funding

Auto Added by WPeMatico

Auto Added by WPeMatico

A new startup called twine wants to help people feel less isolated and alone. Though the project has been in the works for around six months, it’s launching at a time when people are struggling with being cut off from family, friends, neighbors, co-workers and others due to the COVID-19 outbreak and the resulting government lockdowns and self-quarantines. Described simply as a “Zoom for meeting new people,” twine is a group video chat experience where people are encouraged to have meaningful discussions that spark new friendships.

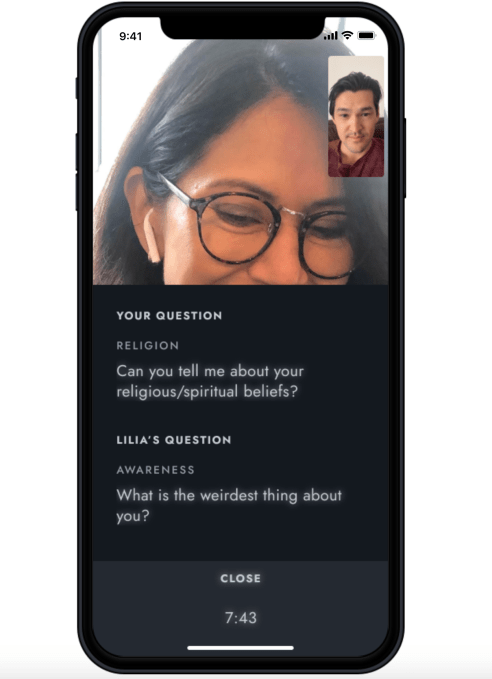

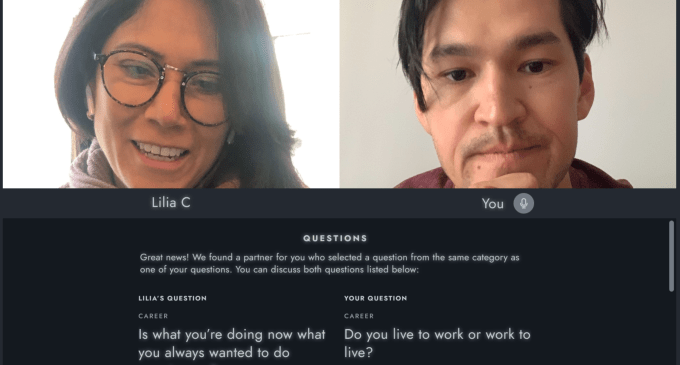

In twine, users are matched with four other partners who they’ll then have 1-to-1 conversations with for eight minutes apiece. The full gathering lasts for a total of 40 minutes, including the virtual guide portion where the ground rules are set.

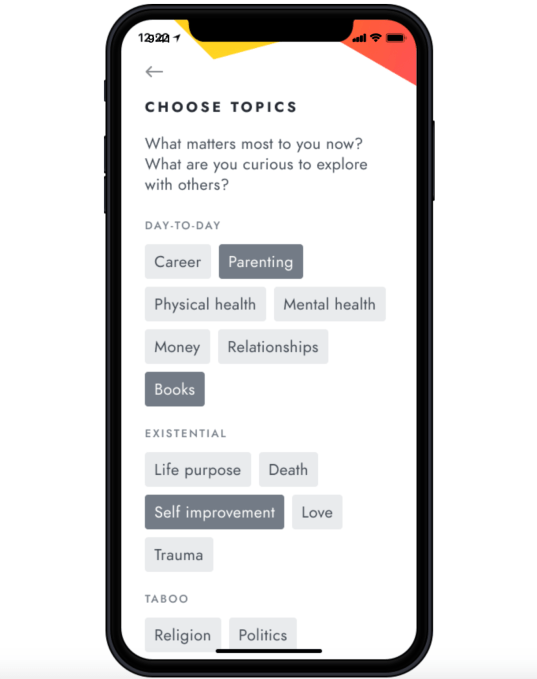

Participants choose from a library of more than 250 “deep” questions, then get matched with partners who want to explore the same topics. They then RSVP for twine’s digital gatherings in their time zone and check in when it’s time to start.

The overall experience is meant to help people find connections by skipping the small talk and going straight to what matters. But the focus is on friendships, not dating. Afterward, users are encouraged to set reminders to get back in touch and meet again in future gatherings.

There’s a hint of Chatroulette to this idea, given that users could be matched to people who are only there to disrupt the experience, in theory at least. But the company aims to reduce the potential for this sort of shock trolling by permanently banning members who are flagged for making others uncomfortable in any sort of way. We also noticed the app asks for your email, phone and ZIP code during its onboarding process, so it’s not entirely an anonymous experience.

In addition, twine requires users to rate each conversation when it ends, and members have to be pre-approved before joining a chat. The company says it’s looking to move toward “real ID only” in the future to further reduce the potential for trolling.

That said, there’s still a bit of a risk in chatting openly with strangers about highly personal topics. Twine’s guidelines say that conversations are not to be discussed with others, but this is not a doctor-patient relationship with legal protections for confidentiality. It’s just a group chat app with people who may or may not be there to follow the rules.

That said, the internet is currently experiencing a rebirth of sorts, due to COVID-19. People are coming online to look for connections. Social media is actually becoming social. This is an ideal environment to test something as optimistic as twine, which at its core believes people are largely good and will use the technology appropriately.

The idea for twine comes from serial entrepreneurs Lawrence Coburn and Diana Rau. Coburn spent the last nine years as founder and CEO of mobile events technology provider DoubleDutch, which was acquired by Cvent in 2019. Rau, meanwhile, was co-founder and CEO of Veterati, a digital mentoring platform for veterans that had also leveraged 1-to-1 conversations as part of its community-building experience.

The founders already knew each other from the Georgetown entrepreneurship ecosystem. And Coburn was an advisor to Veterati, and Rau had worked at DoubeDutch, as well.

Coburn describes his vision for twine as something in between a new social network and a substitute for those who are spiritual, but not religious, in terms of helping people who want to “be better humans.” Rau says she wanted to work on twine to help end loneliness by giving people a place to explore humanity on a one-on-one basis.

The app was originally intended to connect people who would meet up in real-life gatherings, but the coronavirus outbreak shifted those plans and accelerated launch plans.

“Launching a new company during the best of times is really, really hard. During a global pandemic? Yikes!,” wrote Coburn, in a blog post about the launch. “But as the new reality settles in, it has become clear to me that the world needs twine or something like it more than ever. The macro forces that inspired Diana and I to start twine – loneliness, polarization, isolation – will only be exacerbated by social distancing. A societal loneliness that was already classified as an epidemic pre coronavirus, is about to get way, way worse,” he added.

The startup is backed by $1.4 million in seed funding, closed on March 12, led by DoubleDutch investor, Hinge Capital. Other investors from DoubleDutch have also returned to fund twine, including FJ Labs, Brand Foundry and Bragiel Brothers. Angels in the round include April Underwood (Slack), Jay Hoffmann (Rocketmiles), Scott Heiferman (Meetup) and Vishal Kapur (Screenhero).

In the future, twine aims to be subscription-based and launch real-life gatherings, as originally planned, when it’s safe to do so.

The app is currently in private beta on iOS and web. Currently, it has a waitlist of around 1,000 users, mainly from New York City and San Francisco, but twine will be available worldwide.

Powered by WPeMatico

Voice-based social networks and gaming as a new form of identity were among the top emerging trends in consumer social startups, according to an Extra Crunch survey of top social tech investors. Meanwhile, anonymity and dating apps with a superfluous twist were spaces where investors were most pessimistic.

Extra Crunch assembled a list of the most prolific and well-respected investors in social. Many have funded or worked for the breakout companies changing the way we interact with other people. We asked about the most exciting trends they’re seeing and which areas they expect will soon spawn blockbuster social apps.

Subscribe to Extra Crunch to read the full answers to our questionnaire from funds like Andreessen Horowitz, CRV and Initialized.

Here are the 16 leading social network VCs that participated in our survey:

Stay tuned next week for a follow-up article from these investors detailing their thoughts on social investing in the COVID-19 era.

What trends are you most excited about in social from an investing perspective?

First, it’s worth noting that consumer social is very hard to predict. Unlike enterprise software, there’s no rational buyer, and the things that take off can seem “random” or dumb. Startups that see huge success in this space are often pioneering a new feature or way of communicating that hasn’t existed before. Any VC who claims to know what the “next big thing” in consumer social will look like should probably go build it themselves!

Powered by WPeMatico

Securitization is a critical function of the modern financial system. Banks “package” individual loans, say a mortgage or an auto loan, into a group with similar characteristics and sell them to other investors. That gets the debt off the originator’s balance sheet so that they can offer more loans, while also offering private investors alternative investment opportunities to buy up.

Despite the scale of the market — the trade association SIFMA’s research shows that the volume for asset-backed securities reached more than $300 billion in 2019 (excluding mortgages) — much of that structuring remains relatively ad hoc, with structuring agents and buyers constantly seeking each other out.

Much in the way that real estate and startup crowdsourcing platforms democratized access to those alternative investments, Cadence wants to expand access to securitized products while increasing the velocity of transactions for originators and lowering prices. Founder and CEO Nelson Chu said that “our job is to bring transparency and efficiency to this market and through all the various things that we do.” The company operates on top of the Ethereum blockchain network.

Founded in 2018 and launched publicly in 2019, the New York City-based capital markets startup has now structured $88 million in notes across 76 offerings and 12 originators according to the company. The firm’s public leaderboard shows that the largest originators were Sellers Funding with more than $23 million and Wall Street Funding with almost $26 million in transaction volume. Chu said that “I think we are the 21st largest structuring agent the United States in 2020 so far,” which is not a bad place to be for a young startup in a massive multi-trillion dollar market.

In addition to that $88 million volume processed on the company’s retail platform, Cadence also structured a $40 million whole business securitization with FAT Brands, the owner of restaurant chains like Fatburger and Yalla Mediterranean. The company notes that the structuring reduced the company’s interest costs by $2 million.

The company has hit a number of milestones over the past two years. It closed a seed round of $4 million in December led by Revel VC, with Revel’s Thomas Falk, Navtej S. Nandra, former President of E*Trade, and portfolio manager Oliver Wriedt joining the company’s board.

In addition, back in 2019, the company said that it also became the first digital asset company to launch a digital asset ticker on Bloomberg Terminal and also the first to join the Bloomberg App Portal. It also secured the first financial debt rating for a digital asset.

The company has a variety of revenue streams from different areas of its platform. It takes transaction fees on each deal, but also derives revenues from hosting data related to the performance of the underlying loans. Given the company’s technology stack, it has better and more verified data about how the underlying assets that back each security are performing, giving all investment holders a much more robust look at the health of their portfolio.

Longer term, Cadence’s goal is to move to a mostly SaaS model for originators and buyers. “We can be very, very beneficial to every single counterparty involved when we become that,” Chu said, adding “we essentially are Switzerland … because our incentives are all aligned.”

I asked about how the company is responding to the COVID-19 situation, and Chu said that as the world saw in the 2008 global financial crisis, “there are pockets of opportunity here that we continue to find, and we allow retail, accredited investors to get access to that.” Chu gave the example of game developers waiting on payments from Apple and Google who need short-term loans to cover costs.

In addition to Revel, other investors in the seed round included Morgan Creek Digital, Nimble Ventures, Argo, Tuesday Capital, Manatt, and Recharge Capital. R&R Venture Partners, a joint VC firm of former Citi chairman Richard D. Parsons and Clinique chairman Ronald S. Lauder, also participated.

Powered by WPeMatico

CircleCI, an early adherent to the notion of continuous delivery when it launched in 2011, announced a $100 million Series E investment today. It comes on top of a $56 million round last July.

The round was led by IVP and Sapphire Ventures . Under the terms of the deal, Cack Wilhelm will be joining the CircleCI board. Jai Das from Sapphire will also be joining the board as an observer.

Today’s investment brings the total raised to $215 million, according to the company, with $156 million coming over the last 8 months. The company did not want to discuss its current valuation.

Circle CI CEO Jim Rose says with so much uncertainty because of COVID-19 he welcomes not only the money, but the quality of the firms and people involved in the investment.

“We’re really excited to get both IVP and Sapphire because they’ve seen all of it all the way through public and beyond. Given all of the nuttiness over the last few months obviously having cash on the balance sheet is extremely helpful, but the other part, too is that this a time when you want to have more brains around the table, not fewer. And so being able to get people to help out and just think about the problems that we’re encountering right now is really helpful,” Rose told TechCrunch .

Rose recognizes the huge challenge everyone is facing, but he sees this switch to remote workforces really driving the need for more automation, something his company is in a position to help DevOps teams with.

“What we’ve seen from a DevOps perspective is that this forced migration to remote-only for so many organizations has really driven the urgency for more automation in the DevOps pipeline,” he said.

He said this has led to a huge surge in usage on the platform in recent weeks, and today’s investment will at least partly go towards making sure there are enough resources in place to keep the platform stable whatever comes.

“When we think about money and we think about where we’re investing in the near term, we’re investing a lot in making sure that the platform is stable and available and supporting all of our customers as they go through this. You know this is a difficult time, a difficult transition and we’re trying to make sure that we’re doing everything we can to support our customers through that process,” Rose said.

Many companies at this stage of startup maturity begin to look ahead to an IPO, but Rose isn’t ready to discuss that, especially in the current economic climate. “We’re going to have to get folks to some kind of liquidity at some point, but I think right now our focus is on really investing in the platform and investing in our customers and then we’ll let the market clear out and figure out what the new normal looks like,” he said.

The company would consider making some acquisitions with its base of capital if the right opportunity came along. “We’re always evaluating and always looking around. One of the interesting things about our space is that it’s flooded with new and innovative approaches to point problems. There are a lot of companies that are interesting, so we’re definitely always looking around,” he said.

Powered by WPeMatico

WorkClout, a graduate of the Y Combinator Winter 2019 cohort, announced today that it has shifted its focus from manufacturing automation to manufacturing performance support and has raised a $2.3 million seed round.

The funding was led by Spider Capital with participation from Y Combinator, Liquid 2, Soma Capital, Pioneer Fund, Mehta Ventures and several individual investors.

When the company launched last year, it was looking at helping customers drive operational efficiency in their processes, but WorkClout founder and CEO Arjun Patel says they were seeing that there was a ceiling in terms of how much efficiency they could squeeze out of work processes using software.

At that point, Patel decided to take a step back and do some research to figure out how WorkClout could best help manufacturing customers with its software-based solutions. After surveying 124 manufacturers, he says that he realized that these companies really needed help training front-line workers, an area he says is called performance support.

“We found that most of the companies were saying that employees are the biggest challenge that they have to face in terms of how to engage them better or how to empower them better, because ultimately they realize people, even if there is automation, are still the driving force for a lot of sectors,” Patel told TechCrunch.

Towards the end of last year, the company built a new tool to help customers train employees for complex front-line tasks. The workers might have a phone or tablet, which shows them how to complete each task, and gives them feedback as they move through a set of tasks. It also enables these workers to communicate with one another and with management about issues they are seeing on the line. Managers can monitor communication and see how workers are doing on a back-end system in the office.

“We gave them the ability to allow employees to capture and share critical information in real time on the factory floor, where the goal is to actually create standardized multimedia and training content for machines, processes and stations, allowing new and existing employees to get better insight into their work, and at the same time, allowing employees to communicate better about problems on the floor and reduce downtime,” he explained.

Patel recognizes that this is a difficult time to pivot, but says he believes it puts the company in a better position to succeed in the long term. He has cut the team from nine to five employees in an effort to run lean for the short term.

He hopes to begin hiring again in the fourth quarter this year or, at the latest, by Q1 next year. He plans to use that time to build out the product and prepare for a big go-to market push whenever the economy begins to rebound.

He sees this money giving him a long runway of 2.5 years with the company’s current burn and revenue rates, and that should give him enough time to wait out the current economic downturn.

Powered by WPeMatico

DeHaat, an online platform that offers full-stack agricultural services to farmers, has raised $12 million as it looks to scale its network across India.

The Series A financial round for the eight-year-old Patna and Gurgaon-based startup was led by Sequoia Capital India. Dutch entrepreneurial development bank FMO, and existing investors Omnivore and AgFunder, also participated in the round. The startup, which began to seek funding from external investors last year, has raised $16 million to date and $3 million in venture debt.

DeHaat (which means village in Hindi) eases the burden on farmers by bringing together brands, institutional financers and buyers on one platform, explained Shashank Kumar, co-founder and chief executive of the startup, in an interview with TechCrunch.

The platform helps farmers secure thousands of agri-input products, including seeds and fertilizers, and receive tailored advisory on the crop they should sow in a season. “We have built a comprehensive database of crop tests to offer advice to farmers,” he said.

DeHaat, which employs 242 people, also helps them connect with 200 institutional partners to provide farmers with working capital, and when the season is over, helps them sell their yields to bulk buyers such as Reliance Fresh, food delivery startup Zomato and business-to-business e-commerce giant Udaan.

DeHaat today operates in 20 regional hubs in the eastern part of India — states such as Bihar, Uttar Pradesh, and Jharkhand — and serves more than 210,000 farmers, said Kumar.

Shashank Kumar, Amrendra Singh, Adarsh Srivastav and Shyam Sundar Singh co-founded DeHaat in 2012

The startup has developed a network of hundreds of micro-entrepreneurs in rural areas that distribute agri-input goods to farmers from their regional hubs and then bring back the output to the same hub.

“We have an app in local languages and a helpline desk that farmers, many of whom don’t own a smartphone, use to reach out to us and explain their pain points and needs,” he said.

DeHaat does not charge any fee for its advisory, but takes a cut whenever farmers use its platform to buy agri-inputs or sell their crop yields.

The startup will use the fresh capital to extend its network to 2,000 rural retail centres, on-board more micro-entrepreneurs for last-mile delivery and reach 1 million farmers by June of next year, said Kumar. DeHaat is also working on automating its supply chain and developing more sophisticated data analytics, he said.

At stake is India’s agriculture market that is worth $350 billion and serves nearly 100 million small and independent farmers, said Abhishek Mohan, VP at Sequoia Capital India, the VC fund that writes more checks than anyone else in the country.

“This industry is on the brink of a massive transformation thanks to ease of regulation, farmers getting organized and increasing penetration of smartphones. DeHaat is leveraging these trends to build the next-gen product in agricultural supply chain,” said Mohan in a statement.

“The tipping point that led to Sequoia India’s decision to partner with them was the field visit, where the farmers expressed how proud they were to be associated with a platform they felt truly worked in their favour. This impact and deep brand loyalty stems from the leadership team’s razor-sharp focus, deep empathy and fine execution,” he added.

Powered by WPeMatico

The technology that runs our companies these days is staggering in its complexity. We have moved from a monolith to a microservices world, from boxes to SaaS, and while that has added agility to the enterprise, it has come at the cost of a metric f-ton of services and software platforms required by every team in the building.

CIOs need a place to commiserate and get better recommendations on what tech works well and what should be placed in the proverbial recycle bin. Meanwhile, salespeople and investors want to hear these decision-makers’ views on emerging products to identify rich veins to invest in.

At the core of Pulse is a community of vetted CIOs and other tech procurers, currently numbering more than 15,000. On top of this core group of users, Pulse has built a series of products to help exploit their collective wisdom, including several new products the company is announcing today.

In addition to new product launches, the company is announcing a $6.5 million Series A round from AV8 Ventures, which is exclusively backed by mega-insurer Allianz Group and launched last year with a debut $170 million fund. This round closed in December according to the company and brings the startup’s total funding to $10.5 million.

Pulse’s existing product offerings assist product marketers and investment researchers who want to get a “pulse” on the marketplace for tech products by polling CIOs and testing out language around new features and initiatives.

“As an example, Microsoft will come to us and say, ‘Hey, we want to test our messaging and positioning before we sort of blow it up as a campaign. We’d like to do that very quickly through your community.’ And then we facilitate that through a series of questions through surveys and get back the insights to them very quickly,” co-founder and CEO Mayank Mehta explained.

“We think about this as truly becoming a Bloomberg terminal for marketers and investors,” he said. Researchers “can use this as a great way to get a real-time pulse on their buyers and understand how the market is moving, so they can make appropriate investments and ship strategies in real time.”

He said that the company worked with 50 customers last year and delivered some 150 reports. As for the CIOs themselves, “The community is open so long as you are a director level or above,” Mehta said.

In addition to this product for investors and market researchers, the company is also announcing the launch of Product IQ today, which takes the needs of a particular CIO user into account to offer them “personalized” product recommendations for their companies. Those recommendations are surfaced from the continuous data that CIOs are adding into the system through polls and opinion surveys.

“We’re trying to imagine and rethink how decision-making is done for technology executives, especially in a world like this where teams are changing so dramatically,” Mehta said.

Crowdsourced research platforms in the tech industry have become a popular area for VC investment in recent years. StackShare, which raised $5.2 million from e.Ventures, has focused on helping engineers learn from other engineers about the tech they have chosen for their infrastructure. Meanwhile, startups like Wonder and NewtonX, which raised $12 million from Two Sigma Ventures, have focused less on technical solutions and instead answer business questions such as market sizing or competitive landscape.

Pulse was founded in 2017 and is based in San Francisco, and previously raised a seed from True Ventures, according to Crunchbase.

Powered by WPeMatico

GDPR and other data protection and privacy regulations — as well as a significant (and growing) number of data breaches and exposées of companies’ privacy policies — have put a spotlight on not just the vast troves of data that businesses and other organizations hold on us, but also how they handle it. Today, one of the companies helping them cope with that data in a better and legal way is announcing a huge round of funding to continue that work. Collibra, which provides tools to manage, warehouse, store and analyse data troves, is today announcing that it has raised $112.5 million in funding, at a post-money valuation of $2.3 billion.

The funding — a Series F, from the looks of it — represents a big bump for the startup, which last year raised $100 million at a valuation of just over $1 billion. This latest round was co-led by ICONIQ Capital, Index Ventures, and Durable Capital Partners LP, with previous investors CapitalG (Google’s growth fund), Battery Ventures, and Dawn Capital also participating.

Collibra was originally a spin-out from Vrije Universiteit in Brussels, Belgium and today it works with some 450 enterprises and other large organizations. Customers include Adobe, Verizon (which owns TechCrunch), insurers AXA and a number of healthcare providers. Its products cover a range of services focused around company data, including tools to help customers comply with local data protection policies and store it securely, and tools (and plug-ins) to run analytics and more.

These are all features and products that have long had a place in enterprise big data IT, but they have become increasingly more used and in-demand both as data policies have expanded, as security has become more of an issue, and as the prospects of what can be discovered through big data analytics have become more advanced.

With that growth, many companies have realised that they are not in a position to use and store their data in the best possible way, and that is where companies like Collibra step in.

“Most large organizations are in data chaos,” Felix Van de Maele, co-founder and CEO, previously told us. “We help them understand what data they have, where they store it and [understand] whether they are allowed to use it.”

As you would expect with a big IT trend, Collibra is not the only company chasing this opportunity. Competitors include Informatica, IBM, Talend, and Egnyte, among a number of others, but the market position of Collibra, and its advanced technology, is what has continued to impress investors.

“Durable Capital Partners invests in innovative companies that have significant potential to shape growing industries and build larger companies,” said Henry Ellenbogen, founder and chief investment officer for Durable Capital Partners LP, in a statement (Ellenbogen is formerly an investment manager a T. Rowe Price, and this is his first investment in Collibra under Durable). “We believe Collibra is a leader in the Data Intelligence category, a space that could have a tremendous impact on global business operations and a space that we expect will continue to grow as data becomes an increasingly critical asset.”

“We have a high degree of conviction in Collibra and the importance of the company’s mission to help organizations benefit from their data,” added Matt Jacobson, general partner at ICONIQ Capital and Collibra board member, in his own statement. “There is an increasing urgency for enterprises to harness their data for strategic business decisions. Collibra empowers organizations to use their data to make critical business decisions, especially in uncertain business environments.”

Powered by WPeMatico

As companies get to grips with a wider (and, lately, more enforced) model of remote working, a startup that provides a platform to help track and manage all the devices that are accessing networked services — an essential component of cybersecurity policy — has raised a large round of growth funding. Axonius, a New York-based company that lets organizations manage and track the range of computing-based assets that are connecting to their networks — and then plug that data into some 100 different cybersecurity tools to analyse it — has picked up a Series C of $58 million, money it will use to continue investing in its technology (its R&D offices are in Tel Aviv, Israel) and expanding its business overall.

The round is being led by prolific enterprise investor Lightspeed Venture Partners, with previous backers OpenView, Bessemer Venture Partners, YL Ventures, Vertex, and WTI also participating in the round.

Dean Sysman, CEO and Co-Founder at Axonius, said in an interview that the company is not disclosing its valuation, but for some context, the company has now raised $95 million, and PitchBook noted that in its last round, a $20 million Series B in August 2019, it had a post-money valuation of $110 million.

The company has had a huge boost in business in the last year, however — especially right now, not a surprise for a company that helps enable secure remote working, at a time when many businesses have gone remote in an effort to follow government policies encouraging social distancing to slow the spread of the coronavirus pandemic. As of this month, Axonius has seen customer growth increase 910% compared to a year ago.

Sysman said that this round had been in progress for some time ahead of the announcement being made, but the final stages of closing it were all done remotely last week, which has become something of a new normal in venture deals at the moment.

“We’ve all been staying at home for the last few weeks,” he said in an interview. “The crisis is not helping with deals. It’s making everything more complex for sure. But specifically for us there wasn’t a major difference in the process.”

Sysman said that he first thought of the idea for Axonius when at a previous organization — his experience includes several years with the Israeli Defense Forces, as well as time at a startup called Integrity Project, acquired by Mellanox — where he realised the organization itself, and all of its customers, never actually knew how many devices accessed their network, which is a crucial first step in being able to secure any network.

“Every CIO I met I would ask, do you know how many devices you have on your network? And the answer was either ‘I don’t know,’ or big range, which is just another way of saying, ‘I don’t know,’” Sysman said. “It’s not because they’re not doing their jobs but because it’s just a tough problem.”

Part of the reason, he added, is because IP addresses are not precise enough, and de-duplicating and correlating numbers is a gargantuan task, especially in the current climate of people using not just a multitude of work-provided devices, but a number of their own.

That was what prompted Sysman and his cofounders Ofri Shur and Avidor Bartov to build the algorithms that formed the basis of what Axonius is today. It’s not based on behavioural data as some cybersecurity systems are, but something that Sysman describes as “a deterministic algorithm that knows and builds a unique set of identifiers that can be based on anything, including timestamp, or cloud information. We try to use every piece of data we can.”

The resulting information becomes a very valuable asset in itself that can then be used across a number of other pieces of security software to search for inconsistencies in use (bringing in the behavioural aspect of cybersecurity) or other indicators of malicious activity — specifically following the company’s motto, “Know Your Assets, Identify Gaps, and Automate Security Policy Enforcement” — even as data itself may seem a little pedestrian on its own.

“We like to call ourselves the Toyota Camry of cybersecurity,” Sysman said. “It’s nothing exotic in a world of cutting-edge AI and advanced tech. However it’s a fundamental thing that people are struggling with, and it is what everyone needs. Just like the Camry.”

For now, Axonius is following the route of providing a platform that can interconnect with a number of other security products — currently numbering around 100 — rather than building those tools itself, or acquiring them to bring them in house. That could be one option for how potentially it might evolve over time, however.

For now, the idea of being agnostic to those specific tools and providing a platform just to identify and manage assets is a formula that has already seen a lot of traction with customers — which include companies like Schneider Electric, the New York Times, and Landmark Medical, among others — as well as investors.

“Any enterprise CISO’s top priority, with unwavering consistency, is asset discovery and management. You can’t protect a device if you don’t know it exists.” said Arsham Menarzadeh, general partner at Lightspeed Venture Partners, in a statement. “Axonius integrates into any security and management product to show customers their full asset landscape and automate policy enforcement. Their integrated approach and remediation capabilities position them to become the operating system and single source of truth for security and IT teams. We’re excited to play a part in helping them scale.”

Powered by WPeMatico

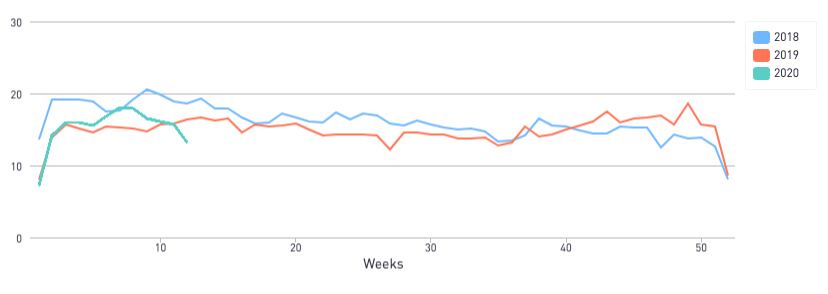

Many founders will have kicked off the new year with a new fundraising round. According to the data we shared last year, March, October and November were the months when VCs were reviewing the most decks.

But the COVID-19 pandemic has ground to a halt many industries, and there are even warnings that this will affect the next two quarters in regards to fundraising.

We’ve reviewed the data in our 2020 DocSend Startup Index and we’ve begun tracking the Pitch Deck Interest Metric. With San Francisco under a shelter-in-place order and many VCs scrambling to adjust their processes to an all-remote world, we saw pitch deck interest drop 11.6% when compared to the same week in 2019. While there has been a drop in interest so far, there is still a lot of activity, and VCs seem to still be reading pitch decks.

We will be monitoring the Pitch Deck Interest Metric in the coming weeks, but if you’re an early-stage startup and are in the middle of your fundraise, or are about to fundraise, there are some things you can do to help insure your startup is ready for funding before you meet with any (more) investors.

The Pitch Deck Interest Metric declined 11.6% compared to the same week in 2019

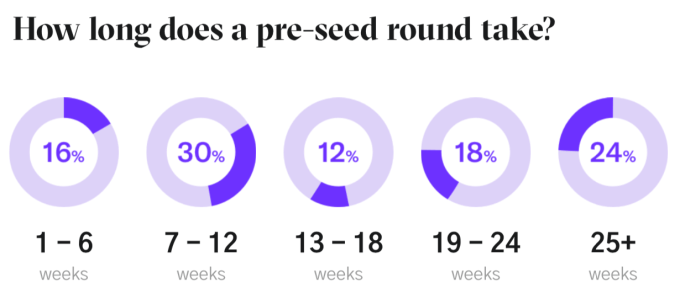

If you were about to kick off a fundraising round, you should have been prepared to contact 50 or more investors, have 20-30 meetings and spend somewhere around 20 weeks before you signed your term sheet. That’s a lot of time and energy to invest, especially when the economy is poised for a downturn and you’re most likely needed in other parts of your business.

If you’ve already started your round and are wondering if you should push through, I’ve written a piece on knowing when to quit and recalibrate versus when to push through (Extra Crunch membership required).

Many factors play into navigating a successful fundraising round, and the expectations of investors are constantly changing — specifically when it comes to the pre-seed round.

Investors are now looking for market-ready products and want to see pitch decks that feature the content they’re expecting. We expect to see this focus intensify over the coming months as VCs have more time to spend not just to review pitch decks, but on due diligence for companies in which they plan to invest. Our new report outlines advice for pre-seed startups that are looking to adjust their fundraising strategy.

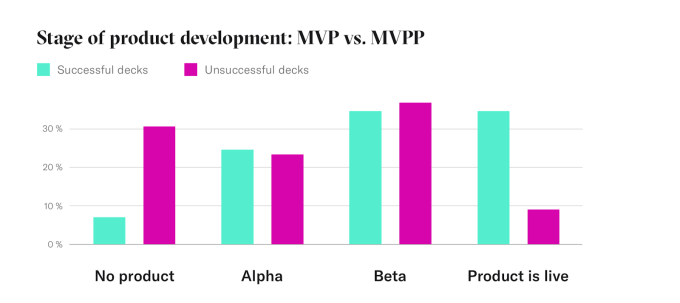

Our analysis reveals a shift in the level of readiness required by institutional investment to receive pre-seed funding. In the past, pre-seed startups could get by with just an MVPP (Minimum Viable PowerPoint). But now, investors are placing their bets on pre-seed startups that have already entered the market and developed an alpha, beta or shipping product.

In fact, 92% of companies with successful pitch decks had either an alpha, beta or shipping product, where only 68% of companies with unsuccessful pitch decks presented the same type of product readiness.

As the economy moves closer to a downturn we can expect VCs to be more cautious with their investments. The current data already shows a preference for companies that have live products; it’s worth the time and effort to be product-ready coming into a pre-seed round or if you’re a startup ready to tackle the round again with a fresh perspective.

That said, even if you do have an MVP, rethinking your pitch deck may be something else to consider. Here’s a good test. Using your pitch deck, spend three to four minutes (that’s all the time you’ll get from a VC) to pitch your business to a friend or family member who knows nothing about your business. Afterward, ask them for a one-sentence description of your company. If they’re not clearly describing what your company does and the problem it’s trying to solve, you probably need to rethink your pitch deck.

According to our recent report, a “less is more” attitude toward creating a compelling pitch deck for meetings could mean more success in pre-seed fundraising.

Your pitch deck will be your main calling card right now. As community events are being replaced with online gatherings during the COVID-19 pandemic, we can expect to see less one-to-one engagement at these events. So pitching a VC in person is not likely to happen anytime soon. Whether you’re sending them a cold email, or getting a warm intro from a portfolio company, you’re going to need to lead with your pitch deck.

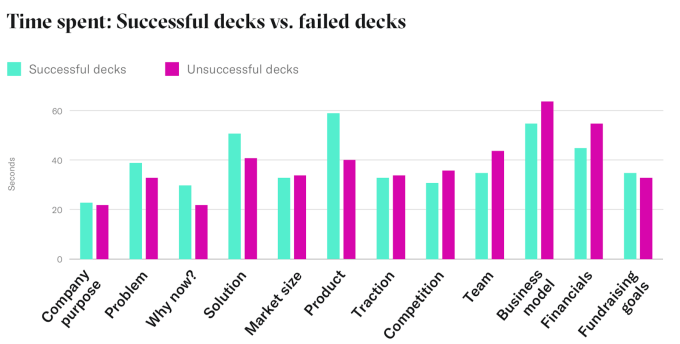

Despite the product taking a more prominent role in the fundraising round, the pitch deck is still a focal point and should be tailored to tell your story in the most effective way, as investors are spending less time evaluating them. On average, investors are spending just 3 minutes and 21 seconds on the pitch deck and the average deck is just 20 slides.

If you are in the process of reevaluating your pitch deck, it could be helpful to make sure your slides feature the right content in the right order. Investors spend nearly 50% more time on the product slides in successful pitch decks and over 18% longer on the business model in unsuccessful pitch decks. Additionally, investors spent more time on solution slides in successful decks than unsuccessful decks.

Another area that could benefit from reevaluation is the number of investors contacted, meetings held and the number of weeks spent in a funding round. Generally speaking, the average amount of investors contacted for successful fundraising rounds is 56, resulting in 26 meetings. On average, successful pre-seed startups will spend 20.5 weeks on fundraising.

When it comes to fundraising, there are diminishing returns for investor outreach. You shouldn’t need to send your deck to more than 60-70 investors and have more than 20-30 meetings. If you’re doing more than that, the ROI on your time just isn’t worth it. Because the current crisis is affecting VCs’ willingness to invest, you’re better off finding a small list of investors who are active and targeting your pitch to them. If you’ve reached out to more than 70 investors, but you’re still faced with a wall of “nos” you’re better off pausing your fundraising and addressing the feedback you’ve received so far. For more on when you should quit and reevaluate versus push through you can read my article here (Extra Crunch membership required).

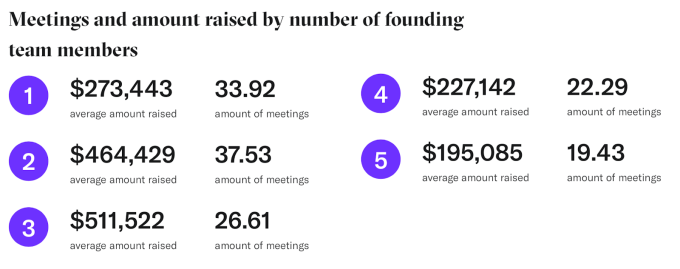

Another area pre-seed startups should evaluate is the number of founders of a company. Our data shows investors still prefer teams of two-three founders, though our data shows that being a solo founder is preferable to having too many founders. For teams of five founders, they averaged earning $195,085 while founding teams of three garnered $511,522.

This may be the right time to find a co-founder. With many people working from home or out of work, this could be the opportunity to take your idea and bring on the technical founder you need. There are online groups and events popping up everywhere in response to social distancing. If you’re worried being a solo founder is going to hold you back, you may want to invest time in those new communities.

For many startups, especially if you are not in Silicon Valley where a substantial amount of funding happens, the process of fundraising can be very opaque. DocSend’s purpose in analyzing this data is to bring some transparency to the process. This in turn provides perspective.

But what founders should do, if they haven’t done so already, is to get some additional perspective. Talk to experts outside your immediate circle of influence. Don’t have a mentor or advisors? Find them. Get a different take on your product idea or the market conditions. Especially now that community events are going virtual, location doesn’t have to hold you back from joining the startup community and finding people to offer feedback on your product or company.

Fundraising is both an art and science. Combining the insights from our data with the benefit of your own community can help you get back on your feet and pitching your company with hopefully a better outcome.

Powered by WPeMatico