Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re taking a look at the world of esports venture capital investment, largely through the lens of preliminary data that we’ll caveat given how reported VC data lags reality. That phenomenon is likely doubly true in the current moment, as COVID-19 absorbs all news cycles and some venture rounds’ announcements are delayed even more than usual.

All the same, the data we do have paints a picture of a change in esports venture investment, one sufficient in size to indicate that an esports VC slowdown could be afoot. As with all early looks, we’re extending ourselves to reach a conclusion. But… no risk, no reward.

We’ll start by looking at Q1 2020 esports venture totals to date, compare them to year-ago results, and then peek at Q4 2019’s results and its year-ago comparison to get a handle on what else has happened lately in the niche. The picture that the quarters draw will help us understand how esports investing is starting a year that isn’t going as anyone expected.

Today we’re using Crunchbase data, looking at both global and U.S.-specific venture totals in both round and dollar volume. To get a picture of the competitive gaming world, we’re examining investments into companies that are tagged as “esports” related in the Crunchbase database. Given that this is a somewhat wide cut, the data below is more directional than precise and should be treated as such.

Powered by WPeMatico

It’s been a bonkers week in the world, with markets gyrating, companies fretting, investors tweeting and founders re-cutting their 2020 forecasts. But for one collection of startups, the past few days weren’t about work crises or the latest Slack share price. Instead, for Y Combinator’s Winter batch, it was Demo Day week.

TechCrunch has covered Y Combinator companies since time immemorial. And we’ve been present throughout a number of format changes over the years. We’ve been around for things like the old single-day events in the South Bay computer history museum, and we’ve been around for the SF era. Hell, we were there for the two-stage concept.

But this year’s Demo Day brought with it something altogether new: No in-person pitches and demos. Yep, in response to COVID-19, Y Combinator made its demo day virtual, even scooting up its presentations by a full week. Obviously we tuned in en masse, writing a host of posts about the presenting companies (read them here, here, here and here). We also caught up with CEO of Y Combinator, Michael Seibel, to here his take on what’s ahead for the accelerator.

Given the scale of change, however, we weren’t content with just those entries. So, we gathered the TechCrunch crew, hopped on a Zoom, invited in our friends until our Zoom account maxed out (we didn’t know that that was a thing; more capacity coming) to chat over observations and the most interesting startups. We didn’t even miss the usual slew of Y Combinator live tweets — for the most part.

Hit the jump and we’ve got the recording for you. And see which companies the TechCrunch staff liked the most.

Powered by WPeMatico

Back in 2017, a formerly hot, formerly profitable company called Blue Apron went public. It didn’t go well. Today as the global stock market continues to fall, shares in the former venture darling are soaring, up more than 140% in midday trading.

Before its IPO, the company had to reduce its price range from $15 to $17 per share to $10 to $11 per share. That pricing change limited the company’s worth, and reduced the capital it raised in its debut. The meal kit delivery company finally priced at $10 per share. It opened up a hair, but closed the day a mere penny above its IPO price.

Then things got worse. In fact, Blue Apron’s share price decline got so bad that in mid-2019 Blue Apron had to execute a 1-for-15 reverse split. In most stock splits, a company’s share price gets too high for comfort. So, the firm decides to give its investors the same value of the company, but in new, smaller chunks. So a concern trading for $1,000 per share that wanted to split would normally give, say, its investors 10 new shares worth $100 apiece in exchange for their single $1,000 share.

A reverse split is the other way. You get fewer shares at a higher per-share value. It’s what you do if you need to avoid slipping under $1 per share, or other, similar fates.

Time passed, and everyone forgot about Blue Apron in the same manner as they did Grubhub, companies that came, made an impact, went public and then slowly dissolved.

Until now. Suddenly Blue Apron is the hottest stock in the world, skyrocketing as other companies shed value. Today in regular trading, American indices fell so far that they triggered protective circuit breakers. At the same time, Blue Apron was doing this (via Google Finance):

Bear in mind that we are looking at the company after its reverse split. So, no, the company is not worth 60% more than its IPO price of $10 per share. It’s worth far less. Indeed, Blue Apron is worth just $211 million today including its day’s gains, according to Google Finance.

Blue Apron was worth about $1.9 billion when it went public, for reference.

Anyway, why is the company skyrocketing? TechCrunch thinks it figured it out. Walk with us:

Don’t pop the champagne. Blue Apron is still worth about what it raised as a private company; its market cap is only about 40% of the money it raised while private in addition to its IPO haul. This company is still priced like it’s on life support.

And that makes some sense. Here are some facts from its Q4 and full-year 2019 report:

Not great! Perhaps Blue Apron will explode, beating guidance and earning its newly resurrected share price. Maybe. But before you pile into the company, pause, and then probably don’t.

Powered by WPeMatico

You’d be excused for feeling that mid-2019 was in a different decade as far as venture-backed IPOs go.

Last year saw a number of successful flotations of venture-backed technology and technology-enabled companies, and most performed well after they began trading. But despite some early success, a number of the most famous 2019 IPOs have seen their valuations decline rapidly in ensuing quarters.

In some cases, once richly valued public unicorns are off more than twice the market’s recent declines, have given up all their gains earned as public companies, or fallen under their final private market valuations. It’s a stunning reversal for several of the most-lauded companies to come out of the venture capital machine in a decade.

Powered by WPeMatico

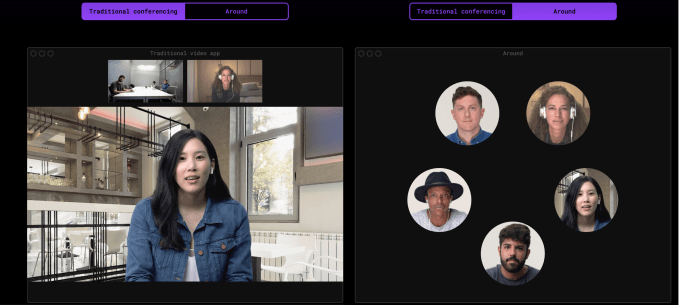

You have to actually get work done, not just video call all day, but apps like Zoom want to take over your screen. Remote workers who need to stay in touch while staying productive are forced to juggle tabs. Meanwhile, call participants often look and sound far away, dwarfed by their background and drowned in noise.

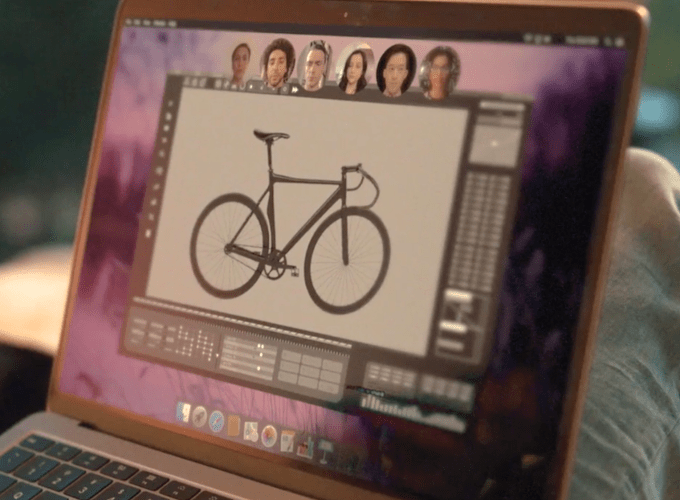

Today, Around launches its new video chat software that crops participants down to just circles that float on your screen so you have space for other apps. Designed for laptops, Around uses auto-zoom and noise cancelling to keep your face and voice in focus. Instead of crowding around one computer or piling into a big-screen conference room, up to 15 people can call from their own laptop without echo — even from right next to each other.

“Traditional videoconferencing tries to maximize visual presence. But too much presence gets in the way of your work,” says Around CEO Dominik Zane. “People want to make eye contact. They want to connect. But they also want to get stuff done. Around treats video as the means to an end, not the end in itself.”

Around becomes available today by request in invite-only beta for Mac, windows, Linux, and web. It’s been in private beta since last summer, but now users can sign up here for early access to Around. The freemium model means anyone can slide the app into their stack without paying at first.

After two years in stealth, Around’s 12-person distributed team reveals that it’s raised $5.2 million in seed funding over multiple rounds from Floodgate, Initialized Capital, Credo Ventures, AngelList’s Naval Ravikant, Product Hunt’s Ryan Hoover, Crashlytics’ Jeff Seibert, and angel Tommy Leep. The plan is to invest in talent and infrastructure to keep video calls snappy.

Around CEO Dominik Zane

Around was born out of frustration with remote work collaboration. Zane and fellow Around co-founder Pavel Serbajlo had built mobile marketing company M.dot that was acquired by GoDaddy by using a fully distributed team. But they discovered that Zoom was “built around decades-old assumptions of what a video call should be” says Zane. “A Zoom video call is basically a telephone connected to a video camera. In terms of design, it’s not much different from the original Picturephone demoed at the 1964 World’s Fair.”

So together, they started Around as a video chat app that slips into the background rather than dominating the foreground. “We stripped out every unnecessary pixel by building a real-time panning and zooming technology that automatically keeps callers’ faces–and only their faces–in view at all times” Zane explains. It’s basically Facebook Messenger’s old Chat Heads design, but for the desktop enterprise.

Calls start with a shared link or /Around Slack command. You’re never unexpectedly dumped into a call, so you can stay on task. Since participants are closely cropped to their faces and not blown up full screen, they don’t have to worry about cleaning their workspace or exactly how their hair looks. That reduces the divide between work-from-homers and those in the office.

As for technology, Around’s “EchoTerminator” uses ultrasonic audio to detect nearby laptops and synchronization to eliminate those strange feedback sounds. Around also employs artificial intelligence and the fast CPUs of modern laptops to suppress noise like sirens, dog barks, washing machines, or screaming children. A browser version means you don’t have to wait for people to download anything, and visual emotes like “Cool idea” pop up below people’s faces so they don’t have to interrupt the speaker.

Traditional video chat vs Around

“Around is what you get when you rethink video chat for a 21st-century audience, with 21st-century technology,” says Initialized co-founder and general partner Garry Tan. “Around has cracked an incredibly difficult problem, integrating video into the way people actually work today. It makes other video-call products feel clumsy by comparison.”

There’s one big thing missing from Around: mobile. Since it’s meant for multitasking, it’s desktop/laptop only. But that orthodoxy ignores the fact that a team member on the go might still want to chime in on chats, even with just audio. Mobile apps are on the roadmap, though, with plans to allow direct dial-in and live transitioning from laptop to mobile. The 15-participant limit also prevents Around from working for all-hands meetings.

Competing with video calling giant Zoom will be a serious challenge. Nearly a decade of perfecting its technology gives Zoom super low latency so people don’t talk over each other. Around will have to hope that its smaller windows let it keep delays down. There’s also other multitask video apps like Loom’s asynchronously-recorded video clips that prevent distraction.

With coronavirus putting a new emphasis on video technology for tons of companies, finding great engineers could be difficult. “Talent is scarce, and good video is hard tech. Video products are on the rise. Google and large companies snag all the talent, plus they have the ability and scale to train audio-video professionals at universities in northern Europe” Zane tells me. “Talent wars are the biggest risk and obstacle for all real-time video companies.”

But that rise also means there are tons of people fed up with having to stop work to video chat, kids and pets wandering into their calls, and constantly yelling at co-workers to “mute your damn mic!” If ever there was a perfect time to launch Around, it’s now.

“Eight years ago we were a team of locals and immigrants, traveling frequently, moving between locations and offices” Zane recalls. “We realized that this was the future of work and it’s going to be one of the most significant transformations of modern society over the next 30 years . . . We’re building the product we’ve wanted for ourselves.”

One of the best things about working remotely is you don’t have colleagues randomly bugging you about superfluous nonsense. But the heaviness of traditional video chat swings things too far in the other direction. You’re isolated unless you want to make a big deal out of scheduling a call. We need presence and connection, but also the space to remain in flow. We don’t want to be away or on top of each other. We want to be around.

Powered by WPeMatico

The novel coronavirus pandemic has rapidly moved companies into a remote-first world.

Nearly all of the world’s largest events have been canceled, put on pause or pivoted to online-only. In the tech world, event cancellations thus far have included SXSW, GDC, Mobile World Congress, Google I/O, Facebook F8, E3 and others.

As more and more hosts consider staging fully remote events as possible alternatives, we decided to take a deeper look into the venture-backed startups focused on supporting large-scale virtual gatherings, like Hopin and Run The World. To further understand the impact of COVID-19, we asked five leading VCs who have invested in or have knowledge of startups focused on remote events to update us on the state of the market and to share where they see opportunity in the sector:

Which trends in remote events/conferencing excite you the most from an investing perspective?

Powered by WPeMatico

Hello TechCrunch friends and family, tomorrow morning at 9 am Pacific Time we’re gathering on Zoom for an in-depth chat about our favorite startups from the latest Y Combinator Demo Day. This year’s installment of the twice-yearly startup event happened yesterday, a week early and online only.

Like many other things, Demo Day was adapted to a new format in the face of COVID-19 disruptions. Despite that, TechCrunch wrote a host of posts on the companies that presented (you can see our notes here), dug into a number of the startups individually (here and here, for example), and sat down with Y Combinator’s CEO for an interview.

We’re wrapping all of that with a group chat about the entire affair. We’d host this from the office in more regular years, but, it’s 2020, and so we’re all gathering on Zoom which means that everyone is invited to listen in.

Here are the details:

We’re recording the chat, and plan to make it available to Extra Crunch subscribers shortly after we’re done. But the main call is open to everyone, so add it to your calendar and we’ll see you there.

Powered by WPeMatico

Earlier today, TechCrunch caught up with Chris Sugden, a managing partner at Edison Partners, to talk about the current fundraising market, what’s next for SaaS startups and if there’s any good news to be found in today’s market.

As the stock market continues to gyrate (more up than down), and the unicorn exit market looks increasingly moribund, understanding how private investors are putting capital to work today and over the next few quarters is critical for startup founders. A host of startups that would have normally raised in Q1 of this year did not. The fundraising market they encounter the rest of the year will help determine their business trajectory.

Before we dive into our Q&A on all that, a short note on Edison Partners . Edison is a growth equity firm, which, according to Sugden, means that its checks range from $5 million to $30 million, with a “sweet spot” between $10 million and $15 million. Regarding stage, Sugden said that Edison looks to put capital into companies with between $8 million and $20 million in revenue, noting that the larger companies stretch his firm’s check size to the max.

About 75% of the firm’s investments are in software-as-a-service companies (SaaS), with the other 25% going into other types of startups. According to the investor, the average growth in Q4 2019 of the firm’s 12 investments from its ninth fund was about 100%, compared to the year-ago period.

So, Sugden is an active investor at a firm that has been around for a few decades with a good-sized account from which to invest. Let’s dig into how he sees the market shaking out.

The following excerpts come from TechCrunch’s chat with Sugden, which we’ve grouped and edited for clarity. We’ve peeled back the conversation, allowing us to pull out the parts that felt the most useful for startups. We start with his view of the 2020 venture capital market.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

As investors struggle to price the stock market as economic and political news continues to break, the private market is entering a rough period. It seems increasingly likely that the period of disruption due to COVID-19 will persist for months, if not quarters. That means missed Q1 and Q2 revenue growth, bookings, and the like from startups domestically and around the world.

And that’s the bullish case. For some cohorts of startups, the outlook is even worse. Think about travel startups, ride-hailing upstarts, and any grouping of private companies that pursued a high-burn, high-growth model; that final category is about to run into the twin issues of the inflexibility of cost structure and the impact of slowing sales. That alone would make fundraising more difficult; toss in a deflating stock market and possible recession, and the mixture is a downright mess.

But we owe it to ourselves to survey what is going on in an attempt to answer our own questions about IPOs, exits, unicorn tallies, and who might be in trouble. Unlike when things were less bad, there will be no laughing this morning and no jokes. Just notes on what’s going wrong and what it might mean for private companies.

Powered by WPeMatico

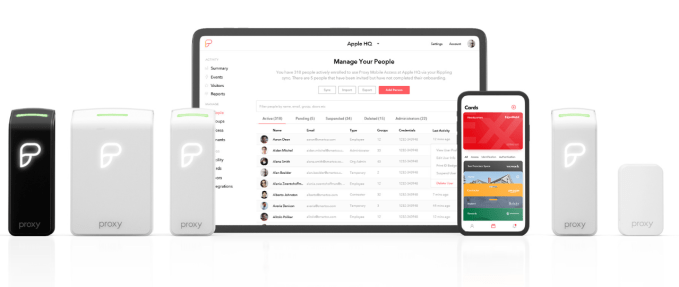

We need to go hands-off in the age of coronavirus. That means touching fewer doors, elevators, and sign-in iPads. But once a building is using phone-based identity for security, there’s opportunities to speed up access to WIFI networks and printers, or personalize conference rooms and video call set-ups. Keyless office entry startup Proxy wants to deliver all of this while keeping your phone in your pocket.

“The door is just a starting point” Proxy co-founder and CEO Denis Mars tells me. “We’re . . . empowering a movement to take back control of our privacy, our sense of self, our humanity, our individuality.”

With the contagion concerns and security risks of people rubbing dirty, cloneable, stealable key cards against their office doors, investors see big potential in Proxy. Today it’s announcing here a $42 million Series B led by Scale Venture Partners with participation from former funders Kleiner Perkins and Y Combinator plus new additions Silicon Valley Bank and West Ventures.

The raise brings Proxy to $58.8 million in funding so it can staff up at offices across the world and speed up deployments of its door sensor hardware and access control software. “We’re spread thin” says Mars. “Part of this funding is to try to grow up as quickly as possible and not grow for growth sake. We’re making sure we’re secure, meeting all the privacy requirements.”

How does Proxy work? Employers get their staff to install an app that knows their identity within the company, including when and where they’re allowed entry. Buildings install Proxy’s signal readers, which can either integrate with existing access control software or the startup’s own management dashboard.

Employees can then open doors, elevators, turnstiles, and garages with a Bluetooth low-energy signal without having to even take their phone out. Bosses can also opt to require a facial scan or fingerprint or a wave of the phone near the sensor. Existing keycards and fobs still work with Proxy’s Pro readers. Proxy costs about $300 to $350 per reader, plus installation and a $30 per month per reader subscription to its management software.

Now the company is expanding access to devices once you’re already in the building thanks to its SDK and APIs. Wifi router-makers are starting to pre-provision their hardware to automatically connect the phones of employees or temporarily allow registered guests with Proxy installed — no need for passwords written on whiteboards. Its new Nano sensors can also be hooked up to printers and vending machines to verify access or charge expense accounts. And food delivery companies can add the Proxy SDK so couriers can be granted the momentary ability to open doors when they arrive with lunch.

Rather than just indiscriminately beaming your identity out into the world, Proxy uses tokenized credentials so only its sensors know who you are. Users have to approve of new networks’ ability to read their tokens, Proxy has SOC-2 security audit certification, and complies with GDPR. “We feel very strongly about where the biometrics are stored . . . they should stay on your phone” says Mars.

Yet despite integrating with the technology for two-factor entry unlocks, Mars says “We’re not big fans of facial recognition. You don’t want every random company having your face in their database. The face becomes the password you were supposed to change every 30 days.”

Keeping your data and identity safe as we see an explosion of Internet Of Things devices was actually the impetus for starting Proxy. Mars had sold his teleconferencing startup Bitplay to Jive Software where he met his eventually co-founder Simon Ratner, who’d joined after his video annotation startup Omnisio was acquired by YouTube. Mars was frustrated about every IoT lightbulb and appliance wanting him to download an app, set up a profile, and give it his data.

The duo founded Proxy in 2016 as a universal identity signal. Today it has over 60 customers. While other apps want you to constantly open them, Proxy’s purpose is to work silently in the background and make people more productive. “We believe the most important technologies in the world don’t seek your attention. They work for you, they empower you, and they get out of the way so you can focus your attention on what matters most — living your life.”

Now Proxy could actually help save lives. “The nature of our product is contactless interactions in commercial buildings and workplaces so there’s a bit of an unintended benefit that helps prevent the spread of the virus” Mars explains. “We have seen an uptick in customers starting to set doors and other experiences in longer-range hands-free mode so that users can walk up to an automated door and not have to touch the handles or badge/reader every time.”

The big challenge facing Proxy is maintaining security and dependability since it’s a mission-critical business. A bug or outage could potentially lock employees out of their workplace (when they eventually return from quarantine). It will have to keep hackers out of employee files. Proxy needs to stay ahead of access control incumbents like ADT and HID as well as smaller direct competitors like $10 million-funded Nexkey and $28 million-funded Openpath.

Luckily, Proxy has found a powerful growth flywheel. First an office in a big building gets set up, then they convince the real estate manager to equip the lobby’s turnstiles and elevators with Proxy. Other tenants in the building start to use it, so they buy Proxy for their office. Then they get their offices in other cities on board…starting the flywheel again. That’s why Proxy is doubling down on sales to commercial real estate owners.

The question is when Proxy will start knocking on consumers’ doors. While leveling up into the enterprise access control software business might be tough for home smartlock companies like August, Proxy could go down market if it built more physical lock hardware. Perhaps we’ll start to get smart homes that know who’s home, and stop having to carry pointy metal sticks in our pockets.

Powered by WPeMatico