Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

As networks get put under increasing pressure from ever-growing amounts of data, network equipment manufacturers are facing huge challenges to increase data transmission speeds over farther distances. As a premier networking equipment company, Cisco wants to be prepared to meet that demand. Today, it opened up its checkbook and announced its intent to acquire Luxtera for $660 million.

Luxtera, which was founded in 2001 and raised more than $130 million, will give Cisco a photonic solution for that data networking problem. Rob Salvagno, head of Cisco’s M&A and venture investment team, sees a company that can help modernize Cisco’s networking equipment.

“That’s why today we announced our intent to acquire Luxtera, Inc., a privately-held semiconductor company that uses silicon photonics technology to build integrated optics capabilities for webscale and enterprise data centers, service provider market segments, and other customers. Luxtera’s technology, design and manufacturing innovation significantly improves performance and scale while lowering costs,” he wrote in a blog post announcing the acquisition.

Photonics uses light to move large amounts of data at higher speeds over increased distances via fiber optic cable. Cisco sees this as a way to future-proof customer networking requirements, while keeping them on Cisco equipment. “The combination of Cisco’s and Luxtera’s capabilities in 100GbE/400GbE optics, silicon and process technology will enable customers to build future-proof networks optimized for performance, reliability and cost,” Salvagno wrote.

While Cisco has been acquiring its share of high-profile software properties in recent years, including AppDyanmics for $3.7 billion in 2017 and Jasper Technologies for $1.4 billion in 2016, it also acquired Israeli chip designer Leaba Semiconductor for $320 million in 2016 for its advanced chip making capability.

Today’s announcement would seem to build on that earlier purchase as Cisco tries to modernize its hardware offerings to meet increasingly stringent demands inside large-scale data centers.

The acquisition is subject to the typical regulatory scrutiny, but Cisco expects it to close in its fiscal year 2019 Q3. It reported its Q1 2019 earnings in November.

Powered by WPeMatico

B-Social, a London fintech that currently offers a “social finance” app and beta debit Mastercard, has raised £3.2 million in seed-round funding from undisclosed high-net-worth individuals. However, the fundraise is just the first step in a journey in which B-Social wants to eventually become a fully licensed bank that reimagines banking around everyday social interactions.

As it exists today, the B-Social app and accompanying card enables users to have control over everyday spending, track expenditures and create groups between friends to split bills and record settlements. It’s currently in the hands of a limited number of beta testers, spanning employees, investors, friends and family, with plans for a wider U.K. launch in February next year.

“We recognise that almost all financial transactions are inherently social,” B-Social co-founder and CEO Nazim Valimahomed tells me. “We want to change the relationship people have with money by helping them overcome the anxiety, awkwardness and wasted time when they engage with their social finances. We are doing that by building a digital bank that truly accommodates the way people live their lives and is dedicated to connecting a person’s finances to their social world.”

The idea was born in part out of Valimahomed’s own frustrations and is informed by his belief that individuals are often a bank themselves, lending and borrowing to friends and family by making shared purchases and then getting paid back.

“A simple example might be that you pay for flights for two or more people and then get paid back individually,” he says. “For multiple transactions, this becomes complex, often resulting in the trip organiser having to create a spreadsheet to work out what people owe across multiple transactions.”

To simplify this problem, B-Social wants to let you to make purchases with your card, which are flagged as an expense on behalf of a group of individuals. From here the bank to be will enable all members of a group — and where groups can be ad hoc and temporary or more long-term — to continuously see who is owed how much and to get paid back easily within the app and record settlements.

Dubbing this future proposition as the seeds of a “social bank,” the B-Social CEO cites competitors as traditional high-street banks that currently dominate the U.K. consumer market (the so-called big 5 have around 87 percent market share in the U.K.).

“We are aiming at winning a part of their market share by targeting customers looking for a bank as social as they are that offers a unique digital experience in order to help change the banking ecosystem forever,” Valimahomed tells me, although he also concedes that challengers such as Monzo, N26, Starling and Revolut have also built some basic social features into their apps.

“Our entire technology and product focus is to build a bank from scratch through a social lens,” he says.

Powered by WPeMatico

K Health, the startup providing consumers with an AI-powered primary care platform, has raised $25 million in Series B funding. The round was led by 14W, Comcast Ventures and Mangrove Capital Partners, with participation from Lerer Hippeau, BoxGroup and Max Ventures — all previous investors from the company’s seed or Series A rounds. Other previous investors include Primary Ventures and Bessemer Venture Partners.

Co-founded and led by former Vroom CEO and Wix co-CEO Allon Bloch, K Health (previously Kang Health) looks to equip consumers with a free and easy-to-use application that can provide accurate, personalized, data-driven information about their symptoms and health.

“When your child says their head hurts, you can play doctor for the first two questions or so — where does it hurt? How does it hurt?” Bloch explained in a conversation with TechCrunch. “Then it gets complex really quickly. Are they nauseous or vomiting? Did anything unusual happen? Did you come back from a trip somewhere? Doctors then use differential diagnosis to prove that it’s a tension headache versus other things by ruling out a whole list of chronic or unusual conditions based on their deep knowledge sets.”

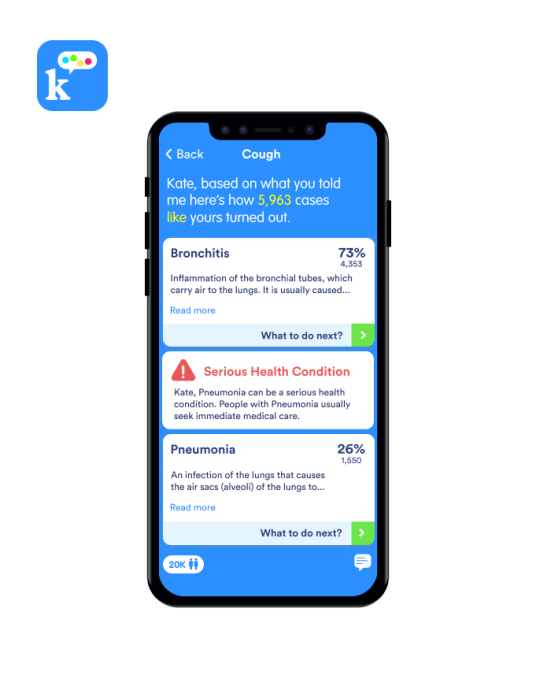

K Health’s platform, which currently focuses on primary care, effectively looks to perform a simulation and data-driven version of the differential diagnosis process. On the company’s free mobile app, users spend three-to-four minutes answering an average of 21 questions about their background and the symptoms they’re experiencing.

Using a data set of two billion historical health events over the past 20 years — compiled from doctors’ notes, lab results, hospitalizations, drug statistics and outcome data — K Health is able to compare users to those with similar symptoms and medical histories before zeroing in on a diagnosis.

With its expansive comparative approach, the platform hopes to offer vastly more thorough, precise and user-specific diagnostic information relative to existing consumer alternatives, like WebMD or, what Bloch calls “Dr. Google,” which often produce broad, downright frightening and inaccurate diagnoses.

Users are able to see cases and diagnoses that had symptoms similar to their own, with K Health notifying users with serious conditions when to consider seeking immediate care. (K Health Press Image / K Health / https://www.khealth.ai)

In addition to pure peace of mind, the utility provided to consumers is clear. With more accurate at-home diagnostic information, users are able to make better preventative health decisions, avoid costly and unnecessary trips to in-person care centers or appointments with telehealth providers and engage in constructive conversations with physicians when they do opt for in-person consultations.

K Health isn’t looking to replace doctors, and, in fact, believes its platform can unlock tremendous value for physicians and the broader healthcare system by enabling better resource allocation.

Without access to quality, personalized medical information at home, many defer to in-person doctor visits even when it may not be necessary. And with around one primary care physician per 1,000 people in the U.S., primary care practitioners are subsequently faced with an overwhelming number of patients and are unable to focus on more complex cases that may require more time and resources. The high volume of patients also forces physicians to allocate budgets for support staff to help interact with patients, collect initial background information and perform less-demanding tasks.

K Health believes that by providing an accurate alternative for those with lighter or more trivial symptoms, it can help lower unnecessary in-person visits, reduce costs for practices and allow physicians to focus on complicated, rare or resource-intensive cases, where their expertise can be most useful and where brute machine processing power is less valuable.

The startup is looking to enhance the platform’s symbiotic patient-doctor benefits further in early-2019, when it plans to launch in-app capabilities that allow users to share their AI-driven health conversations directly with physicians, hopefully reducing time spent on information gathering and enabling more-informed treatment.

With K Health’s AI and machine learning capabilities, the platform also gets smarter with every conversation as it captures more outcomes, hopefully enriching the system and becoming more valuable to all parties over time. Initial results seem promising, with K Health currently boasting around 500,000 users, most having joined since this past July.

With the latest round, the company has raised a total of $37.5 million since its late-2016 founding. K Health plans to use the capital to ramp up marketing efforts, further refine its product and technology and perform additional research to identify methods for earlier detection and areas outside of primary care where the platform may be valuable.

Longer term, the platform has much broader aspirations of driving better health outcomes, normalizing better preventative health behavior and creating more efficient and affordable global healthcare systems.

The high costs of the American healthcare system and the impacts they have on health behavior has been well-documented. With heavy co-pays, premiums and treatment cost, many avoid primary care altogether or opt for more reactionary treatment, leading to worse health outcomes overall.

Issues seen in the American healthcare system are also observable in many emerging market countries with less medical infrastructure. According to the World Health Organization, the international standard for the number of citizens per primary care physician is one for every 1,500 to 2,000 people, with some countries facing much steeper gaps — such as China, where there is only one primary care doctor for every 6,666.

The startup hopes it can help limit the immense costs associated with emerging countries educating millions of doctors for eight-to-10 years and help provide more efficient and accessible healthcare systems much more quickly.

By reducing primary care costs for consumers and operating costs for medical practices, while creating a more convenient diagnostic experience, K Health believes it can improve access to information, ultimately driving earlier detection and better health outcomes for consumers everywhere.

Powered by WPeMatico

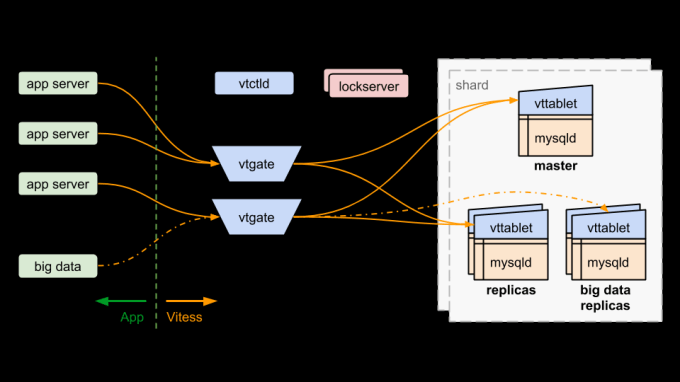

When the former CTOs of YouTube, Facebook and Dropbox seed fund a database startup, you know there’s something special going on under the hood. Jiten Vaidya and Sugu Sougoumarane saved YouTube from a scalability nightmare by inventing and open-sourcing Vitess, a brilliant relational data storage system. But in the decade since working there, the pair have been inundated with requests from tech companies desperate for help building the operational scaffolding needed to actually integrate Vitess.

So today the pair are revealing their new startup PlanetScale that makes it easy to build multi-cloud databases that handle enormous amounts of information without locking customers into Amazon, Google or Microsoft’s infrastructure. Battle-tested at YouTube, the technology could allow startups to fret less about their backend and focus more on their unique value proposition. “Now they don’t have to reinvent the wheel” Vaidya tells me. “A lot of companies facing this scaling problem end up solving it badly in-house and now there’s a way to solve that problem by using us to help.”

PlanetScale quietly raised a $3 million seed round in April, led by SignalFire and joined by a who’s who of engineering luminaries. They include YouTube co-founder and CTO Steve Chen, Quora CEO and former Facebook CTO Adam D’Angelo, former Dropbox CTO Aditya Agarwal, PayPal and Affirm co-founder Max Levchin, MuleSoft co-founder and CTO Ross Mason, Google director of engineering Parisa Tabriz and Facebook’s first female engineer and South Park Commons founder Ruchi Sanghvi. If anyone could foresee the need for Vitess implementation services, it’s these leaders, who’ve dealt with scaling headaches at tech’s top companies.

But how can a scrappy startup challenge the tech juggernauts for cloud supremacy? First, by actually working with them. The PlanetScale beta that’s now launching lets companies spin up Vitess clusters on its database-as-a-service, their own through a licensing deal, or on AWS with Google Cloud and Microsoft Azure coming shortly. Once these integrations with the tech giants are established, PlanetScale clients can use it as an interface for a multi-cloud setup where they could keep their data master copies on AWS US-West with replicas on Google Cloud in Ireland and elsewhere. That protects companies from becoming dependent on one provider and then getting stuck with price hikes or service problems.

PlanetScale also promises to uphold the principles that undergirded Vitess. “It’s our value that we will keep everything in the query pack completely open source so none of our customers ever have to worry about lock-in” Vaidya says.

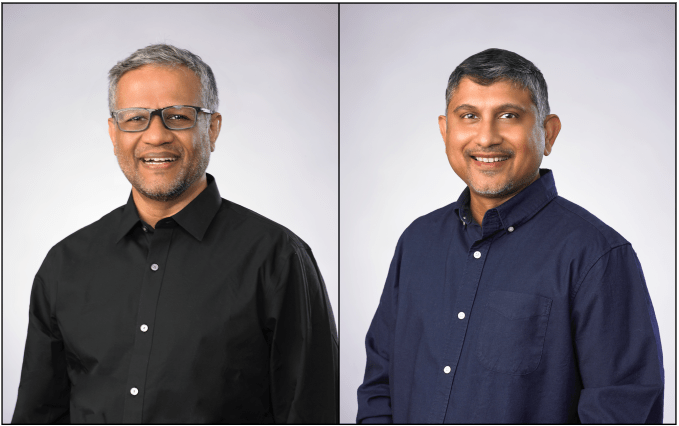

PlanetScale co-founders (from left): Jiten Vaidya and Sugu Sougoumarane

He and Sougoumarane met 25 years ago while at Indian Institute of Technology Bombay. Back in 1993 they worked at pioneering database company Informix together before it flamed out. Sougoumarane was eventually hired by Elon Musk as an early engineer for X.com before it got acquired by PayPal, and then left for YouTube. Vaidya was working at Google and the pair were reunited when it bought YouTube and Sougoumarane pulled him on to the team.

“YouTube was growing really quickly and the relationship database they were using with MySQL was sort of falling apart at the seams,” Vaidya recalls. Adding more CPU and memory to the database infra wasn’t cutting it, so the team created Vitess. The horizontal scaling sharding middleware for MySQL let users segment their database to reduce memory usage while still being able to rapidly run operations. YouTube has smoothly ridden that infrastructure to 1.8 billion users ever since.

“Sugu and Mike Solomon invented and made Vitess open source right from the beginning since 2010 because they knew the scaling problem wasn’t just for YouTube, and they’ll be at other companies five or 10 years later trying to solve the same problem,” Vaidya explains. That proved true, and now top apps like Square and HubSpot run entirely on Vitess, with Slack now 30 percent onboard.

Vaidya left YouTube in 2012 and became the lead engineer at Endorse, which got acquired by Dropbox, where he worked for four years. But in the meantime, the engineering community strayed toward MongoDB-style non-relational databases, which Vaidya considers inferior. He sees indexing issues and says that if the system hiccups during an operation, data can become inconsistent — a big problem for banking and commerce apps. “We think horizontally scaled relationship databases are more elegant and are something enterprises really need.

Fed up with the engineering heresy, a year ago Vaidya committed to creating PlanetScale. It’s composed of four core offerings: professional training in Vitess, on-demand support for open-source Vitess users, Vitess database-as-a-service on PlanetScale’s servers and software licensing for clients that want to run Vitess on premises or through other cloud providers. It lets companies re-shard their databases on the fly to relocate user data to comply with regulations like GDPR, safely migrate from other systems without major codebase changes, make on-demand changes and run on Kubernetes.

The PlanetScale team

PlanetScale’s customers now include Indonesian e-commerce giant Bukalapak, and it’s helping Booking.com, GitHub and New Relic migrate to open-source Vitess. Growth is suddenly ramping up due to inbound inquiries. Last month around when Square Cash became the No. 1 app, its engineering team published a blog post extolling the virtues of Vitess. Now everyone’s seeking help with Vitess sharding, and PlanetScale is waiting with open arms. “Jiten and Sugu are legends and know firsthand what companies require to be successful in this booming data landscape,” says Ilya Kirnos, founding partner and CTO of SignalFire.

The big cloud providers are trying to adapt to the relational database trend, with Google’s Cloud Spanner and Cloud SQL, and Amazon’s AWS SQL and AWS Aurora. Their huge networks and marketing war chests could pose a threat. But Vaidya insists that while it might be easy to get data into these systems, it can be a pain to get it out. PlanetScale is designed to give them freedom of optionality through its multi-cloud functionality so their eggs aren’t all in one basket.

Finding product market fit is tough enough. Trying to suddenly scale a popular app while also dealing with all the other challenges of growing a company can drive founders crazy. But if it’s good enough for YouTube, startups can trust PlanetScale to make databases one less thing they have to worry about.

Powered by WPeMatico

Chorus.ai, a service that listens to sales calls in real time, and then transcribes and analyses them to give helpful tips to the salesperson, has raised $33 million to double down on the current demand for more AI-based tools in the enterprise.

The Series B is being led by Georgian Partners, with participation also from Redpoint Ventures and Emergence Capital, previous investors that backed Israeli-founded, SF-based Chorus.ai in its $16 million Series A two years ago.

In the gap between then and now, the startup has seen strong growth, listening in to some 5 million calls, and performing hundreds of thousands of hours of transcriptions for around 200 customers, including Adobe, Zoom, and Outreach (among others that it will not name).

Micha Breakstone, the co-founder (who has a pretty long history in conversational AI, heading up R&D at Ginger Software and then Intel after it acquired the startup; and before that building the tech that eventually became Summly and got acquired by Yahoo, among other roles), says that while the platform gives information and updates to salespeople in real time, much of the focus today is on providing information to users post-conversation, based on both audio and video calls.

One of its big areas is “smart themes” — patterns and rules Chorus has learned through all those calls. For example, it has identified what kind of language the most successful sales people are using and in turn prompts those who are less successful to use it more. Two general tips Breakstone told me about: using more collaborative terms like we and us; and giving more backstory to clients, although there will be more specific themes and approaches based on Chorus’s specific customers and products.

“I’d say we are super attuned to our customers and what they need and want,” Breakstone said. Which makes sense given the whole premise of Chorus.

It also creates smart “playlists” for managers who will almost certainly never have the time to review hundreds of hours of calls but might want to hear instructive highlights or ‘red alert’ moments where a more senior person might need to step in to save or close a deal.

There are currently what seems like dozens of startups and larger businesses that are currently tackling the opportunity to provide “conversational intelligence” to sales teams, using advances in natural language processing, voice recognition, machine learning and big data to help turn every sales person into a Jerry Maguire (yes, I know he’s an agent, but still, he needs to close deals, and he’s a salesman). They include TalkIQ (which has now been acquired by Dialpad), People.AI, Gong, Voicera, VoiceOps, and I’m pulling from a long list.

“We were among the very first to start this, no one knew what conversational intelligence was before us,” Breakstone says. He describes most of what was out in the market at the time as “Nineties technology” and adds that “our tech is superior because we built it in the correct way from the ground up, with nothing sent to a third party.”

He says that this is one reason why the company has negative churn — it essentially wins customers and hasn’t lost any. And having the tech all in-house not only means the platform is smarter and more accurate, but that helps with compliance around regulations like GDPR, which also has been a boost to its business. It’s also scored well on metrics around reps hitting targets better with its tools (the company claims its products lead to 50 percent greater quota attainment and ‘ramp time’ up by 30 percent for new sales people who use it).

“Chorus.ai has helped us become a smarter sales organization as we’ve scaled. We have visibility into our sales conversations and what is working across all of our offices”, said Greg Holmes, Head of Sales for Zoom Video Communications, in a statement. “We’ve seen a drastic reduction in new hire ramp times and higher sales productivity with even more reps hitting quota. Chorus.ai is a game changer.”

Chorus has raised $55 million to date and Breakstone said he would not disclose its valuation — despite my best attempts to use some of those sales tips to winkle the information out of him. But I understand it to be “significantly higher” than in its last round, and definitely in the hundreds of millions.

As a point of reference, after its Series A two years ago, it was only valued at around $33 million post-money according to PitchBook.

“Maintaining high-quality sales conversations as you scale a sales organization is hard for many companies, but key to delivering predictable revenue growth. Chorus.ai’s Conversation Intelligence platform solves that challenge with a market-leading solution that is easy-to-use and delivers best-in-class results.” said Simon Chong, Managing Partner at Georgian Partners, in a statement. (Chong is joining the board with this round.) “Chorus.ai works with some of the best sales teams in the world and they love the product. We are very excited to partner with Chorus.ai on their next phase of growth as they help world class sales teams reach higher quota attainment and efficiency.”

Powered by WPeMatico

The lines between streetwear and luxury fashion have blurred in recent years, especially as excitement around sneaker brands like Yeezy and Off-White has soared.

A marriage between a luxury fashion marketplace and a sneaker and streetwear reseller seems like a natural way to wrap up M&A in 2018. With that said, Farfetch has acquired New York-based Stadium Goods, opting to pay $250 million for the sneaker startup in a combination of cash and Farfetch stock. Headquartered in London, Farfetch went public on the New York Stock Exchange in September, pricing its shares at $20 apiece and raising $885 million in the process.

What’s more impressive is Stadium Goods’ journey to exit. The company, which sells new and deadstock products online and in a brick-and-mortar store in New York’s Soho neighborhood, was founded in 2015 by John McPheters and Jed Stiller and had only raised $4.6 million in venture capital funding from Forerunner Ventures, The Chernin Group and Mark Cuban, who is an advisor to the startup.

“There was a time not that long ago when you couldn’t wear sneakers and streetwear to nightclubs and restaurants,” McPheters, Stadium Goods’ chief executive officer, told TechCrunch. “But adoption of the stuff we are selling has continued to grow at a very large clip.”

The sale to Farfetch not only provides a major boost to the sneaker tech ecosystem, which is surprisingly much larger than those who aren’t familiar with it might have guessed, but it’s yet another successful e-commerce exit for Kirsten Green, the founding partner of Forerunner Ventures, who’s also backed Dollar Shave Club and Bonobos — direct-to-consumer retailers that sold for $1 billion and $310 million, respectively.

Stadium Goods founders John McPheters (left) and Jed Stiller

Farfetch boarded the sneaker and streetwear hype train a while ago when it incorporated brands like Nike’s Jordan, pairs of which sell for more than $1,000 on the site. The company doubled down on sneakers earlier this year when it began integrating Stadium Goods products. After noticing high-demand, Farfetch founder and CEO José Neves tells TechCrunch, they began acquisition talks with the startup. Stadium Goods will remain independent as part of the deal, with McPheters and Stiller staying on to lead the brand forward. The company’s portfolio of shoes and apparel will be fully available on Farfetch’s e-commerce platform in the coming months.

“Luxury streetwear is a significant part of our business,” Neves said. “For many years now, we have had the largest collection of Off-White, for example, on the internet … What we did not have was the resale, secondary market. It was clear this was an interesting opportunity.”

Together, Farfetch and Stadium Goods will focus on international growth. McPheters tells TechCrunch Stadium Goods already had a significant international base of customers, but a partnership with Farfetch gives them the tools to go places they’ve never been.

“In my mind, we are only just beginning,” McPheters said. “As more and more customers get comfortable with purchasing aftermarket items, we are going to continue to grow.”

The global athletic footwear industry is expected to be worth $95 billion by 2025. Meanwhile, sneaker resale is a $1 billion market and growing, fueled by a cohort of startups making it easier than ever for sneakerheads to locate rare shoes online and have them delivered to their doorsteps. That includes Stadium Goods, Flight Club, GOAT and StockX.

All four of these resellers, which ensure authentication of their products, are backed by VCs. Flight Club merged with GOAT earlier this year and together the pair raised a $60 million Series C. Before that, GOAT had brought in $30 million for its secondary market for collectible shoes from Accel, Upfront Ventures, Matrix Partners and more. StockX, for its part, has raised just over $50 million from Mark Wahlberg, Scooter Braun, Wale, Eminem, SV Angel and others.

According to Crunchbase data, VCs have funneled more than $200 million into sneaker startups in the past two years. Now, given the size of Stadium Goods’ exit, investment in the space will likely pick up significantly as other VCs hope to land an exit multiple that substantial.

Whether the reselling market will continue to expand is in question. Some have called it a bubble poised to burst, claiming it’s at its “height in popularity.” Why? Because corporate shoe brands like Nike and Adidas are keenly aware of the secondary market for their products and how they, too, can profit from it. If they decide to increase the supply of particular shoe models hot on the secondary market, they can radically disrupt the reseller economy. McPheters, however, says this doesn’t concern him.

“Brands need to strangle the demand to keep driving excitement in the space,” McPheters said. “They count on that hype to really move the needle.”

Powered by WPeMatico

Fintech startup YayPay just raised another $8.4 million for its software-as-a-service solution focused on collecting money from outstanding invoices. The company participated in TechCrunch’s Startup Battlefield several years ago.

Information Venture Partners led today’s funding round with existing investors Birchmere, QED, Fifth Third Capital, Gaingels and 500 Fintech Fund also participating.

YayPay targets large companies with an accounting department. The startup provides the perfect service to handle unpaid invoices. YayPay analyzes previous invoices and predicts when you’re supposed to get paid depending on the client and the nature of the invoice. This way, you know which account needs your attention right now.

Teams can collaborate to send reminders and make sure everyone is on the same page. You also can view information about your client directly in YayPay thanks to CRM and ERP integrations.

YayPay also eliminates a bunch of pesky tasks, such as gentle email reminders. You can create automated workflows so that your clients get an email a few days before a payment deadline. If they don’t open the email, you can receive a notification telling you to call them. Customers also can pay invoices directly using YayPay. The platform supports ACH and credit cards.

While this seems like a niche product, the company has managed to attract 480 clients that have generated more than $7 billion in accounts receivables. This represents a 500 percent user base increase over the last 12 months.

Powered by WPeMatico

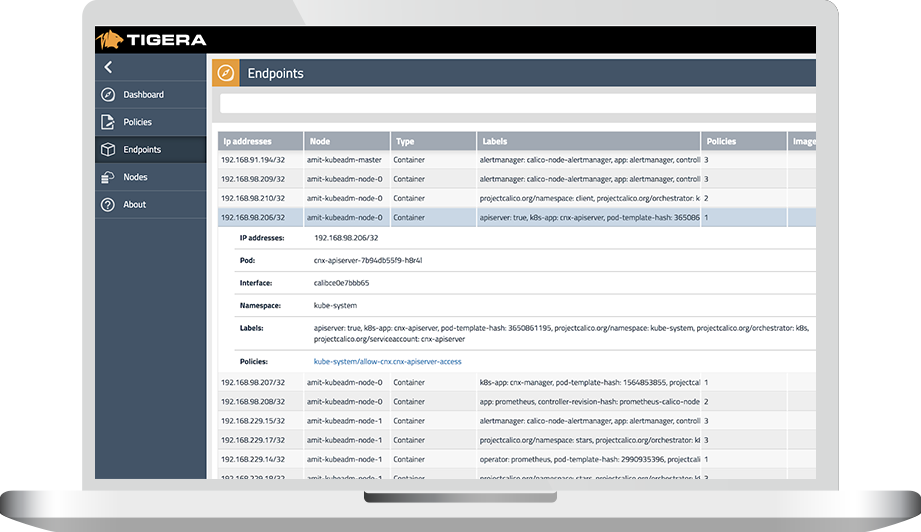

Tigera, a startup that offers security and compliance solutions for Kubernetes container deployments, today announced that it has raised a $30 million Series B round led by Insight Venture Partners. Existing investors Madrona, NEA and Wing also participated in this round.

Like everybody in the Kubernetes ecosystem, Tigera is exhibiting at KubeCon this week, so I caught up with the team to talk about the state of the company and its plans for this new raise.

“We are in a very exciting position,” Tigera president and CEO Ratan Tipirneni told me. “All the four public cloud players [AWS, Microsoft Azure, Google Cloud and IBM Cloud] have adopted us for their public Kubernetes service. The large Kubernetes distros like Red Hat and Docker are using us.” In addition, the team has signed up other enterprises, often in the healthcare and financial industry, and SaaS players (all of which it isn’t allowed to name) that use its service directly.

The company says that it didn’t need to raise right now. “We didn’t need the money right now, but we had a lot of incoming interest,” Tipirneni said. The company will use the funding to expand its engineering, marketing and customer success teams. In total, it plans to quadruple its sales force. In addition, it plans to set up a large office in Vancouver, Canada, mostly because of the availability of talent there.

In the legacy IT world, security and compliance solutions could rely on the knowledge that the underlying infrastructure was relatively stable. Now, though, with the advent of containers and DevOps, workloads are highly dynamic, but that also makes the challenge of securing them and ensuring compliance with regulations like HIPAA or standards like PCI more complex, too. The promise of Tigera’s solution is that it allows enterprises to ensure compliance by using a zero-trust model that authorizes each service on the network, encrypts all the traffic and enforces the policies the admins have set for their company and needs. All of this data is logged in detail and, if necessary, enterprises can pull it for incident management or forensic analysis.

Powered by WPeMatico

After raising $55 million in October at a $500 million valuation, business software marketplace G2 Crowd is making its first-ever acquisition to bring more features to its platform. It is acquiring Siftery, a startup that has built its own database of business software not on user reviews, but by providing a service to businesses where it identifies what is actually getting used and when across their networks.

Terms of the deal are not being disclosed, G2 Crowd’s CEO and founder Godard Abel said in an interview. Siftery had been around for a couple of years and had raised a seed round of $4.1 million from a group of notable investors, including Founders Fund, Felicis and Venrock. All 20 employees, including co-founders CEO Vamshi Mokshagundam and CTO Ayan Barua, are joining G2 Crowd.

G2 Crowd has been building a name for itself as a place where IT buyers can discover and buy software and services for solving specific issues; and if they already are already using or considering a product, a place where they can read other’s reviews and compare it against competitors.

There are some 550,000 reviews on the site today across nearly 60,000 products in 1,200 categories (those reviews are up by 50,000 in the last two months). Around 2 million business professionals visit and use the site each month, which they may go to because they are repeat users, or because G2 Crowd happens to have a very strong SEO game, with its links turning up at the top of the list when you do a search for a specific product or product category.

That economy of scale makes G2 Crowd a pretty logical home for Siftery, which had also provided a database of software for businesses, but at a much smaller scale and before it had been truly commercialised. Abel said that the startup had only around 1,500 customers, with most of them on a free version of the product.

“They were just getting to the point where there was a fork in the road,” he added. “What they hadn’t done yet is monetise and build a business, and we are product people at G2 Crowd.”

This also seems to be the stated logic for Siftery, too. “We’re excited to join the G2 Crowd team so we can more quickly realize our joint vision,” said Vamshi Mokshagundam, co-founder and CEO of Siftery, in a statement. “By becoming part of the G2 family, Siftery’s technology can reach millions more people, continue to develop rapidly, and have a bigger impact around the world in helping to eliminate wasted and inefficient software spend.”

Siftery’s additional functionality is interesting in terms of how G2 Crowd will develop going forward.

The smaller startup engaged with customers and their networks and provided insight into how much each product or service is actually getting used (not just enthused). That makes a handy way to determine whether money was being wasted on licenses for certain apps; or conversely whether companies are suffering from “shadow IT”: overpaying by not consolidating their purchasing and bargaining power. All that data subsequently also helped to provide insight to people searching its database to discover software.

The problem of overspending on software and apps happens to be a big one. G2 Crowd cites data from Netskope which estimates that the average enterprise now runs 1,246 cloud services, a figure that is growing over 10% each year. At the small business end, Siftery estimates that the average organization had 55 SaaS tools, more than doubling over the last three years.

And the challenge is still growing: across the range of company sizes, 35 percent more software gets trialled each year, with software budgets growing by 50 percent year-on-year for the past four. Some $1.4 trillion was spent on software and services last year, with waste in the UK and US collectively estimated at $34 billion, G2 Crowd said.

Abel said that for now the idea will be to keep Siftery’s product separate while it gets gradually integrated into G2 Crowd. There, it will potentially give the company another string in its bow in terms of the services it offers to businesses coming to its platform — and opting for paid usage tiers.

Interestingly, while G2 Crowd will likely continue to be popular as a marketplace to search for apps and services, this deal underscores how the company hopes to develop going forward. It has the opportunity to build a platform where organizations can manage their software, and potentially provide further tools to optimise how it is used, plan more deployments connected to it, and so on.

Abel has a long history building and selling startups focused around software productivity (most recently to Salesforce, but also to Oracle and before that CA), and that appears to be the direction he’s taking G2 Crowd, too. (Indeed, it seems to be part of a mini-wave of tech startups rethinking how businesses interact with software. Just earlier today, Nexthink out of Switzerland raised $85 million for its solution that helps enterprises monitor, triage and assist employees who encounter annoying software issues.)

Abel said that the engineering talent at Siftery was also a big attraction, and that could help shape other acquisitions going forward.

“I think we will look opportunistically,” he said. “It depends on finding a strong product and team.”

Powered by WPeMatico

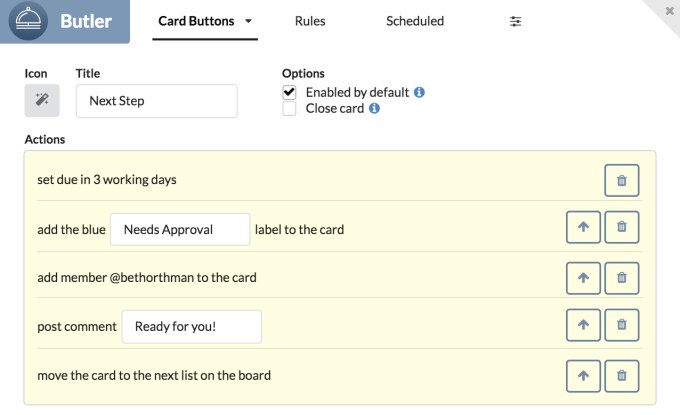

Trello, the organizational tool owned by Atlassian, announced an acquisition of its very own this morning when it bought Butler for an undisclosed amount.

What Butler brings to Trello is the power of automation, stringing together a bunch of commands to make something complex happen automatically. As Trello’s Michael Pryor pointed out in a blog post announcing the acquisition, we are used to tools like IFTTT, Zapier and Apple Shortcuts, and this will bring a similar type of functionality directly into Trello.

Screenshot: Trello

“Over the years, teams have discovered that by automating processes on Trello boards with the Butler Power-Up, they could spend more time on important tasks and be more productive. Butler helps teams codify business rules and processes, taking something that might take ten steps to accomplish and automating it into one click,” Pryor wrote.

This means that Trello can be more than a static organizational tool. Instead, it can move into the realm of light-weight business process automation. For example, this could allow you to move an item from your To Do board to your Doing board automatically based on dates, or to share tasks with appropriate teams as a project moves through its life cycle, saving a bunch of manual steps that tend to add up.

The company indicated that it will be incorporating the Alfred’s capabilities directly into Trello in the coming months. It will make it available to all levels of users, including the free tier, but they promise more advanced functionality for Business and Enterprise customers when the integration is complete. Pryor also suggested that more automation could be coming to Trello. “Butler is Trello’s first step down this road, enabling every user to automate pieces of their Trello workflow to save time, stay organized and get more done.”

Atlassian bought Trello in 2017 for $425 million, but this acquisition indicates it is functioning quasi-independently as part of the Atlassian family.

Powered by WPeMatico