funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Raising capital from a corporate VC can bring many benefits beyond just money. Strategic CVCs, who measure ROI based on the strength of the strategic partnership with their portfolio companies as well as the financial return, will typically seek to maximize their relationships with startups for a long time after the investment is made.

Specifically, a CVC investor can offer the following to an entrepreneur:

Partnerships. CVCs can leverage their supply chain and operations to build new partnerships that otherwise may have taken months or years for startups to create.

Distribution. Strategic CVCs can become a distribution channel for a startup, connect that startup with their suppliers, or even use the startup to become a channel for the parent company.

Branding halo. If a large company is willing to invest in your startup, it’s a strong signal that your product is good and that your business has a bright future.

Acquisition. Many CVCs invest in startups that they may want to acquire down the line. A CVC may also endorse an exit-seeking portfolio company to their partner companies or suppliers.

Granted, seeing results from these benefits takes time, and even the best of intentions during a capital raise process may not always yield an optimal strategic relationship.

Here’s a list of factors to keep in mind for founders who want the best chances of a productive and successful relationship with their CVC.

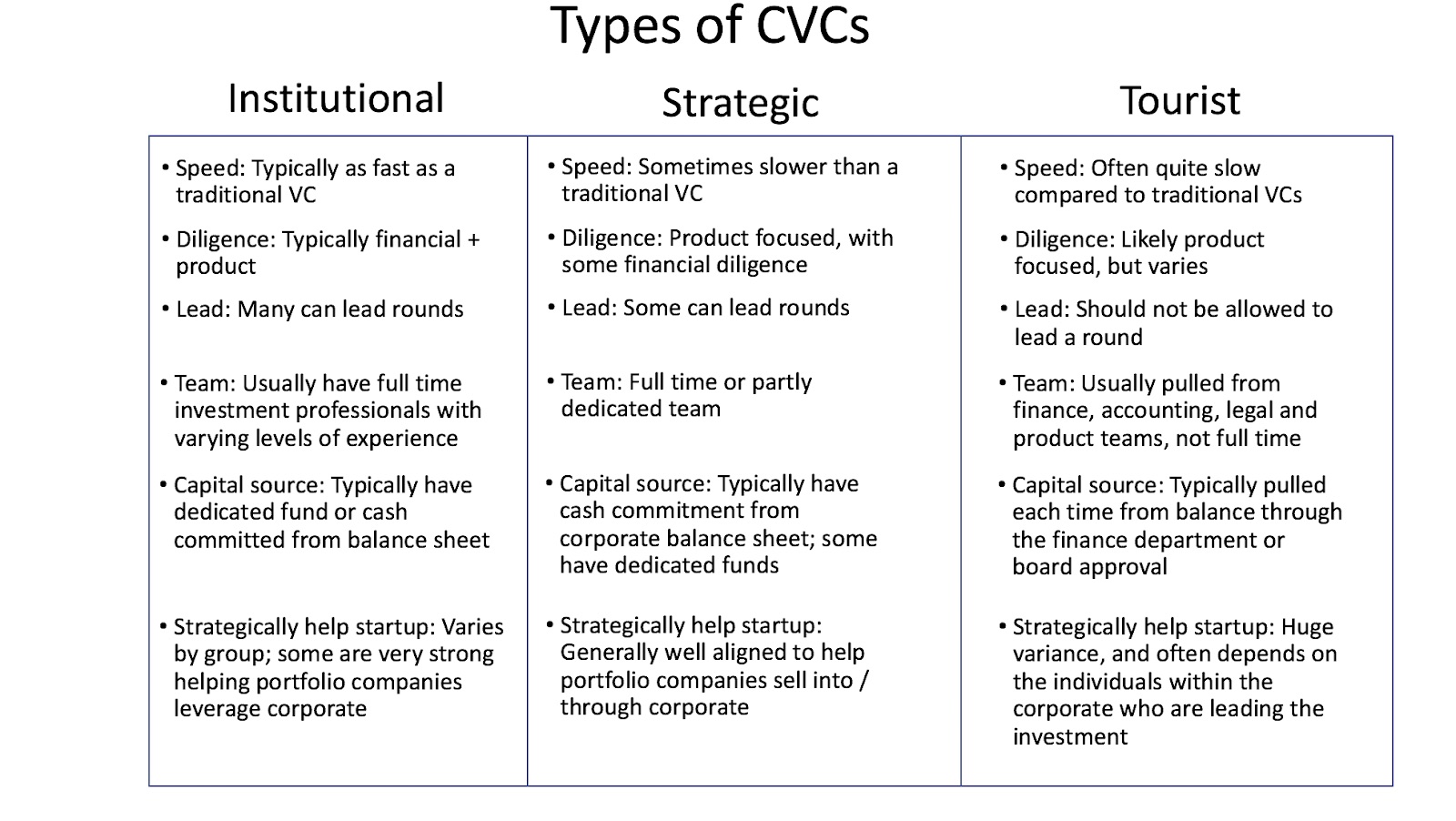

Know which type of CVC you’re dealing with from the outset. In our previous posts, we outlined the three types of CVCs — experienced institutional investors, industry-specific strategics, and beginner or “tourist” CVCs. As we’ve discussed, be sure to spend time interviewing and building relationships with CVCs to determine which type they are, what kinds of benefits and resources they can offer and what their history looks like in terms of successfully partnering with startups over time. When in doubt, ask other founders who have done deals with them!

Powered by WPeMatico

More than $50 billion of corporate venture capital (CVC) was deployed in 2018 and new data indicates that nearly half of all venture rounds will include a corporate investor. The CVC trend is heating up and the need for founders and startup executives to stay informed is higher than ever.

We’ve covered the basics in this series, including how to approach CVCs and what to know before the investment, what to look out for when negotiating, and getting the most out of a CVC partnership after the investment.

A great CVC investor can be the best of both worlds — a strong corporate champion who provides insights and connections to help your startup succeed and a committed financial partner who provides the capital you need to grow. But CVCs aren’t just VCs with different business cards. Finding the right CVC requires the right approach and strategy, and getting the right CVC on your cap table can bring unique and lasting value to your startup.

To wind down this series, here’s a list of the top 15 things every founder should know before signing a term sheet with a CVC.

Image credits: Orn/Growney

There are plenty of benefits to taking CVC investments. Many CVC investments lead to acquisitions, and even if the discussions with a CVC fall apart, your meeting can result in valuable introductions that yield new business relationships. The rising CVC trend offers a brave new world for entrepreneurs. If you know the ropes of CVC investing, you could be in for a partnership that benefits you both.

Powered by WPeMatico

Searchable.ai is an early-stage startup in the alpha phase of testing its initial product, but it has an idea compelling enough to attract investment, even during a pandemic. Today the company announced an additional $4 million in seed capital to continue building its AI-driven search solution.

Susquehanna International Group and Omicron Media co-led the round, with participation by Defy Partners, NextView Ventures and a group of unnamed angel investors. Today’s investment comes on top of the $2 million in seed money the startup announced in October.

Company co-founder and CEO Brian Shin said that when he presented to his investors in early March at the last event he attended before everything shut down, they approached him about additional money, and given the economic uncertainty, he decided to take it.

“Honestly we probably would not have taken additional money if it was not for the uncertainty around the macro environment right now,” he told TechCrunch.

The company is trying to solve enterprise search and, being pre-revenue, Shin recognized that having additional capital would give them more room to build the product and get it to market.

“We are trying to solve this problem where people just can’t find information that they need in order to do their jobs. When you look within the workplace, this problem is just getting worse and worse with the proliferation of different formats and people storing their information in many different places, local networks, cloud repositories, email and Slack,” he explained.

They have a few thousand people in the alpha program right now testing a personal desktop version of the application that helps individual users find their content wherever it happens to be. The plan is to open that up to a wider group soon.

The road map calls for a teams version, where groups of employees can search among their different individual repositories; a developer version to build the search technology into other operations; and eventually an enterprise tool. They also want to add voice search starting with an Alexa skill, with the general belief that we need to move beyond keyword searches to more natural language approaches.

“We believe that there’ll be a whole new category of search, search companies and search products that are more conversational. […] Being able to interact with your information more naturally, more and more conversationally, that’s where we think the market is going,” he said.

The company now has more money in the bank to help achieve that vision.

Powered by WPeMatico

A lot of the attention in medical technology today has been focused on tools and innovations that might help the world better fight the COVID-19 global health pandemic. Today comes news of another startup that is taking on some funding for a disruptive innovation that has the potential to make both COVID-19 as well as other kinds of clinical assessments more accessible.

Nanox, a startup out of Israel that has developed a small, low-cost scanning system and “medical screening as a service” to replace the costly and large machines and corresponding software typically used for X-rays, CAT scans, PET scans and other body imaging services, is today announcing that it has raised $20 million from a strategic investor, South Korean carrier SK Telecom.

SK Telecom in turn plans to help distribute physical scanners equipped with Nanox technology as well as resell the pay-per-scan imaging service, branded Nanox.Cloud, and corresponding 5G wireless network capacity to operate them. Nanox currently licenses its tech to big names in the imaging space, like FujiFilm, and Foxconn is also manufacturing its donut-shaped Nanox.Arc scanners.

The funding is technically an extension of Nanox’s previous round, which was announced earlier this year at $26 million with backing from Foxconn, FujiFilm and more. Nanox says that the full round is now closed off at $51 million, with the company having raised $80 million since launching almost a decade ago, in 2011.

Nanox’s valuation is not being publicly disclosed, but a news report in the Israeli press from December said that one option the startup was considering was an IPO at a $500 million valuation. We understand from sources that the valuation is about $100 million higher now.

The Nanox system is based around proprietary technology related to digital X-rays. Digital radiography is a relatively new area in the world of imaging that relies on digital scans rather than X-ray plates to capture and process images.

Nanox says the ARC comes in at 70 kg versus 2,000 kg for the average CT scanner, and production costs are around $10,000 compared to $1-3 million for the CT scanner.

But in addition to being smaller (and thus cheaper) machines with much of the processing of images done in the cloud, the Nanox system, according to CEO and founder Ran Poliakine, can make its images in a tiny fraction of a second, making them significantly safer in terms of radiation exposure compared to existing methods.

Imaging has been in the news a lot of late because it has so far been one of the most accurate methods for detecting the progress of COVID-19 in patients or would-be patients in terms of how it is affecting patients’ lungs and other organs. While the dissemination of equipment like Nanox’s definitely could play a role in handling those cases better, the ultimate goal of the startup is much wider than that.

Ultimately, the company hopes to make its devices and cloud-based scanning service ubiquitous enough that it would be possible to run early detection, preventative scans for a much wider proportion of the population.

“What is the best way to fight cancer today? Early detection. But with two-thirds of the world without access to imaging, you may need to wait weeks and months for those scans today,” said Poliakine.

The startup’s mission is to distribute some 15,000 of its machines over the next several years to bridge that gap, and it’s getting there through partnerships. In addition to the SK Telecom deal it’s announcing today, last March, Nanox inked a $174 million deal to distribute 1,000 machines across Australia, New Zealand and Norway in partnership with a company called the Gateway Group.

The SK Telecom investment is an interesting development that underscores how carriers see 5G as an opportunity to revisit what kinds of services they resell and offer to businesses and individuals, and SK Telecom specifically has singled out healthcare as one obvious and big opportunity.

“Telecoms carriers are looking for opportunities around how to sell 5G,” said Ilung Kim, SK Telecom’s president, in an interview. “Now you can imagine a scanner of this size being used in an ambulance, using 5G data. It’s a game changer for the industry.”

Looking ahead, Nanox will continue to ink partnerships for distributing its hardware and reselling its cloud-based services for processing the scans, but Poliakine said it does not plan to develop its own technology beyond that to gain insights from the raw data. For that, it’s working with third parties — currently three AI companies — that plug into its APIs, and it plans to add more to the ecosystem over time.

Powered by WPeMatico

COVID-19 has transformed the global business landscape.

So much so that in a matter of weeks after the onset of the pandemic in the United States, Congress provided more than $1.1 trillion in fiscal stimulus directly to businesses and distressed industries — four times more than was distributed during the 2008-09 financial crisis.

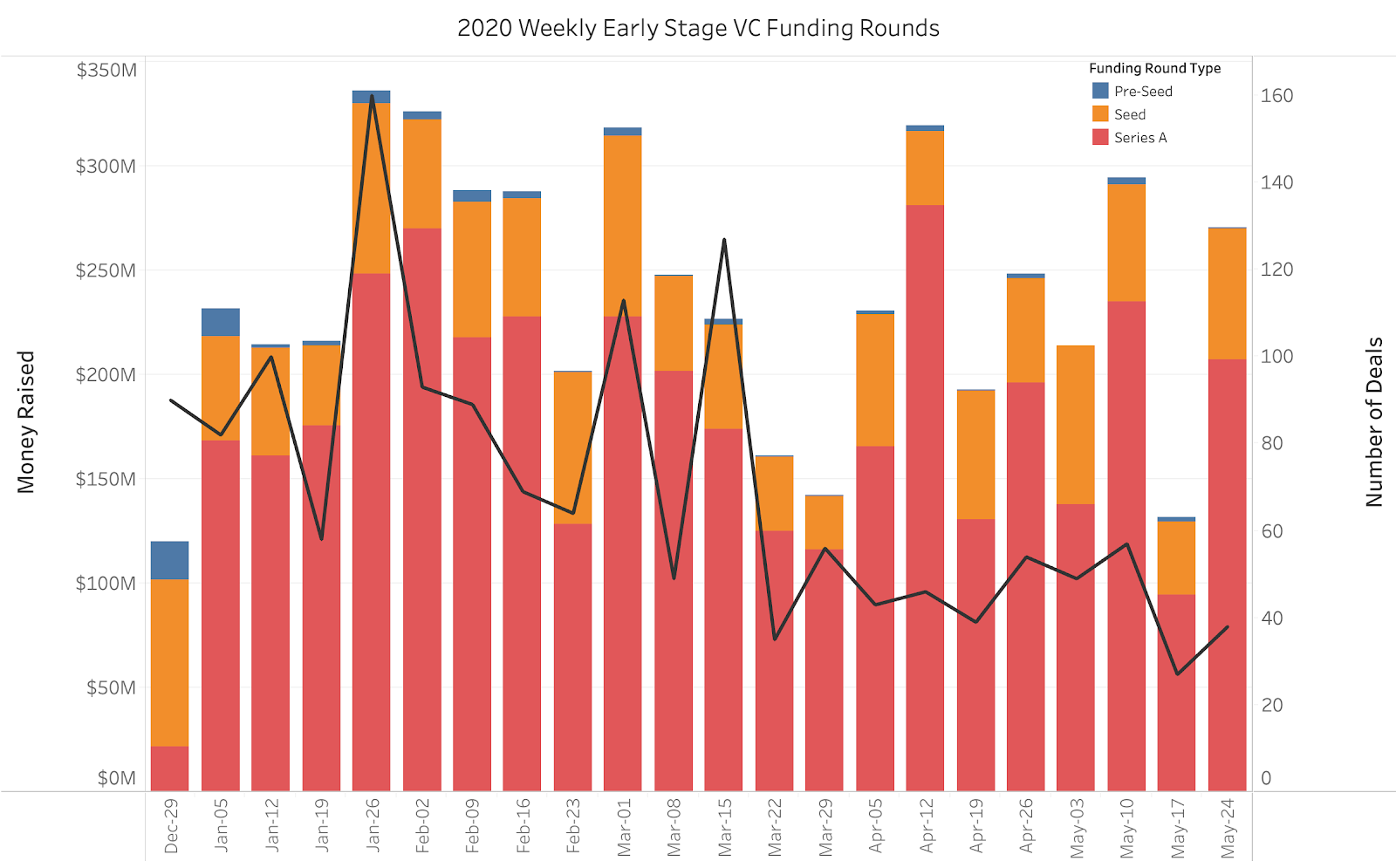

It came as no surprise when, at the start of COVID-19, venture capital investors largely went pencils-down for several weeks and shifted their focus to their existing portfolio companies. Extending company runways, preparing for longer funding cycles and managing operations in a novel business environment became the crux of company resilience. Now, moving into May, we can see this shift reflected in both the decline in number of early-stage companies funded and total capital invested.

As investors begin acclimating to this new normal, they have begun wading into new opportunities in time-proven, healthy industries and new emerging industries that are positioned to succeed during the pandemic. While we are seeing lower valuations, we believe certain B2B technology companies may be uniquely poised to thrive, and are pursuing investment opportunities in this space with a renewed focus.

Image Credits: Crunchbase Data via Tableau Public

*Excluding Biotech & Pharmaceuticals (Source: Crunchbase Data via Tableau Public)

Prior to COVID-19, early-stage B2B investors wanted to see strong growth and healthy unit economics; 3X year-over-year sales growth or 10% monthly growth was the gold standard. An LTV-to-CAC ratio over 3X signified a healthy payback cycle. There was less focus on capital efficiency; for every $1 million invested, investors were happy with $500,000 in generated revenues. Get to these numbers and your next funding round was guaranteed — but no longer.

During COVID, and likely beyond, company expectations and goalposts have been adjusted; 2X year-over-year growth may be the new 3X. While growth and unit economics are important, there are now new health indicators that will determine if a B2B company will thrive in a post-COVID world. With that in mind, we have put together a COVID reslience test that startups can use as a north star to grow their business in this new world.

This COVID-19 test is meant to be a gated checklist that will indicate where efforts should be focused, whether it be sales, product or finance. Before we leave you to your own devices, we wanted to walk through a couple of these new post-COVID questions that you should try to answer (and why they are relevant).

Powered by WPeMatico

As investors’ appetites sour in the midst of a pandemic, a three-and-a-half-year-old Indian firm has secured $10.3 billion in a month from Facebook and four U.S.-headquartered private equity firms.

The major deals for Reliance Jio Platforms have sparked a sudden interest among analysts, executives and readers at a time when many are skeptical of similar big check sizes that some investors wrote to several young startups, many of which are today struggling to make sense of their finances.

Prominent investors across the globe, including in India, have in recent weeks cautioned startups that they should be prepared for the “worst time” as new checks become elusive.

Elsewhere in India, the world’s second-largest internet market and where all startups together raised a record $14.5 billion last year, firms are witnessing down rounds (where their valuations are slashed). Miten Sampat, an angel investor, said last week that startups should expect a 40%-50% haircut in their valuations if they do get an investment offer.

Facebook’s $5.7 billion investment valued the company at $57 billion. But U.S. private equity firms Silver Lake, Vista, General Atlantic, and KKR — all the other deals announced in the past five weeks — are paying a 12.5% premium for their stake in Jio Platforms, valuing it at $65 billion.

How did an Indian firm become so valuable? What exactly does it do? Is it just as unprofitable as Uber? What does its future look like? Why is it raising so much money? And why is it making so many announcements instead of one.

It’s a long story.

Billionaire Mukesh Ambani gave a rundown of his gigantic Indian empire at a gathering in December 2015 packed with 35,000 people including hundreds of Bollywood celebrities and industry titans.

“Reliance Industries has the second-largest polyester business in the world. We produce one and a half million tons of polyester for fabrics a year, which is enough to give every Indian 5 meters of fabric every year, year-on-year,” said Ambani, who is Asia’s richest man.

Powered by WPeMatico

Bonusly, a platform that involves the entire organization in recognizing employees and rewarding them, closed on a $9 million Series A financing round led by Access Venture Partners. Next Frontier Capital, Operator Partners and existing investor FirstMark Capital also participated in the round.

Bonusly launched in 2013 when co-founder and CEO Raphael Crawford-Marks saw the opportunity to reinvent the way employers and colleagues recognize and reward their employees/coworkers.

“I knew that, in order to be successful, companies would be shifting their approach to employee experience and I thought software could enable that shift,” said Crawford-Marks. “Bonusly was this elegant idea of empowering employees to give each other timely, frequent and meaningful recognition that would not only benefit employees because they would feel recognized but also surface previously hidden information to the entire company about who was working with whom and on what and what strengths they were bringing to the workplace.”

Most employers use year-end bonuses and performance reviews to motivate workers, with some employers providing some physical rewards.

Bonusly thinks recognition should happen year-round. The platform works with the employers on their overall budget for recognition and rewards, and breaks that down into “points” that are allotted to all employees at the organization.

These employees can give out points to other co-workers, whether they’re direct reports or managers or peers, at any time throughout the year. Those points translate to a monetary value that can be redeemed by the employee at any time, whether it’s through PayPal as a cash reward or with one of Bonusly’s vendor partners, including Amazon, Tango Card and Cadooz. Bonusly also partners with nonprofit organizations to let employees redeem their points via charitable donation.

In fact, Crawford-Marks noted that Bonusly users just crossed the $500,000 mark for total donations, and have donated more than $100,000 to the WHO in six weeks.

Bonusly integrates with several collaboration platforms, including Gmail and Slack, to give users the flexibility to give points in whatever venue they choose. Bonusly also has a feed, not unlike social media sites like Twitter, that shows in real time employees who have received recognition.

The company has also built in some technical features to help with usability. For example, Bonusly understands the social organization of a company, surfacing the most relevant folks in the point feed based on who employees have given or received points to/from in the past. In a company with tens of thousands of employees, this keeps Bonusly relevant.

Bonusly has also incorporated tools for employers, including an auto-scale button for employers with workers in multiple jurisdictions or companies. The button allows employers to scale up or down the point allotments in different geographies based on cost of living.

There are also privacy controls on Bonusly that allow high-level employees and leadership to give each other recognition for projects that may not be widely known about at the company yet, like say for an acquisition that was completed.

Bonusly says that peer-to-peer recognition is more powerful than manager-only recognition, saying it’s nearly 36% more likely to have better financial outcomes.

The company also cites research that says that a happy workforce raises business productivity by more than 30%.

Bonusly competes with Kazoo and Motivocity, and Crawford-Marks says that the biggest differentiation factor is participation.

“We set a very high bar for how we measure participation and engagement in the platform,” he said. “You’ll see other companies claiming really high participation rates, but typically if you dig into that they’re talking about getting recognition every six months or every year or just logging in, rather than giving recognition every single month, month over month.”

He noted that 75% of employees on average give recognition in the first month of deployment with an organization, and that number gradually increases over time. By the two-year mark, 80% of employees are giving recognition every month.

Bonusly has raised a total of nearly $14 million in funding since inception.

Powered by WPeMatico

Vast monoculture farms outstripped the ability of bee populations to pollinate them naturally long ago, but the techniques that have arisen to fill that gap are neither precise nor modern. Israeli startup BeeHero aims to change that by treating hives both as living things and IoT devices, tracking health and pollination progress practically in real time. It just raised a $4 million seed round that should help expand its operations into U.S. agriculture.

Honeybees are used around the world to pollinate crops, and there has been growing demand for beekeepers who can provide lots of hives on short notice and move them wherever they need to be. But the process has been hamstrung by the threat of colony collapse, an increasingly common end to hives, often as the result of mite infestation.

Hives must be deployed and checked manually and regularly, entailing a great deal of labor by the beekeepers — it’s not something just anyone can do. They can only cover so much land over a given period, meaning a hive may go weeks between inspections — during which time it could have succumbed to colony collapse, perhaps dooming the acres it was intended to pollinate to a poor yield. It’s costly, time-consuming, and decidedly last-century.

So what’s the solution? As in so many other industries, it’s the so-called Internet of Things. But the way CEO and founder Omer Davidi explains it, it makes a lot of sense.

“This is a math game, a probabilistic game,” he said. “We’ve modeled the problem, and the main factors that affect it are, one, how do you get more efficient bees into the field, and two, what is the most efficient way to deploy them?”

Normally this would be determined ahead of time and monitored with the aforementioned manual checks. But off-the-shelf sensors can provide a window into the behavior and condition of a hive, monitoring both health and efficiency. You might say it puts the API in apiculture.

Normally this would be determined ahead of time and monitored with the aforementioned manual checks. But off-the-shelf sensors can provide a window into the behavior and condition of a hive, monitoring both health and efficiency. You might say it puts the API in apiculture.

“We collect temperature, humidity, sound, there’s an accelerometer. For pollination, we use pollen traps and computer vision to check the amount of pollen brought to the colony,” he said. “We combine this with microclimate stuff and other info, and the behaviors and patterns we see inside the hives correlate with other things. The stress level of the queen, for instance. We’ve tested this on thousands of hives; it’s almost like the bees are telling us, ‘we have a queen problem.’ ”

All this information goes straight to an online dashboard where trends can be assessed, dangerous conditions identified early and plans made for things like replacing or shifting less or more efficient hives.

The company claims that its readings are within a few percentage points of ground truth measurements made by beekeepers, but of course it can be done instantly and from home, saving everyone a lot of time, hassle and cost.

The results of better hive deployment and monitoring can be quite remarkable, though Davidi was quick to add that his company is building on a growing foundation of work in this increasingly important domain.

“We didn’t invent this process, it’s been researched for years by people much smarter than us. But we’ve seen increases in yield of 30-35% in soybeans, 70-100% in apples and cashews in South America,” he said. It may boggle the mind that such immense improvements can come from just better bee management, but the case studies they’ve run have borne it out. Even “self-pollinating” (i.e. by the wind or other measures) crops that don’t need pollinators show serious improvements.

The platform is more than a growth aid and labor saver. Colony collapse is killing honeybees at enormous rates, but if it can be detected early, it can be mitigated and the hive potentially saved. That’s hard to do when time from infection to collapse is a matter of days and you’re inspecting biweekly. BeeHero’s metrics can give early warning of mite infestations, giving beekeepers a head start on keeping their hives alive.

“We’ve seen cases where you can lower mortality by 20-25%,” said Davidi. “It’s good for the farmer to improve pollination, and it’s good for the beekeeper to lose less hives.”

“We’ve seen cases where you can lower mortality by 20-25%,” said Davidi. “It’s good for the farmer to improve pollination, and it’s good for the beekeeper to lose less hives.”

That’s part of the company’s aim to provide value up and down the chain, not just a tool for beekeepers to check the temperatures of their hives. “Helping the bees is good, but it doesn’t solve the whole problem. You want to help whole operations,” Davidi said. The aim is “to provide insights rather than raw data: whether the queen is in danger, if the quality of the pollination is different.”

Other startups have similar ideas, but Davidi noted that they’re generally working on a smaller scale, some focused on hobbyists who want to monitor honey production, or small businesses looking to monitor a few dozen hives versus his company’s nearly 20,000. BeeHero aims for scale both with robust but off-the-shelf hardware to keep costs low, and by focusing on an increasingly tech-savvy agriculture sector here in the States.

“The reason we’re focused on the U.S. is the adoption of precision agriculture is very high in this market, and I must say it’s a huge market,” Davidi said. “Eighty percent of the world’s almonds are grown in California, so you have a small area where you can have a big impact.”

The $4 million seed round’s investors include Rabo Food and Agri Innovation Fund, UpWest, iAngels, Plug and Play, and J-Ventures.

BeeHero is still very much also working on R&D, exploring other crops, improved metrics and partnerships with universities to use the hive data in academic studies. Expect to hear more as the market grows and the need for smart bee management starts sounding a little less weird and a lot more like a necessity for modern agriculture.

Powered by WPeMatico

We may be in the thick of a pandemic with all of the economic fallout that comes from that, but certain aspects of technology don’t change, no matter the external factors. Storage is one of them. In fact, we are generating more digital stuff than ever, and Wasabi, a Boston-based startup that has figured out a way to drive down the cost of cloud storage, is benefiting from that.

Today it announced a $30 million Series B led led by Forestay Capital, the technology innovation arm of Waypoint Capital, with help from previous investors. As with the previous round, Wasabi is going with home office investors, rather than traditional venture capital firms. Today’s round brings the total raised to $110 million, according to the company.

While founder and CEO David Friend wouldn’t discuss the specific valuation, he did say it was in the hundreds of millions of dollars.

Friend says the company needs the funds to keep up with the rapid growth. “We’ve got about 15,000 customers today, hundreds of petabytes of storage, 2,500 channel partners, 250 technology partners — so we’ve been busy,” he said.

He says that revenue continues to grow in spite of the impact of COVID-19 on other parts of the economy. “Revenue grew 5x last year. It’ll probably grow 3.5x this year. We haven’t seen any real slowdown from the coronavirus. Quarter over quarter growth will be in excess of 40% — this quarter over Q1 — so it’s just continuing on a torrid pace,” he said.

The challenge for a company like Wasabi, which is looking to capture a large chunk of the growing cloud storage market, is the infrastructure piece. It needs to keep building more to meet increasing demand, while keeping costs down, which remains its primary value proposition with customers.

The money will be used mostly to continue to expand its growing infrastructure requirements. The more they store, the more data centers they need, and that takes money. It will also help the company expand into new markets where countries have data sovereignty laws that require data to be stored in-country.

The company launched in 2015. It previously raised $68 million in 2018.

Note: This article originally stated this was a debt financing round. The company has clarified that it is an equity round.

Powered by WPeMatico

Toro’s founders started at Uber helping monitor the data quality in the company’s vast data catalogs, and they wanted to put that experience to work for a more general audience. Today, the company announced a $4 million seed round.

The round was co-led by Costanoa Ventures and Point72 Ventures, with help from a number of individual investors.

Company co-founder and CEO Kyle Kirwan says the startup wanted to bring to data the kind of automated monitoring we have in applications performance monitoring products. Instead of getting an alert when the application is performing poorly, you would get an alert that there is an issue with the data.

“We’re building a monitoring platform that helps data teams find problems in their data content before that gets into dashboards and machine learning models and other places where problems in the data could cause a lot of damage,” Kirwan told TechCrunch.

When it comes to data, there are specific kinds of issues a product like Toro would be looking at. It might be a figure that falls outside of a specific dollar range that could be indicative of fraud, or it could be simply a mistake in how the data was labeled that is different from previous ways that could break a model.

The founders learned the lessons they used to build Toro while working on the data team at Uber. They had helped build tools there to find these kinds of problems, but in a way that was highly specific to Uber. When they started Toro, they needed to build a more general-purpose tool.

The product works by understanding what it’s looking at in terms of data, and what the normal thresholds are for a particular type of data. Anything that falls outside of the threshold for a particular data point would trigger an alert, and the data team would need to go to work to fix the problem.

Casey Aylward, vice president at Costanoa Ventures, likes the pedigree of this team and the problem it’s trying to solve. “Despite its importance, data quality has remained a challenge for many enterprise companies,” she said in a statement. She added, “[The co-founders] deep experience building several of Uber’s internal data tools makes them uniquely qualified to build the best solution.”

The company has been at this for just over a year and has been keeping it lean with four employees, including the two co-founders, but they do have plans to add a couple of data scientists in the coming year as they continue to build out the product.

Powered by WPeMatico