valley tech firms, and they are doubling monthly.

Element42 – Fraud is a major problem — For example, if you buy a Rolex on eBay, you run the risk of winding up with a counterfeit. Started by ex-VPs from Citibank, the founders are using risk models and technologies that banks use to help brands combat fraud and counterfeiting. Designed with token economics, they also incentivize customers to buy genuine products by serving exclusive content and promotions only to genuine product holders. Built on blockchain at the core, they claim to be the world’s first peer-to-peer authentication platform for physical assets. They have 45 customers across two industry verticals, 800K in ARR and are a member of World Economic Forum’s global initiatives against corruption.

My90 – Distrust between the public and the police has rarely been more strained than it is today. My90 wants to solve that by collecting data about interactions between the police and the public—think traffic stops, service calls, etc.—and turn these into actionable intelligence via an online analytics dashboard. Users text My90 anonymously about their interactions, and My90’s dashboard analyzes the results using natural language processing. Customers include major city police departments like the San Jose Police Department and the world’s largest community policing program. They have booked $150K in pilots and are expanding aggressively across the US.

Nunetz – A Stanford Computer Science grad and UCSF Neurosurgeon have come together to try to build a single unifying interface to replace the deluge of monitors and data sources in today’s clinical health environment. The goal is to prepare a daily “battle map” for physicians, nurses, and other providers, with an initial focus on the Intensive Care Unit (ICU). They have closed 3 paid pilots with hospitals through grants.

When Labs – If you hate managing people, When Labs wants to unburden you. Using an AI-powered assistant that texts with employees to negotiate assignments for hourly work, WhenLabs is trying to free customers like Hilton from spending money on managers who would normally do this manually. As the system gets smarter, they claim employees will prefer interfacing with their AI bot more than a human. AI and HR is a crowded space, but this might be the team to separate from the pack: the founding team’s previous company had a 9 figure exit to IBM.

FirstCut – FirstCut helps businesses put video content out at scale. Video dominates social media — it creates 10x more comments than text — and is emerging as a necessity for B2B media. But putting video out if you are a B2B marketer normally requires using agencies that charge hefty fees. FirstCut wants to disrupt the agencies with software and marketplaces. They use software automation and an on-demand talent marketplace to offer a fixed price product for video content. They are at $180k revenue, and most of it is moving to recurring subscriptions.

LynxCare – LynxCare claims that 90% of healthcare data goes untapped when doctors make critical decisions about your life. Further, they claim the average person’s life could be extended by 4 years if that data can be converted into insights. Their team of clinicians and data scientists aims to do just that — building a data platform that aggregates disparate data sets and drive insight for better clinical outcomes. And it looks like their platform has fans: they are active in 9 hospitals, count Pharma companies like Pfizer as Partners, and grew 4x over the past year and now are at $800K ARR.

ADIAN – Adian is a B2B SaaS product that digitizes the complex agrochemical supply chain in order to improve the sales process between manufacturers and distributors. The company claims manufacturers reduce costs by 20% and increase sales by 4% by using their online framework. $1.5 Billion and 70,000 orders have gone through the platform to date.

Hardin Scientific – Hardin is building IoT-enabled, Smart Lab Equipment. The hardware becomes a gateway to become the hub for monitoring, controlling, and sharing scientific data across teams. They’ve closed over $1.5m in revenue, and raised $15m in equity and debt financing. One of their smart devices is being used to 3D print bio-tissues and human organs in space.

ZaiNar – This team of 5 Stanford grads — 3 PhD’s and 2 MBAs — joined up with the Co-Founder of BlueKai to build the world’s best time synchronization technology. ZaiNar claims their ability to wirelessly synchronize and distribute time between networked devices is a thousand times better than existing technologies. This enables them to locate RF-emitting devices (i.e. phones, cars, drones, & RFID) at long distances with sub-meter accuracy. Beyond location, this technology has applications across data transmission, 5G communications, and energy grids. ZaiNar has raised a $1.7 million seed from AME Cloud and Softbank, and has built an extensive patent portfolio.

SMART Brain Aging – This startup claims to reduce the onset of dementia by 2.25 years with software. They are the only company approved by Medicare to get reimbursed on a preventative basis for the treatment of dementia. In conjunction with Harvard University, they have developed 20,000 exercises that are clinically proven to reduce the onset of dementia and, they claim, help build neurotransmitters. The company works with 300 patients per week ($2.2 million annual revenue) and is building to a goal of helping 22,000 people in 24 months.

Phoneic – Phoneic believes the data trapped in voice calls from cellphones is a gold mine waiting to be unleashed. Their app records and transcribes cell phones conversations, and the company has built an integration layer to enterprise AI and CRM systems that traditionally didn’t have access to voice data. The team is led by the co-founder of 3jam, one of the first group SMS and virtual number companies, which was acquired by Skype in 2011. He is keenly aware of the power of virality — and like Skype, the use of Phoneic spreads its adoption. The company has already raised $800,000 in seed funding.

Arkose Labs – Whether or not you think Russia interfered with the 2016 election, it’s no secret that bots are having significant impact on society. Arkose Labs wants to fight fraud, without adding friction to legit users. Most fraud prevention platforms today focus on gathering info from the user and providing a probability score that the traffic is good or bad. This leaves companies with a difficult decision where they may be blocking revenue generating users. Arkose has a different approach, and uses a bilateral approach that doesn’t force this tradeoff. They claim to be the only solution to offer a 100% SLA on fraud prevention. Big companies like Singapore Airlines and Electronic Arts are customers. USVP led a $6 million investment into the company.

Powered by WPeMatico

GitLab, the developer service that aims to offer a full lifecycle DevOps platform, today announced that it has raised a $100 million Series D funding round at a valuation of $1.1 billion. The round was led by Iconiq.

As GitLab CEO Sid Sijbrandij told me, this round, which brings the company’s total funding to $145.5 million, will help it enable its goal of reaching an IPO by November 2020.

According to Sijbrandij, GitLab’s original plan was to raise a new funding round at a valuation over $1 billion early next year. But since Iconiq came along with an offer that pretty much matched what the company set out to achieve in a few months anyway, the team decided to go ahead and raise the round now. Unsurprisingly, Microsoft’s acquisition of GitHub earlier this year helped to accelerate those plans, too.

“We weren’t planning on fundraising actually. I did block off some time in my calendar next year, starting from February 25th to do the next fundraise,” Sijbrandij said. “Our plan is to IPO in November of 2020 and we anticipated one more fundraise. I think in the current climate, where the macroeconomics are really good and GitHub got acquired, people are seeing that there’s one independent company, one startup left basically in this space. And we saw an opportunity to become best in class in a lot of categories.”

As Sijbrandij stressed, while most people still look at GitLab as a GitHub and Bitbucket competitor (and given the similarity in their names, who wouldn’t?), GitLab wants to be far more than that. It now offers products in nine categories and also sees itself as competing with the likes of VersionOne, Jira, Jenkins, Artifactory, Electric Cloud, Puppet, New Relic and BlackDuck.

As Sijbrandij stressed, while most people still look at GitLab as a GitHub and Bitbucket competitor (and given the similarity in their names, who wouldn’t?), GitLab wants to be far more than that. It now offers products in nine categories and also sees itself as competing with the likes of VersionOne, Jira, Jenkins, Artifactory, Electric Cloud, Puppet, New Relic and BlackDuck.

“The biggest misunderstanding we’re seeing is that GitLab is an alternative to GitHub and we’ve grown beyond that,” he said. “We are now in nine categories all the way from planning to monitoring.”

Sijbrandij notes that there’s a billion-dollar player in every space that GitLab competes. “But we want to be better,” he said. “And that’s only possible because we are open core, so people co-create these products with us. That being said, there’s still a lot of work on our side, helping to get those contributions over the finish line, making sure performance and quality stay up, establish a consistent user interface. These are things that typically don’t come from the wider community and with this fundraise of $100 million, we will be able to make sure we can sustain that effort in all the different product categories.”

Given this focus, GitLab will invest most of the funding in its engineering efforts to build out its existing products but also to launch new ones. The company plans to launch new features like tracing and log aggregation, for example.

With this very public commitment to an IPO, GitLab is also signaling that it plans to stay independent. That’s very much Sijbrandij’s plan, at least, though he admitted that “there’s always a price” if somebody came along and wanted to acquire the company. He did note that he likes the transparency that comes with being a public company.

“We always managed to be more bullish about the company than the rest of the world,” he said. “But the rest of the world is starting to catch up. This fundraise is a statement that we now have the money to become a public company where we’re not we’re not interested in being acquired. That is what we’re setting out to do.”

Powered by WPeMatico

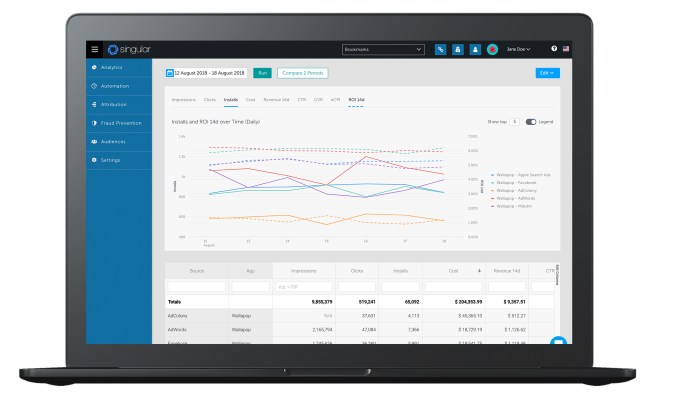

Singular, a startup working to unify data for marketers, is announcing that it has raised $30 million in Series B funding.

The company was founded by former Onavo executives, including Gadi Eliashiv, Eran Friedman and Susan Kuo — who now serve, respectively, as Singular’s CEO, CTO and COO.

Eliashiv explained that Singular was created in response to “this trend of data explosion in the marketing stack,” which require marketers to pull data from hundreds or thousands of different systems.

“Essentially what we see is the creation of this new category of marketing intelligence, where the complexity of the marketing stack has created the need for this layer that sits on top,” he said. “It doesn’t matter if you use a marketing cloud like Adobe that’s bundling five products together — at the end of the day, you need a layer on top making sense of it, helping you make better decisions.”

Eliashiv said Singular is able to go from a high-level dashboard summary for CMOs to “the finest level of detail.” He also noted that while the company is designed to integrate with existing marketing tools, it will “oftentimes displace smaller point solutions.”

“Our principal is, it has to be relevant for data, meaning we’re never going to displace your ad-buying tool,” he added. “It’s not what we do. We’re an intelligence platform.”

The idea of unifying marketing data is one that I hear a lot, but Eliashiv’s claims seem weightier when you see that Singular is already working with a number of big names, including Lyft, Yelp, Airbnb, LinkedIn, Symantec, Zynga, Match and Twitter.

Singular previously raised $20 million in funding. Norwest Venture Partners led the new round, with partner Scott Beechuk joining the board of directors.

Beechuk told me that he’d been studying the marketing analytics market for quite some time, and he argued, “There is something really unique and special about Singular. It’s the bridge between mobile, web and offline, all on a single platform.”

“What you’re going to find is, there are going to be a lot of technologies that Singular replaces,” Beechuk continued. “Let’s say a CMO or [chief growth officer] has 300 different outlets where they are advertising … Every one of those systems tends to have their own analytics built in. The first thing Singular does, it replaces all of those analytics systems with a single pane of glass.”

General Catalyst, Method Capital, Telstra Ventures, Translink Capital and Thomvest also participated in the new funding.

Powered by WPeMatico

WHILL, the startup known for creating sleek, high-tech personal mobility devices, announced today that it has closed a $45 million Series C. The funding will be used for expanding into new international markets, as well as developing new products for large venues, including airports and “last-mile” sidewalk transportation. The round’s lead investors were SBI Investment, Daiwa Securities Group and WHIZ Partners, with participation from returning investors INCJ, Eight Road Ventures, MSIVC, Nippon Venture Capital, DG Incubation and Mizuho Capital.

This brings WHILL’s total funding so far to about $80 million. Founded in Tokyo in 2012, WHILL plans to open a branch in the European Union and enter 10 new European countries. It also plans to start working with partners on developing autonomous capabilities for its mobility devices, senior marketing manager Jeff Yoshioka told TechCrunch. The company will build its own sensors and cameras to use in its “mobility as a service” program, which allows users to control vehicles and call customer service through a mobile app.

One of WHILL’s biggest projects is developing an autonomous personal mobility device system for airports. Yoshioka says that an estimated 20 million people request wheelchairs in U.S. airports each year. This means they need to wait for an airline employee to bring a wheelchair to them and then push them from check-in to their gates. At the same time, it doesn’t give users a lot of flexibility.

The system that WHILL has in mind, on the other hand, would allow individuals to use an app to summon a mobility device over to them. Then they can go wherever they want — coffee shops, restrooms, shops — before heading to the gate without an assistant. Once they are done with the device, it will return to a docking station on its own. WHILL has already begun testing a similar program at Tokyo International Airport in partnership with Panasonic.

Yoshioka says WHILL will most likely pursue distribution partnerships with U.S. airlines, which are responsible for supplying and maintaining the wheelchair systems in American airports, and airports to build the necessary infrastructure.

Along with airports, WHILL wants to bring its technology to other large venues, including shopping malls and sports arenas, as well as create a system for last-mile transportation. Yoshioka notes that “there are already a lot of companies out there like LimeBike and MoBike that offer bikes and electric scooters, but there’s nothing out there for people with disabilities who can’t use those devices.”

Instead, many rely on Ubers or public transportation even for short distances. Like the airport system, WHILL’s last-mile sidewalk system will use autonomous electric vehicles that can be called to users with an app. It faces unique challenges, however, because WHILL’s devices are larger and more expensive than bikes or electric scooters, so the company needs to find safe places to dock them that are still accessible to people with limited mobility. Yoshioka says WHILL likely will focus on partnering with commercial properties to create indoor docking stations.

WHILL’s largest market is still Japan, where it has between 4,000 to 5,000 resellers. In its home market, WHILL’s devices are subsidized by the government and also available for rent. In the U.S., however, many customers need to purchase devices out-of-pocket. To make their products more accessible, WHILL launched the less expensive Model Ci (called the Model C in Europe and Japan) earlier this year. While there is still plenty of room for innovation in the wheelchair market, the Model Ci and other WHILL products compete with devices like the iBot, which can climb stairs, and the Trackchair, designed for off-road use. WHILL’s current products can’t climb stairs, but they do have the advantage of being designed for both indoor and outdoor use, giving users more flexibility, says Yoshioka.

The company also expects demand for its products to grow thanks to a rapidly aging world population, citing statistics that show there are expected to be more than 2.1 billion people over the age of 60 by 2050, up from about 900 million last year.

“We don’t necessarily see [the other companies] as direct competitors. They definitely do impact sales, because people might want something that climbs stairs instead of having better outdoor capabilities, but I think overall it’s very beneficial for the industry,” Yoshioka adds. “As a company that’s trying to disrupt the industry, it’s nice to have them around because it pushes the industry forward and opens eyes for other manufacturers.”

Powered by WPeMatico