Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Startup funding hasn’t changed much in the past decade. Funderbeam is an interesting company trying to turn everything upside down using a marketplace approach, a modern syndication system and a blockchain-based platform. I’m excited to announce that Funderbeam founder and CEO Kaidi Ruusalepp will come to TechCrunch Disrupt Berlin.

The first boom of venture capital of the 1980s changed everything in the tech industry. Countless of tech startups managed to get funding, grow and make money down the road. Without venture capital firms, some of the biggest tech firms out there just wouldn’t be around.

Arguably, convertible notes and accelerators turned startups into a mainstream phenomenon. It became much easier to get seed funding and some sort of mentorship.

But it hasn’t changed much since then. Funderbeam has some ambitious goals as the company wants to change everything by adding more transparency and liquidity into private funding.

Funderbeam combines multiple products into one. As a startup, you can use Funderbeam to raise your next funding round. Funderbeam acts as a funding and trading platform so that angel investors can invest in your startup. Founders can choose their investors on the platform.

As an investor, you can invest in a startup and take advantage of Funderbeam’s liquidity. You’ll be able to cash out on your own terms as the startup is also building a secondary market so that early investors in a company can sell shares to newer investors. And Funderbeam also compiles all its data on startups to create a database of financial information on startups.

Buy your ticket to Disrupt Berlin to listen to this discussion and many others. The conference will take place on November 29-30.

In addition to fireside chats and panels, like this one, new startups will participate in the Startup Battlefield Europe to win the highly coveted Battlefield cup.

Founder & CEO, Funderbeam

Founder and CEO of Funderbeam, the global funding and trading platform of private companies built on blockchain. Funderbeam combines three stages of investor journey into one: startup analytics, investing, and trading on the secondary market. Powered by blockchain technology, the marketplace delivers capital to growth companies and on-demand liquidity to investors worldwide.

Member of Startup Europe Advisory Board at European Commission. Kaidi is a former CEO of Nasdaq Tallinn Stock Exchange and of the Central Securities Depository. Co-Founder of Estonian Service Industry Association. The first IT lawyer in Estonia, she co-author of the Estonian Digital Signatures Act of 2000 — landmark legislation that enables secure digital identities and, in turn, the country’s booming electronic economy.

Kaidi was named as an Entrepreneur of a Year in 2018 by the Playmakers Technology Award and as a Person of a Year in 2016 by the Estonian IT and Telecommunication Association. Co-author of #Foundership Playbook and mentor of various girls and women in tech initiatives.

Powered by WPeMatico

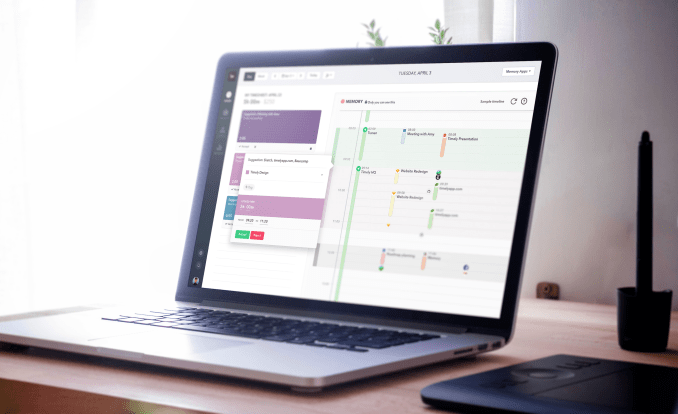

Memory, a startup out of Norway and maker of time tracking app Timely, has raised $5 million in further funding. Leading the round is Concentric, and Investinor, with participation from existing investor SNÖ Ventures. The company had previously raised $1 million in 2016 from 500 Startups, and SNÖ.

Founded by Mathias Mikkelsen, a designer by background and who I understand turned down a job offer at Facebook to try his hand at startup life, Memory is applying what it describes as AI and digital technology to create various tools to help solve “the abuses of time” that workers typically face in the modern workplace. The first of those abuses being tackled is the monotonous and time-consuming task of time tracking and filing time sheets — a meta problem if there ever was one.

“The problem we’re trying to solve is with time tracking, the most common currency of work that exists,” Mikkelsen tells me. “The problem is that people find it extremely painful to do and thus do it incorrectly. For example, what did you do last Friday? How long did it take? Humans are not built to remember that kind of detail and we shouldn’t be doing it. Harvard Business Review estimates that U.S. companies loose billions of dollars per day because of incorrect time tracking, so we think the potential is massive”.

The resulting product, dubbed Timely, is billed as a fully automatic time tracking tool. Powered by “AI”, it automatically records everything employees work on and then claims to create accurate time sheets on their behalf.

“We solve it with tons of data and machine learning,” says Mikkelsen. “We have built an ML model (recurring neural net) that literally tracks, completely privately and securely, everything you do in life. Files you work on, locations, websites, calendar, email, etc. Then we analyse all of that, make sense of it and automatically create a timesheet for you. We round up the time, choose projects, tags, all of it. It matches your individual pattern and the only thing our customers have to do is to hit an Accept button and you’re done with your timesheet”.

Mikkelsen says that Timely is currently used by more than 4,000 paying businesses across 160 countries, and that having created a complete “virtual memory” of time data, the Oslo startup is developing new tools to improve the “quality of time” and help businesses use time more effectively. As part of this effort, Memory will use the new funding to double its current 30-person team. It also plans on refining Timely’s AI model and to accelerate international growth.

Powered by WPeMatico

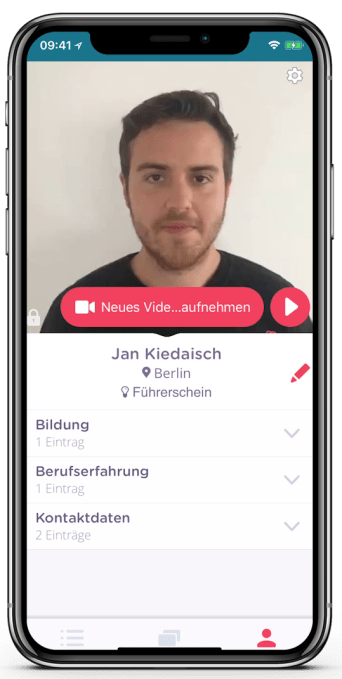

JobUFO, the Berlin-based startup that has built a video focussed app to help facilitate better job applications, has raised €2 million in seed funding. Leading the round is IBB and Hevella Capital, with the investment to be used for growth.

Claiming to re-invent the way companies handle the application process, JobUFO has developed an online/mobile application form that focuses on the personality of the candidate. This includes being asked to created a CV in a specific format and the ability to record or upload a personal application video. The JobUFO application form can be embedded anywhere online, such as a company’s career page or job ad, so that it becomes the preferred way to receive applications.

“The HR market is overloaded with too many information and recruiting tools,” JobUFO co-founder and CEO Thomas Paucker tells me when asked to describe the problem being tackled. “This makes it very hard to find the best process of applying to a job. That’s why everybody is writing the same motivational letters. You still need a laptop and there is no real first impression of yourself when you apply. Recruiters do not read motivational letters because someone else could have written it. The longer a recruiting process is, the higher the average dropout rate of an applicant”.

To remedy this, the JobUFO mobile app or web-version enables applicants to quickly create a “DIN-correct” CV in combination with a guided video of up to thirty seconds. Paucker says the idea is to be able to give a good first impression at the very moment the application is received. JobUFO powered applications are pushed directly into a company’s application tracking system via the JobUFO API.

To remedy this, the JobUFO mobile app or web-version enables applicants to quickly create a “DIN-correct” CV in combination with a guided video of up to thirty seconds. Paucker says the idea is to be able to give a good first impression at the very moment the application is received. JobUFO powered applications are pushed directly into a company’s application tracking system via the JobUFO API.

“Recruiters get more and reliable applications without changing their daily routine,” he says. “Applicants get recommendations based on big data and are guided nearly fully automatically during their whole work life. Additionally we automate the communication between those two groups to focus on the main goal: filling the vacancy with someone who fits and likes the job”.

To that end, in two years since being founded, JobUFO has grown its customer base to over 30 well-known companies operating in Germany. They include Deutsche Bahn, Edeka, Evonik, Hertz, and Ikea. In 2018 alone, over 60,000 applications have been generated.

“Digitalisation is changing the recruiting sector,” adds Paucker, noting that younger applicants have no prior knowledge of a more traditional application process and are much more akin to using consumer apps such as Instagram and YouTube. “Since we guide the applicants directly through the application process, JobUFO is particularly popular with this younger target group,” he says.

In addition, the “talking application photos” concept is resonating with recruiters and HR managers since the last mile to the applicant is often the most time-consuming and least scalable. “The company sees the video as well as the checked data of the applicant directly in its own applicant management system. For both sides, this is an uncomplicated process that continues to spur us on to expand,” says the JobUFO CEO.

Powered by WPeMatico

Only six months ago Barcelona-based TravelPerk bagged a $21 million Series B, off the back of strong momentum for a software as a service platform designed to take a Slack-like chunk out of the administrative tedium of arranging and expensing work trips.

Today the founders’ smiles are firmly back in place: TravelPerk has announced a $44 million Series C to keep stoking growth that’s seen it grow from around 20 customers two years ago to approaching 1,500 now. The business itself was only founded at the start of 2015.

Investors in the new round include Sweden’s Kinnevik, Russian billionaire and DST Global founder Yuri Milner and Tom Stafford, also of DST. Prior investors include the likes of Target Global, Felix Capital, Spark Capital, Sunstone, LocalGlobe and Amplo.

Commenting on the Series C in a statement, Kinnevik’s Chris Bischoff, said: “We are excited to invest in TravelPerk, a company that fits perfectly into our investment thesis of using technology to offer customers more and much better choice. Booking corporate travel is unnecessarily time-consuming, expensive and burdensome compared to leisure travel. Avi and team have capitalised on this opportunity to build the leading European challenger by focusing on a product-led solution, and we look forward to supporting their future growth.”

TravelPerk’s total funding to date now stands at almost $75 million. It’s not disclosing the valuation that its latest clutch of investors are stamping on its business but, with a bit of a chuckle, co-founder and CEO Avi Meir dubs it “very high.”

TravelPerk contends that a $1.3 trillion market is ripe for disruption because legacy business travel booking platforms are both lacking in options and roundly hated for being slow and horrible to use. (Hi Concur!)

Helping business save time and money using a slick, consumer-style trip booking platform that both packs in options and makes business travelers feel good about the booking process (i.e. rather than valueless cogs in a soul-destroying corporate ROI machine) is the general idea — an idea that’s seemingly catching on fast.

And not just with the usual suspect, early adopter, startup dog food gobblers but pushing into the smaller end of the enterprise market too.

“We kind of stumbled on the realization that our platform works for bigger companies than we thought initially,” says Meir. “So the users used to be small, fast-growing tech companies, like GetYourGuide, Outfittery, TypeForm etc… They’re early adopters, they’re tech companies, they have no fear of trying out tech — even for such a mission-critical aspect of their business… But then we got pulled into bigger companies. We recently signed FarFetch for example.”

Other smaller-sized enterprises that have signed up include the likes of Adyen, B&W, Uber and Aesop.

Companies small and big are, seemingly, united in their hatred of legacy travel booking platforms — and feeling encouraged to check out TravelPerk’s alternative, thanks to the SaaS being free to use and free from the usual contract lock ins.

TravelPerk’s freemium business model is based on taking affiliate commissions on bookings. Down the road, it also has its eye on generating a data-based revenue stream via paid-tier trip analytics.

Currently it reports booking revenues growing at 700 percent year on year. And Meir previously told us it’s on course to do $100 million GMV this year — which he confirms continues to be the case.

It also says it’s on track to complete bookings for one million travelers by next year. And it claims to be the fastest growing software as a service company in Europe, a region which remains its core market focus — though the new funding will be put toward market expansion.

And there is at least the possibility, according to Meir, that TravelPerk could actively expand outside Europe within the next 12 months.

“We definitely are looking at expansion outside of Europe as well. I don’t know yet if it’s going to be first U.S. — West or East — because there are opportunities in both directions,” he tells TechCrunch. “And we have customers; one of our largest customers is in Singapore. And we do have a growing amount of customers out of the U.S.”

Doubling down on growth within Europe is certainly on the slate, though, with a chunk of the Series C going to establish a number of new offices across the region.

Having more local bases to better serve customers is the idea. Meir notes that, perhaps unusually for a startup, TravelPerk has not outsourced customer support — but kept customer service in-house to try to maintain quality. (Which, in Europe, means having staff who can speak the local language.)

He also quips about the need for a travel business to serve up “human intelligence” — i.e. by using tech tools to slickly connect on-the-road customers with actual people who can quickly and smartly grapple with and solve problems, versus an automated AI response which is — let’s face it — probably the last thing any time-strapped business traveler wants when trying to get orientated fast and/or solve a snafu away from home.

“I wouldn’t use [human intelligence] for everything but definitely if people are on the road, and they need assistance, and they need to make changes, and you need to understand what they said…” argues Meir, going on to say ‘HI’ has been his response when investors asked why TravelPerk’s pitch deck doesn’t include the almost-impossible-to-avoid tech buzzword: “AI.”

“I think we are probably the only startup in the world right now that doesn’t have AI in the pitch deck somewhere,” he adds. “One of the investors asked about it and I said ‘well we have HI; it’s better’… We have human intelligence. Just people, and they’re smart.”

Also on the cards (it therefore follows): More hiring (the team is at ~150 now and Meir says he expects it to push close to 300 within 18 months), as well as continued investment on the product front, including in the mobile app, which was a late addition, only arriving this year.

The TravelPerk mobile app offers handy stuff like a one-stop travel itinerary, flight updates and a chat channel for support. But the desktop web app and core platform were the team’s first focus, with Meir arguing the desktop platform is the natural place for businesses to book trips.

This makes its mobile app more a companion piece — to “how you travel” — housing helpful additions for business travelers, as nice-to-have extras. “That’s what our app does really well,” he adds. “So we’re unusually contrarian and didn’t have a mobile app until this year… It was a pretty crazy bet but we really wanted to have a great web app experience.”

Much of TravelPerk’s early energy has clearly gone into delivering on the core product via nailing down the necessary partnerships and integrations to be able to offer such a large inventory — and thus deliver expanded utility versus legacy rivals.

As well as offering a clean-looking, consumer-style interface intended to do for business travel booking feels what Slack has done for work chat, the platform boasts a larger inventory than traditional players in the space, according to Meir — by plugging into major consumer providers such as Booking.com and Expedia.

The inventory also includes Airbnb accommodation (not just traditional hotels), while other partners on the flight side include Kayak and Skyscanner.

“We have not the largest bookable inventory in the world,” he claims. “We’re way larger than old-school competitors… We went through this licensing process which is almost as difficult as getting a banking license… which gives us the right to sell you the same product as travel agencies… Nobody in the world can sell you Kayak’s flights directly from their platform — so we have a way to do that.”

TravelPerk also recently plugged trains into its directly bookable options. This mode of transport is an important component of the European business travel market, where rail infrastructure is dense, highly developed and often very high-speed. (Which means it can be both the most convenient and environmentally friendly travel option to use.)

“Trains are pretty complex technically so we found a great partner,” notes Meir on that, listing major train companies including in Germany, Spain and Italy as among those it’s now able to offer direct bookings for via its platform.

On the product side, the team is also working on integrating travel and expenses management into the platform — to serve its growing numbers of (small) enterprise customers who need more than just a slick trip booking tool.

Meir says getting pulled to these bigger accounts is steering its European expansion — with part of the Series C going to fund a clutch of new offices around the region near where some of its bigger customers are based. Beginning in London, with Berlin, Amsterdam and Paris slated to follow soon.

What does the team attribute TravelPerk’s momentum to generally? It comes back to the pain, says Meir. Business travelers are being forced to “tolerate” horrible legacy systems. “So I think the pain-point is so visible and so clear [it sells itself],” he argues, also pointing out this is true for investors (which can’t have hurt TravelPerk’s funding pitch).

“In general we just built a great product and a great service, and we focused on this consumer angle — which is something that really connects well with what people want in this day and age,” he adds. “People want to use something that feels like Slack.”

For the Series C, Meir says TravelPerk was looking for investors who would be comfortable supporting the business for the long haul, rather than pushing for a quick sale. So they are now articulating the possibility of a future IPO.

And while he says TravelPerk hadn’t known much about Swedish investment firm Kinnevik prior to the Series C, Meir says he came away impressed with its focus on “global growth and ambition,” and the “deep pockets and the patience that comes with it.”

“We really aligned on this should be a global play, rather than a European play,” he adds. “We really connected on this should be a very, big independent business that goes to the path of IPO rather than a quick exit to one of the big players.

“So with them we buy patience, and also the condition, when offers do come onto the table, to say no to them.”

Given it’s been just a short six months between the Series B and C, is TravelPerk planning to raise again in the next 12 months?

“We’re never fundraising and we’re always fundraising I guess,” Meir responds on that. “We don’t need to fundraise for the next three years or so, so it will not come out of need, hopefully, unless something really unusual is happening, but it will come more out of opportunity and if it presented a way to grow even faster.

“I think the key here is how fast we grow. And how good a product we certify — and if we have an opportunity to make it even faster or better than we’ll go for it. But it’s not something that we’re actively doing it… So to all investors reading this piece don’t call me!” he adds, most likely inviting a tsunami of fresh investor pitches.

Discussing the challenges of building a business that’s so fast growing it’s also changing incredibly rapidly, Meir says nothing is how he imagined it would be — including fondly thinking it would be easier the bigger and better resourced the business got. But he says there’s an upside too.

“The challenges are just much, much bigger on this scale,” he says. “Numbers are bigger, you have more people around the table… I would say it’s very, very difficult and challenging but also extremely fun.

“So now when we release a feature it goes immediately into the hands of hundreds of thousands of travelers that use it every month. And when you fundraise… it’s much more fun because you have more leverage.

“It’s also fun because — and I don’t want to position myself as the cynical guy — the reality is that most startups don’t cure cancer, right. So we’re not saving the world… but in our little niche of business travel, which is still like $1.3 trillion per year, we are definitely making a dent.

“So, yes, it’s more challenging and difficult as you grow, and the problems become much bigger, but you can also deliver the feedback to more people.”

Powered by WPeMatico

Penta, the German fintech startup that offers a digital bank account targeting SMEs, has raised €7 million in Series A funding. Backing the company once again is Inception Capital, with total funding now at €10 million since Penta was founded in May 2016.

Launched in Germany in December, and powered by Banking-as-a-Platform solarisBank (rather than holding a banking license of its own), Penta is designed to meet the banking needs of small to medium-sized businesses, including startups.

The premise is that SMEs are currently underserved by incumbent banks, including account opening being cumbersome and much more difficult than it should be and exorbitant fees charged for making payments or international money exchange.

Penta is also bringing some much-need innovation and features to the German business banking market.

One of those is multi-card support to make it easier to manage company expenses. Dubbed ‘Team Access,’ the recently launched feature lets business owners issue multiple MasterCards to employees who need to make purchases on a company’s behalf.

Each card is linked to a business’ Penta account but can have custom rules and permissions per card/employee, in terms of how much money can be spent and where. More broadly, the feature is designed to cut down the time and cost of expense management for SMEs.

Notably, I’m told that the Berlin-based challenger bank, which has already grown to a team of 40 and plans to get to 100 over the next year, is seeing 68 percent of new customers switching from their existing business bank account, with the remaining 40 percent newly incorporated businesses.

That suggests many German businesses aren’t satisfied with the banking status quo, even if they’ve already crossed the account opening hurdle. Specifically, I understand that multi-card support has been one of the main draw, the kind of feature that older banks with legacy software often struggle to deliver.

Powered by WPeMatico

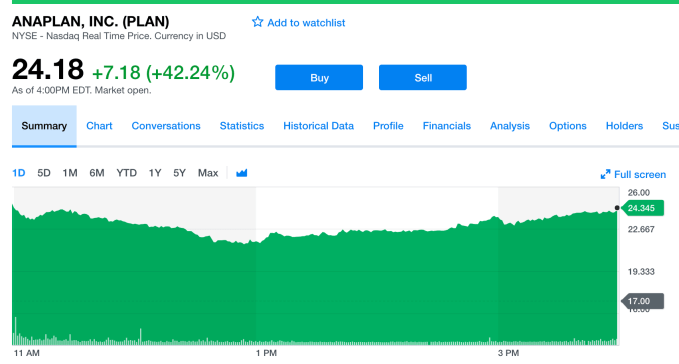

You might think that Anaplan CEO, Frank Calderoni would have had a few sleepless nights this week. His company picked a bad week to go public as market instability rocked tech stocks. Still he wasn’t worried, and today the company had by any measure a successful debut with the stock soaring up over 42 percent. As of 4 pm ET, it hit $24.18, up from the IPO price of $17. Not a bad way to launch your company.

Stock Chart: Yahoo Finance

“I feel good because it really shows the quality of the company, the business model that we have and how we’ve been able to build a growing successful business, and I think it provides us with a tremendous amount of opportunity going forward,” Calderoni told TechCrunch.

Calderoni joined the company a couple of years ago, and seemed to emerge from Silicon Valley central casting as former CFO at Red Hat and Cisco along with stints at IBM and SanDisk. He said he has often wished that there were a tool around like Anaplan when he was in charge of a several thousand person planning operation at Cisco. He indicated that while they were successful, it could have been even more so with a tool like Anaplan.

“The planning phase has not had much change in in several decades. I’ve been part of it and I’ve dealt with a lot of the pain. And so having something like Anaplan, I see it’s really being a disrupter in the planning space because of the breadth of the platform that we have. And then it goes across organizations to sales, supply chain, HR and finance, and as we say, really connects the data, the people and the plan to make for better decision making as a result of all that,” he said.

Calderoni describes Anaplan as a planning and data analysis tool. In his previous jobs he says that he spent a ton of time just gathering data and making sure they had the right data, but precious little time on analysis. In his view Anaplan, lets companies concentrate more on the crucial analysis phase.

“Anaplan allows customers to really spend their time on what I call forward planning where they can start to run different scenarios and be much more predictive, and hopefully be able to, as we’ve seen a lot of our customers do, forecast more accurately,” he said.

Anaplan was founded in 2006 and raised almost $300 million along the way. It achieved a lofty valuation of $1.5 billion in its last round, which was $60 million in 2017. The company has just under 1000 customers including Del Monte, VMware, Box and United.

Calderoni says although the company has 40 percent of its business outside the US, there are plenty of markets left to conquer and they hope to use today’s cash infusion in part to continue to expand into a worldwide company.

Powered by WPeMatico

Fresh off a $150 million round of funding, kids’ gaming platform Roblox is making its first acquisition. The company says it’s acquiring the small startup PacketZoom, bringing its team and technology in-house to help it improve mobile application performance as its platform expands further into worldwide markets.

Founded in 2013, and based in San Mateo, California, PacketZoom had raised a $5 million Series A late last year. The company combines a content delivery network (CDN) to speed up performance with an application performance management tool to identify issues in a single package, TechCrunch had explained at the time.

The company’s products allow developers access to analytics about the app and network-performance related issues, as well as optimize app delivery and content downloads – up to 2 to 3 times faster.

The system in particular is designed to overcome the limitations of slow and unreliable networks, like those found in emerging markets. It also helps to ensure faster and lower latency data transfers worldwide.

It’s clear how this acquisition makes sense for Roblox, which offers a platform where kids create and play in 3D worlds and games and has global expansion in mind. With PacketZoom integrated into its gaming platform, users will be able to join games faster and have a better experience when playing on mobile devices.

Roblox had said earlier this year it was cash-flow positive and continues to be profitable. It raised funds in order to stock its war chest and have a buffer, while focused on its international expansion efforts. It also said it would use the funds to make acquisitions and open offices outside the U.S. in some regions, like China.

PacketZoom had raised $11.2 million to date from investors including Founder Collective, Tandem Capital, First Round Capital, Baseline Ventures, Arafura Ventures, and others.

According to PacketZoom’s website, it was working with customers like Glu Mobile, Sephora, Photofy, Inshorts, Upwork, News Republic, Wave, Belcorp, GOTA, Netmeds, Houzify, Wooplr, Fluik Entertainment, Wondermall, and others. These relationships will be wound down, as Roblox plans to only use the IP internally, not to support other customers.

Roblox declined to speak to the acquisition price, but notes it was an all-cash deal. It includes all of PacketZoom’s IP and code. PacketZoom’s founder and CTO, Chetan Ahuja, along with the PacketZoom’s four-person engineering team will join Roblox.

Powered by WPeMatico

New Relic, a provider of analytics and monitoring around a company’s internal and external facing apps and services to help optimise their performance, is making an acquisition today as it continues to expand a newer area of its business, containers and microservices. The company has announced that it has purchased CoScale, a provider of monitoring for containers and microservices, with a specific focus on Kubernetes.

Terms of the deal — which will include the team and technology — are not being disclosed, as it will not have a material impact on New Relic’s earnings. The larger company is traded on the NYSE (ticker: NEWR) and has been a strong upswing in the last two years, and its current market cap its around $4.6 billion.

Originally founded in Belgium, CoScale had raised $6.4 million and was last valued at $7.9 million, according to PitchBook. Investors included Microsoft (via its ScaleUp accelerator), PMV and the Qbic Fund, two Belgian investors.

“We are thrilled to bring CoScale’s knowledge and deeply technical team into the New Relic fold,” noted Ramon Guiu, senior director of product management at New Relic. “The CoScale team members joining New Relic will focus on incorporating CoScale’s capabilities and experience into continuing innovations for the New Relic platform.”

The deal underscores how New Relic has had to shift in the last couple of years: when the company was founded years ago, application monitoring was a relatively easy task, with the web and a specified number of services the limit of what needed attention. But services, apps and functions have become increasingly complex and now tap data stored across a range of locations and devices, and processing everything generates a lot of computing demand.

New Relic first added container and microservices monitoring to its stack in 2016. That’s a somewhat late arrival to the area, New Relic CEO Lew Cirne believes that it’s just at the right time, dovetailing New Relic’s changes with wider shifts in the market.

‘We think those changes have actually been an opportunity for us to further differentiate and further strengthen our thesis that the New Relic way is really the most logical way to address this,” he told my colleague Ron Miller last month. As Ron wrote, Cirne’s take is that New Relic has always been centered on the code, as opposed to the infrastructure where it’s delivered, and that has helped it make adjustments as the delivery mechanisms have changed.

New Relic already provides monitoring for Kubernetes, Google Kubernetes Engine (GKE), Amazon Elastic Container Service for Kubernetes (EKS), Microsoft Azure Kubernetes Service (AKS), and RedHat Openshift, and the idea is that CoScale will help it ramp up across that range, while also adding Docker and OpenShift to the mix, as well as offering new services down the line to serve the DevOps community.

“The visions of New Relic and CoScale are remarkably well aligned, so our team is excited that we get to join New Relic and continue on our journey of helping companies innovate faster by providing them visibility into the performance of their modern architectures,” said CoScale CEO Stijn Polfliet, in a statement. “[Co-founder] Fred [Ryckbosch] and I feel like this is such an exciting space and time to be in this market, and we’re thrilled to be teaming up with the amazing team at New Relic, the leader in monitoring modern applications and infrastructure.”

Powered by WPeMatico

Enterprise cloud service management company ServiceNow announced today that it will acquire FriendlyData and integrate the startup’s natural language search technology into apps on its Now platform. Founded in 2016, FriendlyData’s natural language query (NLQ) technology enables enterprise customers to build search tools that allow users to ask technical questions even if they don’t know the right jargon.

FriendlyData’s NLQ tech figures out what they are trying to say and then answers with text responses or easy-to-understand data visualizations. ServiceNow said it will integrate FriendlyData’s tech into the Now Platform, which includes apps for IT, human resources, security operations, and customer service management. It will also be available in products for developers and ServiceNow’s partners.

In a statement, Pat Casey, senior vice president of development and operations at ServiceNow, said “ServiceNow is bringing NLQ capabilities to the Now Platform, enabling companies to ask technical questions in plain English and receive direct answers. With this technical enhancement, our goal is to allow anyone to easily make data driven decisions, increasing productivity and driving businesses forward faster.”

The acquisition of FriendlyData is the latest in ServiceNow’s initiative to reduce the friction of support requests within organizations with AI-based tools. For example, it launched a chatbot-building tools called Virtual Agent in May, which enables companies to create custom chatbots for services like Slack or Microsoft Teams to automatically handle routine inquiries such as equipment requests. It also announced the acquisition of Parlo, a chatbot startup, around the same time.

Powered by WPeMatico

French startup Skello just raised a $6.9 million funding round (€6 million) from Aglaé Ventures, XAnge, Jean-Baptiste Rudelle and existing investors Thomas Landais, Guillaume le Dieu de Ville and Gilles Blanchard.

The startup is helping bar, restaurant and hotel managers keep track of all the shifts and staffing issues. Skello uses a software-as-a-service approach to help you save time on pesky admin tasks.

After setting up your rules, you can easily generate shifts. Waiters, receptionists and other staff members receive their schedule via email and SMS. Employees can also request shift changes, say when they’re unavailable and make sure everything is taken into account.

At the end of the month, Skello can generate detailed reports with bonuses, leaves, etc. Everything is then exported to payroll solutions. And of course, Skello helps you visualize how much you’re spending on staff, if you’re keeping costs under control and more.

There are many companies trying to do the same thing. But in reality many bars and restaurants still rely on Excel. Chances are it works quite well if you’re running a small business. But it doesn’t scale well. 30,000 employees are now using Skello every day. Alain Ducasse, Planet Sushi and AccorHotels’ Ibis are using Skello.

With today’s funding round, the company first wants to expand to new categories, such as retail and healthcare. Skello then plans to expand to other European countries.

Powered by WPeMatico