funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Silicon is apparently the new gold these days, or so VCs hope.

What was once a no-go zone for venture investors, who feared the long development lead times and high technical risk required for new entrants in the semiconductor field, has now turned into one of the hottest investment areas for enterprise and data VCs. Startups like Graphcore have reached unicorn status (after its $200 million series D a year ago) while Groq closed $52M from the likes of Chamath Palihapitiya of Social Capital fame and Cerebras raised $112 million in investment from Benchmark and others while announcing that it had produced the first trillion transistor chip (and who I profiled a bit this summer).

Today, we have another entrant with another great technical team at the helm, this time with a Santa Clara, CA-based startup called NUVIA. The company announced this morning that it has raised a $53 million series A venture round co-led by Capricorn Investment Group, Dell Technologies Capital (DTC), Mayfield, and WRVI Capital, with participation from Nepenthe LLC.

Despite only getting started earlier this year, the company currently has roughly 60 employees, 30 more at various stages of accepted offers, and the company may even crack 100 employees before the end of the year.

What’s happening here is a combination of trends in the compute industry. There has been an explosion in data and by extension, the data centers required to store all of that information, just as we have exponentially expanded our appetite for complex machine learning algorithms to crunch through all of those bits. Unfortunately, the growth in computation power is not keeping pace with our demands as Moore’s Law slows. Companies like Intel are hitting the limits of physics and our current know-how to continue to improve computational densities, opening the ground for new entrants and new approaches to the field.

There are two halves to the NUVIA story. First is the story of the company’s founders, which include John Bruno, Manu Gulati, and Gerard Williams III, who will be CEO. The three overlapped for a number of years at Apple, where they brought their diverse chip skillsets together to lead a variety of initiatives including Apple’s A-series of chips that power the iPhone and iPad. According to a press statement from the company, the founders have worked on a combined 20 chips across their careers and have received more than 100 patents for their work in silicon.

Gulati joined Apple in 2009 as a micro architect (or SoC architect) after a career at Broadcom, and a few months later, Williams joined the team as well. Gulati explained to me in an interview that, “So my job was kind of putting the chip together; his job was delivering the most important piece of IT that went into it, which is the CPU.” A few years later in around 2012, Bruno was poached from AMD and brought to Apple as well.

Gulati said that when Bruno joined, it was expected he would be a “silicon person” but his role quickly broadened to think more strategically about what the chipset of the iPhone and iPad should deliver to end users. “He really got into this realm of system-level stuff and competitive analysis and how do we stack up against other people and what’s happening in the industry,” he said. “So three very different technical backgrounds, but all three of us are very, very hands-on and, you know, just engineers at heart.”

Gulati would take an opportunity at Google in 2017 aimed broadly around the company’s mobile hardware, and he eventually pulled over Bruno from Apple to join him. The two eventually left Google earlier this year in a report first covered by The Information in May. For his part, Williams stayed at Apple for nearly a decade before leaving earlier this year in March.

The company is being stealthy about exactly what it is working on, which is typical in the silicon space because it can take years to design, manufacture, and get a product into market. That said, what’s interesting is that while the troika of founders all have a background in mobile chipsets, they are indeed focused on the data center broadly conceived (i.e. cloud computing), and specifically reading between the lines, to finding more energy-efficient ways that can combat the rising climate cost of machine learning workflows and computation-intensive processing.

Gulati told me that “for us, energy efficiency is kind of built into the way we think.”

The company’s CMO did tell me that the startup is building “a custom clean sheet designed from the ground up” and isn’t encumbered by legacy designs. In other words, the company is building its own custom core, but leaving its options open on whether it builds on top of ARM’s architecture (which is its intention today) or other architectures in the future.

Outside of the founders, the other half of this NUVIA story is the collective of investors sitting around the table, all of whom not only have deep technical backgrounds, but also deep pockets who can handle the technical risk that comes with new silicon startups.

Capricorn specifically invested out of what it calls its Technology Impact Fund, which focuses on funding startups that use technology to make a positive impact on the world. Its portfolio according to a statement includes Tesla, Planet Labs, and Helion Energy.

Meanwhile, DTC is the venture wing of Dell Technologies and its associated companies, and brings a deep background in enterprise and data centers, particularly from the group’s server business like Dell EMC. Scott Darling, who leads DTC, is joining NUVIA’s board, although the company is not disclosing the board composition at this time. Navin Chaddha, an electrical engineer by training who leads Mayfield, has invested in companies like HashiCorp, Akamai, and SolarCity. Finally, WRVI has a long background in enterprise and semiconductor companies.

I chatted a bit with Darling of DTC about what he saw in this particular team and their vision for the data center. In addition to liking each founder individually, Darling felt the team as a whole was just very strong. “What’s most impressive is that if you look at them collectively, they have a skillset and breadth that’s also stunning,” he said.

He confirmed that the company is broadly working on data center products, but said the company is going to lie low on its specific strategy during product development. “No point in being specific, it just engenders immune reactions from other players so we’re just going to be a little quiet for a while,” he said.

He apologized for “sounding incredibly cryptic” but said that the investment thesis from his perspective for the product was that “the data center market is going to be receptive to technology evolutions that have occurred in places outside of the data center that’s going to allow us to deliver great products to the data center.”

Interpolating that statement a bit with the mobile chip backgrounds of the founders at Google and Apple, it seems evident that the extreme energy-to-performance constraints of mobile might find some use in the data center, particularly given the heightened concerns about power consumption and climate change among data center owners.

DTC has been a frequent investor in next-generation silicon, including joining the series A investment of Graphcore back in 2016. I asked Darling whether the firm was investing aggressively in the space or sort of taking a wait-and-see attitude, and he explained that the firm tries to keep a consistent volume of investments at the silicon level. “My philosophy on that is, it’s kind of an inverted pyramid. No, I’m not gonna do a ton of silicon plays. If you look at it, I’ve got five or six. I think of them as the foundations on which a bunch of other stuff gets built on top,” he explained. He noted that each investment in the space is “expensive” given the work required to design and field a product, and so these investments have to be carefully made with the intention of supporting the companies for the long haul.

That explanation was echoed by Gulati when I asked how he and his co-founders came to closing on this investor syndicate. Given the reputations of the three, they would have had easy access to any VC in the Valley. He said about the final investors:

They understood that putting something together like this is not going to be easy and it’s not for everybody … I think everybody understands that there’s an opportunity here. Actually capitalizing upon it and then building a team and executing on it is not something that just anybody could possibly take on. And similarly, it is not something that every investor could just possibly take on in my opinion. They themselves need to have a vision on their side and not just believe our story. And they need to strategically be willing to help and put in the money and be there for the long haul.

It may be a long haul, but Gulati noted that “on a day-to-day basis, it’s really awesome to have mostly friends you work with.” With perhaps 100 employees by the end of the year and tens of millions of dollars already in the bank, they have their war chest and their army ready to go. Now comes the fun (and hard) part as we learn how the chips fall.

Update: Changed the text to reflect that NUVIA is intending to build on top of ARM’s architecture, but isn’t a licensed ARM core.

Powered by WPeMatico

Moveworks, a startup using AI to help resolve help desk tickets in an automated fashion, announced a $75 million Series B investment today.

The round was led by Iconiq Capital, Kleiner Perkins and Sapphire Ventures. Existing investors Lightspeed Venture Partners, Bain Capital Ventures and Comerica Bank also participated. The round also included a personal investment from John W. Thompson, a partner at LightSpeed Venture Partners and chairman at Microsoft. Today’s investment brings the total raised to $105 million, according to the company.

That’s a lot of money for an early-stage company, but CEO and co-founder Bhavin Shah says his company is solving a common problem using AI. “Moveworks is a machine learning platform that uses natural language understanding to take tickets that are submitted by employees every day to their IT teams for stuff they need, and we understand [the content of the tickets], interpret them, and then we take the actions to resolve them [automatically],” Shah explained.

He said the company decided to focus on help desk tickets because they saw data when they were forming the company that suggested a common set of questions, and that would make it easier to interpret and resolve these issues. In fact, they are currently able to resolve 25-40% of all tickets autonomously.

He says this should lead to greater user satisfaction because some of their problems can be resolved immediately, even when IT personnel aren’t around to help. Instead of filing a ticket and waiting for an answer, Moveworks can provide the answer, at least part of the time, without human intervention.

Aditya Agrawal, a partner at Iconiq, says that the company really captured his attention. “Moveworks is not just transforming IT operations, they are building a more modern and enlightened way to work. They’ve built a platform that simplifies and streamlines every interaction between employees and IT, enabling both to focus on what matters,” he said in a statement.

The company was founded in 2016, and in the early days was only resolving 2% of the tickets autonomously, so it has seen major improvement. It already has 115 employees and dozens of customers (although Shah didn’t want to provide an exact number).

Powered by WPeMatico

Freshworks, a company that makes a variety of business software tools, from CRM to help-desk software, announced a $150 million Series H investment today from Sequoia Capital, CapitalG (formerly Google Capital) and Accel on a hefty $3.5 billion valuation. The late-stage startup has raised almost $400 million, according to Crunchbase data.

The company has been building an enterprise SaaS platform to give customers a set of integrated business tools, but CEO and co-founder Girish Mathrubootham says they will be investing part of this money in R&D to keep building out the platform.

To that end, the company also announced today a new unified data platform called the “Customer-for-Life Cloud” that runs across all of its tools. “We are actually investing in really bringing all of this together to create the “Customer-for-Life Cloud,” which is how you take marketing, sales, support and customer success — all of the aspects of a customer across the entire life cycle journey and bring them to a common data model where a business that is using Freshworks can see the entire life cycle of the customer,” Mathrubootham explained.

While Mathrubootham was not ready to commit to an IPO, he said they are in the process of hiring a CFO and are looking ahead to one day becoming a public company. “We don’t have a definite timeline. We want to go public at the right time. We are making sure that as a company that we are ready with the right processes and teams and predictability in the business,” he said.

In addition, he says he will continue to look for good acquisition targets, and having this money in the bank will help the company fill in gaps in the product set should the right opportunity arise. “We don’t generally acquire revenue, but we are looking for good technology teams both in terms of talent, as well as technology that would help give us a jumpstart in terms of go-to-market.” It hasn’t been afraid to target small companies in the past, having acquired 12 already.

Freshworks, which launched in 2010, has almost 2,500 employees, a number that’s sure to go up with this new investment. It has 250,00 customers worldwide, including almost 40,000 paying customers. These including Bridgestone Tires, Honda, Hugo Boss, Toshiba and Cisco.

Powered by WPeMatico

Loop Returns, the startup that helps brands handle returns from online purchases, has today announced the close of a $10 million Series A funding round led by FirstMark Capital. Lerer Hippeau and Ridge Ventures also participated in the round.

Loop started when Jonathan Poma, a co-founder and COO and president, was working at an agency and consulting with a big Shopify brand on how to improve their system for returns and exchanges. After partnering with longtime friend Corbett Morgan, Loop Returns was born.

Loop sits on top of Shopify to handle all of a brand’s returns. It first asks the customer if they’d like a different size in the item they bought, quickly managing an exchange. It then asks if the customer would prefer to exchange for a new item altogether, depositing the credit in that person’s account in real time so they can shop for something new immediately.

If an exchange isn’t in the cards, Loop will ask the customer if they’d prefer credit with this brand over a straight-up refund.

The goal, according to Poma and Morgan, is to turn the point of return into a moment where brands can create a life-loyal customer when handled quickly and properly.

The more we shop online, the more brands extend themselves financially, and returns are a big part of that. Returns account for 20 to 30% of e-commerce sales, which can become a terrible financial burden on a growing direct-to-consumer brand. And what’s more, the cost of acquiring those users in the first place also goes down the drain.

Loop Returns hopes to keep that customer in the fold by giving them post-purchase options that are more sticky and more lucrative for the brand than a refund.

The company thinks of it as Connection Infrastructure. Most brands already have a customer acquisition architecture, and Shopify and Amazon are ahead when it comes to the infrastructure around customer convenience. But the ties that bind customers to brands haven’t been optimized for the many D2C brands out there looking to make an impact.

“The big problem we’re trying to solve long term is connection infrastructure,” said Morgan. “Why does this brand matter? Why does it mean something to me? Why does the product matter? We want to enforce more mindfulness and meaning into buying.”

Of course, a more mindful shopper doesn’t yield as many returns. Poma and Morgan admit that the goal of their software is to minimize returns, the very reason for the software’s existence. After all, return volume is one of a handful of variables that help Loop Returns determine what it will charge its brand clients.

But the team is thinking about other layers of the connection infrastructure, with plans to launch a product in 2020 that also focuses on the connection point after purchase. Poma and Morgan believe, with an almost religious reverence, that the brands themselves will help lead shoppers and infrastructure providers to a better, more connected shopping experience.

“Brands are the torch bearers,” said Poma. “They will lead us to a more enlightened era of how we think about buying. Empowerment of the brand will lead us to a better consumerism.”

The co-founders stayed mum on any specific plans for the 2020 product, but did say they will use the funding to expand operations and further build out its current and future products.

Of course, Loop is playing in a crowded space. Not only are there other players thinking about post-purchase connection, but Shopify has itself built out tools to help with exchanges and returns, and even acquired Return Magic, a similar service, in the summer of 2018.

That said, Loop Returns believes there is a long way to go as it builds the “connection infrastructure,” and that one clear path forward is actual personalization. With data from returns and exchanges, Loop Returns is relatively well-positioned to take on personalization in a meaningful way.

For now, Loop Returns has more than 200 customers and has handled more than 2 million returns, working with brands like Brooklinen, Allbirds, PuraVida and more.

Powered by WPeMatico

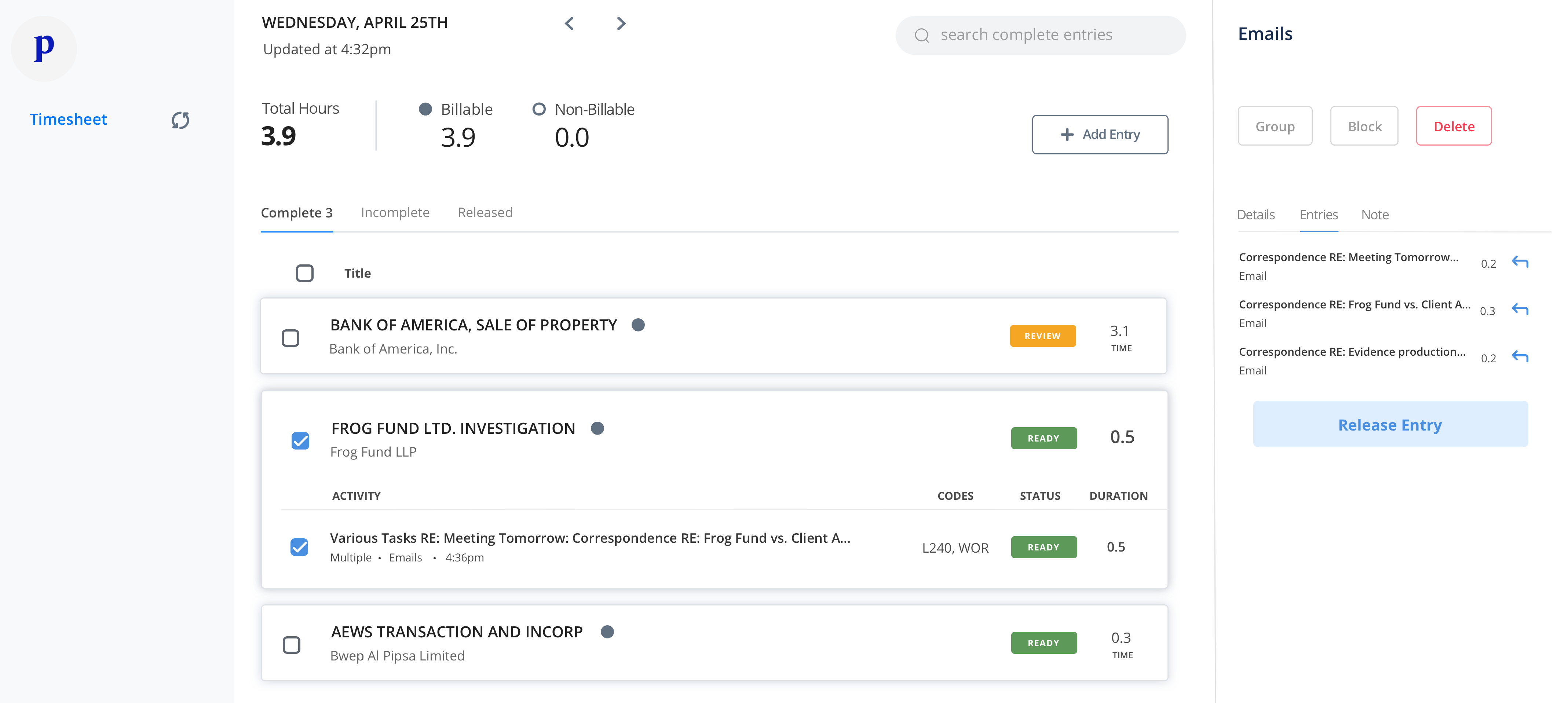

Counting billable time in six-minute increments is the most annoying part of being a lawyer. It’s a distracting waste. It leads law firms to conservatively under-bill. And it leaves lawyers stuck manually filling out timesheets after a long day when they want to go home to their families.

Life is already short, as Ping CEO and co-founder Ryan Alshak knows too well. The former lawyer spent years caring for his mother as she battled a brain tumor before her passing. “One minute laughing with her was worth a million doing anything else,” he tells me. “I became obsessed with the idea that we spend too much of our lives on things we have no need to do — especially at work.”

That’s motivated him as he’s built his startup Ping, which uses artificial intelligence to automatically track lawyers’ work and fill out timesheets for them. There’s a massive opportunity to eliminate a core cause of burnout, lift law firm revenue by around 10% and give them fresh insights into labor allocation.

Ping co-founder and CEO Ryan Alshak (Image Credit: Margot Duane)

That’s why today Ping is announcing a $13.2 million Series A led by Upfront Ventures, along with BoxGroup, First Round, Initialized and Ulu Ventures. Adding to Ping’s quiet $3.7 million seed led by First Round last year, the startup will spend the cash to scale up enterprise distribution and become the new timekeeping standard.

“I was a corporate litigator at Manatt Phelps down in LA and joke that I was voted the world’s worst timekeeper,” Alshak tells me. “I could either get better at doing something I dreaded or I could try and build technology that did it for me.”

The promise of eliminating the hassle could make any lawyer who hears about Ping an advocate for the firm buying the startup’s software, like how Dropbox grew as workers demanded easier file sharing. “I’ve experienced first-hand the grind of filling out timesheets,” writes Initialized partner and former attorney Alda Leu Dennis. “Ping takes away the drudgery of manual timekeeping and gives lawyers back all those precious hours.”

Traditionally, lawyers have to keep track of their time by themselves down to the tenth of an hour — reviewing documents for the Johnson case, preparing a motion to dismiss for the Lee case, a client phone call for the Sriram case. There are timesheets built into legal software suites like MyCase, legal billing software like TimeSolv and one-off tools like Time Miner and iTimeKeep. They typically offer timers that lawyers can manually start and stop on different devices, with some providing tracking of scheduled appointments, call and text logging, and integration with billing systems.

Ping goes a big step further. It uses AI and machine learning to figure out whether an activity is billable, for which client, a description of the activity and its codification beyond just how long it lasted. Instead of merely filling in the minutes, it completes all the logs automatically, with entries like “Writing up a deposition – Jenkins Case – 18 minutes.” Then it presents the timesheet to the user for review before they send it to billing.

The big challenge now for Alshak and the team he’s assembled is to grow up. They need to go from cat-in-sunglasses logo Ping to mature wordmark Ping. “We have to graduate from being a startup to being an enterprise software company,” the CEO tells me. That means learning to sell to C-suites and IT teams, rather than just build a solid product. In the relationship-driven world of law, that’s a very different skill set. Ping will have to convince clients it’s worth switching to not just for the time savings and revenue boost, but for deep data on how they could run a more efficient firm.

Along the way, Ping has to avoid any embarrassing data breaches or concerns about how its scanning technology could violate attorney-client privilege. If it can win this lucrative first business in legal, it could barge into the consulting and accounting verticals next to grow truly huge.

With eager customers, a massive market, a weak status quo and a driven founder, Ping just needs to avoid getting in over its heads with all its new cash. Spent well, the startup could leap ahead of the less tech-savvy competition.

Alshak seems determined to get it right. “We have an opportunity to build a company that gives people back their most valuable resource — time — to spend more time with their loved ones because they spent less time working,” he tells me. “My mom will live forever because she taught me the value of time. I am deeply motivated to build something that lasts . . . and do so in her name.”

Powered by WPeMatico

Stock trading app Robinhood is valued at $7.6 billion, but it only operates in the U.S. Freshly funded fintech startup Alpaca does the dirty work so developers worldwide can launch their own competitors to that investing unicorn. Like the Stripe of stocks, Alpaca’s API handles the banking, security and regulatory complexity, allowing other startups to quickly build brokerage apps on top for free. It has already crossed $1 billion in transactions within a year of launch.

The potential to power the backend of a new generation of fintech apps has attracted a $6 million Series A round for Alpaca led by Spark Capital . Instead of charging developers, Alpaca earns its money through payment for order flow, interest on cash deposits and margin lending, much like Robinhood.

“I want to make sure that people even outside the U.S. have access” to a way of building wealth that’s historically only “available to rich people” Alpaca co-founder and CEO Yoshi Yokokawa tells me.

Alpaca co-founder and CEO Yoshi Yokokawa

Hailing from Japan, Yokokawa followed his friends into the investment banking industry, where he worked at Lehman Brothers until its collapse. After his grandmother got sick, he moved into day-trading for three years and realized “all the broker dealer business tools were pretty bad.” But when he heard of Robinhood in 2013 and saw it actually catering to users’ needs, he thought, “I need to be involved in this new transformation” of fintech.

Yokokawa ended up first building a business selling deep learning AI to banks and trading firms in the foreign exchange market. Watching clients struggle to quickly integrate new technology revealed the lack of available developer tools. By 2017, he was pivoting the business and applying for FINRA approval. Alpaca launched in late 2018, letting developers paste in code to let their users buy and sell securities.

Now international developers and small hedge funds are building atop the Alpaca API so they don’t have to reinvent the underlying infrastructure themselves right away. Alpaca works with clearing broker NTC, and then marks up margin trading while earning interest and payment for order flow. It also offers products like AlpacaForecast, with short-term predictions of stock prices, AlpacaRadar for detecting price swings and its MarketStore financial database server.

AlpacaForecast

The $6 million from Spark Capital, Social Leverage, Portag3, Fathom Capital and Zillionize adds to $5.8 million in previous funding from investors, including Y Combinator. The startup plans to spend the cash on hiring to handle partnerships with bigger businesses, supporting its developer community and ensuring compliance.

One major question is whether fintech businesses that start to grow atop Alpaca and drive its revenues will try to declare independence and later invest in their own technology stack. There’s the additional risk of a security breach that might scare away clients.

Alpaca’s top competitor, Interactive Brokers, offers trading APIs, but other services as well that distract it from fostering a robust developer community, Yokokawa tells me. Alpaca focuses on providing great documentation, open-source contribution and SDKs in different languages that make it more developer-friendly. It will also have to watch out for other fintech services startups like DriveWealth and well-funded Galileo.

There’s a big opportunity to capitalize on the race to integrate stock trading into other finance apps to drive stickiness because it’s a consistent, voluntary behavior rather than a chore or something only done a few times a year. Lender SoFi and point-of-sale system Square both recently became broker dealers as well, and Yokokawa predicts more and more apps will push into the space.

Why would we need so many stock trading apps? “Every single person is involved with money, so the market is huge. Instead of one-player takes all, there will be different players that can all do well,” Yokokawa tells me. “Like banks and investment banks co-exist, it will never be that Bank of America takes 80% of the pie. I think differentiation will be on customer acquisition, and operations management efficiency.”

The co-founder’s biggest concern is keeping up with all the new opportunities in financial services, from cash management and cryptocurrency that Robinhood already deals in, to security token offerings and fractional investing. Yokokawa says, “I need to make sure I’m on top of everything and that we’re executing with the right timing so we don’t lose.”

The CEO hopes that Alpaca will one day power broader access to the U.S. stock market back in Japan, noting that if a modern nation still lags behind in fintech, the rest of the world surely fares even worse. “I want to connect this asset class to as many people as possible on the earth.”

Powered by WPeMatico

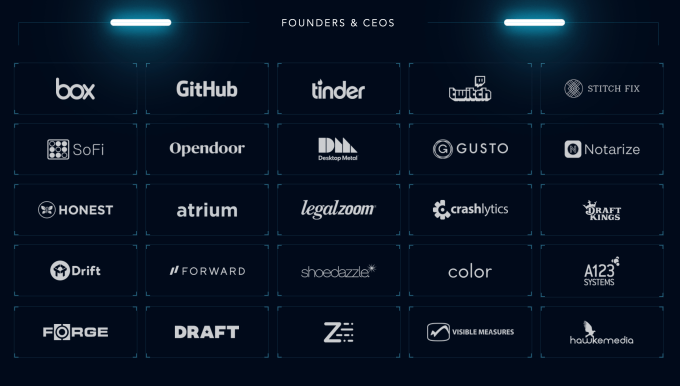

Stealth fintech startup Digits, from the same team that built Crashlytics to scale then sold to Twitter for more than $100 million, has raised a $10.5 million round of Series A funding, the company is announcing today. The round was led by Benchmark and has the backing of 72 angels, including founders and CEOs from companies like Box, GitHub, Tinder, Twitch, StitchFix, SoFi and several others.

With the round, Digits also gains a new board member, Peter Fenton, who has served on the boards at AirTable, Twitter, NewRelic, Yelp and elsewhere.

The funding is a big bet on serial entrepreneurs Wayne Chang and Jeff Seibert, who launched and sold their crash reporting service to Twitter, which itself later sold it to Google. At Twitter, the team remained to build out the product and launch new services, like Answers. After the sale to Google four years later, it was then folded into Google’s own developer platform to become the crash reporting tool for Android. Today, it’s still on nearly 5 billion monthly active devices and used inside millions of apps.

Now, the Crashlytics co-founders have returned with most of their original team to develop a new fintech startup, Digits, which describes itself vaguely as “a counting company.”

The company’s focus aims to solve a problem the founders had faced themselves when building Crashlytics.

“As builders, there is nothing more exciting than cracking the next engineering puzzle; than perfecting the next design; than delivering the next capability to customers. And there is nothing more mind-numbing than the paperwork, and spreadsheets, and financial reports, and inscrutable transaction records that are all required to actually operate the business,” a Digits blog post earlier this year explained.

“Globally, most entrepreneurs today have no formal training in business finance. We certainly didn’t. Today, you start a company to solve a real problem for real people, or to offer a service you’re skilled at, or to provide a living for you and your family. You don’t start a company because you want to operate a business—but you have to anyway,” the founders said.

While Digits isn’t talking about the specifics of its new product yet, its software is described as pairing design and machine learning in order to “democratize financial savvy.”

More specifically, it leverages APIs, classification algorithms and machine learning techniques to provide a real-time view into a business’ finances, proactively alert you to what’s important and allow you to deep dive into your data to better understand what’s driving your business.

The company believes its approach to visualizing a company’s finances is unique, and apparently a sizable number of investors agree.

Among the 70+ angels backing Digits are Box CEO Aaron Levie; Adam Bain and Dick Costolo (ex COO and CEO of Twitter); Ali Rowghani (partner at Y Combinator, ex-COO Pixar); SoFi CEO Anthony Noto; Drift CEO David Cancel; AngelList board member Jeff Fagnan; Justin Kan (CEO Atrium, co-founder Twitch, YC partner); StitchFix CEO Katrina Lake; GitHub CEO Nat Friedman; First Republic Bank COO Mike Selfridge; Desktop Metal CEO Ric Fulop; Tinder co-founder Jonathan Badeen; DraftKings CEO Jason Robins; LegalZoom co-founder Brian Lee; Gusto CEO Josh Reeves; and Notazie CEO Pat Kinsel.

Though Digits hasn’t publicly launched — the product is in invite-only status for now — it already has live customers and is seeing more than $1.5 billion in transactions processing on its platform, the company says.

And unlike Crashlytics, which was based in Boston, Digits is a 100% remote operation. LinkedIn shows just 10 employees, including co-founders Chang and Seibert.

The team hasn’t said when Digits itself will be publicly unveiled or opened to sign-ups.

Powered by WPeMatico

Neural Magic, a startup founded by a couple of MIT professors, who figured out a way to run machine learning models on commodity CPUs, announced a $15 million seed investment today.

Comcast Ventures led the round, with participation from NEA, Andreessen Horowitz, Pillar VC and Amdocs. The company had previously received a $5 million pre-seed, making the total raised so far $20 million.

The company also announced early access to its first product, an inference engine that data scientists can run on computers running CPUs, rather than specialized chips like GPUs or TPUs. That means that it could greatly reduce the cost associated with machine learning projects by allowing data scientists to use commodity hardware.

The idea for this solution came from work by MIT professor Nir Shavit and his research partner and co-founder Alex Mateev. As he tells it, they were working on neurobiology data in their lab and found a way to use the commodity hardware he had in place. “I discovered that with the right algorithms we could run these machine learning algorithms on commodity hardware, and that’s where the company started,” Shavit told TechCrunch.

He says there is this false notion that you need these specialized chips or hardware accelerators to have the necessary resources to run these jobs, but he says it doesn’t have to be that way. He says his company not only allows you to use this commodity hardware, it also works with more modern development approaches, like containers and microservices.

“Our vision is to enable data science teams to take advantage of the ubiquitous computing platforms they already own to run deep learning models at GPU speeds — in a flexible and containerized way that only commodity CPUs can deliver,” Shavit explained.

He says this also eliminates the memory limitations of these other approaches because CPUs have access to much greater amounts of memory, and this is a key advantage of his company’s approach over and above the cost savings.

“Yes, running on a commodity processor you get the cost savings of running on a CPU, but more importantly, it eliminates all of these huge commercialization problems and essentially this big limitation of the whole field of machine learning of having to work on small models and small data sets because the accelerators are kind of limited. This is the big unlock of Neural Magic,” he said.

Gil Beyda, managing director at lead investor Comcast Ventures, sees a huge market opportunity with an approach that lets people use commodity hardware. “Neural Magic is well down the path of using software to replace high-cost, specialized AI hardware. Software wins because it unlocks the true potential of deep learning to build novel applications and address some of the industry’s biggest challenges,” he said in a statement.

Powered by WPeMatico

Search and personalization services continue to be a major area of investment among enterprises, both to make their products and services more discoverable (and used) by customers, and to help their own workers get their jobs done, with the market estimated to be worth some $100 billion annually. Today, one of the big startups building services in this area raised a large round of growth funding to continue tapping that opportunity.

Coveo, a Canadian company that builds search and personalization services powered by artificial intelligence — used by its enterprise customers by way of cloud-based, software-as-a-service — has closed a C$227 million ($172 million in U.S. dollars) round, which CEO Louis Tetu tells me values the company at “well above” $1 billion, “Canadian or U.S. dollars.”

Specifically, the equity stake of this round is 15.5%, equating to a valuation of $1.46 billion Canadian dollars, or $1.1 billion in U.S. dollars.

The round is being led by Omers Capital Private Growth Equity Group, the investing arm of the Canadian pensions giant that makes large, later-stage bets (the company has been stepping up the pace of investments lately), with participation also from Evergreen Coast Capital, FSTQ and IQ Ventures. Evergreen led the company’s last round of $100 million in April 2018, and in total the company has now raised just over $402 million with this round.

The valuation appears to be a huge leap in the context of Coveo’s funding history: in that last round, it had a post-money valuation of about $370 million, according to PitchBook data.

Part of the reason for that is because of Coveo’s business trajectory, and part is due to the heat of the overall market.

Coveo’s round is coming about two weeks after another company that builds enterprise search solutions, Algolia, raised $110 million. The two aim at slightly different ends of the market, Tetu tells me, not directly competing in terms of target customers, and even services.

“Algolia is in a different ZIP code,” he said. Good thing, too, if that’s the case: Salesforce — which is one of Coveo’s biggest partners and customers — was also a strategic investor in the Algolia round. Even if these two do not compete, there are plenty of others vying for the same end of the enterprise search and personalization continuum — they include Google, Microsoft, Elastic, IBM, Lucidworks and many more. That, again, underscores the size of the market opportunity.

In terms of Coveo’s own business, the company works with some 500 customers today and says SaaS subscription revenues grew more than 55% year-over-year this year. Five hundred may sound like a small number, but it covers a lot of very large enterprises spanning web-facing businesses, commerce-based organizations, service-facing companies and enterprise solutions.

In addition to Salesforce, it includes Visa, Tableau (also Salesforce now!), Honeywell, a Fortune 50 healthcare company (whose name is not getting disclosed) and what Tetu described to me as an Amazon competitor that does $21 billion in sales annually but doesn’t want to be named.

Coveo’s basic selling point is that the better discoverability and personalization that it provides helps its customers avoid as many call-center interactions (reducing operating expenditures), improves sales (boosting conversions and reducing cart abandonment) and helps companies themselves just work faster.

Significantly, the area that Coveo works in is going through a noticeable shift these days.

A swing toward stronger data protection and consumers’ preference for having more control over how their data is used and for what — spurred by high-profile revelations detailing how different organizations manipulated user data across social networking sites and other platforms to target people with sneaky political content and advertising to influence voting, subsequently cracking open the wasp nest to reveal just how much of our data is harvested and used all the time — has meant that there are at times fewer tools than there used to be to provide the kind of “discoverability” and “personalization” that companies like Coveo build for their clients.

Tetu believes there is a way to deliver personalization without compromising how a person wants to exist in the digital world.

“The whole notion is to be able to control data but also have personalizaton in the future,” he said. But there are two dimensions to this, he added:

“The continued and growing regulatory pressure around privacy [such as GDPR] is good, it’s the will of the people and legislation will go that way. The world is going cookie-less,” he said. “But we can’t ignore the arbitrage between privacy and utility. If I understand what you will do with my data and use it to provide more relevance, that can be excellent, too.”

He calls himself an “Amazon addict” but points out that it highlights the two sides of the data coin: “Is it predatory or excellent in doing the job it does? I can’t decide on an answer. I think they are both.”

All the same, it’s working on ways around the “cookie-less” future. The company Coveo acquired in Milan earlier this year, Tetu said, “can do machine learning detection. In five clicks it can detect your propensity to buy and your interest. It means you can’t blame anyone for observing you.”

So, while there are a lot of players out there chasing the same discoverability and personalization market, the attraction here is not just about a company doing it well, but looking to skate to where the puck is going (see what I did there, Canadian startup?).

“We believe that Coveo is the market leader in leveraging data and AI to personalize at scale,” said Mark Shulgan, managing director and head of Growth Equity at Omers, in a statement. “Coveo fits our investment thesis precisely: an A-plus leadership team with deep expertise in enterprise SaaS, a Fortune 1000 customer base who deeply love the product, and a track record of high growth in a market worth over $100 billion. This makes Coveo a highly-coveted asset. We are glad to be partnering to scale this business.”

Alongside business development on its own steam — the company now has around 500 employees — Coveo is going to be using this funding for acquisitions. Tetu notes that Coveo still has a lot of money in the bank from previous rounds.

“We are a real company with real positive economics,” he said. “This round is mostly to have dry powder to invest in a way that is commensurate in the AI space, and within commerce in particular.” To get the ball rolling on that, this past July, Coveo acquired Tooso, a specialist in AI-based digital commerce technology.

Powered by WPeMatico

Chronosphere, a startup from two ex-Uber engineers who helped create the open-source M3 monitoring project to handle Uber-level scale, officially launched today with the goal of building a commercial company on top of the open-source project.

It also announced an $11 million investment led by Greylock, with participation from venture capitalist Lee Fixel.

While the founders, CEO Martin Mao and CTO Rob Skillington, were working at Uber, they recognized a gap in the monitoring industry, particularly around cloud-native technologies like containers and microservices. There weren’t any tools available on the market that could handle Uber’s scaling requirements — so like any good engineers, they went out and built their own.

“We looked around at the market at the time and couldn’t find anything in open source or commercially available that could really scale to our needs. So we ended up building and open sourcing our solution, which is M3. Over the last three to four years we’ve scaled M3 to one of the largest production monitoring systems in the world today,” Mao explained.

The essential difference between M3 and other open-source, cloud-native monitoring solutions like Prometheus is that ability to scale, he says.

One of the main reasons they left to start a company, with the blessing of Uber, was that the community began asking for features that didn’t really make sense for Uber. By launching Chronosphere, Mao and Skillington would be taking on the management of the project moving forward (although sharing governance for the time being with Uber), while building those enterprise features the community has been requesting.

The new company’s first product will be a cloud version of M3 to help reduce some of the complexity associated with managing an M3 project. “M3 itself is a fairly complex piece of technology to run. It is solving a fairly complex problem at large scale, and running it actually requires a decent amount of investment to run at large scale, so the first thing we’re doing is taking care of that management,” Mao said.

Jerry Chen, who led the investment at Greylock, saw a company solving a big problem. “They were providing such a high-resolution view of what’s going on in your cloud infrastructure and doing that at scale at a cost that actually makes sense. They solved that problem at Uber, and I saw them, and I was like wow, the rest of the market needs what guys built and I wrote the Series A check. It was as simple as that,” Chen told TechCrunch.

The cloud product is currently in private beta; they expect to open to public beta early next year.

Powered by WPeMatico