funding

Auto Added by WPeMatico

Auto Added by WPeMatico

SoftBank Group confirmed today it is considering selling its T-Mobile U.S. shares.

Bloomberg reported last month that SoftBank was nearing an agreement to sell about $20 billion of its T-Mobile U.S. shares to investors, including Deutsche Telekom, T-Mobile’s controlling shareholder, in an effort to offset major losses from its investment business, including the Vision Fund.

In today’s notice, SoftBank Group, which owns about 25% of T-Mobile U.S. shares, said it is exploring transactions that could include private placements or public offerings and transactions with T-Mobile or its shareholders, including Deutsche Telekom AG, or third parties.

The potential sale would be part of SoftBank Group’s program, announced in March, to sell or monetize up to $41 billion in assets to reduce debt and increase its cash reserves. The company said, however, that it cannot assure any of the transactions involving T-Mobile shares will be completed.

Powered by WPeMatico

Startups need money. State and local governments need startups and the employment growth they offer. It should be obvious that the two groups can work together and make each other happy. Unfortunately, nothing could be further from the truth.

Each year, governments spend tens of billions of dollars on economic development incentives designed to attract employers and jobs to their communities. There are a huge number of challenges, however, for startups and individual contributors trying to apply for these programs.

First, economic development leaders typically focus on massive, flagship projects that are splashy and will drive the news cycle and bring good media attention to their elected official bosses. So, for example, you get a massive, $10 billion Foxconn plant in Wisconsin tied to hundreds of millions of incentives, only to see the project sputter into the ground.

Then there is the paperwork. As you’d expect with any government application process, it can be arduous to find the right incentive programs, apply for credits at the right time and max out the opportunities available.

That’s where MainStreet comes in.

Its CEO and founder Doug Ludlow’s third company. He previously founded Hipster, which sold to AOL, and The Happy Home Company, which sold to Google. After that transaction, Ludlow went on to become chief of staff for SMB ads at the tech giant, where he saw firsthand the challenges that startups and all small companies face in growing outside of major urban hubs like San Francisco.

When he and his co-founders Dan Lindquist and Daniel Griffin first started, they were focused on what Ludlow described as “a network of remote work hubs.” As they were experimenting last November they tried paying people to leave the Bay Area, offering them $10,000 if they moved to other cities. The offer caused a sensation, with outlets like CNN covering the news.

While the interest from customers was great, what ignited Ludlow and his co-founders’ passions was that “literally dozens of cities, states and counties reached out, letting us know that they had an incentive program.” As the team explored further, they realized there was a huge untapped opportunity to connect startups to these preexisting programs.

MainStreet was born, and it’s an idea that has also attracted the attention of investors. The company announced today that it raised a $2.3 million round from Gradient Ventures, Weekend Fund and others.

Startups apply for economic incentives through MainStreet’s platform, and then MainStreet takes a 20% cut of any successful application. Notably, that cut is only taken when the incentive is actually disbursed (there’s no upfront cost), and there is also no on-going subscription fee to use the platform. “If you identify the credit that you’re able to use six months from now, we will charge you six months from now, when you’re actually getting that credit. It seems to be a business model that is aligned well with founders,” Ludlow said.

Right now, he says that the average MainStreet client saves $51,000, and that MainStreet has crossed the $1 million ARR run rate threshold.

Right now, the company’s core clientele are startups applying for payroll credits and research and development credits, but Ludlow says that MainStreet is working to expand beyond its tech roots to all small businesses such as restaurants. The company also wants to expand the number of economic development programs that startups can apply for. Given the myriad of governments and programs, there are hundreds if not thousands of more programs to onboard onto the platform.

MainStreet’s team. Image Credits: MainStreet

While MainStreet is helping startups and small businesses, it also wants to help governments improve their operations around economic development. With MainStreet, “we can report back to cities and states showing exactly what their tax dollars or tax credits are being utilized for,” Ludlow said. “So the accountability is orders of magnitude greater than they had before. So already, there’s this better system for tracking the success of incentives.”

The big question for MainStreet this year is navigating the crisis around the COVID-19 pandemic. While more small businesses than ever need help navigating credits, state and local governments have suffered huge shortfalls in revenues as taxes have dried up and Washington continues to debate over what, if any aid, to offer. There’s no money for economic development, yet, economic development has never been more important than right now.

Ultimately, MainStreet is pushing the vanguard of economic development thinking forward away from massive checks designed to underwrite industrial factories to a more flexible and dynamic model of incentivizing knowledge workers to move to areas outside the major global cities. It’s an interesting bet, and one that, at the very least, will help many startups get the economic incentives they rightly have access to.

Outside of Gradient and Weekend Fund, Shrug Capital, SV Angel, Remote First Capital, Basement Fund, Basecamp Ventures, Backend Capital and a host of angels participated in the round.

Powered by WPeMatico

Sinch said on Monday it has agreed to buy Indian firm ACL Mobile for £56 million (roughly $70 million) in what is the fourth acquisition deal the Swedish mobile voice and messaging firm has entered into at the height of a global pandemic.

The Swedish firm said acquiring ACL Mobile will enable it to leverage the Indian firm’s connections with local mobile operators in the world’s second largest internet market, as well as in Malaysia and UAE, to expand its end-to-end connectivity without working with a third-party firm.

Twenty-year-old ACL Mobile, which has headquarters in Delhi, Dubai and Kuala Lumpur, enables businesses to interact with their customers through SMS, email, WhatsApp and other channels. In a press statement, the Indian firm said it serves more than 500 enterprise customers, including Flipkart, OLX, MakeMyTrip, HDFC Bank and ICICI Bank.

“With ACL we gain critical scale in the world’s second-largest mobile market. We gain customers, expertise and technology and we further strengthen our global messaging product for discerning businesses with global needs,” said Sinch chief executive Oscar Werner.

The Indian firm, which employs 288 people, reported gross profits of $14.2 million on sales of about $65 million in the financial year that ended in March. During the same period, ACL Mobile claims it delivered 47 billion messages on behalf of its enterprise customers.

“Although the long-term growth outlook is favorable, lower commercial activity in India due to the COVID-19 pandemic means that the near-term growth outlook is less predictable,” Sinch said of ACL Mobile’s future outlook.

ACL Mobile is the fourth acquisition Sinch has unveiled since March this year. Last month the company said it was buying SAP’s Digital Interconnect for $250 million. In March, it announced deals to buy Wavy and Chatlayer.

Sinch, founded in 2008, employs more than 700 people in over 40 locations worldwide and is increasingly expanding to more markets. Last month it said acquiring SAP’s Digital Interconnect will help it expand in the U.S. market. The company says it is profitable.

“Together with Sinch we are scaling up to become one of the leading global players in our industry. I’m excited about this next chapter and the many new opportunities that we can pursue together,” said Sanjay K Goyal, founder and chief executive of ACL Mobile.

Powered by WPeMatico

Companies increasingly recognize that one of the greatest stresses for their employees is financial wellness. Even at innovative tech startups, people typically bump up against the limits of how much they know about wealth management pretty fast.

But providing financial education to a workforce, which has become increasingly common, is largely useless as most employees will tell you. The information can be hard to navigate, and it’s often not personalized in a way that addresses an employee’s circumstance and goals, which change over time depending on whether they are a recent graduate, getting married or even eyeing retirement.

It’s why so many employed people look to outside apps that promise to help them to not only understand their financial picture but actually manage it. It’s also a missed opportunity, according to a growing number of founders who are working to convince employers to move beyond education and instead offering automated financial planning (with a dash of human involvement) as an employee perk.

Their understandable argument: While offering benefits around fertility, family planning, and mental health are wonderful, companies are missing out on the chance to address the very top priority for their employees, which is how to avoid financial trouble.

Origin, a year-old San Francisco-based company led by Matt Watson — whose last company was acquired in December — is among the newest entrants to make the case.

Freshly backed by $12 million in funding led by Felicis Ventures, with participation from General Catalyst, Founders Fund and early Stripe employee Lachy Groom, among others, Origin wants to become the place where employees can track financial milestones, get professional advice from licensed financial planners, and take action, whether it be paying down student debt, building emergency savings or finding the right home and automotive insurance.

Currently staffed by 32 employees, six are financial planners, and they can handle the unique circumstances of “mid thousands of people,” says Watson, who notes that after an employee initially sets up a plan, much can be automated until a life event changes the picture.

“If you use just the tech, you’re only getting limited information,” he says, adding that access to Origin’s planners is “unlimited.”

The company already has 15 customers with between 250 and 5,000 employees, including the social network NextDoor; the cloud communications and collaboration software platform Fuze; and Therabody, whose Theragun therapy tool is used by pro athletes and trainers to pulverize their aching muscles.

All are paying $6 per employee per month because it doesn’t matter how much employees are making, says Watson. “The thing about financial stress is that it impacts everyone pretty evenly. The greater your income, the more stuff you buy.”

Considering that employees spend an estimated two to four hours each week dealing with their personal finances, an offering like Origin’s seems like a no-brainer for employers looking to both improve employee productivity and employee retention.

Indeed, the only thing holding back such offerings earlier in time were the kind of open banking APIs that exist today.

Now, the biggest challenge for Origin is to capture employers’ attention ahead of the competition. For example, another startup that’s also developing financial planning services as an employee perk is Northstar, founded by Red Swan Ventures investor Will Peng. More established players like Betterment that have long catered to individual investors are also focusing more on building up ties to employers that can use their offerings as an employee resource.

Either way, the trend is a positive one for employees, who are right now living through an economic roller coaster and could more generally use a lot more help with both staying afloat and saving for the future.

“Everyone struggles with finances,” says Watson, who worked in high-yield credit trading at Citi in New York before moving to San Francisco to start his last company. “I’m supposed to understand this stuff, and it’s complicated for me.”

Powered by WPeMatico

As companies struggle to find ways to control costs in today’s economy, understanding what you are spending on SaaS tools is paramount. That’s precisely what early-stage startup Quolum is attempting to do, and today it announced a $2.75 million seed round.

Surge (a division of Sequoia Capital India) and Nexus Venture Partners led the round, with help from a dozen unnamed angel investors.

Company founder Indus Khaitan says that he launched the company last summer pre-COVID, when he recognized that companies were spending tons of money on SaaS subscriptions and he wanted to build a product to give greater visibility into that spending.

This tool is aimed at finance departments, which might not know about the utility of a specific SaaS tool like PagerDuty, but look at the bills every month. The idea is to give them data about usage as well as cost to make sure they aren’t paying for something they aren’t using.

“Our goal is to give finance a better set of tools, not just to put a dollar amount on [the subscription costs], but also the utilization, as in who’s using it, how much are they using it and is it effective? Do I need to know more about it? Those are the questions that we are helping finance answer,” Khaitan explained.

Eventually, he says he also wants to give that data directly to lines of business, but for starters he is focusing on finance. The product works by connecting to the billing or expense software to give insight into the costs of the services. It takes that data and combines it with usage data in a dashboard to give a single view of the SaaS spending in one place.

While Khaitan acknowledges there are other similar tools in the marketplace, such as Blissfully, Intello and others, he believes the problem is big enough for multiple vendors to do well. “Our differentiator is being end-to-end. We are not just looking at the dollars, or stopping at how many times you’ve logged in, but we’re going deep into consumption. So for every dollar that you’ve spent, how many units of that software you have consumed,” he said.

He says that he raised the money last fall and admits that it probably would have been tougher today, and he would have likely raised on a lower valuation.

Today the company consists of a six-person development team in Bangalore in India and Khaitan in the U.S. After the company generates some revenue he will be hiring a few people to help with marketing, sales and engineering.

When it comes to building a diverse company, he points out that he himself is an immigrant founder, and he sees the ability to work from anywhere, an idea amplified by COVID-19, helping result in a more diverse workforce. As he builds his company, and adds employees, he can hire people across the world, regardless of location.

Powered by WPeMatico

APIs provide a way to build connections to a set of disparate applications and data sources, and can help simplify a lot of the complex integration issues companies face. Postman has built an enterprise API platform and today it got rewarded with a $150 million Series C investment on a whopping $2 billion valuation — all during a pandemic.

Insight Partners led the round with help from existing investors CRV and Nexus Venture Partners. Today’s investment brings the total raised to $207 million, according to the company. That includes a $50 million Series B from a year ago, making it $200 million raised in just a year. That’s a lot of cash.

Abhinav Asthana, CEO and co-founder at Postman, says that what’s attracting all that dough is an end-to-end platform for building APIs. “We help developers, QA, DevOps — anybody who is in the business of building APIs — work on the same platform. They can use our tools for designing, documentation, testing and monitoring to build high-quality APIs, and they do that faster,” Asthana told TechCrunch.

He says that he was not actively looking for funding before this round came together. In fact, he says that investors approached him after the pandemic shut everything down in California in March, and he sees it as a form of validation for the startup.

“We think it shows the strength of the company. We have phenomenal adoption across developers and enterprises and the pandemic has [not had much of an impact on us]. The company has been receiving crazy inbound interest [from investors],” he said.

He didn’t want to touch the question of going public just yet, but he feels the hefty valuation sends a message to the market that this is a solid company that is going to be around for the long term.

Jeff Horing, co-founder and managing director at lead investor Insight Partners, certainly sees it that way. “The combination of the market opportunity, the management team and Postman’s proven track record of success shows that they are ready to become the software industry’s next great success,” he said in a statement.

Today the company has around 250 employees divided between the U.S. and Bangalore in India, and he sees doubling that number in the next year. One thing the pandemic has shown him is that his employees can work from anywhere and he intends to hire people across the world to take advantage of the most diverse talent pool possible.

“Looking for diverse talent as part of our large community as we build this workforce up is going to be a key way in which we want to solve this. Along with that, we are bringing people from diverse communities into our events and making sure that we are constantly in touch with those communities, which should help us build up a very strong diverse kind of hiring function,” he said.

He added, “We want to be deliberate about that, and over the coming months we will also shed more light on what specifically we are doing.”

Powered by WPeMatico

When you think about startup hubs, Tulsa, Oklahoma is probably not the first city that comes to mind.

A coalition of business, education, government and philanthropists are working to foster a startup ecosystem in a city that’s better known for its aerospace and energy companies. These community leaders recognized that raising the standard of living for a wide cross-section of citizens required a new generation of companies and jobs — which takes commitment from a broad set of interested parties.

In Tulsa, that effort began with George Kaiser Family Foundation (GKFF), a philanthropic organization, and ended with the creation of Tulsa Innovation Labs (TIL), a partnership between GKFF, Israeli cybersecurity venture capitalists Team8 and several area colleges and local government.

Tulsa is a city of more than 650,000 people, with a median household income of $53,902 and a median house price of $150,500. Glassdoor reports that the average salary for a software engineer in Tulsa is $66,629; in San Francisco, the median home price is over $1.1 million, household income comes in at $112,376 and Glassdoor’s average software engineer salary is $115,822.

Home to several universities and a slew of cultural attractions, the city has a lot to offer. To sweeten the deal, GKFF spun up “Tulsa Remote,” an initiative that offers $10,000 to remote workers who will relocate and make the city their home base. The goal: draw in new, high-tech workers who will help build a more vibrant economy.

Tulsa is the second-largest city in the state of Oklahoma and 47th-most populous city in the United States. Photo Credit: DenisTangneyJr/Getty Images

Local colleges are educating the next generation of workers; Tulsa Innovation Labs is working with the University of Tulsa in partnership with Team8 through the university’s Cyber Fellows program. There are also ongoing discussions with Oklahoma State University-Tulsa and the University of Oklahoma-Tulsa about building a similar relationship.

These constituencies are trying to grow a startup ecosystem from the ground up. It takes a sense of cooperation and hard work and it will probably take some luck, but they are starting with $50 million, announced just this week from GKFF, for startup investments through TIL.

Powered by WPeMatico

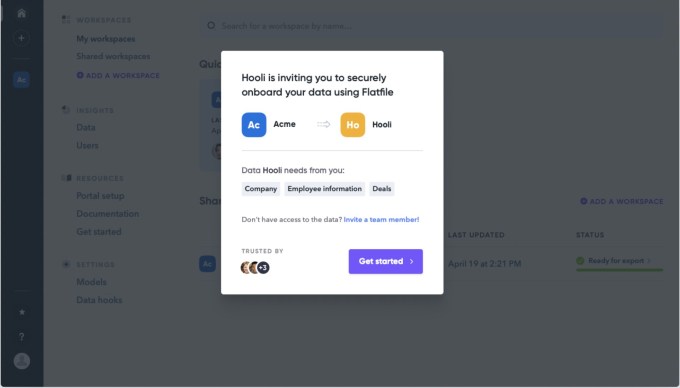

One of the huge challenges companies like enterprise SaaS vendors face with new customers is getting customer data into their service. It’s a problem that Flatfile founders faced firsthand in their jobs, and they decided to solve it. Today, the company announced a healthy $7.6 million seed investment to expand on that vision.

The company also announced the release of its latest product, called Concierge.

Two Sigma Ventures led the investment, with participation from previous investors Afore Capital, Designer Fund and Gradient Ventures (Google’s AI-focused venture fund).

Company CEO David Boskovic says he and co-founder Eric Crane recognized that this is a problem just about every company faces. Let’s say you sign up for a CRM tool like HubSpot (which is a Flatfile customer). Your first step is to get your customer data into the new service.

As Boskovic points out, if you have thousands of existing customers that can be a real problem, often involving days or even weeks to prepare the data, depending on the size of your customer base. It typically includes importing your data from an existing source, then manually moving it to an Excel spreadsheet.

“What we’re trying to solve for at Flatfile is automating that entire process. You can drop in any data that you have and get it into a new product, and what that solves from a market perspective is the speed of adopting new software,” Boskovic told TechCrunch.

Image Credit: Flatfile

He says they have automated the process to the point it usually takes just a few minutes to process the data, If there are problems that Flatfile can’t solve, it presents the issue to the user who can fix it and move on.

The founders realized that not every use case is going to involve a simple one-to-one data transfer, so they created their new product called Concierge to help companies manage more complex data integration scenarios for their customers.

“What we do is we provide a bridge between disparate data formats that are a little bit more complex and let our customers collaborate with their new customers that they are onboarding to bring the data to the right state to use it in the new system,” Boskovic explained.

Whatever they are doing, it seems to be working. The company launched in 2018 and today has 160 customers with 300 sitting on a waiting list. It has increased that customer count by 5x since the beginning of the year in the middle of a pandemic.

Any product that reduces labor and increases efficiency and collaboration in a digital context is going to get the attention of customers right now, and Flatfile is seeing a huge spike in interest in spite of the current economy. “We’re helping onboard customers quickly and more efficiently. And our Concierge service can also help reduce in-person touch points by reducing this long, typical data onboarding process,” Boskovic said.

The company has not had to change the way it has worked because of the pandemic, as it has been a distributed workforce from day one. In fact, Boskovic is in Denver and co-founder Eric Crane is based in Atlanta. The startup currently has 14 employees, but plans to fill at least 10 roles this year.

“We’ve got a pretty aggressive hiring map. Our pipeline is bigger than we can handle from a sales perspective,” he said. That means they will be looking to fill sales, marketing and product jobs.

Powered by WPeMatico

Figma is one of the fastest-growing companies in the world of design and in the broader SaaS category. So it goes without saying that we’re absolutely thrilled to have Figma CEO Dylan Field join us at Early Stage, our virtual two-day conference on July 21 and 22, as a speaker. You can pick up a ticket to the event here!

Early Stage is all about giving entrepreneurs the tools they need to be successful. Experts across a wide variety of core competencies, including fundraising, growth marketing, media management, recruiting, legal and tech development will offer their insights and answer questions from the audience.

Field joins an outstanding speaker list that includes Lo Toney, Ann Muira Ko, Dalton Caldwell, Charles Hudson, Cyan Banister and more.

Field founded Figma in 2012 after becoming a Theil fellow. The company spent four years in development before launching, working tediously on the technology and design of a product that aimed to be the Google Docs of design.

Figma is a web-based design product that allows people to design collaboratively on the same project in real time.

The design space is, in many respects, up for grabs as it goes through a transformation, with designers receiving more influence within organizations and other departments growing more closely involved with the design process overall.

This also means that there is fierce competition in this industry, with behemoths like Adobe iterating their products and growing startups like InVision and Canva sprinting hard to capture as much market as possible.

Figma, with $130 million+ in total funding, has lured investors like Index, A16Z, Sequoia, Greylock, and KPCB.

At Early Stage, we’ll talk to Field about staying patient during the product development process and then transitioning into an insane growth sprint. We’ll also chat about the fundraising process, how he built a team from scratch, and how he took the team remote in the midst of a pandemic, as well as chatting about the product development strategy behind Figma.

Figma spent four years in stealth before ever launching a product. But when it finally did come to market, its industry was in the midst of a paradigm shift. Entire organizations started participating in the design process, and conversely, designers became empowered, asserting more influence over the direction of the company and the products they built. We’ll hear from Figma founder and CEO Dylan Field on how he stayed patient with product development and sprinted towards growth.

Get your pass to Early Stage for access to over to 50 small-group workshops along with world-class networking with CrunchMatch. They start at just $199 but prices increase in a few days so grab yours today.

Powered by WPeMatico

It’s been a big period of positive change for Yugabyte, makers of the open source, cloud native YugabyteDB database. Just last month they brought on former Pivotal president Bill Cook as CEO, and today the company announced it has closed a $30 million Series B.

8VC and strategic investor WiPro led the round with participation from existing investors Lightspeed Venture Partners and Dell Technologies Capital. Today’s investment brings the total raised to $55 million, according to the company.

The startup also announced that former Pivotal co-founder Scott Yara would be joining the company’s board. Along with Cook, that brings a distinct Pivotal influence to the company.

Kannan Muthukkaruppan, who was CEO, now holds the title of president. He says that the company has built “a fully open source, high performance distributed SQL database meant for transactional workloads in the cloud.”

Today, in addition to the open source product, it offers a private Database as a Service platform to enterprise customers. This can run on a variety of platforms including public, private, or hybrid cloud or Kubernetes infrastructure. The company also offers a fully managed cloud service, which is currently available on AWS and Google Cloud Platform with Azure support coming in the future.

The founders have quite a pedigree. Muthukkaruppan spent 13 years at Oracle helping build Oracle’s relational engine. Then he moved onto Facebook in the early days where he met co-founders Karthik Ranganathan and Mikhail Bautin. The founding team worked on database technology that helped scale Facebook from 40 million users to over a billion.

It was that background that really caught the attention of Cook. “First of all, there’s a huge market opportunity here that we think we fit into, and it is unique in the sense of the pedigree that this team has, and what they built and the expertise they have across that whole spectrum of being able to scale and have [a database that is] performant across [geographic] zones,” he said.

As the company gets this investment, it’s not only a period of change inside the organization, it is against the backdrop of the worldwide pandemic and economic fallout from that event, but Muthukkaruppan sees momentum here in spite of the macro conditions.

“With COVID-19, we actually saw an increased sense of urgency across many enterprises, wanting to move businesses to the cloud and improve their operational and go-to-market efficiency around the product that they were bringing to market,” he said. He believes that the company’s database can be a key part of that.

The company currently has 50 employees, but sees doubling that number in the next 12-18 months as interest in the products continues to grow. Cook says the company has a diverse workforce today, and he will continue to build on that in his hiring practices.

“The more inclusive you can be ties to all our principles and values [as a company] already so we’re not changing how we operate,” he says. He says diversity is not only the right thing to do from a human perspective, it also makes good business sense to have a diverse workforce.

Powered by WPeMatico