Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Concord is raising a new $25 million funding round led by Tenaya Capital, with existing investors CRV and Alven also participating. The company is building a platform that makes it easier to manage your contracts all the way from writing them to signing them.

Even if you used a service like DocuSign to sign a contract in the past, chances are you or the sender used Microsoft Word to write the contract. It’s fine if you’re the only one working on this contract. But it can quickly become a mess as your legal team gets larger.

“It’s ultimately bringing a B2C experience to a really complex B2B experience,” VP of Marketing Travis Bickham told me.

And one of the company’s main challenge has been to make it convenient for all teams in your organization. If you work in human resources, you’re dealing with HR contracts. If you’re an office manager, you may need to sign a contract to order a new fridge. If you’re on the sales team, you want to make sure your client signs a contract. The procurement team also wants some sort of legal proof from its partners. And the list goes on.

Concord lets you create templates and workflows. For instance, the most basic contracts don’t require the same attention to details. A non-disclosure agreement is pretty standard. You just have to replace some fields and make the person sign it.

You can create an approval process for more complicated contracts. For instance, you can say that the legal team has to approve any sales contract above $100,000.

Concord has also built integrations with third-party tools. For instance, you can generate a contract in Salesforce using Concord’s integration.

There are currently 80 people working for Concord in San Francisco and Paris. With today’s funding round, the company plans to hire more people, get more clients, target bigger companies, etc. Concord currently works with 200,000 companies.

Powered by WPeMatico

With its latest $34 billion acquisition of Red Hat, IBM may have found something more elementary than “Watson” to save its flagging business.

Though the acquisition of Red Hat is by no means a guaranteed victory for the Armonk, N.Y.-based computing company that has had more downs than ups over the five years, it seems to be a better bet for “Big Blue” than an artificial intelligence program that was always more hype than reality.

Indeed, commentators are already noting that this may be a case where IBM finally hangs up the Watson hat and returns to the enterprise software and services business that has always been its core competency (albeit one that has been weighted far more heavily on consulting services — to the detriment of the company’s business).

Also read as IBM taps out on Watson as its growth engine and returns to basics ie financial engineering and distribution https://t.co/nD7gHyYhQf

— Sunil Rawat (@_sunilrawat) October 28, 2018

Watson, the business division focused on artificial intelligence whose public claims were always more marketing than actually market-driven, has not performed as well as IBM had hoped and investors were losing their patience.

Critics — including analysts at the investment bank Jefferies (as early as one year ago) — were skeptical of Watson’s ability to deliver IBM from its business woes.

As we wrote at the time:

Jefferies pulls from an audit of a partnership between IBM Watson and MD Anderson as a case study for IBM’s broader problems scaling Watson. MD Anderson cut its ties with IBM after wasting $60 million on a Watson project that was ultimately deemed, “not ready for human investigational or clinical use.”

The MD Anderson nightmare doesn’t stand on its own. I regularly hear from startup founders in the AI space that their own financial services and biotech clients have had similar experiences working with IBM.

The narrative isn’t the product of any single malfunction, but rather the result of overhyped marketing, deficiencies in operating with deep learning and GPUs and intensive data preparation demands.

That’s not the only trouble IBM has had with Watson’s healthcare results. Earlier this year, the online medical journal Stat reported that Watson was giving clinicians recommendations for cancer treatments that were “unsafe and incorrect” — based on the training data it had received from the company’s own engineers and doctors at Sloan-Kettering who were working with the technology.

All of these woes were reflected in the company’s latest earnings call where it reported falling revenues primarily from the Cognitive Solutions business, which includes Watson’s artificial intelligence and supercomputing services. Though IBM chief financial officer pointed to “mid-to-high” single digit growth from Watson’s health business in the quarter, transaction processing software business fell by 8% and the company’s suite of hosted software services is basically an afterthought for business gravitating to Microsoft, Alphabet, and Amazon for cloud services.

To be sure, Watson is only one of the segments that IBM had been hoping to tap for its future growth; and while it was a huge investment area for the company, the company always had its eyes partly fixed on the cloud computing environment as it looked for areas of growth.

It’s this area of cloud computing where IBM hopes that Red Hat can help it gain ground.

“The acquisition of Red Hat is a game-changer. It changes everything about the cloud market,” said Ginni Rometty, IBM Chairman, President and Chief Executive Officer, in a statement announcing the acquisition. “IBM will become the world’s number-one hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses.”

The acquisition also puts an incredible amount of marketing power behind Red Hat’s various open source services business — giving all of those IBM project managers and consultants new projects to pitch and maybe juicing open source software adoption a bit more aggressively in the enterprise.

As Red Hat chief executive Jim Whitehurst told TheStreet in September, “The big secular driver of Linux is that big data workloads run on Linux. AI workloads run on Linux. DevOps and those platforms, almost exclusively Linux,” he said. “So much of the net new workloads that are being built have an affinity for Linux.”

Powered by WPeMatico

After rumors flew around this weekend, IBM today confirmed that it would acquire open source, cloud software business Red Hat for $190 per share in cash, working out to a total value of $34 billion. IBM said the deal has already been approved by the boards of directors of both IBM and Red Hat but is still subject to Red Hat shareholder and regulatory approvals. If all goes as planned, the acquisition is expected to close in the latter half of 2019.

The deal is all about IBM, which has long continued to rely on its legacy server business, taking a bigger bet on the cloud, and very specifically cloud services that blend on-premises and cloud-based architectures — something that the two companies have already been working on together since May of this year (which now might be looked at as a test drive). Red Hat will be a distinct unit within IBM’s Hybrid Cloud team — which is already a $19 billion business for IBM, the company said — and it will continue to focus on open-source software.

“The acquisition of Red Hat is a game-changer. It changes everything about the cloud market,” said Ginni Rometty, IBM Chairman, President and Chief Executive Officer, in a statement. “IBM will become the world’s number-one hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses.”

The combined businesses will be able to offer software in services spanning Linux, containers, Kubernetes, multi-cloud management, and cloud management and automation, IBM said. IBM also added that together the companies will continue to build partnerships with multiple cloud providers, including AWS, Microsoft’s Azure, Google Cloud, Alibaba and others, alongside the IBM Cloud.

As Josh Constine notes here, it’s one of the biggest-ever tech acquisitions, and arguably the biggest that is dedicated primarily to software. (Dell acquired EMC for $67 billion, to pick up software but also a substantial hardware and storage business.)

While companies like Amazon have gone all-in on cloud, in many cases, a lot of enterprises are making the move gradually — IBM cites stats that estimate that some 80 percent of business workloads “have yet to move to the cloud, held back by the proprietary nature of today’s cloud market.” Buying Red Hat will help IBM better tap into an opportunity to address that.

“Most companies today are only 20 percent along their cloud journey, renting compute power to cut costs,” she continued. “The next 80 percent is about unlocking real business value and driving growth. This is the next chapter of the cloud. It requires shifting business applications to hybrid cloud, extracting more data and optimizing every part of the business, from supply chains to sales.”

On top of that, it will give IBM a much stronger footing in open source software, the core of what Red Hat builds and deploys today.

“Open source is the default choice for modern IT solutions, and I’m incredibly proud of the role Red Hat has played in making that a reality in the enterprise,” said Jim Whitehurst, President and CEO, Red Hat, in a statement. “Joining forces with IBM will provide us with a greater level of scale, resources and capabilities to accelerate the impact of open source as the basis for digital transformation and bring Red Hat to an even wider audience – all while preserving our unique culture and unwavering commitment to open source innovation.”

While IBM competes against the likes of Amazon, the companies will see to remain partners with them with this acquisition. “IBM is committed to being an authentic multi-cloud provider, and we will prioritize the use of Red Hat technology across multiple clouds” said Arvind Krishna, Senior Vice President, IBM Hybrid Cloud, in a statement. “In doing so, IBM will support open source technology wherever it runs, allowing it to scale significantly within commercial settings around the world.”

IBM said that Red Hat will add to its revenue growth, gross margin and free cash flow within 12 months of closing.

Powered by WPeMatico

After getting EU approval a week ago, today Microsoft’s acquisition of GitHub, the Git-based code sharing and collaboration service with 31 million developers, has officially closed. The Redmond, WA-based software behemoth first said it would acquire GitHub for $7.5 billion in stock in June of this year, and after the acquisition closed it would continue to run it as an independent platform and business.

The acquisition is yet another sign of how Microsoft has been doubling down on courting developers and presenting itself as a neutral partner to help them with their projects.

That is because, despite its own very profitable proprietary software business, Microsoft also has a number of other businesses — for example, Azure, which competes with AWS and Google Cloud — that rely heavily on it being unbiased towards one platform or another. And GitHub, Microsoft hopes, will be another signal to the community of that position.

In that regard, it will be an interesting credibility test for the companies.

As previously announced, Nat Friedman, who had been the CEO of Xamarin (another developer-focused startup acquired by Microsoft, in 2016), will be CEO of the company, while GitHub founder and former CEO Chris Wanstrath will become a Microsoft technical fellow to work on strategic software initiatives. (Wanstrath had come back to his CEO role after his co-founder Tom Preston-Werner resigned following a harassment investigation in 2014.)

Friedman, in a short note, said that he will be taking over on Monday, and he also repeated what Microsoft said at the time of the deal: GitHub will be run as an independent platform and business.

This is a key point because there has been a lot of developer backlash over the deal, with many asking if GitHub would become partial or focused more around Microsoft-based projects or products.

“We will always support developers in their choice of any language, license, tool, platform, or cloud,” he writes, noting that there will be more tools to come. “We will continue to build tasteful, snappy, polished tools that developers love,” he added.

One of those, he noted, will be further development and investment in Paper Cuts, a project it launched in August that it hopes will help address some of the gripes that its developer-users might have with how GitHub works that the company itself hadn’t been planning to address in bigger product upgrades. The idea here is that GitHub can either help find workarounds, or this will become a feedback forum of its own to help figure out what it should be upgrading next on the site.

Of course, the need to remain neutral is not just to keep hold of its 31 million developers (up by 3 million since the deal was first announced), but to keep them from jumping to GitHub competitors, which include GitLab and Bitbucket.

Powered by WPeMatico

The dev team that’s now engineering the Fleksy keyboard app has raised more than $800,000 via an equity crowdfunding route.

As we reported a year ago, the development of Fleksy’s keyboard has been taken over by the Barcelona-based startup behind an earlier keyboard app called ThingThing.

The team says their new funding raise — described as a pre-Series A round — will be put towards continued product development of the Fleksy keyboard, including the core AI engine used for next word and content prediction, plus additional features being requested by users — such as swipe to type.

Support for more languages is also planned. (Fleksy’s Android and iOS apps are currently available in 45+ languages.)

Their other big push will be for growth: Scaling the user-base via a licensing route to market in which the team pitches Android OEMs on the benefits of baking Fleksy in as the default keyboard — offering a high degree of customization, alongside a feature-set that boasts not just speedy typing but apps within apps and extensions.

The Fleksy keyboard can offer direct access to web search within the keyboard, for example, as well as access to third party apps (in an apps within apps play) — to reduce the need for full app switching.

This was the original concept behind ThingThing’s eponymous keyboard app, though the team has refocused efforts on Fleksy. And bagged their first OEMs as licensing partners.

They’ve just revealed Palm as an early partner. The veteran brand unveiled a dinky palm-sized ‘ultra-mobile’ last week. The tiny extra detail is that the device runs a custom version of the Fleksy keyboard out of the box.

With just 3.3 inches of screen to play with, the keyboard on the Palm risks being a source of stressful friction. Ergo enter Fleksy, with gesture based tricks to speed up cramped typing, plus tried and tested next-word prediction.

ThingThing CEO Olivier Plante says Palm was looking for an “out of the box optimized input method” — and more than that “high customization”.

“We’re excited to team up with ThingThing to design a custom keyboard that delivers a full keyboard typing experience for Palm’s ultra mobile form factor,” adds Dennis Miloseski, co-founder of Palm, in a statement. “Fleksy enables gestures and voice-to-text which makes typing simple and convenient for our users on the go.”

Plante says Fleksy has more OEM partnerships up its sleeve too. “We’re pending to announce new partnerships very soon and grow our user base to more than 25 million users while bringing more revenue to the medium and small OEMs desperately looking to increase their profit margins — software is the cure,” he tells TechCrunch.

ThingThing is pitching itself as a neutral player in the keyboard space, offering OEMs a highly tweakable layer where the Qwerty sits as its strategy to compete with Android’s keyboard giants: Google’s Gboard and Microsoft-owned SwiftKey.

“We changed a lot of things in Fleksy so it feels native,” says Plante, discussing the Palm integration. “We love when the keyboard feels like the brand and with Palm it’s completely a Palm keyboard to the end-user — and with stellar performance on a small screen.”

“We’ve beaten our competitor to the punch,” he adds.

That said, the tiny Palm (pictured in the feature image at the top of this post) is unlikely to pack much of a punch in marketshare terms. While Palm is a veteran — and, to nerds, almost cult — brand it’s not even a mobile tiddler in smartphone marketshare terms.

Palm’s cute micro phone is also an experimental attempt to create a new mobile device category — a sort of netbook-esque concept of an extra mobile that’s extra portable — which looks unlikely to be anything other than extremely niche. (Added to its petite size, the Palm is a Verizon exclusive.)

Even so ThingThing is talking bullishly of targeting 550M devices using its keyboard by 2020.

At this stage its user-base from pure downloads is also niche: Just over 1M active users. But Plante says it has already closed “several phone brands partnerships” — saying three are signed, with three more in the works — claiming this will make Fleksy the default input method in more than 20-30 million active users in the coming months.

He doesn’t name any names but describes these other partners as “other major phone brands”.

The plan to grow Fleksy’s user-base via licensing has attracted wider investor backing now, via the equity crowdfunding route. The team had initially been targeting ($300k). In all they’ve secured $815,119 from 446 investors.

Plante says they went down the equity crowdfunding route to spread their pitch more widely, and get more ambassadors on board — as well as to demonstrate “that we’re a user-centric/people/independen

“We are keen to work and fully customize the keyboard to the OEM tastes. We know this is key for them so they can better compete against the others on more than simply the hardware,” he says, making the ‘Fleksy for OEMs’ pitch. “Today, the market is saturated with yet another box, better camera and better screen…. the missing piece in Android ecosystem is software differences.”

Given how tight margins remain for Android makers it remains to be seen how many will bite. Though there’s a revenue share arrangement that sweetens the deal.

It is also certainly true that differentiation in the Android space is a big problem. That’s why Palm is trying its hand at a smaller form factor — in a leftfield attempt to stand out by going small.

The European Union’s recent antitrust ruling against Google’s Android OS has also opened up an opportunity for additional software customization, via unbundled Google apps. So there’s at least a chance for some new thinking and ideas to emerge in the regional Android smartphone space. And that could be good for Spain-based ThingThing.

Aside from the licensing fee, the team’s business model relies on generating revenue via affiliate links and its fleksyapps platform. ThingThing then shares revenue with OEM partners, so that’s another carrot for them — offering a services topper on their hardware margin.

Though that piece will need scale to really spin up. Hence ThingThing’s user target for Fleksy being so big and bold.

“We’re working with brands in order to bring them into any apps where you type, which unlocks brand new use cases and enables the user to share conveniently and the brand to drive mobile traffic to their service,” says Plante. “On this note, we monetize via affiliate/deep linking and operating a fleksyapps Store.”

ThingThing has also made privacy by design a major focus — which is a key way it’s hoping to make the keyboard app stand out against data-mining big tech rivals.

Powered by WPeMatico

We already knew that the electronic scooter space in Europe was heating up, with Berlin’s Tier announcing today it has raised €25 million in a round led by Northzone, and rumours circulating that Delivery Hero founder Lukasz Gadowski has ventured into the space — all within the context of U.S. companies Bird and Lime recently expanding to Europe. However, now it seems that Balderton Capital could be about to make its move by investing in Sweden’s VOI Technology, another e-scooter rental play with pan-European ambitions.

According to multiple sources, the London-based venture capital firm is gearing up to lead a round in Stockholm-based VOI. Two sources say the amount being invested is $15 million at a pre-money valuation of between $35-40 million, while another source said it could be as much as $25 million. Separately, I’m hearing that with multiple term sheets on the table and the pace at which the company is growing, VOI is actually considering increasing the round to $50 million.

Other VC firms thought to be participating are Berlin’s Project A, and Netherlands-based Prime Ventures.

To date, VOI has raised just shy of $3 million in seed funding from Vostok New Ventures.

I contacted Balderton Capital earlier today, but haven’t heard back. A spokesperson for Project A also declined to comment. Neither Prime Ventures or VOI could be reached at the time of publication.

What is particularly noteworthy about Balderton’s entrance into the e-scooter market is that three of the other “big four” London VC firms have already made U.S. investments in the space. Index and Accel have backed Bird, and Atomico has backed Lime.

As I noted in my earlier Tier funding story — which marked the biggest financial backing for a European company in the space to date — this isn’t stopping a number of European investors getting busy trying to create the “Bird or Lime of Europe,” even if it is far from clear that Bird or Lime won’t take that title for themselves (which is obviously the bet being made by Index, Accel and Atomico). The general sentiment of European VCs steadfastly trying to nurture a European born competitor is that they don’t want to see the e-scooter rental market be rolled over by the U.S. in the same way that Uber rode in and knocked out many local players.

As I noted in my earlier Tier funding story — which marked the biggest financial backing for a European company in the space to date — this isn’t stopping a number of European investors getting busy trying to create the “Bird or Lime of Europe,” even if it is far from clear that Bird or Lime won’t take that title for themselves (which is obviously the bet being made by Index, Accel and Atomico). The general sentiment of European VCs steadfastly trying to nurture a European born competitor is that they don’t want to see the e-scooter rental market be rolled over by the U.S. in the same way that Uber rode in and knocked out many local players.

With that said, the worse-case scenario in the eyes of many of those same VCs (and those VCs standing on the sidelines not participating) is that Bird or Lime will eventually acquire the most promising European e-scooter company or companies. In other words, the downside is mitigated somewhat, failing an outright home run.

Meanwhile, Tier, VOI and Gadowski’s Go Flash aren’t the only European born e-scooter startups with pan-European ambitions. There’s also Coup, an e-scooter subsidiary owned by Bosch and backed by BCG Digital Ventures that operates in Berlin, Paris and Madrid. And just two month’s ago Taxify announced its intention to do e-scooter rentals under the brand Bolt, first launched in Paris but also planning to be pan-European, including Germany.

Not that everyone is convinced. Two early-stage European VCs I spoke to today said they hated the space. “I just don’t understand, isn’t it going to be a massive bloodbath?” said one of the VCs, before questioning the total number of rides we could see in Europe annually. “I just don’t see how Europe is going to produce multiple multibillion dollar businesses in this space. I think the market size caps it.”

Powered by WPeMatico

Berlin-based startup GoEuro just raised a new $150 million funding round from Kinnevik and Temasek, with Hillhouse Capital also participating. According to Crunchbase, the company has raised nearly $300 million to date.

Chances are you’ve used some sort of flight aggregator before to compare prices and find the best deal. But if you live in Europe, this isn’t enough. Sometimes, you want to compare flights with trains and buses.

GoEuro allows you to do just that. After entering two cities, you can compare all possible routes and book a ticket.

This is a tedious problem as there are countless airlines, train and bus companies. But it is also a different offering compared to all the flight aggregators out there.

You can see why investors see some value in GoEuro. Transportation in Europe is fragmented. You can make direct bookings with 80 percent of transport providers on GoEuro. It creates an important barrier to entry for other aggregators. In other words, in addition to generating revenue from ticket sales, GoEuro’s technology platform is valuable by itself.

GoEuro operates in 36 European countries and works with all transportation providers in 15 markets. In fact, GoEuro recently acquired BusRadar to improve bus search results. 27 million people use GoEuro every month.

Powered by WPeMatico

Oracle today announced that it has made another acquisition, this time to enhance both the kind of data that it can provide to its business customers, and its artificial intelligence capabilities: it is buying DataFox, a startup that has amassed a huge company database — currently covering 2.8 million public and private businesses, adding 1.2 million each year — and uses AI to analyse that to make larger business predictions. The business intelligence resulting from that service can in turn be used for a range of CRM-related services: prioritising sales accounts, finding leads, and so on.

“The combination of Oracle and DataFox will enhance Oracle Cloud Applications with an extensive set of AI-derived company-level data and signals, enabling customers to reach even better decisions and business outcomes,” noted Steve Miranda, EVP of applications development at Oracle, in a note to DataFox customers announcing the deal. He said that DataFox will sit among Oracle’s existing portfolio of business planning services like ERP, CX, HCM and SCM. “Together, Oracle and DataFox will enrich cloud applications with AI-driven company-level data, powering recommendations to elevate business performance across the enterprise.”

Terms of the deal do not appear to have been disclosed but we are trying to find out. DataFox — which launched in 2014 as a contender in the TC Battlefield at Disrupt — had raised just under $19 million and was last valued at $33 million back in January 2017, according to PitchBook. Investors in the company included Slack, GV, Howard Linzon, and strategic investor Goldman Sachs among others.

Oracle said that it is not committing to a specific product roadmap for DataFox longer term, but for now it will be keeping the product going as is for those who are already customers. The startup counted Goldman Sachs, Bain & Company and Twilio among those using its services.

The deal is interesting for a couple of reasons. First, it shows that larger platform providers are on the hunt for more AI-driven tools to provide an increasingly sophisticated level of service to customers. Second, in this case, it’s a sign of how content remains a compelling proposition, when it is presented and able to be manipulated for specific ends. Many customer databases can get old and out of date, so the idea of constantly trawling information sources in order to create the most accurate record of businesses possible is a very compelling idea to anyone who has faced the alternative, and that goes even more so in sales environments when people are trying to look their sharpest.

It also shows that, although both companies have evolved quite a lot, and there are many other alternatives on the market, Oracle remains in hot competition with Salesforce for customers and are hoping to woo and keep more of them with the better, integrated innovations. That also points to Oracle potentially cross and up-selling people who come to them by way of DataFox, which is an SaaS that pitches itself very much as something anyone can subscribe to online.

Powered by WPeMatico

Silicon Valley is in the midst of a health craze, and it is being driven by “Eastern” medicine.

It’s been a record year for US medical investing, but investors in Beijing and Shanghai are now increasingly leading the largest deals for US life science and biotech companies. In fact, Chinese venture firms have invested more this year into life science and biotech in the US than they have back home, providing financing for over 300 US-based companies, per Pitchbook. That’s the story at Viela Bio, a Maryland-based company exploring treatments for inflammation and autoimmune diseases, which raised a $250 million Series A led by three Chinese firms.

Chinese capital’s newfound appetite also flows into the mainland. Business is booming for Chinese medical startups, who are also seeing the strongest year of venture investment ever, with over one hundred companies receiving $4 billion in investment.

As Chinese investors continue to shift their strategies towards life science and biotech, China is emphatically positioning itself to be a leader in medical investing with a growing influence on the world’s future major health institutions.

We like to talk about things we can interact with or be entertained by. And so as nine-figure checks flow in and out of China with stunning regularity, we fixate on the internet giants, the gaming leaders or the latest media platform backed by Tencent or Alibaba.

However, if we follow the money, it’s clear that the top venture firms in China have actually been turning their focus towards the country’s deficient health system.

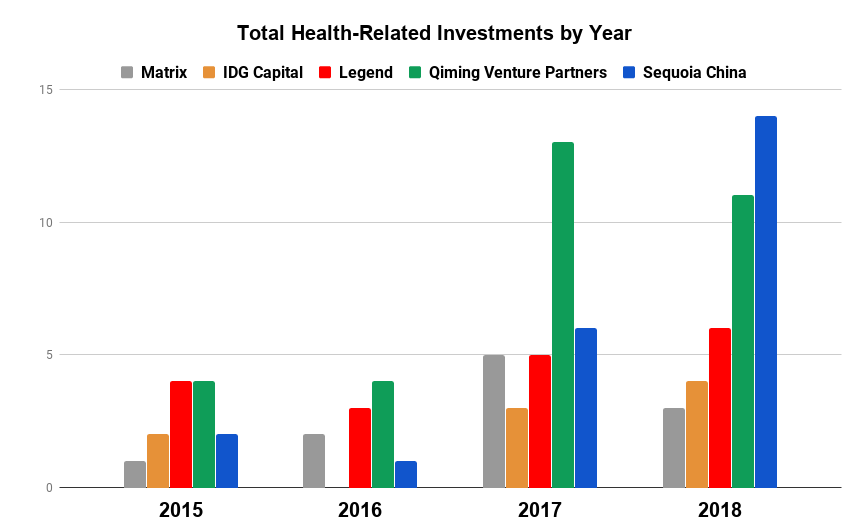

A clear leader in China’s strategy shift has been Sequoia Capital China, one of the country’s most heralded venture firms tied to multiple billion-dollar IPOs just this year.

Historically, Sequoia didn’t have much interest in the medical sector. Health was one of the firm’s smallest investment categories, and it participated in only three health-related deals from 2015-16, making up just 4% of its total investing activity.

Recently, however, life sciences have piqued Sequoia’s fascination, confirms a spokesperson with the firm. Sequoia dove into six health-related deals in 2017 and has already participated in 14 in 2018 so far. The firm now sits among the most active health investors in China and the medical sector has become its second biggest investment area, with life science and biotech companies accounting for nearly 30% of its investing activity in recent years.

Health-related investment data for 2015-18 compiled from Pitchbook, Crunchbase, and SEC Edgar

There’s no shortage of areas in need of transformation within Chinese medical care, and a wide range of strategies are being employed by China’s VCs. While some investors hope to address influenza, others are focused on innovative treatments for hypertension, diabetes and other chronic diseases.

For instance, according to the Chinese Journal of Cancer, in 2015, 36% of world’s lung cancer diagnoses came from China, yet the country’s cancer survival rate was 17% below the global average. Sequoia has set its sights on tackling China’s high rate of cancer and its low survival rate, with roughly 70% of its deals in the past two years focusing on cancer detection and treatment.

That is driven in part by investments like the firm’s $90 million Series A investment into Shanghai-based JW Therapeutics, a company developing innovative immunotherapy cancer treatments. The company is a quintessential example of how Chinese VCs are building the country’s next set of health startups using their international footprints and learnings from across the globe.

Founded as a joint-venture offshoot between US-based Juno Therapeutics and China’s WuXi AppTec, JW benefits from Juno’s experience as a top developer of cancer immunotherapy drugs, as well as WuXi’s expertise as one of the world’s leading contract research organizations, focusing on all aspects of the drug R&D and development cycle.

Specifically, JW is focused on the next-generation of cell-based immunotherapy cancer treatments using chimeric antigen receptor T-cell (CAR-T) technologies. (Yeah…I know…) For the WebMD warriors and the rest of us with a medical background that stopped at tenth-grade chemistry, CAR-T essentially looks to attack cancer cells by utilizing the body’s own immune system.

Past waves of biotech startups often focused on other immunologic treatments that used genetically-modified antibodies created in animals. The antibodies would effectively act as “police,” identifying and attaching to “bad guy” targets in order to turn off or quiet down malignant cells. CAR-T looks instead to modify the body’s native immune cells to attack and kill the bad guys directly.

Chinese VCs are investing in a wide range of innovative life science and biotech startups. (Photo by Eugeneonline via Getty Images)

The international and interdisciplinary pedigree of China’s new medical leaders not only applies to the organizations themselves but also to those running the show.

At the helm of JW sits James Li. In a past life, the co-founder and CEO held stints as an executive heading up operations in China for the world’s biggest biopharmaceutical companies including Amgen and Merck. Li was also once a partner at the Silicon Valley brand-name investor, Kleiner Perkins.

JW embodies the benefits that can come from importing insights and expertise, a practice that will come to define the companies leading the medical future as the country’s smartest capital increasingly finds its way overseas.

Despite heavy investment by China’s leading VCs, Silicon Valley is doubling down in the US health sector. (AFP PHOTO / POOL / JASON LEE)

Innovation in medicine transcends borders. Sickness and death are unfortunately universal, and groundbreaking discoveries in one country can save lives in the rest.

The boom in China’s life science industry has left valuations lofty and cross-border investment and import regulations in China have improved.

As such, Chinese venture firms are now increasingly searching for innovation abroad, looking to capitalize on expanding opportunities in the more mature US medical industry that can offer innovative technologies and advanced processes that can be brought back to the East.

In April, Qiming Venture Partners, another Chinese venture titan, closed a $120 million fund focused on early-stage US healthcare. Qiming has been ramping up its participation in the medical space, investing in 24 companies over the 2017-18 period.

New firms diving into the space hasn’t frightened the Bay Area’s notable investors, who have doubled down in the US medical space alongside their Chinese counterparts.

Partner directories for America’s most influential firms are increasingly populated with former doctors and medically-versed VCs who can find the best medical startups and have a growing influence on the flow of venture dollars in the US.

At the top of the list is Krishna Yeshwant, the GV (formerly Google Ventures) general partner leading the firm’s aggressive push into the medical industry.

Krishna Yeshwant (GV) at TechCrunch Disrupt NY 2017

A doctor by trade, Yeshwant’s interest runs the gamut of the medical spectrum, leading investments focusing on anything from real-time patient care insights to antibody and therapeutic technologies for cancer and neurodegenerative disorders.

Per data from Pitchbook and Crunchbase, Krishna has been GV’s most active partner over the past two years, participating in deals that total over a billion dollars in aggregate funding.

Backed by the efforts of Yeshwant and select others, the medical industry has become one of the most prominent investment areas for Google’s venture capital arm, driving roughly 30% of its investments in 2017 compared to just under 15% in 2015.

GV’s affinity for medical-investing has found renewed life, but life science is also part of the firm’s DNA. Like many brand-name Valley investors, GV founder Bill Maris has long held a passion for the health startups. After leaving GV in 2016, Maris launched his own fund, Section 32, focused specifically on biotech, healthcare and life sciences.

In the same vein, life science and health investing has been part of the lifeblood for some major US funds including Founders Fund, which has consistently dedicated over 25% of its deployed capital to the space since at least 2015.

The tides may be changing, however, as the recent expansion of oversight for the Committee on Foreign Investment in the United States (CFIUS) may severely impact the flow of Chinese capital into areas of the US health sector.

Under its extended purview, CFIUS will review – and possibly block – any investment or transaction involving a foreign entity related to the production, design or testing of technology that falls under a list of 27 critical industries, including biotech research and development.

The true implications of the expanded rules will depend on how aggressively and how often CFIUS exercises its power. But a lengthy review process and the threat of regulatory blocks may significantly increase the burden on Chinese investors, effectively shutting off the Chinese money spigot.

Regardless of CFIUS, while China’s active presence in the US health markets hasn’t deterred Valley mainstays, with a severely broken health system and an improved investment environment backed by government support, China’s commitment to medical innovation is only getting stronger.

Deficiencies in China’s health sector has historically led to troublesome outcomes. Now the government is jump-starting investment through supportive policy. (Photo by Alexander Tessmer / EyeEm via Getty Images)

They say successful startups identify real problems that need solving. Marred with inefficiencies, poor results, and compounding consumer frustration, China’s health industry has many.

Outside of a wealthy few, citizens are forced to make often lengthy treks to overcrowded and understaffed hospitals in urban centers. Reception areas exist only in concept, as any open space is quickly filled by hordes of the concerned, sick, and fearful settling in for wait times that can last multiple days.

If and when patients are finally seen, they are frequently met by overworked or inexperienced medical staff, rushing to get people in and out in hopes of servicing the endless line behind them.

Historically, when patients were diagnosed, treatment options were limited and ineffective, as import laws and affordability issues made many globally approved drugs unavailable.

As one would assume, poor detection and treatment have led to problematic outcomes. Heart disease, stroke, diabetes and chronic lung disease accounts for 80% of deaths in China, according to a recent report from the World Bank.

Recurring issues of misconduct, deception and dishonesty have amplified the population’s mounting frustration.

After past cases of widespread sickness caused by improperly handled vaccinations, China’s vaccine crisis reached a breaking point earlier this year. It was revealed that 250,000 children had been given defective and fallacious rabies vaccinations, a fact that inspectors had discovered months prior and swept under the rug.

Fracturing public trust around medical treatment has serious, potentially destabilizing effects. And with deficiencies permeating nearly all aspects of China’s health and medical infrastructure, there is a gaping set of opportunities for disruptive change.

In response to these issues, China’s government placed more emphasis on the search for medical innovation by rolling out policies that improve the chances of success for health startups, while reducing costs and risk for investors.

Billions of public investment flooded into the life science sector, and easier approval processes for patents, research grants, and generic drugs, suddenly made the prospect of building a life science or biotech company in China less daunting.

For Chinese venture capitalists, on top of financial incentives and a higher-growth local medical sector, loosening of drug import laws opened up opportunities to improve China’s medical system through innovation abroad.

Liquidity has also improved due to swelling global interest in healthcare. Plus, the Hong Kong Stock Exchange recently announced changes to allow the listing of pre-revenue biotech companies.

The changes implemented across China’s major institutions have effectively provided Chinese health investors with a much broader opportunity set, faster growth companies, faster liquidity, and increased certainty, all at lower cost.

However, while the structural and regulatory changes in China’s healthcare system has led to more medical startups with more growth, it hasn’t necessarily driven quality.

US and Western investors haven’t taken the same cross-border approach as their peers in Beijing. From talking with those in the industry, the laxity of the Chinese system, and others, have made many US investors weary of investing in life science companies overseas.

And with the Valley similarly stepping up its focus on startups that sprout from the strong American university system, bubbling valuations have started to raise concern.

But with China dedicating more and more billions across the globe, the country is determined to patch the massive holes in its medical system and establish itself as the next leader in international health innovation.

Powered by WPeMatico

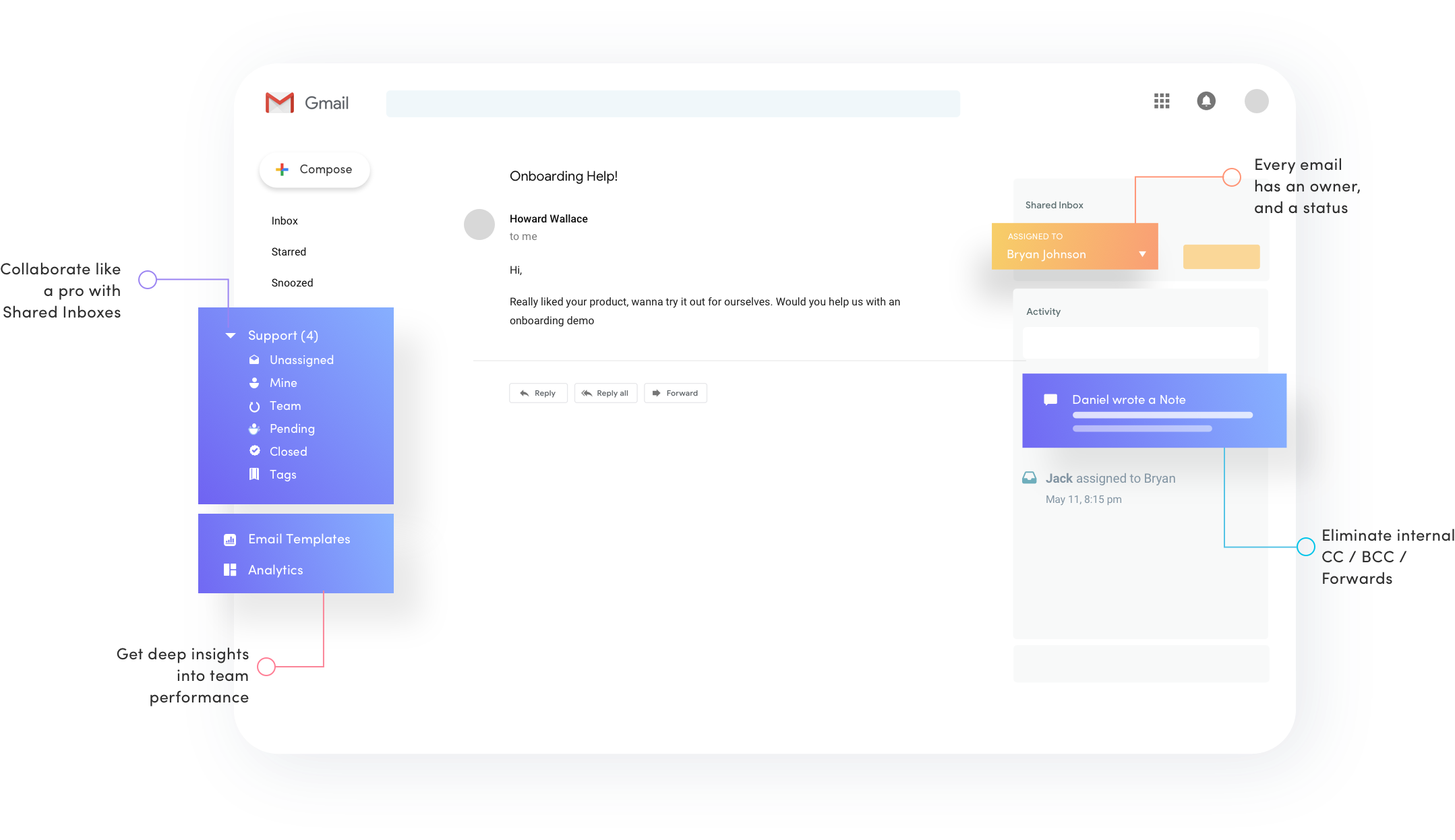

Meet Hiver, a service that lets you collaborate on generic email addresses, such as jobs@yourcompany.com, support@, sales@, etc. Hiver isn’t the only company working on shared inboxes. But compared to Front, everything happens in Gmail directly.

To be fair, Front has been doing a fantastic job when it comes to multiplayer email — and the company has been doing great. Front is a new email client that lets you work together on your inbound emails.

But many teams don’t necessarily want to use a brand new email client. Some people love the Gmail interface so much that they don’t even think about switching to something else.

Hiver is a Google Chrome extension that adds a bunch of feature to your Gmail inbox. In addition to your personal inbox, you can now access shared inboxes with other people in your team. You can then assign an email to one of your coworkers and see what everybody is working on.

If you need help in order to reply to a tedious email, you can write a note in the right column and notify your teammates using @-mentions. All your comments live in this separate column so that you don’t clutter your email thread with forwards and CCs.

Whenever someone starts replying, Hiver shows a collision alert so that customers don’t get two replies. You can also use templates for faster replies, send emails later and share drafts to get another pair of eyes.

More recently, Hiver added automation with simple if/then rules to assign conversations to the right person and categorize your emails automatically.

If you’ve used Front in the past, those features will sound familiar as you can do all of this in Front, and much more. But it turns out that some companies really wanted a “Front for Gmail”.

Hiver just raised a $4 million funding round from Kalaari Capital and Kae Capital. The company is based in India and has 50 employees already. A thousand companies are currently using Hiver, such as Hubspot, Vacasa, Pinterest and Lyft. Most of Hiver’s clients are based in the U.S.

Building a product on top of Gmail creates some limitations. For instance, you’ll have to remain a G Suite customer in order to keep using Hiver. Hiver also works better on desktop. The company has mobile apps, but they are still a bit basic so far.

Hiver uses a software-as-a-service approach. Plans start at $14 per user per month, and you need to pay more for automations, Salesforce integration and more.

Powered by WPeMatico