funding

Auto Added by WPeMatico

Auto Added by WPeMatico

QuestDB, a member of the Y Combinator summer 2020 cohort, is building an open source time series database with speed top of mind. Today the startup announced a $2.3 million seed round.

Episode1 Ventures led the round with assistance from Seedcamp, 7percent Ventures, YCombinator, Kima Ventures and several unnamed angel investors.

The database was originally conceived in 2013 when current CTO Vlad Ilyushchenko was building trading systems for a financial services company and he was frustrated by the performance limitations of the databases available at the time, so he began building a database that could handle large amounts of data and process it extremely fast.

For a number of years, QuestDB was a side project, a labor of love for Ilyushchenko until he met his other co-founders Nicolas Hourcard, who became CEO and Tancrede Collard, who became CPO, and the three decided to build a startup on top of the open source project last year.

“We’re building an open source database for time series data, and time series databases are a multi-billion-dollar market because they’re central for financial services, IoT and other enterprise applications. And we basically make it easy to handle explosive amounts of data, and to reduce infrastructure costs massively,” Hourcard told TechCrunch.

He adds that it’s also about high performance. “We recently released a demo that you can access from our website that enables you to query a super large datasets — 1.6 billion rows with sub-second queries, mostly, and that just illustrates how performant the software is,” he said.

He sees open source as a way to build adoption from the bottom up inside organizations, winning the hearts and minds of developers first, then moving deeper in the company when they eventually build a managed cloud version of the product. For now, being open source also helps them as a small team to have a community of contributors help build the database and add to its feature set.

“We’ve got this open source product that is free to use, and it’s pretty important for us to have such a distribution model because we can basically empower developers to solve their problems, and we can ask for contributions from various communities. […] And this is really a way to spur adoption,” Hourcard said.

He says that working with YC has allowed them to talk to other companies in the ecosystem who have built similar open source-based startups and that’s been helpful, but it has also helped them learn to set and meet goals and have access to some of the biggest names in Silicon Valley, including Marc Andreessen, who delivered a talk to the cohort the same day we spoke.

Today the company has seven employees, including the three founders, spread out across the US, EU and South America. He sees this geographic diversity helping when it comes to building a diverse team in the future. “We definitely want to have more diverse backgrounds to make sure that we keep having a diverse team and we’re very strongly committed to that.”

For the short term, the company wants to continue building its community, working on continuing to improve the open source product, while working on the managed cloud product.

Powered by WPeMatico

Palantir, the sometimes controversial, but always secretive, big data and analytics provider that works with governments and other public and private organizations to power national security, health and a variety of other services, has reportedly been eyeing a public listing this autumn. But in the meantime it’s also continuing to push ahead in the private markets.

The company has filed a Form D — its first in four years — indicating that it is in the process of raising nearly $1 billion — $961,099,010, to be exact — with $549,727,437 of that already sold, and a further $411,371,573 remaining to be raised.

(A Reuters report from June confirmed that Palantir had closed funding from two strategic investors that both work with the company: $500 million from Japanese insurance company Sompo Holdings, and $50 million from Fujitsu. Together, it seems like these might account for $550 million noted as already sold on the Form D.)

The Form D also notes that 58 investors are already attached to the offering, and that “of the total remaining to be sold, all but $671,576.25 represents shares of common stock already subscribed for.” This means that Palantir has already secured commitments for the remaining part of the $961 million raise, although the offering has not closed.

Palantir declined to comment on the filing, except to note that this is related to primary investments, not secondary stakes.

It’s not clear if this latest fundraise, as spelled out by the Form D, spells a delay to a public listing, or if the intention is to complement it.

The filing also appears to confirm a report from September 2019 that Palantir was seeking to raise between $1 billion and $3 billion, its first fundraising in four years.

That report noted Palantir was targeting a $26 billion valuation, up from $20 billion four years ago. The Reuters article in June put its valuation based on secondary market trades at between $10 billion and $14 billion.

To date, Palantir has raised at least $3.3 billion in funding, according to PitchBook, which names no fewer than 108 investors on its cap table.

The PitchBook data (some of which is behind a paywall) also indicates that Palantir has raised a number of previous rounds of undisclosed amounts.

Palantir was last valued at $20 billion when it raised money four years ago, but there are some data points that point to a bigger valuation today.

While the coronavirus pandemic has all but halted the IPO market, we are starting to see some movement again, and Palantir’s own business activity points to what might be a strong candidate to usher in more activity.

In April, according to a Bloomberg report, the company briefed investors with documents showing that it expects to make $1 billion in revenues this year, up 38% on 2019, and breaking even in the first time since being founded 16 years ago by Peter Thiel, Nathan Gettings, Joe Lonsdale, Stephen Cohen and current CEO Alex Karp.

(The Bloomberg report didn’t explain why Palantir was briefing investors, whether for a potential public listing, or for the fundraise we’re reporting on here, or something else.)

On top of that, the company has been in the news a lot around the global novel coronavirus pandemic.

Specifically, it’s been winning business, in the form of projects in major markets like the U.K. (where it’s part of a consortium of companies working with the NHS on a COVID-19 data trove) and the U.S. (where it’s been working on a COVID-19 tracker for the federal government and a project with the CDC), and possibly others. Those projects will presumably need a lot of upfront capital to set up and run, alongside other business deals that Palantir has been securing — possibly one reason it is raising money now.

Updated throughout, including with response from Palantir.

Powered by WPeMatico

Bluedot, a geofencing and location data startup used by companies like Dunkin’, KFC and McDonald’s, is announcing that it has raised $9.1 million in Series B funding.

The San Francisco-headquartered company claims that its technology its 20 times more accurate than competing solutions — something that CEO Emil Davityan attributed to its roots in the toll road industry, where it needed to deliver “lane-level” accuracy.

“Since then, we’ve delivered location-based solutions for retail, restaurants and other verticals,” Davityan told me via email. “The focus is on valuable, contactless experiences that prioritize the consumer’s needs.”

The company is extending its capabilities with the launch of a new product called Tempo, which is supposed to incorporate data like traffic patterns — and even the time it takes to get in and out of a car — to deliver real-time alerts when a customer is approaching.

That sounds particularly desirable in the middle of a pandemic, when businesses are increasingly interacting with customers via curbside pickup and drive-through — and presumably want to minimize contact even when the customers are inside the store. It also sounds a little creepy, but Davityan emphasized that the data is encrypted and anonymized.

“We don’t collect personal data, or track, share or sell location data,” he said. “It’s easy to make claims about being ‘privacy friendly.’ The real challenge is to live and breathe it, to make it central to your business.”

Bluedot says its footprint — as measured by unique monthly users — has increased 2,471% over the past year, and that it’s now powering more than 121 million location events each month.

The startup has now raised a total of $21.9 million. The new funding was led by Autotech Ventures, with participation from previous backer Transurban and new investors Forefront Ventures, IAG Firemark Ventures and Mighty Capital. Autotech’s Alexei Andreev is joining the Bluedot board, with Mighty Capital’s Jennifer Azapian joining as board observer.

“Software that can enable businesses to minimize contact is vital,” Andreev said in a statement. “Moving forward, we see the market favoring contactless solutions and Bluedot is poised to meet this demand. Bluedot’s differentiated offering, focus on consumer experience and scalability are key factors for any business’s future success, especially as we all rethink mobility and brand interactions.”

Powered by WPeMatico

Databases have always been a complex part of the equation for developers requiring a delicate balance to manage inside the application, but Fauna wants to make adding a database a simple API call, and today it announced $27 million in new funding.

The round, which is technically an extension of the company’s 2017 Series A, was led by Madrona Venture Group with participation from Addition, GV, CRV, Quest Ventures and a number of individual investors. Today’s investment brings the total raised to $57 million, according to the company.

While it was at it, the company also added some executive fire power, announcing that it was bringing on former Okta chief product officer Eric Berg as CEO and former Snowflake CEO Bob Muglia as Chairman.

Companies like Stripe for payments and Twilio for communications are the poster children for the move to APIs. Instead of building sophisticated functionality from scratch, a developer can use an API call to a service, and presto, has the tooling built in without any fuss. Fauna does the same thing for databases.

“Within a few lines of code with Fauna, developers can add a full-featured globally distributed database to their applications. They can simplify code, reduce costs and ship faster because they never again worry about database issues such as correctness, capacity, scalability, replication, etc,” new CEO Berg told TechCrunch.

To automate the process even further, the database is serverless, meaning that it scales up or down automatically to meet the needs of the application. Company co-founder Evan Weaver, who has moved to CTO with the hiring of Berg, says that Stripe is a good example of how this works. “You don’t think about provisioning Stripe because you don’t have to. […] You sign up for an account and beyond that you don’t have to provision or operate anything,” Weaver explained.

Like most API companies, it’s working at the developer level to build community and developer consensus around it. Today, they have 25,000 developers using the tool. While they don’t have an open-source version, they try to attract developer interest with a generous free tier, after which you can pay as you go or set up a fixed monthly pricing as you scale up.

The company has always been 100% remote, so when COVID hit, it didn’t really change anything about the way the company’s 40 employees work. As the company grows, Berg says it has aggressive goals around diversity and inclusion.

“Our recruiting and HR team have some pretty aggressive targets in terms of thinking about diversity in our pipelines and in our recruiting efforts, and because we’re a small team today we have the ability to impact that as we grow. If we doubled the size of the company, we could shift those percentages pretty dramatically, so it’s something that is definitely top of mind for us.”

Weaver says that fundraising began at the beginning of this year before COVID hit, but the term sheet wasn’t signed until March. He admits being nervous throughout the process, especially as the pandemic took hold. A company like Fauna is highly technical and takes time to grow, and he worried getting investors to understand that, even without a bleak economic picture, was challenging.

“It’s a deep tech business and it takes real capital to grow and scale. It’s a high-risk, high-reward bet, which is easier to fund in boom times, but broadly I think the best companies get built during recessions when there’s less competition for talent and there’s more focus on capital.”

Powered by WPeMatico

All founders love “free” money, but with the pandemic going on, the necessity of free money has taken on a whole new meaning this year. First, there was the scramble to secure PPP loans a few weeks back for U.S.-based startups, and then the second wave of PPP loans when Congress offered a second tranche of funding. Two weeks ago, I covered a company called MainStreet, which is helping startups apply for local economic development credits that cities offer to businesses relocating to their regions.

In the same vein, neo.tax wants to help startups secure R&D research credits from the federal government — which tend to be fairly easy to acquire for most software-based startups given the current IRS rules for what qualifies as “research.”

The free money is good, but what sets this startup apart is its ambitious vision to bring machine learning to company accounting — making it easier to track expenses and ultimately save on costs.

It’s a vision that has attracted top seed investors to the startup. Neo.tax announced today that it raised $3 million in seed funding from Andy McLoughlin at Uncork Capital and Mike Maples at Floodgate, with Michael Ma at Liquid 2 Ventures and Deena Shakir at Lux Capital participating. The round closed last week.

Neo.tax was founded by Firas Abuzaid, who spent the past few years focused on a Ph.D in computer science from Stanford, where he conducted research in machine learning. He’s joined by Ahmad Ibrahim, who most recently was at Intuit launching small business accounting products; and Stephen Yarbrough, who was head of tax at Kruze Consulting, a popular consultancy for startups on accounting and financial issues. Leonardo De La Rocha, who was creative director of Facebook Ads for nearly five years and currently works at Intuit, is an official advisor to the company.

Neo.tax’s co-founders Stephen Yarbrough, Firas Abuzaid and Ahmad Ibrahim. Image Credits: Neo.tax

Or in short, a perfect quad of folks to tackle small business accounting issues.

Neo.tax wants to automate everything about accounting, and that requires careful application of ML techniques to an absolutely byzantine problem. Abuzaid explained that AI is in some ways a perfect fit for these challenges. “There’s a very clearly defined data model, there’s a large set of constraints that are also clearly defined. There’s an obvious objective function, and there’s a finite search space,” he said. “But if you wanted to develop a machine-learning-based solution to automate this, you have to make sure you collect the right data, and you have to make sure that you can handle all of the numerous edge cases that are going to pop up in the 80,000 page U.S. tax code.“

That’s where neo.tax’s approach comes in. The software product is designed to ingest data about accounting, payroll and other financial functions within an organization and starts to categorize and pattern match transactions in a bid to take out much of the drudgery of modern-day accounting.

One insight is that rather than creating a single model for all small businesses, neo.tax tries to match similar businesses with each other, specializing its AI system to the particular client using it. “For example, let’s train a model that can target early-stage startups and then another model that can target Shopify businesses, another one that can target restaurants using Clover, or pizzerias or nail salons, or ice cream parlors,” Abuzaid said. “The idea here is that you can specialize to a particular domain and train a cascade of models that handle these different, individual subdomains that makes it a much more scalable solution.”

While neo.tax has a big vision long term to make accounting effortless, it wanted to find a beachhead that would allow it to work with small businesses and start to solve their problems for them. The team eventually settled on the R&D tax credit.

“That data from the R&D credit basically gives us the beginnings of the training data for building tax automation,” Ibrahim explained. “Automating tax vertical-by-vertical basically allows us to be this data layer for small businesses, and you can build lots of really great products and services on top of that data layer.“

So it’s a big long-term vision, with a focused upfront product to get there that launched about two months ago.

For startups that make less than $5 million in revenue (i.e., all early-stage startups), the R&D tax credit offers up to a quarter million dollars per year in refunds from the government for startups who either apply by July 15 (the new tax date this year due to the novel coronavirus) or who apply for an extension.

Neo.tax will take a 5% cut of the tax value generated from its product, which it will only take when the refund is actually received from the government. In this way, the team believes that it is better incentive-aligned with founders and business owners than traditional accounting firms, which charge professional services fees up front and often take a higher percentage of the rebate.

Ibrahim said that the company made about $100,000 in revenue in its first month after launch.

The startup is entering what has become a quickly crowded field led by the likes of Pilot, which has raised tens of millions of dollars from prominent investors to use a human and AI hybrid approach to bookkeeping. Pilot was last valued at $355 million when it announced its round in April 2019, although it has almost certainly raised more funding in the interim.

Ultimately, neo.tax is betting that a deeper technical infrastructure and a hyperfocus on artificial intelligence will allow it to catch up and compete with both Pilot and incumbent accounting firms, given the speed and ease of accounting and tax preparation when everything is automated.

Powered by WPeMatico

A big problem for companies these days is finding ways to connect various data sources to their data repositories, and Fivetran is a startup with a solution to solve that very problem. No surprise then that even during a pandemic, the company announced today that it has raised a $100 million Series C on a $1.2 billion valuation.

The company didn’t mess around, with top flight firms Andreessen Horowitz and General Catalyst leading the investment, with participation from existing investors CEAS Investments and Matrix Partners. Today’s money brings the total raised so far to $163 million, according to the company.

Martin Casado from a16z described the company succinctly in a blog post he wrote after its $44 million Series B in September 2019, in which his firm also participated. “Fivetran is a SaaS service that connects to the critical data sources in an organization, pulls and processes all the data, and then dumps it into a warehouse (e.g., Snowflake, BigQuery or RedShift) for SQL access and further transformations, if needed. If data is the new oil, then Fivetran is the pipes that get it from the source to the refinery,” he wrote.

Writing in a blog post today announcing the new funding, CEO George Fraser added that in spite of current conditions, the company has continued to add customers. “Despite recent economic uncertainty, Fivetran has continued to grow rapidly as customers see the opportunity to reduce their total cost of ownership by adopting our product in place of highly customized, in-house ETL pipelines that require constant maintenance,” he wrote.

In fact, the company reports 75% customer growth over the prior 12 months. It now has more than 1,100 customers, which is a pretty good benchmark for a Series C company. Customers include Databricks, DocuSign, Forever 21, Square, Udacity and Urban Outfitters, crossing a variety of verticals.

Fivetran hopes to continue to build new data connectors as it expands the reach of its product and to push into new markets, even in the midst of today’s economic climate. With $100 million in the bank, it should have enough runway to ride this out, while expanding where it makes sense.

Powered by WPeMatico

There’s a lot of complexity around managing data lakes in the cloud that often requires expensive engineering expertise. Upsolver, an early-stage startup, wants to simplify all of that, so that a database administrator could handle it. Today the startup announced a $13 million Series A.

Vertex Ventures US was lead investor, with participation from Wing Venture Capital and Jerusalem Venture Partners. Today’s investment brings the total raised to $17 million, according to the company.

Co-founder and CEO Ori Rafael says that as companies move data to the cloud and store it in data lakes, it becomes increasingly difficult to manage. The goal of Upsolver is to abstract away a lot of those management tasks and allow users to query the data using SQL, making it a lot more accessible.

“The main criticism of data lakes over the years is they become data swamps. It’s very easy to store data there very cheaply, but making it [easy to query] and valuable is hard. For that you need a lot of engineering, which turns the lake into a swamp. So we take the data that you put into a lake and make it easier to query, and we take the biggest disadvantage of using a lake, which is the complexity of doing that process, and we make that process easy,” Rafael explained.

Investor In Sik Rhee, who is general partner and co-founder at Vertex Ventures US, sees a company that’s creating a cloud-native standard for data lake computing. “Upsolver succeeded in abstracting away the engineering complexity of data pipeline management so that enterprise customers can quickly solve their modern data challenges in real time and at any scale without having to build another silo of expertise within the organization,” he said in a statement.

The company currently has 22 employees spread out between San Francisco, New York and Israel. Rafael says they hope to expand to 50 employees by the end of next year, including adding new engineers for their R&D center in Israel and building sales and customer success teams in the U.S.

Rafael says he and his co-founder sat down early on and wrote down the company’s core values, and they see a responsibility of running a diverse company as part of that, as they search for these new hires. Certainly the pandemic has shown them that they can hire from anywhere and that can help contribute to a more diverse workforce as they grow.

He said running the company and raising money has been stressful during these times, but the company has continued to grow through all of this, adding new customers while staying relatively lean, and Rafael says that the investors certainly recognized that.

“We had high revenue compared to the low number of employees with [sales] acceleration during COVID — that was our big trio,” he said.

Powered by WPeMatico

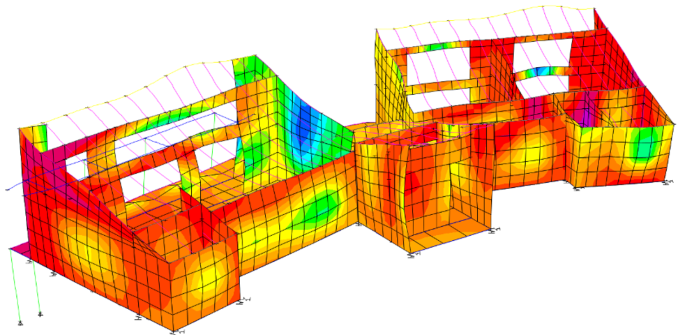

Housing has been constructed for millennia, and while clearly our modern abodes are ever so slightly better than the elk tents we used to live in, the construction techniques behind housing today haven’t progressed all that much. What has progressed are prices — it’s more expensive than ever to build a modern unit, and that’s just for housing — head over to commercial real estate and the numbers don’t look much better.

For Martin Diz and his team, that’s a problem. Diz is not exactly a lifelong builder — in fact, he was building proverbial rockets as an aerospace engineering PhD researcher several years ago. As he was talking to his roommate back then, who was studying structural engineering, he realized that some of the techniques that his roommate’s field was trying to pioneer had already been discovered by the aerospace folks decades ago.

His roommate was trying to simulate an earthquake to model how the tremors would affect objects like a table inside a building. As Diz recalled, he said “Hey dude, did you know that in aerospace engineering, we did the same thing for the space station 50 years ago? … I learned this in grad school, you know, in our basic course because it’s a very old technique.”

Diz is legitimately a nice chap, and totally not the kind of aerospace engineer who goes around talking about how aerospace solved everything a century ago (okay, maybe just a tad of that). But the interaction and followup conversation got him thinking about what aerospace as a field had solved, and whether some of those techniques could be used in other domains.

Diz and his roommate kept talking over the years, and eventually, the two formed Tango Builder. Tango’s main premise is to bring more sophisticated engineering techniques to construction, improving performance and quality while lowering costs. It’s part of the current YC batch, and previously raised a small seed round, which included participation from Tracy Young, co-founder and CEO of PlanGrid.

The two, plus one employee, have already worked on a handful of projects, with some early promising results. Tango helped to design a hospital for COVID-19 patients in Ecuador that saw total savings of $1 million by lowering structural costs by a third. They consulted on the creation of a justice center in Mexico, and were able to reduce the required steel in the project by 40%. And they used their platform to optimize wall thickness in a masonry home to bring total cost down by 15%. All numbers are reported by the company and have not been independently verified.

A look at Tango’s masonry home project. Photo from Tango Builder.

A look at Tango’s masonry home project. Photo from Tango Builder.

There is a heavy focus on structural integrity (as there should be in construction), but Tango particularly shines around seismic modeling. While earthquakes are perhaps most pronounced in places like California and Mexico, both of which suffered major tremors this past week, earthquakes are a lingering threat throughout the world, and buildings need to be designed to handle them even if they are rare.

Diz and his team want to give designers better tools to model what happens in different scenarios while understanding the trade-offs of various building materials and designs. “You’re building with steel stock, but it’s much more expensive now, so it’s up to the user or the owner to decide which of the paths he wants to take,” he said. Safety is always important, but how much steel do you place in a building that might see an earthquake once a century? That’s what Tango wants to help answer.

Beyond improving structural modeling, Tango’s big ambition is to find additional efficiencies in the construction process by helping everyone involved with construction work together through a better workflow. “Each person has benefits from the platform, the architect will get the approvals … faster, the engineer can focus on the creative side of things, the contractor” can bid earlier knowing what design is coming, Diz explained. Saving time in all these processes ultimately translates directly to a project’s bottom line.

It’s very early days of course, with just Diz, his co-founder Juan Aleman, and one employee “working extremely hard.” The hope though is that melding some aerospace engineering techniques with a much more robust and technical platform will help push construction to better quality while saving costs as well. After all, aerospace did all this a century ago.

Powered by WPeMatico

Karat is a new startup promising to build better banking products for the creators who make a living on YouTube, Instagram, Twitch and other online platforms. Today it’s unveiling its first product — the Karat Black Card.

The startup, which was part of accelerator Y Combinator’s Winter 2020 batch, is also announcing that it has raised $4.6 million in seed funding from Twitch co-founder Kevin Lin, SignalFire, YC, CRV and Coatue.

Co-founder and co-CEO Eric Wei knows the creator world well, thanks to his time as product manager for Instagram Live. (His co-founder Will Kim was previously an investor with seed fund Lucky Capital.) Wei told me that although many creators have significant incomes, banks rarely understand their business or offer them good terms when they need capital.

“Traditional banks care a lot about FICO [credit scores],” he said. “A lot of YouTubers, when they’re blowing up, they don’t have time to think: Let me make sure my FICO is awesome as well.”

At the same time, he argued that creators have become suspicious of potentially scammy financial offers, to the point that if you were to attend a pre-COVID VidCon and tried to give out $3,000, “The good creators will not take it, even if you tell them there are no strings behind it.”

Karat co-founders Will Kim and Eric Wei

With the Karat Black Card, the startup is giving creators a credit card that they can use for their business-related expenses. When creators are approved, they receive a $250 bonus that can be applied to any future purchases of electronics or equipment. The card also comes with custom designs, 2% to 5% cash back on purchases and it even offers advances on sponsorship payments.

Underlying it, Wei said Karat has developed an underwriting model that works for creators. Instead of looking at credit scores, Karat focuses on the size of a creator’s following, their current revenue and whether or not they’re “business savvy.”

“It’s not just the number of followers you have, but what platforms,” Wei added. “I would rather have 100,000 subscribers on YouTube than 1 million on TikTok, because on TikTok, it’s all algorithmically driven.”

Karat has already provided the card to an initial group of creators, including TheRussianBadger, TierZoo and Nas Daily. Wei said the model is working so far, with no defaults.

For now, the card is aimed at professional, full-time creators who have at least 100,000 followers. Wei estimated that that’s a potential customer base of 1 million creators. Eventually, he wants to provide those creators with more than a black card.

“We’re building a vertical financial and biz ops experience,” he said. “People in earlier stages, we do want to get to them eventually, but only after we feel like we’ve developed enough of an underwriting model.”

Powered by WPeMatico

Homebuilding is not for the faint of heart, particularly those who want to build something custom. Selecting the right architect and designer, the myriad contractors, the complexity of building codes and siting, the regulatory approvals from local authorities. It’s a full-time job — and you don’t even have a roof built over your head.

Atmos wants to massively simplify homebuilding, and in the process, democratize customization to more and more homeowners.

The startup, which is in the current Y Combinator batch, wants to take both the big decisions and the sundries of construction and combine them onto one platform where selecting a design and moving forward is as simple as clicking through a Shopify shopping cart.

It’s a vision that has already piqued the attention of investors. The company disclosed that it has already raised $2 million, according to CEO and co-founder Nick Donahue, from Sam Altman, former YC president and now head of OpenAI, and Adam Nash, former president and CEO of Wealthfront, along with a bunch of other angels.

It’s also a vision that is a radical turn from where Atmos was before, which was centered in virtual reality.

Donahue comes from a line of homebuilders — his father built home subdivisions as a profession — but his interests initially turned toward the virtual. He dropped out of college after realizing process engineering wasn’t all that exciting (who can blame him?) and headed out to the Valley, where he built projects like “a Burning Man art installation and [an] open-source VR headset.” That headset attracted the attention of angels, who funded its development.

The concept at the heart of the headset was around what the team dubbed the “spatial web.” Donahue explained that the idea was that “the concept of the web would one day flow from the 2D into the 3D and that physical spaces would function more like websites.” The headset he was developing would act as a sort of “browser” to navigate these spaces.

Of course, the limitations around VR hit his company as much as the rest of the industry, including limits on computation performance to build these 3D environments and the lack of scaling in the sector so far.

The thinking around changing physical spaces though got Donahue pondering about what the future of the home would look like. “We think the next kind of wave of this is going to be an introduction to compute,” he said, arguing that “every home will have like a brain to it.” Homes will be digital, controllable and customizable, and that will revolutionize the definition of the home that has remained stagnant for generations.

The big vision for Atmos going forward then is to capture that trend, but for today at least, the company is focused on making housing customization easier.

To use the platform, a user inputs the location for a new home and a floor plan for the site, and Atmos will find builders that best match the plan and coordinate the rest of the tasks to get the home built. It’s targeting homes in the $400,000-$800,000 range, and its focus cities are Raleigh-Durham, Charlotte, Atlanta, Denver and Austin.

It’s very much early stages for the company — Donahue says that the company has its first few projects underway in the Raleigh-Durham area and is working to partner and scale up with larger homebuilders.

Image Credits: KentWeakley / Getty Images

Will it work? That’s the big question with anything that touches construction. Customization is great — everyone loves to have their own pad — but the traditional challenge for construction is that the only way to bring down the cost of housing is to make it as uniform as possible. That’s why you get “cookie-cutter” subdivisions and rows of identical apartment buildings. The sameness allows a builder to find scale. Work crews can move from one lot to the next in synchronicity saving labor costs and time while building materials can be bought in bulk to save costs.

With better technology and some controls, Atmos might be able to find synergies between its customers, particularly if it gets market penetration in individual cities. Yet, I find the longer-term vision ultimately more compelling for the company. Redefining the home may not have made much sense three months ago, but as more people work from home and connect with virtual worlds, how should our homes be redesigned to accommodate these activities? If Atmos can find an answer, it is sitting on a gold mine.

Atmos team pic (minus two). Image Credits: Atmos

In addition to Altman and Nash, Mark Goldberg, JLL Spark, Shrug Capital, Daniel Gross’ Pioneer, Venture Hacks, Yuri Sagalov, Brian Norgard and others participated in the company’s angel/seed round.

Powered by WPeMatico