Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Several months ago, we surveyed more than 20 leading real estate VCs to learn about what was exciting them most in the real estate tech sector and hear their opinions on proptech trends like co-working, flexible office space and remote office space.

Since we published our survey, COVID-19 has flipped the real estate sector on its head as more companies move toward mandatory remote work, retail businesses are forced to temporarily shut their doors and high-traffic properties thin out. Suddenly, the traditionally predictable world of real estate is more chaotic and unclear than ever.

What are the short and long-term impacts of pandemic-induced volatility? Does this open up opportunities for proptech startups or shutter them? What does this mean from an investing point of view? We asked several of the VCs that participated in our last survey to update us on how COVID-19 is impacting real estate startups, non-proptech companies in general and the broader real estate market overall:

Despite its banner year in 2019, proptech will not be immune to the pressures venture-backed companies face in a market pullback, and we are preparing ourselves and our portfolio companies for a bumpy year.

Powered by WPeMatico

As efforts to flatten the spread of COVID-19 pushes employees from their offices, remote work is undergoing a surge in popularity.

Well-known remote-work-friendly companies like Zoom have seen a rise in usage, while Slack has already reported that it is successfully converting new users into paying customers, which is pushing up its growth rate.

The pandemic is creating economic and social upheaval, but for a specific cohort of software companies that help distributed teams work together, it’s proven useful in business terms. But even before the outbreak of the novel coronavirus, execs from a standout project management company swung by TechCrunch HQ to chat with the Equity crew about their business and growth: Monday.com.

What does an interview with Monday.com’s Eran Zinman (co-founder and CTO) and Roy Mann (CEO) have to do with COVID-19? Well, if remote-productivity-friendly services Slack and Zoom are seeing usage spikes amidst the changes, Monday.com is likely benefiting from similar gains. And during our chat with the company’s brass, the pair told TechCrunch that their company had crossed the $130 million annual recurring revenue (ARR) mark by mid-February. Add in a COVID-19 usage boost and perhaps Monday.com (which doesn’t have a free tier) is seeing its growth accelerate.

Previously, Monday.com announced that it had reached the $120 million ARR mark, and TechCrunch had inducted it into the $100 million ARR club earlier this year.

Revenue expansion was not our only topic. We also chatted with the pair of execs about customer acquisition costs and how to a run a SaaS business without terrifying burn. The Monday.com crew had more news up their sleeve, like when they expect the unicorn to become cash-flow positive.

We’ve excised a larger-than-usual chunk of the interview for sharing, as there’s a lot to take in:

After the jump, we dig a bit deeper into the obvious IPO candidate

Powered by WPeMatico

OfferUp, a top online and mobile marketplace app, announced this morning it’s raising $120 million in a new round of funding led by competing marketplace letgo’s majority investor, OLX Group, and others. As a part of the deal, OfferUp will also be acquiring letgo’s classified business, with OLX Group gaining a 40% stake in the newly combined entity.

Other investors in the new round include existing OfferUp backers Andreessen Horowitz and Warburg Pincus. The funds will be put toward continued growth, product innovation and monetization efforts, OfferUp says.

The round will close with the closing of the acquisition, which is expected to take place sometime in May. To date, OfferUp has raised $380 million.

The acquisition will see two of the largest third-party buying and selling marketplaces — outside of Craigslist, eBay and Facebook Marketplace, of course — become a more significant threat to the incumbents. Together, the new entity will have more than 20 million monthly active users across the U.S. For consumers, the deal means they’ll no longer have to list in as many apps when looking to unload some household items, electronics, furniture or whatever else they want to sell.

“My vision for OfferUp has always been to build a company that helps people connect and prosper,” said Nick Huzar, OfferUp CEO, in a statement about the acquisition. “We’re combining the complementary strengths of OfferUp and letgo in order to deliver an even better buying and selling experience for our communities. OLX Group has unparalleled expertise and clear success with growing online marketplace businesses, so they’ll be a great partner as we continue to build the widest, simplest, and most trustworthy experience for our customers.”

OfferUp also acknowledged that mid-pandemic is an odd time to announce such a deal — especially at a time when the COVID-19 outbreak is affecting its own employees, its partners, and the buying and selling community itself. And this will continue for some time.

However, Huzar positions the deal as one that will allow the business to grow, despite the current state of affairs.

“This news helps us to continue to innovate and grow, in spite of these challenging times, and continue to deliver on that promise,” Huzar noted, in a company blog post.

For now, the OfferUp and letgo apps will remain separate experiences and no disruptions to any sales will be made. Consumers will also be able to download both apps to iOS and Android devices for the time being, too.

But soon, both sets of users will gain access to a larger network of buyers and sellers, along with nationwide shipping options, and trust and safety problems. We understand this will involve allowing users of both sets of apps to see more posts and interact with more buyers and sellers — so some sort of merging of the two networks is at play here. There will be additional changes to improve the user experience for all users in the future, as well, but the company isn’t sharing details on that today.

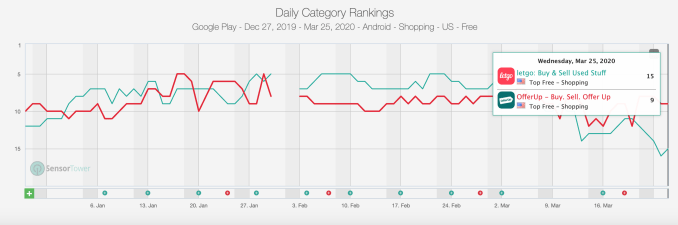

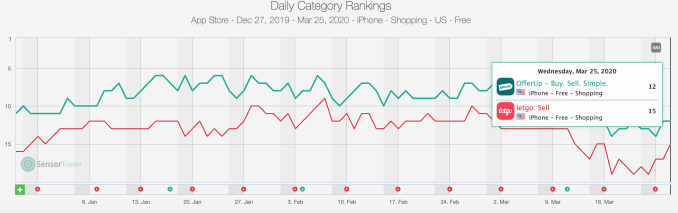

Letgo is bringing to the table an app with more than 100 million worldwide downloads, so there is a potential to reactivate some of the lapsed users who aren’t currently shopping or selling on its marketplace today. The two apps were often neck-and-neck in terms of their app store category rankings, though on iPhone OfferUp has maintained a slight lead. (See App Store and Google Play charts below.)

However, letgo’s business outside of North America will be separately owned and operated as part of the OLX Group, the companies said.

“Letgo and OfferUp have always shared the same core vision for how large America’s secondhand economy can become — harnessing tech innovation to bring about an extraordinarily positive impact on consumers’ wallets and also on the environment,” said letgo co-founder Alec Oxenford. “Bringing our apps together moves us much closer to that vision,” he added.

Prior to this deal, OfferUp had seen a number of executive departures, including the exit of Engineering lead and VP Peter Wilson in 2017, VP of Product Chloe Harford in 2018, VP of Employee Experience Deb Nielsen in 2018, subsequent VP of Employee Experience Sarah Bilton in 2019, and Chief Experience Officer Jerry Howe in January 2020. CFO Rodrigo Brumana has also left, which was previously unreported. The company’s interim CFO is Chief Growth Officer Ian Fliflet, and OfferUp is actively hiring for a new CFO, we’re told.

Huzar characterizes these changes as part of the challenges with growing a startup and getting the right people into place.

“As the company grows up, so must leaders and so must the culture. I think a lot of times when you’re scaling businesses…you go through evolutions where leaders really need to evolve and change,” he says. “If you look to Bill Carr, for example, our COO, you know he helped build out Amazon Video from nothing to over 2,000 employees. We had nobody in the halls of OfferUp that had seen that scale before,” Huzar added.

There’s some admiration for Amazon’s culture, as well.

“There are clearly things that Amazon has done very well — like their ability to innovate at scale is unbelievable,” Huzar says. “We do think people [who] come out of Amazon have great startup DNA. They’re very scrappy. They dive deep into the business and understand things. They can think big. There’s a lot of value I think from that business that I really appreciate,” he added.

OfferUp also just hired former ChannelAdvisor VP Mark Vandegrift as head of e-commerce this month, as the company focuses on growth and scale.

But not all employees have been on board with these exec shakeups. More than a handful of employee reviews on Glassdoor and chatter on networking app Blind speak to various company culture issues, women being treated inequitably, negative office politics, and attrition — including among senior management.

In addition to the COVID-19 crisis, OfferUp may have needed to merge to scale and compete with the marketplace giants. User growth was slowing, for instance — the userbase was 42 million annual users in 2018 that only grew to 44 million in 2019. Presumably, slower revenue growth had followed. (Huzar declined to speak to current revenue and valuation.)

A combination of OfferUp and letgo could help to strengthen numbers outside of coastal cities, like Seattle, L.A., and Miami, where OfferUp was historically strong. Letgo was stronger in other parts of the country, like the Midwest, Huzar says. OfferUp will also bring its shipping business to letgo, which could be particularly helpful now as people are looking to sell household items for extra cash.

The deal is still subject to regulatory approval. If given, the combined businesses will be operated by OfferUp, headquartered in Bellevue, Wash. Huzar will continue to be CEO of OfferUp and chairman of the board. Oxenford, meanwhile, will join the board and serve as a senior advisor to OLX Group and Prosus.

Because the deal is still in the process of closing, the companies can’t speak to any team changes, including potential layoffs as a result of overlapping positions or other redundancies, we’re told.

Updated 3/25/20, 4:00 PM ET with additional quotes and background, following Huzar interview.

Powered by WPeMatico

Zoom, a video chat service then popular with corporations, filed to go public on March 22, 2019.

Best known in venture and corporate circles, Zoom was far from a household name at the time. However, the groundwork for its 2020-era consumer breakthrough during the novel coronavirus epidemic was detailed during its IPO march in the years leading up to its public debut.

The company didn’t begin trading until mid-April last year, but it was through its March 2019 IPO filing that its name took on new prominence; here was a quickly growing software as a service (SaaS) business that was posting profits at the same time. As the rate at which unprofitable companies went public set records, Zoom’s growth and positive net income helped it gain brand recognition even before its shares began to trade.

Investors certainly recognized this was a rarity among SaaS companies, sending its IPO share price up 72% in its first day. The company’s equity has risen more than 100% since that first close, more than doubling in less than a year. Not bad in a market that has turned ice-cold in recent weeks.

To understand how Zoom became so valuable as a business — and later as a consumer product — let’s go back in time to consider its product and business strategies. As we’ll see, to become the video chat tool that everyone is using today, Zoom had to beat a host of entrenched competition. And it did so while making money, helping set the financial stage for its prominence today.

Powered by WPeMatico

Over-the-top live TV streaming service fuboTV announced today it plans to merge with the virtual entertainment technology company, FaceBank Group. The proposed merger would retain the name fuboTV for the combined company, consisting of fuboTV’s direct-to-consumer live TV streaming platform and FaceBank’s technology IP in sports, movies and live performances.

FaceBank is not a household name, but is a developer of hyper-realistic digital humans — including those of celebrities and consumers — for use in emerging technologies, like VR and AR, as well as in live entertainment, interactive, media, social networking and AI-driven applications.

You may remember the company from its creation of the hologram of Michael Jackson at The Billboard Music Awards in 2014, when it was then called Pulse Evolution. It also created a virtual Tupac in 2012, and owns the rights to develop digital representations of Elvis Presley, Marilyn Monroe and others. The company has also worked to create virtual creatures and characters in movies like “The Lord of the Rings: The Two Towers,” “Star Wars III: Revenge of the Sith,” “Transformers,” “Benjamin Button” and more, per its website.

According to the proposed merger agreement, the plan is to create a leading digital entertainment company that combines fuboTV with FaceBank’s IP in order to create a content delivery platform for both traditional and “future-form IP.”

That is to say, you’ll be able to stream your live TV and these virtual/digital human performances on one platform, it seems.

FuboTV also says it plans to leverage FaceBank’s IP sharing relationships with leading celebrities and other digital technologies to enhance its sports and entertainment offerings.

“The business combination of FaceBank Group and fuboTV accelerates our ability to build a category-defining company and supports our goal to provide consumers with a technology-driven cable TV replacement service for the whole family,” said fuboTV CEO David Gandler, in a statement. “With our growing businesses in the U.S., and recent beta launches in Canada and Europe, fuboTV is well-positioned to achieve its goal of becoming a world-leading live TV streaming platform for premium sports, news and entertainment content. In the current COVID-19 environment, stay-at-home stocks make perfect sense – we plan to accelerate our timing to uplist to a major exchange as soon as practicable. We look forward to working with John and his team of creative visionaries,” he added.

“As a tech-driven IP company, FaceBank was looking to find the perfect delivery platform for its celebrity and consumer-driven content, with a dynamic user interface that could support the global consumers’ rapidly evolving practices of content consumption,” added FaceBank founders John Textor and Alex Bafer. “David and his team have a clear vision of the future and fuboTV’s technology is second to none among the disruptor class of content delivery – a perfect match for FaceBank Group,” their statement read.

FaceBank also says it took out a secured revolving line of credit of $100 million, the first $10 million of which will be provided to fuboTV on April 1 or the closing date of the merger, whichever is later.

The merger will allow fuboTV to continue its international expansion, by way of FaceBank Group’s Nexway — an e-commerce and payment platform live in 180 countries, the company says.

FuboTV was founded in 2015, first as a soccer streaming service, then later expanded into more sports and entertainment. It competes with YouTube TV, Hulu with Live TV, AT&T TV Now and, before its shutdown, PlayStation Vue.

The deal follows several other consolidations in online streaming and media, including Disney’s acquisition of 21st Century Fox, Viacom’s purchase of pluto.tv and Fox Corp.’s acquisition of Tubi. For smaller streamers, it’s difficult to keep up with the rising costs of programming amid competition from larger competitors, like Disney (Hulu’s majority owner) and Google (which runs YouTube TV).

The boards of directors of both companies and the major stockholders of fuboTV have approved the transaction, which is anticipated to close during the first quarter of 2020, subject to the satisfaction of certain closing conditions, the companies said.

Powered by WPeMatico

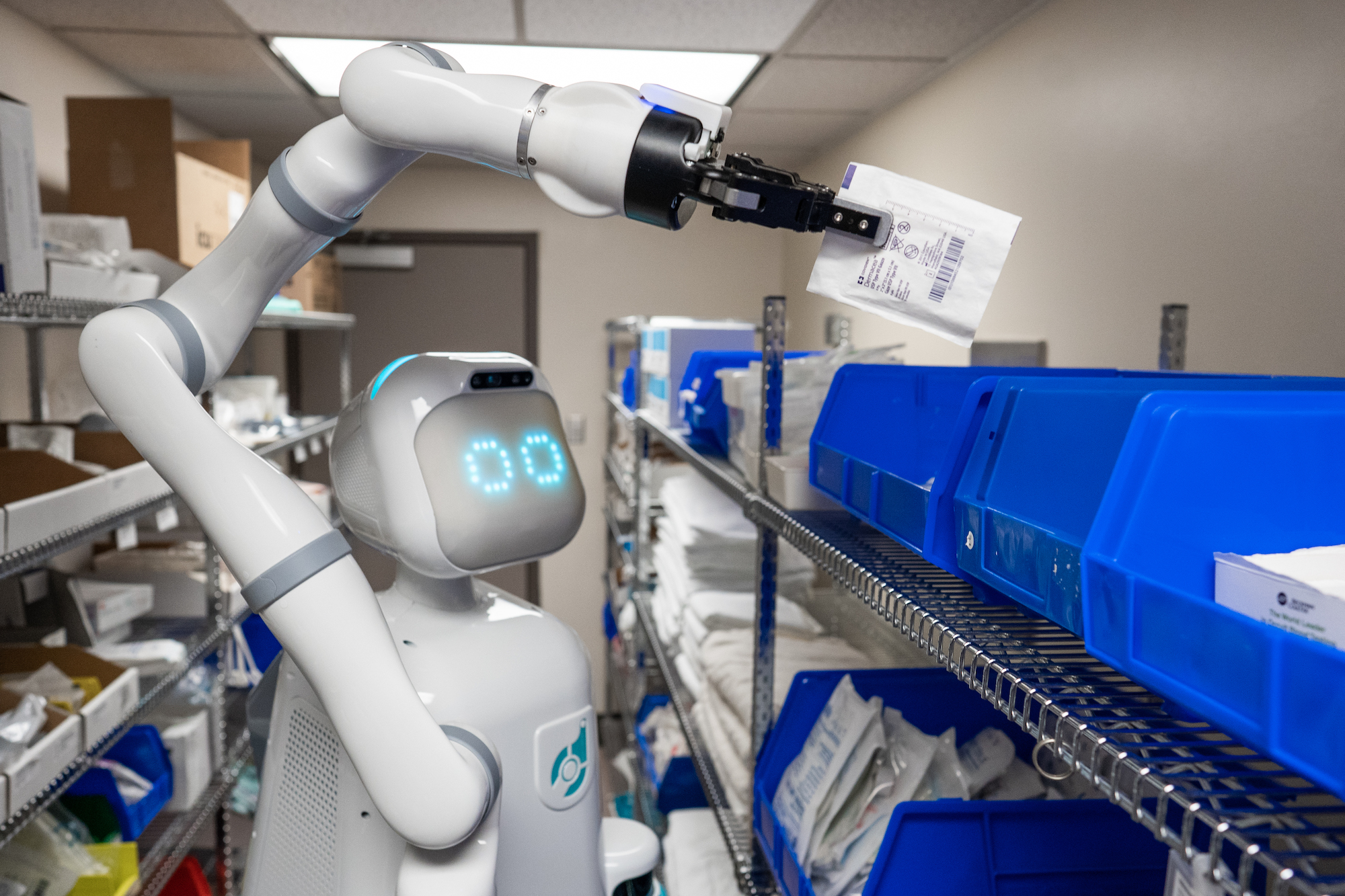

Twenty-eight percent of a nurse’s time is wasted on low-skilled tasks like fetching medical tools. We need them focused on the complex and compassionate work of treating patients, especially amid the coronavirus outbreak. Diligent Robotics wants to give them a helper droid that can run errands for them around the hospital. The startup’s bot Moxi is equipped with a flexible arm, gripper hand and full mobility so it can hunt down lightweight medical resources, navigate a clinic’s hallways and drop them off for the nurse.

With the world facing a critical shortage of medical care professionals, Moxi could help healthcare centers use their staffs as efficiently as possible. And because robots can’t be infected by COVID-19, they’re one less potential carrier interacting with vulnerable populations.

Today, Diligent Robotics announces its $10 million Series A that will help it scale up to deliver “more robots to more hospitals,” CEO Andrea Thomaz tells me. “We’ve been designing our product, Moxi, side by side with hospital customers because we don’t just want to give them an automation solution for their materials management problems. We want to give them a robot that frontline staff are delighted to work with and feels like a part of the team.”

The round, led by DNX Ventures, brings Diligent Robotics to $15.75 million in total funding that’s propelled it to the fifth generation of its Moxi robot. It currently has two deployed in Dallas, Texas, but is already working with two of the three top hospital networks in the U.S. “As the current pandemic and circumstance has shown, the real heroes are our healthcare providers,” says Q Motiwala, partner at DNX Ventures. The new cash from DNX, True Ventures, Ubiquity Ventures, Next Coast Ventures, Grit Ventures, E14 Fund and Promus Ventures will help Diligent Robotics expand Moxi’s use cases and seamlessly complement nurses’ workflows to help alleviate the talent crunch.

The round, led by DNX Ventures, brings Diligent Robotics to $15.75 million in total funding that’s propelled it to the fifth generation of its Moxi robot. It currently has two deployed in Dallas, Texas, but is already working with two of the three top hospital networks in the U.S. “As the current pandemic and circumstance has shown, the real heroes are our healthcare providers,” says Q Motiwala, partner at DNX Ventures. The new cash from DNX, True Ventures, Ubiquity Ventures, Next Coast Ventures, Grit Ventures, E14 Fund and Promus Ventures will help Diligent Robotics expand Moxi’s use cases and seamlessly complement nurses’ workflows to help alleviate the talent crunch.

Thomaz came up with the idea for a hospital droid after doing her PhD in social robotics at the MIT Media lab. Her co-founder and CTO Vivian Chu had done a master’s at UPenn on how to give robots a sense of touch, and then came to work with Thomaz at Georgia Tech. They were inspired by a study revealing how nurses spent so much time acting as hospital gofers, so in 2016 they applied for and won a National Science Foundation grant of $750,000 that funded a six-month sprint to build a prototype of Moxi.

Since then, 18-person Diligent Robotics has worked with hundreds of nurses to learn about exactly what they need from an autonomous assistant. “Today you will go about your day, and you probably won’t interact with any robots….we want to change that,” Thomaz tells me. “The only way you can really bring robots out of the warehouses, off of the factory floors, is to build a robot that can work in our dynamic and messy everyday human environments.” The startup’s intention isn’t to fully replace humans, which it doesn’t think is possible, but to let them focus on the most human elements of their jobs.

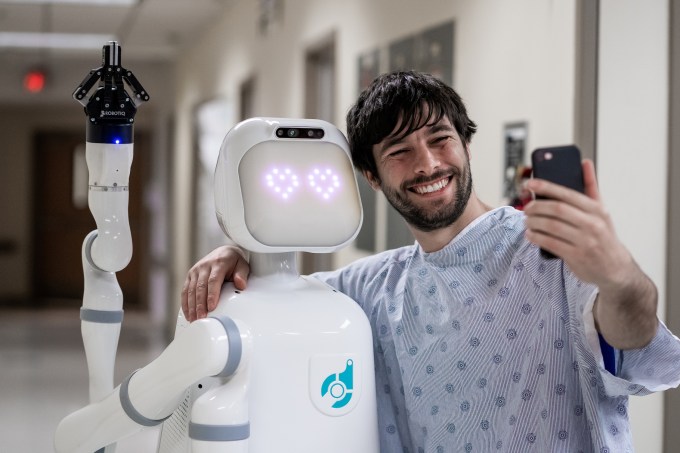

Moxi is about the size of a human, but designed to look like an ’80s movie robot so as not to engender an uncanny valley cyborg weirdness. Its head and eyes can move to signal intent, like which direction it’s about to move, while sounds let it communicate with nurses and acknowledge their commands. A moving pillar lets it adjust its height, while its gripper hand and arm can pick and put down smaller pieces of hospital equipment. Its round shape and courteous navigation makes sure it can politely share crowded hallways and travel via elevator.

Diligent Robotics’ solution engineers work with hospitals to teach Moxi how to get around and what they need. The company hopes to eventually build the ability to learn and adapt right into the bot so nurses can teach it new tasks on the fly. “The team continues to demonstrate unmatched robotics-specific innovation by combining social intelligence and human-guided learning capabilities,” says True Ventures partner and Diligent board member Rohit Sharma.

Hospitals pay an upfront fee to buy Moxi robots, and then there’s a monthly fee for the software, services and maintenance. Thomaz admits that “Hospitals are naturally risk-averse, and can be wary to take up new technology,” so the startup is taking a slow and steady approach to deployment so it can convince buyers that Moxi is worth the learning curve.

Diligent Robotics will be competing with companies like Aethon’s TUG bot for pulling laundry and pharmacy carts. Other players in the hospital tech space include Xenex’s machine that disinfects rooms with light, and surgical bots like those from Johnson & Johnson’s Auris and Intuitive Surgical.

Diligent Robotics hopes to differentiate itself by building social intelligence into Moxi so it feels more like an intern than a gadget. “Time and again, we hear from our hospital partners that Moxi not only returns time back to their day but also brings a smile to their face,” says Thomaz. The company wants to evolve Moxi for other dull, dirty or dangerous service jobs.

Eventually, Diligent Robotics hopes to bring Moxi into people’s homes. “While we don’t see robots replacing the companionship and the human connection, we do dream of a time that robots could make nursing homes more pleasant by offsetting the often staggering numbers of caretakers to bed ratios (as bad as 30:1),” Thomaz concludes. That way, Moxi could “help people age with dignity and hold onto their independence for as long as possible.”

Powered by WPeMatico

Ohio-based Coterie, a startup working on in the commercial insurance space, has announced today it has raised $8.5 million Series A. The company had previously raised a little over $3 million in early investments, bringing its equity capital raised to nearly $12 million to date; the firm also told TechCrunch that it has raised $2.5 million in available venture debt as part of its current round.

In an uncertain market, Coterie is better capitalized than it ever has been, thanks to Intercept, and The Hartford, and RPM Ventures , which led its latest round.

Coterie operates in insurtech, a space we’ve covered extensively in recent months. But it’s not MetroMile or Lemonade, both of which selling consumer insurance. Nor is it akin to The Zebra, Policygenius, Gabi, or Insurify, helping consumers link to third-party insurance products. It’s closest private market comp, looking at our recent coverage, is Briza, which produces APIs linking small businesses to small business insurance products.

But what Coterie does is slightly different if we’re grokking its model correctly: It offers what it calls “commercial insurance as a service,” according to an interview with TechCrunch. Let’s explore.

In a call with TechCrunch about its latest funding event, Coterie explained that, using APIs, it connects “places that have some commercial insurance requirement, or service customers who need commercial insurance, and we simply pass that information into our system and we quote and bind automatically.”

While Coterie does partner with external insurance entities (more on that in a second), it handles a lot of the work in-house: “We actually have the underwriting control, so we don’t we don’t ship it off to 10 different carriers. We actually say yes, we will bind this policy, or no, we won’t,” said Coterie CEO David McFarland, adding that “most of the time we have a pretty broad appetite so we can write a good bit of business.”

Helping it in this process are some partners in the insurance market that help with “the licenses and the capital requirements,” the company said.

What makes Coterie interesting isn’t that is a digital take on a previously paper business, but that it’s product allows it to insure freelancers (Coterie partners with freelance marketplaces, allowing it access to a potential customer base and helping the marketplace itself provide insured providers) for even small increments of time; that’s something that wasn’t economically attractive under old models, if even possible.

According to the firm, it offers general and professional liability insurance, along with business owners policies. Coterie has eyes on various types of data to power its model (and make good policy pricing choices), highlighting information like business payment flows to vet company health, to pick an example.

Coterie only started selling its products in September of 2019, but noted to TechCrunch that it saw “pretty good growth” from from the jump, and “pretty steady growth” since then. But as Coterie noted in our call, insurance is a somewhat low-margin business, meaning that policy growth, while good, needs to be pretty steep for the gross margin generated to stack up too high.

But with $8.5 million in new equity capital and total access to over $10 million in funds, the startup now has more money than ever to pursue its model. And if it’s like the rest of the insurtech space, it has a good shot at quick growth.

Update: The first version of this post included an incorrect investor; it has since been corrected.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week’s episode was a testament to making do, as we’ve had to cancel some trips, juggle a few guests, and get up and running as a podcast that have guests dial in without losing our stride. So, this week Danny and Natasha and Alex were joined by Unshackled VC’s Manan Mehta.

And it went pretty ok, aside from a hiccup or two, expect Equity to still feature guests as often as it makes sense, even if we’re currently locked out of our own studio. Anyhoo, a combo of local recording, remote video setups, and Chris handling the dials meant that we were able to talk over all the good stuff:

All told there were some laughs, and we spent a good few minutes before mentioning COVID-19. It was good fun to have the crew on for a classic Equity episode, and a big thanks to Manan for coming aboard under less-than-optimal circumstances.

Equity drops every Monday at 7:00 AM PT and Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Claimer, a London-based startup that makes it easy for companies to claim R&D tax credits in the U.K., has raised £300,000 in seed funding.

Backing the already revenue-generating company is Ben Holmes (who was previously at Index Ventures), Nick Telson and Andrew Webster (the founders of DesignMyNight, which recently exited), Rupert Loman (founder of Gamer Network), and TrueSight Ventures.

Founded by Adam McCann in January 2018 and then launched in April 2019, Claimer streamlines the process of claiming R&D tax credits, which is a U.K. government subsidy popular with tech startups that is designed to encourage innovation. The startup claims its product is approximately 10x faster and up to 6x cheaper than using a tax consultant.

“Claimer is fixing the R&D tax relief space with tech,” McCann tells me. “If you’re not familiar with the scheme, it’s run by HMRC and allows U.K. businesses to claim back up to 33% of their research & development costs as a cash payment in any industry, such as software and hardware development, manufacturing, textiles, biotechnology, foodtech, and many others.”

“Most accountants don’t have the in-house expertise to process claims, so they refer clients to R&D tax specialists. For many companies, the process is slow, expensive, and frustrating, because these specialists charge very high fees, often taking weeks to process claims.”

In contrast, McCann says Claimer’s platform makes it easy for businesses to reliably complete their R&D relief claims without any prior tax knowledge. After you upload a claim to the platform, which includes the ability to pull numbers from your accounting software, Claimer’s in-house tax specialists check and optimise it before it is submitted to HMRC.

“We’ve processed claims ranging from £1,000 to over £2 million with a 100% success rate (i.e. no rejections or reductions). Our customers have also awarded us 5 stars on TrustPilot,” he adds.

To that end, Claimer’s success is aligned with that of its customers. The startup charges a fee of 5% or less of the saving/credit received in R&D tax credits, capped to £10,000. McCann says this is much less than the typical uncapped 20-30% usually charged by specialists, “often with undesirable terms such as multi-year lock-in contracts, hidden costs, and large minimum fees”.

Meanwhile, Claimer plans to use the seed funding to grow its engineering team and build version two of the product, which McCann says will utilise open data and machine learning, making it possible for claims to be created automatically.

“And yes, we’ll be claiming R&D tax credits for developing our R&D tax credits platform,” quips the Claimer founder.

Powered by WPeMatico

Quantum Machines, a Tel Aviv-based startup that is building both hardware and software to operate quantum computers, today announced that it has raised a $17.5 million Series A funding round. The round was led by Israeli tech entrepreneur Avigdor Willenz (who, among other companies, co-founded Habana Labs and Anapurna Labs and sold them to Intel and Amazon, respectively) and Harel Insurance Investments.

TLV Partners and Battery Ventures also participated in this round. TLV Partners also led the company’s $5.5 million seed round in 2018, in which Battery Partners also participated.

“The race to commercial quantum computers is one of the most exciting technological challenges of our generation,” said Willenz. “Our goal at [Quantum Machines] is to make this happen faster than anticipated and establish ourselves as a key player in this emerging industry.”

The company says it will use the new funding to accelerate the adoption of its Quantum Orchestration Platform. This platform went live earlier this year. What makes it unique is that it’s a combination of custom hardware, which the company designed itself, and software tools that can be used to control virtually any quantum processor. To control a quantum processor, you also need a powerful classical computer, but traditional computers are ill-suited for this task, Quantum Machines argues, and it’ll take specialized hardware for classical computing to harness the power of quantum computing and run complex algorithms on these machines.

“The classical layers of the quantum computer are the real unmet need. They are the bottleneck,” Quantum Machines co-founder Itamar Sivan told me when the platform launched. “We were really looking into what is holding the industry back. What are the things that we can do today to drive this industry forward, but that will also enable faster progress in the future. Since most of the focus in the last years has been devoted to quantum processors, it was only natural that you know we take on this challenge.”

Powered by WPeMatico