Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Contentful, a Berlin- and San Francisco-based startup that provides content management infrastructure for companies like Spotify, Nike, Lyft and others, today announced that it has raised a $33.5 million Series D funding round led by Sapphire Ventures, with participation from OMERS Ventures and Salesforce Ventures, as well as existing investors General Catalyst, Benchmark, Balderton Capital and Hercules. In total, the company has now raised $78.3 million.

It’s been less than a year since the company raised its Series C round and, as Contentful co-founder and CEO Sascha Konietzke told me, the company didn’t really need to raise right now. “We had just raised our last round about a year ago. We still had plenty of cash in our bank account and we didn’t need to raise as of now,” said Konietzke. “But we saw a lot of economic uncertainty, so we thought it might be a good moment in time to recharge. And at the same time, we already had some interesting conversations ongoing with Sapphire [formerly SAP Ventures] and Salesforce. So we saw the opportunity to add more funding and also start getting into a tight relationship with both of these players.”

It’s been less than a year since the company raised its Series C round and, as Contentful co-founder and CEO Sascha Konietzke told me, the company didn’t really need to raise right now. “We had just raised our last round about a year ago. We still had plenty of cash in our bank account and we didn’t need to raise as of now,” said Konietzke. “But we saw a lot of economic uncertainty, so we thought it might be a good moment in time to recharge. And at the same time, we already had some interesting conversations ongoing with Sapphire [formerly SAP Ventures] and Salesforce. So we saw the opportunity to add more funding and also start getting into a tight relationship with both of these players.”

The original plan for Contentful was to focus almost explicitly on mobile. As it turns out, though, the company’s customers also wanted to use the service to handle its web-based applications and these days, Contentful happily supports both. “What we’re seeing is that everything is becoming an application,” he told me. “We started with native mobile application, but even the websites nowadays are often an application.”

In its early days, Contentful focused only on developers. Now, however, that’s changing, and having these connections to large enterprise players like SAP and Salesforce surely isn’t going to hurt the company as it looks to bring on larger enterprise accounts.

Currently, the company’s focus is very much on Europe and North America, which account for about 80 percent of its customers. For now, Contentful plans to continue to focus on these regions, though it obviously supports customers anywhere in the world.

Contentful only exists as a hosted platform. As of now, the company doesn’t have any plans for offering a self-hosted version, though Konietzke noted that he does occasionally get requests for this.

What the company is planning to do in the near future, though, is to enable more integrations with existing enterprise tools. “Customers are asking for deeper integrations into their enterprise stack,” Konietzke said. “And that’s what we’re beginning to focus on and where we’re building a lot of capabilities around that.” In addition, support for GraphQL and an expanded rich text editing experience is coming up. The company also recently launched a new editing experience.

Powered by WPeMatico

LeanIX, the Software-as-a-Service for “Enterprise Architecture Management,” has closed $30 million in Series C funding.

The round is led by Insight Venture Partners, with participation from previous investors Deutsche Telekom Capital Partners (DTCP), Capnamic Ventures and Iris Capital. It brings LeanIX’s total funding to nearly $40 million since the German company was founded in 2012.

Operating in the enterprise architecture space, previously the domain of a company’s IT team only, LeanIX’s SaaS might well be described as a “Google Maps for IT architectures.”

The software lets enterprises map out all of the legacy software or modern SaaS that the organisation is run on, including creating meta data on things like what business process it is used for or capable of supporting, what tech (and version) powers it, what teams are using or have access to it, who is responsible for it, as well as how the different architecture fits together.

From this vantage point, enterprises can not only keep a better handle on all of the software from different vendors they are buying in, including how that differs or might be better utilised across distributed teams, but also act in a more nimble way in terms of how they adopt new solutions or decommission legacy ones.

In a call with André Christ, co-founder and CEO, he described LeanIX as providing a “single source of truth” for an enterprise’s architecture. He also explained that the SaaS takes a semi-automatic approach to how it maps out that data. A lot of the initial data entry will need to be done manually, but this is designed to be done collaboratively across an organisation and supported by an “easy-to-use UX,” while LeanIX also extracts some data automatically via integrations with ServiceNow (e.g. scanning software on servers) or Signavio (e.g. how IT Systems are used in Business Processes).

More broadly, Christ tells me that the need for a solution like LeanIX is only increasing, as enterprise architecture has shifted away from monolithic vendors and software to the use of a sprawling array of cloud or on-premise software where each typically does one job or business process really well, rather than many.

“With the rising adoption of SaaS, multi-cloud and microservices, an agile management of the Enterprise Architecture is harder to achieve but more important than ever before,” he says. “Any company in any industry using more than a hundred applications is facing this challenge. That’s why the opportunity is huge for LeanIX to define and own this category.”

To that end, LeanIX says the investment will be used to accelerate growth in the U.S. and for continued product innovation. Meanwhile, the company says that in 2018 it achieved several major milestones, including doubling its global customer base, launching operations in Boston and expanding its global headcount with the appointment of several senior-level executives. Enterprises using LeanIX include Adidas, DHL, Merck and Santander, with strategic partnerships with Deloitte, ServiceNow and PwC, among others.

“For businesses today, effective enterprise architecture management is critical for driving digital transformation, and requires robust tools that enable collaboration and agility,” said Teddie Wardi, principal at Insight Venture Partners, in a statement. “LeanIX is a pioneer in the space of next-generation EA tools, achieved staggering growth over the last year, and is the trusted partner for some of today’s largest and most complex organizations. We look forward to supporting its continued growth and success as one of the world’s leading software solutions for the modernization of IT architectures.”

Powered by WPeMatico

As the fight against climate change heats up, Cove.Tool is looking to help tackle carbon emissions one building at a time.

The Atlanta-based startup provides an automated big-data platform that helps architects, engineers and contractors identify the most cost-effective ways to make buildings compliant with energy efficiency requirements. After raising an initial round earlier this year, the company completed the final close of a $750,000 seed round. Since the initial announcement of the round earlier this month, Urban Us, the early-stage fund focused on companies transforming city life, has joined the syndicate comprised of Tech Square Labs and Knoll Ventures.

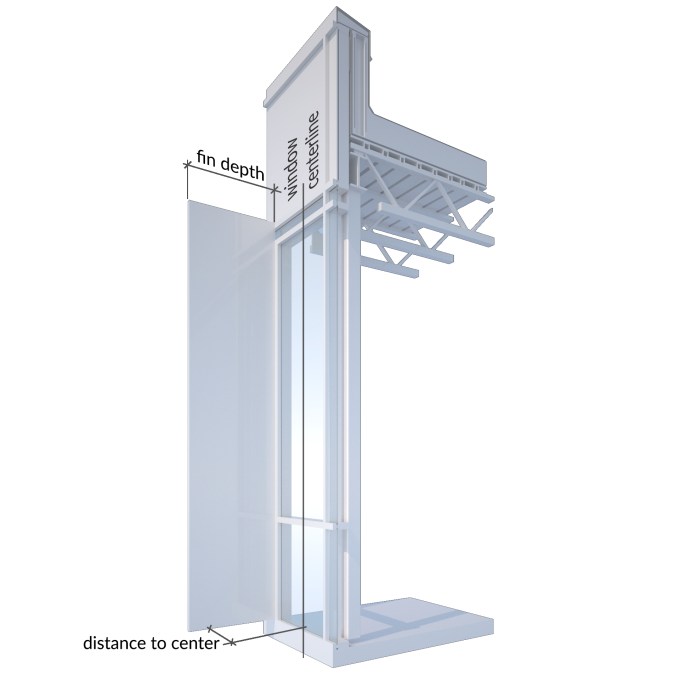

Cove.Tool software allows building designers and managers to plug in a variety of building conditions, energy options, and zoning specifications to get to the most cost-effective method of hitting building energy efficiency requirements (Cove.Tool Press Image / Cove.Tool / https://covetool.com).

In the US, the buildings we live and work in contribute more carbon emissions than any other sector. Governments across the country are now looking to improve energy consumption habits by implementing new building codes that set higher energy efficiency requirements for buildings.

However, figuring out the best ways to meet changing energy standards has become an increasingly difficult task for designers. For one, buildings are subject to differing federal, state and city codes that are all frequently updated and overlaid on one another. Therefore, the specific efficiency requirements for a building can be hard to understand, geographically unique and immensely variable from project to project.

Architects, engineers and contractors also have more options for managing energy consumption than ever before – equipped with tools like connected devices, real-time energy-management software and more-affordable renewable energy resources. And the effectiveness and cost of each resource are also impacted by variables distinct to each project and each location, such as local conditions, resource placement, and factors as specific as the amount of shade a building sees.

With designers and contractors facing countless resource combinations and weightings, Cove.Tool looks to make it easier to identify and implement the most cost-effective and efficient resource bundles that can be used to hit a building’s energy efficiency requirements.

Cove.Tool users begin by specifying a variety of project-specific inputs, which can include a vast amount of extremely granular detail around a building’s use, location, dimensions or otherwise. The software runs the inputs through a set of parametric energy models before spitting out the optimal resource combination under the set parameters.

For example, if a project is located on a site with heavy wind flow in a cold city, the platform might tell you to increase window size and spend on energy efficient wall installations, while reducing spending on HVAC systems. Along with its recommendations, Cove.Tool provides in-depth but fairly easy-to-understand graphical analyses that illustrate various aspects of a building’s energy performance under different scenarios and sensitivities.

Cove.Tool users can input granular project-specifics, such as shading from particular beams and facades, to get precise analyses around a building’s energy performance under different scenarios and sensitivities.

Traditionally, the design process for a building’s energy system can be quite painful for architecture and engineering firms.

An architect would send initial building designs to engineers, who then test out a variety of energy system scenarios over the course a few weeks. By the time the engineers are able to come back with an analysis, the architects have often made significant design changes, which then gets sent back to the engineers, forcing the energy plan to constantly be 1-to-3 months behind the rest of the building. This process can not only lead to less-efficient and more-expensive energy infrastructure, but the hectic back-and-forth can lead to longer project timelines, unexpected construction issues, delays and budget overruns.

Cove.Tool effectively looks to automate the process of “energy modeling.” The energy modeling looks to ease the pains of energy design in the same ways Building Information Modeling (BIM) has transformed architectural design and construction. Just as BIM creates predictive digital simulations that test all the design attributes of a project, energy modeling uses building specs, environmental conditions, and various other parameters to simulate a building’s energy efficiency, costs and footprint.

By using energy modeling, developers can optimize the design of the building’s energy system, adjust plans in real-time, and more effectively manage the construction of a building’s energy infrastructure. However, the expertise needed for energy modeling falls outside the comfort zones of many firms, who often have to outsource the task to expensive consultants.

The frustrations of energy system design and the complexities of energy modeling are ones the Cove.Tool team knows well. Patrick Chopson and Sandeep Ajuha, two of the company’s three co-founders, are former architects that worked as energy modeling consultants when they first began building out the Cove.Tool software.

After seeing their clients’ initial excitement over the ability to quickly analyze millions of combinations and instantly identify the ones that produce cost and energy savings, Patrick and Sandeep teamed up with CTO Daniel Chopson and focused full-time on building out a comprehensive automated solution that would allow firms to run energy modeling analysis without costly consultants, more quickly, and through an interface that would be easy enough for an architectural intern to use.

So far there seems to be serious demand for the product, with the company already boasting an impressive roster of customers that includes several of the country’s largest architecture firms, such as HGA, HKS and Cooper Carry. And the platform has delivered compelling results – for example, one residential developer was able to identify energy solutions that cost $2 million less than the building’s original model. With the funds from its seed round, Cove.Tool plans further enhance its sales effort while continuing to develop additional features for the platform.

The value proposition Cove.Tool hopes to offer is clear – the company wants to make it easier, faster and cheaper for firms to use innovative design processes that help identify the most cost-effective and energy-efficient solutions for their buildings, all while reducing the risks of redesign, delay and budget overruns.

Longer-term, the company hopes that it can help the building industry move towards more innovative project processes and more informed decision-making while making a serious dent in the fight against emissions.

“We want to change the way decisions are made. We want decisions to move away from being just intuition to become more data-driven.” The co-founders told TechCrunch.

“Ultimately we want to help stop climate change one building at a time. Stopping climate change is such a huge undertaking but if we can change the behavior of buildings it can be a bit easier. Architects and engineers are working hard but they need help and we need to change.”

Powered by WPeMatico

Floom, the online marketplace and SaaS for independent florists, has raised $2.5 million in a seed funding. The round was round led by Firstminute Capital, and will be used by the London headquartered startup to continue to expand to the U.S., where it already operates in New York and L.A., and to further develop its software offering.

Additional investors include Tom Singh (founder of New Look), Pembroke VCT, Wing Chan (CTO digital experiences of The Hut Group), and Carlos Morgado (former CTO of Just Eat). Morgado has also joined Floom’s board.

Founded by 31-year-old Lana Elie in 2016, Floom bills itself as a curated marketplace for independent florists. Alongside this, the company’s technology platform gives florists the software and tools they need to create and deliver “beautifully crafted bouquets” to customers. It’s this SaaS play that Elie says sets Floom apart from competitors.

“We rely on a network [of florists], like many of the bigger competitors, so that we can offer same-day delivery without the risk of holding stock ourselves,,” she tells me. “But instead of telling the florists what to create and what to hold in stock, we built them an Etsy-like UI to design and deliver beautifully crafted bouquets to our online communities themselves”.

This sees florists provided with a “backend management dashboard” to create, allocate and manage inventory, and to co-ordinate with Floom’s marketplace. The software manages and tracks delivery, too.

“Customers receive more bouquet options, in more areas, by vetted florists, with the ultimate convenience of a seamless check-out and what everyone really wants: confirmation of safe receipt in their loved one’s hand,” explains Elie. “If the final product doesn’t match the picture, they get their money back, something that most competitors can’t offer, but we solved this by relying on the florists to generate the bouquet catalogue themselves”.

On the flower delivery front, Floom’s main competitors are Interflora in the U.K. (owned by 100-year-old conglomerate FTD in the U.S.), as well as 1-800-flowers and Teleflora. “There have been some new players in the flower space, but none solve the problem by creating better technologies,” argues the Floom founder.

“Floom’s not just a flower delivery service but a tech company. I wanted to solve a problem: showing customers all the amazing artisanal florists in their home cities, and making the experience of sending flowers enjoyable and hassle-free. On top of that, we wanted to create a fresh brand that appealed to an audience of my generation… and different from how you might typically think of the flower industry”.

With that said, Elie concedes that there is other florist software in existence, but says it doesn’t really consider the florists as a customer in the same way that Floom does. This is especially true in how the startup understands that the “brand and UI is just as important as functionality”.

“Florists are creative, skilled in a way that I’m definitely not, but when it comes to something like a website build, they’re paying the wrong people much more than they need to build badly UX’d sites,” she adds. “Florists are given no chance to really compete in a world where everything is digital. Building a management tool that speaks to all florists’ consumer facing channels (phone, email, chat, webshop, POS etc) will ultimately mean cost and time savings for the florist, less unnecessary waste for environmental purposes, and better products and delivery experiences for the customer”.

Powered by WPeMatico

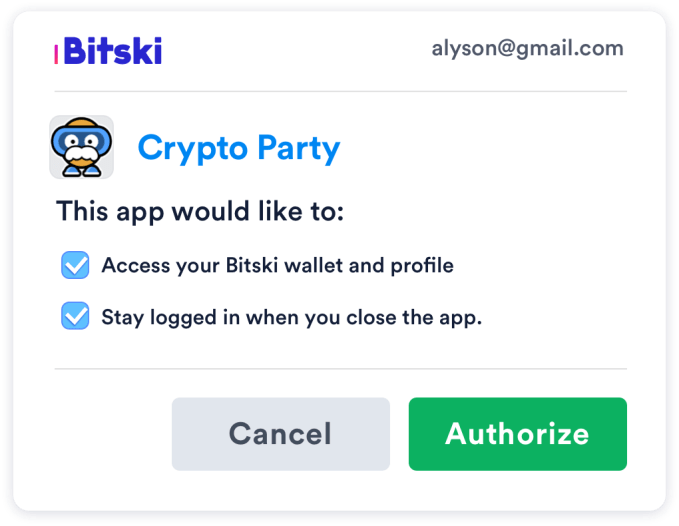

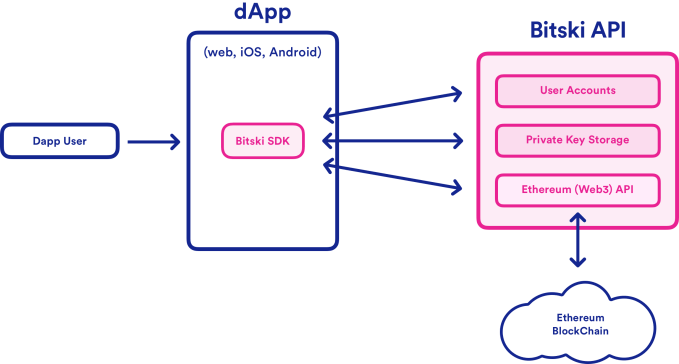

The mainstream will never adopt blockchain-powered decentralized apps (dApps) if it’s a struggle to log in. They’re either forced to manage complex security keys themselves, or rely on a clunky wallet-equipped browser like MetaMask. What users need is for signing in to blockchain apps to be as easy as Login with Facebook. So that’s what Bitski built. The startup emerges from stealth today with an exclusive on TechCrunch about the release of the developer beta of its single sign-on cryptocurrency wallet platform.

Ten projects, including 7 game developers, are lined up to pay a fee to integrate Bitski’s SDK. Then, whenever they need a user’s identity or to transact a payment, their app pops open a Bitski authorization screen, where users can grant permissions to access their ID, send money or receive items. Users sign up just once with Bitski, and then there’s no more punching in long private keys or other friction. Using blockchain apps becomes simple enough for novices. Given the recent price plunge, the mainstream has been spooked about speculating on cryptocurrencies. But Bitski could unlock the utility of dApps that blockchain developers have been promising but haven’t delivered.

“One of the great challenges for protocol teams and product companies in crypto today is the poor UX in dApps, specifically onboarding, transactions, and sign-in/password recovery,” says co-founder and CEO Donnie Dinch. “We interviewed a ton of dApp developers. The minute they used a wallet, there was a huge drop-off of folks. Bitski’s vision is to solve user onboarding and wallet usability for developers, so that they can in-turn focus on creating unique and useful dapps.”

The scrappy Bitski team raised $1.5 million in pre-seed capital from Steve Jang’s Kindred Ventures, Signia, Founders Fund, Village Global and Social Capital. They were betting on Dinch, a designer-as-CEO who’d built concert discovery app WillCall that he sold to Ticketfly, which was eventually bought by Pandora. After 18 months of rebranding Ticketfly and overhauling its consumer experience, Dinch left and eventually recruited engineer Julian Tescher to come with him to found Bitski.

Bitski co-founder and CEO Donnie Dinch

After Riff failed to hit scale, the team hung up its social ambitions in late 2017 and “started kicking around ideas for dApps. We mocked up a Venmo one, a remittance app…but found the hurdle to get someone to use one of these products is enormous,” Dinch recalls. “Onboarding was a dealbreaker for anyone building dApps. Even if we made the best crypto Venmo, to get normal people on it would be extremely difficult. It’s already hard enough to get people to install apps from the App Store.” They came up with Bitski to let any developer ski jump over that hurdle.

Looking across the crypto industry, the companies like Coinbase and Binance with their own hosted wallets that permitted smooth UX were the ones winning. Bitski would bring that same experience to any app. “Our hosted wallet SDK lets developers drop the Bitski wallet into their apps and onboard users with standards web 2.0 users have grown to know and love,” Dinch explains.

Imagine an iOS game wants to reward users with a digital sword or token. Users would have to set up a whole new wallet, struggle with their credentials or use another clumsy solution. They’d have to own Ethereum already to pay the Ethereum “gas” price to power the transaction, and the developer would have to manually approve sending the gift. With Bitski, users can approve receiving tokens from a developer from then on, and developers can pay the gas on users’ behalf while triggering transactions programmatically.

Magik is an AR content platform that’s one of Bitski’s first developers. Magik’s founders tell me, “We’re building towards reaching millions of mainstream consumers, and Bitski is the only wallet solution that understands what we need to reach users at that scale. They provide a dead-simple, secure and familiar interface that addresses every pain point along the user-onboarding journey.”

Bitski will offer a free tier, priced tiers based on transaction volume or a monthly fee and an enterprise version. In the future, the company is considering doubling-down on premium developer services to help them build more on top of the blockchain. “We will never, ever monetize user data. We’ve never had any intent at looking at it,” Dinch vows. The startup hopes developers will seize on the network effects of a cross-app wallet, as once someone sets up Bitski to use one product, all future sign-ins just require a few clicks.

In August, Coinbase acquired a startup called Distributed Systems that was building a similar crypto identity platform called the Clear Protocol. A “login with Coinbase” feature could be popular if launched, but the company’s focus is to spread a ton of blockchain projects. “If [login with Coinbase] launched tomorrow, they wouldn’t be able to support games or anything with a unique token. We’re a lockbox, they’re a bank,” Dinch claims.

The spectre of single sign-on’s biggest player, Facebook, looms, as well. In May it announced the formation of a blockchain team we suspect might be working on a crypto login platform or other ways to make the decentralized world more accessible for mom and pop. Dinch suspects that fears about how Facebook uses data would dissuade developers and users from adopting such a product. Still, Bitski’s haste in getting its developer platform into beta just a year after forming shows it’s eager to beat them to market.

Building a centralized wallet in a decentralized ecosystem comes with its own security risks. But Dinch assures me Bitski is using all its own hardware with air-gapped computers that have been stripped of their Wi-Fi cards, and it’s taking other secret precautions to prevent anyone from snatching its wallets. He believes cross-app wallets will also deliver a future where users actually own their virtual goods instead of just relying on the good will of developers not to pull them away or shut them down.” The idea of we’ve never been able to provably own unique digital assets is crazy to me,” Dinch notes. “Whether it’s a skin in Fortnite or a movie on iTunes that you purchase, you don’t have liquidity to resell those things. We think we’ll look back in 5 to 10 years and think it’s nuts that no one owned their digital items.”

While the crypto prices might be cratering and dApps like Cryptokitties have cooled off, Dinch is convinced the blockchain startups won’t fade away. “There is a thriving developer ecosystem hellbent on bringing the decentralized web to reality; regardless of token price. It’s a safe assumption that prices will dip a bit more, but will eventually rise whenever we see real use cases for a lot of these tokens. Most will die. The ones that succeed will be outcome-oriented, building useful products that people want.” Bitski’s a big step in that direction.

Powered by WPeMatico

Red Hat is in the process of being acquired by IBM for a massive $34 billion, but that deal hasn’t closed yet and, in the meantime, Red Hat is still running independently and making its own acquisitions, too. As the company today announced, it has acquired Tel Aviv-based NooBaa, an early-stage startup that helps enterprises manage their data more easily and access their various data providers through a single API.

NooBaa’s technology makes it a good fit for Red Hat, which has recently emphasized its ability to help enterprise more effectively manage their hybrid and multicloud deployments. At its core, NooBaa is all about bringing together various data silos, which should make it a good fit in Red Hat’s portfolio. With OpenShift and the OpenShift Container Platform, as well as its Ceph Storage service, Red Hat already offers a range of hybrid cloud tools, after all.

“NooBaa’s technologies will augment our portfolio and strengthen our ability to meet the needs of developers in today’s hybrid and multicloud world,” writes Ranga Rangachari, the VP and general manager for storage and hyperconverged infrastructure at Red Hat, in today’s announcement. “We are thrilled to welcome a technical team of nine to the Red Hat family as we work together to further solidify Red Hat as a leading provider of open hybrid cloud technologies.”

While virtually all of Red Hat’s technology is open source, NooBaa’s code is not. The company says that it plans to open source NooBaa’s technology in due time, though the exact timeline has yet to be determined.

NooBaa was founded in 2013. The company has raised some venture funding from the likes of Jerusalem Venture Partners and OurCrowd, with a strategic investment from Akamai Capital thrown in for good measure. The company never disclosed the size of that round, though, and neither Red Hat nor NooBaa are disclosing the financial terms of the acquisition.

Powered by WPeMatico

Some consolidation is afoot in the world of business software. TechCrunch has learned that Parallels, the virtualization specialist with millions of users, is getting acquired by Corel, the Canadian company behind design apps like CorelDraw and other productivity apps like WordPerfect.

Some employees at Parallels have already been briefed on the acquisition, which is expected to be announced to the whole company today. Terms have not been disclosed but we understand it is an all-cash deal.

Corel has changed ownership and gone in and out of being listed publicly a number of times since being founded in the 1980s in Ottawa. It’s now owned by Vector Capital, which is essentially the one buying Parallels.

From what we understand, Corel will keep Parallels an independent product.

Parallels was originally founded in 1999 with roots in Russia and is currently headquartered in Bellevue, Washington. It has never made much of a fanfare around its financing or valuation. According to PitchBook its last funding round was in 2015, an undisclosed amount from Endeavour Vision, KG Investments, Maxfield Capital, Savano Capital Partners and others. It had raised $300 million from Ingram Micro the year before that.

It’s not fully clear what the rationale was for the sale, except it seems many investors were longstanding and looking to exit, while Corel has slowly been consolidating a number of sodtware businesses, most recently before this, Gravit Designer from Germany earlier this year.

Parallels provides a number of products that help people work seamlessly across multiple platforms, essentially letting people (and IT managers) run a unified workflow regardless of the device or operating system, ranging from Windows, Mac, iOS, Android, Chromebook, Linux, Raspberry Pi and cloud — a particularly compelling offering in the current, fragmented IT climate.

Corel once had designs to take on Microsoft in the world of software — to be the Pepsi to Microsoft’s Coke, as I once saw it described. That didn’t really pan out, with Microsoft at the time having a vice grip on platform and software (this was before the rise of Google, the rebirth of Apple, the rise of apps, and other big shifts in the industry). At one point, Microsoft signed a partnership with Corel that saw it investing in the company: a sell out, as one disappointed Canadian journalist described it at the time.

The two have also sparred over patents.

These days Corel is “highly profitable”, says Vector, selling software that includes CorelDraw, WordPerfect, WinZip, PaintShop Pro, and WinDVD. You could potentially imagine Parallels existing alongside that, or even perhaps helping increase the functionality and usefulness of Corel’s other apps with more cross-platform functionality.

The Parallels deal is expected to close next year, our source said.

We have written both to Corel and Parallels and will update this post as we learn more.

There have been a number of enterprise software acquisitions with a view to legacy businesses raising their game in open source, cloud and other newer developments. The most notable of these has been IBM announcing its intent to acquire Red Hat for $34 billion in October.

Powered by WPeMatico

After focusing on Asian markets, particularly in Southeast Asia, Bangkok-based Eko Communications is getting ready to take on Slack, Microsoft Teams, and other enterprise messaging apps in Europe. The startup announced today that it has raised a Series B of $20 million and opened offices in London (which will serve as its new commercial headquarters), Amsterdam, and Berlin.

The funding, led by SMD Ventures, with participation from AirAsia’s digital investment arm Redbeat Ventures, Gobi Partners, East Ventures, and returning investors, brings Eko Communication’s total raised to $28.7 million. The company’s Series A was announced in 2015, followed by $2 million in strategic funding from Japanese conglomerate Itochu last year. Eko Communications (not to be confused with Eko, an interactive video startup) has already served clients like Thai mobile operator True, Radisson, and 7-Eleven.

Eko Communications’ Series B is earmarked for its ambitious global expansion plans in the first quarter of 2019. Korawad Chearavanont, the company’s CEO and co-founder, told TechCrunch in an email that it has already localized products for target markets including the UK, Ireland, Benelux, and the DACH region (Germany, Austria, and Switzerland).

Eko Communications wants to expand in the European Union and the United States because their economies are both significantly larger than Southeast Asia’s, said Chearavanont. This, plus the fact that both have larger enterprise IT markets thanks to higher spending on software by companies, means that “for Eko to achieve the necessary scale to become a global player in the mobile enterprise market, continued growth in these markets is critical,” he added.

The company claims that its revenues have more than tripled in the past year and that it now has more than 500,000 recurring paid users. Of course, any enterprise messaging startup has to contend with the specter of Slack and Microsoft Teams. Positioning Eko Communications as a rival to those services, however, isn’t totally accurate because they are aimed at different customers.

Slack and Microsoft Teams are “primarily utilized by ‘knowledge workers’ and these systems are priced for these types of users,” Chearavanont said. “Being a mobile-first company, we target companies that have a large presence of mobile-first staff traditionally in industries like retail and hospitality (the services sector in general).” Many employees in those sectors still rely on messaging apps like WhatsApp or email to communicate, so Eko Communications seeks to make it easy for companies to transition from their ad hoc communication methods to a more secure and efficient system with tools like APIs to help them integrate legacy systems.

Powered by WPeMatico

Berlin-based Zizoo — a startup which self describes as booking.com for boats — has nabbed a €6.5 million (~$7.4M) Series A to help more millennials find holiday yachts to mess about taking selfies in.

Zizoo says its Series A — which was led by Revo Capital, with participation from new investors including Coparion, Check24 Ventures and PUSH Ventures — was “significantly oversubscribed”.

Existing investors including MairDumont Ventures, aws Founders Fund, Axel Springer Digital Ventures and Russmedia International also participated in the round.

We first came across Zizoo some three years ago when they won our pitching competition in Budapest.

We’re happy to say they’ve come a long way since, with a team that’s now 60-people strong, and business relationships with ~1,500 charter companies — serving up more than 21,000 boats for rent, across 30 countries, via a search and book platform that caters to a full range of “sailing experiences”, from experienced sailor to novice and, on the pricing front, luxury to budget.

Registered users passed the 100,000 mark this year, according to founder and CEO Anna Banicevic. She also tells us that revenue growth has been 2.5x year-on-year for the past three years.

Commenting on the Series A in a statement, Revo Capital’s managing director Cenk Bayrakdar said: “The yacht charter market is one of the most underserved verticals in the travel industry despite its huge potential. We believe in Zizoo’s successful future as a leading SaaS-enabled marketplace.”

The new funds will be put towards growing the business — including by expanding into new markets; plus product development and recruitment across the board.

Zizoo founder and CEO Anna Banicevic at its Berlin offices

“We’re looking to strengthen our presence in the US, where we’ve seen the biggest YoY growth while also expand our inventory in hot locations such as Greece, Spain and the Caribbean,” says Banicevic on market expansion. “We will also be aggressively pushing markets such as France and Spain where consumers show a growing interest in boat holidays.”

Zizoo is intending to hire 40 more employees over the course of the next year — to meet what it dubs “the booming demand for sailing experiences, especially among millennials”.

So why do millennials love boating holidays so much? Zizoo says the 20-40 age range makes up the “majority” of its customer.

Banicevic reckons the answer is they’re after a slice of ‘affordable luxury’.

“After the recent boom of the cruising industry, millennials are well familiar with the concept of holidays at sea. However, sailing holidays (yachting) are much more fitting to the millennial’s strive for independence, adventure and experiences off the beaten path,” she suggests.

“Yachting is a growing trend no longer reserved for the rich and famous — and millennials want a piece of that. On our platform, users can book a boat holiday for as low as £25 per person per night (this is an example of a sailboat in Croatia).”

On the competition front, she says the main competition is the offline sphere (“where 90% of business is conducted by a few large and many small travel agents”).

But a few rival platforms have emerged “in the last few years” — and here she reckons Zizoo has managed to outgrow the startup competition “thanks to our unique vertically integrated business model, offering suppliers a booking management system and making it easy for the user to book a boat holiday”.

Powered by WPeMatico

Wluper, the London-based tech startup building a conversational AI to power knowledge-based voice assistants, has raised $1.3 million in seed funding. Leading the round is “deep tech” VC IQ Capital, with participation from Seedcamp, Aster, and Magic Pony co-founder Dr Zehan Wang.

Founded in 2016 and originally backed by Jaguar Land Rover’s InMotion Ventures, Wluper’s “conversational AI” is initially targeting navigation products with what it describes as “goal-driven dialogue” technology that is designed to have more natural conversations to help with various navigation tasks.

The ‘secret sauce’, as it were, is that Wluper believes voice assistants work much better when the underlying AI is tasked with becoming an expert in a more narrow and specialist domain.

“When we think of intelligent assistants like Alexa or Siri, the only time you’ll believe they’re really good is if they understand you properly; most of the time, they simply can’t,” says Wluper co-founder Hami Bahraynian. “It is not the speech recognition which fails. It is the missing focus and lacking reasoning of these systems, because they all can do a lot of things reasonably well, but nothing perfectly”.

Describing the goal of “general” conversation AI as one that could take 15, 20 or more years to achieve, Bahraynian says that in the interim what is needed is “intelligent agents” that are created for a certain purpose, now.

“This is exactly what we do,” he says. “We build domain-expert conversational intelligence, which does one thing, understanding everything transport-related, but that one thing perfectly”.

Furthermore, Wluper’s approach is able to make clear assumptions regarding what the user is talking about, and therefore claims to be able to understand much more complex questions and in a more natural way. This includes multi-intent queries, and follow-up questions to enable a “true” conversation, says Bahraynian.

In addition, Wluper has been conducting R&D in what comes after the “understanding” bit of the NLP pipeline, leading the startup to undergo further research on a machine’s “knowledge acquisition” capabilities, which it believes is a crucial piece of the puzzle needed to solve conversational AI.

“Even if naturally asked user queries are eventually understood correctly, extracting and providing relevant and useful information from the right places is even more challenging, and with current mostly ruled-based approaches, ultimately impossible to scale,” adds Bahraynian.

“We work on this problem by moving away from traditional handcrafted methods and work on new ways to optimise a machine’s knowledge acquisition and finding the right balance between structured and unstructured data in order to provide more meaningful results”.

Meanwhile, Wluper’s seed investment will be used to hire more engineers and research scientists to expand the startup’s research and development capabilities.

Powered by WPeMatico