Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

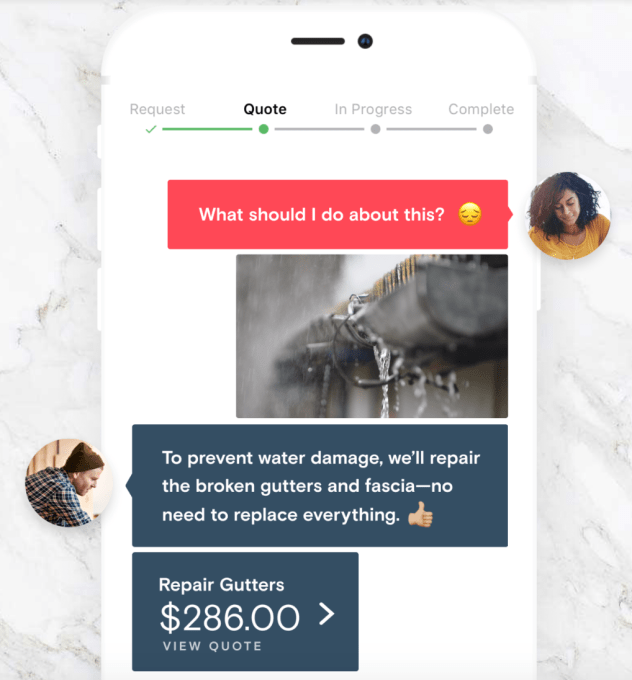

You probably don’t know how much it should cost to get your home’s windows washed, yard landscaped or countertops replaced. But Setter does. The startup pairs you with a home improvement concierge familiar with all the vendors, prices and common screwups that plague these jobs. Setter finds the best contractors across handiwork, plumbing, electrical, carpentry and more. It researches options, negotiates a bulk rate and, with its added markup, you pay a competitive price with none of the hassle.

One of the most reliable startup investing strategies is looking at where people spend a ton of money but hate the experience. That makes home improvement a prime target for disruption, and attracted a $10 million Series A round for Setter co-led by Sequoia Capital and NFX. “The main issue is that contractors and homeowners speak different languages,” Setter co-founder and CEO Guillaume Laliberté tells me, “which results in unclear scopes of work, frustrated homeowners who don’t know enough to set up the contractors for success, and frustrated contractors who have to come back multiple times.”

Setter is now available in Toronto and San Francisco, with seven-plus jobs booked per customer per year costing an average of over $500 each, with 70 percent repeat customers. With the fresh cash, it can grow into a household name in those cities, expand to new markets and hire up to build new products for clients and contractors.

I asked Laliberté why he cared to start Setter, and he told me “because human lives are made better when you can make essential human activities invisible.” Growing up, his mom wouldn’t let him buy video games or watch TV so he taught himself to code his own games and build his own toys. “I’d saved money to fix consoles and resell them, make beautiful foam swords for real live-action games, buy and resell headphones — anything that people around me wanted really!” he recalls, teaching him the value of taking the work out of other people’s lives.

I asked Laliberté why he cared to start Setter, and he told me “because human lives are made better when you can make essential human activities invisible.” Growing up, his mom wouldn’t let him buy video games or watch TV so he taught himself to code his own games and build his own toys. “I’d saved money to fix consoles and resell them, make beautiful foam swords for real live-action games, buy and resell headphones — anything that people around me wanted really!” he recalls, teaching him the value of taking the work out of other people’s lives.

Meanwhile, his co-founder David Steckel was building high-end homes for the wealthy when he discovered they often had ‘home managers’ that everyone would want but couldn’t afford. What if a startup let multiple homeowners share a manager? Laliberté says Steckel describes it as “I kid you not, the clouds parted, rays of sunlight began to shine through and angels started to sing.” Four days after getting the pitch from Steckel, Laliberté was moving to Toronto to co-found Setter.

Users fire up the app, browse a list of common services, get connected to a concierge over chat and tell them about their home maintenance needs while sending photos if necessary. The concierge then scours the best vendors and communicates the job in detail so things get done right the first time, on time. They come back in a few minutes with either a full price quote, or a diagnostic quote that gets refined after an in-home visit. Customers can schedule visits through the app, and stay in touch with their concierge to make sure everything is completed to their specifications.

The follow-through is what sets Setter apart from directory-style services like Yelp or Thumbtack . “Other companies either take your request and assign it to the next available contractor or simply share a list of available contractors and you need to complete everything yourself,” a Setter spokesperson tells me. They might start the job quicker, but you don’t always get exactly what you want. Everyone in the space will have to compete to source the best pros.

Though potentially less scalable than Thumbtack’s leaner approach, Setter is hoping for better retention as customers shift off of the Yellow Pages and random web searches. Thumbtack rocketed to a $1.2 billion valuation and had raised $273 million by 2015, some from Sequoia (presenting a curious potential conflict of interest). That same ascent may have lined up the investors behind Setter’s $2 million seed round from Sequoia, Hustle Fund and Avichal Garg last year. Today’s $10 million Series A also included Hustle Fund and Maple VC.

The toughest challenge for Setter will be changing the status quo for how people shop for home improvement away from ruthless bargain hunting. It will have to educate users about the pitfalls and potential long-term costs of getting slapdash service. If Laliberté wants to fulfill his childhood mission, he’ll have to figure out how to make homeowners value satisfaction over the lowest sticker price.

Powered by WPeMatico

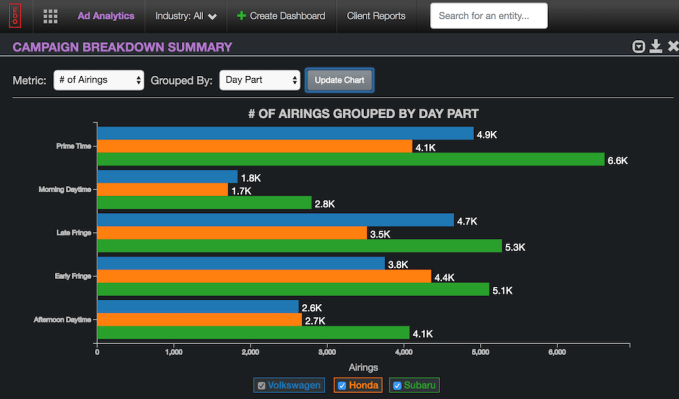

Edo, an ad analytics startup founded by Daniel Nadler and actor Edward Norton, announced today that it has raised $12 million in Series A funding.

Nadler and Norton have both had startup success before — Nadler co-founded and led Kensho, which S&P Global acquired for $550 million. Norton invested in Kensho and co-founded CrowdRise, which was acquired by GoFundMe.

Even so, ad analytics might seem like an arcane industry for an actor/filmmaker to want to tackle. However, Norton said he was actually the one to convince Nadler that it was worth starting the company, and he argued that this is an important topic to both of them as creators. (Nadler’s a poet.)

“Movie studios and publishers, they take risks on talent, on creative people like us,” Norton said. “We want them to do well … The better they do with the dollars they spend, the less risk adverse they become.”

Nadler and Norton recruited Kevin Krim, the former head of digital at CNBC, to serve as Edo’s CEO.

Krim explained that while linear TV advertising still accounts for the majority of ad budgets, the effectiveness of those ads is still measured using old-fashioned “survey-based methodologies.” There are other measurement companies looking online, Norton said they’re focused on social media sentiment and other “weak proxies” for consumer behavior.

In contrast, Edo pulls data from sources like search engines and content sites where people are doing research before making a purchase. By applying data science, Krim said, “We basically can measure the change in consumer engagement, the behaviors that are indicative of intent. We can measure the change in consumer behavior for every ad.”

In fact, Edo says that since its founding in 2015, it has created a database of 47 million ad airings, so advertisers can see not just their own ad performance, but also that of their competitors. This allows advertisers to adjust their campaigns based on consumer engagement — Krim said that in some cases, advertisers will receive the overnight data and then adjust their ad rotation for that very night.

As for the Series A, it was led by Breyer Capital. (Jim Breyer has backed everything from Facebook to Etsy to Marvel.) Vista Equity co-founders Robert Smith and Brian Sheth participated in the round, as did WGI Group.

“For more than a decade I’ve watched the data science talent arbitrage transform industries from finance to defense, from transportation to commerce,” Breyer said in the funding announcement. “We needed someone to bring these capabilities to bear on the systemic inefficiencies and methodological shortcomings of measurement and analytics in media and advertising.”

On the customer side, Edo is already working with ESPN, Turner, NBCUniversal, Warner Bros. I wondered whether some of the TV networks might have been worried about what Edo would reveal about their ads, but Norton said the opposite was true.

“I don’t sense that they in any way have trepidation that we’re going to pull their pants down — quite the opposite,” he said. “They are absolutely thrilled with our ability to help burnish and validate their assertions about the strength of what they’re offering.”

Powered by WPeMatico

The past decade in retail has been the golden age of direct-to-consumer (D2C) and digitally native vertical brands (DNVBs) that use the internet to communicate with customers, execute transactions, handle distribution and offer better economics.

But as small independent startups have scaled into unicorn territory and as countless brands have saturated digital channels, customer acquisition has gotten harder and costlier. Companies are now trying to meet customers with different purchase habits by developing physical stores.

However, building an effective brick-and-mortar presence can be expensive and risky for DNVBs, requiring resources outside their core competencies. Chicago-based startup Leap is hoping to make it easier for digital brands to grow physical retail footprints without the typical risks of store development by taking care of the entire process for them.

Leap offers a full-service platform covering the complete life cycle of a brand’s brick-and-mortar launch. In addition to owning the lease and the financial commitments that come with it, Leap covers everything from staffing, experiential design, tech integration and even day-to-day operations.

(Photo by Alexander Scheuber/Getty Images)

Less than a year since its founding, Leap announced today the launch of its first store and the close of a $3 million seed round, led by Costanoa Ventures, with participation from Equal Ventures and Brand Foundry Ventures.

The debut store will act as the first Chicago location for Koio, the high-end D2C sneaker brand backed by headline-grabbing names like the Winklevoss twins, director Simon Kinberg and actor Miles Teller.

Instead of paying a monthly lease fee, along with all the other variable costs associated with operating a physical store, companies like Koio pay Leap on a percent of sales basis, effectively minimizing risk and incentivizing performance.

On top of minimizing development expense for brands, Leap believes its customer insights and intelligent logistics platform can help improve shopper engagement, increase customer traffic and drive brand lift. If the startup’s thesis proves true, brands can improve both sides of their brick-and-mortar unit economics by reducing customer acquisition costs and amplifying customer value.

At its core, Leap simplifies a DNVB’s physical retail operations into a single line item on its P&L, allowing the company to focus on brand building and supply chain rather than retail strategy, while also allowing them to scale faster.

With the latest fundraise, the company hopes to build out its team and continue new location expansion. Longer-term, Leap’s co-founders hope to build a vast network of sites that can help provide intelligence around new store development and shopper preference.

“We want to be the platform to help brands go to market in the offline space”, said co-founder Amish Tolia. “We want to help brands build direct-to-consumer relationships in local neighborhoods across the country and enable them to focus on what they’re best at. Enable them to focus on product innovation, supply chain management, great marketing and brand building.”

While Leap’s value proposition is straightforward, its business model points to a bigger trend in the world of retail.

By opting to sell its software and brick-and-mortar services rather than creating its own brands, Leap effectively acts as a “retail-as-a-service” platform. The as-a-service strategy is already quietly growing in popularity in the retail space, with companies like b8ta, the Internet of Things gadget retailer, launching its hardware-oriented “Built by b8ta” platform earlier this year.

Though likely heavy in upfront capital costs, retail-as-a-service businesses don’t have the same constant concern around supply chain, manufacturing, consumer acquisition and marketing spend. And in certain pricing models based on a monthly fee or percent of square footage basis, platforms can see more stable revenues relative to pure retail startups.

From a brand perspective, DNVBs have been looking for ways to extend growth runways while minimizing the cost and uncertainty that deterred them from physical stores in the first place. The as-a-service model can make brick-and-mortar retail a much more scalable engine, possibly even cooling rising concern around bubbling consumer valuations.

As more of the young digitally born D2C giants resort to as-a-service companies to find marginal customers, we may see the rise of a new set of startups fighting to establish themselves as the platform on which brands operate.

If the last decade was defined by retail online, it’s possible that the next decade will be defined by retail-as-a-service.

And if you find yourself in Chicago, feel free to check out the Leap-enabled Koio Store at 924 W Armitage in Lincoln Park.

Powered by WPeMatico

HashiCorp, the company that has made hay developing open-source tools for managing cloud infrastructure, obviously has a pretty hefty commercial business going too. Today the company announced an enormous $100 million round on a unicorn valuation of $1.9 billion.

The round was led by IVP, whose investments include AppDynamics, Slack and Snap. Newcomer Bessemer Venture Partners joined existing investors GGV Capital, Mayfield, Redpoint Ventures and True Ventures in the round. Today’s investment brings the total raised to $179 million.

The company’s open-source tools have been downloaded 45 million times, according to data provided by the company. It has used that open-source base to fuel the business (as many have done before).

“Because practitioners choose technologies in the cloud era, we’ve taken an open source-first approach and partnered with the cloud providers to enable a common workflow for cloud adoption. Commercially, we view our responsibility as a strategic partner to the Global 2000 as they adopt hybrid and multi-cloud. This round of funding will help us accelerate our efforts,” company CEO Dave McJannet said in a statement.

To keep growing, it needs to build out its worldwide operations and that requires big bucks. In addition, as the company scales that means adding staff to beef up customer success, support and training teams. The company plans on making investments in these areas with the new funding.

HashiCorp launched in 2012. It was the brainchild of two college students, Mitchell Hashimoto and Armon Dadgar, who came up with the idea of what would become HashiCorp while they were still at the University of Washington. As I wrote in 2014 on the occasion of their $10 million Series A round:

After graduating and getting jobs, Hashimoto and Dadgar reunited in 2012 and launched HashiCorp. They decided to break their big problem down into smaller, more manageable pieces and eventually built the five open source tools currently on offer. In fact, they found as they developed each one, the community let them know about adjacent problems and they layered on each new tool to address a different need.

HashiCorp has continued to build on that early vision, layering on new tools over the years. It is not alone in building a business on top of open source and getting rewarded for their efforts. Just this morning, Neo4j, a company that built a business on top of its open-source graph database project, announced an $80 million Series E investment.

Powered by WPeMatico

Rockset, a startup that came out of stealth today, announced $21.5M in previous funding and the launch of its new data platform that is designed to simplify much of the processing to get to querying and application building faster.

As for the funding, it includes $3 million in seed money they got when they started the company, and a more recent $18.5 million Series A, which was led by Sequoia and Greylock.

Jerry Chen, who is a partner at Greylock sees a team that understands the needs of modern developers and data scientists, one that was born in the cloud and can handle a lot of the activities that data scientists have traditionally had to handle manually. “Rockset can ingest any data from anywhere and let developers and data scientists query it using standard SQL. No pipelines. No glue. Just real time operational apps,” he said.

Company co-founder and CEO Venkat Venkataramani is a former Facebook engineer where he learned a bit about processing data at scale. He wanted to start a company that would help data scientists get to insights more quickly.

Data typically requires a lot of massaging before data scientists and developers can make use of it and Rockset has been designed to bypass much of that hard work that can take days, weeks or even months to complete.

“We’re building out our service with innovative architecture and unique capabilities that allows full-featured fast SQL directly on raw data. And we’re offering this as a service. So developers and data scientists can go from useful data in any shape, any form to useful applications in a matter of minutes. And it would take months today,” Venkataramani explained.

To do this you simply connect your data set wherever it lives to Rockset and it deals with the data ingestion, building the schema, cleaning the data, everything. It also makes sure you have the right amount of infrastructure to manage the level of data you are working with. In other words, it can potentially simplify highly complex data processing tasks to start working with the raw data almost immediately using SQL queries.

To achieve the speed, Venkataramani says they use a number of indexing techniques. “Our indexing technology essentially tries to bring the best of search engines and columnar databases into one. When we index the data, we build more than one type of index behind the scenes so that a wide spectrum of pre-processing can be automatically fast out of the box,” he said. That takes the burden of processing and building data pipelines off of the user.

The company was founded in 2016. Chen and Sequoia partners Mike Vernal joined the Rockset board under the terms of the Series A funding, which closed last August.

Powered by WPeMatico

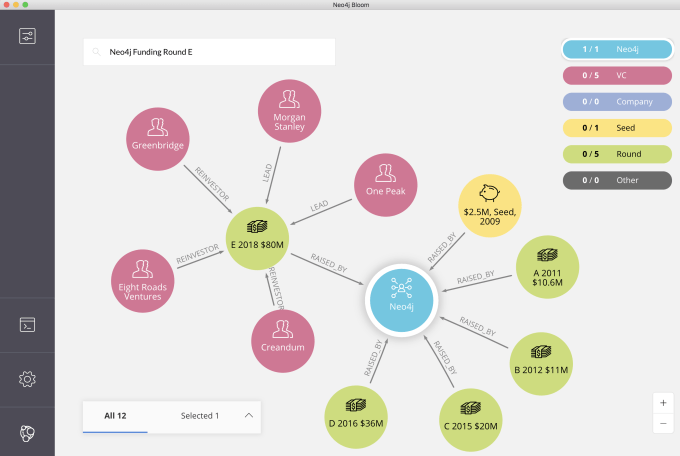

Neo4j has helped popularize the graph database. Today it was rewarded with an $80 million Series E to bring their products to a wider market in what could be the company’s last private fundraise.

The round was led by One Peak Partners and Morgan Stanley Expansion Capital with participation from existing investors Creandum, Eight Roads and Greenbridge Partners. Today’s investment exactly doubles their previous amount bringing the total raised to $160 million.

Neo4j founder and CEO Emil Eifrem didn’t want to discuss valuation, calling it essentially a vanity metric. “We’re not sharing that. I never understood that. It’s just weird bragging rights. It makes no sense to customers, and makes no sense to anyone,” he said referring to the valuation.

Graph view of Neo4j funding rounds. Graphic: Neo4j

When you bring a company like Morgan Stanley on as an investor, it could be interpreted as a kind of signal that the company is thinking ahead to going public. While Eifrem wasn’t ready to commit to anything, he suggested that this is very likely the last time he raises funds privately. He says that he doesn’t like to think in terms of how he will exit so much as building a good company and seeing where that takes him. “If your mental framework is around building a great company, you’re going to have all kinds of options along the way. So that’s what I’m completely focused on,” Eifrem explained.

In 2016, when his company got a $36 million Series D investment, Eifrem says that they were working to expand in the enterprise. They have been successful with around 200 enterprise customers to their credit including Walmart, UBS, IBM and NASA. He says their customers include 20 of the top 25 banks and 7 of the top 10 retailers.

This year, the company began expanding into artificial intelligence. It makes sense. Graph databases help companies understand the connections in large datasets and AI usually involves large amounts of data to drive the learning models.

Two common graph database use case examples are the social graph on a social site like Facebook, which lets you see the connections between you and your friends or the purchase graph on an Ecommerce site like Amazon which lets you see if you bought one product, chances are you’ll also be interested in these others (based on your purchase history and what other consumers have done who have bought similar products).

Eifrem wants to use the money to expand the company internationally and provide localized service in terms of language and culture wherever their customers happen to be. As an example, he says today European customers might get an English speaking customer service agent if they called in for help. He wants to provide service and the website in the local language and the money should help accomplish that.

Neo4j was founded in 2007 as an open source project. Companies and individuals can still download the base product for free, but the company has also built a successful and growing commercial business on top of that open source project. With an $80 million runway, the next stop could be Wall Street.

Powered by WPeMatico

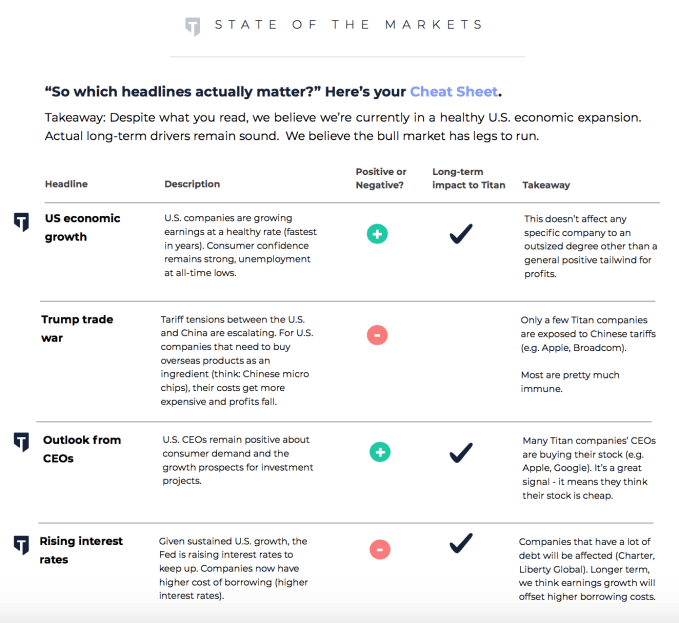

Titan could put an end to stock market FOMO. The app chooses the best 20 stocks by scraping top hedge fund data, adds some shorts based on your personal risk profile and puts your money to work. No worrying about market fluctuations or constantly rebalancing your portfolio. You don’t have to do anything, but can get smarter about stocks thanks to its in-app explanations and research reports. Titan wants to be the easiest way to invest in stocks for a mobile generation that wants an affordable coach to guide them through the market themselves.

“Our goal is to take things that aren’t accessible [in wealth management] and make them accessible, starting with hedge funds,” says Titan co-founder Joe Percoco. That potential to democratize one of the keys to financial mobility has won Titan a $2.5 million seed round from Y Combinator’s co-founder Paul Graham, president Sam Altman and partners including Gmail creator Paul Bucheit. The rest of the capital comes from Maverick Ventures, BoxGroup and Liquid2 Ventures.

“Titan is where investing meets virality,” says Graham. “Those are two very powerful forces.” Since TechCrunch broke the news of Titan’s launch in August, it’s doubled its assets under management to $20 million and hired its first non-founder engineer.

Now it’s launching in-app educational videos so stock market dummies can get up to speed if they want to understand where their money’s going amidst a swirling see of financial news. “There are so many different headlines telling so many different narratives,” Percoco tells me. “Everyone is searching for explanations in a voice they trust. An ‘ETF’ can’t talk back. Sometimes a human face is better than writing. A video can really help people make choices.” Here’s its two-minute video about Facebook’s Q2 earnings a few months ago, explaining why the share price crashed 25 percent:

Percoco and Clayton Gardner met on their first day of Wharton business school, while their third co-founder was earning a hedge fund patent and studying computer science at Stanford. They went on to work at hedge funds and private equity firms like Goldman Sachs, but got fed up just growing the fortunes of the already rich.

So they started Titan to invent a modern, mobile version of BlackRock, the investment giant founded in the 1980s. Titan uses the public disclosures of hedge funds to find consensus around the 20 best performing stocks. With as little as $1,000, users can let Titan robo-manage their investments for a 1 percent fee on assets. Users provide some info on how big they want to gamble, and Titan personalizes their portfolio with more or less conservative shorts to hedge their bets.

Titan’s simplicity combined with the sense of participation could help it grow quickly. It sits between do-it-yourself options like Robinhood or E*Trade, where you’re basically left to fend for yourself, and totally passive options like Wealthfront and Betterment, where you’re so divorced from your portfolio that you’re not learning. Managed hedge funds and fellow active investment vehicles like BlackRock with a human advisor can require a $100,000 minimum investment that’s too steep for millennials.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

Essentially, Titan is a stock trading auto-pilot merged with a flight simulator so you improve your finance skills without having to fear a crash. Percoco tells me the sense of accomplishment that engenders is why clients say they’re telling friends about Titan. “When I invest, I look for companies that are growing quickly and making a huge positive impact on the world. Titan is one of those companies,” investor Altman says. “I think they could improve the financial well-being of an entire generation.”

Powered by WPeMatico

Messaging app firm Line has given up majority control of its Line Games business after it raised outside financing to expand its collection of titles and go after global opportunities.

The Line Games business was formed earlier this year when Line merged its existing gaming division from NextFloor, the Korea-based game publisher that it acquired in 2017. Now the business has taken on capital from Anchor Equity Partners, which has provided 125 billion KRW ($110 million) in financing via its Lungo Entertainment entity, according to a disclosure from Line.

A Line spokesperson clarified that the deal will see Anchor acquire 144,743 newly created shares to take a 27.55 percent stake in Line Games. That increase means Line Corp’s own shareholding is diluted from 57.6 percent to a minority 41.73 percent stake.

Korea-based Anchor is best known for a number of deals in its homeland, including investments in e-commerce giant Ticket Monster, Korean chat giant Kakao’s Podotree content business and fashion retail group E-Land.

Line operates its eponymous chat app, which is the most popular messaging platform in Japan, Thailand and Taiwan, and also significantly used in Indonesia, but gaming is a major source of income. This year to date, Line has made 28.5 billion JPY ($250 million) from its content division, which is primarily virtual goods and in-app purchases from its social games. That division accounts for 19 percent of Line’s total revenue, and it is a figure that is only better by its advertising unit, which has grossed 79.3 billion JPY, or $700 million, in 2018 to date.

The games business is currently focused on Japan, Korea, Thailand and Taiwan, but it said that the new capital will go toward finding new IP for future titles and identifying games with global potential. It is also open to more strategic deals to broaden its focus.

While Line has always been big on games, Line Games isn’t just building for its own service. The company said earlier this year that it plans to focus on non-mobile platforms, which will include the Nintendo Switch among others consoles.

That comes from the addition of NextFloor, which is best known for titles like Dragon Flight and Destiny Child. Dragon Flight has racked up 14 million users since its 2012 launch; at its peak it saw $1 million in daily revenue. Destiny Child, a newer release in 2016, topped the charts in Korea and has been popular in Japan, North America and beyond.

Line went public in 2016 via a dual U.S.-Japan IPO that raised more than $1 billion.

Note: The original version of this article was updated to clarify that Lungo Entertainment is buying newly issued shares.

Powered by WPeMatico

Monzo, the U.K. challenger bank that now boasts more than a million customers, has raised £85 million in Series E funding. The round is led by U.S. venture capital firm General Catalyst, and Accel. Existing backers Passion Capital, Goodwater, Thrive Capital, Orange Digital Ventures, and Stripe also participated.

The latest funding was at a pre-money valuation of £1 billion (~$1.27b), meaning that Monzo is now a bonafide member of the U.K. fintech unicorn club, joining recent entrant Revolut.

Meanwhile, the bank upstart is also planning to launch a large crowdfunding round later this year. Like a lot of other fintechs — and before it was fashionable — Monzo has historically opened up its fundraising to its passionate community and other armchair investors.

In a brief call earlier today with Monzo co-founder and CEO Tom Blomfield, he told me the new funding will be primarily used for increasing headcount to further develop the Monzo product line and to cover other operational costs now that the challenger bank has reached “contribution margin positive”.

In other words, on average each customer is generating more revenue than the cost of servicing their current account, which is undoubtedly evidence of how much progress Monzo has made over the last year. This includes bringing down costs, such as weaning customers off costly debit card “top ups” and imposing a cap on fee-free foreign ATM withdrawals — as well as starting to generate meaningful revenue.

On where that revenue is now coming from, Blomfield cited lending in the form of Monzo’s overdraft product, interest it earns on deposits (currently Monzo doesn’t share that interest with customers, even if it is very small in percentage terms), and interchange fees (the money Monzo makes any time you spend on your Monzo debit card).

Another revenue stream is the nascent Monzo marketplace, which he says will be the next focus going forward now that the Monzo current account, with the omission of savings accounts and cash deposits, is basically “done“.

That’s noteworthy given that Monzo embraced developers extremely early on in its existence, holding four very popular hackathons and conducting a few early partnership pilots, but has since mostly stalled on the roll out of marketplace banking and other partnership integrations, sometimes to the frustration of the wider U.K. fintech ecosystem and developers. The exception being the recent integration with TransferWise for sending money abroad.

Blomfield doesn’t dispute this framing but says it wasn’t that Monzo changed course on offering an open API or working on deeper integrations that will put partner products inside of the Monzo banking app, but that gaining a banking license and building out all of the features of the current account had to be the short-term priority. Now that heavy lifting is complete and armed with new operational capital, it is marketplace game on.

To that end, the Monzo CEO says headcount over the next year could double again, from around 450 now to 900. And in terms of customer growth, extrapolating stats from a recent Nationwide annual report (PDF link), the challenger bank says it now accounts for 15 percent of all new bank accounts opened each month in the U.K. It also says it has 800,000 monthly active users.

Account switching — that is customers ditching their existing bank — still makes up the bulk of customer acquisition, even if Monzo recently began targeting 16-18 year olds who would be opening their first ever bank account. Another key metric: the number of customers who deposit their salary each month with Monzo is now at around 26 percent, although I’m told that this isn’t as important for Monzo as it might be for traditional banks and isn’t the main correlation with engagement or those accessing a Monzo overdraft.

Asked what Monzo’s biggest challenge will be over the next year, its CEO doesn’t mince his words: “Increasing revenue,” he says. This means ensuring that its lending models are correct (ie avoiding too many defaults as it scales) and steadfastly growing the marketplace and third-party product partnerships that will bring in additional revenue.

I was also intrigued to see a U.S. venture capital firm once again back the U.K. challenger bank — many of its existing backers have a U.S. bent and Blomfield has made no secret of his ambitions to expand across the pond at some stage. In an email exchange a few hours before publication, General Catalyst’s Adam Valkin (who was previously at Accel in London where he invested in GoCardless, which Blomfield also co-founded), gave me the following statement:

We’re investing in Tom and his team because they are delivering a high-quality banking experience for consumers at scale that is sorely missing from the market. Today’s incumbent UK banks represent billions of market cap but suffer from low NPS scores, reflecting their inability to meet their customers’ needs. Monzo, in contrast, explicitly builds product and banking features in a community-driven approach based on customers’ feedback and requests. This has driven very high organic growth, strong retention and engagement, and unprecedented customer love for and trust in Monzo. Beyond this, Tom and the Monzo team have improved upon the traditional business model of banking, removing the traditional offline retail-based banking model in favor of a highly scalable and lower cost mobile-only experience. All of this creates the potential for Monzo to become a leading U.K. bank, launch a successful financial marketplace, and eventually expand internationally.

Powered by WPeMatico

On the heels of a funding round to the tune of $18.8 million, Even Financial has acquired Birch Finance for an undisclosed sum.

Even offers products like a pre-approval API, real-time pricing, machine learning optimization, a product comparison and recommendation engine for consumers and more. Birch Finance, a TC Startup Battlefield alum that raised $1 million earlier this year, aims to help people make the most of the credit cards in their wallets by telling them which cards will earn them the most points. It works by analyzing your transaction history to identify missed rewards opportunities. Even’s plan with this acquisition is for Even to expand its offerings within the credit card space.

“The credit card market continues to expand with millions of consumers opening up hundreds of different types of credit cards every year for countless reasons,” Phillip Rosen said in a statement. “Birch already has one of the largest credit card databases and their technology perfectly complements our existing platform as we expand our offering to the credit card space. This acquisition will allow our partners to optimize the process of getting the right cards to the right consumers.”

Even’s slate of partners includes Credit.com, a personal loans marketplace, The Penny Hoarder and Transunion. With the Birch team on board, Even will enable its partners to save on consumer acquisition while also scaling its credit card recommendation platform. At Even, Birch co-founder Alex Cohen will serve as senior director of the credit card marketplace.

In a statement, Cohen said, “We saw a clear synergy with Even’s business strategy and growth plans, and I’m thrilled to join Even’s team as we expand and scale our offerings into new areas.”

Powered by WPeMatico