funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Superpeer is giving YouTube creators and other experts a new way to make money.

The startup announced today that it has raised $2 million in pre-seed funding led by Eniac Ventures, with participation from angel investors including Steven Schlafman, Ankur Nagpal, Julia Lipton, Patrick Finnegan, Justin De Guzman, Chris Lu, Paul Yacoubian and Cheryl Sew Hoy. It also launched on ProductHunt.

The idea is that if you’re watching a video to learn how to paint, or how to code, or about whatever the topic might be, there’s a good chance you have follow-up questions — maybe a lot of them. Ditto if you follow someone on Twitter, or read their blog posts, to learn more about a specific subject.

Now you could try to submit a question or two via tweet or comment section, but you’re probably not going to get any in-depth interaction — and that’s if they respond. You could also try to schedule a “Can I pick your brain?”-type coffee meeting, but again, the odds aren’t in your favor, particularly when it comes to picking the brain of someone famous or highly in-demand.

With Superpeer, experts who are interested in sharing their knowledge can do so via remote, one-on-one video calls. They upload an intro video, the times that they want to be available for calls and how much they want to charge for their time. Then Superpeer handles the appointments (integrating directly with the expert’s calendar), the calls and the payments, adding a 15% fee on top.

So a YouTube creator could start adding a message at the end of their videos directing fans who want to learn more to their Superpeer page. And if you’re a founder who wants to talk to an experienced designer, executive coach, product manager, marketing/sales expert, VC or other founder, you could start with this list.

Of course, there might be some wariness on both sides, whether you’re an expert who doesn’t want to get stuck on the phone with someone creepy or annoying, or someone who doesn’t want to pay for a call that turns out to be a complete waste of time.

To address this, co-founder and CEO Devrim Yasar (who previously founded collaborative programming startup Koding) said the company has created a user rating system, as well as a way to ask for a refund if you feel that a call violated the terms of service — the calls will be recorded and stored for 48 hours for this purpose.

Superpeer launched in private beta two weeks ago, and Yasar said the startup already has more than 100 Superpeers signed up.

Powered by WPeMatico

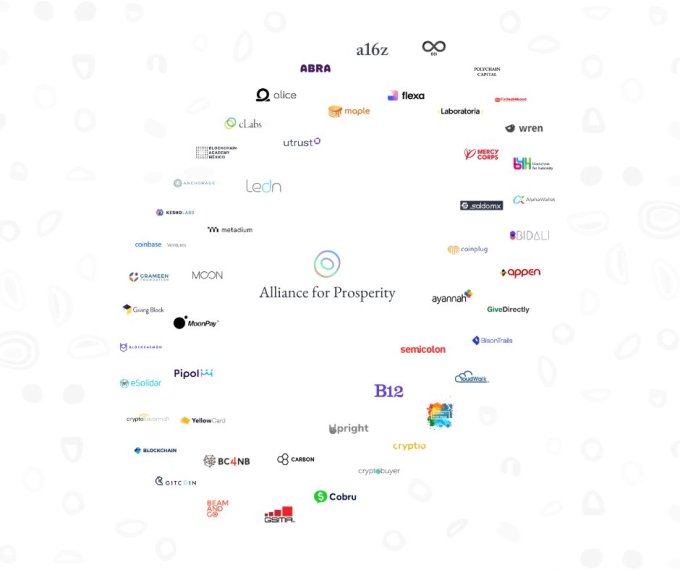

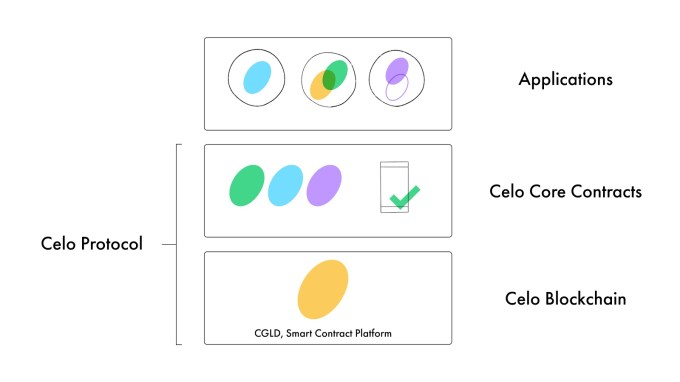

Some Libra Association members like Andreessen Horowitz and Coinbase Ventures are double-dipping, backing a competing cryptocurrency developer platform. Launching today with over 50 partners, non-profit The Celo Foundation’s ‘Alliance For Prosperity’ offers a way for developers to build decentralized mobile apps that are based on Celo’s blockchain platform and USD stablecoin.

The open-source Celo platform is still in testing with plans to officially launch its mainnet in April. The non-profit founded in 2017 has raised $36.4 million, including its Series A where Andreessen Horowitz’s a16z Crypto bought $15 million worth of Celo Gold tokens.

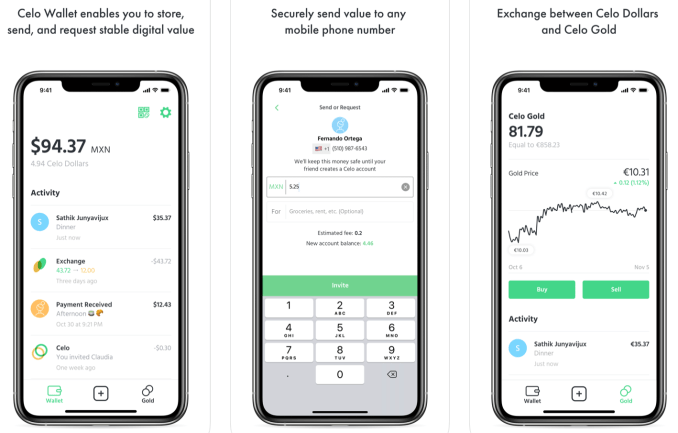

The biggest differentiator of Celo’s network versus other blockchains is that payments in the Celo Dollar stablecoin can be sent to people’s phone numbers rather than complicated addresses. The goal is to make delivering utility via blockchain easier by building a flexible network of applications that doesn’t scare regulators like Libra has.

The Alliance For Prosperity includes Andreessen Horowitz (which funded Celo), Coinbase (Ventures), Bison Trails, Anchorage, and Mercy Corps — all of which are also Libra Association members. That could potentially create a conflict of interest regarding which cryptocurrency and developer platform they promote to their portfolio companies, integrate into their products, or focus on for delivering financial services to the needy.

Other high-profile Alliance partners include Carbon, GiveDirectly, Grameen Foundation, Maple, and Polychain. Partners have made a somewhat vague commitment to “backing development efforts of the project, building infrastructure, implementing desired use cases on the platform, integrating Celo assets in their projects, or collaborating on education campaigns in their communities to further advance the use of blockchain technology” according to Chuck Kimble, Celo’s cLabs head of business development and head of the Alliance. Anyone can apply to join the open network, and there’s no minimum financial investment like Libra’s $10 million prerequisite.

Celo isn’t trying to replace the dollar with its own synthetic currency, and its reserve is backed with other cryptocurrencies rather than fiat cash. That might make it more acceptable to regulators who were worried that Libra’s token and fiat currency bundle-backed reserve could impact the global financial system. The first of the decentralized apps on the platform, the Celo Wallet, is already available for iOS and Android.

Like many blockchain projects, there are some lofty intentions for social impact with Celo. Use cases include “powering mobile and online work, enabling faster and affordable remittances, reducing the operational complexities of delivering humanitarian aid, facilitating payments, and enabling microlending” says Kimble. The real driver of this potential is Celo’s promise of much lower transaction fees than traditional middlemen charge.

When asked what the biggest threats to Celo’s success are, he told me “Banking infrastructure improving faster than we expect” and “Mobile adoption or LTE data not expanding on their current trajectory.” He did not mention the developer fatigue, regulatory scrutiny, technical complexity, or slow adoption of blockchain utilities that have plagued other crypto for good projects.

Here’s the full list of members working towards these goals:

Abra, Alice, AlphaWallet, Anchorage, Appen, Ayannah, Andreessen Horowitz, B12, BC4NB (Blockchain for the Next Billion), BeamAndGo, Bidali, Bison Trails, Blockchain Academy Mexico, Blockchain.com, Blockchain for Humanity (b4h), Blockchain for Social Impact (BSIC), Blockdaemon, Carbon, cLabs, CloudWalk Inc, Cobru, Coinbase, Coinplug, Cryptio, Cryptobuyer, CryptoSavannah, eSolidar, Fintech4Good, Flexa, Gitcoin, GiveDirectly, Grameen Foundation, GSMA, KeshoLabs, Laboratoria, Ledn, Maple, Mercy Corps, Metadium, Moon, MoonPay, Pipol, Pngme, Polychain, Project Wren, SaldoMX, Semicolon Africa, The Giving Block, Utrust, Upright, Yellow Card, and 88i. [Update: Ledger joined this morning.]

“Many of these organizations have on-the-ground operations that will begin to get Celo into the hands of those who have been underserved by the current global financial system” Andreessen Horowitz general partner Katie Haun told me. “Our hope is that this partnership will start unlocking the potential of internet money”. To spur adoption, the Alliance will distribute ‘Prosperity Gifts’ in the form of financial grants to developers proposing Celo products that would benefit society.

There are also some peculiar characteristics of Celo’s system. People exchange other cryptocurrencies for Celo Gold, then exchange that for Celo Dollars they can spend. The reserve is backed with other cryptocurrencies like bitcoin and ethereum rather that fiat, and isn’t fully collateralized. That could make it vulnerable to a Celo bank run or crash in price of those currencies. Celo also lets arbitrageurs pocket the difference if Celo Gold and Celo Dollars get out of sync.

While it might not be a danger to the world financial system like Libra, it could be a danger to itself. At least on the anti-money laundering front, cLabs — the team that’s kicking off development of the Celo platform — has hired former Capital One head of enterprise risk management Jai Ramaswamy. Plus, the Celo founders come well pedigreed, including Marek Olszewski and Rene Reinsberg who spun out machine learning startup Locu from MIT and sold it to GoDaddy, as well as EigenTrust inventor and former MIT Media Lab professor Sep Kamvar.

While it might not be a danger to the world financial system like Libra, it could be a danger to itself. At least on the anti-money laundering front, cLabs — the team that’s kicking off development of the Celo platform — has hired former Capital One head of enterprise risk management Jai Ramaswamy. Plus, the Celo founders come well pedigreed, including Marek Olszewski and Rene Reinsberg who spun out machine learning startup Locu from MIT and sold it to GoDaddy, as well as EigenTrust inventor and former MIT Media Lab professor Sep Kamvar.

So far, 130 teams have expressed interest in building on the Celo platform. For reference, Libra said 1,500 organizations had said they wanted to work on that project four months after its reveal. Celo Camp and Blockchain for Social Impact Incubator will also be fostering projects for the blockchain.

Celo could make banking cheaper and more accessible while power new fintech innovation. But for any of that to happen, it will need to get enough developers building truly useful products, make the blockchain and currency exchange simple enough for mainstream audiences in developing nations, and grow adoption to meaningful levels few cryptocurrency projects have yet achieved. The Alliance For Prosperity will have to throw their weight into this project, not just their names, if it’s going to succeed.

Powered by WPeMatico

Electric, the platform that delivers IT services to small and medium businesses, has today announced that it has raised an additional $14.5 million on its Series B from 01 Advisors, the fund led by Twitter alums Dick Costolo and Adam Bain.

Though the funding is a part of the company’s Series B financing, founder Ryan Denehy explained that the deal was signed on an uptick in valuation, though wouldn’t elaborate further.

Electric raised a $25 million Series B led by GGV in January of 2019.

The company allows businesses with small IT teams, or no IT team, to get on the platform and either automate or manage with one click the various administrative facets of that role. Most IT tasks are focused on administration, distribution and maintenance of software programs.

Electric customers ensure that the software is installed on every corporate machine, effectively giving the top IT employee or decision-maker an easy way to grant and revoke permissions, assign roles and make sure software is up to date on various machines.

The hope is that this allows IT specialists to focus on the jobs that are best suited to their skills, such as troubleshooting, hardware installation and other more difficult tasks.

Denehy said this new fundraise was all about bringing strategic operators under the tent, not cash. He explained that at the close of last year, VCs started reaching out to get in on the company’s Series C. The team sat down for a board meeting where they weighed their options, one of which being a $40 million Series C.

“We have no immediate use for most of that money,” said Denehy. “Is it going to make our customers happy or is it going to make us a better-run company? It’s kind of a philosophical question. A lot of founders sort of equate success to the fact that they raised two rounds within six months of each other, and I just took the contrarian view. I wondered what we could actually do to make our company run better and the conclusion was to get the best business leaders and operators in tech to get around the table at our company.”

This brings Electric’s total funding to just over $50 million. Denehy says part of the reluctance around fundraising stemmed from the fact that Electric had tripled top-line growth over the past two years. But that doesn’t mean he had all the answers when it comes to hyper growth and scaling the business.

Costolo recalled when Bain first met Ryan Denehy, and came back excited about his willingness to learn.

“Ryan is a really enthusiastic founder/CEO,” said Costolo. “Some founders know they don’t have the answers to everything and that there’s still a lot to learn, and they want to learn. And Ryan is right down the middle for that.”

Costolo also explained that he’s excited about how well Electric fits in to the dogma of “software is eating the world,” automating these low-level tasks to free up resources and energy for higher-order tasks.

Costolo and Bain operate slightly unusually for a growth-stage fund (01 Advisors writes checks for later A rounds and B rounds). The duo don’t want to take board seats, as they’d rather be “sitting next to the founder instead of across the table from the founder.”

This results in a hands-on approach based on their experience as operators. Remember, Costolo grew Twitter to a market cap of $23.4 billion before stepping down, and Bain spent six years at Twitter as president of Global Revenue and Partnerships before stepping into the COO role.

Costolo and Bain have already brought their hands-on approach to Electric, having conversations with the head of HR around how to introduce HR business partners to different departments and how to scale and set goals for the enterprise sales team.

Powered by WPeMatico

BackboneAI, an early-stage startup that wants to help companies dealing with lots of data, particularly coming from a variety of external sources, announced a $4.7 million seed investment today.

The round was led by Fika Ventures with participation from Boldstart Ventures, Dynamo Ventures, GGV Capital, MetaProp, Spider VC and several other unnamed investors.

Company founder Rob Bailey says he has spent a lot of time in his career watching how data flows in organizations. There are still a myriad of challenges related to moving data between organizations, and that’s what his company is trying to solve. “BackboneAI is an AI platform specifically built for automating data flows within and between companies,” he said.

This could involve any number of scenarios from keeping large, complex data catalogues up-to-date to coordinating the intricate flow of construction materials between companies or content rights management across an entertainment industry.

Bailey says that he spent 18 months talking to companies before he built the product. “What we found is that every company we talked to was, in some way or another, concerned about an absolute flood of data from all these different applications and from all the companies that they’re working with externally,” he explained.

The BackboneAI platform aims to solve a number of problems related to this. For starters, it automates the acquisition of this data, usually from third parties like suppliers, customers, regulatory agencies and so forth. Then it handles ingestion of the data, and finally it takes care of a lot of actual processing from external sources, while mapping it to internal systems like the company ERP system.

As an example, he uses an industrial supply company that may deal with a million SKUs across a couple of dozen divisions. Trying to track that with manual or even legacy systems is difficult. “They take all this product data in [from external suppliers], and then process the information in their own [internal] product catalog, and then finally present that data about those products to hundreds of thousands of customers. It’s an incredibly large and challenging data problem as you’re processing millions and millions of SKUs and orders, and you have to keep that data current on a regular basis,” he explained.

The company is just getting started. It spent 2019 incubating inside of Boldstart Ventures . Today the company has close to 20 employees in New York City, and it has signed its first Fortune 500 customer. Bailey says they have 15 additional Fortune 500 companies in the pipeline. With the seed money, he hopes to build on this initial success.

Powered by WPeMatico

As of this writing, COVID-19 has killed more than 3,400 people around the globe and the coronavirus has infected tens of thousands more. But its impact has gone much further, causing major disruptions in public markets and leading corporations to pull out of conferences and delay travel. Big tech companies are asking workers to stay home and investors are now urging startups to prepare accordingly.

Coronavirus fears are now affecting fundraising for startups. I am seeing advice that tells any company that might run out of cash in 2020 to start raising now before things might get a lot tighter. RIPGoodTimes?

— Josh Elman (@joshelman) March 1, 2020

Sequoia Capital sent a letter to its founders on Thursday warning that the coronavirus was a “black swan” event and startups should “brace themselves for turbulence” by considering if they have enough cash and preparing to face supply chain disruptions. The letter also warned they could have a harder time fundraising, similar to the market downturns of 2001 and 2009.

The coronavirus effect is rippling throughout the tech world. Seattle, which has seen a cluster of cases, seems almost a ghost town in some parts, according to entrepreneur and former Madrona Capital partner Shauna Causey. She told TechCrunch that many of the coffee shops and co-working spaces popular among VCs have gone empty in the last week and all of her fundraising meetings are conducted via Zoom.

Given that fundraising can take several months, if their cash out date is 2020, they should be fundraising soon anyway

also hearing from founders it’s already getting hard

— Evelyn Rusli (@EvelynRusli) March 2, 2020

A Singapore-based VC firm told a startup I’m working with that they’re not going to wire the entire $2m investment they committed to in the Series A, which has been in closing the last few weeks. The rationale was to conserve capital due to coronavirus. The funding risk is real.

— Tommy Leep (@leepnet) March 4, 2020

And already there’s some chatter that funding might be drying up for early-stage startups, though Bloomberg Beta’s Roy Bahat tells TechCrunch that startups should always be fundraising as soon as they can to protect themselves from this type of calamity.

Powered by WPeMatico

Hungry, a catering marketplace that connects businesses with independent chefs, announced this week that it has raised $20 million in Series B funding. Hungry tells me that the funding valued the company at more than $100 million (pre-money).

The investors were also pretty impressive: The round was led by Evolution VC Partners and former Whole Foods co-CEO Walter Robb, who’s joining the startup’s board. Kevin Hart, Jay-Z, Los Angeles Rams running back Todd Gurley, former Obama aide Reggie Love and Seattle Seahawks linebacker Bobby Wagner also participated.

CEO Jeff Grass said that he and his co-founders Eman Pahlavani (COO) and Shy Pahlevani (president) got the idea for the company while working at their previous startup LiveSafe.

“LiveSafe was in a food desert, where the best options were Subway and Ruby Tuesday,” Grass said. “We wanted more authentic food and we started thinking about, ‘Is there a better way that taps into local chefs?’ ”

That eventually led to Hungry, which has built up a network of independent chefs in Washington, D.C., Philadelphia, Boston, New York and Atlanta, providing catering to companies including Amazon, E-Trade, Microsoft and BCG. The chefs are all screened by Hungry, they cook out of “ghost kitchens” (commercial kitchens that aren’t attached to a restaurant) and then the food is delivered by the Hungry team.

“The food is produced at a much lower cost structure than at a restaurant with a retail location,” Grass said. “And yet you’re not sacrificing on quality. These are top chefs cooking their best dishes — you get higher than restaurant-quality food, but produced at a much lower cost.”

He added that this lower cost also allows the startup to be generous. Specifically, for every two meals sold, Hungry is supposed to donate one meal to end hunger in the U.S., and it has donated nearly 500,000 meals already.

As for the funding, Grass and his team will use it to expand into new markets — he hopes to be in 23 cities by the end of 2021.

Powered by WPeMatico

Netlify, the startup that wants to kill the web server and change the way developers build websites, announced a $53 million Series C today.

EQT Ventures Fund led the round with contributions from existing investors Andreessen Horowitz and Kleiner Perkins and newcomer Preston-Werner Ventures. Under the terms of the deal Laura Yao, deal partner and investment advisor at EQT Ventures will be joining the Netlify board. The startup has now raised $97 million, according to the company.

Like many startups recently, Netlify’s co-founder Chris Bach says they weren’t looking for new funding, but felt with the company growing rapidly, it would be prudent to take the money to help continue that growth.

While Bach and CEO Matt Biilmann didn’t want to discuss valuation, they said it was “very generous” and in line with how they see their business. Neither did they want to disclose specific revenue figures, but did say that the company has tripled revenue three years running.

One thing fueling that growth is the sheer number of developers joining the platform. When we spoke to the company for its Series B in 2018, it had 300,000 sign-ups. Today that number has ballooned to 800,000.

As we wrote about the company in a 2018 article, it wants to change the way people develop web sites:

“Netlify has abstracted away the concept of a web server, which it says is slow to deploy and hard to secure and scale. By shifting from a monolithic website to a static front end with back-end microservices, it believes it can solve security and scaling issues and deliver the site much faster.”

While developer popularity is a good starting point, getting larger customers on board is the ultimate goal that will drive more revenue, and the company wants to use its new injection of capital to build the enterprise side of the business. Current enterprise customers include Google, Facebook, Citrix and Unilever.

Netlify has grown from 38 to 97 employees since the beginning of last year and hopes to reach 180 by year’s end.

Powered by WPeMatico

mParticle, which helps companies like Spotify, Paypal and Starbucks umanage their customer data, is announcing that it has raised $45 million in Series D funding.

Co-founder and CEO Michael Katz told me that the company has benefited from broader shifts — like new privacy regulation and the shift away from cookie-based browser tracking — that increase brands’ needs for a platform like mParticle that uses “modern data infrastructure” to deliver a personalized experience for customers without running afoul of any regulations.

As result, he said mParticle has nearly quintupled its revenue since it raised a $35 million Series C in 2017. (The company has raised more than $120 million total.)

“The challenges that we solve are universal,” Katz said. “It doesn’t matter if there’s a small company or big company. Data fragmentation, data quality, consistent change in the privacy landscape, consistent change in the technology ecosystem, these are universal challenges.”

Perhaps for that very reason, a whole industry of customer data platforms has sprung up since mParticle was founded back in 2013, all offering tools to help marketers create a single view of their customers by unifying data from various sources. Even big players like Adobe and Salesforce have announced their own CDPs as part of their larger marketing clouds.

When asked about the competition, Katz said, “The market has responded overwhelmingly by saying, ‘I don’t want one vendor to rule everything for me.’ Why be beholden to one suite of tools that’s just an amalgamation of products that were built in the early 2000s?”

Instead, he argued that mParticle customers want “a best-in-breed combination of independent solutions that can be integrated seamlessly.”

Getting back to the new funding — Arrowroot Capital led the round, with the firm’s managing partner Matthew Safaii joining mParticle’s board of directors. Existing investors also participated.

Katz said the funding will be spent in three broad areas: building new products, scaling its global data infrastructure and finding new partners. In fact, the company is also announcing a partnership with LiveRamp, through which mParticle customers can combine their first-party data with the third-party party data from Liveramp.

“We see this partnership with Liveramp as an opportunity to extend the surface area by which our customers can deliver highly personalized, privacy-friendly experiences,” Katz said.

Powered by WPeMatico

The world of consumer banking has seen a massive shift in the last ten years. Gone are the days where you could open an account, take out a loan, or discuss changing the terms of your banking only by visiting a physical branch. Now, you can do all this and more with a few quick taps on your phone screen — a shift that has accelerated with customers expecting and demanding even faster and more responsive banking services.

As one mark of that switch, today a startup called Thought Machine, which has built cloud-based technology that powers this new generation of services on behalf of both old and new banks, is announcing some significant funding — $83 million — a Series B that the company plans to use to continue investing in its platform and growing its customer base.

To date, Thought Machine’s customers are primarily in Europe and Asia — they include large, legacy outfits like Standard Chartered, Lloyds Banking Group, and Sweden’s SEB through to “challenger” (AKA neo-) banks like Atom Bank. Some of this financing will go towards boosting the startup’s activities in the US, including opening an office in the country later this year and moving ahead with commercial deals.

The funding is being led by Draper Esprit, with participation also from existing investors Lloyds Banking Group, IQ Capital, Backed and Playfair.

Thought Machine, which started in 2014 and now employs 300, is not disclosing its valuation but Paul Taylor, the CEO and founder, noted that the market cap is currently “increasing healthily.” In its last round, according to PitchBook estimates, the company was valued at around $143 million, which, at this stage of funding, puts this latest round potentially in the range of between $220 million and $320 million.

Thought Machine is not yet profitable, mainly because it is in growth mode, said Taylor. Of note, the startup has been through one major bankruptcy restructuring, although it appears that this was mainly for organisational purposes: all assets, employees and customers from one business controlled by Taylor were acquired by another.

Thought Machine’s primary product and technology is called Vault, a platform that contains a range of banking services: checking accounts, savings accounts, loans, credit cards and mortgages. Thought Machine does not sell directly to consumers, but sells by way of a B2B2C model.

The services are provisioned by way of smart contracts, which allows Thought Machine and its banking customers to personalise, vary and segment the terms for each bank — and potentially for each customer of the bank.

It’s a little odd to think that there is an active market for banking services that are not built and owned by the banks themselves. After all, aren’t these the core of what banks are supposed to do?

But one way to think about it is in the context of eating out. Restaurants’ kitchens will often make in-house what they sell and serve. But in some cases, when it makes sense, even the best places will buy in (and subsequently sell) food that was crafted elsewhere. For example, a restaurant will re-sell cheese or charcuterie, and the wine is likely to come from somewhere else, too.

The same is the case for banks, whose “Crown Jewels” are in fact not the mechanics of their banking services, but their customer service, their customer lists, and their deposits. Better banking services (which may not have been built “in-house”) are key to growing these other three.

“There are all sorts of banks, and they are all trying to find niches,” said Taylor. Indeed, the startup is not the only one chasing that business. Others include Mambu, Temenos and Italy’s Edera.

In the case of the legacy banks that work with the startup, the idea is that these behemoths can migrate into the next generation of consumer banking services and banking infrastructure by cherry-picking services from the VaultOS platform.

“Banks have not kept up and are marooned on their own tech, and as each year goes by, it comes more problematic,” noted Taylor.

In the case of neobanks, Thought Machine’s pitch is that it has already built the rails to run a banking service, so a startup — “new challengers like Monzo and Revolut that are creating quite a lot of disruption in the market” (and are growing very quickly as a result) — can integrate into these to get off the ground more quickly and handle scaling with less complexity (and lower costs).

Taylor was new to fintech when he founded Thought Machine, but he has a notable track record in the world of tech that you could argue played a big role in his subsequent foray into banking.

Formerly an academic specialising in linguistics and engineering, his first startup, Rhetorical Systems, commercialised some of his early speech-to-text research and was later sold to Nuance in 2004.

His second entrepreneurial effort, Phonetic Arts, was another speech startup, aimed at tech that could be used in gaming interactions. In 2010, Google approached the startup to see if it wanted to work on a new speech-to-text service it was building. It ended up acquiring Phonetic Arts, and Taylor took on the role of building and launching Google Now, with that voice tech eventually making its way to Google Maps, accessibility services, the Google Assistant and other places where you speech-based interaction makes an appearance in Google products.

While he was working for years in the field, the step changes that really accelerated voice recognition and speech technology, Taylor said, were the rapid increases in computing power and data networks that “took us over the edge” in terms of what a machine could do, specifically in the cloud.

And those are the same forces, in fact, that led to consumers being able to run our banking services from smartphone apps, and for us to want and expect more personalised services overall. Taylor’s move into building and offering a platform-based service to address the need for multiple third-party banking services follows from that, and also is the natural heir to the platform model you could argue Google and other tech companies have perfected over the years.

Draper Esprit has to date built up a strong portfolio of fintech startups that includes Revolut, N26, TransferWise and Freetrade. Thought Machine’s platform approach is an obvious complement to that list. (Taylor did not disclose if any of those companies are already customers of Thought Machine’s, but if they are not, this investment could be a good way of building inroads.)

“We are delighted to be partnering with Thought Machine in this phase of their growth,” said Vinoth Jayakumar, Investment Director, Draper Esprit, in a statement. “Our investments in Revolut and N26 demonstrate how banking is undergoing a once in a generation transformation in the technology it uses and the benefit it confers to the customers of the bank. We continue to invest in our thesis of the technology layer that forms the backbone of banking. Thought Machine stands out by way of the strength of its engineering capability, and is unique in being the only company in the banking technology space that has developed a platform capable of hosting and migrating international Tier 1 banks. This allows innovative banks to expand beyond digital retail propositions to being able to run every function and type of financial transaction in the cloud.”

“We first backed Thought Machine at seed stage in 2016 and have seen it grow from a startup to a 300-person strong global scale-up with a global customer base and potential to become one of the most valuable European fintech companies,” said Max Bautin, Founding Partner of IQ Capital, in a statement. “I am delighted to continue to support Paul and the team on this journey, with an additional £15 million investment from our £100 million Growth Fund, aimed at our venture portfolio outperformers.”

Powered by WPeMatico

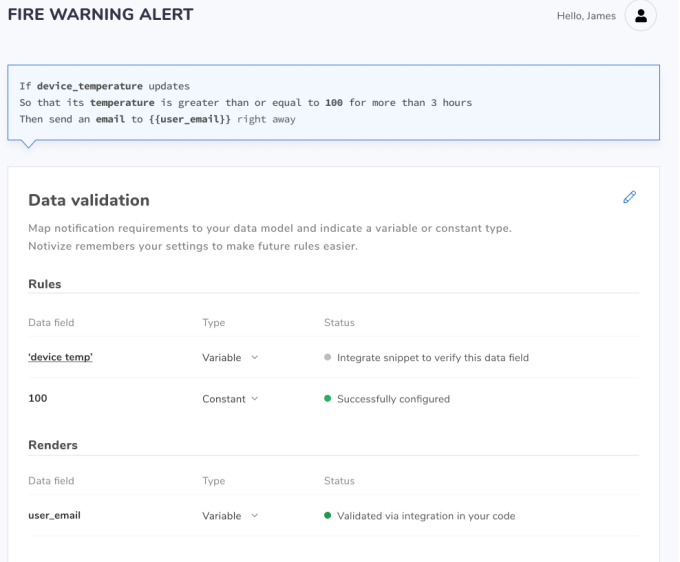

A new startup called Notivize aims to give product teams direct access to one of their most important tools for increasing user engagement — notifications.

The company has been testing the product with select customers since last year and says it has already sent hundreds of thousands of notifications. And this week, it announced that it has raised $500,000 in seed funding led by Heroic Ventures .

Notivize co-founder Matt Bornski has worked at a number of startups, including AppLovin and Wink, and he said he has “so many stories I can tell you about the time it takes to change a notification that’s deeply embedded in your stack.”

To be clear, Bornski isn’t talking about a simple marketing message that’s part of a scheduled campaign. Instead, he said that the “most valuable” notifications (e.g. the ones that users actually respond to) are usually driven by activity in an app.

For example, it might sound obvious to send an SMS message to a customer once the product they’ve purchased has shipped, but Bornski said that actually creating a notification like that would normally require an engineer to write new code.

“There’s the traditional way that these things are built: The product team specs out that we need to send this email when this happens, or send this SMS or notification when this happens, then the engineering team will go in and find the part of the code where they detect that such a thing has happened,” he said. “What we really want to do is give [the product team] the toolkit, and I think we have.”

So with Notivize, non-coding members of the product and marketing team can write “if-then” rules that will trigger a notification. And this, Bornski said, also makes it easier to “A/B test and optimize your copy and your send times and your channels” to ensure that your notifications are as effective as possible.

He added that companies usually don’t build this for themselves, because when they’re first building an app, it’s “not a rational thing to invest your time and effort in when you’re just testing the market or you’re struggling for product market fit.” Later on, however, it can be challenging to “go in and rip out all the old stuff” — so instead, you can just take advantage of what Notivize has already built.

Bornski also emphasized that the company isn’t trying to replace services that provide the “plumbing” for notifications. Indeed, Notivize actually integrates with SendGrid and Twilio to send the notifications.

“The actual sending is not the core value [of what we do],” he said. “We’re improving the quality of what you’re paying for, of what you send.”

Notivize allows customers to send up to 100 messages per month for free. After that, pricing starts at $14.99 per month.

“The steady march of low-code and no-code solutions into the product management and marketing stack continues to unlock market velocity and product innovation,” said Heroic Ventures founder Michael Fertik in a statement. “Having been an early investor in several developer platforms, it is clear that Notivize has cracked the code on how to empower non-technical teams to manage critical yet complex product workflows.”

Powered by WPeMatico