funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The world of healthcare has notoriously been described as “broken” — plagued with high-friction workflows, sky-high costs and convoluted business models.

Over the past several years, a long list of innovative startups and salivating venture investors have pinned their focus on repairing the healthcare industry, but its digital transformation still appears to be in the very early innings. After a record-setting 2018, however, digital health investing continued to reach meteoric heights in 2019.

Mammoth pools of capital have flooded into various sub-verticals and business models, backing collections of new B2B and B2C companies focused on optimizing healthcare workflows, improving healthcare access and offering lower-cost distribution models. Over the past two years, digital health startups have raised well over $10 billion in funding across nearly 1,000 deals, according to data from Pitchbook and Crunchbase.

As we close out another strong year for innovation and venture investing in the sector, we asked nine leading VCs who work at firms spanning early to growth stages to share what’s exciting them most and where they see opportunity in the sector:

Participants discuss trends in digital therapeutics, telehealth, mental health and the latest in biotech and medical devices, while also diving into startups improving medical practitioner efficiency, evaluating the evolving regulatory environment and debating valuations and offering a ‘temp check’ on the market for digital health startups leveraging ML.

Although Kleiner Perkins has a long history of investing in iconic health companies, we believe it is still the early innings of digital health as a category today.

When I evaluate new opportunities in the space, I often start by thinking through how the company will move the needle on cost, quality, and access to care — the “iron triangle” of health care systems. Conventional wisdom has been that it’s impossible to improve all three dimensions simultaneously, but we are seeing companies leverage technology to shift this paradigm in meaningful ways.

It’s no longer just a promise. For example, Viz.ai is using artificial intelligence to detect and alert stroke teams to suspected large vessel occlusion strokes, enabling patients to get treatment faster. Their workflows improve access to life-saving care, deliver higher quality through reduced time to treatment (every minute counts as ‘time is brain’ in stroke care), and dramatically reduce the costs associated with long-term disability.

We are also seeing companies provide this type of tech-enabled care outside of the hospital setting. Modern Health is a mental health benefits platform that employers are making available to their employees. The platform triages individual employees to the right level of care, providing clinical care to those with diagnosable depression or anxiety, and making self-guided or preventative care available to everyone else. Their solution improves quality and access by offering mental health services to every employee and reduces the cost associated with untreated mental illness, lost productivity, or employee churn.

Heading into 2020, we’re eager to back digital health companies in new areas that leverage technology to impact cost, quality, and access. A few spaces that I’m excited about are behavioral health (mental health, substance abuse, addiction, etc), care navigation, digital therapeutics, and new models integrating telehealth, remote care and AI to better leverage medical professionals’ time.

Below are some thoughts and coming predictions on health tech broadly:

- Digital therapeutics continue to pick up steam — on the back of Pear and Akili, more companies push to FDA and enter the market. In addition, broader consumer platforms like Calm and Headspace look to broaden their offerings by investigating clinical approvals.

- At least one major pharma looks to expand its consumer surface area by acquiring one of the new digital, consumer-facing generics platform (ex Hims, Ro, NuRx).

- Venture funding for biotech continues to boom with at least three Series A’s of $100M or more in size.

- Drug discovery for neurodegeneration sees a renaissance. High-profile failings of Biogen and the beta-amyloid hypothesis sees a shift of innovation to early-stage biotech and venture creation.

- Big pharma has its DeepMind moment acquiring at least one machine-learning (AI) enabled drug discovery company.

- Clinical trial tech investments heat up; new companies and technologies emerge to make trials patients first and systems get smarter at finding the right patients at their point of care; large incumbents like IQVIA, LabCorp and PPD get acquisitive.

- At least three traditional Sand Hill Road tech venture firms open life science practices or raise dedicated funds.

- Machine learning targets chemistry driven by large advancements in transformer (NLP) models; has the time for computational chemistry finally come?

- HCIT sees a renaissance driven by increased CIO responsibility towards data interoperability. Companies either working on federated ML to allow systems to speak to each other or lightweight edge applications enabling rapid clinical deployment will see quick uptake and traction, until now impossible in HC.

Kristin Baker Spohn, CRV

In the last 10 years, digital health has exploded. Over $16B has been invested in the sector by VCs and we’ve seen IPOs from Livongo, Progyny and Health Catalyst, just in the last year alone. That said, there’s still a lot that mystifies people about the sector — there are spots that are overheated and models that will struggle to deliver venture scale outcomes. I’ve seen digital health evolve first hand as both an operator and investor, and I’m more excited than ever about the future of the space.

A few areas and trends that I’ve been following recently include:

Powered by WPeMatico

Licious, a Bangalore-based startup that sells fresh meat and seafood online, has secured $30 million in a new financing round as it looks to expand its footprint in the nation.

The new financing round, dubbed Series E, for the four-year-old startup was led by Singapore-based Vertex Growth Fund, it said Monday. Existing investors 3one4 Capital, Bertelsmann India Investments, Vertex Ventures Southeast Asia and India and Sistema Asia Fund also participated in the round.

The Series E pushes Licious’ to-date raise to $94.5 million.

Licious operates an eponymous e-commerce platform to sell meat and seafood in cities in India (Bengaluru, NCR, Hyderabad, Chandigarh, Panchkula, Mohali, Mumbai, Pune, and Chennai). The startup does not stock any inventory, so any raw material it procures, it processes and ships on the same or next day. It processes more than 17,000 orders every day.

The startup, which employs more than 2,000 people, has built its own supply chain network to control sourcing and production of food, it said. Licious executives said the startup is growing at a healthy rate of 300% year-over-year and aims to generate $140 million in annual revenue by 2023.

Licious will use the fresh capital to expand to more cities in India, and launch new products, said Vivek Gupta, co-founder of the startup.

The startup competes with Bangalore-based FreshToHome, which has amassed more than 650,000 customers in 10 cities in India. As of August, when FreshToHome raised $20 million in a new funding round, the startup was handling 14,000 orders a day.

Gupta said the vast majority of the Indian meat and seafood industry remains unorganized, which has created an immense opportunity for startups to address the sector. The cold-chain market of India is estimated to grow to $37 billion in the next five years, according to industry estimates.

“The traditional meat and seafood industry are in dire need of tech intervention, quality standardisation and a skilled talent pool. Licious is working towards creating these differentiators and will stay committed towards elevating India’s meat and seafood experience,” he said.

Powered by WPeMatico

Reliance Industries, one of India’s largest industrial houses, has acquired a majority stake in NowFloats, an Indian startup that helps businesses and individuals build online presence without any web developing skills.

In a regulatory filing on Thursday, Reliance Strategic Business Ventures Limited said (PDF) it has acquired an 85% stake in NowFloats for 1.4 billion Indian rupees ($20 million).

Seven-and-a-half-year old, Hyderabad-headquartered NowFloats operates an eponymous platform that allows individuals and businesses to easily build an online presence. Using NowFloats’ services, a mom and pop store, for instance, can build a website, publish their catalog, as well as engage with their customers on WhatsApp.

The startup, which has raised about 12 million in equity financing prior to today’s announcement, claims to have helped over 300,000 participating retail partners. NowFloats counts Blume Ventures, Omidyar Network, Iron Pillar, IIFL Wealth Management, and Hyderabad Angels among its investors.

Last year, NowFloats acquired LookUp, an India-based chat service that connects consumers to local business — and is backed by Vinod Khosla’s personal fund Khosla Impact, Twitter co-founder Biz Stone, Narayana Murthy’s Catamaran Ventures and Global Founders Capital.

Reliance Strategic Business Ventures Limited, a wholly-owned subsidiary of Reliance Industries, said that it would invest up to 750 million Indian rupees ($10.6 million) of additional capital into the startup, and raise its stake to about 89.66%, if NowFloats achieves certain unspecified goals by the end of next year.

In a statement, Reliance Industries said the investment will “further enable the group’s digital and new commerce initiatives.” NowFloats is the latest acquisition Reliance has made in the country this year. In August, the conglomerate said it was buying a majority stake in Google-backed Fynd for $42.3 million. In April, it bought a majority stake in Haptik in a deal worth $100 million.

There are about 60 million small and medium-sized businesses in India. Like hundreds of millions of Indians, many in small towns and cities, who have come online in recent years thanks to world’s cheapest mobile data plans and inexpensive Android smartphones, businesses are increasingly building online presence as well.

But vast majority of them are still offline, a fact that has created immense opportunities for startups — and VCs looking into this space — and major technology giants. New Delhi-based BharatPe, which helps merchants accept online payments and provides them with working capital, raised $50 million in August. Khatabook and OkCredit, two digital bookkeeping apps for merchants, have also raised significant amount of money this year.

In recent years, Google has also looked into the space. It has launched tools — and offered guidance — to help neighborhood stores establish some presence on the web. In September, the company announced that its Google Pay service, which is used by more than 67 million users in India, will now enable businesses to accept digital payments and reach their customers online.

Powered by WPeMatico

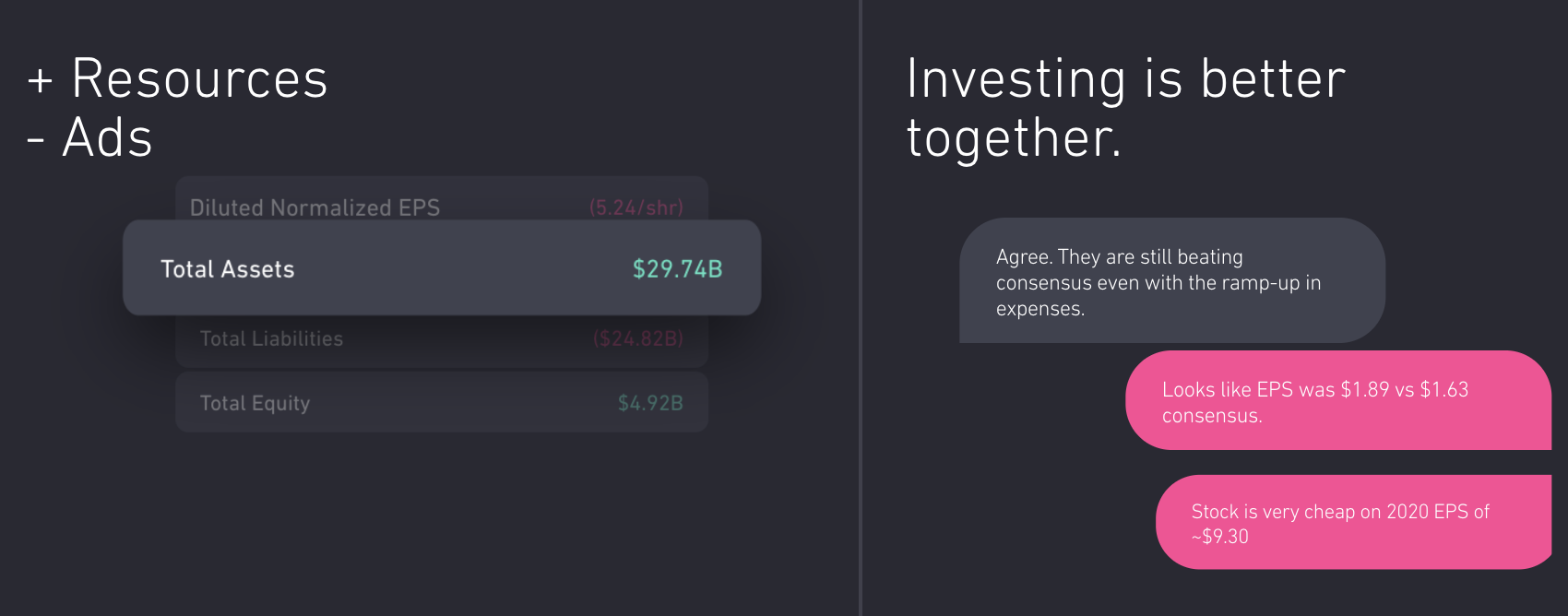

If you want to win on Wall Street, Yahoo Finance is insufficient but Bloomberg Terminal costs a whopping $24,000 per year. That’s why Atom Finance built a free tool designed to democratize access to professional investor research. If Robinhood made it cost $0 to trade stocks, Atom Finance makes it cost $0 to know which to buy.

Today Atom launches its mobile app with access to its financial modeling, portfolio tracking, news analysis, benchmarking and discussion tools. It’s the consumerization of finance, similar to what we’ve seen in enterprise SaaS. “Investment research tools are too important to the financial well-being of consumers to lack the same cycles of product innovation and accessibility that we have experienced in other verticals,” CEO Eric Shoykhet tells me.

In its first press interview, Atom Finance today revealed to TechCrunch that it has raised a $10.6 million Series A led by General Catalyst to build on its quiet $1.9 million seed round. The cash will help the startup eventually monetize by launching premium tiers with even more hardcore research tools.

Atom Finance already has 100,000 users and $400 million in assets it’s helping steer since soft-launching in June. “Atom fundamentally changes the game for how financial news media and reporting is consumed. I could not live without it,” says The Twenty Minute VC podcast founder and Atom investor Harry Stebbings.

Individual investors are already at a disadvantage compared to big firms equipped with artificial intelligence, the priciest research and legions of traders glued to the markets. Yet it’s becoming increasingly clear that investing is critical to long-term financial mobility, especially in an age of rampant student debt and automation threatening employment.

“Our mission is two-fold,” Shoykhet says. “To modernize investment research tools through an intuitive platform that’s easily accessible across all devices, while democratizing access to institutional-quality investing tools that were once only available to Wall Street professionals.”

Shoykhet saw the gap between amateur and expert research platforms firsthand as an investor at Blackstone and Governors Lane. Yet even the supposedly best-in-class software was lacking the usability we’ve come to expect from consumer mobile apps. Atom Finance claims that “for example, Bloomberg hasn’t made a significant change to its central product offering since 1982.”

The Atom Finance team

So a year ago, Shoykhet founded Atom Finance in Brooklyn to fill the void. Its web, iOS and Android apps offer five products that combine to guide users’ investing decisions without drowning them in complexity:

“Our Sandbox feature allows users to create simple financial models directly within our platform, without having to export data to a spreadsheet,” Shoykhet says. “This saves our users time and prevents them from having to manually refresh the inputs to their model when there is new information.”

Shoykhet positions Atom Finance in the middle of the market, saying, “Existing solutions are either too rudimentary for rigorous analysis (Yahoo Finance, Google Finance) or too expensive for individual investors (Bloomberg, CapIQ, Factset).”

With both its free and forthcoming paid tiers, Atom hopes to undercut Sentieo, a more AI-focused financial research platform that charges $500 to $1,000 per month and raised $19 million a year ago. Cheaper tools like BamSEC and WallMine are often limited to just pulling in earnings transcripts and filings. Robinhood has its own in-app research tools, which could make it a looming competitor or a potential acquirer for Atom Finance.

Shoykhet admits his startup will face stiff competition from well-entrenched tools like Bloomberg. “Incumbent solutions have significant brand equity with our target market, and especially with professional investors. We will have to continue iterating and deliver an unmatched user experience to gain the trust/loyalty of these users,” he says. Additionally, Atom Finance’s access to users’ sensitive data means flawless privacy, security, and accuracy will be essential.

The $12.5 million from General Catalyst, Greenoaks, Global Founders Capital, Untitled Investments, Day One Ventures and a slew of angels gives Atom runway to rev up its freemium model. Robinhood has found great success converting unpaid users to its subscription tier where they can borrow money to trade. By similarly starting out free, Atom’s eight-person team hailing from SoFi, Silver Lake, Blackstone and Citi could build a giant funnel to feed its premium tiers.

Fintech can feel dry and ruthlessly capitalistic at times. But Shoykhet insists he’s in it to equip a new generation with methods of wealth creation. “I think we’ve gone long enough without seeing real innovation in this space. We can’t be complacent with something so important. It’s crucial that we democratize access to these tools and educate consumers . . . to improve their investment well-being.”

Powered by WPeMatico

Zetwerk, an Indian business-to-business marketplace for manufacturing items, has closed a significantly large financing round as it scales its operations in the nation and also helps local businesses find customers overseas.

The 18-month-old startup said on Wednesday it has raised $32 million in a Series B financing round led by Lightspeed and Greenoaks Capital. Zetwerk co-founder and chief executive Amrit Acharya told TechCrunch in an interview that the startup has also raised about $14.2 million in debt from a consortium of banks, and others.

Existing investors Accel, Sequoia India and Kae Capital also participated in the round, which pushes the Bangalore-based startup’s total raise to date to about $41 million. Vaibhav Gupta, co-founder of business-to-business marketplace Udaan, and Maninder Gulati, one of the top executives at budget lodging startup Oyo also participated.

Zetwerk was founded by Acharya, Srinath Ramakkrushnan, Rahul Sharma and Vishal Chaudhary last year. The startup connects OEMs (original equipment manufacturers) and EPC (engineering procurement construction) customers with manufacturing small-businesses and enterprises.

Unlike the more common e-commerce firms we come across every day, Zetwerk sells goods such as parts of a crane, doors, chassis of different machines and ladders. The startup operates to serve customers in fabrication, machining, casting and forging businesses. Currently, Zetwerk works with more than 100 enterprises and 1,500 small and medium-sized businesses. It delivers more than 15,000 parts each month.

“These are all custom-made products,” explained Acharya. “Nobody has a stock of such inventories. You get the order, you find manufacturers and workshops that make them. Our customers are companies that are in the business of building infrastructure.”

“We index these small workshops and understand the kinds of products they have built before. These indexes help bigger companies discover and work with them,” he added.

Once a firm has placed an order, Zetwerk allows them to keep a tab on the progress of manufacturing and then the shipping. This “hand-holding” is crucial, as in this line of business, manufacturing and shipping typically take more than two to three months.

Zetwerk has also enabled manufacturers in India to discover and find clients overseas. Today, manufacturers on the platform export their goods to North America and Southeast Asia, Acharya said. “India has a lot of depth in manufacturing, but much of it has not been tapped well,” he said.

Helping these manufacturing workshops find clients online is still a new phenomenon in the nation. Acharya said Zetwerk largely competes with domain project consultants in the offline work. “They specialize in certain products and geographies. So let’s say someone wanted to buy a machine XYZ in Orissa, they reach out to consultants who help them find workshops and estimate how much time it would take to get the project done.”

According to industry reports, manufacturing today accounts for 14% of India’s GDP. But the nation lacks a supporting ecosystem to execute projects in an efficient manner.

Vaibhav Agarwal, a partner at Lightspeed, said it was unusual to come across a market that is as large as $40 billion to $60 billion in India and global trade-tailwinds that creates opportunity to serve international demand.

The startup plans to infuse portions of the fresh capital into expanding its international operations. Acharya did not share exactly how many clients it has outside of India but said exports currently account for less than 5% of the startup’s GMV, or gross merchandize value.

He said the startup will continue to focus on helping Indian manufacturers find clients outside, as it is better suited to address this, as opposed to helping Indian companies find manufacturers overseas.

The startup will also explore helping its manufacturing workshops access working capital, though Acharya cautioned that it is not something that would happen anytime soon.

In a statement, Prayank Swaroop, a partner at Accel, said, “the use of technology in project planning, procurement, audits, and supply chain transparency is the core offering of Zetwerk which is completely original. Accel is very fortunate to be part of Zetwerk journey since the startup’s inception.”

Powered by WPeMatico

Babies have options these days when it comes to what goes in their mouths. No more is it just the standard mush in a jar. Now they’ve got everything from pouches to organic purees delivered right to their parents’ door — and Yumi is one of several startups cashing in.

The company has just announced that it raised another $8 million from several of Silicon Valley’s household names, including Allbirds, Warby Parker, Harry’s, Sweetgreen, SoulCycle, Uber, Casper and the CEO of Blue Bottle Coffee, James Freeman. That puts the total raised now to $12.1 million.

But it’s a tough and saturated market full of products all vying for mom and dad’s attention, and that’s not a lot of cash to go on, compared to the billion-dollar industry Yumi is up against. According to Zion Market Research, the global baby food market could reach as much as $76 billion by 2021. However, you wouldn’t know Yumi was up against such odds if you ask them and their financial supporters.

The advantage, according to the company, is in providing fresh food alternatives, and that “shelf-stable” competitors like Gerber lack key nutrients parents want for their little ones.

“Our goal is to change the standards for childhood nutrition, and completely upend what it means to be a food brand in America,” Yumi co-founder and CEO Angela Sutherland said. “This group of visionary leaders have all redefined their categories and now we have the opportunity to work together to reimagine early-age nutrition for the next generation.”

Will that bet pay off and help this startup stand out? Sales continue to rise and have risen by 10 times in the last year, according to the company — we’ve asked but don’t know what those sales numbers are, unfortunately. However, Yumi’s bet on fresh and delivered could prove to be just what parents want as the company continues to grow.

“As a parent, Yumi’s mission immediately resonated,” said co-founder and co-CEO of Warby Parker Neil Blumenthal . “As we’ve seen at Warby Parker, and now at Yumi, there is a massive shift happening in the world of retail. There’s now a new generation of consumers who are actively seeking brands that reflect their values and lifestyle — the moat that big, legacy brands once enjoyed has evaporated.”

Powered by WPeMatico

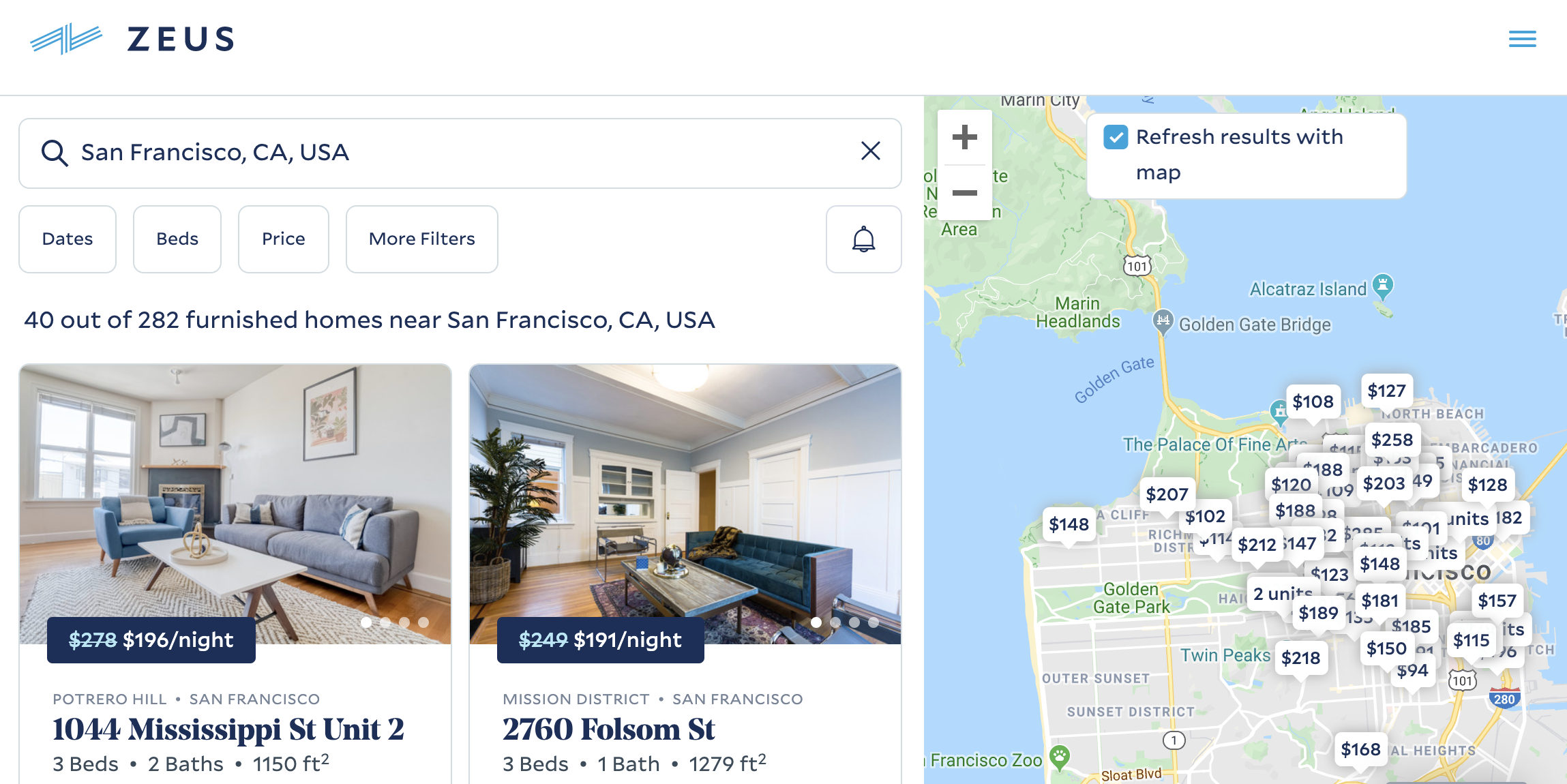

As Airbnb absorbs more and more of the demand for housing, it’s exploring how to monetize opportunities beyond vacation rentals. A marketplace for longer-term corporate housing could be a huge business, but rather than build that itself, Airbnb is making a strategic investment in one of the market leaders called Zeus Living, which will list its homes on the Airbnb site.

In just four years of redecorating landlords’ homes and renting them to relocated workers for 30-day stays (or longer), Zeus Living has grown to a $100 million revenue run rate. It boosted revenue 300% in 2019, and now has 250 employees and more than 2,000 homes under management. Zeus makes money by charging landlords one free month of usage, and marking up the rent charged to customers. It could rent out a $4,000 per month home for $5,000 plus take the extra month to earn $16,000 in a year.

Zeus CEO and co-founder Kulveer Taggar tells me, “I fundamentally believe that a lot of human potential is bound by location. At Zeus, we’re deeply committed to making it easier for people to live where opportunity takes them.” It’s already hosted 27,000 residents for a total of 650,000 nights.

Strong margins, swift momentum and that megatrend of more mobile workforces have earned Zeus Living a new $55 million Series B round it’s announcing on TechCrunch today. The funding comes from Airbnb, Comcast, CEAS Investments and TI Platform Management, plus existing investors Alumni Ventures Group, Initialized Capital, NFX and Spike Ventures. The funding comes at a $205 million post-money valuation.

“The opportunity here is huge, consumer spend is going toward housing and everyone needs to stay somewhere. But it’s Kulveer and Zeus’ go-to-market strategy that is impressive,” says Initialized co-founder and managing partner Garry Tan. “Zeus decided to start with corporate rentals, which we believe is the best go-to-market since it is the highest margin, and capital efficiency wins in a space with many competitors. Corporate needs are longer term, consistent and predictable, and partnering with Airbnb strengthens this approach as they expand to build a platform for every city.”

Zeus co-founder and CEO Kulveer Taggar

Zeus previously raised a $2.5 million seed and then an $11.5 million Series A led by Initialized, as well as $10 million in debt to cover taking on properties in the San Francisco Bay Area, Los Angeles, New York, Seattle and D.C. Now that it’s scaling up, Zeus could add a sizable debt facility to cover the risk of filling apartments with employees from clients like Brex, Disney, ServiceTitan and Samsara.

Instead of moving into a bland corporate housing block, struggling to find a place themselves or ending up in expensive long-term Airbnbs, workers moving to new cities can go to Zeus. It takes over apartments, handles maintenance and fills them with branded comforts like Parachute bedding and Helix mattresses that Zeus gets at bulk rates. The startup is betting that as workers move between jobs and cities more frequently, fewer will own furniture and instead look for furnished homes like those Zeus offers.

Thanks to the premium stays it provides, Zeus can charge clients a lucrative rate, while Taggar claims his service is still about half the price of standard corporate housing. For property owners, Zeus makes it easy to get a consistent rent paycheck with none of the traditional landlord work. Zeus takes care of cleaning and key exchanges so owners don’t need to do any chores like if they were running an Airbnb. Its goal is to get the first renters in within 10 days of taking on a property.

The new funding will help Zeus expand to more neighborhoods and cities while retaining a focus on breadth within each market so clients have plenty of homes from which to choose. The startup will be revamping its booking and invoicing tools for enterprise partners, and improving how it sources real estate. Meanwhile, it will be investing in customer care to maintain its high 70s NPS scores so relocated workers brag to their colleagues about how nice their new place is.

“Finding housing is stressful and time-consuming for both individuals and employers. As someone who has moved countries four times, I’ve lived through that tension,” says Taggar. “Zeus Living has built technology to remove complexity from housing, turning it into a service that enables a more mobile world.”

Taggar got into the real estate business early, remortgaging his mom’s house to buy a condo in Mumbai to rent out. After moving to the U.S., he built and sold Y Combinator-backed auction tool Auctomatic with co-founder and future Stripe starter Patrick Collison. It was while working on NFC-triggered task launcher Tagstand that Taggar recognized the hassle of both finding new corporate housing and reliably renting out one’s home. With Uber, Stripe and more startups growing huge by simplifying processes that move a lot of money around, he was inspired to do the same with Zeus Living.

“Modern professionals travel more frequently, stay longer and seek accommodations that feel like home. As more companies look to Airbnb for Work for extended-stay and relocation solutions, this segment remains a key focus for Airbnb,” says David Holyoke, global head of Airbnb for Work.

“We have great alignment with the Airbnb team in terms of serving the changing needs of business travelers that want the comforts of home when traveling for extended 30-day stays for work or a project,” Taggar follows. Airbnb can help Zeus drive demand thanks to all its inbound traffic, while Zeus offers Airbnb more supply for customers seeking longer stays.

Zeus Living’s co-founders

Zeus’ biggest threat is that it could get overextended, misjudge demand and end up on the hook to pay rent for two-year leases it can’t fill. And now with more funding, there will be added scrutiny regarding its margins, especially in the wake of the WeWork implosion.

Taggar recognizes these threats. “This is a business where we have to be focused on maximizing the gross profit we generate for the investments we make, with the least amount of risk. At Zeus Living, we’re continuously improving the ways we predict and secure demand.” He’s also building out teams on the ground in different markets to ensure regulatory compliance and push for more conducive laws around 30-day (or longer) rental stays.

Property tech has become a heated space, though, so Zeus will have heavy competition. There are traditional corporate housing providers, pure marketplaces that don’t deal with logistics and direct competitors like $66 million-funded Domio and juggernaut Sonder, which has raised a whopping $360 million. Zeus might also see its model copied abroad before it can get there. Over time, landlords and real estate investment trusts like Blackstone could force Zeus, Sonder and others to compete to pay them the most for leases, eating into all the startups’ margins.

At least with Airbnb as an investor, Zeus won’t have to fear a bitter battle with the tech giant over corporate housing. Instead, Airbnb could keep investing to coin off this adjacent market while listing Zeus properties, or potentially acquired the startup one day. For now though, Taggar just wants to prove startups can be accountable in the real world, acknowledging that taking over people’s homes is “a lot of responsibility! Our homes represent hundreds of millions of dollars of assets we manage and we take that very seriously.”

Powered by WPeMatico

Neuron Mobility, a Singapore-based startup, has closed an $18.5 million financing round as it looks to scale its e-scooter startup in international markets — a month after the nation introduced difficult regulatory changes.

The new financing round, dubbed Series A, was funded by GSR Ventures, a venture capital firm that was the first institutional investor in Chinese ride-hailing giant DiDi Chuxing, and Square Peg, Australia’s largest venture capital firm.

Existing investors SeedPlus and SEEDS Capital also participated in the round. The three-year-old startup has raised about $23.5 million to date.

Neuron Mobility, which began its journey in Singapore, operates an eponymous e-scooter rental platform. In recent years and quarters, Neuron has expanded to cities in Malaysia, Thailand, Australia and New Zealand.

Neuron’s e-scooters are affordable in every market where they are available. In Brisbane, Australia, for instance, anyone can begin a trip with a Neuron bike by paying one Australian Dollar (68 U.S. cents) and then 38 Australian cents for each minute of the ride, Zachary Wang, co-founder and chief executive of Neuron, told TechCrunch in an interview.

These electric scooters can go as fast as 25 kilometre per hour (15.5 miles per hour), and automatically slow down at certain places, such as near a school. Wang said the startup closely works with city councils to understand how these e-scooters should operate.

In a statement, Square Peg’s Tushar Roy said, “the culture of collaboration with cities permeates through Neuron. Its entire DNA is built around working very closely with local leadership to bring new mobility solutions to citizens in a safe and sustainable way.”

On a single charge, a Neuron scooter can travel up to 60 kilometres (37.2 miles). These e-scooters are equipped with a swappable battery. Once the ride is finished, a customer can drop the bike at any nearby parking station or any suitable location. Neuron works with a large number of people who actively swap the batteries on these scooters.

Like India’s electric scooter and bike startups Bounce and Yulu, Neuron Mobility also designs its electric scooters, but relies on a Chinese equipment manufacturer for producing them. (Yulu recently inked a strategic deal with Bajaj Auto to task the Indian auto manufacturing giant with the production job.)

As Neuron expands to international markets, it has had to halt its e-scooter rental service in the home market of Singapore. Last month, Singapore said e-scooters could no longer operate on footpaths, creating major challenges for all the players. Wang and executives from other startups have expressed concerns over the decision.

Telepod, which uses e-scooters to deliver food; GrabFood, another food delivery startup; and shared e-scooter service startup Beam, said they could no longer offer the same level of customer service to their users, and had little choice but to focus on other markets.

Wang said that Neuron still has teams that work from Singapore, but they have always focused on the larger Asia Pacific region and other markets. Besides, Neuron stopped its service in Singapore months before the nation passed any new law. (Prior to the recent order, Singapore had other issues with electric scooters.)

Neuron will use the fresh capital to further its footprint in the markets where it operates and explore building new categories, Wang said. “We feel we are in the midst of a wave where a number of technologies are falling into place that could help us improve our electric scooter and build more mobility solutions.” The startup is also exploring new markets, though Wang declined to name them.

Like in the United States, electric scooters and bikes have imploded in Southeast Asian markets, where a growing number of familiar brands such as Lime, Bird, Ofo, oBike and local players are increasingly expanding their presence.

Powered by WPeMatico

When the storied venture firm Sequoia likes a deal, it will sometimes not only lead one of its financing rounds but fund it exclusively — no matter how that impacts earlier investors. Given the firm’s powerful brand, it’s hard to complain (too much), even if it means that earlier backers see their stakes diluted.

Such looks to be the case with Dolls Kill, an eight-year-old, San Francisco-based online boutique for “misfits” and “miss legits,” that began selling platform shoes and other club-type clothing and has apparently grown like a weed, alongside the festivals that its customers attend, from Burning Man to Coachella.

The company has just raised $40 million in Series B funding from Sequoia, and when we talked yesterday with co-founder and CEO Bobby Farahi about the deal — which brings Dolls Kill’s funding to roughly $60 million — he said there was “no room” for earlier backers, including the consumer-focused venture firm Maveron.

He quickly added that the company’s board members — specifically Maveron partner Jason Stoffer, along with former Hot Topic CEO Betsy McLaughlin — have been instrumental in helping the company “think through growth while maintaining authenticity.”

It’s easy to appreciate enthusiasm around the brand, which employs around 400 people, has retail stores in both San Francisco and LA and sells its own clothes under an array of different labels, as well as sells the clothing of third parties whose aesthetic happens to fit that of Dolls Kill at any particular moment in time.

As says Farahi, “Right now there’s a resurgence in ’90s fashion, but in another year, we could move on to other third-party brands that we believe will resonate with our customers.”

Farahi doesn’t break out how much of the company’s clothing is made by the startup itself — in China and the U.S., among other “international” locations, according to Farahi. He shies from sharing many metrics at all, in fact. But the company, whose counter-culture approach began at the fringes of society, has seemingly gone mainstream as young shoppers increasingly ditch logos and look to express who they are through what Farahi calls their “inner IDGF.”

Adds Farahi, “The macro world changed a lot to give us a lot of tailwinds.”

Dolls Kill also has — for now, at least — a deep connection to its customers, thanks partly to its creative approach. When the company told its three million Instagram followers earlier this year that it would drive an ice cream truck filled with a particular combat boot called the Billionaire Bling Boot to dozens of U.S. cities, customers “four blocks long” waited in line to buy them, says Farahi.

In another inventive twist, it opened its LA location — which looks more like a nightclub — to shoppers at midnight on Black Friday and it stayed open the following 24 hours.

Sequoia — which reached out to the company directly — told Farahi that it had looked at a lot of fashion brands and “they said we believe you’re the next generation-defining brand, the way The Gap was in the ’80s,” recounts Farahi. “I think they see the company not just as a brand but also a movement.”

Certainly, Sequoia’s Alfred Lin — who as Zappos’s COO helped grow the company into the giant that Amazon acquired in 2009 — understands such things, given the famously strong early emphasis at Zappos on company culture and growing while remaining true to its early employees and customers.

As for the name Dolls Kill, the brand was the idea of Farahi’s wife and co-founder Shoddy Lynn, who liked the “dichotomous words, one very soft and one very hard,” says Fahari, explaining that while “the brand is very girly, these girls aren’t taking shit from anybody.”

Adds Farahi, “And the domain was available.”

Powered by WPeMatico

Work tools startup Notion, which recently reached a reported $800 million valuation, isn’t on the verge of a big SoftBank round. In fact, COO Akshay Kothari says the startup has “never felt like if we had more money we could grow faster.”

The company, centered around an app that helps non-developers build collaboration tools, has more than one million users and has scaled its product quickly despite having a team of just 27.

I wrote about the company’s partnership with some of tech’s top accelerators and venture capital firms last month. People are very curious about this small company and how it is run, so here’s more from my recent interview with COO Akshay Kothari in which we discussed the hyped startup’s philosophy of staying small and some of the challenges it may have ahead with this brand of thinking as competitors are raising massive sums.

This interview has been edited for length and clarity.

Notion COO Akshay Kothari (Photo: Notion)

Where does your story begin with Notion? Give me a snapshot of where the team is now.

Akshay Kothari: [Notion co-founders Ivan Zhao and Simon Last] started Notion six years ago and that’s when I invested. I had sold my previous company and I had this newfound money that I didn’t know what to do with. I invested in Notion, so that’s my connection.

We were kind of in research mode for many years trying to uncover what the market needs were. We launched about two years ago; 1.0 was just notes that you could take and a wiki so that you could collaborate with people. And then last year we launched databases and that was the 2.0 version, which kind of seemed like an inflection point, where now you could not only have your notes and your wiki, but also manage your tasks, manage your projects, manage candidates and recruiting, all in a single tool.

Over the last year and a half, the company has grown extremely fast. I joined about a year ago, there were about 10 people at the beginning of this year and now we’re close to 30. It’s still a really small engineering team. We’re 9 engineers, we don’t have any product managers, and we’re 2 designers. So there are about 10 people that are building the product, and 10 people on community and support teams, something that we’ve invested very heavily in. We’re starting to have a sales and marketing team. We have 2 people in marketing and 2 people in sales. That all rounds up to about 27 which is where we are now.

Since you joined do you think the idea has shifted at all?

In terms of the original idea, we were thinking about how people who didn’t know how to code could build things like tools and software that were really useful. I guess the only realization has been that not everyone wakes up wanting to build software, but everyone wakes to solve problems. That was the pivot to focusing on notes, wikis and tasks, because that’s actually something that every team needs.

Are those needs universal for big and small teams?

For the first 100 people you can actually do a lot with Notion. With 30 people, we pretty much run the entire company, except for using Slack for internal communication and Intercom for external communication like talking to customers. Everything else is actually on Notion, like our application tracking system for recruiting inside Notion, our sales CRM is in Notion, our wiki obviously is, our project management as well — no, we don’t use Jira.

For sub-100 businesses, you actually don’t need another tool. When you get to hundreds of people what tends to happens is that some person or some team tends to have a preference for a specific tool. In those situations, Notion plays well with other tools. You can embed things easily. So let’s say Excel or Google Sheets is something that you want to use, you can just embed that inside Notion. So Notion becomes this kind of central nervous system for all of the work that people are doing.

Building on that, one of the things we haven’t done is we don’t do synchronous communication so we’ve stayed away from that because I feel like people like using Slack. On Slack, you can’t actually collaborate on a project… Notion has become a place where you can actually do a lot of your work alongside the synchronous communication.

So, no interest in building a chat or video chat product?

Not in the near term. I think Slack is one of those enterprise tools that people at companies actually like. For a lot of these other tools, we just have to use it, not because we love it but because that that’s what exists.

Notion’s headquarters (Photo: Notion)

What are the barriers for satisfying the customers with 100+ employees?

Powered by WPeMatico