Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Now that “utility” tokens have become a popular and international way to fund major blockchain projects, a pair of investors are creating a new way to turn tokens into true equities. The investors, Jonathan Nelson and Laura Nelson, have created Hack Fund, an early stage investment vehicle that allows startups to launch what amounts to “blockchain stock certificates,” according to Jonathan.

“Our previous business model exchanged equity from startup companies for services, and wrapped that equity into funds that we then sold to investors. These fund investors have included family offices, institutions, and high net worth individuals,” said Jonathan. “However, Hack Fund represents a new business model. Because Hack Fund leverages the blockchain, investors all over the world at all levels can participate in startup investing by trading blockchain stock certificates. Also, its SEC compliant structure means that it is also available to a limited number of accredited investors in the US.”

The team originally created Hackers/Founders, a tech entrepreneur group in Silicon Valley, and they now support 300,000 members in 133 cities and 49 countries. Hack Fund is a vehicle to support some of the startups in the Hackers/Founders network.

“HACK Fund, through its Hackers/Founders heritage, has a large, unique global network,” said Jonathan. “This provides Hack Fund with unparalleled reach and deal flow across the global technology market. There are a few blockchain-based funds, but they are limited themselves to blockchain-only investments. Unlike typical venture funds, HACK Fund will provide quick liquidity for investors, leveraging blockchain technology to make typically illiquid private stocks tradeable.”

The idea behind Hack Fund is quite interesting. In most cases investing in a company leads to up to ten years of waiting for a liquidity event. However, with blockchain-based stock certificates investors can buy shares that can be bought and sold instantly while company performance drives the value up or down. In short, startups become liquid in an instant, which can be a good thing or a bad thing, depending on the founding team.

“HACK Fund is a publicly traded closed-end fund. The fund’s venture investments are valued on a quarterly basis by an independent third party, audited and posted to the blockchain for all token holders to review. There are no K-1 statements issued, there is no partnership/LLC, rather HACK Fund is an investment company akin to Berkshire Hathaway which invests in the same manner as early-stage venture capital,” said Jonathan.

The $100 million fund raise has already kicked off across Asia, Middle East, Latin America and to a small number of accredited investors in the US. The fund will be rounded out with $2 million from retail investors who will be able to buy some of the tokens on October 29th through BRD wallet.

Powered by WPeMatico

Netlify wants to revolutionize the way developers build websites, abstracting away the web server and breaking web sites into microservices, making the process more like building a mobile application than a traditional website. Today, the company announced a $30M Series B investment to help continue to build on that vision.

Kleiner Perkins led the round. Andreessen Horowitz and the founders of Slack (Stewart Butterfield), Yelp (Jeremy Stoppelman) and Figma (Dylan Field) all participated. Today’s investment brings the total raised to over $44 million, according to Crunchbase data.

Chris Bach, co-founder and president and Matt Biilmann, co-founder and CEO see the change they are trying to make as part of the larger shift to an API economy. They want to take the same ease of development APIs have given programmers in a mobile context and bring that to web development.

As I wrote earlier this year when they announced support for AWS Lambda, they want to reduce the complexity around web development:

“Netlify has abstracted away the concept of a web server, which it says is slow to deploy and hard to secure and scale. By shifting from a monolithic website to a static front end with back-end microservices, it believes it can solve security and scaling issues and deliver the site much faster.”

The founders have a grand vision, “We are basically out to replace all web servers with a with a global application delivery network,” Bach explained.

Mamoon Hamid, general partner at investor Kleiner Perkins says that while the website backend has evolved over recent years, the front end has remained static, and that’s what Netlify is addressing with their microservices-based approach to web development. “Netlify smack dab hits our view of where we need to go for the web to flourish,” Hamid told TechCrunch.

He believes the last shift of this magnitude in web development at the presentation layer was the advent of the CMS 15 years ago, and we are starting to see developers attracted to the Netlify approach in a big way. “We really believe that with this 300,000 strong developer force that’s already behind Netlify that they’re showing early signs of tapping into what could be the platform from which a significant portion of the web content is served from [in the future],” Hamid said.

Netlify is working to increase the number of websites running on their approach in the coming years and see this as a mission to change the web. “For us, it’s very important to keep being a place where developers want to go and very easily can get something up and running. And then you can scale from there,” Bach said.

The company wants to build out a more organized sales and marketing team to sell the Netlify approach to larger organizations, while continuing to build out the product and developer outreach. All of this takes money and that’s why they went for such a large round today.

Powered by WPeMatico

Zocdoc founder Cyrus Massoumi and Indiegogo founder Slava Rubin have created a new $30 million fund called Humbition aimed at early stage, founder-led companies in New York.

“The fund is focused on connecting startups with investors and advisors experienced in building and growing successful businesses,” said Rubin.

“We are seeking to fill a void in NYC, where the vast majority of early stage investors have no significant experience building and scaling businesses,” he said. “The fund’s main areas of investment include marketplaces, consumer and health tech. But the primary criteria for investments is high quality founders. The fund is also seeking out mission-driven businesses because the companies that are socially responsible will be the most successful in the coming decades.”

The fund has brought on ClassPass founder Payal Kadakia, Warby Parker founder Neil Blumenthal, Charity: Water CEO and founder Scott Harrison, and Casper founder and CEO Philip Krim as advisors. They have already invested some of the $30 million raise in Burrow, a couch-on-demand service.

“New York City is home to a tremendous number of mission-driven startups that are simply not receiving the same level of support as their peers in the Bay Area. This void presents a unique opportunity for humbition to reach the incredible local talent who need the funding and guidance to build and grow their businesses in New York City,” said Rubin.

Powered by WPeMatico

London ‘proptech’ startup Goodlord, which offers cloud-based software to help estate agents, landlords and tenants manage the rental process, has raised £7 million in Series B funding. The round is led by Finch Capital, with participation from existing investor Rocket Internet/GFC, and is roughly equal in size to Goodlord’s Series A in 2017. However, it would be fair to say a lot has happened since then.

In January, we reported that Goodlord had let go of nearly 40 employees, and that co-founder and CEO Richard White was leaving the company (we also speculated that the company’s CTO had departed, too, which proved to be correct). In signs of a potential turnaround, Goodlord then announced a new CEO later that month: serial entrepreneur and investor William Reeve (pictured), a veteran of the London tech scene, would now head up the property technology startup.

As I wrote at the time, Reeve’s appointment could be viewed as somewhat of a coup for Goodlord and showed how seriously its backers — which, along with Rocket Internet (and now Finch), also includes LocalGlobe and Ribbit Capital — were treating their investment and the turn-around/refocus of the company. With today’s Series B and news that Reeve has appointed a new CTO, Donovan Frew, that effort seems to be paying off.

Founded in 2014, unlike other startups in the rental market space that want to essentially destroy traditional brick ‘n mortar letting agents with an online equivalent, Goodlord’s Software-as-a-Service is designed to support all stakeholders, including traditional high-street letting agents, as well as landlords and, of course, tenants.

The Goodlord SaaS enables letting agents to “digitize” the moving-in process, including utilizing e-signatures and collecting rental payments online. In addition, the company sells landlord insurance, and has been working on other related products, such as rental guarantees, and “tenant passports.”

If Goodlord can reach enough scale, it wants to let tenants easily take their rental transaction history and landlord references with them when moving from one rental property to another as proof that they are a trustworthy tenant.

Meanwhile, the company says new funding will be used to build new products, grow its customer base, and invest in the further development of its proprietary technology to continue to make “renting simple and more transparent for letting agents, tenants and landlords”.

Powered by WPeMatico

Photographer: Daro Sulakauri/Bloomberg

According to a new study conducted by the Center for American Entrepreneurship and NYU’s Shack Institute of Real Estate, the US may be losing its competitive advantage as the dominant nucleus of the startup and venture capital universe.

The analysis, led by senior Brookings Institution fellow Ian Hathaway and “Rise of the Creative Class” author Richard Florida, examines the flow of venture capital over 100,000 deals from 2005 to 2017 and details how the historically US-centric practice of venture capital has become a global phenomenon.

While the US still appears to produce the largest amount of venture activity in the world, America’s share of the global pie is falling dramatically and doing so quickly.

In the mid-90s, the US accounted for more than 95% of global venture capital investment. By 2012, this number had fallen to 70%. At the end of 2017, the US share of total venture investment had fallen to just 50%.

Over the last decade, non-US countries have propelled growth in the global startup and venture economy, which has swelled from $50 billion to over $170 billion in size. In particular, China, India and the UK now account for a third of global venture deal count and dollars – 2-3x the share held ten years ago. And with VC dollars increasingly circulating into modernizing Asia-Pac and European cities, the researchers found that the erosion in the US share of venture capital is trending in the wrong direction.

We’ve spent the summer discussing the notion of Silicon Valley reaching its parabolic peak – Observing the “rise of the rest” across smaller American tech hubs. In reality, the data reveals a “rise in the rest of the world”, with startup ecosystems outside the US growing at a faster pace than most US hubs.

The Bay Area remains the world’s preeminent beneficiary of VC investment, and New York, Los Angeles, and Boston all find themselves in the top ten cities contributing to global venture growth. However, only six of the top 20 cities are located in the US, while 14 are in Asia or Europe. At the individual level, only two American cities crack the top 20 fastest growing startup hubs.

Still, the authors found the bulk of VC activity remains highly concentrated in a small number of incumbent startup cities. More than 50% of all global venture capital deployed can be attributed to only six cities and half of the growth in VC activity over the last five years can be attributed to just four cities. Despite the growing number of ecosystems playing a role in venture decisions, the dominant incumbent startup hubs hold a firm grip on the majority of capital deployed.

Unsurprisingly, the largest contributor to the globalization of venture capital and the slimming share of the US is the rapid escalation of China’s startup ecosystem.

In the last three years, China has captured nearly a fourth of total VC investment. Since 2010, Beijing contributed more to VC deployment growth than any other city, while three other Chinese cities (Shanghai, Hangzhou, Shenzhen) fell in the top 15.

A major part of China’s ascension can be tied to the idiosyncratic rise of late-stage “mega deals”, which the study defines as $500 million or more in size. Once an extremely rare occurrence, mega deals now make up a significant portion of all venture dollars deployed. From 2005-2007, only two mega deals took place. From 2010-2012, eight of such deals took place. From 2015-2017, there were 80 global mega deals, representing a fifth of the total venture capital activity. Chinese cities accounted for half of all mega deal investment over the same period.

It’s not all bad for the US, with the study highlighting continued ecosystem growth in established US hubs and leading roles for non-valley markets in NY, LA, and Boston.

And the globalization of the startup and venture economy is by no means a “bad thing”. In fact, access to capital, the spread of entrepreneurial spirit, and stronger global economic development and prosperity is almost unquestionably a “good thing.”

However, the US’ share of venture-backed startups is falling, and the US losing its competitive advantage in the startup and venture capital market could have major implications for its future as a global economic leader. Five of the six largest US companies were previously venture-backed startups and now provide a combined value of around $4 trillion.

The intense competition for talent marks another major challenge for the US who has historically been a huge beneficiary of foreign-born entrepreneurs. With the rise of local ecosystems across the globe, entrepreneurs no longer have to flock to the US to build their companies or have access to venture capital. The problem attracting entrepreneurs is compounded by notoriously unfriendly US visa policies – not to mention recent harsh rhetoric and tension over immigration that make the US a less attractive destination for skilled immigrants.

At a recent speaking event, Florida stated he believed the US’ fading competitive advantage was a greater threat to American economic power than previous collapses seen in the steel and auto industries. A sentiment echoed by Techstars co-founder Brad Feld, who in the report’s forward states, “government leaders should read this report with alarm.”

It remains to be seen whether the train has left the station or if the US can hold on to its position as the world’s venture leader. What is clear is that Silicon Valley is no longer the center of the universe and the geography of the startup and venture capital world is changing.

“The Rise of the Global Startup City: The New Map of Entrepreneurship and Venture Capital” tries to illustrate these tectonic shifts and identifies tiers of global startup cities based on size, growth and balance of VC deals and investments.

Powered by WPeMatico

Salesforce’s Marketing and Commerce Cloud is the company’s smallest division today, so to help beef it up, the company is making an acquisition to add in more features. Salesforce has acquired Rebel, a startup that develops interactive email services for businesses to enhance their direct marketing services: recipients of interactive emails can write reviews, shop and take other actions without leaving the messages to do so.

In an announcement on Rebel’s site, the startup said it will be joining Salesforce’s Marketing Cloud operation, which will integrate Rebel’s API-based services into its platform.

“With Rebel’s Mail and API solutions, brands, including Dollar Shave Club, L’Oreal and HelloFresh, turn emails into an extension of their website or app – collecting data, removing friction from the conversion process, and enhancing the customer experience. Rebel will enhance the power of Salesforce Marketing Clod and fundamentally change the way people interact with email,” the founders note.

That makes it sound as if the company’s existing business will be wound down as part of the move, although Salesforce and Rebel are not specifically commenting on that yet, and so customers haven’t been informed yet one way or the other.

Terms of the deal have not been disclosed in the Rebel announcement. We have contacted both the startup and Salesforce for further comment and to ask about the price. To date, Rebel — co-founded originally as Rebelmail by Joe Teplow and Trever Faden — had raised only about $3 million, with investors including Lerer Hippeau, Sinai Ventures, David Tisch, Gary Vaynerchuk, and others, so if the deal size is equally small, Salesforce likely will not be disclosing it.

Salesforce has made a number of acquisitions to build and expand its marketing services to compete with Adobe and others. Perhaps most notable of these was buying ExactTarget, one of its biggest-ever acquisitions, for $2.5 billion in 2013. (And according to some, it even wanted to buy Adobe at one point.) Competition has been heating up between the two, with Adobe most recently snapping up Marketo for $4.75 billion.

But on the other hand, marketing is currently Saleforce’s smallest division. It pulled in $452 million in revenues last quarter, putting it behind revenues for Sales Cloud ($1 billion), Service Cloud ($892 million) and Salesforce Platform ($712 million). Adding in interactive email functionality isn’t likely to float Marketing and Commerce Cloud to the top of that list, but it does show that Salesforce is trying to improve its products with more functionality for would-be and current customers.

Those customers have a lot of options these days, though, in targeting their own customers with rich email services. Microsoft and Google have both started to add in a lot more features into their own email products, with Outlook and Gmail supporting things like in-email payments and more. There are ways of building such solutions through your current direct marketing providers, or now directly using other avenues.

What will be interesting to see is whether Rebel continues to integrate with the plethora of email service providers it currently works with, or if Salesforce will keep the functionality for itself. Today Rebel’s partners include Oracle, SendGrid, Adobe, IBM, SailThru and, yes, Salesforce.

We’ll update this post as we learn more.

Powered by WPeMatico

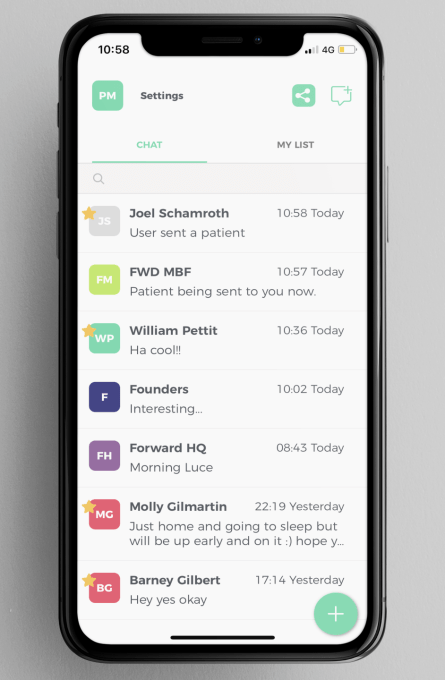

Forward Health, the U.K. startup that has built an app to help healthcare professionals communicate in a secure and compliant way, has picked up $3.9 million in seed funding.

Leading the round is Stride.VC, the new VC fund from Fred Destin, formerly a partner at Accel, and Harry Stebbings, producer of the “The Twenty Minute VC” and most recently Entrepreneur-in-Residence at VC firm Atomico.

Additional backing comes from Albion Capital, while Forward already boasts a decent array of angel investors. They include healthtech founders Jay Desai from U.S. company Patient Ping, and Melissa Morris from U.K.-based Lantum.

Founded in 2016 by U.K. doctors Barney Gilbert and Lydia Yarlott, with serial entrepreneur Philip Mundy (who previously founded Goodlord), Forward Health is a messaging app and broader communications platform designed for healthcare professionals, particularly those working in hospitals.

Founded in 2016 by U.K. doctors Barney Gilbert and Lydia Yarlott, with serial entrepreneur Philip Mundy (who previously founded Goodlord), Forward Health is a messaging app and broader communications platform designed for healthcare professionals, particularly those working in hospitals.

One overly simple way to think of it is as a “WhatsApp for doctors,” helping to wean healthcare professionals off of using the popular messaging app professionally, which is entirely unsuited for a regulated industry like healthcare. However, the bigger vision is to “connect healthcare systems around the world” by improving clinician-to-clinician (and potentially clinician-to-patient) communication and information-sharing with a platform that is built from the get-go to be secure, flexible and compliant.

“Healthcare communication is incredibly fragmented,” Forward Healthcare’s Mundy tells me. “This has a direct impact on how well clinicians can do their jobs and the level of care patients receive. Currently, doctors and nurses working within the NHS have to rely on an outdated and inefficient combination of pagers, landlines, switchboards and fax machines to contact each other. This 1960s infrastructure wastes huge amounts of time and can lead to critical delays in information flow.”

It is in this context that clinicians have resorted to alternative methods of communication, such as WhatsApp, which Mundy rightfully says are not fit for purpose and pose real risks.

“Any communication of this kind needs to support the exchange of highly sensitive patient information, any app used needs to be NHS digital compliant, GDPR compliant and operate within the highest levels of data security,” he explains. “WhatsApp and others don’t do this, meaning individual doctors could be liable should patient data be sent to the wrong contact or thread. Additionally, an app such as Forward is designed by and for doctors, meaning it can perform in just the right way.”

In Forward’s case, that means offering an in-app directory of healthcare professionals who work within the same hospital so that it is possible to message colleagues even if you don’t know their number, “safe exchange of information and images,” the ability to create task lists and a way of ensuring everyone involved with a patient’s care “is on the same page and working from the same information.” The latter includes the ability for clinicians to share patient cards, akin to a mini electronic health record, on a need-to-know basis.

To that end, the Forward app is GDPR compliant, NHS IG Toolkit Certified and meets the GMC’s confidentiality guidelines. Clinicians must have an approved NHS or Trust email address to log into the app. Over the last year it has been piloted with a community of 5,000 doctors across five partner hospitals.

In a call with Harry Stebbings — who led the round on behalf of Stride and whom I promised not to refer to as a podcaster-turned-VC (sorry, Harry, I’m a terrible person!) — he told me that Forward Health’s mission resonated with him personally due to his first-hand experience of how doctors communicate and share information in the NHS. It is quite well-known that Stebbings’ mother has MS, while more recently his father suffered a heart attack.

“I knew healthcare communication was broken when, post my father’s heart attack, they faxed his ECG scans,” he says, aghast.

When he was introduced to the Forward Health team, Stebbings says he already understood the problem. But, more so, he looks for founder-market fit and believes the Forward founders are extremely well-placed to solve this particular problem, with the right mixture of healthcare and product backgrounds.

He says that another thing that has impressed him is the bottom-up growth that the Forward app has garnered, which we both agree is a little reminiscent to how business social network Yammer originally penetrated corporations. This sees healthcare professionals download the app and sign up using their NHS email address, without the need for a central diktat. They then typically encourage colleagues to do the same, which creates further network effects. This viral growth is also benefiting from the current career path of junior doctors, who, as part of their training, move from hospital to hospital and in turn spread use of the Forward app.

Adds Mundy: “The last year has not only furthered our aims to help thousands of doctors and nurses avoid using pagers and WhatsApp, but it’s also shown us the scale of the clinical communication problem. It’s an issue at every level of healthcare, from A&E to community services, and affects all clinicians and every patient. With this capital, we’ll be able to work with even more clinicians across the U.K. to identify their challenges and expand our product to help solve them. We believe our current offering is just the start of what our platform is set to become.”

Powered by WPeMatico

Of all the things to add to the blockchain, wine makes a lot of sense. Given the need for provenance for every grape and barrel, it’s clear that the ancient industry could use a way to track ingredients from farm to glass. VinX, an Israeli company founded by Jacob Ner-David, is ready to give it a try.

According to a release, the plan is to create a “token-based digital wine futures platform based on the Bordeaux futures model” that lets you track wine from end to end “at a cost bearable to the industry.”

Investment banker Gil Picovsky joined Ner-David to build out the service.

“I was relating to Gil my frustrations with the way most wine is sold, and I had some early thoughts around using blockchain and tokens to radically remake the wine industry,” said Ner-David. “Together Gil and I developed the core concepts of VinX, and started to actively devote ourselves full time to VinX in November 2017.”

“VinX is democratizing the capital structure of the wine industry by bringing consumers in direct contact with producers early in the wine-making cycle,” said Ner-David. “We are riding the wave of direct-to-consumer. In addition, because we are registering all wine futures as tokens on a blockchain, we are bringing a powerful validating force that will go a long way toward reducing fraud.”

Overstock’s investment arm, Medici Ventures, is not reporting how much cash they are dumping into VinX, but the company claims that “it is a seven-figure investment.”

The tool will help reduce the rate of fakery in winemaking. Experts estimate that 20 percent of all wine in the world is counterfeit. VinX will follow individual bottles from filling to drinking, ensuring a bottle is real.

Ner-David is also the co-founder of Jezreel Valley Winery, a boutique winery in Israel.

“We want to use modern technologies, including blockchain and tokening assets, in bringing consumers in direct contact with wineries around the world, humanizing the connection, and leaving more value in the hands of wineries and wine lovers,” he said.

Powered by WPeMatico

Palo Alto Networks launched in 2005 in the age of firewalls. As we all know by now, the enterprise expanded beyond the cozy confines of a firewall long ago and vendors like Palo Alto have moved to securing data in the cloud now too. To that end, the company announced its intent to pay $173 million for RedLock today, an early-stage startup that helps companies make sure their cloud instances are locked down and secure.

The cloud vendors take responsibility for securing their own infrastructure, and for the most part the major vendors have done a decent job. What they can’t do is save their customers from themselves and that’s where a company like RedLock comes in.

As we’ve seen time and again, data has been exposed in cloud storage services like Amazon S3, not through any fault of Amazon itself, but because a faulty configuration has left the data exposed to the open internet. RedLock watches configurations like this and warns companies when something looks amiss.

When the company emerged from stealth just a year ago, Varun Badhwar, company founder and CEO told TechCrunch that this is part of Amazon’s shared responsibility model. “They have diagrams where they have responsibility to secure physical infrastructure, but ultimately it’s the customer’s responsibility to secure the content, applications and firewall settings,” Badhwar told TechCrunch last year.

Badhwar speaking in a video interview about the acquisition says they have been focused on helping developers build cloud applications safely and securely, whether that’s Amazon Web Services, Microsoft Azure or Google Cloud Platform. “We think about [RedLock] as guardrails or as bumper lanes in a bowling alley and just not letting somebody get that gutter ball and from a security standpoint, just making sure we don’t deviate from the best practices,” he explained.

“We built a technology platform that’s entirely cloud-based and very quick time to value since customers can just turn it on through API’s, and we love to shine the light and show our customers how to safely move into public cloud,” he added.

The acquisition will also fit nicely with Evident.io, a cloud infrastructure security startup, the company acquired in March for $300 million. Badhwar believes that customers will benefit from Evident’s compliance capabilities being combined with Red Lock’s analytics capabilities to provide a more complete cloud security solution.

RedLock launched in 2015 and has raised $12 million. The $173 million purchase would appear to be a great return for the investors who put their faith in the startup.

Powered by WPeMatico

In what looks like a European first, the London-based early-stage venture capital firm Balderton Capital is announcing it has closed a new $145 million “secondary” fund dedicated to buying equity stakes from early shareholders in European-founded “high growth, scale-up” technology companies.

Dubbed “Balderton Liquidity I,” the new fund will invest in European growth-stage companies through the mechanism of purchasing shares from existing, early shareholders who want to liquidate some or all of their shares “pre-exit.”

“Balderton will take minority stakes, between regular fund-raising rounds, making it possible for early shareholders — including angels, seed funds, current and former founders and employees — to realise early returns, reinvest capital in the ecosystem, or reward founders and early employees,” explains the firm.

The move essentially formalises the secondary share dealing that already happens — typically as part of a Series C or other later rounds — which often sees founders take some money off the table so they can improve their own financial situation and won’t be tempted to sell their company too soon, but also gives early investors a way out so they can begin the cycle all over again. Otherwise it can literally take five to 10 years before a liquidity event happens, either via IPO or through a private acquisition, if it happens at all.

“The bigger picture is there are lots of shareholders who either want or need or have to take liquidity at some point,” Balderton partner Daniel Waterhouse tells me on a call. “Founders are one part of that… but I think the majority of this fund is more targeted at other shareholders — business angels, seed funds, maybe employees who left, founders who left — who want to reinvest their money, want to solve a personal financial issue, want to de-risk their personal balance sheets, etc. So we’re not obsessed with founders in this fund, we’re obsessed with many different types of early shareholders, which for many different reasons would like to get liquidity before the grand exit event.”

Waterhouse says that one of the big drivers for doing this now is that Balderton’s analysis suggests there is “a critical mass of interesting companies” that are in the growth stage: “businesses that have got a scalable commercial engine” and a proven commercial model. This critical mass has happened only over the last two years, which is why — unlike in Silicon Valley — we haven’t yet seen a fund of this kind launch in Europe.

“We think there’s now about 500 companies in Europe that have raised over $20 million. That doesn’t mean they are all great companies but it’s an interesting, crude data point in terms of the scale they’ve got to. As a consequence, within that 500 we expect there to be quite a lot of interesting companies for this fund to help and we obviously have a pretty good lens on the market. Through our early-stage investing, and working with companies from the early-stage through to exit, and then obviously staying in touch with companies we don’t necessarily invest in, we have a pretty good sense of that from a bottom up perspective on how many opportunities are out there.”

He explained that there are three aspects behind the secondary funding strategy. First is that by investing via secondary funding, more companies will gain access to the “Balderton platform,” which includes an extensive executive and CEO network and support with recruitment and marketing. Secondly, it is good for the ecosystem as it will not only help relieve financial pressure from founders so they can “shoot for the next growth point” but will also let business angels cash out and recycle their money by investing in new startups. Thirdly, and perhaps most importantly, Balderton thinks it represents a good investment opportunity for the firm and its LPs as secondary liquidity is “underserved as a market.”

(Separately, one London VC I spoke to said a dedicated secondary fund in Europe made sense except in one scenario: that European valuations see a price correction sometime in the future promoted by the current trajectory of available funding slowing down, which he believes will eventually happen. “Funds are 10 years so they just have to get out in time,” is how said VC framed it.)

To that end, Waterhouse says Balderton is looking to do around 15-20 investments out of the fund, but in some instances may start slowly and then buy more shares in the same company at an even later stage. It will be managed by Waterhouse with support from investment principal Laura Connell, who recently joined the VC firm.

Struggling to see many downsides to the new fund — which by virtue of being later-stage is less risky and will likely command a discount on secondary shares it does purchase — I ask if perhaps Balderton is being a little opportunistic in bringing a reasonably large amount of institutional capital to the secondary market.

“No, I don’t think so,” he replies. “What we’ve seen in our portfolio is [that] the point in time when someone is looking for liquidity isn’t set on the calendar alongside when companies do fund raising. In particular as a company gets more mature, the gap between fund raises can stretch out because the businesses are more close to profitability. And so it’s not deterministic. We want to just be there to help people who are actually looking to sell out of cycle in those points of time and at the moment have very little options. If someone wants to wait, they’ll wait.”

Finally, I was curious to know how it might feel the first time Balderton buys a substantial amount of secondary shares in a company that it previously turned its nose down at during the Series A stage. After pointing out that companies usually look very different at Series A compared to later on in their existence — and that Balderton can’t and doesn’t invest in every promising company — Waterhouse replies diplomatically: “Maybe we kick ourselves a bit, but we’re quite happy with the performance of our early funds and obviously we’ll be happy to add other new companies that are doing really well into the family.”

Powered by WPeMatico