funding

Auto Added by WPeMatico

Auto Added by WPeMatico

For better or worse, digital identity management services — the process of identifying and authenticating users on networks to access services — has become a ubiquitous part of interacting on the internet, all the more so in the recent weeks as we have been asked to carry out increasingly more of our lives online.

Used correctly, they help ensure that it’s really you logging into your online banking service; used badly, you feel like you can’t innocently watch something silly on YouTube without being watched yourself. Altogether, they are a huge business: worth $16 billion today according to Gartner but growing at upwards of 30% and potentially as big as $30.5 billion by 2024, according to the latest forecasts.

Now, a company called ForgeRock, which has built a platform that is used to help make sure that those accessing services really are who they say are, and help organizations account for how their services are getting used, is announcing a big round of funding to continue expanding its business amid a huge boost in demand.

The company is today announcing that it has raised $93.5 million in funding, a Series E it will use to continue expanding its product and take it to its next step as a business, specifically investing in R&D, cloud services and its ForgeRock Identity Cloud, and general global business development.

The round is being led by Riverwood Capital, and Accenture Ventures, as well as previous investors Accel, Meritech Capital, Foundation Capital and KKR Growth, also participated.

Fran Rosch, the startup’s CEO, said in an interview that this will likely be its final round of funding ahead of an IPO, although given the current static of affairs with a lot of M&A, there is no timing set for when that might happen. (Notably, the company had said its last round of funding — $88 million in 2017 — would be its final ahead of an IPO, although that was under a different CEO.)

This Series E brings the total raised by the company to $230 million. Rosch confirmed it was raised as a material upround, although he declined to give a valuation. For some context, the company’s last post-money valuation was $646.50 million per PitchBook, and so this round values the company at more than $730 million.

ForgeRock has annual recurring revenues of more than $100 million, with annual revenues also at over $100 million, Rosch said. It operates in an industry heavy with competition, with some of the others vying for pole position in the various aspects of identity management including Okta, LastPass, Duo Serurity and Ping Identity.

But within that list it has amassed some impressive traction. In total it has 1,100 enterprise customers, who in turn collectively manage 2 billion identities through ForgeRock’s platform, with considerably more devices also authenticated and managed on top of that.

Customers include the likes of the BBC — which uses ForgeRock to authenticate and log not just 45 million users but also the devices they use to access its iPlayer on-demand video streaming service — Comcast, a number of major banks, the European Union and several other government organizations. ForgeRock was originally founded in Norway about a decade ago, and while it now has its headquarters in San Francisco, it still has about half its employees and half its customers on the other side of the Atlantic.

Currently ForgeRock provides services to businesses related to identity management including password and username creation, identity governance, directory services, privacy and consent gates, which they in turn provide both to their human customers as well as to devices accessing their services, but we’re in a period of change right now when it comes to identity management. It stays away from direct-to-consumer password management services and Rosch said there are no plans to move into that area.

These days, we’ve become more aware of privacy and data protection. Sometimes, it’s been because of the wrong reasons, such as giant security breaches that have leaked some aspect of our personal information into a giant database, or because of a news story that has uncovered how our information has unwittingly been used in ‘legit’ commercial schemes, or other ways we never imagined it would.

Those developments, combined with advances in technology, are very likely to lead us to a place over time where identity management will become significantly more shielded from misuse. These could include more ubiquitous use of federated identities, “lockers” that store our authentication credentials that can be used to log into services but remain separate from their control, and potentially even applications of blockchain technology.

All of this means that while a company like ForgeRock will continue to provide its current services, it’s also investing big in what it believes will be the next steps that we’ll take as an industry, and society, when it comes to digital identity management — something that has had a boost of late.

“There are a lot of interesting things going on, and we are working closely behind the scenes to flesh them out,” Rosch said. “For example, we’re looking at how best to break up data links where we control identities to get access for a temporary period of time but then pull back. It’s a powerful trend that is still about four to five years out. But we are preparing for this, a time when our platform can consume decentralised identity, on par with logins from Google or Facebook today. That is an interesting area.”

He notes that the current market, where there has been an overall surge for all online services as people are staying home to slow the speed of the coronavirus pandemic, has seen big boosts in specific verticals.

Its largest financial services and banking customers have seen traffic up by 50%, and digital streaming has been up by 300% — with customers like the BBC seeing spikes in usage at 5pm every day (at the time of the government COVID-19 briefing) that are as high as its most popular primetime shows or sporting events — and use of government services has also been surging, in part because many services that hadn’t been online are now developing online presences or seeing much more traffic from digital channels than before. Unsurprisingly, its customers in hotel and travel, as well as retail, have seen drops, he added.

“ForgeRock’s comprehensive platform is very well-positioned to capitalize on the enormous opportunity in the Identity & Access Management market,” said Jeff Parks, co-founder and managing partner of Riverwood Capital, in a statement. “ForgeRock is the leader in solving a wide range of workforce and consumer identity use cases for the Global 2000 and is trusted by some of the largest companies to manage millions of user identities. We have seen the growth acceleration and are thrilled to partner with this leadership team.” Parks is joining the board with this round.

Powered by WPeMatico

In today’s grim economic climate, companies are looking for ways to automate wherever they can. Bridgecrew, an early-stage startup that makes automated cloud security tooling aimed at engineers, announced a $14 million Series A today.

Battery Ventures led the round with participation from NFX, the company’s $4 million seed investor. Sorensen Ventures, DNX Ventures, Tectonic Ventures, and Homeward Ventures also participated. A number of individual investors also helped out. The company has raised a total of $18 million.

Bridgecrew CEO and co-founder Idan Tendler says that it is becoming easier to provision cloud resources, but that security tends to be more challenging. “We founded Bridgecrew because we saw that there was a huge bottleneck in security engineering, in DevSecOps, and how engineers were running cloud infrastructure security,” Tendler told TechCrunch.

They found that a lot issues involved misconfigurations, and while there were security solutions out there to help, they were expensive, and they weren’t geared towards the engineers who were typically being charged with fixing the security issues, he said.

The company decided to solve that problem by coming up with a solution geared specifically for the way engineers think and operate. “We do that by codifying the problem, by codifying what the engineers are doing. We took all the tasks that they needed to do to protect around remediation of their cloud environment and we built a playbook,” he explained.

The playbooks are bits of infrastructure as code that can resolve many common problems quickly. When they encounter a new problem, they build a playbook and then that becomes part of the product. He says that 90% of the issues are fairly generic like following AWS best practices or ensuring SOC-2 compliance, but the engineers are free to tweak the code if they need to.

Tendler says he is hiring and sees his product helping companies looking to reduce costs through automation. “We are planning to grow fast. The need is huge and the COVID-19 implications mean that more and more companies will be moving to cloud and trying to reduce costs, and we help them do that by reducing the barriers and bottlenecks for cloud security.”

The company was founded 14 months ago and has 100 playbooks available. It’s keeping the crew lean for now with 16 employees, but it has plans to double that by the end of the year.

Powered by WPeMatico

Anodot, a startup that helps customers monitor business operations against a set of KPIs, announced a $35 million Series C investment today.

Intel Capital led this round with a lot of help. New investors SoftBank Ventures Asia, Samsung NEXT and La Maison also participated along with existing investors Disruptive Technologies L.P., Aleph Venture Capital and Redline Capital. Today’s investment brings the total raised to $62.5 million, according to the company.

Anodot lets you take any kind of data, whatever your company finds important, and it tracks it automatically and reports on changes that would have an impact on the business, according to David Drai, CEO and co-founder.

“We take any kind of normalized data into our platform and learn all the behavior of the data against normal behavior. When I say normal behavior, it means any time-based data in what is called a time series. And we understand all the trends of that data, and we do this autonomously without any configuration, except defining what is interesting for you,” Drai explained.

That means that the platform will let you know, for example, of any drop in your business, any drop in your conversions, any spike in your costs — and so forth. What you track depends on your vertical and what’s important to your business.

He compares it to applications performance monitoring, but instead of monitoring the company’s technology systems, it’s monitoring the systems that run the business. Just as you don’t want to miss signals that your servers could be going down, neither do you want to let factors that could cost your business money go unnoticed.

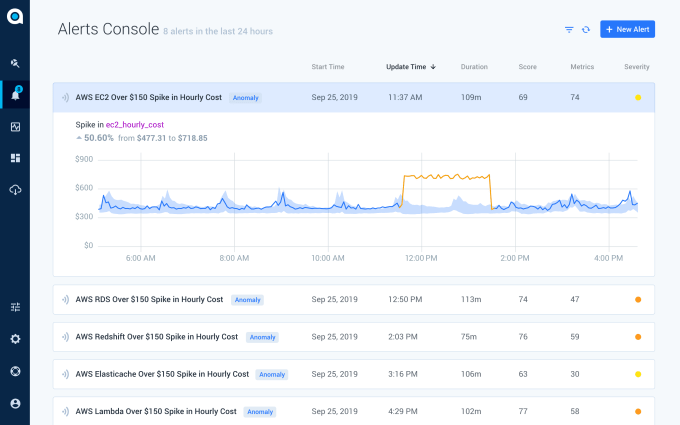

This dashboard lets you monitor unusual changes in cloud costs. Image Credit: Anodot

The way it works is you connect to the systems that matter, and Anodot can review those systems, learn what constitutes a level of normal behavior, then identify when anomalies occur. It does this by mapping against your KPIs, and this can involve thousands or even tens of thousands of KPIs based on an individual company.

As Drai points out, an eCommerce company with 1000 products in 50 countries, will have 50,000 KPIs, one for each product in each country, and you can track these in Anodot.

He says that under the current economic conditions, he is taking a two-pronged approach to building his business involving both offense and defense. On defense, he will take a cautious approach to hiring, but he sees his product helping companies understand and control costs, so he will continue to sell the product as a cost-saving device at a time when that is of increasing importance to businesses everywhere.

The company was founded in 2014. It currently has 70 employees and 100 paying customers including Atlassian, T Mobile, Lyft and Pandora.

Powered by WPeMatico

VAST Data, a startup that has come up with a cost-effective way to deliver flash storage, announced a $100 million Series C investment today on a $1.2 billion valuation, both unusually big numbers for an enterprise startup in Series C territory.

Next47, the investment arm of Siemens, led the round with participation from existing investors 83North, Commonfund Capital, Dell Technologies Capital, Goldman Sachs, Greenfield Partners, Mellanox Capital and Norwest Venture Partners. Today’s investment brings the total raised to $180 million.

That’s a lot of cash any time, but especially in the middle of a pandemic. Investors believe that VAST is solving a difficult problem around scaled storage. It’s one where customers tend to deal with petabytes of data and storage price tags beginning at a million dollars, says company founder and CEO Renen Hallak.

As Hallak points out, traditional storage is delivered in tiers with fast, high-cost flash storage at the top of the pyramid all the way down to low-cost archival storage at the bottom. He sees this approach as flawed, especially for modern applications driven by analytics and machine learning that rely on lots of data being at the ready.

VAST built a system they believe addresses these issues around the way storage has traditionally been delivered.”We build a single system. This as fast or faster than your tier one, all-flash system today and as cost effective, or more so, than your lowest tier five hard drives. We do this at scale with the resilience of the entire [traditional storage] pyramid. We make it very, very easy to use, while breaking historical storage trade-offs to enable this next generation of applications,” Hallak told TechCrunch.

The company, which was founded in 2016 and came to market with its first solution in 2018, does this by taking advantage of some modern tools like Intel 3D XPoint technology, a kind of modern non-volatile memory along with consumer-grade QLC flash, NVMe over Fabrics protocol and containerization.

“This new architecture, coupled with a lot of algorithmic work in software and types of metadata structures that we’ve developed on top of it, allows us to break those trade-offs and allows us to make much more efficient use of media, and also allows us to move beyond scalability limits, resiliency limits and problems that other systems have in terms of usability and maintainability,” he said.

They have a large average deal size; as a result, the company can keep its cost of sales and marketing to revenue ratio low. They intend to use the money to grow quickly, which is saying something in the current economic climate.

But Hallak sees vast opportunity for the kinds of companies with large amounts of data who need this kind of solution, and even though the cost is high, he says ultimately switching to VAST should save companies money, something they are always looking to do at this kind of scale, but even more so right now.

You don’t often see a unicorn valuation at Series C, especially right now, but Hallak doesn’t shy away from it at all. “I think it’s an indication of the trust that our investors put in our growth and our success. I think it’s also an indication of our very fast growth in our first year [with a product on the market], and the unprecedented adoption is an indication of the product-market fit that we have, and also of our market efficiency,” he said.

They count The National Institute of Health, General Dynamics and Zebra as customers.

Powered by WPeMatico

As silently and swiftly as it has devastated families and communities around the world, COVID-19 has also left many startups gasping for air. Emerging companies with strong 2020 revenue forecasts have seen their high-confidence plans reduced by 60%-80% in a matter of days. Even in the best of times, startups must reach value-unlocking milestones to successfully raise new capital. But today, a globally synchronized halt to business activity has made irrelevant normal benchmarks for financing rounds.

Obtaining payroll support from the recently enacted special government programs for small businesses will not resolve the cascading problems startups are grappling with, regardless of whether or not they are VC-backed.

Product development roadmaps in many innovation-driven industries are changing in ways that may permanently alter a company’s future strategic direction. Merger and acquisition discussions are being shelved. Normal financing rounds, in process and contemplated, are contracting or being abandoned altogether. Many venture funds, including corporate venture programs, have unilaterally “taken a pause” to reevaluate the radically changing landscape for their early-stage company portfolios.

I last experienced this phenomenon in the aftermath of the Great Technology Bubble: 2002-2003. And all signs show that we are at the beginning of a new round of punitive “incentives” for venture investors to keep their companies alive.

Several of my current portfolio companies have recently proposed “emergency bridge” convertible note financings of between $5 million and $15 million, each featuring a painful feature for non-participants: multiple liquidation preferences benefiting only the new money above 3x, with discounts greater than 20% on conversion in a new equity financing. Of course, these financings are open to both existing and new investors. But the likelihood of another round is actually diminished by this type of structure.

Powered by WPeMatico

Mobile messaging startup Attentive continues to bring in new funding.

The startup raised a $40 million Series B last summer, followed by a $70 million Series C at the beginning of this year. Today it’s announcing that it’s extended the Series C by another $40 million, bringing the total round size to $110 million.

CEO Brian Long (who previously founded TapCommerce with his Attentive co-founder Andrew Jones and sold the company to Twitter) told me that the new funding closed just a week ago. He said the money comes from institutional investors who had wanted to participate in the Series C, but “for whatever reason, the timing didn’t work out.”

Then, as the startup wanted to invest in new areas — particularly in response to the COVID-19 pandemic — Long reached out again. Once they saw Attentive’s numbers for the first quarter of 2020, the firms were willing to invest.

Apparently, the number of new customer sign-ups is only increasing, with Attentive now working with more than 1,000 businesses. Companies like Coach, Urban Outfitters, CB2, PacSun, Lulus and Jack in the Box use the platform to manage their mobile messaging, with tools around adding text message subscribers, creating engaging messages and tracking the results of those campaigns.

And while we’re at the beginning of what’s likely to be a dramatic slowdown in advertising and marketing, Long suggested that even if businesses pull back on acquiring new customers, they’ll still need to maintain a relationship with existing ones.

“CRM is such a critical channel for companies … email and text are the last thing you would shut down,” he said.

Sequoia Capital Global Equities and Coatue are the new investors in the Series C. Sequoia’s venture fund already led (or co-led) the Series C and the Series B, but Long said he was interested in working with the firm’s crossover fund — and with Coatue — partly because they invest in public companies as well.

Not that he has immediate plans for Attentive to go public, but he said, “It just creates optionality,” so that there are fewer financial pressures regardless of the route the company takes.

Other investors in the Series C include IVP, Bain Capital Ventures, NextView Ventures, Eniac Ventures and High Alpha.

“Attentive’s rapid growth is an indicator of how consumers are eager to find a more direct, personalized and efficient channel to interact with businesses,” said Jeff Wang, managing partner at Sequoia Capital Global Equities, in a statement. “We’ve been impressed by how quickly Attentive’s business has scaled, its strong customer momentum, and the expertise of the team. We are thrilled to increase Sequoia’s partnership with Attentive through our Global Equities fund.”

As for how Attentive is responding to COVID-19, the startup plans to create funds to help customers navigate the economic fallout. There will be more details released in the coming weeks, but Long said the idea is to launch funds focused on the e-commerce/retail, food/beverage and educational sectors, providing free access to Attentive tools and services “to help those companies get recharged.”

Long added that he hopes to grow Attentive’s headcount from 260 employees to more than 400 by the end of this year.

Powered by WPeMatico

Frame AI, a New York City startup that uses artificial intelligence and machine learning to help companies understand their customers better across multiple channels, announced a $6.3 million Series A investment today.

G20 Ventures and Greycroft led the round together. Bill Wiberg, co-founder and partner at G20, will join Frame’s board under the terms of the deal. The total raised with an earlier seed round is over $10 million, according to the company.

“Frame is basically an early warning system and continuous monitoring tool for your customer voice,” Frame CEO and co-founder George Davis told TechCrunch . What that means, in practice, is the tool plugs into help desk software, call center tooling, CRM systems and anywhere else in a company that communicates with a customer.

“We then use natural language understanding to pull out emerging themes and basically aggregate them to account and segment levels so that customer experience leaders can prioritize taking actions to improve their relationships,” Davis explained.

He believes that customer experience leaders are being asked to do more and more in terms of talking to customers on ever more channels and digesting that into useful information for the rest of their company to be responsive to customer needs, and he says that there isn’t a lot of tooling to help with this particular part of the customer experience problem.

“We don’t think they have the right tools to do either the listening in the first place or the analysis. We’re trying to make it possible for them to hear their customers everywhere they’re already talking to them, and then act on that information,” he said.

He says they work alongside customer data platforms (CDPs) like Segment, Salesforce Customer 360 and Adobe Real-time CDP. “We can take the customer voice information from all of these unstructured sources, all these natural language sources and turn it into moments that can be contributed back to one of these structured data platforms.”

Davis certainly recognizes that his company is getting this money in the middle of a health and economic crisis, and he hopes that a tool like his that can help take the pulse of the customer across multiple channels can help companies succeed at a time when a data-driven approach to customer experience is more important than ever.

He says that by continuing to hire through this and building his company, he can contribute to restarting the economic engine, even if in some small way.

“It’s a bleak time, but I have a lot of confidence in New York and in the country, in the customer experience community and in the world’s ability to bounce back strong from this. I think it’s actually created a lot of solidarity that we’re all going to find a lot of new opportunities, and we’re going to just keep building Frame as fast as we can.”

Powered by WPeMatico

Could avatars that show what co-workers are up to save work-from-home teams from constant distraction and loneliness? That’s the idea behind Pragli, the Bitmoji for the enterprise. It’s a virtual office app that makes you actually feel like you’re in the same building.

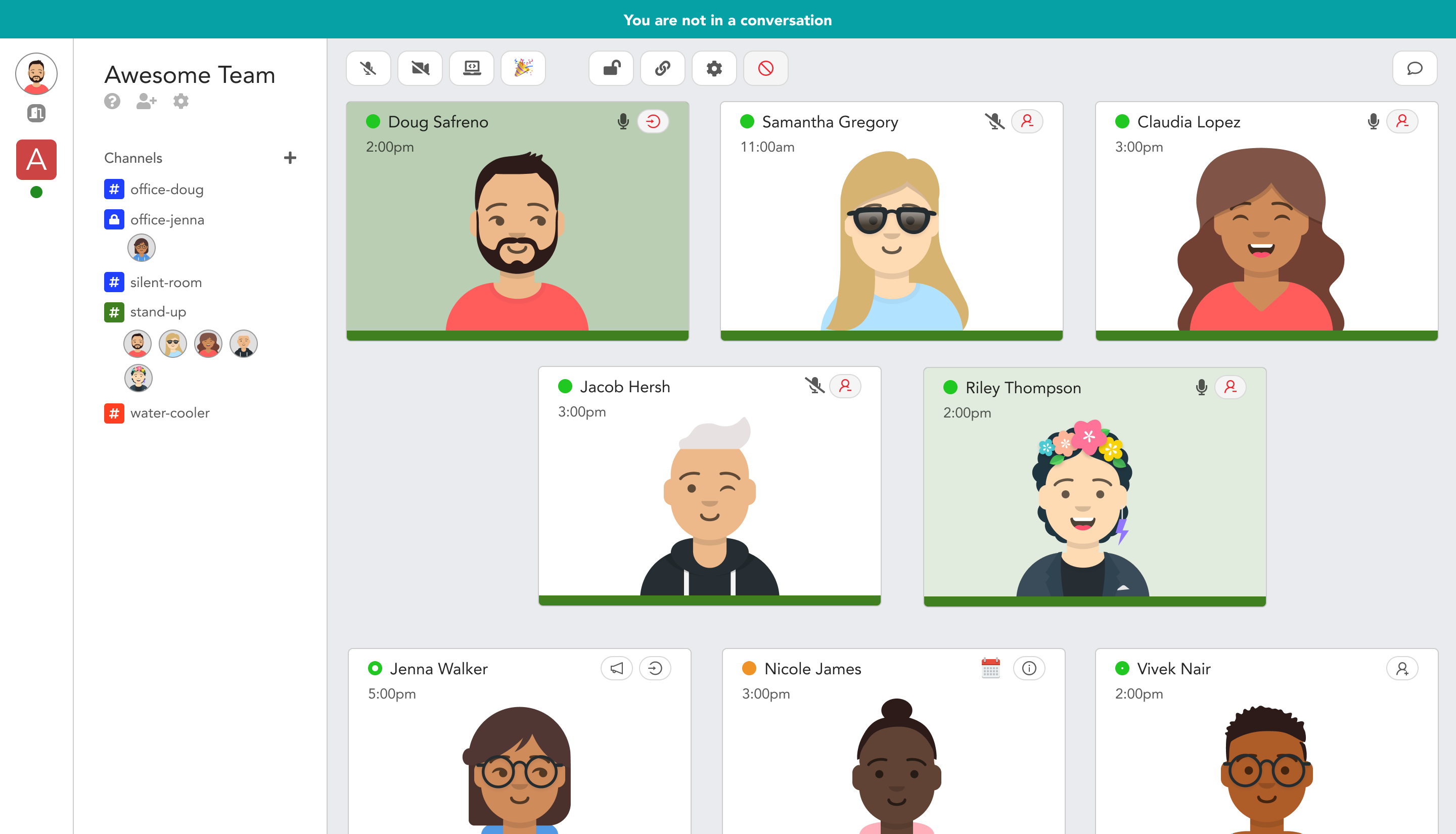

Pragli uses avatars to signal whether co-workers are at their desk, away, in a meeting, in the zone while listening to Spotify, taking a break at a digital virtual water coooler or done for the day. From there, you’ll know whether to do a quick ad hoc audio call, cooperate via screenshare, schedule a deeper video meeting or a send a chat message they can respond to later. Essentially, it translates the real-word presence cues we use to coordinate collaboration into an online workplace for distributed teams.

“What Slack did for email, we want to do for video conferencing,” Pragli co-founder Doug Safreno tells me. “Traditional video conferencing is exclusive by design, whereas Pragli is inclusive. Just like in an office, you can see who is talking to who.” That means less time wasted planning meetings, interrupting colleagues who are in flow or waiting for critical responses. Pragli offers the focus that makes remote work productive with the togetherness that keeps everyone sane and in sync.

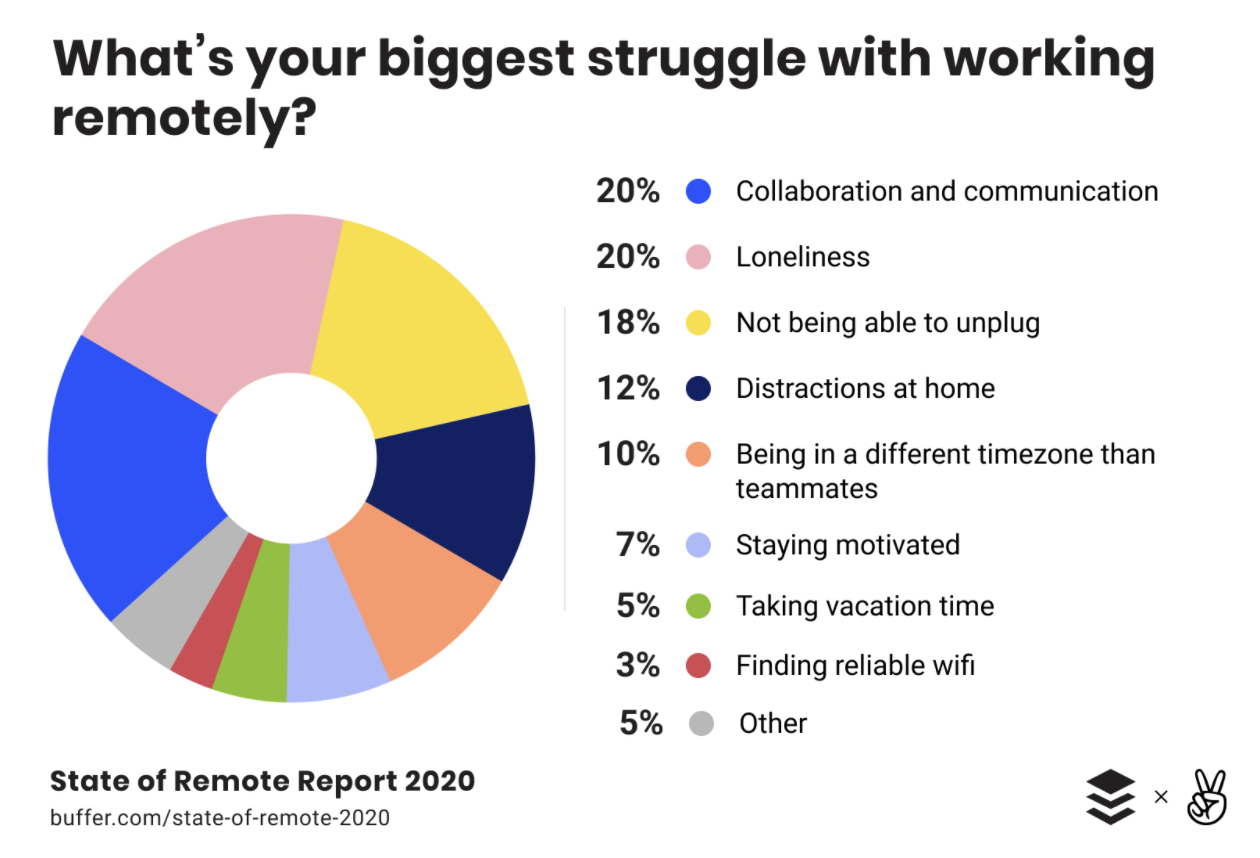

The idea is to solve the top three problems that Pragli’s extensive interviews and a Buffer/AngelList study discovered workers hate:

You never have to worry about whether you’re intruding on someone’s meeting, or if it’d be quicker to hash something out on a call instead of vague text. Avatars give remote workers a sense of identity, while the Pragli water cooler provides a temporary place to socialize rather than an endless Slack flood of GIFs. And because you clock in and out of the Pragli office just like a real one, co-workers understand when you’ll reply quickly versus when you’ll respond tomorrow unless there’s an emergency.

“In Pragli, you log into the office in the morning and there’s a clear sense of when I’m working and when I’m not working. Slack doesn’t give you a strong sense if they’re online or offline,” Safreno explains. “Everyone stays online and feels pressured to respond at any time of day.”

Pragli co-founder Doug Safreno

Safreno and his co-founder Vivek Nair know the feeling first-hand. After both graduating in computer science from Stanford, they built StacksWare to help enterprise software customers avoid overpaying by accurately measuring their usage. But when they sold StacksWare to Avi Networks, they spent two years working remotely for the acquirer. The friction and loneliness quickly crept in.

They’d message someone, not hear back for a while, then go back and forth trying to discuss the problem before eventually scheduling a call. Jumping into synchronous communicating would have been much more efficient. “The loneliness was more subtle, but it built up after the first few weeks,” Safreno recalls. “We simply didn’t socially bond while working remotely as well as in the office. Being lonely was de-motivating, and it negatively affected our productivity.”

The founders interviewed 100 remote engineers, and discovered that outside of scheduled meetings, they only had one audio or video call with co-workers per week. That convinced them to start Pragli a year ago to give work-from-home teams a visual, virtual facsimile of a real office. With no other full-time employees, the founders built and released a beta of Pragli last year. Usage grew 6X in March and is up 20X since January 1.

Today Pragli officially launches, and it’s free until June 1. Then it plans to become freemium, with the full experience reserved for companies that pay per user per month. Pragli is also announcing a small pre-seed round today led by K9 Ventures, inspired by the firm’s delight using the product itself.

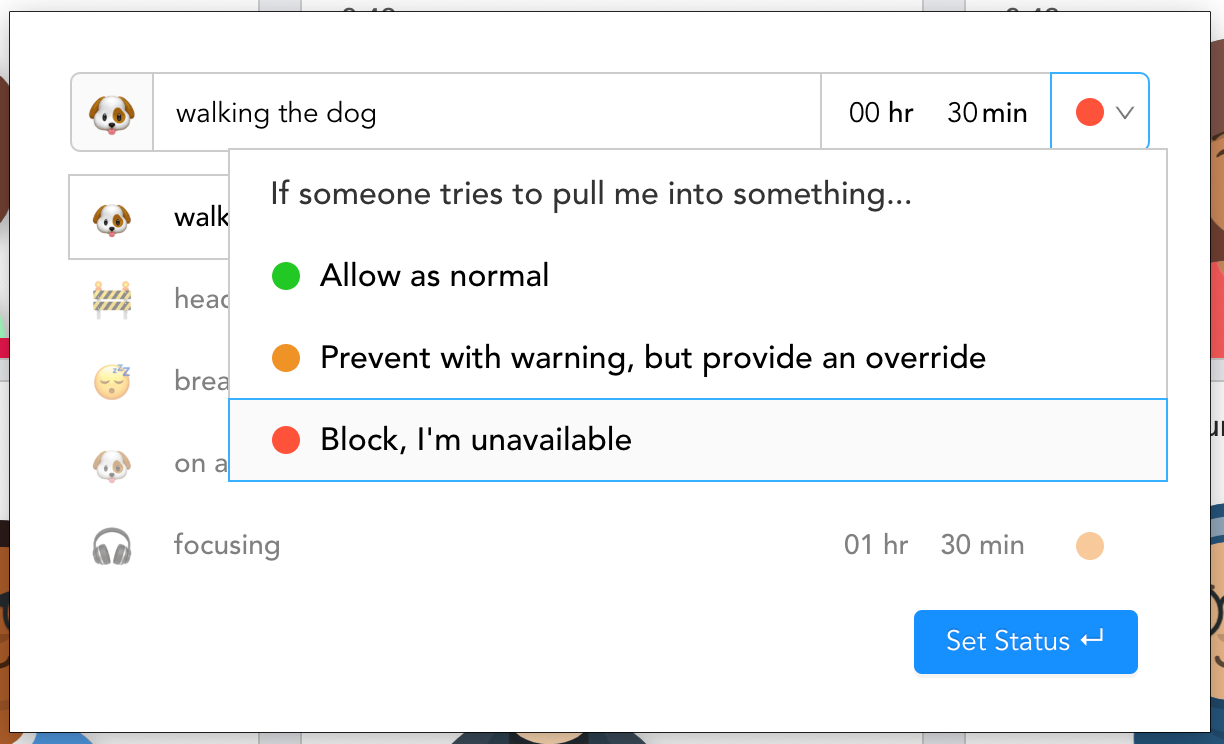

To get started with Pragi, teammates download the Pragli desktop app and sign in with Google, Microsoft or GitHub. Users then customize their avatar with a wide range of face, hair, skin and clothing options. It can use your mouse and keyboard interaction to show if you’re at your desk or not, or use your webcam to translate occasional snapshots of your facial expressions to your avatar. You can also connect your Spotify and calendar to show you’re listening to music (and might be concentrating), reveal or hide details of your meeting and decide whether people can ask to interrupt you or that you’re totally unavailable.

![]()

From there, you can by audio, video or text communicate with any of your available co-workers. Guests can join conversations via the web and mobile too, though the team is working on a full-fledged app for phones and tablets. Tap on someone and you can instantly talk to them, though their mic stays muted until they respond. Alternatively, you can jump into Slack-esque channels for discussing specific topics or holding recurring meetings. And if you need some down time, you can hang out in the water cooler or trivia game channel, or set a manual “away” message.

Pragli has put a remarkable amount of consideration into how the little office social cues about when to interrupt someone translate online, like if someone’s wearing headphones, in a deep convo already or if they’re chilling in the microkitchen. It’s leagues better than having no idea what someone’s doing on the other side of Slack or what’s going on in a Zoom call. It’s a true virtual office without the clunky VR headset.

“Nothing we’ve tried has delivered the natural, water-cooler-style conversations that we get from Pragli,” says Storj Labs VP of engineering JT Olio. “The ability to switch between ‘rooms’ with screen sharing, video and voice in one app is great. It has really helped us improve transparency across teams. Plus, the avatars are quite charming as well.”

With Microsoft’s lack of social experience, Zoom consumed with its scaling challenges and Slack doubling down on text as it prioritizes Zoom integration over its own visual communication features, there’s plenty of room for Pragli to flourish. Meanwhile, COVID-19 quarantines are turning the whole world toward remote work, and it’s likely to stick afterwards as companies de-emphasize office space and hire more abroad.

The biggest challenge will be making comprehensible enough to onboard whole teams such a broad product encompassing every communication medium and tons of new behaviors. “How do you build a product that doesn’t feel distracting like Slack but where people can still have the spontaneous conversations that are so important to companies innovating?,” Safreno asks. The Pragli founders are also debating how to encompass mobile without making people feel like the office stalks them after hours.

“Long-term, [Pragli] should be better than being in the office because you don’t actually have to walk around looking for [co-workers], and you get to decide how you’re presented,” Safreno concludes. “We won’t quit, because we want to work remotely for the rest of our lives.”

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Airbnb’s recent moves in the wake of a global travel slowdown are interesting and worth understanding in chronological order. What it details is a company spending heavily today to keep up its future health. Demand will return to the world travel market in time — how much, no one knows — and Airbnb wants to be a well-liked participant in the return to form.

Building off our last look at the company, we should understand how Airbnb intends to not only survive, but come out the other side of the pandemic with enough user trust to get back to work.

Powered by WPeMatico

Sony said on Thursday that it is investing $400 million to secure a 4.98% stake in Chinese entertainment giant Bilibili.

10-year old Bilibili started as an animation site, but has expanded to other categories including e-sports, user-generated music videos, documentaries, and games. The service, which has amassed over 130 million users, has attracted several big investors over the years, including Chinese giants Tencent and Alibaba.

The announcement pushed Bilibili’s share up by 7.6% in pre-market trading. Sony has made the investment through its wholly-owned subsidiary Sony Corporation of America.

In a statement, Sony said the company believes China is a key strategic region in the entertainment business. BiliBili says it targets China’s Gen-Z. The vast majority of its users — about 80% — were born between 1990 and 2009.

The two companies have also agreed to pursue collaboration opportunities in the entertainment field in China, including animation and mobile game apps, they said.

You can read more about Bilibili’s business and dominance in China in my colleague Rita Liao’s piece here.

Powered by WPeMatico