Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Emma, the personal finance management app that bills itself as your best “financial friend,” has raised $2.5 million in seed funding.

Connect Ventures led the round, with participation from Ithaca Investments, Tiny.vc and existing investor, Aglaé Ventures. The fintech previously raised $700,000 in angel funding in June 2018.

Launched in the U.K. in early 2018 — and most recently expanding to the U.S. and Canada — the Emma app connects to your bank accounts (and crypto wallets) to help you budget, track spending and save money.

It aims to let you understand how much money you have left to spend until payday, track and find wasteful subscriptions or alert you when you are paying over the odds on utility bills, and preemptively help you avoid going into your bank’s overdraft.

For those who like to be more hands-on with tracking their finances, Emma also offers a paid subscription version of its app dubbed “Emma Pro”. It lets you do additional things like create custom categories, add emojis to custom categories, export your data between specified time ranges, create manual accounts in any currency, create manual transactions, and split transactions,

“In a world where 70% of mental health issues are derived by financial problems, Emma is defining a new category, financial therapy,” says Emma founder and CEO Edoardo Moreni. “Our mission is to remove anxiety regarding money matters and bring instant gratification whenever our users interact with money regardless of their financial situation”.

Noteworthy, Connect Ventures is also an investor in open banking platform TrueLayer, which Emma uses to power its account aggregation in the U.K. (it uses Plaid in the U.S.). Describing TrueLayer as the “infrastructure layer,” Connect’s Rory Stirling says Emma represents investing in the “application layer” – perhaps as it is just the kind of app open banking promised.

“The team at Emma have built a product people love and as a result they have the highest engagement and retention we’ve seen in this category,” he says in a statement. “That’s really exciting to us – better tools for financial education and empowerment are only valuable if people engage with them”. (Users open the app on average five times a week, twice a day).

“We have about 200,000 users now and are growing pretty fast in the U.S., Canada and U.K.,” Moreni tells me. “We’ll be launching in every english speaking country and we’ll raise our Series A in the next 12 months. If you think about it, every single generation in history had a tracker. At Emma, we want to become the abacus for the modern world”.

Powered by WPeMatico

Justin Kan’s hybrid legal software and law firm startup Atrium is shutting down today after failing to figure out how to deliver better efficiency than a traditional law firm, the CEO tells TechCrunch exclusively. The startup has now laid off all its employees, which totaled just over 100. It will return some of its $75.5 million in funding to investors, including Series B lead Andreessen Horowitz. The separate Atrium law firm will continue to operate.

“I’m really grateful to the customers and the team members who came along with me and our investors. It’s unfortunate that this wasn’t the outcome that we wanted but we’re thankful to everyone that came with us on the journey” said Kan. He’d previously founded Justin.tv which pivoted to become Twitch and later sold to Amazon for $970 million. “We decided to call it and wind down the startup operations. There will be some capital returned to investors post wind-down” Kan told me.

Atrium had attempted a pivot back in January, laying off its in-house lawyers to become a more pure software startup with better margins. Some of its lawyers formed a separate standalone legal firm and took on former Atrium clients. But Kan tells me that it was tough to regain momentum coming out of that change, which some Atrium customers tell me felt chaotic and left them unsure of their legal representation.

More layoffs quietly ensued as divisions connected to those lawyers were eliminated. But trying to build software for third-party lawyers, many of which have entrenched processes and older leadership, proved difficult. The streamlined workflows may not have seemed worth the thrash of adopting new technology.

“If you look at our original business model with the veritcalized law firm, a lot of these companies that have this kind of full stack model are not going to survive” Kan explained. “A lot of these companies, Atrium included, did not figure out how to make a dent in operational efficiency.”

Founded in 2017, Atrium built software for startups to navigate fundraising, hiring, acquisition deals, and collaboration with their legal team. Atrium also offered in-house lawyers that could provide counsel and best practices in these matters. The idea was that the collaboration software would make its lawyers more efficient than a traditional law firm so they could get work done faster, translating to savings for clients and Atrium.

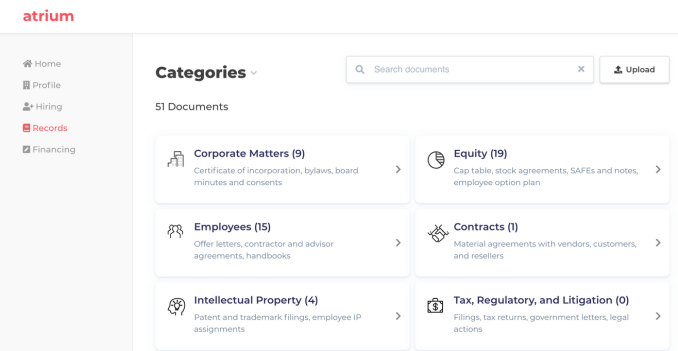

Atrium’s software included Records, a Dropbox-esque system for keeping track of legal documents, and Hiring, which instantly generated employment offer letters based on details punched into a form while keeping track of signatures. The startup hoped it could prevent clients and lawyers from wasting time digging through email chains or missing a sign-off that could put them in legal jeopardy.

The company tried to generate client leads by hosting fundraising workshops for startups, starring Kan and his stories from growing Twitch. A charismatic leader with a near-billion dollar exit under his belt, investors and founders alike were quick to buy into Kan’s vision and advice. Startups saw Atrium as an ally with industry expertise that could help them avoid dirty term sheets or botched hires.

But keeping a large squad of lawyers on staff proved costly. Atrium priced packages of its software and legal assistance under subscriptions, with momentous deals like acquisitions incurring add-on fees. The model relied less on milking clients with steep hourly rates measured down to six-minute increments like most law firms.

Yet eliminating the busy work for lawyers through its software didn’t materialize into bountiful profits. The pivot saught to create a professional services network where Atrium could route clients to attorneys. The layoffs had shaken faith in the startup as clients demanded stability lest they be caught without counsel at a tough time

Rather than trudge on, Kan decided to fold the company. The standalone Atrium law firm will continue to operate under partners Michel Narganes and Matthew Melville, but the startup developing legal software is done.

Atrium’s implosion could send ripples through the legaltech scene, and push other entrepreneurs to start with a more focused software-only approach.

Powered by WPeMatico

I was honestly surprised to find out from Sensel that the company is only just recently raising its Series A. The Sunnyvale-based hardware startup has been around since 2013, bringing its first product, the modular music and computing Morph peripheral, to market a few years back.

Over the past few years, however, the company’s been undergoing a bit of a slow motion pivot. As fascinating as the Morph has been, the multiple touch input device has proven to be something more akin to a proof of concept for Sensel. I’ve met with co-founder and CEO Ilya Rosenberg at CES the last couple of years and watched as it changed its outward facing focus from a standalone hardware offering to smartphone and tablet components.

The new $28 million Series A brings its total funding up to $38 million, courtesy of Susquehanna International Group, Morningside Group, SMiT, Palm Commerce Holdings Co. Ltd, Chariot Gold Limited, SV Tech Ventures and Innolinks Ventures. A big part of this funding will no doubt be used to play a role in that shift, as Sensel works with OEMs to bring its advanced sensing technology to different devices.

“Since Sensel’s founding in 2013, we’ve worked tirelessly to create a sensor that outperforms existing touch technologies on every metric and at a lower overall cost,” Rosenberg says in a release. “This financing brings us closer to our ultimate goal of improving how people experience the products they rely on every single day.”

Sensel notes that it will “continue supporting the Morph,” but the language seems to pretty heavily imply that the device will no longer be a focus — something the company more or less confirmed with me during our most recent meeting. But working with OEMs to implement its technologies on third-party device is potentially a much more lucrative way forward.

Powered by WPeMatico

Sonantic, a U.K. startup that has developed “human-quality” artificial voice technology for the games and entertainment industry, has raised €2.3 million in funding.

Leading the round is EQT Ventures, with participation from existing backers, including Entrepreneur First (EF), AME Cloud Ventures and Bart Swanson of Horizons Ventures. I also understand one of the company’s earlier investors is Twitch co-founder Kevin Lin.

Founded in 2018 by CEO Zeena Qureshi and CTO John Flynn as they went through EF’s company builder programme in London, Sonantic (previously Speak Ai) says it wants to disrupt the global gaming and entertainment voice industry. The startup has developed artificial voice tech that it claims is able to offer “expressive, realistic voice acting” on-demand for use by game studios. It already has R&D partnerships underway with more than 10 AAA game studios.

“Getting dialogue into game development is a slow, expensive and labour-intensive task,” says Qureshi, when asked to define the problem Sonantic wants to solve. “Dialogue pipelines consist of casting, booking studios, contracts, scheduling, editing, directing and a whole lot of coordination. Voiced narrative video games can take up to 10 years to make with game design changing frequently, defaulting game devs to carry out several iteration cycles — often leading to going over budgets and game releases being delayed.”

To help remedy this, Sonantic offers what Qureshi dubs “dynamic voice acting on-demand,” with the ability to craft the exact type of character in terms of gender, personality, accent, tone and emotional state. The startup’s human quality text-to-speech system is offered via an API and a graphical user interface tool that lets its synthetic voice actors be edited, sculpted and directed “just like a human actor,” she tells me.

This sees Sonantic work directly with actors to synthesise their voices whilst also harnessing their unique skills in performance. “We then augment how actors work by offering them a digital version of themselves that can create passive income for them,” explains the Sonantic CEO.

For the games studios, Sonantic offers faster iteration cycles at a cheaper price because it cuts down logistical costs and has voice models ready to perform. Its SaaS model and API also makes it easier to create audio performances to test out potential narratives or to finesse a story, helping with editing and directing.

Meanwhile, Sonantic says it is gearing up to publicly reveal how its technology can capture “deep emotions across the full spectrum,” from subtle all the way through to exaggerated, which it says is usually something only very skilled actors can achieve.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re in for a treat, as we get to dig into Procore’s S-1 filing. In case you aren’t familiar, Procore sells software that helps manage construction projects, but it offers more than a single app: Procore’s service allows other apps to plug into it, making it a platform of sorts. The company filed to go public last Friday, meaning that we have endless new numbers to delve into.

Even better for us, Procore is a SaaS company, which means we can understand its numbers.

Procore lists $100 million as its IPO placeholder raise, intends to list on the NYSE as PCOR and its debut is being underwritten by Goldman, J.P. Morgan, Barclays and Jefferies.

Why do we care about this particular IPO? A few reasons. First, Procore filed to go public after the worst week in the stock market since the 2008 crash. That’s either calculated bravery, unbridled hubris or accidental folly. We’ll see. And second, the company’s backers are well-known: Bessemer, Greater Pacific Capital, ICONIQ, Dragoneer and Tiger, according to Crunchbase.

Powered by WPeMatico

Good morning friends, and welcome back to TechCrunch’s Equity Monday, a short-form audio hit to kickstart your week. Regular Equity episodes still drop Friday morning, so if you’ve listened to the show over the years don’t worry — we’re not changing the main show. (Here’s last week’s episode with Danny Crichton, going over the huge Roblox round and what is going on with no-code startups.)

What to say about this Monday other than it feels a bit like last Monday. The markets aren’t doing well, coronavirus is a worry, and we have a cool early-stage round to talk about.

After the stock market took a beating last week, the weekend brought more news concerning the novel coronavirus, with more infections being discovered in the United States. It’s not been the best time to check your 401k if you saving for the long-term.

But in better news, DoorDash’s filing was followed by one from Procore, meaning that IPO season isn’t dead, it’s just glacial, slow, slothful, and far too measured compared to our prior hopes.

This week will see a few sets of earnings that we care about some (JD.com), less, (HPE), and lots (Zoom). When Zoom reports on March 4th it will be carrying the torch for recent, venture-backed IPOs, SaaS companies more broadly, and future-of-work startups specifically. Other than that, no one will be watching what happens to the video conferencing startup that is caught in a rare COVID19 updraft.

Next, we talked about Briza, a very neat early-stage startup that is working in the commercial insurance API space. Yes, this the fusion of several things I love to write about. Namely insurance-tech and API-infra companies. What would you get if you crossed the insurance marketplaces we’ve been writing about with Plaid? Something like Briza, I reckon.

The 500 Startups-backed company has put together $3 million in capital to date, has 10 people on-staff, is looking to double its personnel, and is heading to the market soon on the back of some notable momentum. With more insurance providers hitting Briza up for inclusion in its product, the startup has good pace heading into its impending Demo Day. And it already has the cash it needs to grow.

Infra is hot because it’s the digital equivalent of selling picks and shovels. And APIs are hot because they are the SaaS of infra.

Infra APIs? So hot right now.

I’m stoked beyond belief that Equity turns three this month. Who would have thought that our little show that started life as a few Facebook Lives with myself, Katie Roof (WSJ) and Matthew Lynley (ex-Brex and now a solo operator) would make it this far. I’m lucky to still be a part of it.

Ok! Back Friday. Stay cool.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

mParticle, which helps companies like Spotify, Paypal and Starbucks umanage their customer data, is announcing that it has raised $45 million in Series D funding.

Co-founder and CEO Michael Katz told me that the company has benefited from broader shifts — like new privacy regulation and the shift away from cookie-based browser tracking — that increase brands’ needs for a platform like mParticle that uses “modern data infrastructure” to deliver a personalized experience for customers without running afoul of any regulations.

As result, he said mParticle has nearly quintupled its revenue since it raised a $35 million Series C in 2017. (The company has raised more than $120 million total.)

“The challenges that we solve are universal,” Katz said. “It doesn’t matter if there’s a small company or big company. Data fragmentation, data quality, consistent change in the privacy landscape, consistent change in the technology ecosystem, these are universal challenges.”

Perhaps for that very reason, a whole industry of customer data platforms has sprung up since mParticle was founded back in 2013, all offering tools to help marketers create a single view of their customers by unifying data from various sources. Even big players like Adobe and Salesforce have announced their own CDPs as part of their larger marketing clouds.

When asked about the competition, Katz said, “The market has responded overwhelmingly by saying, ‘I don’t want one vendor to rule everything for me.’ Why be beholden to one suite of tools that’s just an amalgamation of products that were built in the early 2000s?”

Instead, he argued that mParticle customers want “a best-in-breed combination of independent solutions that can be integrated seamlessly.”

Getting back to the new funding — Arrowroot Capital led the round, with the firm’s managing partner Matthew Safaii joining mParticle’s board of directors. Existing investors also participated.

Katz said the funding will be spent in three broad areas: building new products, scaling its global data infrastructure and finding new partners. In fact, the company is also announcing a partnership with LiveRamp, through which mParticle customers can combine their first-party data with the third-party party data from Liveramp.

“We see this partnership with Liveramp as an opportunity to extend the surface area by which our customers can deliver highly personalized, privacy-friendly experiences,” Katz said.

Powered by WPeMatico

The world of consumer banking has seen a massive shift in the last ten years. Gone are the days where you could open an account, take out a loan, or discuss changing the terms of your banking only by visiting a physical branch. Now, you can do all this and more with a few quick taps on your phone screen — a shift that has accelerated with customers expecting and demanding even faster and more responsive banking services.

As one mark of that switch, today a startup called Thought Machine, which has built cloud-based technology that powers this new generation of services on behalf of both old and new banks, is announcing some significant funding — $83 million — a Series B that the company plans to use to continue investing in its platform and growing its customer base.

To date, Thought Machine’s customers are primarily in Europe and Asia — they include large, legacy outfits like Standard Chartered, Lloyds Banking Group, and Sweden’s SEB through to “challenger” (AKA neo-) banks like Atom Bank. Some of this financing will go towards boosting the startup’s activities in the US, including opening an office in the country later this year and moving ahead with commercial deals.

The funding is being led by Draper Esprit, with participation also from existing investors Lloyds Banking Group, IQ Capital, Backed and Playfair.

Thought Machine, which started in 2014 and now employs 300, is not disclosing its valuation but Paul Taylor, the CEO and founder, noted that the market cap is currently “increasing healthily.” In its last round, according to PitchBook estimates, the company was valued at around $143 million, which, at this stage of funding, puts this latest round potentially in the range of between $220 million and $320 million.

Thought Machine is not yet profitable, mainly because it is in growth mode, said Taylor. Of note, the startup has been through one major bankruptcy restructuring, although it appears that this was mainly for organisational purposes: all assets, employees and customers from one business controlled by Taylor were acquired by another.

Thought Machine’s primary product and technology is called Vault, a platform that contains a range of banking services: checking accounts, savings accounts, loans, credit cards and mortgages. Thought Machine does not sell directly to consumers, but sells by way of a B2B2C model.

The services are provisioned by way of smart contracts, which allows Thought Machine and its banking customers to personalise, vary and segment the terms for each bank — and potentially for each customer of the bank.

It’s a little odd to think that there is an active market for banking services that are not built and owned by the banks themselves. After all, aren’t these the core of what banks are supposed to do?

But one way to think about it is in the context of eating out. Restaurants’ kitchens will often make in-house what they sell and serve. But in some cases, when it makes sense, even the best places will buy in (and subsequently sell) food that was crafted elsewhere. For example, a restaurant will re-sell cheese or charcuterie, and the wine is likely to come from somewhere else, too.

The same is the case for banks, whose “Crown Jewels” are in fact not the mechanics of their banking services, but their customer service, their customer lists, and their deposits. Better banking services (which may not have been built “in-house”) are key to growing these other three.

“There are all sorts of banks, and they are all trying to find niches,” said Taylor. Indeed, the startup is not the only one chasing that business. Others include Mambu, Temenos and Italy’s Edera.

In the case of the legacy banks that work with the startup, the idea is that these behemoths can migrate into the next generation of consumer banking services and banking infrastructure by cherry-picking services from the VaultOS platform.

“Banks have not kept up and are marooned on their own tech, and as each year goes by, it comes more problematic,” noted Taylor.

In the case of neobanks, Thought Machine’s pitch is that it has already built the rails to run a banking service, so a startup — “new challengers like Monzo and Revolut that are creating quite a lot of disruption in the market” (and are growing very quickly as a result) — can integrate into these to get off the ground more quickly and handle scaling with less complexity (and lower costs).

Taylor was new to fintech when he founded Thought Machine, but he has a notable track record in the world of tech that you could argue played a big role in his subsequent foray into banking.

Formerly an academic specialising in linguistics and engineering, his first startup, Rhetorical Systems, commercialised some of his early speech-to-text research and was later sold to Nuance in 2004.

His second entrepreneurial effort, Phonetic Arts, was another speech startup, aimed at tech that could be used in gaming interactions. In 2010, Google approached the startup to see if it wanted to work on a new speech-to-text service it was building. It ended up acquiring Phonetic Arts, and Taylor took on the role of building and launching Google Now, with that voice tech eventually making its way to Google Maps, accessibility services, the Google Assistant and other places where you speech-based interaction makes an appearance in Google products.

While he was working for years in the field, the step changes that really accelerated voice recognition and speech technology, Taylor said, were the rapid increases in computing power and data networks that “took us over the edge” in terms of what a machine could do, specifically in the cloud.

And those are the same forces, in fact, that led to consumers being able to run our banking services from smartphone apps, and for us to want and expect more personalised services overall. Taylor’s move into building and offering a platform-based service to address the need for multiple third-party banking services follows from that, and also is the natural heir to the platform model you could argue Google and other tech companies have perfected over the years.

Draper Esprit has to date built up a strong portfolio of fintech startups that includes Revolut, N26, TransferWise and Freetrade. Thought Machine’s platform approach is an obvious complement to that list. (Taylor did not disclose if any of those companies are already customers of Thought Machine’s, but if they are not, this investment could be a good way of building inroads.)

“We are delighted to be partnering with Thought Machine in this phase of their growth,” said Vinoth Jayakumar, Investment Director, Draper Esprit, in a statement. “Our investments in Revolut and N26 demonstrate how banking is undergoing a once in a generation transformation in the technology it uses and the benefit it confers to the customers of the bank. We continue to invest in our thesis of the technology layer that forms the backbone of banking. Thought Machine stands out by way of the strength of its engineering capability, and is unique in being the only company in the banking technology space that has developed a platform capable of hosting and migrating international Tier 1 banks. This allows innovative banks to expand beyond digital retail propositions to being able to run every function and type of financial transaction in the cloud.”

“We first backed Thought Machine at seed stage in 2016 and have seen it grow from a startup to a 300-person strong global scale-up with a global customer base and potential to become one of the most valuable European fintech companies,” said Max Bautin, Founding Partner of IQ Capital, in a statement. “I am delighted to continue to support Paul and the team on this journey, with an additional £15 million investment from our £100 million Growth Fund, aimed at our venture portfolio outperformers.”

Powered by WPeMatico

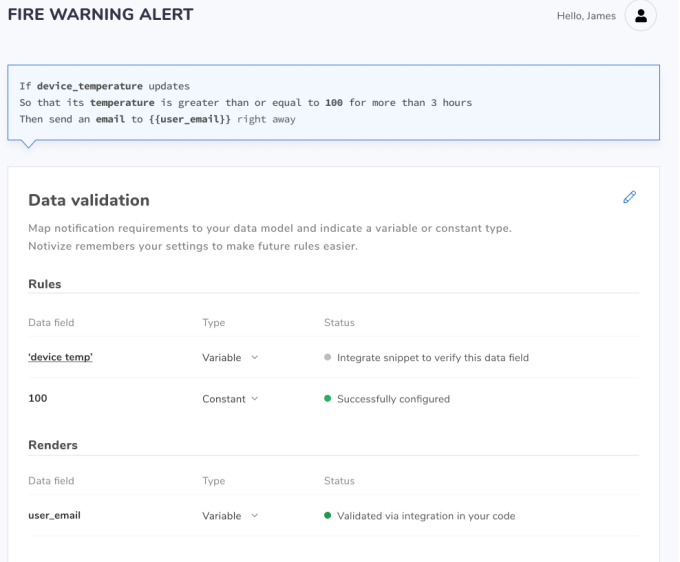

A new startup called Notivize aims to give product teams direct access to one of their most important tools for increasing user engagement — notifications.

The company has been testing the product with select customers since last year and says it has already sent hundreds of thousands of notifications. And this week, it announced that it has raised $500,000 in seed funding led by Heroic Ventures .

Notivize co-founder Matt Bornski has worked at a number of startups, including AppLovin and Wink, and he said he has “so many stories I can tell you about the time it takes to change a notification that’s deeply embedded in your stack.”

To be clear, Bornski isn’t talking about a simple marketing message that’s part of a scheduled campaign. Instead, he said that the “most valuable” notifications (e.g. the ones that users actually respond to) are usually driven by activity in an app.

For example, it might sound obvious to send an SMS message to a customer once the product they’ve purchased has shipped, but Bornski said that actually creating a notification like that would normally require an engineer to write new code.

“There’s the traditional way that these things are built: The product team specs out that we need to send this email when this happens, or send this SMS or notification when this happens, then the engineering team will go in and find the part of the code where they detect that such a thing has happened,” he said. “What we really want to do is give [the product team] the toolkit, and I think we have.”

So with Notivize, non-coding members of the product and marketing team can write “if-then” rules that will trigger a notification. And this, Bornski said, also makes it easier to “A/B test and optimize your copy and your send times and your channels” to ensure that your notifications are as effective as possible.

He added that companies usually don’t build this for themselves, because when they’re first building an app, it’s “not a rational thing to invest your time and effort in when you’re just testing the market or you’re struggling for product market fit.” Later on, however, it can be challenging to “go in and rip out all the old stuff” — so instead, you can just take advantage of what Notivize has already built.

Bornski also emphasized that the company isn’t trying to replace services that provide the “plumbing” for notifications. Indeed, Notivize actually integrates with SendGrid and Twilio to send the notifications.

“The actual sending is not the core value [of what we do],” he said. “We’re improving the quality of what you’re paying for, of what you send.”

Notivize allows customers to send up to 100 messages per month for free. After that, pricing starts at $14.99 per month.

“The steady march of low-code and no-code solutions into the product management and marketing stack continues to unlock market velocity and product innovation,” said Heroic Ventures founder Michael Fertik in a statement. “Having been an early investor in several developer platforms, it is clear that Notivize has cracked the code on how to empower non-technical teams to manage critical yet complex product workflows.”

Powered by WPeMatico

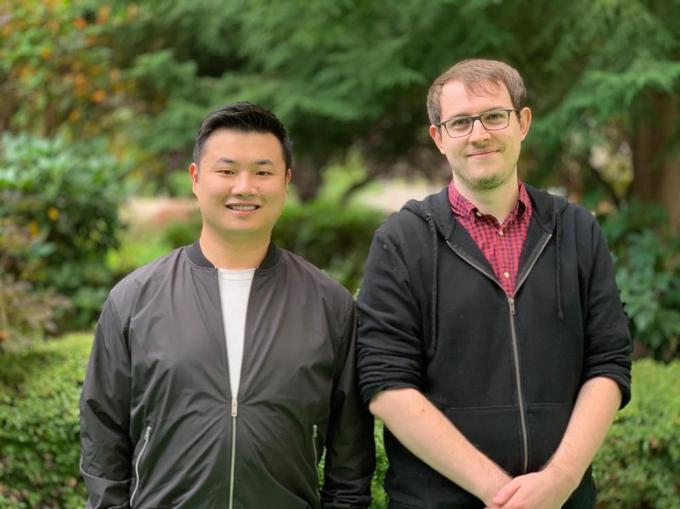

End Game Interactive CEO Yang C. Liu has a refreshingly straightforward description of what he and his co-founder Luke Zbihlyj are up to: “We’re just building games. And to be honest, we don’t know what we’re doing.”

Despite this self-proclaimed ignorance, End Game has just raised $3 million in seed funding from an impressive group of investors: The round was led by the game-focused firm Makers Fund, with participation from Clash of Clans developer Supercell, Unity CEO David Helgason, Twitch COO Kevin Lin, Twitch VP Hubert Thieblot, Danny Epstien and Alexandre Cohen of Main Street Advisors and music executive Scooter Braun.

Liu told me that he and Zbihlyj got their start by building websites tied to existing games, such as PokéVision, a site for finding Pokémon in Pokémon GO. However, they were inspired by the success of simple, browser-based multiplayer games like Slither.io to create games of their own — first Zombs.io, then Spinz.io, then Zombs Royale.

Altogether, End Game says its titles have attracted more than 160 million players, with 1 million people playing in a single day. Zombs Royale, in particular, seems to have been a hit — the battle royale game (where a single map can pit up to 100 players against each other) was one of 2018’s most Googled games in the United States.

Liu said the team’s success convinced them to focus their efforts on game development: “Do we want to make products that people simply use, or games that people think about out when they’re going to school, or going to work, or dream about?”

Zombs Royale was supposedly built in less than four weeks, but Liu said that after its launch in early 2018, the team spent most of the year maintaining and scaling the game. Then 2019 was all about building a team and creating the next game, Fate Arena, a title in the new Auto Chess genre that’s supposed to launch on PC, mobile and other platforms soon.

Liu noted that unlike End Game’s previous work, which featured simple 2D art (“On Zombs Royale and Spinz, I did the art, and it’s terrible”), Fate Arena will feature a “3D, high-fidelity art style.”

But even as the company’s games start looking a little less primitive, the goal is still to develop and iterate quickly. Liu said he hopes to fund “many tries” at building other cross-platform, multiplayer games with this seed round.

“We pride ourselves on rapid experimentation,” he said, adding that the key is “not biting off more than we can chew. We design [our games] to scale from the beginning. We don’t necessarily need to be World of Warcraft, where you need to make 100 quests as the baseline. We’re focused on games with a small starting point that can scale into something much bigger.”

Supercell Developer Relations Lead Jaakko Harlas made a similar point in a statement included in the funding announcement:

Many companies are quick to point out how fast-moving they are. Then you come across a team like this and realize what being lean and moving fast really means. Yang, Luke and the team have already shown that they can ship accessible games that showcase a real flair for fun, and we look forward to supporting them in their quest for the next big hit game.

Powered by WPeMatico