funding

Auto Added by WPeMatico

Auto Added by WPeMatico

InsightFinder, a startup from North Carolina based on 15 years of academic research, wants to bring machine learning to system monitoring to automatically identify and fix common issues. Today, the company announced a $2 million seed round.

IDEA Fund Partners, a VC out of Durham, N.C., led the round, with participation from Eight Roads Ventures and Acadia Woods Partners. The company was founded by North Carolina State University professor Helen Gu, who spent 15 years researching this problem before launching the startup in 2015.

Gu also announced that she had brought on former Distil Networks co-founder and CEO Rami Essaid to be chief operating officer. Essaid, who sold his company earlier this year, says his new company focuses on taking a proactive approach to application and infrastructure monitoring.

“We found that these problems happen to be repeatable, and the signals are there. We use artificial intelligence to predict and get out ahead of these issues,” he said. He adds that it’s about using technology to be proactive, and he says that today the software can prevent about half of the issues before they even become problems.

If you’re thinking that this sounds a lot like what Splunk, New Relic and Datadog are doing, you wouldn’t be wrong, but Essaid says that these products take a siloed look at one part of the company technology stack, whereas InsightFinder can act as a layer on top of these solutions to help companies reduce alert noise, track a problem when there are multiple alerts flashing and completely automate issue resolution when possible.

“It’s the only company that can actually take a lot of signals and use them to predict when something’s going to go bad. It doesn’t just help you reduce the alerts and help you find the problem faster, it actually takes all of that data and can crunch it using artificial intelligence to predict and prevent [problems], which nobody else right now is able to do,” Essaid said.

For now, the software is installed on-prem at its current set of customers, but the startup plans to create a SaaS version of the product in 2020 to make it accessible to more customers.

The company launched in 2015, and has been building out the product using a couple of National Science Foundation grants before this investment. Essaid says the product is in use today in 10 large companies (which he can’t name yet), but it doesn’t have any true go-to-market motion. The startup intends to use this investment to begin to develop that in 2020.

Powered by WPeMatico

The nearly seven-year-old, New York-based fitness subscription app ClassPass is reportedly trying to raise $285 million in a new funding round that would push its valuation to more than $1 billion.

The company will issue 22.7 million Series E shares as part of the funding round, according to a securities filing obtained by Reuters from analytics firm Lagniappe Labs.

We’ve reached out to its press office for more information.

According to TC’s sources, ClassPass has been in fundraising mode since at least early fall.

The company began life as a way for people to book classes across different fitness studios but has more recently been pushing a corporate business that sees it adding ClassPass to employee benefit packages.

It is right now valued at $536.4 million, according to Reuters, which cites the Prime Unicorn Index. Its backers include the Singapore sovereign wealth fund Temasek and Alphabet, along with General Catalyst, Thrive Capital and Acequia Capital.

To date, the company has raised roughly $240 million from investors altogether, according to Crunchbase. It closed its most recent round of funding, an $85 million Series D round, in July 2018.

ClassPass was founded by Payal Kadakia, who is now the company’s executive chairman. She stepped aside in 2017 to make room for Fritz Lanman, the company’s former executive chairman and co-operator and now CEO.

Lanman acknowledged in an interview with Fortune earlier this year that ClassPass has endured some ups and downs in its time. Though it originally charged $99 per month for an unlimited number of fitness classes in New York, it was forced to raise prices before more recently instituting fluctuating class prices based on demand (and the availability of classes) of particular studios. The end result: Customers currently pay between $9 and $199 per month for credits that can be spent on classes.

As for its corporate memberships, it currently promises not just classes and a way to customize programs for employees but also streaming audio and video workouts. The last owes to an investment that ClassPass made in a broadcast studio, from which it built a library of on-demand video workouts. TC covered that development back in 2018.

Powered by WPeMatico

December has been a strong month for Brazilian startups, bringing a big IPO and a new unicorn for local companies. Tech-driven investment firm XP Investimentos went public on the U.S. Stock Exchange in mid-December, raising $1.81 billion in the fourth-largest IPO of 2019. XP’s stock price jumped 30% on its first day of trading, from $27 per share to $34.50.

XP was founded in 2001 to provide brokerage training classes to Brazilians to help them invest in the international stock market. Today, it is a full-service brokerage firm, providing fund management and distribution to more than 1.5 million customers in Brazil.

Notably, XP has outlined a strategy for beating Brazilian banks, among the most profitable in the world, in its 354-page report to the SEC. Brazil’s banking market is highly concentrated, with the top five players dominating 93% of market share. This concentration has led to significant inefficiencies that XP tries to disrupt by offering a variety of financial products through an accessible online platform.

The heavy bureaucracy of these banks will prevent them from innovating quickly enough to compete with newer institutions like XP, whose debt products are attractive to frustrated Brazilian customers. The inefficiency of the Brazilian financial system has opened opportunities for companies like XP, or neobank Nubank, to rapidly attract customers who are disgruntled with the traditional system.

Brazil has seen a new unicorn emerge almost every month this year, and December was no exception. Gaming startup Wildlife raised a $60 million Series A round led by U.S.-investor Benchmark Capital at a $1.3 billion valuation to become the country’s eleventh unicorn. This round was big even for Silicon Valley standards, and it is uncommon for startups even in markets like the U.S. or Europe to hit a $1 billion-plus valuation in such an early round.

Wildlife has created more than 60 games since 2011, including Zooba and Tennis Clash, which have both reached global acclaim. Founded by brothers Victor and Arthur Lazarte, Wildlife operates on a freemium model that only charges users for in-app purchases. They plan to use the funding to double their employee base and grow to $2 billion in 2020, continuing the 80% yearly growth they have seen since 2011.

Konfio provides small business loans in Mexico through an online platform to help SMEs gain liquidity and grow their operations. These small businesses are often overlooked by banks in Mexico and Latin America, which do not know how to price risk for businesses that process less than $10 million per year.

Konfio recently raised $100 million from SoftBank’s Innovation Fund, the third investment that SoftBank has made into Mexico since launching the fund. The capital will go toward financing working capital loans, as well as creating new products for Konfio’s customers. Today, Konfio’s loans average around $12,000, while banks still struggle to loan less than $40,000. The tech-driven platform allows Konfio to disburse loans within 24 hours without requiring collateral.

Small business lending is a tremendous opportunity in Latin America, where banks are among the most profitable and the least competitive in the world. Brazil’s Creditas and Colombia’s OmniBnk are among the other startups providing innovative products that calculate risk more effectively than banks in Latin America’s complex lending environment.

In an extension of a Series A round, Mexico’s albo raised a further $19 million from Valar Ventures to bring their newest round to $26.4 million in total. Albo previously raised $7.4 million from Mountain Nazca, Omidyar Network and Greyhound Capital in January 2019. Albo’s mission is to provide banking services to unbanked and underbanked clients in Mexico. More than half of albo’s customers claim that albo was their first-ever bank account.

Founded by Angel Sahagun in 2016, albo quickly became Mexico’s largest neobank, serving more than 200,000 customers and sending out thousands of new cards every day. The investment from Valar Ventures, founded by Peter Thiel (also an investor in N26 and TransferWise), is a vote of confidence for this Mexican fintech. Albo has also previously received investment from Arkfund, Magma Partners and Mexican angels.

Albo plans to use the capital to develop new products, including savings and credit services, in the coming year. Mexico will likely be a battleground for Latin American neobanks in 2020, as Klar, Nubank and potentially Argentina’s Uala will begin to grow in the region’s second-largest market. While there is room for several competitive neobanks to thrive in Mexico, this industry will be one to watch in 2020.

Goldman Sachs loaned $125 million to MercadoLibre to continue developing their credit product, MercadoCredito. MercadoLibre will use the capital to triple its $100 million debt facility for small business loans in Mexico. To date, MercadoCredito has loaned more than $610 million to 270,000 businesses around the region in Mexico, Brazil and Argentina.

Brazilian cloud-kitchen startup Mimic raised $9 million in a seed round led by Monashees to develop a more efficient food delivery model in Brazil. Mimic will exclusively manage the logistics of “dark kitchens,” which exist only for delivery and have no sit-down facilities, saving time and money for clients. Mimic will use the investment to grow its team.

An early-stage online lending startup in Brazil, Rebel, recently raised $10 million from Monashees and Fintech Collective to provide unsecured loans to middle-class Brazilians at affordable rates. Rebel has lowered rates to around 2.9% per month, compared to 40-400% at Brazil’s largest banks. The startup uses a proprietary algorithm to calculate risk for clients and provide loans rapidly through its online platform.

Colombia’s Rappi recently announced an expansion into Ecuador, where it has rapidly reached 100,000 users between Quito and Guayaquil, the country’s two largest cities. Rappi is now active in nine countries and more than 50 cities in Latin America.

Given the arrival of the SoftBank Innovation Fund, Latin American startup investment in 2019 will likely more than double the $2 billion invested in 2018. Here are a few of the highlights we saw this year:

Latin America’s startup and investment ecosystem has likely more than doubled this year as compared to 2019. As international investors like SoftBank, Andreessen Horowitz, Sequoia, Accel, Tencent and others are taking more bets on the region, more startups than ever have scaled and reached unicorn status. These startups will continue to scale in 2020, taking on a regional presence to provide services to Latin America’s 650 million population.

Powered by WPeMatico

HomeLane, a Bangalore-based startup that helps people manage home renovations and interior design, today announced it has raised $30 million in a new financing round as it looks to expand its proprietary technology.

The financing round, dubbed Series D, was led by Evolvence India Fund (EIF), Pidilite Group and FJ Labs. Existing investors Accel Partners, Sequoia Capital and JSW Ventures also participated in the round, which pushes the five-year-old startup’s all-time raise to $46 million.

HomeLane helps property owners furnish and install fixtures in their new apartments and houses. Interior designers need to be local to customers and supply chain partners need to have the capacity to ship to a location. So HomeLane has established 16 experience centers in seven Indian cities so consumers can touch and see materials and furniture.

The startup plans to use the fresh capital to broaden its technology infrastructure and expand to eight to 10 additional cities.

HomeLane competes with other online furniture sellers such as Livspace and Urban Ladder, as well as brick-and-mortar stores. Founders Rama Harinath and Srikanth Iyer say their startup differentiates by offering a one-stop shop — it sells everything from fitted kitchens and wardrobes to entertainment units and shoe racks — and by providing guaranteed on-time delivery and after-sale services to help homeowners finish projects.

The site allows property owners to upload floor plans, which are reviewed by interior designers who provide product suggestions, price quotes and 3D pictures of how furnishings and fixtures will look after they are installed. The startup, which has worked with more than 900 design experts to deliver over 6,000 projects, pays to the designers a fraction of the money it charges customers.

Iyer, who serves as the chief executive of HomeLane, claimed that the startup is inching closer to being EBIDTA profitable (which does not include taxes and a range of other expenses). That would be a notable turnaround for HomeLane, which reported a net loss of $4.1 million on revenue of $5.6 million in the financial year that ended in March 2018.

Prashanth Prakash, a partner at Accel India, said, “We are very happy with HomeLane’s current growth trajectory and are believers in the long-term growth prospects of the home improvement consumer segment in India.”

Powered by WPeMatico

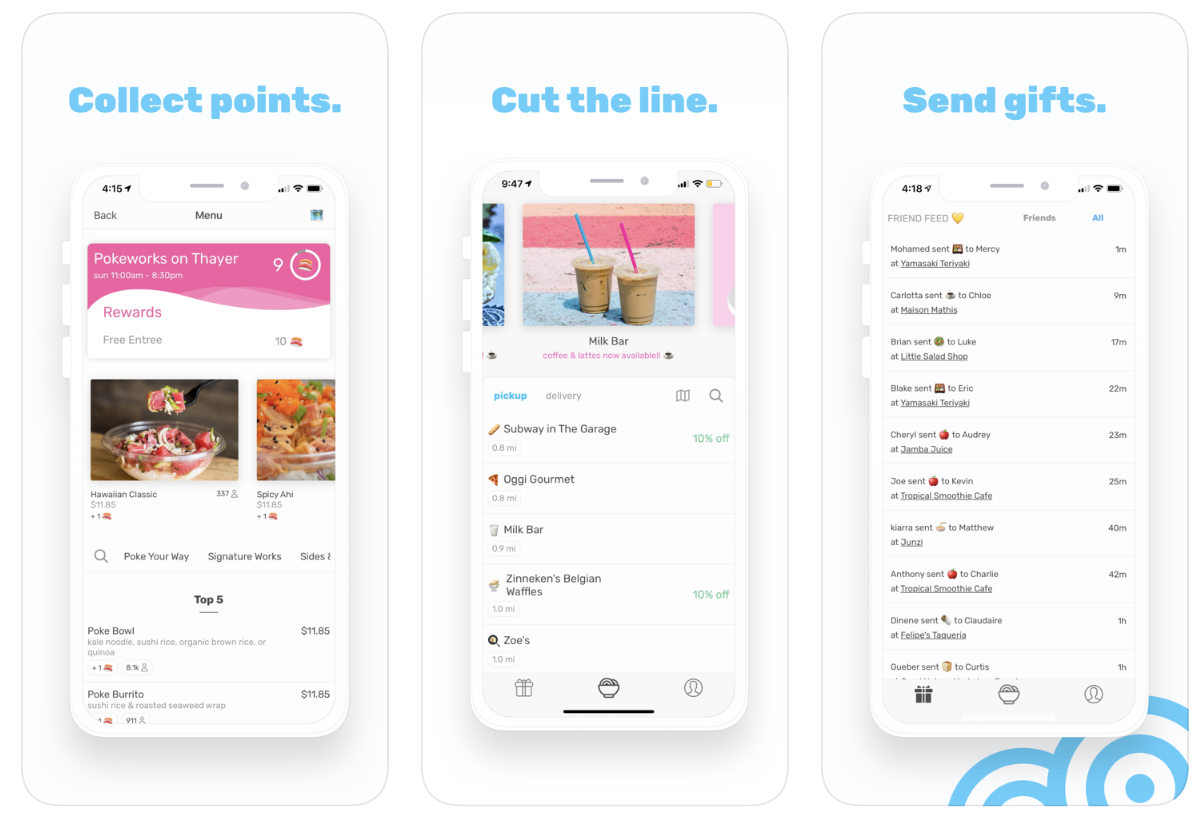

“We were in the back washing blenders so they could keep taking Snackpass orders,” recalls co-founder and CEO Kevin Tan. The team from order-ahead food startup Snackpass was willing to get their hands dirty to keep up with demand at one of their first restaurant partners, Tropical Smoothie Cafe on the Yale University campus.

Why were people so eager to pay for takeout through Snackpass? Because it lets them earn loyalty points to redeem for free food — both for themselves and as gifts for their friends. Sending people Snackpass rewards became a new way to flirt or show gratitude at Yale. And through the Venmo-esque Snackpass social feed, users could keep up with a fresh form of gossip while discovering restaurants.

“Anywhere someone is standing in line to order something, we can solve that with Snackpass,” says Tan. “Consumer spending will be social in the future.”

That future is already taking hold. Two years after launch, Snackpass is on 11 college campuses across the U.S., often boasting a 75% penetration rate amongst students within six months. It takes a cut of every order and keeps margins high because users pick up the food themselves rather than waiting for delivery. While other food ordering startups battle to offer discounts as marauding users deal-hop between apps, Snackpass keeps users coming back through its loyalty program.

Its momentum, retention and opportunity to expand from colleges to dense cities has now won Snackpass a $21 million Series A led by Andreessen Horowitz partner Andrew Chen. The round was joined by other heavy hitters, like Y Combinator, General Catalyst, Inspired Capital and First Round, plus angels, including musician Nas, NFL star Larry Fitzgerald and legendary talent agent Michael Ovitz. Building on Snackpass’ $2.7 million seed, the cash will go toward hiring up with the goal of reaching 100 campuses in two years.

Its momentum, retention and opportunity to expand from colleges to dense cities has now won Snackpass a $21 million Series A led by Andreessen Horowitz partner Andrew Chen. The round was joined by other heavy hitters, like Y Combinator, General Catalyst, Inspired Capital and First Round, plus angels, including musician Nas, NFL star Larry Fitzgerald and legendary talent agent Michael Ovitz. Building on Snackpass’ $2.7 million seed, the cash will go toward hiring up with the goal of reaching 100 campuses in two years.

“Takeout is an important market because it’s huge — also in the hundreds of billions — and fragmented,” writes Chen. “The opportunity complements the food delivery market in a big way: For the average restaurant, there are 6 takeout orders for every delivery order!”

Like many of the best startup ideas, Snackpass was born out of the founders’ own needs at Yale. Slow and expensive food delivery services didn’t make sense for smaller orders like a coffee, ice cream or a pepperoni slice on campuses small enough for customers to walk or bike to the restaurant. Tan says, “I was dabbling in several side projects, including helping a friend who managed a local pizza shop build a website to help better reach the local student community.” He realized how tough it was for restaurants around colleges to retain and reward customers, especially as regulars graduated.

Tan joined up with neuroscience student and Thiel Fellow Jamie Marshall, who became Snackpass’ COO. “I had grown up calling in every order,” Marshall tells me. “Waiting in line didn’t make sense for me. I used every order-ahead platform and thought this was the future.” Jonathan Cameron, a serial entrepreneur who’d built his own order-ahead app called Happy Hour, rounded out the founding team.

Snackpass founders (from left): Jamie Marshall and Kevin Tan

Snackpass offers users a list of nearby restaurants from which they can order ahead, with special tags for ones offering deals. Menu items include counts of how many people have ordered them and how many rewards points you’ll earn buying them. You pay in the app, skip the line at the restaurant and grab your order from the counter. Each restaurant can configure their own rewards system with how much items earn and cost, such as giving you a free coffee for every 10 you buy.

Users can then spend their points to get themselves free menu items, or send a virtual Snackpass gift card to any of their phone contacts or people they find via search. This gives Snackpass a way to grow virally that most food apps lack. Thankfully, you can block people on Snackpass if they get creepy showering you with gifts.

Each purchase and gift on Snackpass shows up in its social feed unless you make it private. “That’s become its own language. People use it to flirt with each other, or bond and connect with someone new,” Tan tells me. “There’s some drama or intrigue there seeing who’s sending gifts to who. People even look at the feed in the way they look at someone’s Instagram to see what’s going on with them.”

Snackpass has also done some integration work specifically for the college market that sets it apart from other order-ahead and delivery services. It can sync with students’ campus meal plans so they can spend them through the app. And student groups from clubs to fraternities can pre-load and replenish accounts for their members. Snackpass works with the same organizations to launch on new campuses. “We host parties, sponsor tailgates and make it feel like a student-led effort so it grows organically across campus communities,” Tan explains. “These efforts, combined with the social feed which would give anyone FOMO if they’re not in the app.”

With all the competition in the space, restaurants can be inundated with apps to manage, some of which just exacerbate spikes in demand that overwhelm kitchens. “There is certainly a risk that local restaurants will start to get platform fatigue, finding that using some apps will take too big of a bite out of their margins,” says Tan. That’s why Snackpass built features that let restaurants batch orders and control how many come in at a certain time so dine-in patients and non-app users aren’t stuck with unreasonable delays.

With all the competition in the space, restaurants can be inundated with apps to manage, some of which just exacerbate spikes in demand that overwhelm kitchens. “There is certainly a risk that local restaurants will start to get platform fatigue, finding that using some apps will take too big of a bite out of their margins,” says Tan. That’s why Snackpass built features that let restaurants batch orders and control how many come in at a certain time so dine-in patients and non-app users aren’t stuck with unreasonable delays.

Snackpass has recruited talent from Uber Eats and an advisor from Yelp’s executive team to help it navigate the tricky SMB sales process. One ace up its sleeve is that it can offer to send push notifications to announce recently signed partners or specials they’re launching, driving the new customers restaurants are desperate for. Tan says his startup is considering if it could charge for this kind of promotion down the line. Most customers who walk into restaurants are effectively in incognito mode, but Snackpass provides its partners with analytics to help them improve their own businesses.

“At the surface level there is a lot of competition in this space,” Tan admits. “The social aspect of the app has been the key differentiator for us. Other companies have been focused on creating the fastest, cheapest, most efficient delivery service, but it’s really hard to make those margins work and consumers are trained to shop around on different apps to get the best deal or fastest delivery time . . . Eating food is supposed to be fun and social, and our generation grew up online and in social networks. We’re combining the social aspect of eating with the utility of order ahead, which has helped us build loyalty and enable retention amongst our users.”

It will still be a battle to overtake long-running competitors like Allset, Level Up and Ritual, plus incumbents that offer takeout pickup like Uber and Grubhub. Logistics is a cut-throat business, and plenty of startups have already failed in the restaurant loyalty space.

Having Andreessen Horowitz’s support could give Snackpass some extra firepower. “A16z has better support and services for their portfolio companies than any other VC we’ve come across and they’ve delivered,” Tan tells me. “We knew that Andrew Chen understands growth and marketplaces from his blog and his Twitter.” That’s critical in a crowded space where such a precise balance of customer acquisition and lifetime value is necessary.

Snapchat, TikTok and Fortnite have all tapped into the youth market with a lighthearted nature that keeps users coming back until they develop network effect. Snackpass is managing to do the same, not with a messaging app or game, but a commerce platform. “We play up creativity, silliness and delight in areas where most companies focus on utility and convenience,” Tan concludes. “We built Snackpass for ourselves and our friends. We’ve carried on this philosophy: if something makes us laugh, we put it in the app.”

Powered by WPeMatico

Tusk Venture Partners, the venture capital firm led by Bradley Tusk and managing partner Jordan Nof, has secured $70 million for its second flagship fund, the firm has confirmed to TechCrunch following a report by Fortune this morning.

Fundraising for the effort began in January, when the pair filed paperwork with the U.S. Securities Exchange Commission for Tusk Venture Partners II. The firm, and affiliated political advisory outfit Tusk Ventures, is behind a number of high-profile startups, including e-scooter “unicorn” Bird, cryptocurrency exchange Coinbase and Ro, a direct-to-consumer healthcare business best known for selling erectile dysfunction medication.

The New York-based firm, founded in 2011, previously raised $36 million for its debut fund — capital it used to back fantasy sports company Fanduel, insurtech business Lemonade and D2C vitamin seller Care/of.

Tusk, before launching Tusk Ventures, served as campaign manager for Mike Bloomberg, as deputy governor of Illinois and as communications director for Senator Chuck Schumer. He also penned the book, The Fixer: My Adventures Saving Startups from Death by Politics, released in 2018.

Naturally, Tusk Ventures provides companies more than just checks. The politically savvy team lends its expertise to support companies plagued with regulatory barriers and communications issues, as well as help with grassroots organizing, opposition research and partnerships.

Powered by WPeMatico

Sapphire Ventures, the former corporate venture arm of SAP, has raised $1.4 billion for growth investments, including a $150 million opportunity fund to support larger deals.

The firm, which focuses primarily on enterprise tech companies in the U.S., Europe and Israel, writes checks to Series B through pre-IPO businesses. Its portfolio includes 23andMe, Sumo Logic and TransferWise.

The new funds brings Sapphire Ventures, which became independent from the German software company SAP in 2011, assets under management to north of $4 billion. Sapphire will write checks sized between $5 million and $100 million with the new funds, allowing the team “to do any financing we need to or want to,” chief executive officer and managing director Nino Marakovic tells TechCrunch. Sapphire’s fourth growth fund is the firm’s largest to date, at more than double the size of their $700 million Fund III.

“We need this fund because companies are staying private much longer because they want to get to a $200 million revenue run rate before they go public,” Sapphire Ventures president and co-founder Jai Das (pictured) tells TechCrunch. “We want to have the capital to support these companies as they keep growing.”

News of the fund comes nearly one year after Sapphire Ventures lassoed $115 million from new limited partners to invest at the intersection of tech, sports, media and entertainment. Sapphire Sport has ties to the sports industry, from City Football Group, which owns English Premier League team Manchester City, to Adidas, the owners of the Indiana Pacers, New York Jets, San Jose Sharks and Tampa Bay Lightning, among others.

Before that, the firm closed on $1 billion for its third flagship venture fund.

With seven check writers and another seven investment professionals focused on growth-stage investments, Sapphire has had a number of recent wins, counting a total of 21 initial public offerings and 55 exits since the firm’s inception.

“We’re excited to have now reached critical mass with $4 billion under management,” Marakovic said. “We are the right size to take advantage of our target area of early and later-stage enterprise software companies. We are innovating on the model by adding value-add LPs and trying to align our whole model of services to the target companies to serve them as best as possible.”

Powered by WPeMatico

Oto, a startup spun off from research at SRI International to help customer service operations understand voice intonation, announced a $5.3 million seed round today.

Participants in the round included Firstminute Capital, Fusion Fund, Interlace Ventures, SAP.iO and SRI International . The total includes a previous $1 million seed round, according to the company.

Teo Borschberg, co-founder and CEO at Oto, says the company launched out of SRI International, the same company where Apple’s Siri technology was originally developed. It has been developing intonation data, based originally on SRI research, to help customer service operations respond better to caller’s emotions. The goal is to use this area of artificial intelligence to improve interactions between customer service reps (CSRs) and customers in real time.

As part of the research phase, the company compiled a database of 100,000 utterances from 3,000 speakers, culled from two million sales conversations. From this data, it has built a couple of tools to help customer service operations automate intonation understanding.

The first is a live coaching tool. It’s difficult to have management monitor every call, so only a small percentage gets monitored. With Oto, CSRs can get real-time coaching on every call to raise their energy or to calm a frustrated customer before a problem escalates. “In real time, we’re able to guide the agents on how they sound, how energetic they are, and we can nudge and push them to be more energetic,” Borschberg explained.

He says this has three main advantages: more engaged agents, higher sales conversion rates and better satisfaction scores and cost reduction.

The other product measures the quality of a customer experience and gives a score at the end of each call to help the CSR (and their managers) understand how well they did, simply based on intonation. It displays the score in a dashboard. “We’re building a universal understanding of satisfaction from intonation, where we can learn acoustic signatures that are positive, neutral, negative,” Borschberg said.

He sees a huge market opportunity here, pointing to Qualtrics, which sold to SAP last year for $8 billion. He believes that surveying people is just a part of the story. You can build a better customer experience when you understand intonation of just how well that experience is going, and you put it on a scale so that it makes it easy to understand just how well or how poorly you are doing.

The company has 20 employees today, with offices in New York, Zurich and Lisbon. It has seven customers working with the product so far, but it is still early days.

Powered by WPeMatico

The amount of data that most companies now store — and the places they store it — continues to increase rapidly. With that, the risk of the wrong people managing to get access to this data also increases, so it’s no surprise that we’re now seeing a number of startups that focus on protecting this data and how it flows between clouds and on-premises servers. Satori Cyber, which focuses on data protecting and governance, today announced that it has raised a $5.25 million seed round led by YL Ventures.

“We believe in the transformative power of data to drive innovation and competitive advantage for businesses,” the company says. “We are also aware of the security, privacy and operational challenges data-driven organizations face in their journey to enable broad and optimized data access for their teams, partners and customers. This is especially true for companies leveraging cloud data technologies.”

Satori is officially coming out of stealth mode today and launching its first product, the Satori Cyber Secure Data Access Cloud. This service provides enterprises with the tools to provide access controls for their data, but maybe just as importantly, it also offers these companies and their security teams visibility into their data flows across cloud and hybrid environments. The company argues that data is “a moving target” because it’s often hard to know how exactly it moves between services and who actually has access to it. With most companies now splitting their data between lots of different data stores, that problem only becomes more prevalent over time and continuous visibility becomes harder to come by.

“Until now, security teams have relied on a combination of highly segregated and restrictive data access and one-off technology-specific access controls within each data store, which has only slowed enterprises down,” said Satori Cyber CEO and co-founder Eldad Chai. “The Satori Cyber platform streamlines this process, accelerates data access and provides a holistic view across all organizational data flows, data stores and access, as well as granular access controls, to accelerate an organization’s data strategy without those constraints.”

Both co-founders (Chai and CTO Yoav Cohen) previously spent nine years building security solutions at Imperva and Incapsula (which acquired Imperva in 2014). Based on this experience, they understood that onboarding had to be as easy as possible and that operations would have to be transparent to the users. “We built Satori’s Secure Data Access Cloud with that in mind, and have designed the onboarding process to be just as quick, easy and painless. On-boarding Satori involves a simple host name change and does not require any changes in how your organizational data is accessed or used,” they explain.

Powered by WPeMatico

HungerBox, an Indian food tech startup that has courted 10 of the 11 largest companies in the country to use its services, today announced it has raised $12 million from Paytm and others as it looks to sign clients in Southeast Asia.

The three-year-old startup’s new financing round, a Series C, was funded by a consortium of Indian and international investors, including payments firm Paytm and NPTK, an Asian VC fund that invests in emerging firms. Existing investors Sabre Partners and Neoplux also participated in the round, which pushes the Bangalore-based startup’s to-date raise to $16.5 million.

HungerBox offers management services to companies and institutions to improve and run their in-house cafeterias and canteens. HungerBox also enables its clients to connect with food partners through an app and get real-time updates of their order.

The startup, which also provides these firms with a point-of-sale machine, helps them get better insight into the quality of food being catered to their employees, and enables scheduled delivery and tracking of orders to address the long queues, said Sandipan Mitra, co-founder and chief executive of HungerBox, in an interview with TechCrunch.

“We all talk about the food delivery to consumers, but not many are looking to improve the quality of food and how it is being catered to tens of millions of employees in the country each day,” he said. “It’s a challenge that has not been addressed well.”

It turns out, when a startup finally looked into the space, many quickly jumped to appreciate it. HungerBox has amassed more than 126 large businesses and institutions — with more than 100,000 workforce each, across 18 Indian cities, said Mitra. Food delivery startups Swiggy and Zomato have started to explore this space, too, in recent quarters.

HungerBox is processing 560,000 orders each day, a figure that is growing 10% every month, claimed Mitra. The startup’s solutions are today employed at more than 535 cafeterias for its clients that work in IT / technology, retail, healthcare, aviation, education, financial services and manufacturing, he said. He declined to reveal the name of the clients, citing confidential agreements.

Annual food sales on the HungerBox platform have exceeded $100 million, he said.

The startup, which employs 1,500 people, will use the fresh capital to fuel its expansion in 10 additional Indian cities and to markets in Southeast Asia, said Mitra.

In a statement, Madhur Deora, president of Paytm, said HungerBox has enabled Paytm to add new use cases for the company’s payments business and digitization of offline transactions.

“HungerBox is the market leader in the institutional food tech space and we will partner closely with them and bring the benefits of Paytm’s ecosystem to HungerBox,” he said.

Powered by WPeMatico