funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Cockroach Labs, the NYC enterprise database company, announced an $86.6 million Series D funding round today. The company was in no mood to talk valuations, but was happy to have a big chunk of money to help build on its recent success and ride out the current economic malaise.

Altimeter Capital and Bond co-led the round with participation from Benchmark, GV, Index Ventures, Redpoint Ventures, Sequoia Capital, Tiger Capital and FirstMark Capital. Today’s funding comes on top of a $55 million Series C last August, and brings the total raised to $195 million, according to the company.

Cockroach has a tough job. It’s battling both traditional databases like Oracle and modern ones from the likes of Amazon, but investors see a company with a lot of potential market building an open source, on prem and cloud database product. In particular, the open source product provides a way to attract users and turn some percentage of those into potential customers, an approach investors tend to favor.

CEO and co-founder Spenser Kimball says that the company had been growing fast before the pandemic hit. “I think the biggest change between now and last year has just been our go to market which is seeing pretty explosive growth. By number of customers, we’ve grown by almost 300%,” Kimball told TechCrunch.

He says having that three-pronged approach of open source, cloud an on-prem products has really helped fuel that growth. The company launched the cloud service in 2018, and it has helped expand its market. Whereas the on-prem version was mostly aimed at larger customers, the managed service puts Cockroach in reach of individual developers and teams who might not want to deal with all of the overhead of managing a complex database on their own.

Kimball says it’s really too soon to say what impact the pandemic will have on his business. He recognizes that certain verticals like travel, hospitality and some retail business are probably going to suffer, but other businesses that are accelerating in the crisis could make use of a highly scalable database like CockroachDB.

“Obviously it’s a new world right now. I think there are going to be some losers and some winners, but on balance I think [our] momentum will continue to grow for something that really does represent a best in class solution for businesses, whether they are startups or big enterprises, as they’re trying to figure out how to build for a cloud native future,” Kimball said.

The company intends to keep hiring through this, but is being careful and regularly evaluating what its needs are much more carefully than it might have done prior to this crisis with a much more open mind toward remote work.

Kimball certainly recognizes that it’s not an easy time to be raising this kind of cash, and he is grateful to have the confidence of investors to keep growing his company, come what may.

Powered by WPeMatico

Orca Security, an Israeli cloud security firm that focuses on giving enterprises better visibility into their multi-cloud deployments on AWS, Azure and GCP, today announced that it has raised a $20 million Series A round led by GGV Capital. YL Ventures and Silicon Valley CISO Investments also participated in this round. Together with its seed investment led by YL Ventures, this brings Orca’s total funding to $27 million.

One feature that makes Orca stand out is its ability to quickly provide workload-level visibility without the need for an agent or network scanner. Instead, Orca uses low-level APIs that allow it to gain visibility into what exactly is running in your cloud.

The founders of Orca all have a background as architects and CTOs at other companies, including the likes of Check Point Technologies, as well as the Israeli army’s Unit 8200. As Orca CPO and co-founder Gil Geron told me in a meeting in Tel Aviv earlier this year, the founders were looking for a big enough problem to solve and it quickly became clear that at the core of most security breaches were misconfigurations or the lack of security tools in the right places. “What we deduced is that in too many cases, we have the security tools that can protect us, but we don’t have them in the right place at the right time,” Geron, who previously led a security team at Check Point, said. “And this is because there is this friction between the business’ need to grow and the need to have it secure.”

Orca delivers its solution as a SaaS platform and on top of providing work level visibility into these public clouds, it also offers security tools that can scan for vulnerabilities, malware, misconfigurations, password issues, secret keys in personally identifiable information.

“In a software-driven world that is moving faster than ever before, it’s extremely difficult for security teams to properly discover and protect every cloud asset,” said GGV managing partner Glenn Solomon . “Orca Security’s novel approach provides unparalleled visibility into these assets and brings this power back to the CISO without slowing down engineering.”

Orca Security is barely a year and a half old, but it also counts companies like Flexport, Fiverr, Sisene and Qubole among its customers.

Powered by WPeMatico

When we launched in 2016, we took the unusual approach of saying we’d buy common stock in startups. We believed then, and still do, that alignment with founders was more important than covering our downside in investments that didn’t work as planned. Said differently, we wanted to enhance our upside through alignment, rather than maximizing our downside through terms.

The world has changed a lot since that time. While we are actively making investments, and still buying common stock, we know that many entrepreneurs may be trying to raise money now — and it is very hard.

Fred Destin wrote a great piece about the ugly terms that can creep into term sheets during difficult times. If you have a choice between a good term sheet and a bad one, of course, you’ll take the good one. But what if you have no choice? And how can you compare term sheets in the first place?

To this end, we developed the term-sheet grader, a simple way to compare different term sheets or help characterize whether a term sheet is good or evil.

Let me first point out that none of this has anything to do with the valuation of the round (share price), the amount of capital, the likelihood of reaching a closing, the quality of the firm or the trust you have with the individual leading the investment, all absolutely critical pieces of the puzzle. Here, we are just looking at the terms and conditions, the legal structure of the investment.

We’ve listed nine key terms below — five that have to do with economics and four that relate to control and decision-making:

FWIW, the Pillar common stock standard deal earns a +8 (shown below).

Powered by WPeMatico

Byju’s, an education learning startup in India that has seen a surge in its popularity in recent weeks amid the coronavirus outbreak, is in talks to raise as much as $400 million in fresh capital at a $10 billion valuation, said three people familiar with the matter.

The additional capital would be part of the Bangalore-based startup’s ongoing financing round that has already seen Tiger Global and General Atlantic invest between $300 million to $350 million into the nine-year-old startup.

That investment by the two firms, though, was at an $8 billion valuation, said people familiar with the matter. Byju’s was valued at $5.75 billion in July last year, when it raised $150 million from Qatar Investment Authority and Owl Ventures.

If the deal goes through at this new term, Byju’s would become the second most valuable startup in India, joining budget lodging startup Oyo, which is also valued at $10 billion, and following financial services firm Paytm that raised $1 billion at $16 billion valuation late last year.

The talks haven’t finalized yet and terms could change, said one of the aforementioned people. This person, along with the other two, requested anonymity as the matter is private.

Spokespeople of Byju’s and Prosus Ventures, the largest investor in the startup, declined to comment. A spokesperson for Tiger Global did not respond to a request for comment.

Byju’s has seen a sharp surge in both its free users and paying customers in recent weeks as it looks to court students who are stuck at home because of the nationwide lockdown New Delhi ordered in late March.

The startup told TechCrunch last month that traffic on its app and website was up 150% in March and it added six million students to the platform during the month.

Other edtech startups, including Unacademy, which was recently backed by Facebook, and early-stage startups such as Sequoia Capital India-backed Classplus, and Chennai-based SKILL-LYNC, have also seen growth in recent weeks, they told TechCrunch last month.

Through its app, tutors on Byju’s help all school-going children understand complex subjects using real-life objects such as pizza and cake. The app also prepares students who are pursuing undergraduate and graduate-level courses.

Over the years, Byju’s has invested in tweaking the English accents in its app and adapted to different education systems. It had amassed more than 35 million registered users, about 2.4 million of which are paid customers as of late last year.

Powered by WPeMatico

Figma, the design platform that lets folks work collaboratively and in the cloud, has today announced the close of a $50 million Series D financing. The round was led by Andreessen Horowitz, with partner Peter Levine and cofounding partner Marc Andreessen managing the deal for the firm. New angel investors, including Henry Ellenbogen from Durable Capital, also participated in the round alongside existing investors Index, Greylock, KPCB, Sequoia and Founders Fund.

Forbes reports that the latest funding round values Figma at $2 billion.

Dylan Field, Figma founder and CEO, told TechCrunch that discussions between a16z and Figma actually began towards the end of the fundraising cycle for the company’s Series C, which closed in February of 2019.

“It felt a bit like a shotgun wedding,” said Field, explaining that both parties instead opted to get to know each other better. They’ve been building their relationship over the past year, leading to today’s Series D close. Field also added that he has not met other investors in this round in person, and the vast majority of the deal was done over Zoom.

“When you think about the future of Silicon Valley, there is an interesting question around capital infrastructure being here and people not being able to access that if they’re not here, too,” said Field. “I got to see firsthand how a deal done online can work and I think more and more investors aren’t going to worry about whether you’re in Silicon Valley or not.”

Figma launched in 2015 after nearly six years of development in stealth. The premise was to create a collaborative, cloud-based design tool that would be the Google Docs of design.

Since, Figma has built out the platform to expand access and usability for individual designers, small firms and giant enterprise companies alike. For example, the company launched plug-ins in 2019, allowing developers to build in their own tools to the app, such as a plug-in for designers to automatically rename and organize their layers as they work (Rename.it) and one that gives users the ability to add placeholder text that they can automatically find and replace later (Content Buddy).

The company also launched an educational platform called Community, which gives designers the ability to share their work and let other users ‘remix’ that design, or simply check out how it was built, layer by layer.

A spokesperson told TechCrunch that this deal was “opportunistic,” and that the company was in a strong cash position pre-financing. The new funding expands Figma’s runway during these uncertain times, with coronavirus halting a lot of enterprise purchasing and ultimately slowing growth of some rising enterprise players.

Field explained that Figma’s data is counter to the expected narrative around enterprise purchasing because Figma is specifically built to let teams collaborate in the cloud.

“We’re actually seeing a lot of acceleration for bigger deals on the sales side,” said Field. “Figma is a tool that can help right now.”

The company says that one interesting change they’ve seen in the COVID era is a significant jump in user engagement from teams to collaborate more in Figma. The firm has also seen an uptick in whiteboarding, note taking, slide deck creation and diagramming, as companies start using Figma as a collaborative tool across an entire organization rather than just within a team of designers.

This latest deal brings Figma’s total funding to $132.9 million. Field added that, though the company is not yet profitable, this latest financing gives the company three to four years of runway, even with aggressive scaling and hiring efforts moving forward.

Powered by WPeMatico

Material Bank, a logistics platform for the architectural and design industry, has announced the close of a $28 million Series B financing today, led by Bain Capital Ventures. Bain’s Merritt Hummer led the round on behalf of the firm and will join the board of directors at Material Bank, along with Jeff Sine, cofounder and partner at The Raine Group.

Existing investors Raine Ventures and Starwood Capital Group cofounder, Chairman and CEO Barry Sternlicht also participated in the round.

Material Bank launched in January 2019, founded by Adam I. Sandow. Its platform is meant to serve designers, architects and others who source and purchase the very building blocks of our physical world: materials.

Most architectural firms and designers have their own physical library of materials in their office, like carpet swatches, wall covering samples, tiles, and hardwoods for flooring. These libraries are nearly impossible to keep up to date — not only do styles change over time (just like clothes or anything else) but architects pull this or that binder of wall coverings or carpets and there’s no telling if or when that binder returns to the library, or if the binder will still be complete when it does return.

The other big obstacle for designers and architects is that there’s no real aggregation across the many, many manufacturers of these materials.

Sandow likens it to searching for a flight in the old days.

“We all used to book airline travel through an agent, and then the airlines offered websites,” said Sandow. “We thought ‘this is great! I can just go to AA.com or Delta.com to book my flights.’ Until we wanted to price shop. Then you had to search four or five different websites and write down all the prices and by the time you found the price you wanted, it may be gone.”

Then came Expedia and Hotwire.

That’s how Sandow thinks of Material Bank for the architectural industry.

Material Bank aggregates materials across hundreds of vendors, giving users the ability to filter around multiple parameters to find a selection of materials in minutes instead of hours.

But aggregation and powerful search are only half the battle. Designers and architects are also burdened by the time it takes to get their samples. One package may arrive tomorrow, with two others in the next three days, and still more coming in one week.

This leads to a confusing experience of getting all these samples together to show a client, and is a huge environmental waste with dozens of boxes arriving at the same exact location over several days.

To combat this waste, Material Bank built a facility in Memphis directly next door to FedEx’s sorting center. This facility is the very last stop that FedEx makes each night before sorting and sending off its overnight packages by plane.

That means that Material Bank users can place an order by midnight EST and get their samples, from any vendor on Material Bank, by 10am ET the next morning. These samples come in a single box with a tray that can be repurposed into a return package to send back unneeded samples.

Obviously, Material Bank’s facility would require hundreds of workers to turn around orders that come in late to be picked up by FedEx if it weren’t for advancements in robotics. Material Bank partners with Locus Robotics in its facility, and is thus able to pay $17.50 an hour to its human workers in the building.

Sandow says that coronavirus has not hampered the business at all, with the company seeing record revenues in March and with expectations to beat that record in April. That is partially due to the fact that those physical sample libraries in architectural and design firms are no longer accessible to employees who have had to shift to working from home.

Material Bank doesn’t charge architects or designers for the service, but does have a hybrid SaaS model in place for manufacturers and vendors on the platform. Manufacturers pay a monthly fee to access and use the platform, listing their SKUs, as well as a transactional fee to get access to the architects and designers placing orders for samples of their materials. Essentially, the manufacturers pay for the lead generation and hand-off to potential customers.

Sandow spent the last two decades growing a media network of architectural and design-focused magazines and knew early on that a reliance on advertising wouldn’t cut it as media moved online, with plans to build tools and services instead.

Material Bank was born out of that effort, and spun out of Sandow group relatively early on in its life.

The company has raised a total of $55 million since inception.

Powered by WPeMatico

The world has been turned upside down the past few weeks, but one lesson of business remains as important as ever: treating your customers well is the best avenue to future business strength, particularly at a moment of extreme stress.

As businesses come to terms with the economic crisis underway, executives are moving resources from customer acquisition to customer retention — and that’s proving very lucrative to startups that service the customer success market.

Case in point: New York City-based Catalyst, which I profiled just last summer following its $15 million Series A led by Accel’s Vas Natarajan, has seen huge revenue growth the past few months. The data-driven customer success platform has seen its revenue grow by 380% since the Series A financing according to CEO Edward Chiu.

Steep revenue growth is (unsurprisingly) attractive to investors, and in a moment of fortuitous timing, the company signed a $25 million Series B term sheet with Spark Capital just as the COVID-19 crisis was getting underway.

Chiu said Catalyst wasn’t seeking the investment, having much of its Accel round still in the bank, but he ultimately decided that having the extra capital in hand through a looming economic recession was the right decision. The capital officially hit the bank account at the end of March, and was led by the firm’s growth investor Will Reed.

While the company didn’t disclose the valuation, a source with knowledge of the matter quoted a valuation of $125 million. That’s a serious valuation for a company that launched just two years ago in April of 2018.

Outside of more funding, the core story of the company’s product remains the same. Catalyst wants to bring together all the data sources and team members who interact with customers — everyone from designers and engineers to customer success managers — into one dashboard to ensure that everyone has accurate and up-to-date access to all the information they need on the health of every customer.

The one airbrush: the company’s previous URL of getcatalyst.io has become catalyst.io, and officially re-launched this morning.

One growth area that the company is exploring outside of the B2B space of its existing customers is in healthcare, where the company has seen some inbound interest. Chiu says that Catalyst is exploring the steps required to reach HIPAA compliance with its platform, and hopes to expand to more sectors over time with the capital from its Series B.

The Catalyst team. Photo via Catalyst.

When we last checked in with the company, Catalyst had 19 employees and was targeting 40 employees by July 2020. Chiu said that Catalyst is already at 35 employees, and will likely hit 60 to 70 employees by the end of the year.

Powered by WPeMatico

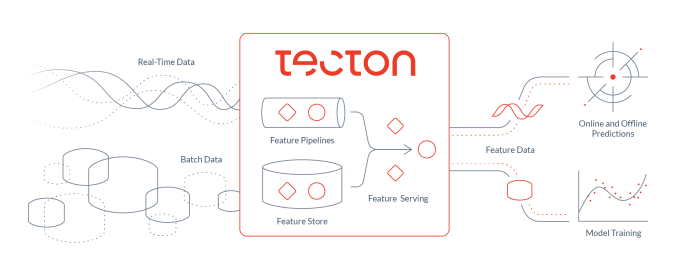

Three former Uber engineers, who helped build the company’s Michelangelo machine learning platform, left the company last year to form Tecton.ai and build an operational machine learning platform for everyone else. Today the company announced a $20 million Series A from a couple of high-profile investors.

Andreessen Horowitz and Sequoia Capital co-led the round with Martin Casado, general partner at a16z and Matt Miller, partner at Sequoia joining the company board under the terms of the agreement. Today’s investment combined with the seed they used to spend the last year building the product comes to $25 million. Not bad in today’s environment.

But when you have the pedigree of these three founders — CEO Mike Del Balso, CTO Kevin Stumpf and VP of Engineering Jeremy Hermann all helped build the Uber system — investors will spend some money, especially when you are trying to solve a difficult problem around machine learning.

The Michelangelo system was the machine learning platform at Uber that looked at things like driver safety, estimated arrival time and fraud detection, among other things. The three founders wanted to take what they had learned at Uber and put it to work for companies struggling with machine learning.

“What Tecton is really about is helping organizations make it really easy to build production-level machine learning systems, and put them in production and operate them correctly. And we focus on the data layer of machine learning,” CEO Del Balso told TechCrunch.

Image Credit: Tecton.ai

Del Balso says part of the problem, even for companies that are machine learning-savvy, is building and reusing models across different use cases. In fact, he says the vast majority of machine learning projects out there are failing, and Tecton wanted to give these companies the tools to change that.

The company has come up with a solution to make it much easier to create a model and put it to work by connecting to data sources, making it easier to reuse the data and the models across related use cases. “We’re focused on the data tasks related to machine learning, and all the data pipelines that are related to power those models,” Del Balso said.

Certainly Martin Casado from a16z sees a problem in search of a solution and he likes the background of this team and its understanding of building a system like this at scale. “After tracking a number of deep engagements with top ML teams and their interest in what Tecton was building, we invested in Tecton’s A alongside Sequoia. We strongly believe that these systems will continue to increasingly rely on data and ML models, and an entirely new tool chain is needed to aid in developing them…,” he wrote in a blog post announcing the funding.

The company currently has 17 employees and is looking to hire, particularly data scientists and machine learning engineers, with a goal of 30 employees by the end of the year.

While Del Balso is certainly cognizant of the current economic situation, he believes he can still build this company because he’s solving a problem that people genuinely are looking for help with right now around machine learning.

“From the customers we’re talking to, they need to solve these problems, and so we don’t see things slowing down,” he said.

Powered by WPeMatico

While human travel has become severely restricted in recent months, the movement of goods has remained a constant priority — and in some cases, has become even more urgent. Today, a startup out of Switzerland that builds hardware and operates a logistics network designed to transport one item in particular — pharmaceuticals — is announcing a significant round to fuel its growth.

SkyCell — a designer of “smart containers” powered by software to maintain constant conditions for drugs that need to be kept at strict temperatures, humidity levels, and levels of vibration, which are in turn used to transport pharmaceuticals around the globe on behalf of drug companies — is today announcing. that it has raised $62 million in growth funding.

This latest round is being led by healthcare investor MVM Partners, with participation also from family offices, a Swiss insurance company that declined to be named, as well as previous investors the Swiss Entrepreneurs Fund (managed by Credit Suisse and UBS), and the BCGE Bank’s growth fund.

The company was founded in 2012 Switzerland when Richard Ettl and Nico Ros were tasked to design a storage facility for one of the big Swiss pharma giants. The exec charged with overseeing the project brainstormed that the work they were putting in could potentially be applied to transportation containers, and thus SkyCell was born.

Today, Ettl (who is the CEO, while Ros is the CTO), said in an interview that the company now works with eight of the world’s biggest pharmaceutical companies and has been in validation trials with a further seven. These use SkyCell’s network of some 22,000 air freight pallets to move their products around the world.

The new capital will be used to expand that reach further, specifically in the U.S. and Asia, and to double its fleet to become the biggest pharmaceutical transportation company globally. With 30 of the 50 biggest-selling drugs in the world being temperature sensitive (and some generics for one of the biggest-selling, the arthritis medication Humira, now also coming out), this makes for a huge opportunity.

And unsurprisingly, several of SkyCell’s customers are working on COVID-19 medications, Ettl said, either to help ease symptoms or potentially to vaccinate or eradicate the virus, and so it’s standing at the ready to play a role in getting drugs to where they need to be.

“We are well positioned in case there is a vaccine developed. Out of the six pharma companies developing these right now, four of them are our customers, so there is a high likelihood we would transport something,” Ettl said.

For now, he said SkyCell has been involved in helping to transport “supportive” medications related to the outbreak, such as flu shots to make sure people are not falling ill with other viral infections at the same time.

SkyCell is not disclosing its valuation but we understand that it’s in the many hundreds of millions of dollars. The company had raised some $36 million in equity and debt before this, bringing the total outside funding now to $98 million.

In a market that’s estimated to be worth some $2.8 billion annually and growing at a rate of between 15% and 20% each year, there are a number of freight businesses that focus on the transportation of pharmaceuticals. They include not only freight companies but airlines themselves, which often buy in containers from third parties. (And for some more context, one of its competitors, Envirotainer, was acquired for over $1 billion in 2918; while another, CSafe, has raised significantly more funding.)

But there was virtually no innovation in the market, and most pharmaceutical companies factored in failure rates of between 4% and 12% depending on where the drugs were headed.

One key differentiator with SkyCell has been its containers, which are able to withstand temperatures as high as 60 degrees Celsius or as low as negative 10 degrees Celsius, and have tracking on them to better monitor their movements from A to B.

These came to the market at a time when incumbents were only able to (and some still are only able to) guarantee insulation for temperatures as high as 40 degrees, which was not as pressing an issue in the past as it is today, in part because of rising temperatures around the globe, and in part because of the growing sophistication of pharmaceuticals.

“We’ve found that the number of days where [one has to consider] temperature extremes has been going up,” Ettl said. “Last year, we had 30 days where it was warmer than 40 degrees Celsius across our network of countries.”

On top of the containers themselves, SkyCell has built a software platform that taps into the kind of big data analytics that are now part and parcel of how modern companies in the logistics industry work today, in order to optimise movement and best routing for packages.

The conditions it considers include not only the obvious ones around temperature, humidity and vibration, but distance and time of travel, as well as overall carbon emissions. SkyCell claims that its failure rate comes out at less than 0.1%, with CO2 emissions reduced by almost half on a typical shipment.

Together, the hardware and software are covered by some 100 patents, the company says.

Powered by WPeMatico

Online lending firms might be beginning to feel the heat of the coronavirus pandemic in Southeast Asia, but investors’ faith in digital insurance startups remains unflinching in the region.

Jakarta-based Qoala has raised $13.5 million in its Series A financing round, the one-year-old startup said Tuesday. Centauri Fund, a joint venture between funds from South Korea’s Kookmin Bank and Telkom Indonesia, led the round.

Sequoia India, Flourish Ventures, Kookmin Bank Investments, Mirae Asset Venture Investment, Mirae Asset Sekuritas and existing investors MassMutual Ventures Southeast Asia, MDI Ventures, SeedPlus and Bank Central Asia’s Central Capital Ventura participated in the round, which pushes the startup’s to-date raise to $15 million.

Qoala works with leading insurers including AXA Mandiri, Tokio Marine, Great Eastern to offer customers cover against phone display damage, e-commerce logistics and hotel-quality checks. The startup says it offers personalized products to customers and eases the burden while making claims by allowing them to upload pictures.

The startup maintains partnership with several e-commerce firms including Grabkios, JD.ID, Shopee and Tokopedia and hotel and travel booking firms PegiPegi and RedBus.

It uses machine learning to detect fraud claims. It’s a win-win scenario for customers, who can make claims easily and have more affordable and sachet insurance products to buy, and for insurers, who can reach more customers.

Qoala processes more than 2 million policies each month, up from 7,000 in March last year. The startup said it is working on insurance products to cover health and peer-to-peer categories. The startup, which employs about 150 people currently, plans to double its headcount in a year.

“As a relatively new entrant in the space we are delighted to partner with leading global investors whose tremendous thought leadership as well as operational experience will allow us to maintain our innovative edge. This truly demonstrates the ecosystem’s belief in what Qoala is trying to achieve — humanizing insurance and making it accessible and affordable to all,” said Harshet Lunani, founder and chief executive of Qoala, in a statement.

Kenneth Li, managing partner at Centauri Fund, said Qoala’s multi-channel approach has the potential to unlock Indonesia’s untapped insurance industry.

“Our thesis identified that Indonesia has a considerably low gross written premium (GWP) to GDP ratio in comparison to other emerging countries, coupled with the large growing middle class in need of more security in their financial planning which allows immense potential for the insurance sector to take off in Indonesia through innovative propositions,” he added.

According to one estimate (PDF), Southeast Asia’s digital insurance market is currently valued at $2 billion and is expected to grow to $8 billion by 2025. Last week, Singapore-based Igloo extended its Series A financing round to add $8.2 million to it.

Powered by WPeMatico