funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Simsim, a social commerce startup in India, said on Friday it has raised $16 million in seven months of its existence as it attempts to replicate the offline retail experience in the digital world with help from influencers.

The Gurgaon-based startup said it raised $16 million across seed, Series A and Series B financing rounds from Accel Partners, Shunwei Capital and Good Capital. (The most recent round, Series B, was of $8 million in size.)

“Despite e-commerce players bandying out major discounts, most of the sales in India are still happening in brick-and-mortar stores. There is a simple reason for that: Trust,” explained Amit Bagaria, co-founder of Simsim, in an interview with TechCrunch.

The vast majority of Indians are still not comfortable with reading descriptions — and that too in English, he said.

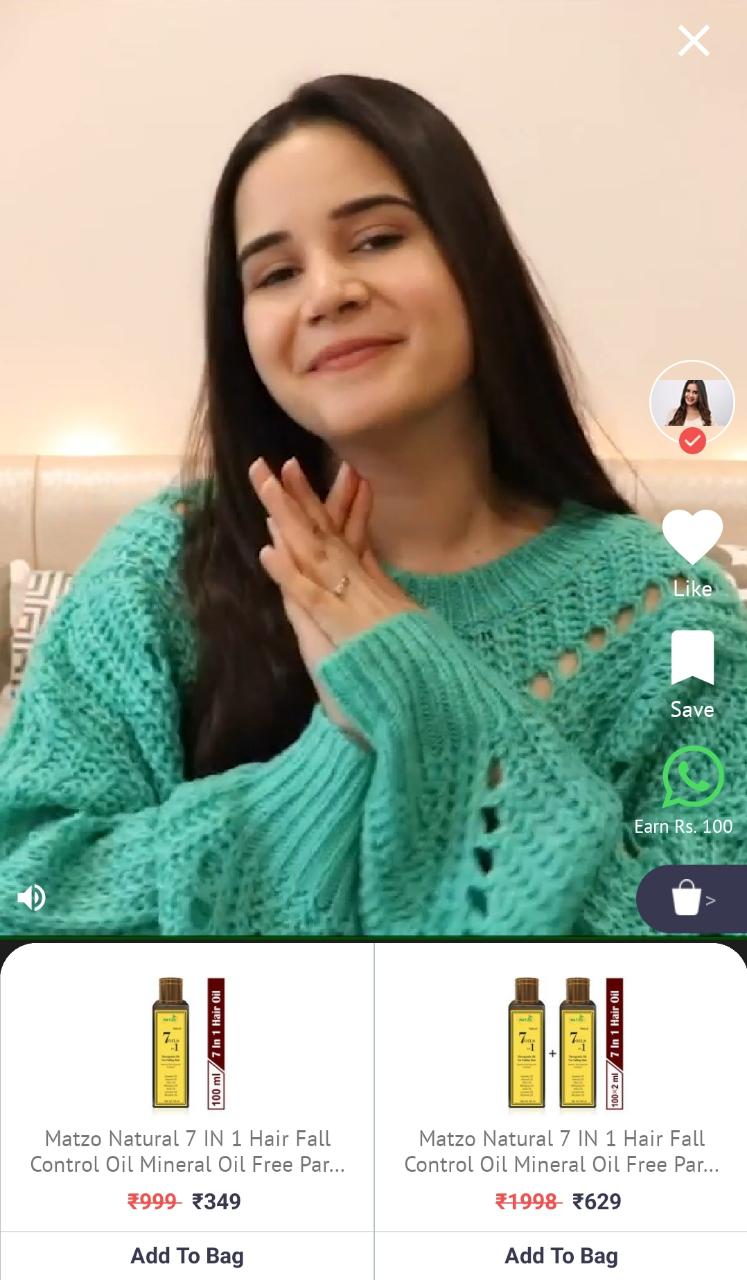

Simsim is taking a different approach to tackle this opportunity. On its app, users watch short-videos produced in local languages by influencers who apply beauty products or try out dresses and explain the ins-and-outs of the products. Below the video, the items appear as they are being discussed and users can tap on them to proceed with the purchase.

“Videos help in educating users about the category. So many of them may not have used face masks, for instance. But it becomes easier when the community influencer is able to show them how to apply it,” said Rohan Malhotra, managing partner at Good Capital, in an interview with TechCrunch.

Influencers typically sell a range of items and users can follow them to browse through the past catalog and stay on top of future sales, said Bagaria, who previously worked at the e-commerce venture of financial services firm Paytm .

“This interactiveness is enabling Simsim to mimic the offline stores experience,” said Malhotra, who is one of the earliest investors in Meesho, also a social commerce startup that last year received backing from Facebook and Prosus Ventures.

“The beauty to me of social commerce is that you’re not changing consumer behavior. People are used to consuming on WhatsApp — and it’s working for Meesho. Over here, you are getting the touch and feel experience and are able to mentally picture the items much clearer,” he said.

Simsim handles the inventories, which it sources from manufacturers and brands, and it works with a number of logistics players to deliver the products.

“Several Indian cities and towns are some of the biggest production hubs of various high-quality items. But these people have not been able to efficiently sell online or grow their network in the offline world. On Simsim, they are able to work with influencers and market their products,” said Bagaria.

The platform today works with more than 1,200 influencers, who get a commission for each item they sell, said Bagaria, who plans to grow this figure to 100,000 in the coming years.

Even as Simsim, which has been open to users for six months, is still in its nascent stage, it is beginning to show some growth. It has amassed over a million users, most of whom live in small cities and towns, and it is selling thousands of items each day, said Bagaria.

He said the platform, which currently supports Hindi, Tamil, Bengali and English, will add more than a dozen additional languages by the end of the year. In about a month, Simsim also plans to start showing live videos, where influencers will be able to answer queries from users.

A handful of startups have emerged in India in recent years that are attempting to rethink the e-commerce market in the nation. Amazon and Walmart, both of which have poured billions of dollars in India, have taken a notice too. Both of them have added support for Hindi in the last two years and have made several more tweaks to their platforms to expand their reach.

Powered by WPeMatico

Moving data to the cloud from an on-prem data warehouse like Teradata is a hard problem to solve, especially if you’ve built custom applications that are based on that data. Datometry, a San Francisco startup, has developed a solution to solve that issue, and today it announced a $17 million Series B investment.

WRVI Capital led the round with participation from existing investors including Amarjit Gill, Dell Technologies Capital, Redline Capital and Acorn Pacific. The company has raised a total of $28 million, according to Crunchbase data.

The startup is helping move data and applications — lock, stock and barrel — to the cloud. For starters, it’s focusing on Teradata data warehouses and applications built on top of that because it’s a popular enterprise offering, says Mike Waas CEO and co-founder at the company.

“Pretty much all major enterprises are struggling right now with getting their data into the cloud. At Datometry, we built a software platform that lets them take their existing applications and move them over to new cloud technology as is, and operate with cloud databases without having to change any SQL or APIs,” Waas told TechCrunch.

Today, without Datometry, customers would have to hire expensive systems integrators and take months or years rewriting their applications, but Datometry says it has found a way to move the applications to the cloud, reducing the time to migrate from years to weeks or months, by using virtualization.

The company starts by building a new schema for the cloud platform. It supports all the major players including Amazon, Microsoft and Google. It then runs the applications through a virtual database running the schema and connects the old application with a cloud data warehouse like Amazon Redshift.

Waas sees virtualization as the key here as it enables his customers to run the applications just as they always have on prem, but in a more modern context. “Personally I believe that it’s time for virtualization to disrupt the database stack just the way it has disrupted pretty much everything else in the datacenter,” he said.

From there, they can start developing more modern applications in the cloud, but he says that his company can get them to the cloud faster and cheaper than was possible before, and without disrupting their operations in any major way.

Waas founded the company in 2013 and it took several years to build the solution. This is a hard problem to solve, and he was ahead of the curve in terms of trying to move this type of data. As his solution came online in the last 18 months, it turned out to be good timing as companies were suddenly looking for ways to move data and applications to the cloud.

He says he has been able to build a client base of 40 customers with 30 employees because the cloud service providers are helping with sales and walking them into clients, more than they can handle right now as a small startup.

The plan moving forward is to use some of the money from this round to build a partner network with systems integrators to help with implementation so that they can concentrate on developing the product and supporting other data repositories in the future.

Powered by WPeMatico

Model9, an Israeli startup launched by mainframe vets, has come up with a way to transfer data between mainframe computers and the cloud, and today the company announced a $9 million Series A.

Intel Capital led the round with help from existing investors, including StageOne, North First Ventures and Glenrock Israel. The company reports it has now raised almost $13 million.

You may not realize it, but the largest companies in the world, like big banks, insurance companies, airlines and retailers, still use mainframes. These companies require the massive transaction processing capabilities of these stalwart machines, but find it’s difficult to get the valuable data out for more modern analytics capabilities. This is the hard problem that Model9 is attempting to solve.

Gil Peleg, CEO and co-founder at Model9, says that his company’s technology is focused on helping mainframe users get their data to the cloud or other on-prem storage. “Mainframe data is locked behind proprietary storage that is inaccessible to anything that’s happening in the evolving, fast-moving technology world in the cloud. And this is where we come in with patented technology that enables mainframes to read and write data directly to the cloud or any non-mainframe distributed storage system,” Peleg explained.

This has several important use cases. For starters, it can act as a disaster recovery system, eliminating the need to maintain expensive tape backups. It also can move this data to the cloud where customers can apply modern analytics to data that was previously inaccessible.

The company’s solution works with AWS, Google Cloud Platform, Microsoft Azure and IBM’s cloud solution. It also works with other on-prem storage solutions like EMC, Nutanix, NetApp and Hitatchi. He says the idea is to give customers true hybrid cloud options, whether a private cloud or a public cloud provider.

“Ideally our customers will deploy a hybrid cloud topology and benefit from both worlds. The mainframe keeps doing what it should do as a reliable, secure, trusted [machine], and the cloud can manage the scale and the rapidly growing amount of data and provide the new modern technologies for disaster recovery, data management and analytics,” he said.

The company was founded in 2016 and took a couple of years to develop the solution. Today, the company is working with a number of large organizations using mainframes. Peleg says he wants to use the money to expand the sales and marketing operation to grow the market for this solution.

Powered by WPeMatico

MoEngage, a San Francisco and Bangalore-based startup that helps firms better understand their customers and improve their engagement, has raised $25 million in a new financing round as it looks to grow its network in North America and Europe.

The Series C was led by Eight Roads Ventures . F-Prime Capital, Matrix Partners India and Ventureast also participated in the round. The six-year-old startup, which is an Alchemist alum, has raised about $40 million to date.

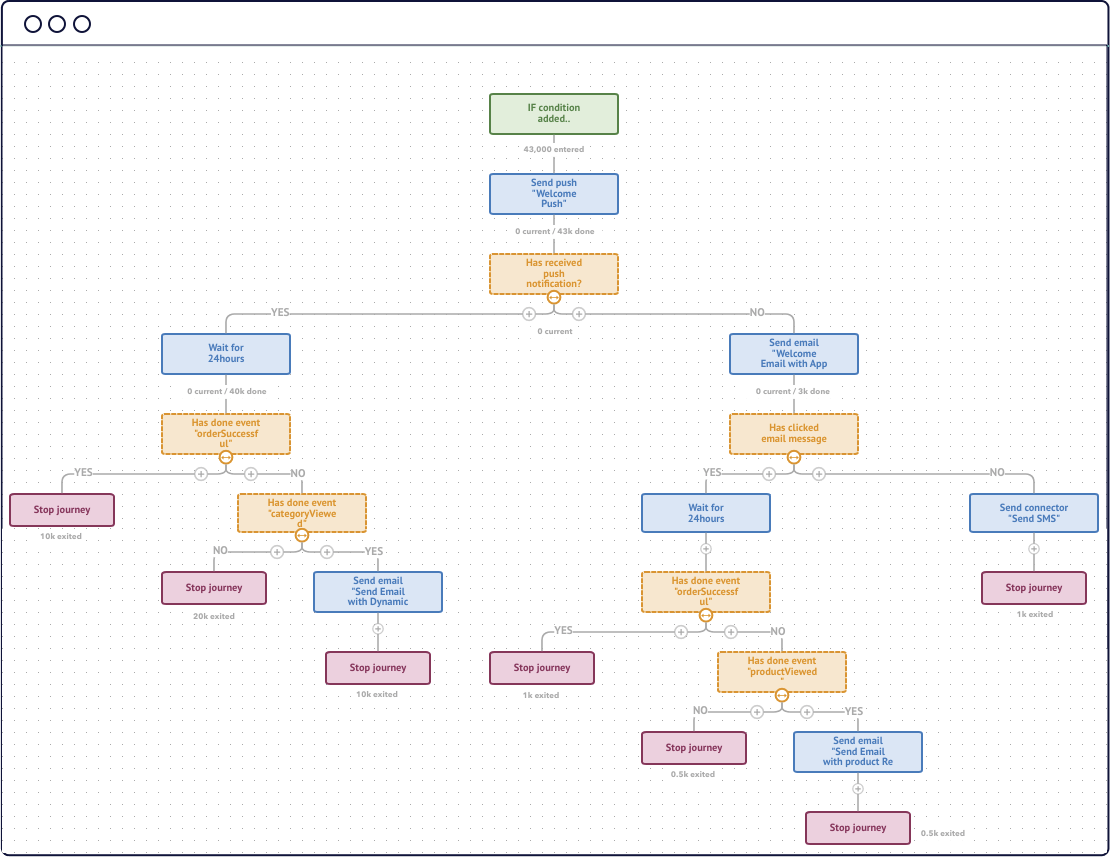

MoEngage offers a product that allows clients to gain deeper insights into the way their customers or users are engaging with their apps and websites. “We can, for instance, tell at what time a customer is using the app,” said Raviteja Dodda, founder and chief executive of MoEngage, in an interview with TechCrunch.

These insights, all displayed on one dashboard, could be very useful for firms to retain their existing customers or find optimized ways to attempt to sell more to them.

“Based on your understanding about the customer, you can send them personalized notifications. Say you’re using a ride-hailing app. The firm would now know how often you use their app and at what time you tend to avail their service. Based on these learnings, they can offer you deals or reminders that could help them improve their conversion rate,” he said.

MoEngage today works with a number of major firms in North America, Europe and Asia. Some of its clients include Deutsche Telekom, CIMB Bank, Travelodge, Samsung, McAfee, Vodafone, retail chain Future Retail, ride-hailing service Ola, budget-hotel operator OYO, grocery delivery startup Bigbasket and music streaming service Gaana.

In total, Dodda said his startup has amassed “hundreds of clients” in over 35 countries and is serving more than 400 million active users for them each month.

“MoEngage, with its differentiated offering, scalable platform and a customer-first approach, will play an important role in enabling us to deliver contextual and relevant communications to our customers and drive higher customer lifetime value,” said Arun Srinivas, chief operating officer at Indian ride-hailing startup Ola, in a statement.

MoEngage, which competes with a handful of startups including India-based Clevertap, will infuse the fresh capital to find more customers in North America and Europe, and scale its product operations, said Dodda.

“What differentiates MoEngage from other engagement platforms is the combination of their ever-evolving AI-enabled customer journey capabilities, industry-best channel reachability and top-notch customer support. We are thrilled to partner with Raviteja and his team as they look to expand globally,” said Shweta Bhatia, Partner at Eight Roads Ventures.

Powered by WPeMatico

Snowflake, the cloud-based data warehouse company, doesn’t tend to do small rounds. On Friday night word leaked out about its latest mega round. This one was for $479 million on a $12.4 billion valuation. That’s triple the company’s previous $3.9 billion valuation from October 2018, and CEO Frank Slootman suggested that the company’s next finance event is likely an IPO.

Dragoneer Investment Group led the round along with new investor Salesforce Ventures. Existing Snowflake investors Altimeter Capital, ICONIQ Capital, Madrona Venture Group, Redpoint Ventures, Sequoia, and Sutter Hill Ventures also participated. The new round brings the total raised to over $1.4 billion, according to PitchBook data.

All of this investment begs the question when this company goes public. As you might expect, Slootman is keeping his cards close to the vest, but he acknowledges that is the next logical step for his organization, even if he is not feeling pressure to make that move right now.

“I think the earliest that we could actually pull that trigger is probably early- to mid-summer timeframe. But whether we do that or not is a totally different question because we’re not in a hurry, and we’re not getting pressure from investors,” he said.

He grants that the pressure is about allowing employees to get their equity out of the company, which can only happen once the company goes public. “The only reason that there’s always a sense of pressure around this is because it’s important for employees, and I’m not minimizing that at all. That’s a legitimate thing. So, you know, it’s certainly a possibility in 2020 but it’s also a possibility the year thereafter. I don’t see it happening any later than that,” he said.

The company’s most recent round prior to this was $450 million in October 2018. Slootman says that he absolutely didn’t need the money, but the capital was there, and the chance to forge a relationship with Salesforce also was key in their thinking in taking this funding.

“At a high level, the relationship is really about allowing Salesforce data to be easily accessed inside Snowflake. Not that it’s impossible to do that today because there are lots of tools that will help you do that, but this relationship is about making that seamless and frictionless, which we find is really important,” Slootman said.

Snowflake now has relationships with AWS, Microsoft Azure and Google Cloud Platform, and has a broad content strategy to have as much quality data (like Salesforce) on the platform. Slootman says that this helps induce a network effect, while helping move data easily between major cloud platforms, a big concern as more companies adopt a multiple cloud vendor strategy.

“One of the key distinguishing architectural aspects of Snowflake is that once you’re on our platform, it’s extremely easy to exchange data with other Snowflake users. That’s one of the key architectural underpinnings. So content strategy induces network effect which in turn causes more people, more data to land on the platform, and that serves our business model,” he said.

Slootman says investors want to be part of his company because it’s solving some real data interchange pain points in the cloud market, and the company’s growth shows that in spite of its size, that continues to attract new customers at high rate.

“We just closed off our previous fiscal year which ended last Friday, and our revenue grew at 174%. For the scale that we are, this by far the fastest growing company out there…So, that’s not your average asset,” he said.

The company has 3400 active customers, which he defines as customers who were actively using the platform in the last month. He says that they have added 500 new customers alone in the last quarter.

Powered by WPeMatico

Snafu Records is bringing a new approach to finding musical talent — founder and CEO Ankit Desai described the Los Angeles-headquartered startup as “the first full-service, AI-enabled record label.”

It’s a world that Desai knows well, having spent the past five years working on digital and streaming strategy at Capitol Records and Universal Music Group. He argued that there’s still a vast pool of musical talent that the record labels are ill-equipped to tap into.

“If there’s some girl in Indonesia whose music the world is dying to hear, they’re never going to get the chance,” he said. “The bridge to connect her to the world doesn’t exist today. The music business is entrenched in a very old way of working, finding artists through word-of-mouth.”

There are other companies like Chartmetric creating software to help the labels scout artists, but Desai said, “I used to be the one buying the service. What always ended up happening was that we were trying to put 21st century technology into a 20th century machine.”

The machine, in other words, is the record label itself. So he decided to create a label of his own — Snafu Records, which is officially launching today.

The startup is also announcing that it has raised $2.9 million in seed funding led by TrueSight Ventures, with participation from Day One Ventures, ABBA’s Agnetha Fältskog, Spotify’s John Bonten, William Morris’ Samanta Hegedus Stewart, Soundboks founder Jesper Theil Thomsen, Headstart.io founder Nicholas Shekerdemian and others.

The Snafu approach, Desai said, uses technology “to essentially turn everyone listening to music into a talent scout on our behalf.”

The company’s algorithms are supposedly looking at around 150,000 tracks from unsigned artists each week on services like YouTube, Instagram and SoundCloud, and evaluating them based on listener engagement, listener sentiment and the music itself — Desai said the sweet spot is to be 70 or 75% similar to the songs on Spotify’s top 200 list, so that the music sounds like what’s already popular, while also doing just enough to “break the mold.”

This analysis is then translated into a score, which Snafu uses to go “from this firehose of music, distill it down to 15 or 20 per week, and then the human [team] gets involved.”

The goal is to sign musicians as Snafu artists, who then get access the company’s industry expertise (including advice from the label’s head of creative Carl Falk, who’s written songs for Madonna, One Direction and Nicki Minaj) and marketing support in exchange for a share of streaming revenue. Desai added that Snafu will share more of the revenue with artists and lock them in for shorter periods of time than a standard record contract.

Asked whether streaming (as opposed to touring or merchandising) will provide enough money for Snafu to build a big business, Desai said, “Economics-wise, streaming sometimes does get a bad rap sometimes. It’s a bit misunderstood — there’s still just as many artists making really, really good numbers through streaming, it’s just a different kind of artist.”

And while Snafu is only officially launching today, it has already signed 16 artists, including the Little Rock-based duo Joan and the jazz musician Mishcatt, whose song “Fade Away” has been streamed 5 million times in the five weeks since it was released.

“There’s a major opportunity for Ankit and the Snafu team to build a new innovative and enduring music label at the intersection of technology and deep industry expertise,” said Hampus Monthan Nordenskjöld, founding partner at TrueSight Ventures, in a statement. “The music industry is going through a tectonic shift and we’re extremely excited to work with Snafu as they redefine what it means to be a music label in the 21st century.”

Powered by WPeMatico

Netskope has always focused its particular flavor of security on the cloud, and as more workloads have moved there, it has certainly worked in its favor. Today the company announced a $340 million investment on a valuation of nearly $3 billion.

Sequoia Capital Global Equities led the round, but in a round this large, there were a bunch of other participating firms, including new investors Canada Pension Plan Investment Board and PSP Investments, along with existing investors Lightspeed Venture Partners, Accel, Base Partners, ICONIQ Capital, Sapphire Ventures, Geodesic Capital and Social Capital. Today’s investment brings the total raised to more than $740 million, according to Crunchbase data.

As with so many large rounds recently, CEO Sanjay Beri said the company wasn’t necessarily looking for more capital, but when brand name investors came knocking, they decided to act. “We did not necessarily need this level of capital but having a large balance sheet and a legendary set of investors like Sequoia, Lightspeed and Accel putting all their chips behind Netskope for the long term to dominate the largest market in security is a very strong signal to the industry,” Beri said.

From the start, Netskope has taken aim at cloud and mobile security, eschewing the traditional perimeter security that was still popular when the company launched in 2012. “Legacy products based on traditional notions of perimeter security have gone obsolete and inhibit the needs of digital businesses. Today’s urgent requirement is security that is fast, delivered from the cloud, and provides real-time protection against network and data threats when cloud services, websites, and private apps are being accessed from anywhere, anytime, on any device,” he explained.

When Netskope announced its $168.7 million round at the end of 2018, the company had a valuation over $1 billion at that time. Today, it announced it has almost tripled that number, with a valuation close to $3 billion. That’s a big leap in just two years, but it reports 80% year-over-year growth, and claims to be “the fastest-growing company at scale in the fastest-growing areas of cybersecurity: secure access server edge (SASE) and cloud security,” according to Beri.

The next natural step for a company at this stage of maturity would be to look to become a public company, but Beri wasn’t ready to commit to that just yet. “An IPO is definitely a possible milestone in the journey, but it’s certainly not limited to that and we’re not in a rush and have no capital needs, so we’re not commenting on timing.”

Powered by WPeMatico

Datree, the early-stage startup building a DevOps policy engine on GitHub, announced an $8 million Series A today. It also announced it has joined the Y Combinator Winter 20 cohort.

Blumberg and TLV Partners led the round with participation from Y Combinator . The company has now raised $11 million with the $3 million seed round announced in 2018.

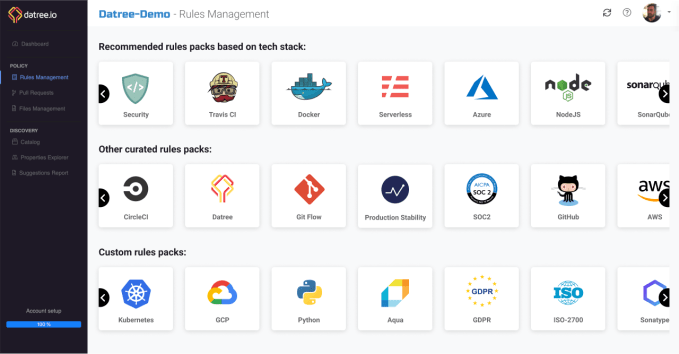

Since that seed round, company co-founder and CEO Shimon Tolts says that the company learned that while scanning code for issues was something DevOps teams found useful, they wanted help defining the rules. So Datree has created a series of rules packages you can run against the code to find any gaps or issues.

“We offer development best practices, coding standards and security and compliance policies. What happens today is that, as you connect to Datree, we connect to your source code and scan the entire code base, and we recommend development best practices based on your technology stack,” Tolts explained.

He says that they build these rules packages based on the company’s own expertise, as well as getting help from the community, and in some cases partnering with experts. For its Docker security package, it teamed up with Aqua Security.

The focus remains on applying these rules in GitHub where developers are working. Before committing the code, they can run the appropriate rules packages against it to ensure they are in compliance with best practices.

Datree rules packages. Screenshot: Datree

Tolts says they began looking at Y Combinator after the seed round because they wanted more guidance on building out the business. “We knew that Y Combinator could really help us because our product is relevant to 95 percent of all YC companies, and the program has helped us go and work on six figure deals with more mature YC companies,” he said.

Datree is working directly with Y Combinator CEO Michael Seibel, and he says being part of the Winter 20 cohort has helped him refine his go-to-market motion. He admits he is not a typical YC company having been around since 2017 with an existing product and 12 employees, but he thinks it will help propel the company in the long run.

Powered by WPeMatico

In part two of a survey that asks top VCs about exciting opportunities in open source and dev tools, we dig into responses from 10 leading open-source-focused investors at firms that span early to growth stage across software-specific firms, corporate venture arms and prominent generalist firms.

In the conclusion to our survey, we’ll hear from:

These responses have been edited for clarity and length.

Powered by WPeMatico

The once-polarizing world of open-source software has recently become one of the hotter destinations for VCs.

As the popularity of open source increases among organizations and developers, startups in the space have reached new heights and monstrous valuations.

Over the past several years, we’ve seen surging open-source companies like Databricks reach unicorn status, as well as VCs who cashed out behind a serious number of exits involving open-source and dev tool companies, deals like IBM’s Red Hat acquisition or Elastic’s late-2018 IPO. Last year, the exit spree continued with transactions like F5 Networks’ acquisition of NGINX and a number of high-profile acquisitions from mainstays like Microsoft and GitHub.

Similarly, venture investment in new startups in the space has continued to swell. More investors are taking shots at finding the next big payout, with annual invested capital in open-source and dev tool startups increasing at a roughly 10% compounded annual growth rate (CAGR) over the last five years, according to data from Crunchbase. Furthermore, attractive returns in the space seem to be adding more fuel to the fire, as open-source and dev tool startups saw more than $2 billion invested in the space in 2019 alone, per Crunchbase data.

As we close out another strong year for innovation and venture investing in the sector, we asked 18 of the top open-source-focused VCs who work at firms spanning early to growth stages to share what’s exciting them most and where they see opportunities. For purposes of length and clarity, responses have been edited and split (in no particular order) into part one and part two of this survey. In part one of our survey, we hear from:

Powered by WPeMatico