Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Pangea.app, a Providence, Rhode Island-based startup has raised a $400,000 pre-seed round, it told TechCrunch this week. The company’s new capital, raised as a post-money SAFE, comes from PJC, a Boston-based venture capital firm and Underdog Labs. Previously, Pangea.app raised money from angel investors.

The company links “remote college freelancers,” per its website, to businesses around the country. College students want paid work and resume-building experience, while businesses need help with piece-work that students can help with, like graphic design. Today, with colleges and universities closing due to COVID-19, students stuck at home, and many businesses leery about adding new, full-time staff, Pangea.app could find itself in a market sweet spot.

Some students that had work lined up for the summer are now unexpectedly free, possibly adding to the startup’s labor rolls. “I can’t tell you how many students I’ve spoken with who have had summer internships and on-campus jobs canceled,” Adam Alpert, Pangea.app’s CEO and co-founder told TechCrunch, “we are filling an important gap helping them find short-term, remote opportunities that enable them to contribute while learning.”

Pangea.app CEO Adam Alpert and CTO John Tambunting

If its marketing position resonates as its CEO hopes, the firm could see quick growth. According to Alpert the company has seen five figures of contracts flow through its platform to date, and expects to reach a gross merchandise volume run rate that’s a multiple of its current size by the end of summer.

Some 250 schools have students on the platform; 60 schools have joined in the last three weeks.

Pangea.app makes money in two ways, taking a 15% cut of transaction volume and charging some companies a SaaS fee for access to its best-vetted student workers. The company had targeted a $500,000 raise, a sum that Alpert says he’s confident that his company can meet.

While the national economy stutters and the venture capital world slows, Pangea.app may have picked up capital at a propitious time; raising capital is only going to get harder as the year continues and it now has enough to operate for a year without generating revenue; it will generate top line, however, extending its cash cushion.

Pangea.app aspires to more than just growth. Alpert told TechCrunch that it has a number of development-focused hires on the docket for 2020, including a UI/UX designer and engineering talent. The company also intends to use its own platform to staff up over the summer to help speed up its own development.

Being based in Providence, not precisely the center of the world’s startup gravity, may have some advantages for Pangea.app. The company said that it is working to reach break-even profitability before it works on the next part of its business. It’s easier to do that in Providence where the cost of living and doing business is far lower than it is in larger startup hubs.

Update: The round was a pre-seed investment, not a seed deal as originally reported. The post has been corrected.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Airbnb’s recent moves in the wake of a global travel slowdown are interesting and worth understanding in chronological order. What it details is a company spending heavily today to keep up its future health. Demand will return to the world travel market in time — how much, no one knows — and Airbnb wants to be a well-liked participant in the return to form.

Building off our last look at the company, we should understand how Airbnb intends to not only survive, but come out the other side of the pandemic with enough user trust to get back to work.

Powered by WPeMatico

As domestic and global economies grapple with the COVID-19 era, its impact on startups is coming into focus: All will be impacted, many will suffer and some will close.

Boston, a city that TechCrunch keeps tabs on, has seen a number of well-known startups struggle in recent weeks. Their misfortunes come quickly after companies in the region recorded huge venture raises, generating notable momentum.

In December, TechCrunch wrote that “despite winter’s chill, the Northeast’s tech ecosystem is white-hot,” taking into account Boston’s historical gains in the venture world. And earlier in 2020 we covered a few huge rounds that the city’s own Toast and Flywire had put together; worth $520 million as a pair, the two venture deals stood out for how large they were and how close to one another they were announced.

Indeed, looking at preliminary venture data from Crunchbase, Boston was on track to crush its 2019 tally of venture rounds of $50 million or more in 2020. That record-setting pace is now in doubt.

To get a feel for Boston’s new reality, we’ve collected the region’s recent news and spoke to area investors and founders, including David Cancel of Drift (the previous founder of Compete and other companies), Drew Volpe of First Star VC and a team of folks from Underscore VC.

TechCrunch had intended to start a monthly series on Boston and its venture capital and startup scenes later this month. We’re kicking it off early because the news is already here.

Earlier this week, restaurant management platform Toast cut 50% of its staff. The Boston-based company was valued at $5 billion in recent months, and — before the pandemic hit — was planning to spend the next few years gearing up to go public. Toast sits uniquely between fintech and restaurant tech, industries that have been arguably impacted the most by COVID-19’s spread and widespread restaurant closures.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

The whole crew was present this week: Natasha, Danny and Alex, along with our intrepid producer Chris. And like the last few episodes it was good to have everyone around as there was so very much to get through. Even better there was a lot of good, non-COVID-19 news to cover. Yes, there were bad tidings and some COVID-19 material as well, but, hey, not everything can be fun.

We started with a look at Clearbanc and its runway extension not-a-loan program, which may help startups survive that are running low on cash. Natasha covered it for TechCrunch. Most of us know about Clearbanc’s revenue-based financing model; this is a twist. But it’s good to see companies work to adapt their products to help other startups survive.

Next we chatted about a few rounds that Danny covered, namely Sila’s $7.7 million investment to help build technology that could take on the venerable and vulnerable ACH, and Cadence’s $4 million raise to help with securitization. Even better, per Danny, they are both blockchain-using companies. And they are useful! Blockchain, while you were looking elsewhere, has done some cool stuff at last.

Sticking to our fintech theme — the show wound up being super fintech-heavy, which was an accident — we turned to SoFi’s huge $1.2 billion deal to buy Galileo, a Utah-based payments company that helps power a big piece of UK-based fintech. SoFi is going into the B2B fintech world after first attacking the B2C realm; we reckon that if it can pull the move off, other financial technology companies might follow suit.

Tidying up all the fintech stories is this round up from Natasha and Alex, working to figure out who in fintech is doing poorly, who’s hiding for now, and who is crushing it in the new economic reality.

Next we touched on layoffs generally, layoffs at Toast, AngelList, and not LinkedIn — for now. Per their plans to not have plans to have layoffs. You figure that out.

And then at the end, we capped with good news from Thrive and Index. We didn’t get to Shippo, sadly. Next time!

Equity drops every Monday at 7:00 AM PT and Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Mergers and acquisitions largely grinded to a halt at the end of March, in the wake of the coronavirus pandemic spreading around the world, but today comes news of a deal out of Europe that underscores where pockets of activity are still happening. Avira, a cybersecurity company based out of Germany that provides antivirus, identity management and other tools both to consumers and as a white-label offering from a number of big tech brands, has been snapped up by Investcorp Technology Partners, the PE division of Investcorp Bank. Investcorp’s plan is to help Avira make acquisitions in a wider security consolidation play.

The financial terms of the acquisition are not being disclosed in the companies’ joint announcement, but the CEO of Avira, Travis Witteveen, and ITP’s MD, Gilbert Kamieniecky, both said it gives Avira a total valuation of $180 million. The deal will involve ITP taking a majority ownership in the company, with Avira founder Tjark Auerbach retaining a “significant” stake of the company in the deal, Kamieniecky added.

Avira is not a tech startup in the typical sense. It was founded in 1986 and has been bootstrapped (in that it seems never to have taken any outside investment as it has grown). Witteveen said that it has “tens of millions” of users today of its own-branded products — its anti-virus software has been resold by the likes of Facebook (as part of its now-dormant antivirus marketplace) — and many more via the white-label deals it makes with big names. Strategic partners today include NTT, Deutsche Telekom, IBM, Canonical and more.

He said that the company has had many strategic approaches for acquisition from the ranks of tech companies, and also from more typical investors, but these were not routes that it has wanted to follow, since it wanted to grow as its own business, and needed more of a financial injection to do that than what it could get from more standard VC deals.

“We wanted a partnership where someone could step in and support our organic growth, and the inorganic [acquisition] opportunity,” he said.

The plan will be to make more acquisitions to expand Avira’s footprint, both in terms of products and especially to grow its geographic footprint: today the company is active in Asia, Europe and to a lesser extent in the US, while Investcorp has a business that also extends deep into the Middle East.

Cybersecurity, meanwhile, may never go out of style as an investment and growth opportunity in tech. Not only have cyber threats become more sophisticated and ubiquitous and targeted at individual consumers and businesses over the last several years, but our increasing reliance on technology and internet-connected systems will increase the demand and need to keep these safe from malicious attacks.

That has become no more apparent than in recent weeks, when much of the world’s population has been confined to shelter in place. People have in turn spent unprecedented amounts of time online using their phones, computers and other devices to read news, communicate with their families and friends, entertain themselves, and do critical work that they may have in part done in the past offline.

“In the current market, you can imagine a lot are concerned about the uncertainties of the technology landscape, but this is one that continues to thrive,” said Kamieniecky. “In security, we have seen companies develop quite rapidly and quickly, and here we have an opportunity to do that.”

Avira has been somewhat of a consolidator up to now, buying companies like SocialShield (which provided online security specifically for younger and social media users), while ITP, with Investcorp having some $34 billion under management, has made many acquisitions (and divestments) over the years, with some of the tech deals including Ubisense, Zeta Interactive and Dialogic.

Powered by WPeMatico

Earlier this week, the Equity crew caught up with Work-Bench investor Jon Lehr to get his take on the current market, and how his firm goes about making investment decisions.

The conversation was a treat, so we cut a piece of it off for everyone to listen to. The full audio and a loose transcript are also available after the jump.

What did Danny and Alex learn while talking to Lehr? A few things, including what Seed II-level investments need these days to be attractive (Hint: It’s not a raw ARR threshold), and what’s going on in SaaS today (deals slowing, but not for select founders; relationships are key to doing deals today), and why being a VC is actually work.

But what stood out the most was how Lehr thinks about finding investment opportunities. While some VCs like to cultivate images of being gut-investors, cutting checks based on first meetings and the like, Lehr told TechCrunch about how he researches the market to find pain-points, and then the startups that might solve those issues.

You can listen to that bit of the chat in the clip below:

Extra Crunch subscribers, the rest of the goodies are below. (A big thanks to Danny for cleaning up the written transcript.)

Powered by WPeMatico

Voice-based social networks and gaming as a new form of identity were among the top emerging trends in consumer social startups, according to an Extra Crunch survey of top social tech investors. Meanwhile, anonymity and dating apps with a superfluous twist were spaces where investors were most pessimistic.

Extra Crunch assembled a list of the most prolific and well-respected investors in social. Many have funded or worked for the breakout companies changing the way we interact with other people. We asked about the most exciting trends they’re seeing and which areas they expect will soon spawn blockbuster social apps.

Subscribe to Extra Crunch to read the full answers to our questionnaire from funds like Andreessen Horowitz, CRV and Initialized.

Here are the 16 leading social network VCs that participated in our survey:

Stay tuned next week for a follow-up article from these investors detailing their thoughts on social investing in the COVID-19 era.

What trends are you most excited about in social from an investing perspective?

First, it’s worth noting that consumer social is very hard to predict. Unlike enterprise software, there’s no rational buyer, and the things that take off can seem “random” or dumb. Startups that see huge success in this space are often pioneering a new feature or way of communicating that hasn’t existed before. Any VC who claims to know what the “next big thing” in consumer social will look like should probably go build it themselves!

Powered by WPeMatico

Early this afternoon Shippo, a shipping software and services company, announced that it has closed a $30 million Series C. The funding round roughly doubles the capital that the firm has raised to-date, from a little over $29 million to just under $60 million.

The round, however, wasn’t put together recently. As is often the case with funding events, Shippo raised its capital a while back and is only announcing it now. According to its CEO, Laura Behrens Wu, her startup started raising its Series C in late Q4 2019, with the capital hitting its accounts the day after Christmas. So, Shippo started 2020 well capitalized, and should have a comfortable capital base heading into this year’s economic uncertainty.

The funding round was led by a new investor, D1 Capital Partners, and participated in by a number of prior investors including Uncork Capital (which led a 2014 Seed investment into the company), Union Square Ventures (which led the company’s Series A in 2016) and Bessemer (which led its 2017 Series B).

Shippo sits between retailers and consumers, helping sellers ship goods to buyers quickly and, it promises, inexpensively. The startup works with nearly five dozen shipping partners around the world, and plugs into the merchant worlds of Amazon, Shopify, Wix and others.

Like a number of successful startups, Shippo is trying to take something that is complex, and make it simple while generating revenue along the way. There are a number of loose examples we can lean on. For example, Plaid took all the complexity of talking to different financial institutions and shoved it into an accessible API. Twilio did something similar for telephony. Stripe made payments simple for others to integrate. You get the idea. Shippo wants to the same for shipping.

So far its model has good momentum. Heading into its funding round the firm had doubled (“100% growth,” Behrens Wu) in the preceding year, the sort of expansion that investors covet. It’s never bad to raise on the back of aggressive growth, as Shippo’s Series C shows; the company’s new valuation is “slightly higher” than TechCrunch’s estimate of $150 million, according to its CEO.

And even more, Shippo’s hybrid software and sales model (it charges for access to its shipping software and generates revenue from select shipping spend) creates attractive economics. Shippo’s gross margins are right around 80%, according to the startup, putting the company in the middle-upper tier of SaaS firms. Its growth isn’t based on the upselling shipping by a few points at volume; Shippo does have venture-ready economics.

It might seem odd to stress that point, but after WeWork’s implosion, it’s worth checking to make sure that startups raising as if they have strong revenue quality actually do.

Shippo has big aspirations, as you’d expect. “When you think about shipping software,” Behrens Wu told TechCrunch during an interview, “most people, even in tech, can’t name a single shipping software company, but everyone can name one or two payment companies. Everyone knows PayPal, Stripe, maybe Adyen or Braintree.” She wants to make Shippo as well known for shipping as Stripe is for payments.

There was secular movement towards her vision even before the pandemic. Today, online shopping — the grist for Shippo’s mill — is even more important. And it’s likely to become even more so over time, if growth shown by Amazon and Shopify in recent quarters is any indication of what’s to come, which means that the market for Shippo’s services will grow in time, and it’s always easier to grow in an expanding market than to claw for share in a stagnant pool.

Finally, in addition to its new capital and raised valuation, Shippo also announced that it has hired Catherine Stewart, former chief business officer at WordPress juggernaut Automattic, to be its COO. If Shippo is hiring a COO now, then we expect to see a CFO added around the time of its Series D. And then we get to start annoying the company about its IPO timeline.

Shippo is one of the lucky startups that raised right before the world changed. Now it’s up to the startup to conserve cash while continuing to grow while the global economy struggles. Let’s see how it performs.

Powered by WPeMatico

Palo Alto Networks announced today that it has an agreement in place to acquire CloudGenix for $420 million.

CloudGenix delivers a software-defined wide area network (SD-WAN) that helps customers stay secure by setting policies to enforce compliance with company security protocols across distributed locations. This is especially useful for companies with a lot of branch offices or a generally distributed workforce, something just about everyone is dealing with at the moment as we find millions suddenly working from home.

Nikesh Arora, chairman and CEO at Palo Alto Networks, says that this acquisition should contribute to Palo Alto’s “secure access service edge,” or SASE solutions, as it is known in industry parlance.

“As the enterprise becomes more distributed, customers want agile solutions that just work, and that applies to both security and networking. Upon the close of the transaction, the combined platform will provide customers with a complete SASE offering that is best-in-class, easy to deploy, cloud-managed, and delivered as a service,” Arora said in a statement.

CloudGenix was founded 2013 by Kumar Ramachandran, Mani Ramasamy and Venkataraman Anand, all of whom will be joining the company as part of the deal. It has 250 customers across a variety of verticals. The company has raised almost $100 million, according to PitchBook data.

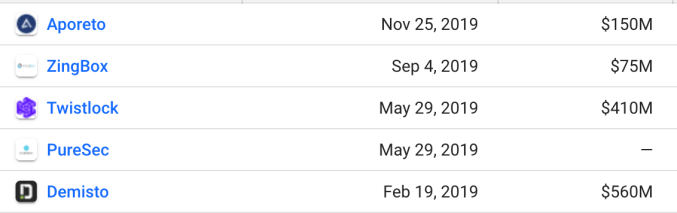

Palo Alto Networks has been on an acquisitive streak. Going back to February 2019, this represents the sixth company it has acquired, to the tune of more than $1.6 billion overall.

The acquisition is expected to close in the fourth quarter, subject to customary regulatory approvals.

Powered by WPeMatico

Today 500 Startups hosted a virtual demo day for its 26th batch of startups, a group of companies that TechCrunch covered back in February.

500 is not the only accelerator that moved its traditional investor pitch event online; Y Combinator made a similar move after efforts to flatten the spread of COVID-19 required changes that made its traditional demo day setup temporarily impossible.

In addition to hosting a few dozen startup pitches today, 500 also explained changes to its own format and provided notes on the current state of the venture market.

Regarding how 500 Startups is shaking up how it handles its accelerator, the group intends to pivot to a rolling-admissions setup that will give participants more flexibility; the group will still hold two demo days each year — TechCrunch has more on the changes here.

Regarding the venture market, 500 Startups said venture capital’s investment pace could slow for several months. This seems likely, given how the economy has taken body blows in recent weeks as huge swaths of the world’s economy shut down. What advice did 500 have in the face of the new world? What you’d expect: startups should cut burn and focus on customers.

Got all that? OK, let’s talk about our favorite companies from the current 500 cohort.

Powered by WPeMatico