Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Microsoft has been all in on AI this year, and in the build versus buy equation, the company has been leaning heavily toward buying. This morning, the company announced its intent to acquire Xoxco, an Austin-based software developer with a focus on bot design, making it the fourth AI-related company Microsoft has purchased this year.

“Today, we are announcing we have signed an agreement to acquire Xoxco, a software product design and development studio known for its conversational AI and bot development capabilities,” Lili Cheng, corporate VP for conversational AI at Microsoft wrote in a blog post announcing the acquisition.

Xoxco, which was founded in 2009 — long before most of us were thinking about conversational bots — has raised $1.5 million. It began working on bots in 2013, and is credited with developing the first bot for Slack to help schedule meetings. The companies did not reveal the price, but it fits nicely with Microsoft’s overall acquisition strategy this year, and an announcement today involving a new bot building tool to help companies build conversational bots more easily.

When you call into a call center these days, or even interact on chat, chances are your initial interaction is with a conversational bot, rather than a human. Microsoft is trying to make it easier for developers without AI experience to tap into Microsoft’s expertise on the Azure platform (or by downloading the bot framework from its newly acquired GitHub).

“With this acquisition, we are continuing to realize our approach of democratizing AI development, conversation and dialog, and integrating conversational experiences where people communicate,” Cheng wrote.

The new Virtual Assistant Accelerator solution announced today also aligns with the Xoxco purchase. Eric Boyd, corporate VP for AI at Microsoft, says the Virtual Assistant Accelerator pulls together some AI tools such as speech-to-text, natural language processing and an action engine into a single place to simplify bot creation.

“It’s a tool that makes it much easier for you to go and create a virtual assistant. It orchestrates a number of components that we offer, but we didn’t make them easy to use [together]. And so it’s really simplifying the creation of a virtual assistant,” he explained.

Today’s acquisition comes on the heels of a number of AI-related acquisitions. The company bought Semantic Machines in May to give users a more life-like conversation with bots. It snagged Bonsai in June to help simplify AI development. And it grabbed Lobe in September, another tool for making it easier for developers to incorporate AI in their applications.

Powered by WPeMatico

WeWork has picked up another $3 billion in financing from SoftBank Corp, not to be confused with SoftBank Vision Fund. The deal comes in the form of a warrant, allowing SoftBank to pay $3 billion for the opportunity to buy shares before September 2019 at a price of $110 or higher, ultimately valuing WeWork at $42 billion minimum.

In August, SoftBank Corp invested $1 billion in WeWork in the form of a convertible note.

According to the Financial Times, SoftBank will pay WeWork $1.5 billion on January 15, 2019 and another $1.5 billion on April 15.

SoftBank is far and away WeWork’s biggest investor, with SoftBank Vision Fund having poured $4.4 billion into the company just last year.

The real estate play out of WeWork is just one facet of the company’s strategy.

More than physical land, WeWork wants to be the central connective tissue for work in general. The company often strikes deals with major service providers at “whole sale” prices by negotiating on behalf of its 300,000 members. Plus, WeWork has developed enterprise products for large corporations, such as Microsoft, who tend to sign longer, more lucrative leases. In fact, these types of deals make up 29 percent of WeWork’s revenue.

The biggest issue is whether or not WeWork can sustain its outrageous growth, which seems to have been the key to its soaring valuation. After all, WeWork hasn’t yet achieved profitability.

Can the vision become a reality? SoftBank seems willing to bet on it.

Powered by WPeMatico

Cognigo, a startup that aims to use AI and machine learning to help enterprises protect their data and stay in compliance with regulations like GDPR, today announced that it has raised an $8.5 million Series A round. The round was led by Israel-based crowdfunding platform OurCrowd, with participation from privacy company Prosegur and State of Mind Ventures.

The company promises that it can help businesses protect their critical data assets and prevent personally identifiable information from leaking outside of the company’s network. And it says it can do so without the kind of hands-on management that’s often required in setting up these kinds of systems and managing them over time. Indeed, Cognigo says that it can help businesses achieve GDPR compliance in days instead of months.

To do this, the company tells me, it’s using pre-trained language models for data classification. That model has been trained to detect common categories like payslips, patents, NDAs and contracts. Organizations can also provide their own data samples to further train the model and customize it for their own needs. “The only human intervention required is during the systems configuration process, which would take no longer than a single day’s work,” a company spokesperson told me. “Apart from that, the system is completely human-free.”

To do this, the company tells me, it’s using pre-trained language models for data classification. That model has been trained to detect common categories like payslips, patents, NDAs and contracts. Organizations can also provide their own data samples to further train the model and customize it for their own needs. “The only human intervention required is during the systems configuration process, which would take no longer than a single day’s work,” a company spokesperson told me. “Apart from that, the system is completely human-free.”

The company tells me that it plans to use the new funding to expand its R&D, marketing and sales teams, all with the goal of expanding its market presence and enhancing awareness of its product. “Our vision is to ensure our customers can use their data to make smart business decisions while making sure that the data is continuously protected and in compliance,” the company tells me.

Powered by WPeMatico

Today, Real Estate Technology Ventures (RET Ventures) announced the final close of $108 million for its first fund. RET focuses on early-stage investments in companies that are primarily looking to disrupt the North American multifamily rental industry, with the firm boasting a roster of LPs made up of some of the largest property owners and operators in the multifamily space.

RET is one of the latest in a rising number of venture firms focused on the real estate sector, which by many accounts has yet to experience significant innovation or technological disruption.

The firm was founded in 2017 by managing director John Helm, who possesses an extensive background as an operator and investor in both real estate and real estate technology. Helm’s real estate journey began with a position right out of college and eventually led him to the commercial brokerage giant Marcus & Millichap, where he worked as CFO before leaving to build two venture-backed real estate technology companies. After successfully selling both companies, Helm worked as a venture partner at Germany-based DN Capital, where he invested in companies such as PurpleBricks and Auto1.

Speaking with investors and past customers, John realized there was a need for a venture fund specifically focused on the multifamily rental sector. RET points out that while multifamily properties have traditionally fallen under the commercial real estate umbrella, operators are forced to deal with a wide set of idiosyncratic dynamics unique to the vertical. In fact, outside of a select group, most of the companies and real estate investment trusts that invest in multifamily tend to invest strictly within the sector.

Now, RET has partnered with leading multifamily owners to help identify innovative startups that can help the LPs better run their portfolios, which account for nearly a million units across the country in aggregate. With its deep sector expertise and its impressive LP list, RET believes it can bring tremendous value to entrepreneurs by providing access to some of the largest property owners in the U.S., effectively shortening a notoriously lengthy sales cycle and making it much easier to scale.

Photo: Alexander Kirch/Shutterstock

One of the first companies reaping the benefits of RET’s deep ties to the real estate industry is SmartRent, the startup providing a property analytics and automation platform for multifamily property managers and renters. Today, SmartRent announced it had closed $5 million in series A financing, with seed investor RET providing the entire round.

SmartRent essentially provides property managers with many of the smart home capabilities that have primarily been offered to consumers to date, making it easier for them to monitor units remotely, avoid costly damages and streamline operations, all while hopefully enhancing the resident experience through all-in-one home controls.

By combining connected devices with its web and mobile platform, SmartRent hopes to provide tools that can help identify leaks or faulty equipment, eliminate energy waste and provide remote access control for door locks. The functions provided by SmartRent are particularly valuable when managing vacant units, in which leaks or unnecessary energy consumption can often go unnoticed, leading to multimillion-dollar damage claims or inflated utility bills. SmartRent also attempts to enhance the leasing process for vacant units by pre-screening potential renters that apply online and allowing qualified applicants to view the unit on their own without a third-party sales agent.

Just like RET, SmartRent is the brainchild of accomplished real estate industry vets. Founder and CEO Lucas Haldeman was still the CTO of Colony Starwood’s single-family portfolio when he first rolled out an early version of the platform in around 26,000 homes. Haldeman quickly realized how powerful the software was for property managers and decided to leave his C-suite position at the publicly traded REIT to found SmartRent.

According to RET, the strong industry pedigree of the founding team was one of the main drivers behind its initial investment in SmartRent and is one of the main differentiators between the company and its competitors.

With RET providing access to its leading multifamily owner LPs, SmartRent has been able to execute on a strong growth trajectory so far, with the company on pace to complete 15,000 installations by the end of the year and an additional 35,000 apartments committed for 2019. And SmartRent seems to have a long runway ahead. The platform can be implemented in any type of rental property, from retrofit homes to high rises, and has only penetrated a small portion of the nearly one million units owned by RET’s LPs alone.

SmartRent has now raised $10 million to date and hopes to use this latest round of funding to ramp growth by broadening its sales and marketing efforts. Longer-term, SmartRent hopes to permeate throughout the entire multifamily industry while continuing to improve and iterate on its platform.

“We’re so early on and we’ve made great progress, but we want to make deep penetration into this industry,” said Haldeman. “There are millions of apartment units and we want to be over 100,000 by year one, and over a million units by year three. At the same time, we’re continuing to enhance our offering and we’re focused on growing and expanding.”

As for RET Ventures, the firm hopes the compelling value proposition of its deep LP and industry network can help RET become the go-to venture firm startups looking to disrupt the real estate rental sector.

Powered by WPeMatico

Some more comments from readers on the changing culture around startups filing their Form Ds with the SEC, and then a short update on SoftBank and a bunch more article reviews.

We are experimenting with new content forms at TechCrunch. This is a rough draft of something new – provide your feedback directly to the authors: Danny at danny@techcrunch.com or Arman at Arman.Tabatabai@techcrunch.com if you like or hate something here.

If you haven’t been following our obsession with Form Ds, be sure to read our original piece and follow up. The gist is that startups are increasingly foregoing filing a Form D with the SEC that provides details of their venture rounds like investment size and main investors in order to stay stealth longer. That has implications for journalists and the public, since we rely on these filings in many cases to know who is funding what in the Valley.

Morrison Foerster put together a good presentation two years ago that provides an overview of the different routes that startups can take in disclosing their rounds properly.

Traditionally, the vast majority of startups used Rule 506 for their securities, which mandates that a Form D be filed within 15 days of the first money of the round closing. These days though, more and more startups are opting to use Section 4(a)(2), which doesn’t require a Form D, but also doesn’t provide a “blue sky” exception to start securities laws, which means that startups have to file in relevant state jurisdictions and no longer have preemption from the SEC.

David Willbrand, who chairs the Early Stage & Emerging Company Practice at Thompson Hine LLP, read our original articles on Form Ds and explained by email that the practices around securities disclosures have indeed been changing at his firm and others:

We started pushing 4(a)(2) very hard when our clients kept getting “outed” thru the Form D and upset about it. In my experience, for 99% is the desire to remain in stealth mode, period.

[…]

When I started in 1996, Form Ds were paper, there was no internet, and no one looked. Now they are electronic and the media and blogs scrape daily and publish the information. It actually really is true disclosure! And it’s kind of ironic, right, which goes to your point – now that it’s working, these issuers don’t want it.

[…]

What I find is that the proverbial Series A is the brass ring, and issuers wants to call everything seed rounds (saving the title) until something chunky shows up, and stay below the radar too. So they pop out of the cake publicly for the first time with a big “Series A” that they build press around – and their first Form D.

Another piece of feedback we received was from Augie Rakow, the co-founder and managing partner of Atrium, which bills itself as a “better law firm for startups” that TechCrunch has covered a few times before. He wrote to us that in addition to the media concerns, startups also have to be aware of the broad cross-section of interested parties to Form Ds that hasn’t existed in the past:

Today, there is a bigger audience in terms of who cares about venture backed companies. Whether this spun off from the launch of the Facebook movie or the fact that over two billion people across the global have the internet at their fingertips via smartphones, people are connected and curious. The audience is not only larger but also encompasses more national and international interests. This means there are simply more eyes on trends, announcements, and intel on privately held companies whether they are media, investors, or your competitors. Companies that have a good reason to stay stealth may want to avoid attracting this attention by not making a public Form D filing.

For startups, the obvious advice is to just consult your attorney and consider the tradeoffs of having a very clean safe harbor versus more work around regulatory filings to stay stealthy.

But the real message here is for journalists. Form Ds are no longer common among seed-stage startups, and indeed, startup founders and venture investors have a lot of latitude in choosing how and when they file. You can no longer just watch the SEC’s EDGAR search platform and break stories anymore. Building up a human sourcing capability is the only way to get into those early investment rounds today.

Finally — and this is something that is hard to prove one way or the other — the lack of disclosure may also mean that the fears around seed financing dropping off a cliff may be at least a little bit unfounded. Eliot Brown at the Wall Street Journal reported just yesterday that the number of seed financings is down 40 percent, according to PitchBook data. How much of that drop is because of changing macroeconomic conditions, versus changes in filing disclosures?

Tokyo Stock Exchange. Photo by electravk via Getty Images

Last week, I also got obsessed with SoftBank. The company confirmed today that it intends to move forward with the IPO of its Japanese mobile telecom unit, according to WSJ and many other sources. The company is targeting more than $20 billion in proceeds, and its overallotment could drive that above $25 billion, or roughly the level of Alibaba’s record IPO haul.

One interesting note from Taiga Uranaka at Reuters on the public issue is that everyday investors will likely play an outsized role in the IPO process:

Yet SoftBank’s brand name is still likely to draw retail investors long accustomed to using SoftBank’s phone and internet services. Many still see CEO Son as a tech visionary who challenged entrenched rivals NTT DoCoMo Inc ( 9437.T ) and KDDI, and brought Apple Inc’s ( AAPL.O ) iPhone to Japan.

Japanese households are commonly seen as an attractive target in IPOs with their 1,829 trillion yen in financial assets, even if they are traditionally risk-averse with over 50 percent of assets in cash and deposits.

More than 80 percent of the shares will be offered to domestic retail investors, a person with knowledge of the matter told Reuters.

Pavel Alpeyev at Bloomberg noted that “SoftBank is looking to tempt investors with a dividend payout ratio of about 85 percent of net income, according to the filing. Based on net income in the last fiscal year, that would work out to an almost 5 percent yield at the indicated IPO price.” A higher dividend ratio is particularly attractive to retired individual investors.

Despite SoftBank’s horrifying levels of debt, Japanese consumers may well save the company from itself and allow it to effectively jump start its balance sheet yet again. Complemented with a potential Vision Fund II, Masayoshi Son’s vision for a completely transformed SoftBank seems waiting for him in the cards.

Tech C.E.O.s Are in Love With Their Principal Doomsayer – Nellie Bowles writes a feature on Yuval Noah Harari, the noted philosopher and popular author of Sapiens. Bowles investigates the paradoxical popularity of Harari, who sees technology as creating a permanent “useless class” and criticizes Silicon Valley with his now enduring popularity in the region. Interesting personal details on the somewhat reclusive Israeli, but ultimately the question of the paradox remains sadly mostly unanswered. (2,800 words)

Why Doctors Hate Their Computers – Atul Gawande discusses learning and using Epic, the dominant electronic medical records software platform, and discovers the challenges of building static software for the complex adaptive system that is health care. His observations of the challenges of software engineering will be well-known to anyone who has read Fred Brooks, but the piece does an excellent job of exploring the balancing act between the needs of technocratic systems and the human design needed to make messy and complicated professions work. Worth a read. (8,900 words)

Picking flowers, making honey: The Chinese military’s collaboration with foreign universities – An excellent study by Alex Joske at the Australia Strategic Policy Institute on the hundreds of military scientists from China who use foreign academic exchanges as a means of information acquisition for critical scientific and engineering knowledge, including in the United States. China’s government under Xi Jinping has made indigenous technology development a chief domestic priority, and the U.S. innovation economy is encouraged to increasingly guard its intellectual property. (6,500 words)

The Digital Deciders – New America report by Robert Morgus who investigates the fracturing of the internet, which I have written about at some length. Morgus finds that a small group of countries (the “digital deciders”) will determine whether the internet continues to be open or whether nationalist interests will close it off. Let’s all hope that Iraq believes in freedom of expression and not Chinese-style surveillance. Worth a skim. (45 page report, but with prodigious tables)

Powered by WPeMatico

Black Friday may still be 10 days away, but shopping season started early in the enterprise this year. We have seen acquisitions totaling almost $50 billion in the last couple of months alone, topped by the mega $34 billion IBM-Red Hat deal two weeks ago. What exactly is going on here?

While not every deal has been for that kind of money, we are seeing an unusually large number of mega deals this year, something that some folks were predicting would happen when the big tech companies were allowed to repatriate their money as part of last year’s tax deal.

Let’s look at some of the multi-billion deals we have seen so far this year:

Big companies are opening their checkbooks in a big way right now, buying everything from marketing to analytics to security companies. They are grabbing open source and proprietary. They are looking at ways to bridge the cloud and on-prem. There is a whole host of software and not much rhyme or reason across the deals.

What they have in common is that they are enormous offers that are simply too huge to refuse. These companies flush with cash see opportunities to fill holes, and they are going for one piece after another.

One of the reasons the prices are going so high is that there is a limited number of companies available to buy, and that is driving up the price, says Ray Wang, founder and principal analyst at Constellation Research. As he sees it, there are only 3-5 decent players per category right now. He compares that with 10 years ago when we were seeing 10-15 players per category. With a limited number of viable startups, companies seem to be going after these companies harder. Combine that with fat wallets full of cash, and you suddenly have this wave of super-sized deals.

The companies being acquired by large organizations can justify selling in the usual ways. They can reward shareholders and investors. These larger organizations allow them to push their product roadmaps much more quickly than they could on their own. They give them access to international markets and mega sales teams.

Still, companies have been spending unusually large sums for relatively small amounts of revenue. In deals over the last three weeks, we have seen IBM pay $34 billion for a company with around $3 billion in revenue. We saw SAP paying $8 billion for a mere $400 million in revenue.

This certainly seems on its face to be a massive overpay, but Constellation’s Wang says ultimately this often comes down to a classic build versus buy decision. SAP could build a similar product to Qualtrics, or they could simply buy it and put the massive SAP salesforce to bear on it. “SAP can sell into 100,000 customers. They only have a 10 percent overlap with Qualtrics. The numbers work, and it beats taking a new product to market,” Wang told TechCrunch.

Wang believes this could be the strategy behind many of these acquisitions, while admitting that the numbers sound a bit crazy. As he says, the formula used to be three times, three years trailing revenues. Now it’s 15-20 times. While those may be hard numbers to justify, he believes it’s a win-win for buyer and acquired — and investors win big too, of course.

In many instances like Red Hat, GitHub and Qualtrics, the companies will likely remain separate, independent units inside the larger organization, at least for the time being, while looking for meaningful crossover inside the larger company when it makes sense.

But Tony Byrne, founder and principal analyst at Real Story Group, says these large companies tend to listen to Wall Street, and customers should be wary of what they hear when it comes to their favorite products and services. “You cannot trust the initial pleasantries about continuity that come out of the first press release. These are huge vendors that listen first and foremost to Wall Street. If there’s an offering that doesn’t totally align with their story to investors, it is not going to get much love and is at risk for getting eliminated or calved off,” Byrne explained.

It’s also hard to know how well two companies are going to fit together until the deal actually closes. Sometimes the acquiring company doesn’t know what they have or how to sell it. Sometimes the two companies don’t fit well together or the founders or key executives don’t fit smoothly into the new hierarchy. They try to figure this all out beforehand, but it’s not always easy to know how it will play out in reality.

Regardless, we are seeing an unusually high level of massive acquisitions, and chances are, there are more coming.

Powered by WPeMatico

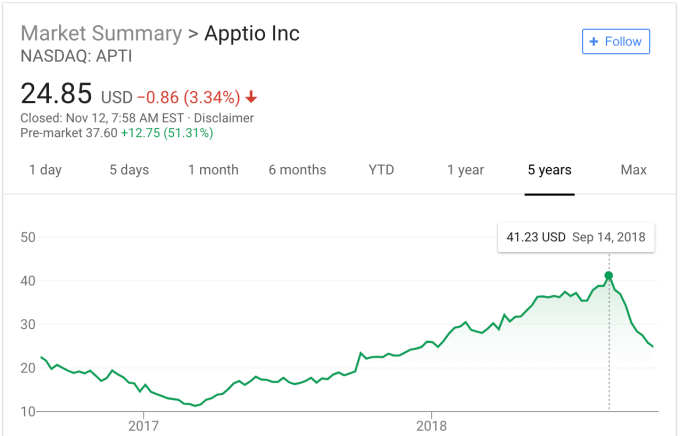

It seems that Sunday has become a popular day to announce large deals involving enterprise companies. IBM announced the $34 billion Red Hat deal two weeks ago. SAP announced its intent to buy Qualtrics for $8 billion last night, and Vista Equity Partners got into the act too, announcing a deal to buy Apptio for $1.94 billion, representing a 53 percent premium for stockholders.

Vista paid $38 per share for Apptio, a Seattle company that helps companies manage and understand their cloud spending inside a hybrid IT environment that has assets on-prem and in the cloud. The company was founded in 2007 right as the cloud was beginning to take off, and grew as the cloud did. It recognized that companies would have trouble understanding their cloud assets alongside on-prem ones. It turned out to be a company in the right place at the right time with the right idea.

Investors like Andreessen Horowitz, Greylock and Madrona certainly liked the concept, showering the company with $261 million before it went public in 2016. The stock price has been up and down since, peaking in August at $41.23 a share before dropping down to $24.85 on Friday. The $38 a share Vista paid comes close to the high-water mark for the stock.

Stock Chart: Google

Sunny Gupta, co-founder and CEO at Apptio, liked the idea of giving his shareholders a good return while providing a good landing spot to take his company private. Vista has a reputation for continuing to invest in the companies it acquires and that prospect clearly excited him. “Vista’s investment and deep expertise in growing world-class SaaS businesses and the flexibility we will have as a private company will help us accelerate our growth…,” Gupta said in a statement.

The deal was approved by Apptio’s board of directors, which will recommend shareholders accept it. With such a high premium, it’s hard to imagine them turning it down. If it passes all of the regulatory hurdles, the acquisition is expected to close in Q1 2019.

It’s worth noting that the company has a 30-day “go shop” provision, which would allow it to look for a better price. Given how hot the enterprise market is right now and how popular hybrid cloud tools are, it is possible it could find another buyer, but it could be hard to find one willing to pay such a high premium.

Vista clearly likes to buy enterprise tech companies, having snagged Ping Identity for $600 million and Marketo for $1.8 billion in 2016. It grabbed Jamf, an Apple enterprise device management company and Datto, a disaster recovery company last year. It turned Marketo around for $4.75 billion in a deal with Adobe just two months ago.

Powered by WPeMatico

Framer, the Amsterdam-based startup behind interactive design platform Framer X, has raised $24 million in Series B investment. The round is led by European VC firm Atomico, with participation from Accel and AngelList. The startup says it will use the new capital to continue building out its platform for designers and product teams. It brings the total raised to date by Framer to $33 million.

Founded by ex-Facebookers Koen Bok and Jorn van Dijk, Framer has set out to ride (and power) a trend that is seeing every company having to become a digital business and often a product-first company, as consumers become accustomed to high-quality apps and other desirable digital experiences. This means that better tools are required to prototype news apps or features, and therefore help shorten the feedback loop and speed up the development process overall.

To that end, Framer X is described as a “fully integrated design, prototyping and developer handoff tool” that makes it easy to create app designs and prototypes that are as visually polished as a production app. Designs created in Framer X are powered by the React framework, and the platform enables a lot of off-the-shelf interactivity, rather than prototypes simply being static wireframes or designs with limited transitions or hotspots. You can also export front-end code for use in your production apps, should you so desire.

However, as explained during a video presentation by Bok and Dijk, what potentially sets Framer X apart from other competing app design and prototyping tools is that you can also import production components and assets into the software for re-use so that designers aren’t continually re-inventing the wheel. Via the “Framer X Store,” these React-based components can also come from and be shared by the wider developer community. Examples include video players (such as YouTube), live maps and data generators, to UI kits and interactive design systems.

This means that Framer is attempting to be a platform play in the true sense of the word, while in turn the Framer X Store is a clever way of creating network effects. Tech brands that have their own developer ecosystems (and are in part “API businesses”) can make components and visual assets available in the store to further lower the barriers for third-party app developers who want to build integrations.

Related to this, the company is announcing the beta launch of a private design store for teams on Framer X. The Team Store enables members of teams at the same company to collaborate and share brand assets, design components and more, so as to allow for internal interactive design systems to also live within the Framer platform.

Cue a statement from Atomico partner Hiro Tamura, who led on behalf of the London-based venture capital firm: “The world’s best digital products, like Google, Facebook, Dropbox, Twitter and Snap, are designed and built by teams. Those teams are already using Framer X. We are excited about partnering with Koen, Jorn and the Framer team to help make that level of digital product excellence and innovation accessible to any company in any traditional industry, from financial services to retail and beyond.”

Meanwhile, the Framer founding backstory is worth noting. Bok and Dijk previously founded app and design studio Sofa, which they sold to Facebook in 2011. As part of the deal they relocated to Facebook’s headquarters in the U.S., and worked on various products, reporting directly to Facebook founder Mark Zuckerberg. However, seeing an opportunity to help more companies transition to becoming digital-first and product-led, the pair left to found Framer in 2014.

Powered by WPeMatico

Selling equity to buy Facebook and Google ads is a bad deal for startups. Clearbanc offers a fundraising alternative. For fast-growing businesses reliably earning sales from their marketing spend, Clearbanc offers funding from $5,000 to $10 million in exchange for a steady revenue share of their earnings until it’s paid back plus a 6 percent fee. Clearbanc picks which merchants qualify by developing tech that scans their Stripe, Facebook ads and other accounts to assess financial health and momentum. It’s already doled out $100 million this year.

“As a business successfully scales, we continue to provide them ongoing capital,” co-founder and CEO Andrew D’Souza tells me. “Our goal is to be the first and last backer of a successful business and save the entrepreneur from having to take hundreds of pitch meetings to keep their company funded.”

“As a business successfully scales, we continue to provide them ongoing capital,” co-founder and CEO Andrew D’Souza tells me. “Our goal is to be the first and last backer of a successful business and save the entrepreneur from having to take hundreds of pitch meetings to keep their company funded.”

After largely flying under the radar since being found in 2015, now Clearbanc has some big funding news of its own. It’s now raised $70 million from a seed and new Series A round from Emergence Capital, Social Capital, CoVenture, Founders Fund, 8VC and more, with Emergence’s Santi Subotovsky joining the board.

“Venture capital has shifted. Instead of funding true research and development, today 40 percent of venture capital goes directly to buying Google and Facebook ads,” D’Souza claims (that may be true for some e-commerce startups, but TechCrunch could not verify that stat for all startups). “Equity is the most expensive way to fund digital ad spend and repeatable growth. So we created something new.”

Clearbanc emerged from an angel investing alliance between two serial entrepreneurs. D’Souza built Andreessen Horowitz-funded social recruiting site Top Prospect, USV-backed education tech company Top Hat and Mastercard portfolio biometric authentication wearable startup Nymi. He helped raise more than $300 million in venture after a stint at McKinsey, when he began co-investing with Michele Romanow, a VC from Canada’s version of the TV show Shark Tank called Dragons’ Den. She’d bootstrapped shopping hub Buytopia that acquired 10 other e-commerce companies, and discount-finder SnapSaves that she sold to Groupon in 2014.

“We started investing together in some of the deals we would see from Dragons’ Den and often found that an equity investment wasn’t the right structure for these consumer product companies. They had great economics and had found a niche of customers, but often didn’t want to exit the business at any point,” D’Souza recalls. “They needed money to acquire more customers, scale up their marketing efforts and online ad spend. So we started to do these revenue share deals.”

Both engineers, they built tech to automate the due diligence and find companies with healthy unit economics and customer acquisition costs. The partnership blossomed into Clearbanc, and romance. “We’re also a couple, so we spend a lot of time together,” D’Souza writes. Inter-startup dating can be problematic, but so far seems to be working for Clearbanc.

Clearbanc’s team

Now Clearbanc has poured over $100 million into 500 companies in 2018, like Vinebox. The subscription wine box company used Clearbanc to grow its membership numbers while raising a Series A for developing new products. Clearbanc’s companies pay out 5 percent in revenue share until the investment plus 6 percent is paid back. That’s a great deal for companies that are already proven moneymakers, like Hunt A Killer, a murder mystery game subscription box that had raised $10,000 and was selling swiftly. Derisked, it didn’t need venture, and has now taken $8 million from Clearbanc to ramp its business.

Clearbanc co-founders Andrew D’Souza and Michele Romanow

Clearbanc is rising up at a time when organic growth channels are shutting down. The ruthless optimization of algorithmic feeds by Facebook, Instagram and Twitter suppress marketing content unless businesses are willing to pay. Without free virality opportunities, companies must rely on venture funding or loans just to turn around and pay that money to big ad platforms. With the new cash, which also comes from iNovia Capital, Real Ventures, Portag3, Precursor, WTI, Berggruen and FJ Labs, Clearbanc plans to expand abroad after doing deals in the U.S. and Canada. It’s also going to invest in building awareness as well as its data science capabilities.

D’Souza and Romanow must have confidence in their tech, as a wrong investment means they might never get their cash back. “We pay a lot of attention to our underwriting and decision-making process because if we make a mistake, we can lose a lot of money. Unlike a VC, we don’t expect the majority of our companies to fail and have the winners make up for the losses,” says D’Souza. One big misstep could wipe out the gains from a bunch of other investments.

Meanwhile, it has to break the norms of how businesses find funding. Startups immediately seek traditional venture or debt financing that can depend on the flashy names already on their cap table, while merchants turn to exploitative online lenders that require a personal guarantee and base their decisions on the founders’ own credit history instead of the business.

While riskier hard-tech startups that will take years to get to market will still need venture, a new crop of direct-to-consumer products and other fast-monetizing startups that are already humming can avoid diluting their team and investors by using Clearbanc. D’Souza concludes, “We’ve spent our entire careers as entrepreneurs and wanted to build a new asset class to help entrepreneurs grow.”

Powered by WPeMatico

Ryan Smith of Qualtrics speaks onstage during TechCrunch Disrupt SF 2015

Enterprise software giant SAP announced today that it has agreed to acquire Qualtrics for $8 billion in cash, just before the survey and research software company was set to go public. The deal is expected to be completed in the first half of 2019. Qualtrics last round of venture capital funding in 2016 raised $180 million at a $2.5 billion valuation.

This is the second-largest ever acquisition of a SaaS company, after Oracle’s purchase of Netsuite for $9.3 billion in 2016.

In a conference call, SAP CEO Bill McDermott said Qualtrics’ IPO was already oversubscribed and that the two companies began discussions a few months ago. SAP claims its software touches 77 percent of the world’s transaction revenue, while Qualtrics’ products include survey software that enables its 9,000 enterprise users to gauge things like customer sentiment and employee engagement.

McDermott compared the potential impact of combining SAP’s operational data with Qualtrics’ customer and user data to Facebook’s acquisition of Instagram. “The legacy players who carried their ‘90s technology into the 21st century just got clobbered. We have made existing participants in the market extinct,” he said. (SAP’s competitors include Oracle, Salesforce.com, Microsoft, and IBM.)

SAP, whose global headquarters is in Walldorf, Germany, said it has secured financing of €7 billion (about $7.93 billion) to cover acquisition-related costs and the purchase price, which will include unvested employee bonuses and cash on the balance sheet at close.

Ryan Smith, who co-founded Qualtrics in 2002, will continue to serve as its CEO. After the acquisition is finalized, the company will become part of SAP’s Cloud Business Group, but retain its dual headquarters in Provo, Utah and Seattle, as well as its own branding and personnel.

According to Crunchbase, the company raised a total of $400 million in VC funding from investors including Accel, Sequoia, and Insight Ventures. It had intended to sell 20.5 million shares in its debut for $18 to $21, which could have potentially grossed up to about $495 million. This would have put its valuation between $3.9 billion to $4.5 billion, according to CrunchBase’s Alex Wilhelm.

This year, Qualtrics’ revenue grew 8.5 percent from $97.1 million in the second-quarter to $105.4 million in the third-quarter, according to its IPO filing. It reported third-quarter GAAP net income of $4.9 million. That represented an increase from the $975,000 it reported in the previous quarter, as well as its net profit in the same period a year ago of $4.7 million. Qualtrics grew its operating cash flow to $52.5 million in the first nine months of 2018, compared to $36.1 million during the same period in 2017.

In today’s announcement, Qualtrics said it expects its full-year 2018 revenue to exceed $400 million and forecasts a forward growth rate of more than 40 percent, not counting the potential synergies of its acquisition by SAP.

Qualtrics’ main competitors include SurveyMonkey, which went public in September.

Powered by WPeMatico