funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Tuna is on a mission to “fine tune” the payments space in Latin America and has raised two seed rounds totaling $3 million, led by Canary and by Atlantico.

Alex Tabor, Paul Ascher and Juan Pascual met each other on the engineering team of Peixe Urbano, a company Tabor co-founded and he referred to as a “Groupon for Brazil.” While there, they came up with a way to use A/B testing to create a way of dealing with payments in different markets.

They eventually left Peixe Urbano and started Tuna in 2019 to make their own payment product that enables merchants to use A/B testing of credit card processors and anti-fraud providers to optimize their payments processing with one integration and a no-code interface.

Tabor explained that the e-commerce landscape in Latin America was consolidated, meaning few banks controlled more of the market. The address verification system merchants use to verify a purchaser is who they say they are, involves sending information to a bank that is returned to the merchant with a score of whether that match is legitimate.

“In the U.S., that score is used to determine if the purchaser is legit, but they didn’t implement that in Latin America,” he added. “Instead, merchants in LatAm have to tap into other organizations that have that data.”

That process involves manual analysis and constant adjusting due to fraud. Instead, Tuna’s A/B tests between processors and anti-fraud providers in real time and provides a guarantee that a decision to swap providers is based on objective data that considers all components of performance, like approval rates, and not just fees.

Over the past year, the company added 12 customers and saw its revenue increase 15%. It boasts a customer list that includes the large Brazilian fashion chain Riachuelo, and its platform integrates with others including VTEX, Magento and WooCommerce.

The share of e-commerce in overall retail is less than 10% in Latin America. Marcos Toledo, Canary’s managing partner, said via email that e-commerce in LatAm is currently at an inflexion point: not only has the global pandemic driven more online purchases, but also fintech innovation that has occurred in recent years.

In Brazil alone, e-commerce sales grew 73.88% in 2020, but Toledo said there was much room for improvement. What Tuna is building will help companies navigate the situation and make it easier for more customers to buy online.

Toledo met the Tuna team from his partner, Julio Vasconcellos, who was one of the co-founders of Peixe Urbano. When the firm heard that the other Tuna co-founders were starting a business that was applying some of the optimization methods they had created at Peixe Urbano, but for every company, they saw it as an opportunity to get involved.

“The vast tech expertise that Alex, Paul and Juan bring to a very technical business is something that we really admire, as well as their vision to create a solution that can impact companies throughout Latin America,” Toledo said. “The no-code solution that Tuna is building is exciting because it is scalable and can help companies not only get better margins, but also drive their developers to other efforts — and developers have been a very scarce workforce in the region.”

To meet demand for an e-commerce industry that surpassed $200 billion in 2020, Tuna plans to use the new funding to build out its team and grow outbound customer success and R&D, Tabor said.

Up next, he wants to be able to show traction in payments optimization and facilitators in Brazil before moving on to other countries. He has identified Mexico, Colombia and Argentina as potential new markets.

Powered by WPeMatico

Wildfires are burning in countries all around the world. California is dealing with some of the worst wildfires in its history (a superlative that I use essentially every year now) with the Caldor fire and others blazing in the state’s north. Meanwhile, Greece and other Mediterranean nations have been fighting fires for weeks to bring a number of massive blazes under control.

With the climate increasingly warming, millions of homes just in the United States alone are sitting in zones at high risk for wildfires. Insurance companies and governments are putting acute pressure on homeowners to invest more in defending their homes in what is typically dubbed “hardening,” or ensuring that if fires do arrive, a home has the best chance to survive and not spread the disaster further.

SF-based Firemaps has a bold vision for rapidly scaling up and solving the problem of home hardening by making a complicated and time-consuming process as simple as possible.

The company, which was founded just a few months ago (in March), sends out a crew with a drone to survey a homeowner’s house and property if it is in a high-risk fire zone. Within 20 minutes, the team will have generated a high-resolution 3D model of the property down to the centimeter. From there, hardening options are identified and bids are sent out to trade contractors to perform the work on the company’s marketplace.

Once the drone scans a house, Firemaps can create a full CAD model of the structure and the nearby property. Image Credits: Firemaps.

While early, it’s already gotten traction. In addition to hundreds of homeowners who have signed up on its website and a few dozen that have been scanned, Andrew Chen of a16z has led a $5.5 million seed round into the business (the Form D places the round sometime around April). Uber CEO Dara Khosrowshahi and Addition’s Lee Fixel also participated.

Firemaps is led by Jahan Khanna, who co-founded it along with his brother, who has a long-time background in civil engineering, and Rob Moran. Khanna was co-founder and CTO of early ridesharing startup Sidecar, where Moran joined as one of the company’s first employees. The trio spent cycles exploring how to work on climate problems, while staying focused on helping people in the here and now. “We have crossed certain thresholds [with the climate] and we need to get this problem under control,” Khanna said. “We are one part of the solution.”

Over the past few years Khanna and his brother explored opening a solar farm or a solar-powered home in California. “What was wild, whenever we talked to someone, is they said you cannot build anything in California since it will burn down,” Khanna said. “What is kind of the endgame of this?” As they explored fire hardening, they realized that millions of homeowners needed faster and cheaper options, and they needed them sooner rather than later.

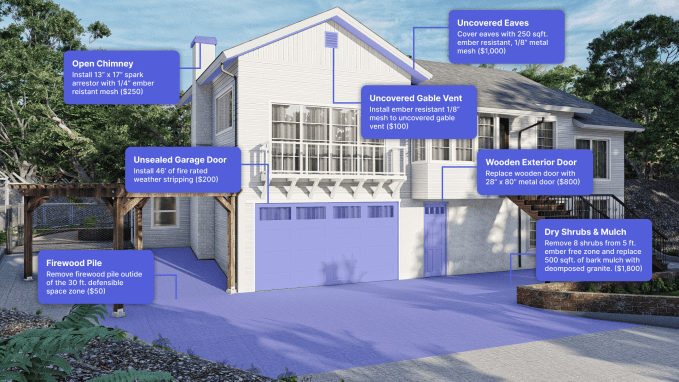

While there are dozens of options to harden a home to fire, some popular options include constructing an ember-free zone within a few feet of a home, often by placing gravel made of granite on the ground, as well as ensuring that attic vents, gutters and siding are fireproof and can withstand high temperatures. These options can vary widely in cost, although some local and state governments have created reimbursement programs to allow homeowners to recoup at least some of the expenses of these improvements.

A Firemaps house in 3D model form with typical hardening options and associated prices. Image Credits: Firemaps.

The company’s business model is simple: vetted contractors pay Firemaps to be listed as an option on its platform. Khanna believes that because its drone offers a comprehensive model of a home, contractors will be able to bid for contracts without doing their own site visits. “These contractors are getting these shovel-ready projects, and their acquisition costs are basically zero,” Khanna said.

Long-term, “our operating hypothesis is that building a platform and building these models of homes is inherently valuable,” Khanna said. Right now, the company is launched in California, and the goal for the next year is to “get this model repeatable and scalable and that means doing hundreds of homes per week,” he said.

Powered by WPeMatico

At a time when remote work, cybersecurity attacks and increased privacy and compliance requirements threaten a company’s data, more companies are collecting and storing their observability data, but are being locked in with vendors or have difficulty accessing the data.

Enter Cribl. The San Francisco-based company is developing an “open ecosystem of data” for enterprises that utilizes unified data pipelines, called “observability pipelines,” to parse and route any type of data that flows through a corporate IT system. Users can then choose their own analytics tools and storage destinations like Splunk, Datadog and Exabeam, but without becoming dependent on a vendor.

The company announced Wednesday a $200 million round of Series C funding to value Cribl at $1.5 billion, according to a source close to the company. Greylock and Redpoint Ventures co-led the round and were joined by new investor IVP, existing investors Sequoia and CRV and strategic investment from Citi Ventures and CrowdStrike. The new capital infusion gives Cribl a total of $254 million in funding since the company was started in 2017, Cribl co-founder and CEO Clint Sharp told TechCrunch.

Sharp did not discuss the valuation; however, he believes that the round is “validation that the observability pipeline category is legit.” Data is growing at a compound annual growth rate of 25%, and organizations are collecting five times more data today than they did 10 years ago, he explained.

“Ultimately, they want to ask and answer questions, especially for IT and security people,” Sharp added. “When Zoom sends data on who started a phone call, that might be data I need to know so I know who is on the call from a security perspective and who they are communicating with. Also, who is sending files to whom and what machines are communicating together in case there is a malicious actor. We can also find out who is having a bad experience with the system and what resources they can access to try and troubleshoot the problem.”

Cribl also enables users to choose how they want to store their data, which is different from competitors that often lock companies into using only their products. Instead, customers can buy the best products from different categories and they will all talk to each other through Cribl, Sharp said.

Though Cribl is developing a pipeline for data, Sharp sees it more as an “observability lake,” as more companies have differing data storage needs. He explains that the lake is where all of the data will go that doesn’t need to go into an existing storage solution. The pipelines will send the data to specific tools and then collect the data, and what doesn’t fit will go back into the lake so companies have it to go back to later. Companies can keep the data for longer and more cost effectively.

Cribl said it is seven times more efficient at processing event data and boasts a customer list that includes Whole Foods, Vodafone, FINRA, Fannie Mae and Cox Automotive.

Sharp went after additional funding after seeing huge traction in its existing customer base, saying that “when you see that kind of traction, you want to keep doubling down.” His aim is to have a presence in every North American city and in Europe, to continue launching new products and growing the engineering team.

Up next, the company is focusing on go-to-market and engineering growth. Its headcount is 150 currently, and Sharp expects to grow that to 250 by the end of the year.

Over the last fiscal year, Cribl grew its revenue 293%, and Sharp expects that same trajectory for this year. The company is now at a growth stage, and with the new investment, he believes Cribl is the “future leader in observability.”

“This is a great investment for us, and every dollar, we believe, is going to create an outsized return as we are the only commercial company in this space,” he added.

Scott Raney, managing director at Redpoint Ventures, said his firm is a big enterprise investor in software, particularly in companies that help organizations leverage data to protect themselves, a sweet spot that Cribl falls into.

He feels Sharp is leading a team, having come from Splunk, that has accomplished a lot, has a vision and a handle on the business and knows the market well. Where Splunk is capturing the machine data and using its systems to extract the data, Cribl is doing something similar in directing the data where it needs to go, while also enabling companies to utilize multiple vendors and build apps to sit on top of its infrastructure.

“Cribl is adding opportunity by enriching the data flowing through, and the benefits are going to be meaningful in cost reduction,” Raney said. “The attitude out there is to put data in cheaper places, and afford more flexibility to extract data. Step one is to make that transition, and step two is how to drive the data sitting there. Cribl is doing something that will go from being a big business to a legacy company 30 years from now.”

Powered by WPeMatico

Bodo.ai, a parallel compute platform for data workloads, is developing a compiler to make Python portable and efficient across multiple hardware platforms. It announced Wednesday a $14 million Series A funding round led by Dell Technologies Capital.

Python is one of the top programming languages used among artificial intelligence and machine learning developers and data scientists, but as Behzad Nasre, co-founder and CEO of Bodo.ai, points out, it is challenging to use when handling large-scale data.

Bodo.ai, headquartered in San Francisco, was founded in 2019 by Nasre and Ehsan Totoni, CTO, to make Python higher performing and production ready. Nasre, who had a long career at Intel before starting Bodo, met Totoni and learned about the project that he was working on to democratize machine learning and enable parallel learning for everyone. Parallelization is the only way to extend Moore’s Law, Nasre told TechCrunch.

Bodo does this via a compiler technology that automates the parallelization so that data and ML developers don’t have to use new libraries, APIs or rewrite Python into other programming languages or graphics processing unit code to achieve scalability. Its technology is being used to make data analytics tools in real time and is being used across industries like financial, telecommunications, retail and manufacturing.

“For the AI revolution to happen, developers have to be able to write code in simple Python, and that high-performance capability will open new doors,” Totoni said. “Right now, they rely on specialists to rewrite them, and that is not efficient.”

Joining Dell in the round were Uncorrelated Ventures, Fusion Fund and Candou Ventures. Including the new funding, Bodo has raised $14 million in total. The company went after Series A dollars after its product had matured and there was good traction with customers, prompting Bodo to want to scale quicker, Nasre said.

Nasre feels Dell Technologies Capital was “uniquely positioned to help us in terms of reserves and the role they play in the enterprise at large, which is to have the most effective salesforce in enterprise.”

Though he was already familiar with Nasre, Daniel Docter, managing director at Dell Technologies, heard about Bodo from a data scientist friend who told Docter that Bodo’s preliminary results “were amazing.”

Much of Dell’s investments are in the early-stage and in deep tech founders that understand the problem. Docter puts Totoni and Nasre in that category.

“Ehsan fits this perfectly, he has super deep technology knowledge and went out specifically to solve the problem,” he added. “Behzad, being from Intel, saw and lived with the problem, especially seeing Hadoop fail and Spark take its place.”

Meanwhile, with the new funding, Nasre intends to triple the size of the team and invest in R&D to build and scale the company. It will also be developing a marketing and sales team.

The company is now shifting from financing to customer- and revenue-focused as it aims to drive up adoption by the Python community.

“Our technology can translate simple code into the fast code that the experts will try,” Totoni said. “I joined Intel Labs to work on the problem, and we think we have the first solution that will democratize machine learning for developers and data scientists. Now, they have to hand over Python code to specialists who rewrite it for tools. Bodo is a new type of compiler technology that democratizes AI.”

Powered by WPeMatico

Forward Kitchens was working quietly on its digital storefront for restaurants and is now announcing a $2.5 million seed round.

Raghav Poddar started the company two years ago and was part of the Y Combinator Summer 2019 cohort. Poddar told TechCrunch he has been a foodie his entire life. Lately, he was relying on food delivery and pickup services, and while visiting with some of the restaurant owners, he realized a few things: first, not many had a good online presence, and second, these restaurants had the ability to cook cuisine representative of their communities.

That led to the idea of Forward Kitchens, which provides a turnkey tool for restaurants to set up an online presence, including food delivery, where they can create multiple digital storefronts easily and without having to contact each delivery platform. The company ran pilot programs in a handful of restaurants, and this is the first year coming out of stealth.

“It’s an expansion of what they have on the menu, but is not immediately available in the neighborhood,” Poddar added. “Kitchens can keep the costs and headcount the same, but be able to service the demand and get more orders because it is fulfilling a need for the neighborhood, which is why we can grow so fast.”

Here’s how it works: Forward Kitchens goes into a restaurant and takes into account its capacity for additional cooking and the demographic area, as well as what food is available near it, and helps the restaurant create the storefront.

Each restaurant is able to build multiple storefronts, for example, an Italian restaurant setting up a storefront just to sell its popular mac n’ cheese or other small plates on demand. A couple hundred digital storefronts were already created, Poddar said.

A group of investors, including Y Combinator, Floodgate, Slow Ventures and SV Angel and angel investors Michael Seibel of YC, Ram Shriram and Thumbtack’s Jonathan Swanson, were involved in the round.

The new funding will be used to expand the company’s footprint and reach, and to hire a team in operations, sales and engineering to help support the product.

“Forward Kitchens is empowering independent kitchens to create digital storefronts and receive more online sales,” Seibel said via email. “With Forward Kitchens, a kitchen can create world-class digital storefronts at the click of a button.”

Powered by WPeMatico

Ken Babcock and his co-founders, Dan Giovacchini and Brian Shultz, were in the midst of Harvard Business School in March 2020 when they felt the call to start Tango, a Chrome extension that auto-captures workflow best practices so that teams can learn from their top performers.

“This window of opportunity was driven by the pandemic as we saw a lot of companies become distributed and go remote,” CEO Babcock told TechCrunch. “Team leaders were remotely onboarding people, for perhaps the first time, and accelerating ramp times. There was no longer the opportunity to tap on people’s shoulders in the office, so much of the training was left to people’s own devices.”

They dropped out of their program to start Los Angeles-based Tango, and today, announced a $5.7 million seed round for its workflow intelligence platform. Wing Venture Capital led the round and was joined by General Catalyst, Global Silicon Valley, Outsiders Fund and Red Sea Ventures. A group of angel investors also joined, including former Yelp executive Michael Stoppelman, former Uber head of data Jai Ranganathan, KeepTruckin CEO Shoaib Makani and Awesome People Ventures’ Julia Lipton.

Tango is designed to help employees, particularly in customer success and sales enablement, get back as much as 20% of their workweek spent searching for that one piece of information or tracking down the right colleague to assist with a task. Its technology creates tutorials by recording a users’ workflow — actions, links to pages, URLs and screenshots — and turns that into step-by-step documentation with a video.

Previously the co-founders bootstrapped the company, and decided to go after seed funding to expand the product and growth teams and invest in product development so that Tango could take a product-led growth strategy, Babcock said. The team now has 13 employees.

Since starting last year, Tango has secured 10 pilots to figure out the data and capabilities before it is set to launch publicly in September. Babcock said the company will always have a free version of the product, as well as premium and enterprise versions that will unlock additional capabilities.

“The big thing is around integrations and meeting people where the consumer content is,” Babcock added. “We are reducing that burden of creating documentation, and for companies that already have Wikis or other materials, learning how to inject ourselves into those systems.”

Zach DeWitt, partner at Wing Venture Capital, said he met the company three years ago through a mutual friend.

His firm invests in early-stage, business-to-business startups unlocking a novel data set. In Tango’s case, the company was creating a new data set for the enterprise and business, where users can analyze workflow.

With the average tech company using 150 SaaS apps, up from 20 a decade ago, there are permutations about which app to use, how to use them, what happens if the user gets stuck and what if none of the data is being captured, Dewitt said. Tango works in the background and captures workflow, which is the foundation to the business’ success.

“I was blown away by the approach,” he added. “You have to meet people where they get stuck and even anticipate where they get stuck so you can serve the Tango tutorial to get unstuck. It can also change the company’s culture when it rewards people to share knowledge. The whole idea is beneficial to multiple parties: to those who are getting stuck and to new hires. That is powerful.”

Powered by WPeMatico

Creating single-family homes for the homeless using 3D printing robotics. Developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA. Delivering what is believed to be the largest 3D-printed structure in North America — a barracks for Texas Military Department.

These are just some of the things that Austin, Texas-based construction tech startup ICON has been working on.

And today, the company is adding a massive $207 million Series B raise to its list of accomplishments.

I’ve been covering ICON since its $9 million seed round in October of 2018, so seeing the company reach this milestone less than three years later is kind of cool.

Norwest Venture Partners led the startup’s Series B round, which also included participation from 8VC, Bjarke Ingels Group (BIG), BOND, Citi Crosstimbers, Ensemble, Fifth Wall, LENx, Moderne Ventures and Oakhouse Partners. The financing brings ICON’s total equity raised to $266 million. The company declined to reveal its valuation.

ICON was founded in late 2017 and launched during SXSW in March 2018 with the first permitted 3D-printed home in the U.S. That 350-square-foot house took about 48 hours (at 25% speed) to print. ICON purposely chose concrete as a material because, as co-founder and CEO Jason Ballard put it, “It’s one of the most resilient materials on Earth.”

Since then, the startup says it has delivered more than two dozen 3D-printed homes and structures across the U.S. and Mexico. More than half of those homes have been for the homeless or those in chronic poverty. For example, in 2020, ICON delivered 3D-printed homes in Mexico with nonprofit partner New Story. It also completed a series of homes serving the chronically homeless in Austin, Texas, with nonprofit Mobile Loaves & Fishes.

The startup broke into the mainstream housing market in early 2021 with what it said were the first 3D-printed homes for sale in the U.S. for developer 3Strands in Austin, Texas. Two of the four homes are under contract. The remaining two homes will hit the market on August 31.

And recently, ICON revealed its “next generation” Vulcan construction system and debuted its new Exploration Series of homes. The first home in the series, “House Zero,” was optimized and designed specifically for 3D printing.

For some context, ICON says its proprietary Vulcan technology produces “resilient, energy-efficient” homes faster than conventional construction methods and with less waste and more design freedom. The company’s new Vulcan construction system, according to Ballard, can 3D print homes and structures up to 3,000 square feet, is 1.5x larger and 2x faster than its previous Vulcan 3D printers.

From the company’s early days, Ballard has maintained ICON is motivated by the global housing crisis and lack of solutions to address it. Using 3D printers, robotics and advanced materials, he believes, is one way to tackle the lack of affordable housing, a problem that is only getting worse across the country and in Austin.

ICON’s list of future plans include the delivery of social, disaster relief and more mainstream housing, Ballard said, in addition to developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA.

ICON also has two ongoing projects with NASA. Recently, Mars Dune Alpha was just announced by NASA, ICON and BIG – and ICON so far has finished printing the wall system and is onto the roof now. Also, NASA is recruiting for crewed missions to begin nextfFall to live in the first simulated Martian habitat 3D printed by ICON.

When asked, Ballard said the most significant thing that has happened since the company’s $35 million Series A last August has been the “the radical increase in demand for 3D-printed homes and structures.”

“That single metric represents a lot for us,” Ballard told TechCrunch. “People have to want these houses.”

To tackle the housing shortage, the world needs to increase supply, decrease cost, increase speed, increase resiliency, increase sustainability… all without compromising quality and beauty, he added.

“Perhaps there are a few approaches that can do some of those things, but only construction scale 3D printing holds the potential to do all of those things,” he said.

ICON has seen impressive financial growth, with 400% revenue growth nearly every year since inception, according to Ballard. It’s also tripled its team in the past, year and now has more than 100 employees. It expects to double in size within the next year.

Image Credits: Co-founders with next-gen Vulcan Construction System / ICON

The series B funds will go toward more construction of 3D-printed homes, “rapid scaling and R&D,” further space-based tech advancements and creating “a lasting societal impact on housing issues,” Ballard said.

“We have already stood up early-stage manufacturing and are in the process of upgrading and accelerating those efforts in order to meet demand for more 3D-printed houses even as we close the round,” Ballard said. “In the next five years, we believe we will be delivering thousands of homes per year and on our way to tens of thousands of homes per year.”

Norwest Venture Partners Managing Partner Jeff Crowe, who is joining ICON’s board as part of the financing, said his firm believes that ICON’s 3D printing construction technology will “massively impact the housing shortage in the U.S. and around the globe.”

It is “enormously difficult” to bring together the advanced robotics, materials science and software to develop a robust 3D printing construction technology in the first place, Crowe said.

“It is still harder to develop the technology in a way that can produce hundreds and thousands of beautiful, affordable, comfortable, energy efficient homes in varying geographies with reliability and predictability — not just one or two demonstration units in a controlled setting,” he wrote via e-mail. “ICON has done all that, and…has all the elements to be a breakout, generational success.”

Powered by WPeMatico

With COVID-19 disrupting the entire manufacturing supply chain including semiconductor shortages, companies across multiple industries have been struggling to seek a procurement solution that can rebalance the gap between supply and demand.

CADDi, a Tokyo-based B2B ordering and supply platform in the manufacturing and procurement industry, helps both procurement (demand side) and manufacturing facilities (supply side) by aggregating and rebalancing supply and demand via its automated calculation system for manufacturing costs and databases of fabrication facilities across Japan.

The company announced this morning a $73 million Series B round co-led by Globis Capital Partners and World Innovation Lab (WiL), with participation from existing investors DCM and Global Brain. Six new investors also have joined the round including Arena Holdings, DST Global, Minerva Growth Partners, Tybourne Capital Management, JAFCO Group and SBI Investment.

CADDi was founded by CEO Yushiro Kato and CTO Aki Kobashi in November 2017.

The post-money valuation is estimated at $450 million, according to sources close to the deal.

The new funding brings CADDi’s total raised so far to $90.5 million. In December 2018, the company closed a $9 million Series A round led by DCM and followed by Globis Capital Partners and WiL and Global Brain.

The funding proceeds will be used for accelerating digital transformation of the platform, hiring and expanding to global markets.

“We enable integrated production of complete sets of equipment consisting of custom-made parts such as sheet metal, machined parts and structural frames. Using an automatic quotation system based on a proprietary cost calculation algorithm, we select the processing company that best matches the quality, delivery date and price of the order and build an optimal supply chain,” CEO and co-founder Yushiro Kato said.

The goal of CADDi’s ordering platform is to transform the manufacturing industry from a multiple subcontractor pyramid structure to a flat, connected structure based on each manufacturers’ individual strengths, thus creating a world where those on the front lines of manufacturing can spend more time on essential and creative work, Kato said.

CADDi’s ordering platform, backed by its unique technology including automatic cost calculation system, optimal ordering and production management system, and drawing management system, offers a 10%-15% cost reduction, stable capacity and balanced order placement to its more than 600 Japanese supply partners spanning a multitude of industries.

“The demand for CADDi’s services has seen significant acceleration. Our business has been growing very fast, and our latest orders have grown more than six times compared to the previous year, leading to the company’s expanded presence into both eastern and western Japan in order to meet this increase in demand,” Kato said.

“Going forward, in addition to continuously expanding our ordering platform, we will also start to provide purchases (manufacturers) and supply partners with our technology directly to promote digital transformation of their operations, for example, the production management system and drawing management system,” Kato continued.

“As a start point, in the near future, we are thinking about selling ‘Drawing Management SaaS,’” which has been used internally for CADDi’s ordering operation, to help customers solve operational pains in handling piles of drawings. “Our ‘Drawing Management SaaS’ technology will not only help manage drawings as documents properly but also allow utilization of data of drawings in a practical way for future decision-making and action in their procurement process.”

CADDi’s next axis of growth will be other growing markets, especially in Southeast Asia, Kato pointed out. “Many of our Japanese customers have subsidiaries and branches in these countries, so it’s a natural expansion opportunity for us to strengthen our value proposition and provide more continuity and seamless service to our customers,” Kato added.

Kato also said it wants to continue investing in hiring, especially engineers, to further the development of its platform CADDi and new business. It plans to hire 1,000 employees in the next three years. CADDi had 102 employees as of March 2021.

The company aims to become a global platform with sales of USD 9.1 billion (that is 1 trillion YEN) by 2030, Kato said.

COVID-19 had a different impact on different industries in the procurement and manufacturing sector, with “the automobile and machine tool industries were negatively affected by the pandemic and experienced an up to 90% temporary drop in sales, while other industries such as the medical and semiconductor industries have experienced explosive growth in demand. The overall result of COVID-19 is that the company has captured more demand because CADDi’s system rebalances receipts across multiple industries,” according to Kato.

Masaya Kubota, partner at World Innovation Lab, told TechCrunch, “CADDi’s solution of aggregating and rebalancing supply and demand has once again proven to be indispensable to both purchasers and manufacturers, with the pandemic disrupting the entire supply chain in manufacturing. We first invested in CADDi in 2018, because we strongly believed in their mission of digitally transforming one of the most analog industries, the $1 trillion procurement market.”

Another investor principal at DCM, Kenichiro Hara, also said in an email interview with TechCrunch, “The pandemic made the manufacturing industry’s supply chain vulnerabilities quite clear early on. For example, if a country is on lockdown or a factory stalls the operations, their customers cannot procure necessary parts to produce their products. This impact amplifies, and the entire supply chain is affected. Therefore, the demand for finding new, available and accessible suppliers in a timely manner increased in importance, which is CADDi’s primary value-add.”

Powered by WPeMatico

Getting children to school safely and reliably is a challenge as old as public education itself. But rarely have any entrepreneurs tackled the problem of updating and optimizing one of the nation’s largest legacy transit systems, now nearly a century old. It’s still common to find people at U.S. student transportation hubs speaking into walkie-talkies and wrangling clipboards as they sort passengers into gas-guzzling yellow buses.

Ritu Narayan was working as a product executive at eBay when her two children began attending school. Finding safe and reliable options for getting them to campus was sometimes so difficult that anytime those options would fall out, she would be on the verge of leaving her job.

“We had the minimum viable product, which we expanded upon, built the entire platform, and we kept on going to better places with our solutions.”

Bearing in mind that her mother in India had set aside a career to raise Narayan and her three siblings, she founded Zūm in 2016 with brothers Abhishek and Vivek Garg to optimize routes, create transparency and make school commutes greener; since then, Zūm has operated in several California districts (including San Francisco), as well as in Seattle, Chicago and Dallas. In Oakland, Zūm has optimized routes to reduce the previous bus requirement by 29 percent, with the balance being serviced by midsized vehicles.

Zūm also plans to have a fleet of 10,000 electric school buses by 2025 and is partnering with AutoGrid to transform that fleet into a virtual power plant with the potential capacity to route 1 GW of energy back to the grid.

To get a deeper look into the startup’s plans and hear what Narayan has learned from its journey so far, we discussed the pandemic’s impacts on Zūm’s development, where she thinks the company will be a year from now, and how she convinced investors to back a business model that embraces accessibility and equity.

(Editor’s note: This interview has been edited for clarity and length.)

How did COVID-19 affect your business? What percentage of your business is back now?

It’s funny, because we used to say that student transportation is a recession-proof business, and no matter what, kids are still going to go to school, but the pandemic was the first time in probably the last 100 years when kids across the globe did not go to school. It was an interesting time for us, because overnight, all the rides were closed and we had to focus on what was needed immediately to support our districts and students.

We realized that the school is such an important physical infrastructure that’s not just for education, but students get meals there as well as physical and emotional help. So we helped the school districts with reverse logistics, taking the meals or laptops from the school districts and delivering them to homes, because our software could handle that kind of thing. That was just an interim to make sure the communities settled. Starting last year, rides started coming back around 30%, and this year starting in April, it has been 100% back in the business.

Powered by WPeMatico

Silicon Valley was once one of the most productive regions in the country for the defense industry, churning out chips and technologies that helped the United States overtake the Soviet Union during the Cold War. Since then, the region has been known far less for silicon and defense than for the consumer internet products of Google, Facebook and Netflix.

A small number of startups, though, are attempting to revitalize that important government-industry nexus as the rise of China pushes more defense planners in Washington to double down on America’s technical edge. Vannevar Labs is one of this new crop, and it has hit some new milestones in its quest to displace traditional defense contractors with Silicon Valley entrepreneurial acumen.

I last chatted with the company just as it was debuting in late 2019, having raised a $4.5 million seed. The company has been quiet and heads down the past two years as it developed a product and traction within the defense establishment. Now it’s ready to reveal a bit more of what all that work has culminated in.

First, the company officially launched its Vannevar Decrypt product in January of this year. It’s focused on foreign language natural language processing, organizing overseas data and resources that are collected by the intelligence community and then immediately translating and interpreting those documents for foreign policy decisionmakers. CEO and co-founder Brett Granberg said that the product “went from one deployment to a dozen adoptions.”

Second, the company raised a $12 million Series A investment in May from Costanoa Ventures and Point72, with General Catalyst participating. Costanoa and GC co-led the startup’s seed round.

Finally, the company has been on a hiring spree. The team has grown into a crew of 20 employees, and the firm last week brought on Scott Sanders to lead business development. Sanders was one of the earliest employees at Anduril, and had spent several years at the company. Vannevar also added to its board John Doyle, a long-time Palantir employee who was head of its national security business, according to Granberg. Today, the team is equally split between national security folks and technologists, and he says that the team is set to double this year.

Co-founders Nini Moorhead and Brett Granberg of Vannevar Labs. Photo via Vannevar Labs.

With a few years of hindsight, Granberg says that he has refined what he considers the best model for defense tech startups to break into the hardscrabble market at the Pentagon and across Northern Virginia.

First, there needs to be incredible focus on getting access to actual end users and learning their work. The functions that defense and intelligence personnel perform are completely different from operations in the commercial economy, and trying to translate what works at a large corporation into defense is a fool’s errand. “You need to have both the DNA of understanding new technology and the DNA of deeply understanding a lot of different use cases within DoD,” Granberg said, referencing the Department of Defense.

That has directly informed how Decrypt has developed over time. “We started focusing on the counter-terrorism space, and as the government moved away from counter-terrorism, we started moving to the foreign actors that were important,” he said. “Once we have our first couple of deployments, we are able to iterate very, very quickly.”

He also strongly eschews a popular view in defense procurement circles that there are “dual-use” technologies that can be used equally well in commercial and defense applications. “Some of the most important mission problems where the government spends the most money and has the most interest,” he explained, are also contexts where commercial off-the-shelf products (dubbed COTS in the industry parlance) are least useful. He says startups targeting defense simply cannot split their bandwidth by also trying to learn commercial use cases.

In fact, he went so far to predict that “you are going to see a lot of companies that have raised a lot of money that will fizzle out in the coming years” because they just can’t nail the dual-use model well.

Second, he argues that defense tech startups need to move beyond the model that each company should work on one platform, and instead move to an organizational model where a company offers multiple products to reach scale. Each product has the potential to reach “a couple of hundred million in revenue,” according to Granberg, but it is hard to expand a company’s size if it doesn’t parallelize product development.

To that end, Granberg said that he pushes Vannevar Labs to always be exploring new product lines for growth. “Decrypt is our first product [but]10% of our energy is in new product efforts,” he said. “I can imagine when we are three to four years down the line… it might be nine-10 products.” He said that the one platform approach might have worked for Palantir, which ironically, is the major winner in the defense tech space the last few years. But newer companies like Anduril and Shield AI have been designed around product line expansion.

Finally, noting those other companies, Granberg believes there is something of a collective benefit as each startup makes headway in the defense sector. “There is this theory in our space that we don’t view ourselves as competitors — if one of us does well, we all do well,” he said. Given the varied mission requirements of different agencies and the absolute massive scale of budgets in this field, startups actually have a lot of independent terrain to explore, even if they come up against the big legacy defense contractors on a regular basis.

As for Vannevar Labs, its next goal is to turn its Decrypt product into a program of record, which would guarantee it a certain level of sales and revenue for potentially years into the future. That’s a huge bar to leap, but would be a turning point in the company’s long-term trajectory.

Powered by WPeMatico