funding

Auto Added by WPeMatico

Auto Added by WPeMatico

As we move through life in the pandemic, companies are being forced to review and understand how workflows happen. How do you distribute laptops to your workforce? How do you make sure everyone has the correct tool set? FortressIQ, a startup that wants to help companies use data to understand and improve internal processes, announced a $30 million Series B investment today.

M12, Microsoft’s venture fund and Tiger Global Management led the round with help from previous investors Boldstart Ventures, Comcast Ventures, Eniac Ventures and Lightspeed Venture Partners. The company has now raised almost $65 million, according to Pitchbook data.

As the product has matured, founder and CEO Pankaj Chowdhry, says its focus has shifted a bit. Whereas before it was primarily about using computer vision to understand workflows, customers are now using that data to help drive their own internal transformations.

That used to require a high priced consulting team to pull off, but FortressIQ is trying to use software, data and artificial intelligence to replace the consultant and expose processes that could be improved.

“We’re building this kind of cool computer vision to help with process discovery, mostly in the automation space to help you automate processes. But what we’ve seen is people leveraging our data to drive transformation strategies, of which automation ends up being a pretty small component,” Chowdry explained.

He said that this is helping define new ways of using the tool they hadn’t considered when they first started the company. “If you think about it, we can use analytics to drive better experiences, better training, all of that. We’ve seen how customers are driving overall improvement strategies by leveraging the data coming out of this system,” he said.

The company currently has 65 employees, but he couldn’t commit to a future number at this point because of the uncertainty that exists in the economy. He knows he wants to hire, but he’s not sure what that will look like. He said they used to revisit hiring every six months. Now it’s ever six weeks, and so they keep having to reevaluate based on an ever-shifting set of conditions.

Chowdry believes that companies will need to be more agile moving forward to react more quickly to changing circumstances beyond the current crisis, and he thinks that’s going to require solid business relationships to pull off.

“I think the idea is to be leveraging this time to build that relationship with your customers so as they do start looking at what are they going to do and where they need to be invested in the business, that we’ve got both the data and the infrastructure to help them do that.”

Powered by WPeMatico

Even in these trying economic times, there are some services that companies can’t do without. Having good security tools is one of them. Expel, a four-year-old startup that offers security operations as a service, announced a $50 million Series D financing today.

CapitalG led the round with participation from existing investors Battery Ventures, Greycroft, Index Ventures, Paladin Capital Group and Scale Venture Partners. The company has now raised almost $117 million, according to PitchBook data.

It’s never easy finding quality security talent to help protect a large organization. The idea behind Expel is to give customers a set of tools to help use automation to reduce the number of people required to keep an organization safe.

Most companies struggle to find experienced security employees, so it’s using automation to solve a real pain point for them. While co-founder and CEO Dave Merkel says you still need to staff the security operations center, you can do it with fewer people with his platform.

“You may have a 24×7 Security Operations Center, but you don’t need the number of people everybody else does to protect your customers because Workbench does all of the heavy lifting for you. So instead of a SOC with 100 people, maybe you’ve got one with 15 people, and that gives tremendous leverage through this platform, and the platform ensures that you can provide high quality security without having to continually grow headcount,” Merkel explained.

Merkel sees the same economy everyone else does, but he believes that companies will continue to invest in security because they have to.

“Security tends to be a need as opposed to a want in many organizations, and so we still do see business happening. We will be using some of the money to continue to invest smartly in sales and marketing, but we’ll just need to be deliberate to make sure that we’re picking the right things that are still effective right now,” he said.

One thing that’s remarkable about this round is that Expel didn’t go looking for this new money. In fact, CapitalG came knocking, according to CapitalG general partner Gene Frantz.

“We sought out Expel, first and foremost. It wasn’t that Expel sought out to raise money and they called a bunch of people. We called them, and that was in response to a bunch of thematic work that we continually do in the security space,” Frantz told TechCrunch.

That work involved three main areas, where Expel happened to check all the boxes. The first was the threat landscape becoming ever more treacherous. The second was information overload from a variety of security products, and finally the dearth of experienced security personnel to deal with the first two problems.

“And so our bet is that this is the company in the space that actually will take on and address these challenges,” Frantz said.

Merkel describes having a company like CapitalG come to him as a humbling experience for him and his co-founders, especially under the current circumstances.

“It’s tremendous validation, but it is also humbling. We’re pretty thankful to be in that position, and we want to make sure that we do the right things to continue to honor the opportunity that we see in front of us.”

Powered by WPeMatico

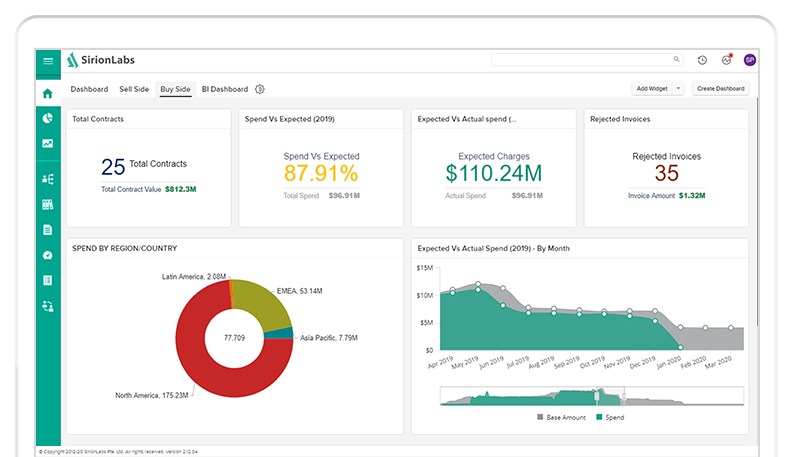

SirionLabs, a startup that provides contract management software to enterprises, has raised $44 million in a new financing round as it looks to expand and handle surge in demand from clients.

Tiger Global and Avatar Growth Capital led the Seattle-headquartered startup’s Series C round. The eight-year-old startup, which was founded in India, has raised $66 million to date. The new round values the startup at about $250 million. Indian VC fund Avatar has long invested in SaaS startups in India, an area that Tiger Global has also made serious bets on in recent quarters.

Enterprises broadly handle two kinds of contracts, one when they are buying things from a supplier for which they use a procurement contract, and the other when they are selling things to customers, when a sales contract comes into play.

A significant number of companies today handle these contracts manually with different teams within an organization often dealing with the same entity, which leads to discrepancies in their promises. Teams work in silos and often don’t know the terms others in the organization have already agreed upon.

That’s where SirionLabs comes into the picture. “We use artificial intelligence and natural language processing to connect the dots between contracts and what happens after the contract has been signed,” explained Ajay Agrawal, cofounder, chairman and chief executive of the startup, in an interview with TechCrunch.

“For us, it’s not just creating a contract, but also realizing the promises that have been made in those contracts,” he said. SirionLabs also audits the invoice of suppliers, which has enabled its customers to save a significant amount of money.

SirionLabs today hosts contracts in over 40 languages for more than 200 of the world’s largest companies including Credit Suisse, Vodafone, EY, Unilever, Abbvie, BP, and Fujitsu.

Agrawal said the startup has seen a 4X growth in the number of customers it has signed up in the last 18 months. Part of the new capital would go into handling their demand. He said the coronavirus crises has resulted in many companies becoming more cautious about what they promise in their contracts.

The startup, which just opened a technology center in Seattle, also plans to open an AI laboratory in the Washington state to fuel technology innovation and grow sales.

It has also hired several industry veterans including the appointment of Amol Joshi as chief revenue officer, Anu Engineer as chief technology officer, Mahesh Unnikrishnan as chief product officer, and Vijay Khera, who will serve as chief customer officer.

Vishal Bakshi, founder and managing partner at Avatar Growth Capital, said he expects SirionLabs, which competes with Apttus and Icertis among other firms, to “capture massive network effects as the platform continues to scale.”

Powered by WPeMatico

Global investment firm KKR is betting on the pizza business — it just led a $43 million Series C investment in Slice.

Formerly known as MyPizza, Slice has created a mobile app and website where diners can order a custom pizza delivery from their local, independent pizzeria.

And for those pizzerias, CEO Ilir Sela said Slice helps to digitize their whole business by also creating a website, improving their SEO and even allowing them to benefit from the “economies of scale” of the larger network, through bulk orders of supplies like pizza boxes.

Sela contrasted his company’s approach with other popular food delivery apps that he characterized as aggregators. For one thing, Slice “anchors” your favorite pizzerias in the app, giving them the top spots and making it easy to place your regular order with just a few taps. And it will be adding more loyalty features soon.

“Our job is to make loyal customers even more loyal,” he said.

In addition, while there’s been services like Grubhub have faced criticism for their steep fees, Sela said Slice’s fee is capped at $2.25 per order, allowing pizzerias to get all the upside from large orders.

Of course, the environment for restaurants has changed dramatically in the last few months, thanks to COVID-19. But most pizzerias are already set up for takeout and delivery, and Sela said that more than 90% of the 12,000-plus pizzerias that work with Slice have stayed open.

He also pointed to the company’s Pizza vs Pandemic initiative, which raises funds for pizzerias to feed healthcare workers. The program has raised more than $470,000 and fed an estimated 140,000 workers.

“Local independent pizzerias have been feeding Americans across communities for decades and we are excited to put our resources behind Slice as they help to move these businesses online,” said KKR Principal Allan Jean-Baptiste in a statement. “Slice charges small business owners a fraction of the fees charged by food delivery apps and offers a suite of vertical specific solutions to solve the challenges faced by independent pizza makers.”

Slice had previously raised $30 million, according to Crunchbase. Sela said he’ll be using the new funding to bring on more pizzerias and continue building a “vertically integrated solution for the small businesses, in order to solve more and more of their challenges.”

Powered by WPeMatico

Krishna Rangasayee, founder and CEO, at SiMa.ai, has 30 years of experience in the semiconductor industry. He decided to put that experience to work in a startup and launched SiMa.ai last year with the goal of building an ultra low-power software and chip solution for machine learning at the edge.

Today he announced a $30 million Series A led by Dell Technologies Capital with help from Amplify Partners, Wing Venture Capital and +ND Capital. Today’s investment brings the total raised to $40 million, according to the company.

Rangasayee says in his years as a chip executive he saw a gap in the machine learning market for embedded devices running at the edge and he decided to start the company to solve that issue.

“While the majority of the market was serviced by traditional computing, machine learning was beginning to make an impact and it was really amazing. I wanted to build a company that would bring machine learning at significant scale to help the problems with embedded markets,” he told TechCrunch.

The company is trying to focus on efficiency, which it says will make the solution more environmentally friendly by using less power. “Our solution can scale high performance at the lowest power efficiency, and that translates to the highest frames per second per watt. We have built out an architecture and a software solution that is at a minimum 30x better than anybody else on the frames per second,” he explained.

He added that achieving that efficiency required them to build a chip from scratch because there isn’t a solution available off the shelf today that could achieve that.

So far the company has attracted 20 early design partners, who are testing what they’ve built. He hopes to have the chip designed and the software solution in Beta in the Q4 timeframe this year, and is shooting for chip production by Q2 in 2021.

He recognizes that it’s hard to raise this kind of money in the current environment and he’s grateful to the investors, and the design partners who believe in his vision. The timing could actually work in the company’s favor because it can hunker down and build product while navigating through the current economic malaise.

Perhaps by 2021 when the product is in production, the market and the economy will be in better shape and the company will be ready to deliver.

Powered by WPeMatico

A new data set from Silicon Valley Bank (SVB) details how startups are reacting to the post-unicorn era as COVID-19-related disruptions upset the global economy and remake the risk tolerance of private investors.

What SVB’s new report shows is unsurprising: venture capital deal volumes are falling, startups are tapping existing debt capacities to add cash to balances while they still can and some upstart firms are curtailing spend to reduce unprofitability. The last data point comes via the lens of startups that recently raised, making the data more a snapshot of what companies that are successfully attracting capital may have accomplished with regard to improving profitability — the directional shifts are material regardless of that particular nuance.

Let’s briefly examine what the data says and what it tells us about the state of the startup market.

Venture capitalists are pulling back, SVB data indicates. A chart from its Q2 markets report notes that the “SVB Deal Activity Index” had fallen from a rating of 160 in early March to just over 70 by mid-to-late-April. That staggering decline means fewer rounds are getting done and that there is less capital going into startups of all sizes.

Powered by WPeMatico

ReadySet, a diversity, equity and inclusion startup led by Project Include founding member Y-Vonne Hutchinson, has raised its first, and perhaps last, round of funding from Indie.vc.

“We were lucky enough to close our round right as the coronavirus was hitting and then shifted our business to doing remote stuff that offered connection,” Hutchinson told TechCrunch.

For the last five years, ReadySet has been sustaining itself off of revenue, and in the last year saw about $1 million in annual revenue. ReadySet makes money by offering consulting services to companies looking to create more inclusive workplaces and cultures. ReadySet has worked with companies like Salesforce, Airbnb, Amazon, GitHub, UCSF Health, Mailchimp, Medium and many others.

“We’ve been profitable the entire time we’ve been in business,” Hutchinson said. “But we wanted to be able to maximize our impact beyond in-person training services and doing stuff that felt a little more like product development that didn’t necessitate immediate revenue.”

ReadySet decided to take funding from Indie.vc because of the firm’s focus on startups that are profit-driven, she said. She also “didn’t want to give up a huge chunk of ownership in a firm I built from scratch.”

Indie.vc doesn’t take any equity upfront. If a startup in its portfolio raises additional money or sells, Indie.vc converts its investment to equity at a percentage decided on by the company. If the company never sells or never raises another round, Indie.vc gets a share of the company’s revenue until the firm makes 5x its investment.

“They weren’t interested in taking a big chunk of the business but were instead interested in helping us get more profitable,” she said. “For me, as a founder that has not been in the VC space, it’s been hard to be seen as a real entrepreneur.”

Indie.vc aims to be the last outside financing founders ever need to take. For Hutchinson, she said that could be the case.

“I don’t want to be the kind of founder that chases the next round,” she said. “I want to smartly leverage the funding and continue our profitability and do it at scale. I think some founders get stuck doing that and then don’t focus on the product.”

In light of these trying times amid the COVID-19 pandemic, ReadySet is investing more heavily in remote training offerings.

“We’re really sort of looking for ways we can resource companies trying to rethink digital interaction,” she said. “I also think a lot of people or some people think this is a blip on the radar and we’ll go back to normal. We don’t think that is necessarily going to happen.”

Despite these rocky times where many tech companies are laying off staff members and putting some on furlough, Hutchinson said some companies have doubled down on what they’re doing in terms of workplace culture.

In past recessions, where diversity, equity and inclusion has been seen as a ” ‘nice to have,’ there is an existential threat that has changed the way we live and the way we have to show up at work,” Hutchinson said.

People are now isolated or needing to take care of family, she says. Perhaps they’re drinking more and/or working through grief, loss and death — all of which are traumatic, she said.

“All of those issues actually implicate DE&I,” Hutchinson said. “We’re used to siloing it, but in reality, DE&I speaks to how people show up, how they feel included, how we support people and now, more than ever, that’s really important.”

Hutchinson says her clients are asking her more about mental health, belonging, childcare and bringing compassion into these trying times.

“A lot of tech companies don’t necessarily have strong management cultures,” she said. “Those gaps are now becoming really obvious to people. I think we’re all in a place where we’re trying to figure out how we adjust to what’s going on now. It’s about so much more than work right now. I would encourage companies, even if they don’t consider that to be DE&I, to think about how they’re treating their employees.”

Powered by WPeMatico

Peacetime CEO/Wartime CEO by Ben Horowitz is one of the most commonly cited management think pieces of the last decade.

And for good reason; Horowitz surfaced a fundamental distinction in operating philosophy that is necessary for companies to survive, reinvent and ultimately win when macroeconomic environments shift. The framework is especially useful given how counterintuitive the advice is — behaviors of a peacetime CEO and wartime CEO are often on diametrically opposite sides of the spectrum; it is rare to find a CEO who can successfully emulate both personas.

While in concept it is easy to understand these principles, as with most things in life, nothing can replace the visceral comprehension that comes via learned experience. We are at the onset of enduring the most challenging startup environment of (at least) the last 15 years. COVID-19 is an indiscriminate event that is systematically wiping out businesses, whether “atoms” or “bits.”

For most startup operators, this is the first taste of true systematic adversity. The undercurrents of frothy valuations, the social milieu of early-stage investing and stores of excess capital are coming to a grinding halt as the bull market of the last 12 years is dramatically disrupted. We have an entire generation of founders/CEOs who may conceptually understand the peacetime CEO/wartime CEO ethos, but now, they’re going to actually live it. At the same time as every other founder/CEO. Brutal.

Since the onset of COVID-19, we have spoken to more than 100 founders and CEOs. Naturally, we are hearing frequent allusions to peacetime CEO/wartime CEO as a framework to help navigate the landscape. We’ve even used it over the last few months. While we believe it is a helpful framework, it is also incomplete. Further, we believe its application can lead to deeply problematic outcomes.

At a micro level, the misplaced application of peacetime CEO/wartime CEO can fundamentally change a company for the worse. A wartime CEO, as Horowitz notes, is “completely intolerant, rarely speaks in a normal tone, sometimes uses profanity purposefully, heightens contradictions, and neither indulges consensus building nor tolerates disagreements.” In the strictest application, we are seeing this align with a common false trope that has plagued the tech industry: “To change the world like Steve Jobs, I need to emulate all aspects of Steve Jobs’ personality.” A classic logical fallacy many founders/CEOs have learned the hard way — if you emulate all aspects of Steve Jobs’ personality, it doesn’t mean you will change the world like he did.

Each company is driven by its own unique culture and values — in a crisis situation, while it is important to be adept and agile, it’s equally, if not more important, to triple down on the strongest elements of your culture established pre-crisis. Many of the strongest founders/CEOs we have had the pleasure of coaching and investing in are uniquely world-class in their patience and tolerance, their ability to make the abnormal normal and their commitment to inspire with clarity. It is the adherence to these principles that will help carry their companies through this time.

At a macro level, peacetime CEO/wartime CEO conjures outdated themes that are at best inaccurate, and at worst, counterproductive. War implies “destruction, ruthlessness, blood, death;” there is an innate sense of machismo and bravado in this language reinforcing a homogeneous tech community. This type of vernacular and attitude increases barriers to a more inclusive community excluding women and underrepresented minority participation.

Now is the time for us to propagate community, resourcefulness and generosity.

One of the most common takeaways we have heard in reference to the framework is, “now is the time when real founders are made.” If Rent the Runway, ClassPass, Away, the Wing and the countless other women-led/minority-led startups that have been adversely affected by COVID-19 are not able to bounce back, we highly doubt it is because “they weren’t able to cut it as real founders,” a ridiculous assertion to make under any circumstance.

The peacetime CEO/wartime CEO framework is clearly valuable — it forces us to dissect the behavioral shifts necessary to survive in a crisis. That being said, it needs to evolve. Being firm, decisive and staring down an existential crisis is not mutually exclusive with applying empathy, gratitude and generosity. You can be an intense, laser-focused and paranoid CEO without losing yourself or fundamentally changing the culture of your company.

We know dozens of leaders who are leading their companies through these challenging times without leaving a wake of carnage or damage to the foundation they have spent years building. They are leading with their heart and values and will be remembered for how they carried themselves, treated their employees and guided the company through the crisis. COVID-19 presents us with a unique opportunity as an industry. Now is the right time to retire the false dilemma of peacetime CEO or wartime CEO and empower the rise of the human-centric CEO:

There’s no way to mince words. COVID-19 is having a devastating impact on the startup community. The inevitable is unfortunately occurring every day — many startups will never come back from this. As eternal optimists, however, we see opportunity in this crisis for the broader industry: the rise of the human-centric CEO. Now is the time for us to propagate community, resourcefulness and generosity. It’s the time to be ever thoughtful about employees, colleagues, stakeholders and fellow founder/CEOs in need. Individual startups may not survive this crisis, but it is our hope that an everlasting mentality does.

By no means is this list exhaustive, but it captures the behaviors and attributes from the top leaders we are working with. We believe CEOs should strive to become human-centric. Not only because it’s the right thing to do, but also because we believe it will lead to healthier organizations and better results over time.

Powered by WPeMatico

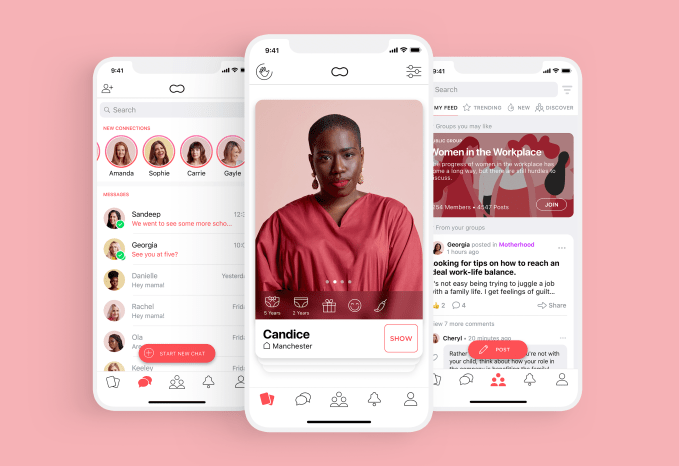

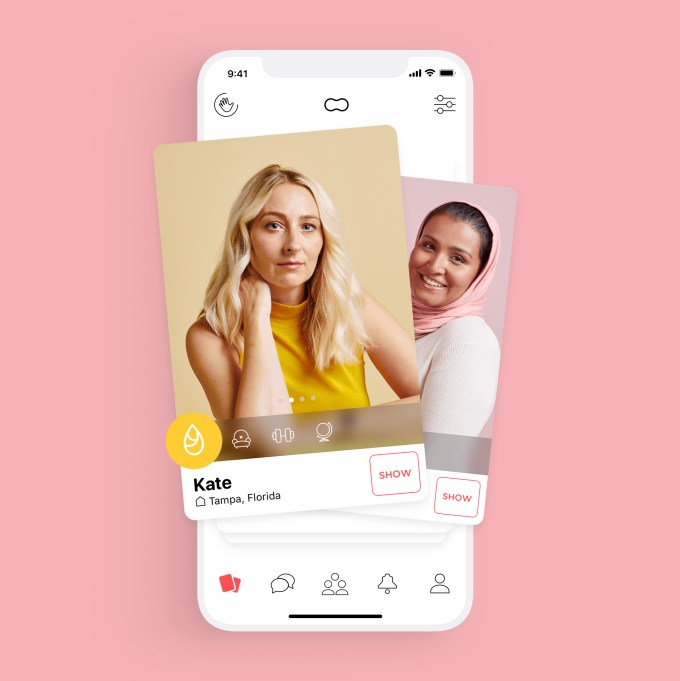

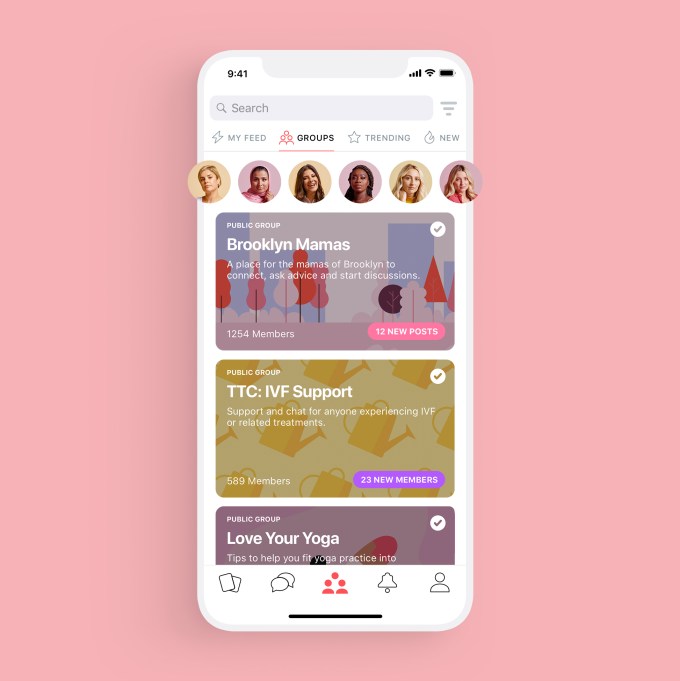

Peanut, an app that began as a tool for finding new mom friends, has evolved into a social network now used by 1.6 million women to discuss a range of topics, from pregnancy and parenthood to marriage and menopause, and everything in between. On the heels of significant growth in online networking fueled by the COVID-19 pandemic, the company is today announcing the close of a $12 million Series A round of funding, led by EQT Ventures, a multi-stage VC firm that invests in companies across Europe and the U.S.

Index Ventures and Female Founders Fund also participated, bringing Peanut’s total raise to date to $21.8 million.

The round itself closed just weeks ago — arriving at a time when the coronavirus pandemic is impacting the startup world, often drying up venture capital for emerging companies. Some startups, as a result, have laid off employees to self-sustain, while others have sought exits or even folded.

Peanut, on the other hand, has seen rapid growth for its platform as women looked for a supportive online environment to discuss their own concerns over how COVID-19 was impacting their lives.

Many women participating in Peanut’s newer “Trying to Conceive” group, for example, worried about their canceled IVF rounds and how to plan for the future. Current moms-to-be wanted to hear from others about how COVID-19 would impact their hospital delivery plans. And others stuck working at home with kids looked for advice and coping strategies.

Since the outbreak, Peanut has seen engagement across its app increase by 30% and content consumption increase by 40%. Its total community also grew from 1 million users in December 2019 to now 1.6 million, as of April.

“We’re really lucky in that we’re growing and that we are, for the most part, untouched by what’s happening,” says Peanut founder and CEO Michelle Kennedy. “And actually, if anyone needed community more, it’s now,” she added.

Though the pandemic has sent the app’s usage skyrocketing, it has also readjusted Peanut’s priorities with regard to its roadmap.

Most notably, its friend-finding feature needs a rethink.

Peanut originally worked as a sort of “Tinder for mom friends” — an idea that arose from Kennedy’s personal experience with how difficult it was to forge female friendships after motherhood. As the former deputy CEO at dating app Badoo and an inaugural board member at Bumble, she brought her extensive experience in matchmaking apps to Peanut, which uses a similar swipe-based mechanism.

But COVID-19 has up-ended this side of Peanut’s business. Today, Peanut users are meeting in Zoom chat rooms to hangout or play games, but not in person.

Kennedy says the company will try to meet these users where they are with the development of more video networking features, potentially with technology built in-house. Other plans for the new capital include improvements to the social discovery aspects of its app, the development of a web version of Peanut, and the creation of more groups beyond those focused on fertility and motherhood, which have so far been core to the Peanut experience.

Specifically, the company soon plans to launch a new community focused on women living with menopause, an experience that will reach more than a billion women by 2025. Despite the fact that all women with ovaries will go through menopause, there are relatively few online communities dedicated to it — which Peanut sees as an untapped market.

Peanut’s real strength, however, is not in the types of communities it grows on its platform, but how they’re created.

There has not yet been a social network that focused on “building a platform for women, thinking about women’s needs and built by a women,” explains Kennedy. “So what we end up doing is using things that already exist — trying to twist them and mold them into what we need, and never getting it exactly right,” she says. “We can do better than that.”

One small example of this is the recent launch of Peanut’s “Mute Keywords” feature that allows women to remove certain types of discussions from their feeds and notifications. Some women used this to create a coronavirus-free news feed that focused on other aspects of motherhood. Others who were trying to conceive muted conversations around “pregnancy,” which they found emotionally triggering.

With the Series A’s close, Peanut says Naza Metghalchi from EQT Ventures joins the company’s majority-female board, alongside Hannah Seal from existing investor Index Ventures.

“Peanut’s user engagement metrics are a testament to the app’s ability to act as a true emotional companion throughout women’s journeys,” said Naza Metghalchi, venture lead and investment advisor at EQT Ventures, in a statement. “The EQT Ventures team is excited to partner with Michelle and continue to grow Peanut into a platform that serves all women at different life milestones, exploring topics beyond fertility and motherhood which have already seen such huge traction.”

The additional funding allows London-based Peanut to expand its business and hire more engineers to join its current team of just 16.

“I think having closed a round in this climate is great for the team,” says Kennedy. “It’s also great for the community because it means that we can grow the team, build quicker, build faster and develop the product more quickly,” she adds.

Powered by WPeMatico

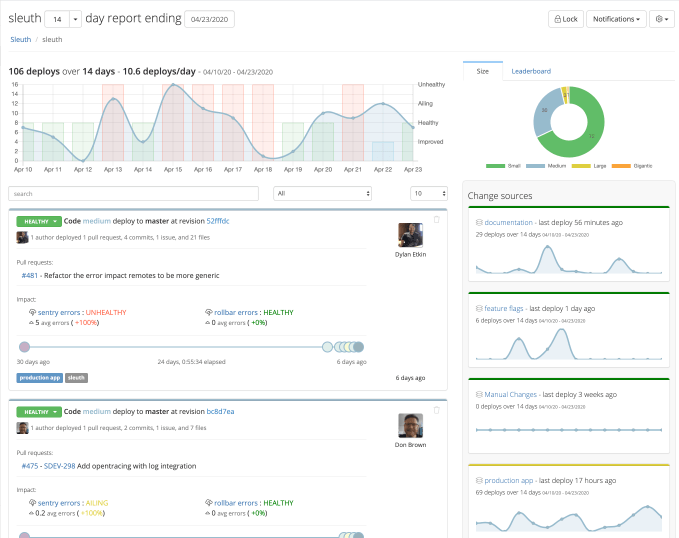

Sleuth, an early stage startup from three former Atlassian employees, wants to bring some much-needed order to the continuous delivery process. Today, the company announced it has raised a $3 million seed round.

CRV led the round with participation from angel investors from New Relic, Atlassian and LaunchDarkly.

“Sleuth is a deployment tracker built to solve the confusion that comes when companies have adopted continuous delivery,” says CEO and co-founder Dylan Etkin. The company’s founders recognized that more and more companies were making the move to continuous delivery deployment, and they wanted to make it easier to track those deployments and figure out where the bottle necks were.

He says that typically, on any given DevOps team, there are perhaps two or three people who know how the entire system works, and with more people spread out now, it’s more important than ever that everyone has that capability. Etkin says Sleuth lets everyone on the team understand the underlying complexity of the delivery system with the goal of helping them understand the impact of a given change they made.

“Sleuth is trying to make that better by targeting the developer and really giving them a communications platform, so that they can discuss the [tools] and understand what is changing and who has changed what. And then more importantly, what is the impact of my change,” he explained.

Image Credit: Sleuth

The company was founded by three former Atlassian alumni — Ektin along with Michael Knighten and Don Brown — all of whom were among the first 50 employees at the now tremendously successful development tools company.

That kind of pedigree tends to get the attention of investors like CRV, but it is also telling that three companies including their former employer saw enough potential here to invest in the company, and be using the product.

Etkin recognizes this is a tricky time to launch an early-stage startup. He said that when he first entered the lock down, his inclination was to hunker down, but they concluded that their tool would have even greater utility at the moment. “The founders took stock and we were always building a tool that was great for remote teams and collaboration in general, and that hasn’t changed… if anything, I think it’s becoming more important right now.”

The company plans to spend the next 6-9 months refining the product, adding a few folks to the five person team and finding product-market fit. There is never an ideal time to start a company, but Sleuth believes now is its moment. It may not be easy, but they are taking a shot.

Powered by WPeMatico