Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

As the second quarter races to a close, we’re down to the wire for IPOs looking to get out before June ends. One such company is SentinelOne, a cybersecurity startup backed by Insight Venture Partners, Redpoint, Tiger Global Management, Data Collective and Anchorage Capital, among others.

SentinelOne raised an ocean of capital while private, including nearly $500 million across two rounds in 2020. Its debut is therefore a huge liquidity event for a host of investing groups. And today, the cybersecurity unicorn had good news in the form of an upgrade to its IPO price range.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Last week, The Exchange wrote that the company’s IPO would be a “good heat check for the IPO market” given its rapid growth and pace of losses. How investors valued it would help explain the public market’s current appetite for loss-making startups. Today’s news implies healthy appetites.

SentinelOne raised its IPO price range this morning from $26 to $29 per share to $31 to $32 per share, a sizable lift to its valuation and IPO raise.

SentinelOne raised its IPO price range this morning from $26 to $29 per share to $31 to $32 per share, a sizable lift to its valuation and IPO raise.

This morning, we’re unpacking the company’s new valuation range, thinking about SentinelOne’s growth and revenue results compared to similar public companies, and working to understand if the company is inexpensive, neutrally priced or expensive compared to current comps. Sound fun? It will be!

Recall that when SentinelOne last raised capital it was valued at $2.7 billion on a pre-money basis. The company was therefore worth just under $3 billion after the $267 million round. The unicorn is going to yeet that figure into space in its IPO, barring something catastrophic.

Its new IPO price range of $31 to $32 per share values the company on a much richer basis. With an anticipated simple share count of 253,530,006 after its IPO, inclusive of a private placement, the company would be worth $7.86 billion to $8.11 billion.

Powered by WPeMatico

Hey Equity fam, we have a small clip of extra goodness for you today. After our live show — listen to the recording here, it was good fun — we got to take a few questions from the audience, audio that was not included in the main episode, as we didn’t have the time. But we’ve cut it out, given it a short polish, and have it for you today.

If you wanted even more Equity, here you go!

As a small note from the team, we know that this week’s Wednesday episode didn’t have the best audio quality. And to do a Twitter Spaces experiment the same week as a live show might have felt like a lot of change. Don’t worry, it just worked out that way. Equity will keep tinkering and having fun, but we’re back to normal next week.

Enjoy the Q&A, and we’ll see you at our next live show!

— Grace, Chris, Natasha, Danny, and Alex

Powered by WPeMatico

Years ago, U.S. ride-hailing giant Uber and its Chinese rival Didi were locked in an expensive rivalry in the Asian nation. After a financially bruising competition, Uber sold its China-based business to Didi, focusing instead on other markets.

The two companies are coming head-to-head again, however, as Didi looks to list in the United States. The company’s IPO filing was big news for the SoftBank Vision Fund, Tencent and Uber, thanks to its stake in Didi from its earlier transaction.

Uber is more diversified both geographically and in terms of its revenue mix. Didi is larger, more profitable and more concentrated.

But Didi appears set to be valued at a discount to Uber. By several tens of billions of dollars, it turns out. And we can’t quite figure out why.

This week, Didi indicated that it will target a $13 to $14 per-share IPO price, with each share on the U.S. markets worth one-fourth of a Class A share in the company. In more technical language, each ADR is 25% of a Class A ordinary share in Didi, if you prefer it put like that.

With 288 million shares to be sold in its U.S. IPO, Didi could raise as much as $4.03 billion, a huge sum.

What’s Didi worth at $13 to $14 per ADR? Using a nondiluted share count, Didi is valued between $62.3 billion and $67.1 billion. Inclusive of shares that may be issued thanks to vested options and the like, Didi could be worth as much as $70 billion; Renaissance Capital calculates the company’s midpoint valuation using a fully diluted share count at $67.5 billion.

Regardless of which number you prefer, Didi is not set to challenge Uber’s own valuation. Yahoo Finance pegged Uber at $95.2 billion as of this morning.

Why is the Chinese company worth less than its erstwhile rival? Let’s dig around in their numbers and find out.

As a reminder, Uber’s Q1 2021 included adjusted revenues of $3.5 billion, a gain of 8% compared to the year-ago quarter. Uber’s adjusted EBITDA came in for the period at -$359 million.

Powered by WPeMatico

Earlier this week, The Exchange wrote about the early-stage venture capital market, with the goal of understanding how some startups are raising more seed capital before they work on their Series A, while other startups are seemingly raising their first lettered round while in the nascent stages of scaling.

The expedition was rooted in commentary from Rudina Seseri of Glasswing Ventures, who said abundant seed capital in the United States allows founders to get a lot done before they raise a Series A, effectively delaying these rounds. But after those founders did raise that A, their Series B round could rapidly follow thanks to later-stage money showing up in earlier-stage deals in hopes of snagging ownership in hot companies.

The idea? Slow As, fast Bs.

After chatting with Seseri more and a number of other venture capitalists about the concept, a second dynamic emerged. Namely that the “typical” early-stage funding round, as Seseri described it, was “becoming atypical because of the rise of preemptive rounds [in which] typical expectations on metrics go out the window.”

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Series As, she said, could come mere months after a seed deal, and Series B rounds were seeing expected revenue thresholds tumble in part to “large, multiasset players that have come down market and are offering a different product than typical VCs — very fast term sheets, no active involvement post-investment, large investments amounts and high valuations.”

Focusing on just the Series A dynamic, the old rule of thumb that a startup would need to reach $1 million in annual recurring revenue (ARR) is now often moot. Some startups are delaying their A rounds until they reach $2 million in ARR thanks to ample seed capital.

While some startups delay their A rounds, others raise the critical investment earlier and earlier, perhaps with even a few hundred thousand in ARR.

While some startups delay their A rounds, others raise the critical investment earlier and earlier, perhaps with even a few hundred thousand in ARR.

What’s different between the two groups? Startups with “elite status” are able to jump ahead to their Series A, while other founders spend more time cobbling together adequate seed capital to get to sufficient scale to attract an A.

The dynamic is not merely a United States phenomenon. The two-tier venture capital market is also showing up in Latin America, a globally important and rapidly expanding startup region. (Brazilian fintech startup Nubank, for example, just closed a $750 million round.)

This morning, we’re diving into the Latin American venture capital market and its early-stage dynamics. We also have notes on the European scene, so expect more on the topic next week. Let’s go!

Mega-rounds are no longer an exception in Latin America; in fact, they have become a trend, with ever-larger rounds being announced over the last few months.

The announcements themselves often emphasize round size: For instance, the recent $100 million Series B round into Colombian proptech startup Habi was touted as “the largest Series B for a startup headquartered in Colombia.” This follows other 2021 records such as “the largest Series A for Mexico ” — $65 million for online grocer Jüsto — and “the largest Series A ever raised by a Latin American fintech” — $43 million for “Plaid for Latin America” Belvo.

Powered by WPeMatico

Mercuryo, a startup that has built a cross-border payments network, has raised $7.5 million in a Series A round of funding.

The London-based company describes itself as “a crypto infrastructure company” that aims to make blockchain useful for businesses via its “digital asset payment gateway.” Specifically, it aggregates various payment solutions and provides fiat and crypto payments and payouts for businesses.

Put more simply, Mercuryo aims to use cryptocurrencies as a tool for putting in motion next-gen, cross-border transfers or, as it puts it, “to allow any business to become a fintech company without the need to keep up with its complications.”

“The need for fast and efficient international payments, especially for businesses, is as relevant as ever,” said Petr Kozyakov, Mercuryo’s co-founder and CEO. While there is no shortage of companies enabling cross-border payments, the startup’s emphasis on crypto is a differentiator.

“Our team has a clear plan on making crypto universally available by enabling cheap and straightforward transactions,” Kozyakov said. “Cryptocurrency assets can then be used to process global money transfers, mass payouts and facilitate acquiring services, among other things.”

Image Credits: Left to right: Alexander Vasiliev, Greg Waisman, Petr Kozyakov / MercuryO

Mercuryo began onboarding customers at the beginning of 2019, and has seen impressive growth since with annual recurring revenue (ARR) in April surpassing over $50 million. Its customer base is approaching 1 million, and the company has partnerships with a number of large crypto players including Binance, Bitfinex, Trezor, Trust Wallet, Bithumb and Bybit. In 2020, the company said its turnover spiked by 50 times while run-rate turnover crossed $2.5 billion in April 2021.

To build on that momentum, Mercuryo has begun expanding to new markets, including the United States, where it launched its crypto payments offering for B2B customers in all states earlier this year. It also plans to “gradually” expand to Africa, South America and Southeast Asia.

Target Global led Mercuryo’s Series A, which also included participation from a group of angel investors and brings the startup’s total raised since its 2018 inception to over $10 million.

The company plans to use its new capital to launch a cryptocurrency debit card (spending globally directly from the crypto balance in the wallet) and continuing to expand to new markets, such as Latin America and Asia-Pacific.

Mercuryo’s various products include a multicurrency wallet with a built-in crypto exchange and digital asset purchasing functionality, a widget and high-volume cryptocurrency acquiring and OTC services.

Kozyakov says the company doesn’t charge for currency conversion and has no other “hidden fees.”

“We enable instant and easy cross-border transactions for our partners and their customers,” he said. “Also, the money transfer services lack intermediaries and require no additional steps to finalize transactions. Instead, the process narrows down to only two operations: a fiat-to-crypto exchange when sending a transfer and a crypto-to-fiat conversion when receiving funds.”

Mercuryo also offers crypto SaaS products, giving customers a way to buy crypto via their fiat accounts while delegating digital asset management to the company.

“Whether it be virtual accounts or third-party customer wallets, the company handles most cryptocurrency-related processes for banks, so they can focus more on their core operations,” Kozyakov said.

Mike Lobanov, Target Global’s co-founder, said that as an experiment, his firm tested numerous solutions to buy Bitcoin.

“Doing our diligence, we measured ‘time to crypto’ – how long it takes from going to the App Store and downloading the app until the digital assets arrive in the wallet,” he said.

Mercuryo came first with 6 minutes, including everything from KYC and funding to getting the cryptocurrency, according to Lobanov.

“The second-best result was 20 minutes, while some apps took forever to process our transaction,” he added. “This company is a game-changer in the field, and we are delighted to have been their supporters since the early days.”

Looking ahead, the startup plans to release a product that will give businesses a way to send instant mass payments to multiple customers and gig workers simultaneously, no matter where the receiver is located.

Powered by WPeMatico

Making the choice to adopt, or to find an adopting family, is a legally complex, emotionally taxing, expensive and time-consuming process. PairTree aims to make one part at least considerably easier and faster with its online matching platform where expectant mothers and hopeful adopters can find each other without the facilitation of an agency or other organization. The company has just raised a $2.25 million seed round, a rarity in the industry.

The path to adoption is different for everyone, but there are generally some things they have in common: Once the process is started, it can take upwards of $50,000 and over a year-and-a-half to organize a match. While some of this comprises the ordinary legal hurdles involved in any adoption, a big part of it is simply that there are limited opportunities for adoption, and compatibility isn’t guaranteed. As many people considering adoption are doing so on the heels of unsuccessful fertility treatment, it can be a lot to take on and a dispiriting wait.

Erin Quick, CEO and co-founder (with CTO Justin Friberg) of PairTree, said that the modern adoption landscape is marked by the fact that nearly 95 percent of adoptions are open, meaning there is ongoing contact between a biological mother and adopting family.

“They’ll be working together forever, and that makes finding a highly compatible match that much more important,” Quick, herself a happy adopter, told TechCrunch in an interview. But because of the way adoption is generally done — through agencies licensed by states — there are limitations on how far anyone involved can reach.

“It’s so bound by geography,” she said. “It’s regulated at the state level and has been facilitated by state level, not because of state laws — there’s no rule saying you can’t adopt out of state — but because the facilitators are small nonprofits. They bind themselves to their geographic region because that’s what they can serve. We’re building a platform that makes what people are already doing much easier and more efficient.”

That platform is in many ways very much like a dating app, though of course the comparison is not exact and does not reflect the gravity of choosing to adopt. But like in the dating world, in adoption you have a cloud of people looking to connect over something highly dependent on personality and individual needs.

PairTree onboards both expectant mothers and adopters with personality tests — not the light-hearted stuff of OkCupid but a broader, more consequential set of Jungian archetypes that signal a person’s high-level priorities in life. Think “wants to travel and learn” versus “wants to provide and nurture” (not that these are necessarily incompatible) — they serve as important indicators of preferences that might not be so easily summarized with a series of checkboxes. That’s not the only criterion, of course. Other demographic and personal details are also collected.

The adopters are added to a pool through which expectant mothers can sift and, if desired, contact (in this, Quick suggested, PairTree mirrors Bumble, where women must message first). PairTree also does basic due diligence stuff like identify verification and confirmation of other important steps like home studies.

If a likely match is found, all the relevant information is passed to the adoption facilitator, who will be coordinating the other legal and financial steps. PairTree isn’t looking to replace these agencies — in fact Quick said that they have been huge proponents of the platform, since it can shorten wait times and improve outcomes. She said based on their existing successful adoptions that the wait can be cut by half or even two-thirds, and thus the cost (which involves recurring payments as the agency searches and does the legal work) by a similar amount.

“These are small nonprofits; they don’t have a lot of tech chops. When we launched we went to attorneys first, actually, and we were surprised when agencies started reaching out,” she explained.

Agencies have been referring their adopters to PairTree, which has led to a lot of early traction, Quick said. And importantly, they’ve seen great diversity in their early success.

“Adoption has historically been denied by faith-based systems — LGBTQ families and single women have been subject to discrimination,” she noted. And in fact just last week a Supreme Court decision held up the right of religious adoption agencies to deny services to same-sex couples. Quick was proud to say that they have already facilitated adoptions by same-sex couples and single parents.

The company will also set aside 5 percent of its net profits, which hopefully will manifest in volume, for the Lifetime Healing Foundation, which offers counseling and support to birth mothers who have gone though the adoption process.

The $2.25 million seed round was led by Urban Innovation Fund, with Founder Collective, Female Founders Alliance and Techstars participating. It will surprise few to hear that adoption is not a particularly hot industry for venture capital, but rising interest and investment in fertility tech may have shed light on opportunities in adjacent spaces. Adoption is one where significant improvements can be enabled by technology, meaning startups can grow fast while having a positive impact.

The company plans to use the money to expand its product portfolio, pursue more partnerships, and perhaps most importantly for its users, build a native mobile app, since 90 percent of the service’s viewership is mobile.

“We’re grateful to our expert and diverse group of investors who share our vision that adoption should be a viable path to parenting for more people,” said Quick in the release announcing the raise. “Like us, our investors believe in the importance of supporting Biological and Adopting Families along with the Adoptees, because adoption is not a single transaction but a journey they’re taking over the course of a lifetime.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

For this week’s deep dive Danny, Alex, and a bunch of the TechCrunch crew took on the recent happenings in the world of Bitcoin. In a break from our regular format, we recorded live from a Twitter Space — it’s like a Clubhouse, but closer to where your social network is — so the audio quality is not going to be Utterly Perfect. But we think the conversation will more than make up for it!

Before we get into the show notes, do not forget that we’re recording Equity live on Hopin Thursday the 24th. Come hang with us and have some fun. It’s free, of course, and should be a good time. Details here, sign up here!

So what did we get into? A lot!

And more. A big thanks to Romain Dillet and Lucas Matney for hanging with us, Drew Olanoff for hosting and Chris Gates for snagging the audio and making it all work.

See you tomorrow!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday morning at 7:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Lower, an Ohio-based home finance platform, announced today it has raised $100 million in a Series A funding round led by Accel.

This round is notable for a number of reasons. First off, it’s a large Series A even by today’s standards. The financing also marks the previously bootstrapped Lower’s first external round of funding in its seven-year history. Lower is also something that is kind of rare these days in the startup world: profitable. Silicon Valley-based Accel has a history of backing profitable, bootstrapped companies, having also led large Series A rounds for the likes of 1Password, Atlassian, Qualtrics, Webflow, Tenable and Galileo (which went on to be acquired by SoFi).

In fact, Galileo founder Clay Wilkes introduced the VC firm to Dan Snyder, Lower’s founder and CEO. The two companies have a few things in common besides being profitable: they were both bootstrapped for years before taking institutional capital and both have headquarters outside of Silicon Valley.

“We were immediately intrigued because Ohio-based Lower echoes both of these themes,” said Accel partner John Locke, who led the firm’s investment in Lower and is taking a seat on the company’s board as part of the investment. “Like Galileo, Lower will be one of the most successful bootstrapped fintech companies globally. The combination of a company built in a nontraditional region across the globe and a bootstrapped company reminds us of [other] companies we have partnered with for a large Series A.”

There were other unnamed participants in the round, but Accel provided the “majority” of the investment, according to Lower.

Snyder co-founded Lower in 2014 with the goal of making the home-buying process simpler for consumers. The company launched with Homeside, its retail brand that Snyder describes as “a tech-leveraged retail mortgage bank” that works with realtors and builders, among others.

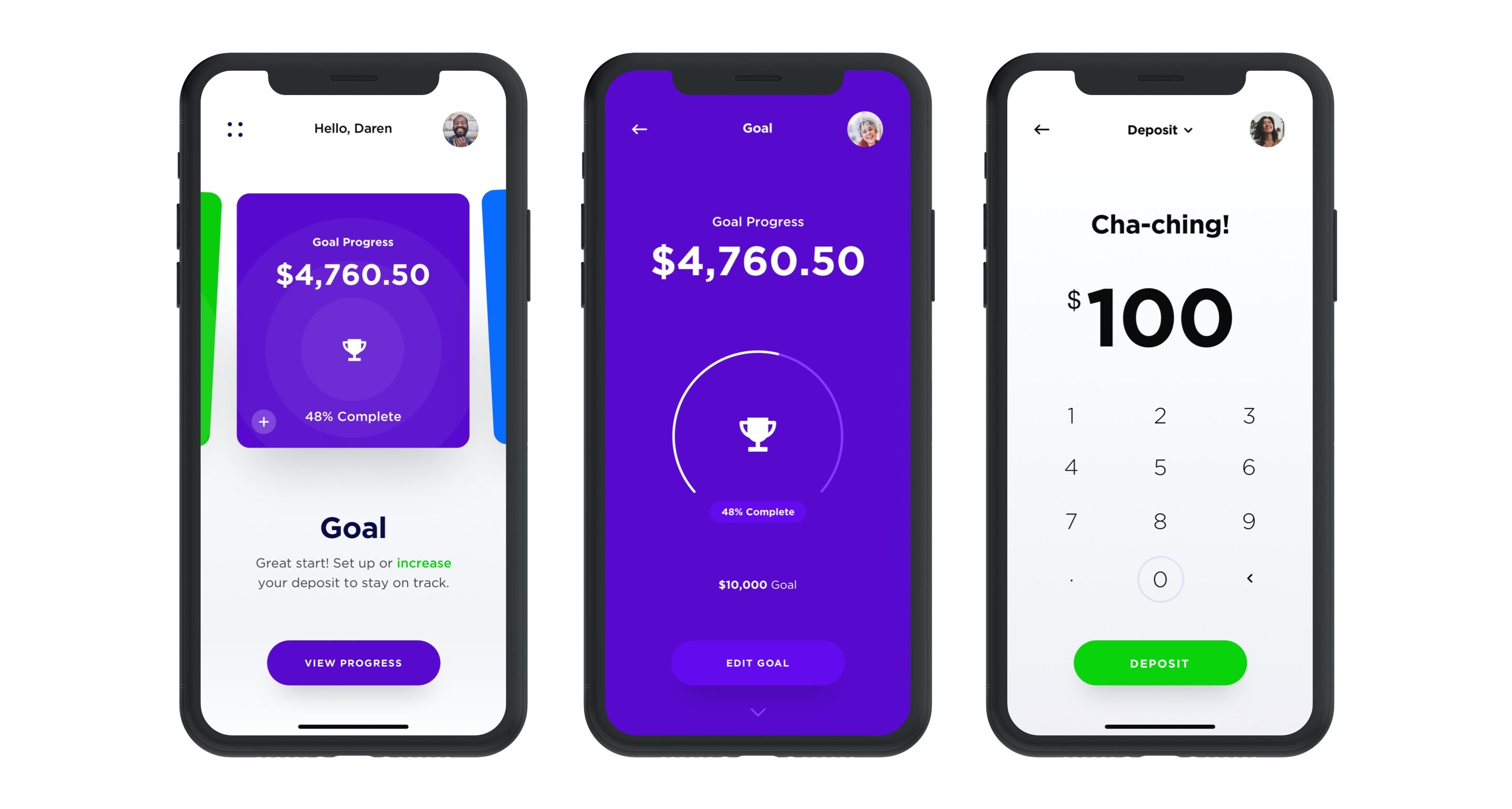

In 2018, the company launched the website for Lower, its direct-to-consumer digital lending brand with the mission of making its platform a one-stop shop where consumers can go online to save for a home, obtain or refinance a mortgage and get insurance through its marketplace. This year, it launched the Lower mobile app with a savings account.

Sitting (L to R): Co-founders Dan Snyder, Grayson Hanes

Standing (L to R): Co-founders Mike Baynes, Chris Miller

Not pictured: Robert Tyson; Image credit: Lower

Over the years, Lower has funded billions of dollars in loans and notched an impressive $300 million in revenue in 2020 after doubling revenue every year, according to Snyder.

“Our history is maybe a little atypical of fintech companies today,” he told TechCrunch. “We’ve had a view going back to the start of the company that we wanted to run it profitably. That’s been one of our pillars, so that’s what we’ve done. Also, we all grew up in the mortgage industry, so we saw firsthand the size of the market, but also how broken it was, so we wanted to change it.”

In launching the direct-to-consumer digital lending brand, the company was working to make the homebuying process more “digital, transparent and easier for consumers to access,” Snyder said.

At the same time, the company didn’t want to lose the human touch.

“We tried to design the app flow in a way where you can get as far along as you can in the application but if you want, at any point in time, to talk or chat with someone, we’re available,” Snyder added.

Image Credits: Lower

Lower’s typical customer is the millennial and now Gen Z who’s aspiring to own their first home, according to Snyder.

“They might be thinking, ‘OK, I might be living in an apartment now, but in the next few years I’m going to meet someone and/or have a child and I want to unlock the investment that is a home,’” he told TechCrunch. “And we’ll help them on that journey.”

Lower’s recently launched new app offers a deposit account it’s dubbed “HomeFund.” The interest-bearing, FDIC-insured deposit account offers a 0.75% Annual Percentage Yield and is designed to help consumers save for a home with a “dollar-for-dollar match in rewards” up to the first $1,000 saved, Snyder said.

Lower works with more than 35 major insurance carriers nationally, including Nationwide, Liberty Mutual and Allstate. It has more than 1,600 employees, about half of which are based in Lower’s home state. That’s up from about 650 employees in June of 2020.

Looking ahead, the company plans to add more services and has an “aggressive roadmap” for adding new features to its platform. Today, for example, Lower sells primarily to Fannie Mae and Freddie Mac. And while it services the majority of its loans, like many large lenders, it uses a subservicer. That will change, however, in early 2022, when Lower intends to launch its own native servicing platform.

And while the company intends to continue to run profitably, Snyder said he and his co-founders “think the time is now to gain share.”

“We want to become a global brand, raise money and gain market share,” he added. “We’re going to continue to double down on product and build out our capabilities. We are the best-kept secret in fintech and plan to change that with smart branding, advertising and sponsorships.”

And last but not least, Lower is eyeing the public markets as part of its longer-term roadmap.

“Ultimately, we know we can build a great public company,” Snyder told TechCrunch. “We’re of the scale to be a public company right now, but we’re going to keep our heads down and we’re going to keep building for the next few years and then I think we can be in a spot to be a strong public business.”

Accel’s Locke points out that in the U.S., mortgage and home finance are among the largest financial service markets, and they have primarily been handled by large banks.

“For most consumers, getting a mortgage through these banks continues to be an overly complex, slow-moving process,” Locke told TechCrunch. “We believe by providing consumers a great mobile experience, Lower will gain share from incumbent banks, in the same way that companies like Monzo have in banking or Venmo in payments or Trade Republic and Robinhood in stock trading.”

Powered by WPeMatico

Vercel, the company behind the popular open-source Next.js React framework, today announced that it has raised a $102 million Series C funding round led by Bedrock Capital. Existing investors Accel, CRV, Geodesic Capital, Greenoaks Capital and GV also participated in this round, together with new investors 8VC, Flex Capital, GGV, Latacora, Salesforce Ventures and Tiger Global. In total, the company has now raised $163 million and its current valuation is $1.1 billion.

As Vercel notes, the company saw strong growth in recent months, with traffic to all sites and apps on its network doubling since October 2020. The number of sites among the world’s largest 10,000 websites that use Next.js grew 50% in the same time frame, too.

Given the open-source nature of the Next.js framework, not all of these users are obviously Vercel customers, but its current paying customers include the likes of Carhartt, Github, IBM, McDonald’s and Uber.

“For us, it all starts with a front-end developer,” Vercel CEO Guillermo Rauch told me. “Our goal is to create and empower those developers — and their teams — to create delightful, immersive web experiences for their customers.”

With Vercel, Rauch and his team took the Next.js framework and then built a serverless platform that specifically caters to this framework and allows developers to focus on building their front ends without having to worry about scaling and performance.

Older solutions, Rauch argues, were built in isolation from the cloud platforms and serverless technologies, leaving it up to the developers to deploy and scale their solutions. And while some potential users may also be content with using a headless content management system, Rauch argues that increasingly, developers need to be able to build solutions that can go deeper than the off-the-shelf solutions that many businesses use today.

Rauch also noted that developers really like Vercel’s ability to generate a preview URL for a site’s front end every time a developer edits the code. “So instead of just spending all your time in code review, we’re shifting the equation to spending your time reviewing or experiencing your front end. That makes the experience a lot more collaborative,” he said. “So now, designers, marketers, IT, CEOs […] can now come together in this collaboration of building a front end and say, ‘that shade of blue is not the right shade of blue.’”

“Vercel is leading a market transition through which we are seeing the majority of value-add in web and cloud application development being delivered at the front end, closest to the user, where true experiences are made and enjoyed,” said Geoff Lewis, founder and managing partner at Bedrock. “We are extremely enthusiastic to work closely with Guillermo and the peerless team he has assembled to drive this revolution forward and are very pleased to have been able to co-lead this round.”

Powered by WPeMatico

Aircall has raised a $120 million Series D round led by Goldman Sachs Asset Management. Following today’s funding round, the company has reached unicorn status, which means it has a valuation above $1 billion — this is the 16th French unicorn.

The startup has been building a cloud-based phone system for call centers, support lines and sales teams. It integrates with Salesforce, HubSpot, Zendesk, Slack, Intercom and other popular CRM, support and communication systems.

Aircall customers can create local numbers and set up an interactive voice response directory. The service manages the call queue for you and your agents can start answering inbound calls. Agents can transfer calls and put customers on hold. Admins can see analytics, monitor calls and see how everyone is doing.

In addition to Goldman Sachs Asset Management, existing investors DTCP, eFounders, Draper Esprit, Adam Street Partners, NextWorldCap and Gaia are also participating once again in today’s funding round.

As a cloud-based software product, Aircall works well with remote or hybrid teams. For the past year, many companies have been looking for a new phone system with various lockdowns taking place around the world. And Aircall has capitalized on this influx of customers.

When it comes to metrics, it means that signups increased by 65% in 2020. New customers include Caudalie, OpenClassrooms and Too Good To Go. Overall, Aircall has 8,500 customers. 15% of them are based in France, 35% in the U.S. and 50% in other countries.

With the new funding round, the company plans to iterate on its product with new integrations with third-party tools, and in particular industry-specific integrations. There will be new offices in London and Berlin as well as new hires in the company’s existing offices based in New York, Paris, Sydney and Madrid.

The company also plans to control a bigger chunk of its tech stack. It means that it’ll collaborate with big telecommunications companies to leverage their networks. You can also expect more product features with better transcription and better sentiment analysis.

Powered by WPeMatico