funding

Auto Added by WPeMatico

Auto Added by WPeMatico

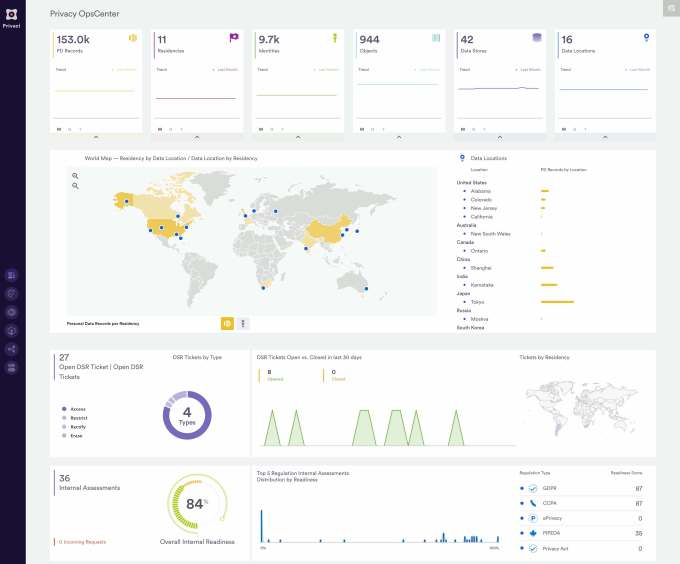

Securiti.ai, a San Jose startup, is working to bring a modern twist to data governance and security. Today the company announced a $50 million Series B led by General Catalyst, with participation from Mayfield.

The company, which only launched in 2019, reports it has already raised $81 million. What is attracting all of this investment in such a short period of time is that the company is going after a problem that is an increasing pain point for companies all over the world because of a growing body of data privacy regulation like GDPR and CCPA.

These laws are forcing companies to understand the data they have, and find ways to be able to pull that data into a single view, and, if needed, respond to customer wishes to remove or redact some of it. It’s a hard problem to solve with customer data spread across multiple applications, and often shared with third parties and partners.

Company CEO and founder Rehan Jalil says the goal of his startup is to provide an operations platform for customer data, an area he has coined PrivacyOps, with the goal of helping companies give customers more control over their data, as laws increasingly require.

“In the end it’s all about giving individuals the rights on the data: the right to privacy, the right to deletion, the right to redaction, the right to stop the processing. That’s the charter and the mission of the company,” he told TechCrunch.

You begin by defining your data sources, then a bot goes out and gathers customer data across all of the data sources you have defined. The company has links to more than 250 common modern and legacy data sources out of the box. Once the bot grabs the data and creates a central record, humans come in to review the results and make any adjustments and final decisions on how to handle a data request.

It has a number of security templates for different kinds of privacy regulations, such as GDPR and CCPA, and the bot finds data that must meet these requirements and lets the governance team see how many records could be in violation or meet a set of criteria you define.

Securiti.ai data view. Screenshot: Securiti.ai (cropped)

There are a number of tools in the package, including ways to look at your privacy readiness, vendor assessments, data maps and data breaches to look at data privacy in broad way.

The company launched in 2019, and in just five months has already grown to 185 employees, a number that is expected to increase in the next year with the new funding.

Powered by WPeMatico

What if it was easier to eat salad than junk food? Most diet routines take a ton of time, whether you’re cooking from scratch, making a meal kit or seeking a nutritious restaurant. But on-demand prepared food delivery companies like Sprig that tried to eliminate that work have gone bankrupt from poor unit economics.

Thistle is a different type of food startup. It delivers thrice-weekly cooler bags customized with meat-optional, plant-based breakfasts, lunches, dinners, snacks, sides and juices. By batching deliveries in the less-congested early morning hours and optimizing routes to its subscribers, or by mailing weekly boxes beyond its own geographies, Thistle makes sure you already have your food the moment you’re hungry. Whether you heat them up or eat them straight out of the fridge, you’re actually dining faster than you could even place an Uber Eats order.

The food on Thistle’s constantly rotating menu is downright tasty. You might get a sunrise chia parfait for breakfast, a chicken tropical mango salad for lunch, a microwaveable bulgogi noodle bowl for dinner, with beet hummus and kale-cucumber juice for snacks. Thistle’s not cheap, with meals averaging about $14 each. But compared to competitors’ on-demand delivery markups and service fees, wasting ingredients from the grocer and the hours of cooking for yourself, it can be a good deal for busy people.

“We see Thistle as part of a movement to make health convenient rather than a high willpower chore,” CEO Ashwin Cheriyan tells me. What Peloton did to shave time off getting a great workout, Thistle does for eating a nourishing meal. It makes the right choice the easiest choice.

Thistle COO Shiri Avnery and CEO Ashwin Cheriyan with their daughter

The idea of a button you can push to make you healthier has attracted a new $5.65 million Series A round for Thistle led by its first institutional investor, PowerPlant Ventures . Bringing the startup to $15 million in funding, the cash will expand Thistle’s delivery domain. Dan Gluck of PowerPlant, which has also funded food break-outs like Beyond Meat, Thrive Market and Rebbl, will join the board.

Currently Thistle delivers in-person to the Bay Area, LA metro, San Diego and Sacramento while shipping to most of Washington, Oregon, Utah, Idaho, Nevada and Arizona. Thistle actually held off on raising more since launching in 2013 to make sure it hammered out unit economics to prevent an implosion. It’s also planning broader meal options, additional product lines and fresh distribution strategies like getting stocked in office smart kitchens or subsidized by wellness plans.

“The reasons that so many food delivery companies have failed likely fall into two buckets: one, a lack of focus on margins and unit economics, and two, premature geographic expansion before proving out the business model,” says Cheriyan. “Thistle makes money similar to how a well-run restaurant would make money — by having strong gross margins, efficient customer acquisition costs and solid customer retention / lifetime metrics. We currently deliver tens of thousands of meals on a weekly basis to customers on the West Coast and our annual average growth rate since launch has been 100%+.”

It’s nice that Thistle hasn’t gone out of business, because I’ve been eating its salads 6X a week for three years. It’s been the most efficient way for me to get healthier and lose weight after a half-decade of ordering takeout sandwiches and then feeling sluggish all day. I legitimately look forward to each one since they often have 20+ ingredients and only repeat every few months, so they’re never boring.

It has helped me keep my work-from-home lunches to about 20 minutes so I have more time for writing. Thistle is one of the few startups I consistently recommend to people. When asked how I lost 25lbs before my wedding, I point to Peloton cycling, Future remote personal training and Thistle salads — none of which require me to leave the house.

Cheriyan tells me, “We wanted the better-for-you and better-for-planet choice to be the default choice.”

Thistle has already pivoted past the business model burning tons of cash across the startup world. The company started as an on-demand cold-pressed juice delivery service, sending hipster glass bottles of watermelon and charcoal extract to doors around San Francisco. It was 2013, yoga was booming and people were paying crazily high prices for liquified lemongrass. Health made simple seemed like a sure bet to the founding team of Alap Shah, Naman Shah, Sheel Mohnot and Johnny Hwin, some of whom run Studio Management, a family office and startup incubator. [Disclosure: Hwin and Alap Shah are friends of mine, but didn’t pitch or discuss this article with me.]

Thistle eventually straightened things out with a shift to subscriptions and batched delivery under the leadership of the newly added co-founders, Cheriyan and his wife and COO Shiri Avnery. “I came from a family of physicians — both my parents, brother, and enough aunts, uncles, and cousins are doctors that they could start a small hospital,” Cheriyan, a former corporate attorney in M&A tells me. “A common point of frustration was about patients suffering from diet-related illnesses who were unable to make a lifestyle change because it was too hard.”

Avnery, a PhD in air pollution and climate change’s impact on agriculture, had become exasperated with the slow pace of policy change and the inaction of governments and corporations. The two quit their jobs, moved to San Francisco, and searched for a point of leverage for positively influencing people’s diets and interaction with the environment. They teamed up with the founders and launched Thistle v1.

A lack of experience in logistics led to the initial detour into on-demand. But rather than trying to fix the problem with VC money, Thistle stayed lean and discovered the opportunity nestled between Uber Eats and Blue Apron: sending people food they don’t have to eat now, but that takes low or no time to prepare when they’re peckish. Through its app, users can customize their meal plans, ban their allergens, pause deliveries and see what they’ll eat next.

A sample of Thistle 8 meal plans

“The unit economics problem most heavily plagued the early on-demand food companies. Food / labor waste and inefficient deliveries were likely the biggest reasons why the economics were unsustainable without venture life support. We know this personally as Thistle started our delivery service as an on-demand company before quickly realizing that the unit economics couldn’t sustain a healthy business,” Cheriyan explains, regarding companies like Sprig, DoorDash and Grubhub. Beyond unsold food, “the margins very likely did not support ordering a $12-$15 single meal for immediate delivery when average hourly driver wages reached $18-20.”

Meal kits were supposed to make dining healthier and cheaper, but they proved too much of a chore and led customers to boxes of ingredients piling up unused. Munchery and Nomiku went out of business while giants like Blue Apron have incinerated hundreds of millions of dollars and seen their share prices sink.

“The meal kit companies fared a little better from a gross margin perspective (due to pre-orders and more efficient deliveries), but suffer most from an easy-to-copy business model. This led to a rise in copycats, and, as a result, heavily rising customer acquisition costs, low switching costs and poor retention,” Cheriyan tells me. “Fundamentally the meal kit companies face another challenge, which is that people have less and less time to cook and are increasingly looking for ready-to-eat options.”

A slower, steadier approach with less overhead, more convenience and fewer direct competitors has helped Thistle grow to 400 employees, from culinary to engineering to logistics.

Still, it’s vulnerable. It may still be too expensive for some markets and demographics. Logistics experts like Amazon and Whole Foods could try to barge into the market. Cloud kitchens without dining rooms are making restaurant food more affordable for delivery. And another startup could always take the gamble on raising a ton of cash and subsidizing prices to steal market share, especially where Thistle doesn’t operate yet.

Thistle could counter these threats by further eliminating delivery costs by selling through partners like office smart fridges where employees pay on the spot, or equipping gym lobbies with more than just Muscle Milk.

“One opportunity we’re excited to test is attended and unattended retail — it would be great to be able to pick up Thistle products at your local grocery store, gym or coffee shop,” Cheriyan says. As for offices, “Today’s corporate lunchtime solutions often require a trade-off between health and convenience: either wait in line for 30+ minutes at your favorite salad spot for a healthy option, or opt into catered restaurant meals that leave you feeling sluggish and unproductive.” Thistle could help employers prevent the 3pm energy lull.

The startup’s focus on plant-forward meals also centers it in the path of another megatrend: the shift to environmentally conscious diets. Almost 60% of Americans are trying to eat less meat and 50% are eating meat-alternatives like Impossible Burgers. That stems both from interest in the humane treatment of animals and how 15% of green house emissions come from livestock. But 45% of Americans say they hate to cook. That’s why Thistle makes pre-made meals where meat and egg are optional, but the food is healthy and delicious without them.

In the age of Uber, we’ve acclimated to an effortless life. The new wave of “push-button health” startups like Thistle could finally take the hassle out of aligning your actions in the gym or kitchen with your intentions.

Powered by WPeMatico

We are living through one of the nation’s longest periods of economic growth. Unfortunately, the good times can’t last forever. A recession is likely on the horizon, even if we can’t pinpoint exactly when. Founders can’t afford to wait until the midst of a downturn to figure out their game plans; that would be like initiating swim lessons only after getting dumped in the open ocean.

When recession inevitably strikes, it will be many founders’ — and even many VCs’ — first experiences navigating a downturn. Every startup executive needs a recession playbook. The time to start building it is now.

While recessions make running any business tough, they don’t necessitate doom. I co-founded two separate startups just before downturns struck, yet I successfully navigated one through the 2000 dot-com bust and the second through the 2008 financial crisis. Both companies not only survived but thrived. One went public and the second was acquired by Mastercard.

I hope my lessons learned prove helpful to building your own recession game plan.

Powered by WPeMatico

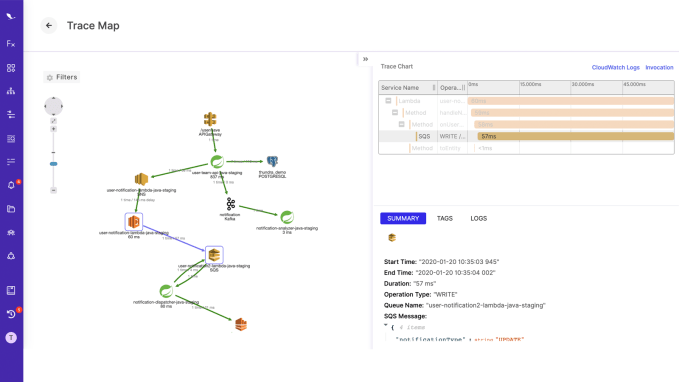

Thundra, an early-stage serverless tooling startup, announced a $4 million Series A today led by Battery Ventures. The company spun out from Opsgenie after it was sold to Atlassian for $295 million in 2018.

York IE, Scale X Ventures and Opsgenie founder Berkay Mollamustafaoglu also participated in the round. Battery’s Neeraj Agarwal is joining the company’s board under the terms of the agreement.

The startup also announced that it had recently hired Ken Cheney as CEO, with technical founder Serkan Ozal becoming CTO.

Originally, Thundra helped run the serverless platform at Opsgenie. As a commercial company, it helps monitor, debug and secure serverless workloads on AWS Lambda. These three tasks could easily be separate tools, but Cheney says it makes sense to include them all because they are all related in some way.

“We bring all that together and provide an end-to-end view of what’s happening inside the application, and this is what really makes Thundra unique. We can actually provide a high-level distributed view of that constantly changing application that shows all of the components of that application, and how they are interrelated and how they’re performing. It can also troubleshoot down to the local service, as well as go down into the runtime code to see where the problems are occurring and let you know very quickly,” Cheney explained.

He says that this enables developers to get this very detailed view of their serverless application that otherwise wouldn’t be possible, helping them concentrate less on the nuts and bolts of the infrastructure, the reason they went serverless in the first place, and more on writing code.

Serverless trace map in Thundra. Screenshot: Thundra

Thundra is able to do all of this in a serverless world, where there isn’t a fixed server and resources are ephemeral, making it difficult to identity and fix problems. It does this by installing an agent at the Lambda (AWS’ serverless offering) level on AWS, or at runtime on the container at the library level, he said.

Battery’s Neeraj Agarwal says having invested in Opsgenie, he knew the engineering team and was confident in the team’s ability to take it from internal tool to more broadly applicable product.

“I think it has to do with the quality of the engineering team that built Opsgenie. These guys are very microservices-oriented, very product-oriented, so they’re very quick at iterating and developing products. Even though this was an internal tool I think of it as very much productized, and their ability to now sell it to the broader market is very exciting,” he said.

The company offers a free version, then tiered pricing based on usage, storage and data retention. The current product is a cloud service, but it plans to add an on-prem version in the near future.

Powered by WPeMatico

Snyk, the company that wants to help developers secure their code as part of the development process, announced a $150 million investment today. The company indicated the investment brings its valuation to more than $1 billion (although it did not share the exact figure).

Today’s round was led by Stripes, a New York City investment firm, with help from Coatue, Tiger Global, BoldStart,Trend Forward, Amity and Salesforce Ventures. The company reports it has now raised more than $250 million.

The idea behind Snyk is to fit security firmly in the development process. Rather than offloading it to a separate team, something that can slow down a continuous development environment, Snyk builds in security as part of the code commit.

The company offers an open-source tool that helps developers find open-source vulnerabilities when they commit their code to GitHub, Bitbucket, GitLab or any CI/CD tool. It has built up a community of more than 400,000 developers with this approach.

Snyk makes money with a container security product, and by making available to companies as a commercial product the underlying vulnerability database they use in the open-source product.

CEO Peter McKay, who came on board last year as the company was making a move to expand into the enterprise, says the open-source product drives the revenue-producing products and helped attract this kind of investment. “Getting to [today’s] funding round was the momentum in the open source model from the community to freemium to [land] and expand — and that’s where we are today,” he told TechCrunch.

He said the company wasn’t looking for this money, but investors came knocking and gave them a good offer, based on Snyk’s growing market momentum. “Investors said we want to take advantage of the market, and we want to make sure you can invest the way you want to invest and take advantage of what we all believe is this very large opportunity,” McKay said.

In fact, the company has been raising money at a rapid clip since it came out of the gate in 2016 with a $3 million seed round. A $7 million Series A and $22 million Series B followed in 2018, with a $70 million Series C last fall.

The company reports over 4X revenue growth in 2019 (without giving exact revenue figures), and some major customer wins, including the likes of Google, Intuit, Nordstrom and Salesforce. It’s worth noting that Salesforce thought enough of the company that it also invested in this round through its Salesforce Ventures investment arm.

Powered by WPeMatico

As the global cybersecurity market becomes increasingly crowded, the Start Up Nation remains a bulwark of innovation and opportunity generation for investors and global cyber companies alike. It achieved this chiefly in 2019 by adapting to the industry’s competitive developments and pushing forward its most accomplished entrepreneurs in larger numbers to meet them.

New data illustrates how Israeli entrepreneurs have seized on the country’s reputation for building radically cutting-edge technologies as the number of new Israeli cybersecurity startups addressing nascent sectors eclipses its more traditional counterparts. Moreover, related findings highlight how cybersecurity companies looking to expand beyond their traditional offerings are entering Israel’s cybersecurity ecosystem in larger numbers through highly strategic acquisitions.

Broadly, new findings also reveal the Israeli cybersecurity market’s overall coming of age, seasoned entrepreneurial dominance and greater appetite for longer-term visions and strategies — the latter of which received record-breaking investor backing in 2019.

Powered by WPeMatico

SpinLaunch, a company that aims to turn the launch industry on its head with a wild new concept for getting to orbit, has raised a $35M round B to continue its quest. The team has yet to demonstrate their kinetic launch system, but this year will be the year that changes, they claim.

TechCrunch first reported on SpinLaunch’s ambitious plans in 2018, when the company raised its previous $35 million, which combined with $10M it raised prior to that and today’s round comes to a total of $80M. With that kind of money you might actually be able to build a space catapult.

The basic idea behind SpinLaunch’s approach is to get a craft out of the atmosphere using a “rotational acceleration method” that brings a craft to escape velocity without any rockets. While the company has been extremely tight-lipped about the details, one imagines a sort of giant rail gun curled into a spiral, from which payloads will emerge into the atmosphere at several thousand miles per hour — weather be damned.

Naturally there is no shortage of objections to this method, the most obvious of which is that going from an evacuated tube into the atmosphere at those speeds might be like firing the payload into a brick wall. It’s doubtful that SpinLaunch would have proceeded this far if it did not have a mitigation for this (such as the needle-like appearance of the concept craft) and other potential problems, but the secretive company has revealed little.

The time for broader publicity may soon be at hand, however: the funds will be used to build out its new headquarter and R&D facility in Long Beach, but also to complete its flight test facility at Spaceport America in New Mexico.

“Later this year, we aim to change the history of space launch with the completion of our first flight test mass accelerator at Spaceport America,” said founder and CEO Jonathan Yaney in a press release announcing the funding.

Lowering the cost of launch has been the focus of some of the most successful space startups out there, and SpinLaunch aims to leapfrog their cost savings by offering orbital access for under $500,000. First commercial launch is targeted for 2022, assuming the upcoming tests go well.

The funding round was led by previous investors Airbus Ventures, GV, and KPCB, as well as Catapult Ventures, Lauder Partners, John Doerr and Byers Family.

Powered by WPeMatico

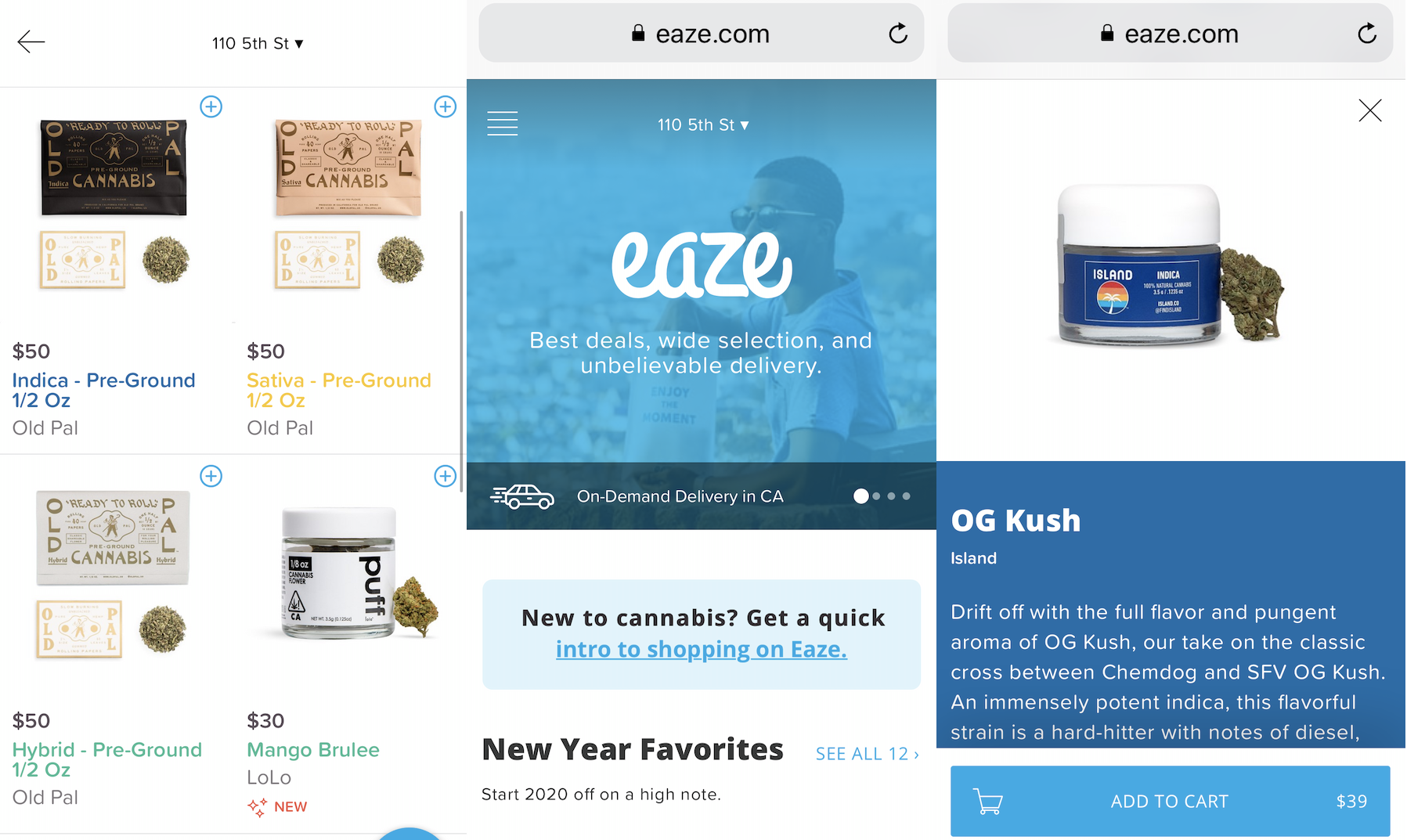

The first cannabis startup to raise big money in Silicon Valley is in danger of burning out. TechCrunch has learned that pot delivery middleman Eaze has seen unannounced layoffs, and its depleted cash reserves threaten its ability to make payroll or settle its AWS bill. Eaze was forced to raise a bridge round to keep the lights on as it prepares to attempt major pivot to ‘touching the plant’ by selling its own marijuana brands through its own depots.

TechCrunch spoke with nine sources with knowledge of Eaze’s struggles to piece together this report. If Eaze fails, it could highlight serious growing pains amid the ‘green rush’ of startups into the marijuana business.

Eaze, the startup backed by some $166 million in funding that once positioned itself as the “Uber of pot” — a marketplace selling pot and other cannabis products from dispensaries and delivering it to customers — has recently closed a $15 million bridge round, according to multiple source. The funding was meant to keep the lights on as Eaze struggles to raise its next round of funding amid problems with making decent margins on its current business model, lawsuits, payment processing issues, and internal disorganization.

An Eaze spokesperson confirmed that the company is low on cash. Sources tell us that the company, which laid off some 30 people last summer, is preparing another round of cuts in the meantime. The spokesperson refused to discuss personnel issues but noted that there have been layoffs at many late stage startups as investors want to see companies cut costs and become more efficient.

From what we understand, Eaze is currently trying to raise a $35 million Series D round according to its pitch deck. The $15 million bridge round came from unnamed current investors. (Previous backers of the company include 500 Startups, DCM Ventures, Slow Ventures, Great Oaks, FJ Labs, the Winklevoss brothers, and a number of others.) Originally, Eaze had tried to raise a $50 million Series D, but the investor that was looking at the deal, Athos Capital, is said to have walked away at the eleventh hour.

Eaze is going into the fundraising with an enterprise value of $388 million, according to company documents reviewed by TechCrunch. It’s not clear what valuation it’s aiming for in the next round.

An Eaze spokesperson declined to discuss fundraising efforts but told TechCrunch, “The company is going through a very important transition right now, moving to becoming a plant-touching company through acquisitions of former retail partners that will hopefully allow us to more efficiently run the business and continue to provide good service to customers.

The news comes as Eaze is hoping to pull off a “verticalization” pivot, moving beyond online storefront and delivery of third-party products (rolled joints, flower, vaping products and edibles) and into sourcing, branding and dispensing the product directly. Instead of just moving other company’s marijuana brands between third-party dispensaries and customers, it wants to sell its own in-house brands through its own delivery depots to earn a higher margin. With a number of other cannabis companies struggling, the hope is that it will be able to acquire brands in areas like marijuana flower, pre-rolled joints, vaporizer cartridges, or edibles at low prices.

An Eaze spokesperson confirmed that the company plans to announce the pivot in the coming days, telling TechCrunch that it’s “a pretty significant change from provider of services to operating in that fashion but also operating a depot directly ourselves.”

The startup is already making moves in this direction, and is in the process of acquiring some of the assets of a bankrupt cannabis business out of Canada called Dionymed — which had initially been a partner of Eaze’s, then became a competitor, and then sued it over payment disputes, before finally selling part of its business. These assets are said to include Oakland dispensary Hometown Heart, which it acquired in an all-share transaction (“Eaze effectively bought the lawsuit,” is how one source described the sale). This will become Eaze’s first owned delivery depot.

In a recent presentation deck that Eaze has been using when pitching to investors — which has been obtained by TechCrunch — the company describes itself as the largest direct-to-consumer cannabis retailer in California. It has completed more than 5 million deliveries, served 600,000 customers and tallied up an average transaction value of $85.

To date, Eaze has only expanded to one other state beyond California, Oregon. Its aim is to add five more states this year, and another three in 2021. But the company appears to have expected more states to legalize recreational marijuana sooner, which would have provided geographic expansion. Eaze seems to have overextended itself too early in hopes of capturing market share as soon as it became available.

An employee at the company tells us that on a good day Eaze can bring in between $800,000 and $1 million in net revenue, which sounds great, except that this is total merchandise value, before any cuts to suppliers and others are made. Eaze makes only a fraction of that amount, one reason why it’s now looking to verticatlize into more of a primary role in the ecosystem. And that’s before considering all of the costs associated with running the business.

Eaze is suffering from a problem rampant in the marijuana industry: a lack of working capital. Since banks often won’t issue working capital loans to weed-related business, deliverers like Eaze can experience delays in paying back vendors. Another source says late payments have pushed some brands to stop selling through Eaze.

Another drain on its finances have been its marketing efforts. A source said out-of-home ads (billboards and the like) allegedly were a significant expense at one point. It has to compete with other pot purchasing options like visiting retail stores in person, using dispensaries’ in-house delivery services, or buying via startups like Meadow that act as aggregated online points of sale for multiple dispensaries.

Indeed, Eaze claims that its pivot into verticalization will bring it $204 million in revenues on gross transactions of $300 million. It notes in the presentation that it makes $9.04 on an average sale of $85, which will go up to $18.31 if it successfully brings in ‘private label’ products and has more depot control.

The poor margins are only one of the problems with Eaze’s current business model, which the company admits in its presentation have led to an inconsistent customer experience and poor customer affinity with its brand — especially in the face of competition from a number of other delivery businesses.

Playing on the on-demand, delivery-of-everything theme, it connected with two customer bases. First, existing cannabis consumers already using some form of delivery service for their supply; and a newer, more mainstream audience with disposable income that had become more interested in cannabis-related products but might feel less comfortable walking into a dispensary, or buying from a black market dealer.

It is not the only startup that has been chasing that audience. Other competitors in the wider market for cannabis discovery, distribution and sales include Weedmaps, Puffy, Blackbird, Chill (a brand from Dionymed that it founded after ending its earlier relationship with Eaze), and Meadow, with the wider industry estimated to be worth some $11.9 billion in 2018 and projected to grow to $63 billion by 2025.

Eaze was founded on the premise that the gradual decriminalisation of pot — first making it legal to buy for medicinal use, and gradually for recreational use — would spread across the US and make the consumption of cannabis-related products much more ubiquitous, presenting a big opportunity for Eaze and other startups like it.

It found a willing audience among consumers, but also tech workers in the Bay Area, a tight market for recruitment.

“I was excited for the opportunity to join the cannabis industry,” one source said. “It has for the most part has gotten a bad rap, and I saw Eaze’s mission as a noble thing, and the team seemed like good people.”

Eaze CEO Ro Choy

That impression was not to last. The company, this employee was told when joining, had plenty of funding with more on the way. The newer funding never materialised, and as Eaze sought to figure out the best way forward, the company cycled through different ideas and leadership: former Yammer executive Keith McCarty, who cofounded the company with Roie Edery (both are now founders at another Cannabis startup, Wayv), left, and the CEO role was given to another ex-Yammer executive, Jim Patterson, who was then replaced by Ro Choy, who is the current CEO.

“I personally lost trust in the ability to execute on some of the vision once I got there,” the ex-employee said. “I thought that on one hand a picture was painted that wasn’t the truth. As we got closer and as I’d been there longer and we had issues with funding, the story around why we were having issues kept changing.” Several sources familiar with its business performance and culture referred to Eaze as a “shitshow”.

The quick shifts in strategy were a recurring pattern that started well before the company got tight financial straits.

One employee recalled an acquisition Eaze made several years ago of a startup called Push for Pizza. Founded by five young friends in Brooklyn, Push for Pizza had gone viral over a simple concept: you set up your favourite pizza order in the app, and when you want it, you pushed a single button to order it. (Does that sound silly? Don’t forget, this was also the era of Yo, which was either a low point for innovation, or a high point for cynicism when it came to average consumer intelligence… maybe both.)

Eaze’s idea, the employee said, was to take the basics of Push for Pizza and turn it into a weed app, Push for Kush. In it, customers could craft their favourite mix and, at the touch of a button, order it, lowering the procurement barrier even more.

The company was very excited about the deal and the prospect of the new app. They planned a big campaign to spread the word, and held an internal event to excite staff about the new app and business line.

“They had even made a movie of some kind that they showed us, featuring a caricature of Jim” — the CEO at a the time — “hanging out of the sunroof of a limo.” (I’ve been able to find the opening segment of this video online, and the Twitter and Instagram accounts that had been created for Push for Kush, but no more than that.)

Then just one week later, the whole plan was scrapped, and the founders of Push for Pizza fired. “It was just brushed under the carpet,” the former employee said. “No one could get anything out of management about what had happened.”

Something had happened, though: the company had been taking payments by card when it made the acquisition, but the process was never stable and by then it had recently gone back to the cash-only model. Push for Kush by cash was less appealing. “They didn’t think it would work,” the person said, adding that this was the normal course of business at the startup. “Big initiatives would just die in favor of pushing out whatever new thing was on the product team’s radar.”

Eaze’s spokesperson confirmed that “we did acquire Push For Pizza . . but ultimately didn’t choose to pursue [launching Push For Kush].”

Payments were a recurring issue for the startup. Eaze started out taking payments only in cash — but as the business grew, that became increasingly problematic. The company found itself kicked off the credit card networks and was stuck with a less traceable, more open to error (and theft) cash-only model at a time when one employee estimated it was bringing in between $800,000 and $1 million per day in sales.

Eventually, it moved to cards, but not smoothly: Visa specifically did not want Eaze on its platform. Eaze found a workaround, employees say, but it was never above board, which became the subject of the lawsuit between Eaze and Dionymed. Currently the company appear to only take payments via debit cards, ACH transfer, and cash, not credit card.

Another incident sheds light on how the company viewed and handled security issues.

At one point, employees allegedly discovered that Eaze was essentially storing all of its customer data — including users’ signatures and other personal information — in an Azure bucket that was not secured, meaning that if anyone was nosing around, it could be easily discovered and exploited.

The vulnerability was brought to the company’s attention. It was something that was up to product to fix, but the job was pushed down the list. It ultimately took seven months to patch this up. “I just kept seeing things with all these huge holes in them, just not ready for prime time,” one ex-employee said of the state of products. “No one was listening to engineers, and no one seemed to be looking for viable products.” Eaze’s spokesperson confirms a vulnerability was discovered but claims it was promptly resolved.

Today, the issue is a more pressing financial one: the company is running out of money. Employees have been told the company may not make its next payroll, and AWS will shut down its servers in two days if it doesn’t pay up.

Eaze’s spokesperson tried to remain optimistic while admitting the dire situation the company faces. “Eaze is going to continue doing everything we can to support customers and the overall legal cannabis industry. We’re excited about the future and acknowledge the challenges that the entire community is facing.”

As medicinal and recreational marijuana access became legal in some states in the latter 2010s, entrepreneurs and investors flocked to the market. They saw an opportunity to capitalize on the end of a major prohibition — a once in a lifetime event. But high government taxes, enduring black markets, intense competition, and a lack of financial infrastructure willing to deal with any legal haziness have caused major setbacks.

While the pot business might sound chill, operations like Eaze depend on coordinating high-stress logistics with thin margins and little room for error. Plenty of food delivery startups from Sprig to Munchery went under after running into similar struggles, and at least banks and payment processors would work with them. With the odds stacked against it, Eaze has a tough road ahead.

Powered by WPeMatico

The last few years have seen many cities ban plastic bags, plastic straws and other common forms of waste, giving environmentally conscious alternatives a huge boost — among them Loliware, purveyor of fine disposable goods created from kelp. Huge demand and smart sourcing has attracted a big first funding round.

I covered Loliware early on when it was one of the first companies to be invested in by the Ocean Solutions Accelerator, a program started in 2017 by the nonprofit Sustainable Ocean Alliance. Founder Chelsea “Sea” Briganti told me about the new funding on the SOA’s strange yet quite successful “Accelerator at Sea” program late last year.

The company makes straws primarily, with other products planned, out of kelp matter. Kelp, if you’re not familiar, is a common type of aquatic algae (also called seaweed) that can grow quite large and is known for its robustness. It also grows in vast, vast quantities in many coastal locations, creating “kelp forests” that sustain entire ecosystems. Intelligent stewardship of these fast-growing kelp stocks could make them a significantly better source than corn or paper, which are currently used to create most biodegradable straws.

A proprietary process turns the kelp into straws that feel plastic-like but degrade simply (and not in your hot drink — it can stand considerably more exposure than corn and paper-based straws). Naturally the taste, desirable in some circumstances but not when drinking a seltzer, is also removed.

It took a lot of R&D and fine-tuning, Briganti told me:

“None of this has ever been done before. We led all development from material technology to new-to-world engineering of machinery and manufacturing practices. This way we ensure all aspects of the product’s development are truly scalable.”

They’ve gone through more than a thousand prototypes and are continuing to iterate as advances make possible things like higher flexibility or different shapes.

“Ultimately our material is a massive departure from the paradigms with which other companies are approaching the development of biodegradable materials,” she said. “They start with a problematic, last-forever, fossil fuel-derived paradigm and try to make it not so bad — this is step-change development and too slow and frumpy to truly make an impact.”

Of course it doesn’t matter how good your process is if no one is buying it, a fact that plagues many ethics-first operations, but in fact demand has grown so fast that Loliware’s biggest challenge has been scaling to meet it. The company has gone from a few million to a hundred million in recent years to a projected billion straws shipping in 2020.

“It takes us about 12 months to get to full automation [from the lab],” she said. “Once we get to full automation, we license the tech to a strategic plastic or paper manufacturer. Meaning, we do not manufacture billions of straws, or anything, in-house.”

It makes sense, of course, just as contracting out your PCB or plastic mold or what have you. Briganti wanted to have global impact, and that requires taking advantage of global infrastructure that’s already there.

Lastly, the consideration of a sustainable ecosystem was always important to Briganti, as the whole company is founded on the idea of reducing waste and using fundamentally ethical processes.

“Our products utilize a super-sustainable supply of seaweed, a supply that is overseen and regulated by local governments,” Briganti said. “In 2020, Loliware will launch the first-ever Algae Sustainability Council (ASC), which allows us to be at the helm of the design of these new global seaweed supply chain systems as well as establishing the oversight, ensuring sustainable practices and equitability. We are also pioneering what we have coined the ‘Zero Waste Circular Extraction Methodology,’ which will be a new paradigm in seaweed processing, utilizing every component of the biomass as it suggests.”

The $5.9 million “super seed” round has many investors, including several who were on board the ship in Alaska for the Accelerator at Sea this past October (as SOA Seabird Ventures). The CEO of Blue Bottle Coffee has invested, as have New York Ventures, Magic Hour, For Good VC, Hatzimemos/Libby, Geekdom Fund, HUmanCo VC, CityRock and Closed Loop Partners.

The money will be used for scaling and further R&D; Loliware plans to launch several new straw types (like a bent straw for juice boxes), a cup and a new utensil. 2020 may be the year you start seeing the company’s straws in your favorite coffee shop rather than a few early adopters here and there. You can keep track of where they can be found here at the company’s website.

Powered by WPeMatico

Epsagon, an Israeli startup that wants to help monitor modern development environments like serverless and containers, announced a $16 million Series A today.

U.S. Venture Partners (USVP), a new investor, led the round. Previous investors Lightspeed Venture Partners and StageOne Ventures also participated. Today’s investment brings the total raised to $20 million, according to the company.

CEO and co-founder Nitzan Shapira says that the company has been expanding its product offerings in the last year to cover not just its serverless roots, but also provide deeper insights into a number of forms of modern development.

“So we spoke around May when we launched our platform for microservices in the cloud products, and that includes containers, serverless and really any kind of workload to build microservices apps. Since then we have had a few significant announcements,” Shapira told TechCrunch.

For starters, the company announced support for tracing and metrics for Kubernetes workloads, including native Kubernetes, along with managed Kubernetes services like AWS EKS and Google GKE. “A few months ago, we announced our Kubernetes integration. So, if you’re running any Kubernetes workload, you can integrate with Epsagon in one click, and from there you get all the metrics out of the box, then you can set up a tracing in a matter of minutes. So that opens up a very big number of use cases for us,” he said.

The company also announced support for AWS AppSync, a no-code programming tool on the Amazon cloud platform. “We are the only provider today to introduce tracing for AppSync and that’s [an area] where people really struggle with the monitoring and troubleshooting of it,” he said.

The company hopes to use the money from today’s investment to expand the product offering further with support for Microsoft Azure and Google Cloud Platform in the coming year. He also wants to expand the automation of some tasks that have to be manually configured today.

“Our intention is to make the product as automated as possible, so the user will get an amazing experience in a matter of minutes, including advanced monitoring, identifying different problems and troubleshooting,” he said

Shapira says the company has around 25 employees today, and plans to double headcount in the next year.

Powered by WPeMatico