funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Several months ago, we surveyed more than 20 leading real estate VCs to learn about what was exciting them most in the real estate tech sector and hear their opinions on proptech trends like co-working, flexible office space and remote office space.

Since we published our survey, COVID-19 has flipped the real estate sector on its head as more companies move toward mandatory remote work, retail businesses are forced to temporarily shut their doors and high-traffic properties thin out. Suddenly, the traditionally predictable world of real estate is more chaotic and unclear than ever.

What are the short and long-term impacts of pandemic-induced volatility? Does this open up opportunities for proptech startups or shutter them? What does this mean from an investing point of view? We asked several of the VCs that participated in our last survey to update us on how COVID-19 is impacting real estate startups, non-proptech companies in general and the broader real estate market overall:

Despite its banner year in 2019, proptech will not be immune to the pressures venture-backed companies face in a market pullback, and we are preparing ourselves and our portfolio companies for a bumpy year.

Powered by WPeMatico

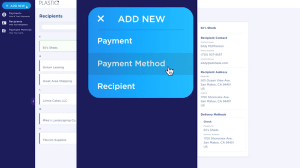

When Eliot Buchanan tried to use his credit card to pay his Harvard tuition bill, the payment was rejected because the university said it doesn’t accept credit. Realizing the same problem exists for thousands of different transactions like board, rent and vendor payments, he launched Plastiq. Plastiq helps people use credit cards to pay, or get paid, for anything.

Plastiq today announced that it has raised $75 million in venture capital in a Series D round led by B Capital Group. Kleiner Perkins, Khosla Ventures, Accomplice and Top Tier Capital Partners also participated in the round. The round brings the company’s total known venture capital raised to more than $140 million.

To use Plastiq, users enter their credit card information on Plastiq’s platform. In return, Plastiq will charge you a 2.5% fee and get your bills paid. While Plastiq was started with consumers in mind, SMBs have now accounted for 90% of the revenue, according to Buchanan. The new financing round will invest in building out features to give SMBs faster services around payments and processing.

Plastiq provides a way for SMBs and consumers to pay their bills and make sure they have reliable cash flow. For example, restaurants sometimes have a drop in revenue due to seasonality or, as we’re experiencing now with COVID-19, pandemic lockdowns. Or tourism companies for cities that are struggling to attract visitors. Those companies still need cash flow, and using Plastiq’s service, they can use credit cards to pay suppliers even in an off season.

There is no shortage of competition from other companies also trying to solve pain points in small-business cash flow. According to Buchanan, Plastiq’s biggest competitors are traditional lenders, as well as companies like Kabbage and Fundbox. Similar claims could be made about Brex, which offers a credit card for startups to access capital faster.

Kabbage provides funding to SMBs through automated business loans. The SoftBank-backed company landed $200 million in a revolving credit line back in July, fresh off of landing strong partnerships with banks and giants like Alibaba to access more customers. Kabbage loans out roughly $2-3 billion to SMBs every year.

Plastiq, according to its release, is also on track to make more than $2 billion in transactions. But unlike Kabagge, Plastiq doesn’t issue loans or credit, it just unlocks a payment opportunity.

“SMBs don’t need to be burdened with additional debt or additional loans,” Buchanan said. “So rather than trying to reinvent the wheel, let’s use a behavior they have already earned.”

Buchanan would not disclose Plastiq’s current valuation or revenue, but he did say that it’s not too far away from $100 million in revenue run rate. The company’s revenue has grown 150% from 2018 to 2019.

The company also noted that it has surpassed “well over 1 million users,” up 150% in unique new users from 2018 to 2019.

In terms of profitability, Buchanan said that “we could be profitable if we wanted to be,” noting that Plastiq’s revenue and margins could lead them toward profitability if they wanted to focus less on growth. But he added they don’t plan to “slow down” the growth engine any time soon — especially in the wake of the COVID-19 pandemic.

Because the Series D round closed at the end of 2019, Buchanan said the pandemic did not impact the deal. However, the company had planned to time the announcement with tax season. Now, as small businesses struggle to secure capital and stay afloat due to lockdowns across the country, Plastiq’s new raise feels more fitting.

“Our customers are more thankful for solutions like ours as traditional sources of lending are drying up and not as easy to access” Buchanan said. “Hopefully, we can measure how many businesses make it through this because of us.”

The 140-person company is currently hiring across product and engineering roles.

Powered by WPeMatico

OfferUp, a top online and mobile marketplace app, announced this morning it’s raising $120 million in a new round of funding led by competing marketplace letgo’s majority investor, OLX Group, and others. As a part of the deal, OfferUp will also be acquiring letgo’s classified business, with OLX Group gaining a 40% stake in the newly combined entity.

Other investors in the new round include existing OfferUp backers Andreessen Horowitz and Warburg Pincus. The funds will be put toward continued growth, product innovation and monetization efforts, OfferUp says.

The round will close with the closing of the acquisition, which is expected to take place sometime in May. To date, OfferUp has raised $380 million.

The acquisition will see two of the largest third-party buying and selling marketplaces — outside of Craigslist, eBay and Facebook Marketplace, of course — become a more significant threat to the incumbents. Together, the new entity will have more than 20 million monthly active users across the U.S. For consumers, the deal means they’ll no longer have to list in as many apps when looking to unload some household items, electronics, furniture or whatever else they want to sell.

“My vision for OfferUp has always been to build a company that helps people connect and prosper,” said Nick Huzar, OfferUp CEO, in a statement about the acquisition. “We’re combining the complementary strengths of OfferUp and letgo in order to deliver an even better buying and selling experience for our communities. OLX Group has unparalleled expertise and clear success with growing online marketplace businesses, so they’ll be a great partner as we continue to build the widest, simplest, and most trustworthy experience for our customers.”

OfferUp also acknowledged that mid-pandemic is an odd time to announce such a deal — especially at a time when the COVID-19 outbreak is affecting its own employees, its partners, and the buying and selling community itself. And this will continue for some time.

However, Huzar positions the deal as one that will allow the business to grow, despite the current state of affairs.

“This news helps us to continue to innovate and grow, in spite of these challenging times, and continue to deliver on that promise,” Huzar noted, in a company blog post.

For now, the OfferUp and letgo apps will remain separate experiences and no disruptions to any sales will be made. Consumers will also be able to download both apps to iOS and Android devices for the time being, too.

But soon, both sets of users will gain access to a larger network of buyers and sellers, along with nationwide shipping options, and trust and safety problems. We understand this will involve allowing users of both sets of apps to see more posts and interact with more buyers and sellers — so some sort of merging of the two networks is at play here. There will be additional changes to improve the user experience for all users in the future, as well, but the company isn’t sharing details on that today.

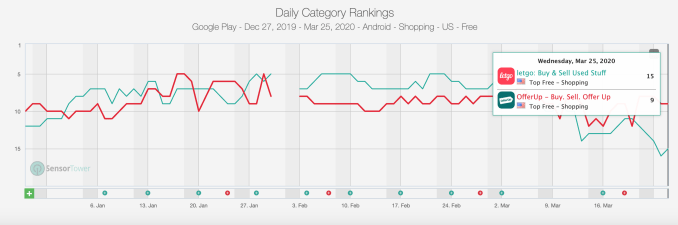

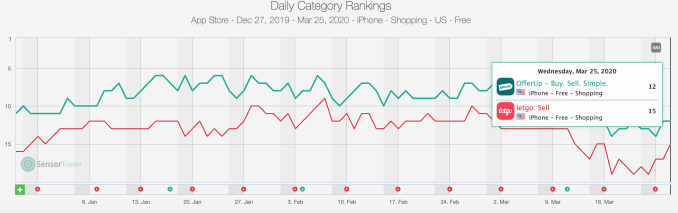

Letgo is bringing to the table an app with more than 100 million worldwide downloads, so there is a potential to reactivate some of the lapsed users who aren’t currently shopping or selling on its marketplace today. The two apps were often neck-and-neck in terms of their app store category rankings, though on iPhone OfferUp has maintained a slight lead. (See App Store and Google Play charts below.)

However, letgo’s business outside of North America will be separately owned and operated as part of the OLX Group, the companies said.

“Letgo and OfferUp have always shared the same core vision for how large America’s secondhand economy can become — harnessing tech innovation to bring about an extraordinarily positive impact on consumers’ wallets and also on the environment,” said letgo co-founder Alec Oxenford. “Bringing our apps together moves us much closer to that vision,” he added.

Prior to this deal, OfferUp had seen a number of executive departures, including the exit of Engineering lead and VP Peter Wilson in 2017, VP of Product Chloe Harford in 2018, VP of Employee Experience Deb Nielsen in 2018, subsequent VP of Employee Experience Sarah Bilton in 2019, and Chief Experience Officer Jerry Howe in January 2020. CFO Rodrigo Brumana has also left, which was previously unreported. The company’s interim CFO is Chief Growth Officer Ian Fliflet, and OfferUp is actively hiring for a new CFO, we’re told.

Huzar characterizes these changes as part of the challenges with growing a startup and getting the right people into place.

“As the company grows up, so must leaders and so must the culture. I think a lot of times when you’re scaling businesses…you go through evolutions where leaders really need to evolve and change,” he says. “If you look to Bill Carr, for example, our COO, you know he helped build out Amazon Video from nothing to over 2,000 employees. We had nobody in the halls of OfferUp that had seen that scale before,” Huzar added.

There’s some admiration for Amazon’s culture, as well.

“There are clearly things that Amazon has done very well — like their ability to innovate at scale is unbelievable,” Huzar says. “We do think people [who] come out of Amazon have great startup DNA. They’re very scrappy. They dive deep into the business and understand things. They can think big. There’s a lot of value I think from that business that I really appreciate,” he added.

OfferUp also just hired former ChannelAdvisor VP Mark Vandegrift as head of e-commerce this month, as the company focuses on growth and scale.

But not all employees have been on board with these exec shakeups. More than a handful of employee reviews on Glassdoor and chatter on networking app Blind speak to various company culture issues, women being treated inequitably, negative office politics, and attrition — including among senior management.

In addition to the COVID-19 crisis, OfferUp may have needed to merge to scale and compete with the marketplace giants. User growth was slowing, for instance — the userbase was 42 million annual users in 2018 that only grew to 44 million in 2019. Presumably, slower revenue growth had followed. (Huzar declined to speak to current revenue and valuation.)

A combination of OfferUp and letgo could help to strengthen numbers outside of coastal cities, like Seattle, L.A., and Miami, where OfferUp was historically strong. Letgo was stronger in other parts of the country, like the Midwest, Huzar says. OfferUp will also bring its shipping business to letgo, which could be particularly helpful now as people are looking to sell household items for extra cash.

The deal is still subject to regulatory approval. If given, the combined businesses will be operated by OfferUp, headquartered in Bellevue, Wash. Huzar will continue to be CEO of OfferUp and chairman of the board. Oxenford, meanwhile, will join the board and serve as a senior advisor to OLX Group and Prosus.

Because the deal is still in the process of closing, the companies can’t speak to any team changes, including potential layoffs as a result of overlapping positions or other redundancies, we’re told.

Updated 3/25/20, 4:00 PM ET with additional quotes and background, following Huzar interview.

Powered by WPeMatico

Humio, a startup that has built a modern unlimited logging solution, announced a $20 million Series B investment today.

Dell Technologies Capital led the round with participation from previous investor Accel. Today’s investment brings the total raised to $32 million, according to the company.

Humio co-founder and CEO Geeta Schmidt says the startup wanted to build a solution that would allow companies to log everything, while reducing the overall cost associated with doing that, a tough problem due to the resource and data volume involved. The company deals with customers who are processing multiple terabytes of data per day.

“We really wanted to build an infrastructure where it’s easy to log everything and answer anything in real time. So we built an index-free logging solution which allows you to ask […] ad hoc questions over large volumes of data,” Schmidt told TechCrunch.

They are able to ingest so much data by using streaming technology, says company EVP of sales Morten Gram. “We have this real time streaming engine that makes it possible for customers to monitor whatever they know they want to be looking at. So they can build dashboards and alerts for these [metrics] that will be running in real time,” Gram explained.

What’s more, because the solution enables companies to log everything, rather than pick and choose what to log, they can ask questions about things they might not know, such as an on-going security incident or a major outage, and trace the answer from the data in the logs as the incident is happening.

Perhaps more importantly, the company has come up with technology to reduce the cost associated with processing and storing such high volumes of data. “We have thought a lot about trying to do a lot more with a lot less resources. And so, for example, one of our customers, who moved from a competitor, has gone from 80 servers to 14 doing the same volumes of data,” she said.

Deepak Jeevankumar, managing director and lead investor at Dell Technologies Capital, says that his firm recognized that Humio was solving these issues in a creative and modern way.

“Humio’s team has created a new log analysis architecture for the microservices age. This can support real-time analysis at full-speed ingest, while decreasing cost of storage and analysis by at least an order of magnitude,” he explained. “In a short-period of time, Humio has won the confidence of many Fortune 500 customers who have shifted their log platforms to Humio from legacy, decade-old architectures that do not scale for the cloud world.”

The company’s customers include Netlify, Bloomberg, HP Aruba and Michigan State University. It offers on-prem, cloud and hosted SaaS products. Today, the company also announced it was introducing an unlimited ingest plan for hosted SaaS customers.

Powered by WPeMatico

Espressive, a four-year-old startup from former ServiceNow employees, is working to build a better chatbot to reduce calls to company help desks. Today, the company announced a $30 million Series B investment.

Insight Partners led the round with help from Series A lead investor General Catalyst along with Wing Venture Capital. Under the terms of today’s agreement, Insight founder and managing director Jeff Horing will be joining the Espressive Board. Today’s investment brings the total raised to $53 million, according to the company.

Company founder and CEO Pat Calhoun says that when he was at ServiceNow he observed that, in many companies, employees often got frustrated looking for answers to basic questions. That resulted in a call to a Help Desk requiring human intervention to answer the question.

He believed that there was a way to automate this with AI-driven chatbots, and he founded Espressive to develop a solution. “Our job is to help employees get immediate answers to their questions or solutions or resolutions to their issues, so that they can get back to work,” he said.

They do that by providing a very narrowly focused natural language processing (NLP) engine to understand the question and find answers quickly, while using machine learning to improve on those answers over time.

“We’re not trying to solve every problem that NLP can address. We’re going after a very specific set of use cases which is really around employee language, and as a result, we’ve really tuned our engine to have the highest accuracy possible in the industry,” Calhoun told TechCrunch.

He says what they’ve done to increase accuracy is combine the NLP with image recognition technology. “What we’ve done is we’ve built our NLP engine on top of some image recognition architecture that’s really designed for a high degree of accuracy and essentially breaks down the phrase to understand the true meaning behind the phrase,” he said.

The solution is designed to provide a single immediate answer. If, for some reason, it can’t understand a request, it will open a help ticket automatically and route it to a human to resolve, but they try to keep that to a minimum. He says that when they deploy their solution, they tune it to the individual customers’ buzzwords and terminology.

So far they have been able to reduce help desk calls by 40% to 60% across customers with around 85% employee participation, which shows that they are using the tool and it’s providing the answers they need. In fact, the product understands 750 million employee phrases out of the box.

The company was founded in 2016. It currently has 65 employees and 35 customers, but with the new funding, both of those numbers should increase.

Powered by WPeMatico

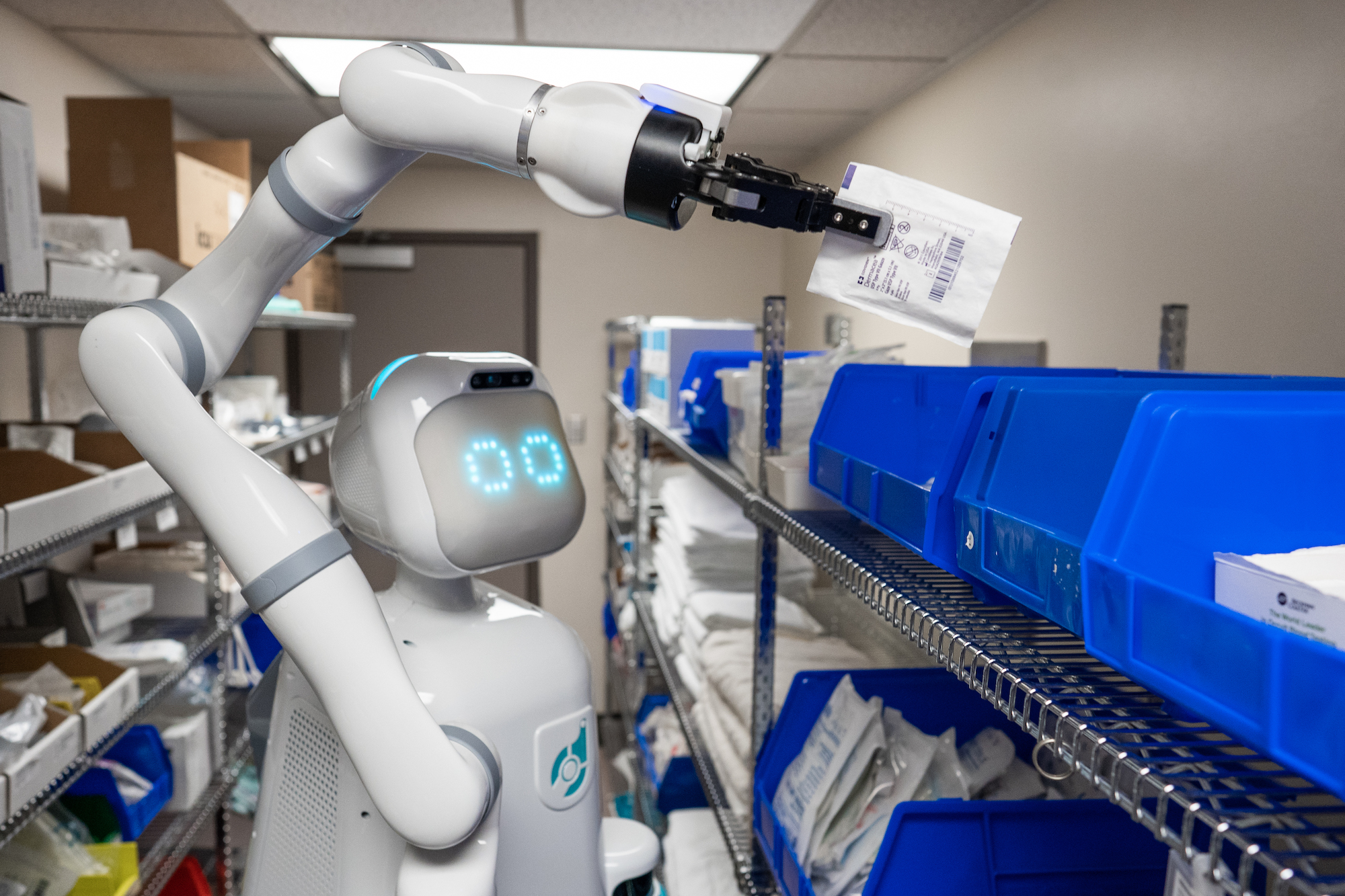

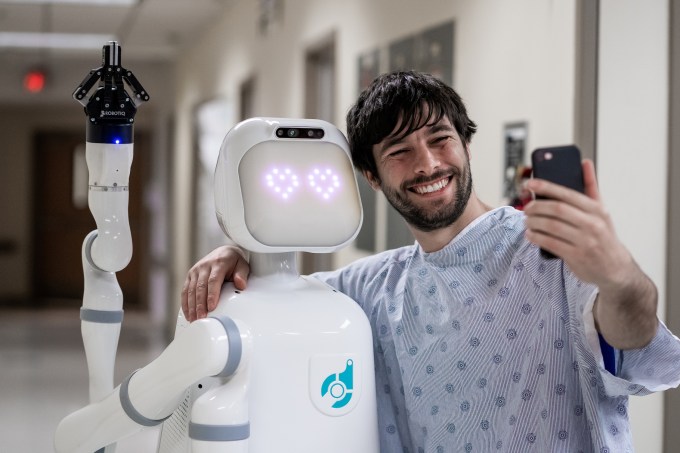

Twenty-eight percent of a nurse’s time is wasted on low-skilled tasks like fetching medical tools. We need them focused on the complex and compassionate work of treating patients, especially amid the coronavirus outbreak. Diligent Robotics wants to give them a helper droid that can run errands for them around the hospital. The startup’s bot Moxi is equipped with a flexible arm, gripper hand and full mobility so it can hunt down lightweight medical resources, navigate a clinic’s hallways and drop them off for the nurse.

With the world facing a critical shortage of medical care professionals, Moxi could help healthcare centers use their staffs as efficiently as possible. And because robots can’t be infected by COVID-19, they’re one less potential carrier interacting with vulnerable populations.

Today, Diligent Robotics announces its $10 million Series A that will help it scale up to deliver “more robots to more hospitals,” CEO Andrea Thomaz tells me. “We’ve been designing our product, Moxi, side by side with hospital customers because we don’t just want to give them an automation solution for their materials management problems. We want to give them a robot that frontline staff are delighted to work with and feels like a part of the team.”

The round, led by DNX Ventures, brings Diligent Robotics to $15.75 million in total funding that’s propelled it to the fifth generation of its Moxi robot. It currently has two deployed in Dallas, Texas, but is already working with two of the three top hospital networks in the U.S. “As the current pandemic and circumstance has shown, the real heroes are our healthcare providers,” says Q Motiwala, partner at DNX Ventures. The new cash from DNX, True Ventures, Ubiquity Ventures, Next Coast Ventures, Grit Ventures, E14 Fund and Promus Ventures will help Diligent Robotics expand Moxi’s use cases and seamlessly complement nurses’ workflows to help alleviate the talent crunch.

The round, led by DNX Ventures, brings Diligent Robotics to $15.75 million in total funding that’s propelled it to the fifth generation of its Moxi robot. It currently has two deployed in Dallas, Texas, but is already working with two of the three top hospital networks in the U.S. “As the current pandemic and circumstance has shown, the real heroes are our healthcare providers,” says Q Motiwala, partner at DNX Ventures. The new cash from DNX, True Ventures, Ubiquity Ventures, Next Coast Ventures, Grit Ventures, E14 Fund and Promus Ventures will help Diligent Robotics expand Moxi’s use cases and seamlessly complement nurses’ workflows to help alleviate the talent crunch.

Thomaz came up with the idea for a hospital droid after doing her PhD in social robotics at the MIT Media lab. Her co-founder and CTO Vivian Chu had done a master’s at UPenn on how to give robots a sense of touch, and then came to work with Thomaz at Georgia Tech. They were inspired by a study revealing how nurses spent so much time acting as hospital gofers, so in 2016 they applied for and won a National Science Foundation grant of $750,000 that funded a six-month sprint to build a prototype of Moxi.

Since then, 18-person Diligent Robotics has worked with hundreds of nurses to learn about exactly what they need from an autonomous assistant. “Today you will go about your day, and you probably won’t interact with any robots….we want to change that,” Thomaz tells me. “The only way you can really bring robots out of the warehouses, off of the factory floors, is to build a robot that can work in our dynamic and messy everyday human environments.” The startup’s intention isn’t to fully replace humans, which it doesn’t think is possible, but to let them focus on the most human elements of their jobs.

Moxi is about the size of a human, but designed to look like an ’80s movie robot so as not to engender an uncanny valley cyborg weirdness. Its head and eyes can move to signal intent, like which direction it’s about to move, while sounds let it communicate with nurses and acknowledge their commands. A moving pillar lets it adjust its height, while its gripper hand and arm can pick and put down smaller pieces of hospital equipment. Its round shape and courteous navigation makes sure it can politely share crowded hallways and travel via elevator.

Diligent Robotics’ solution engineers work with hospitals to teach Moxi how to get around and what they need. The company hopes to eventually build the ability to learn and adapt right into the bot so nurses can teach it new tasks on the fly. “The team continues to demonstrate unmatched robotics-specific innovation by combining social intelligence and human-guided learning capabilities,” says True Ventures partner and Diligent board member Rohit Sharma.

Hospitals pay an upfront fee to buy Moxi robots, and then there’s a monthly fee for the software, services and maintenance. Thomaz admits that “Hospitals are naturally risk-averse, and can be wary to take up new technology,” so the startup is taking a slow and steady approach to deployment so it can convince buyers that Moxi is worth the learning curve.

Diligent Robotics will be competing with companies like Aethon’s TUG bot for pulling laundry and pharmacy carts. Other players in the hospital tech space include Xenex’s machine that disinfects rooms with light, and surgical bots like those from Johnson & Johnson’s Auris and Intuitive Surgical.

Diligent Robotics hopes to differentiate itself by building social intelligence into Moxi so it feels more like an intern than a gadget. “Time and again, we hear from our hospital partners that Moxi not only returns time back to their day but also brings a smile to their face,” says Thomaz. The company wants to evolve Moxi for other dull, dirty or dangerous service jobs.

Eventually, Diligent Robotics hopes to bring Moxi into people’s homes. “While we don’t see robots replacing the companionship and the human connection, we do dream of a time that robots could make nursing homes more pleasant by offsetting the often staggering numbers of caretakers to bed ratios (as bad as 30:1),” Thomaz concludes. That way, Moxi could “help people age with dignity and hold onto their independence for as long as possible.”

Powered by WPeMatico

Quantum Machines, a Tel Aviv-based startup that is building both hardware and software to operate quantum computers, today announced that it has raised a $17.5 million Series A funding round. The round was led by Israeli tech entrepreneur Avigdor Willenz (who, among other companies, co-founded Habana Labs and Anapurna Labs and sold them to Intel and Amazon, respectively) and Harel Insurance Investments.

TLV Partners and Battery Ventures also participated in this round. TLV Partners also led the company’s $5.5 million seed round in 2018, in which Battery Partners also participated.

“The race to commercial quantum computers is one of the most exciting technological challenges of our generation,” said Willenz. “Our goal at [Quantum Machines] is to make this happen faster than anticipated and establish ourselves as a key player in this emerging industry.”

The company says it will use the new funding to accelerate the adoption of its Quantum Orchestration Platform. This platform went live earlier this year. What makes it unique is that it’s a combination of custom hardware, which the company designed itself, and software tools that can be used to control virtually any quantum processor. To control a quantum processor, you also need a powerful classical computer, but traditional computers are ill-suited for this task, Quantum Machines argues, and it’ll take specialized hardware for classical computing to harness the power of quantum computing and run complex algorithms on these machines.

“The classical layers of the quantum computer are the real unmet need. They are the bottleneck,” Quantum Machines co-founder Itamar Sivan told me when the platform launched. “We were really looking into what is holding the industry back. What are the things that we can do today to drive this industry forward, but that will also enable faster progress in the future. Since most of the focus in the last years has been devoted to quantum processors, it was only natural that you know we take on this challenge.”

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re taking a look at the world of esports venture capital investment, largely through the lens of preliminary data that we’ll caveat given how reported VC data lags reality. That phenomenon is likely doubly true in the current moment, as COVID-19 absorbs all news cycles and some venture rounds’ announcements are delayed even more than usual.

All the same, the data we do have paints a picture of a change in esports venture investment, one sufficient in size to indicate that an esports VC slowdown could be afoot. As with all early looks, we’re extending ourselves to reach a conclusion. But… no risk, no reward.

We’ll start by looking at Q1 2020 esports venture totals to date, compare them to year-ago results, and then peek at Q4 2019’s results and its year-ago comparison to get a handle on what else has happened lately in the niche. The picture that the quarters draw will help us understand how esports investing is starting a year that isn’t going as anyone expected.

Today we’re using Crunchbase data, looking at both global and U.S.-specific venture totals in both round and dollar volume. To get a picture of the competitive gaming world, we’re examining investments into companies that are tagged as “esports” related in the Crunchbase database. Given that this is a somewhat wide cut, the data below is more directional than precise and should be treated as such.

Powered by WPeMatico

As a former Jam City executive, Jill Wilson led teams behind some of the top-grossing gaming franchises, like Cookie Jam and Panda Pop. Now she’s running her own startup, Robin Games, where a team of mostly women is working to create a new niche in mobile entertainment they’re calling “lifestyle gaming.” As the name implies, the idea is to create a mobile gaming experience — in this case, fantasy gaming — that’s more like the sophisticated and stylish lifestyle content that’s popular today.

Robin Games is backed by $7 million in seed funding, the company announced on Thursday, as it made its public debut. The round was led by early-stage fund LVP, which has invested in other to game companies including Supercell, Playfish, and NaturalMotion . Additional investors in the oversubscribed round include 1Up Ventures, Alpha Edison, Everblue Management, firstminute Capital, Greycroft Tracker Fund, Hearst Ventures, and Third Kind Venture Capital.

“Traditionally in gaming, when you say ‘fantasy,’ you mean dragons and other mythical creatures, disproportionately built women, armies and battles and explosions and glory,” explained Wilson, Robin Games’ sole founder and CEO. “As a lifelong gamer, I love (most) of these themes, but traditional gamers are no longer in the majority. Thanks to the smartphone, everyone now has access to a gaming console in their pockets. We are expanding the definition of “fantasy” for this modern wave of gamers, whose fantasies are just as diverse as they are,” she added.

Wilson clarified that she’s not meaning to stereotype women as not enjoying fantasy games about things like warriors and dragons. Instead, Robin Games aims to expand the types of fantasies being explored through gaming — including those mobile gaming has yet to include.

While the company isn’t yet announcing its first titles or specific details, like launch dates, the games are said to cover content you’d typically find in a lifestyle magazine, on an Instagram influencer’s profile or on a lifestyle blog for example.

“We are focused on developing games that are deeply sophisticated under the hood, with an elevated, real-world, approachable style that reflects more of the lifestyle content you’d previously see outside of gaming,” Wilson told TechCrunch .

All this will be wrapped up in the free-to-play business model that powers most top-grossing games. In addition, Robin Games’ strategy will allow it to expand to include a partnership strategy, which will diversify its revenue streams further down the road.

Wilson said the idea for Robin Games was something she had in mind for some time, as she was personally looking for games to like this to play herself — only to find they didn’t exist.

“I’ve always designed products for myself first and foremost, which allows me to deeply connect with what the end-user really wants — since the end-user is me,” said Wilson. “Recently, I realized that not only did we have a unique answer to a pretty major gap in the market, but also that the timing was right and, most importantly, that we could pull together the exact right team to execute this vision.”

The startup is currently a team of nine based in Venice Beach. Management is 80% women and everyone had worked together to make hit games in years prior. In terms of hiring, the company is focused on building out a diverse team in order to better realize its vision, Wilson said, and, more broadly, change the face of the gaming industry as it stands today.

“Our mission goes beyond filling a gap in the market. We’re really looking to shake up the games industry, not only redefining what a modern game team looks like, but also changing the definition itself of what it means to be a gamer,” noted Wilson.

In previous studies, female players have been shown to prefer match-3 and social farming games, among others, with fantasy and MMOs further down the list, and sports and shooting games last. But the types of games Robin Games is proposing don’t really fit into any one category that exists today, so it’s still unknown how female gamers will respond.

However, it makes sense to target this underserved market, given that women account for 46% of all U.S. game enthusiasts.

“Jill Wilson and her incredible team are already further along than most developers starting out,” added Are Mack Growen, partner at LVP and member of Robin Games’ Board of Directors, about the firm’s investment. “This team has developed and operated some of the world’s most successful games for a decade, and now they have assembled to bring premium experiences to the massively underserved audience of women. In addition to their industry expertise, they fundamentally understand their audience and the ingredients for powerful entertainment. We are proud to have led their seed round and look forward to helping them redefine what it means to be a gamer.”

Powered by WPeMatico

Quit Genius, the YC-backed startup that uses cognitive behavioral therapy to help folks quit smoking and vaping tobacco products, has today announced the close of an $11 million Series A round.

The new funding was led by Octopus Ventures, with participation from Y Combinator, Startup Health and Triple Point Ventures.

Quit Genius was built by doctors — Yusuf Sherwani (co-founder and CEO), Maroof Ahmed (co-founder and COO) and Sarim Siddiqui (co-founder and head of product) — who met on the first day of medical school. They saw the terrible effects of smoking on patients’ health but didn’t see doctors giving those patients a clear path to quit smoking.

Cognitive behavioral therapy is seen as one of the more effective treatments for breaking addiction, helping patients focus on their thoughts, feelings and behaviors and understanding how one affects the others. The Quit Genius app helps users recognize when a negative thought or feeling pops up, and replace those triggering thoughts and emotions with more positive, healthier thoughts. This is done through various types of content, such as audio sessions, animated videos and interactive exercises.

The company also offers a device that can pair with the app to test users’ breath and help hold them accountable to their goal of quitting.

Quit Genius has already made headway with its smoking and vaping products, and is going to use the funding to expand into other types of addiction, such as alcohol and opioid addiction.

Alongside its consumer-facing product, Quit Genius also offers an enterprise product to businesses that are looking to foster a healthy workforce and also save money on healthcare for employees. Unlike most enterprise wellness programs that charge per person per year (regardless of utilization or engagement), Quit Genius only charges by engagement (employees who use the program) and offers a 25% quit rate guarantee.

In other words, if 25% of enrolled users don’t achieve their goal of quitting, Quit Genius will partially refund fees. Thus far, the company hasn’t had to do that, reports CEO Sherwani.

Sherwani added that the company has signed up 15 enterprise clients, split between self-insured employers and health plan providers.

Beyond the funding and expansion into other forms of addiction, Quit Genius is also trying to do its own part as the novel coronavirus pandemic spreads across the globe. Noting the high-risk status of smokers, Sherwani said that the company will offer its product for free to new sign-ups through April so that they can quit smoking immediately.

Founded by doctors, Quit Genius prioritizes efficacy. The company has enlisted independent research studies to show the success rate of its product, the results of which have been published in peer-reviewed journals. According to that research, more than 60,000 people have quit smoking, with a 53% quit rate, which is higher than other quit-smoking techniques.

The startup has raised a total of $13.6 million from investors listed above, as well as Eric Ries, Serena Williams’ Serena Ventures, Venus Williams and Instacart co-founder Max Mullen.

Powered by WPeMatico